NOTICE: This post references card features that have changed, expired, or are not currently available

On our Best Offers Page under Amex App Tips, we show the following rules (among others):

- You can have max 5 Amex credit cards, but no known limit for charge cards

- Max 1 credit card approval per 5 days and 2 in 90 days, but no known limit for charge cards

[2 credit cards in 1 day is possible when instantly approved]

Readers may remember how I accidentally signed up for the consumer SPG card a few weeks ago. I was expecting to see a popup warning me that I wasn’t eligible for the card, but received an instant approval instead. That became my sixth Amex credit card (I have other charge cards too, but that’s irrelevant here). This was surprising because it seemed to blow out of the water the “max 5 Amex credit cards” rule. So, to really put the limit to the test, I also applied for the SPG business credit card and was instantly approved for that too. Now I have 7 Amex credit cards.

You can read all about that adventure here: Is the Amex 5 Credit Card Limit Gone? For those wondering about whether I’ll get the welcome bonus on either card: I don’t yet know. I’ve met the minimum spend requirements on both cards, but haven’t yet received new SPG accounts (I expected to get assigned new SPG accounts since I hadn’t put my SPG membership number in either application).

Could I push it to 8?

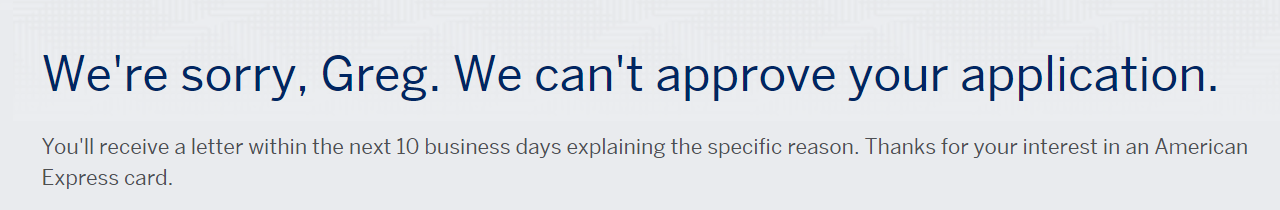

Yesterday I tried to apply for the SPG Luxury Credit Card. My application was instantly denied.

I then followed the link on our Best Offers Page to check application status (within the Amex App Tips box), and found the reason I was denied:

Thank you for your application for the Starwood Preferred Guest® American Express Luxury Card. We’re writing to let you know that we’re unable to approve this request.

The reason for our decision is that you have reached the maximum number and type of Cards that we will approve within the period of a few months.

The reason “you have reached the maximum number and type of Cards that we will approve within the period of a few months” is not a static limit (like the maximum credit card limit), but rather a time based limit: “within the period of a few months“.

With this, I feel comfortable reporting that the “Max … 2 in 90 days…” rule is still in play.

This means that my little experiment with the consumer and business SPG cards ruined my chances of getting the SPG Lux card in the small window of opportunity available (see: 3 days left for up to 425K Marriott/SPG points. What to do?).

But, I can still get the SPG Lux card welcome bonus if:

- I wait 91 days after signing up for the other SPG cards (due to the 2 in 90 days limit); and

- Cancel my Ritz card 31 days prior to signing up for the SPG Lux card; and

- Avoid upgrading my Marriott Rewards Premier Card to the Premier Plus.

To understand the above, see: Navigating Marriott’s Byzantine Credit Card Rules.

Luckily, I also have family members…

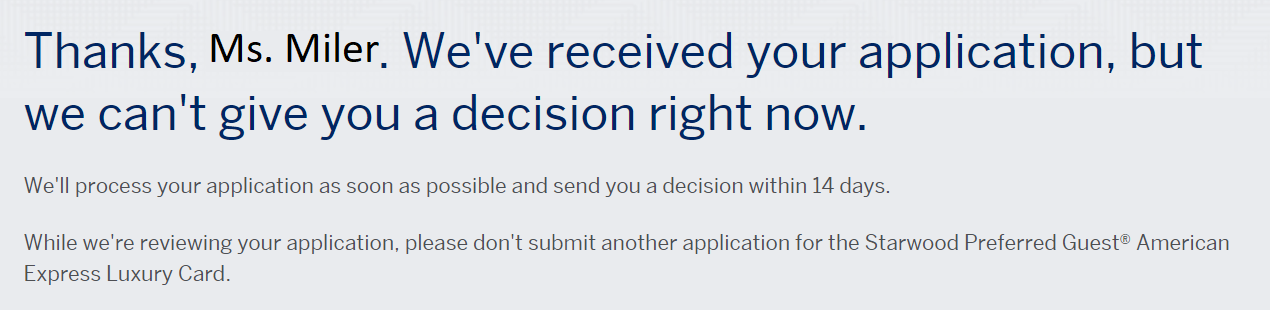

My wife’s application went pending

My wife applied for the Luxury Card and her application went pending. We’re now waiting to see what happens. If her application gets approved, it will be further evidence that the 5 credit card limit is gone (she currently has 5).

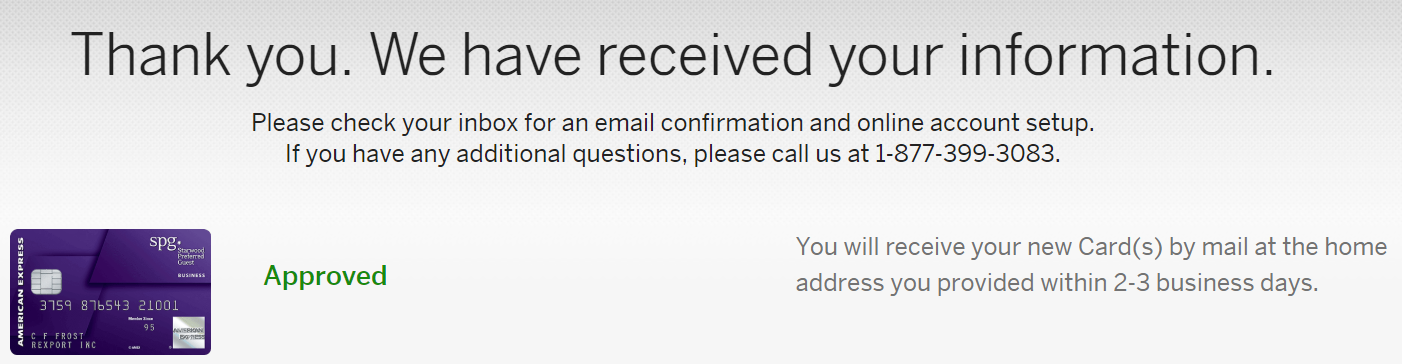

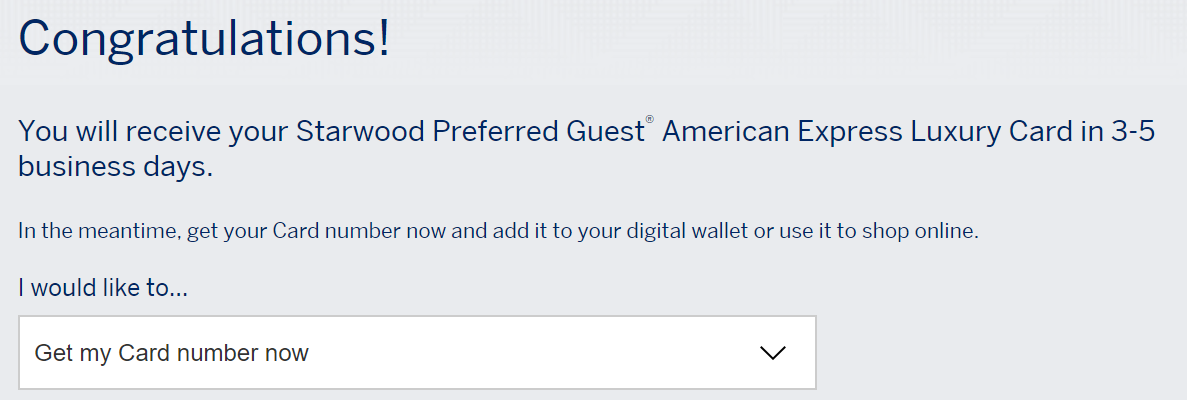

My son’s applications were approved instantly

We went back and forth about which cards my son should apply for. When he turned 18 last November he signed up for the Discover It Student card and hasn’t gotten any more cards since then. So, yesterday he applied for the SPG Business Card, and the SPG Luxury Card. He was instantly approved for both! Of course I’ll help him meet minimum spend (and help him spend those points…).

I applied for the SPG Lux on Saturday, but was denied today because I have too make cards. I called up AMEX and they said that 5 was the limit, so all I had to do was cancel one of my credit accounts to be approved.

5 card limit for me. Had to close the old Blue for Business to get SPG personal card approved.

[…] The Amex 5 credit card limit may be in question, but 2 in 90 day limit holds […]

I thought I got denied, but application for the Hilton business card also went pending with the exact language as above. Now waiting. This would be my sixth card if approved. I doubt it though. But if they use the reason of max cards allowed by Amex then I can just cancel the SPG biz card.

yes I got the same rejection language – odd as I applied for the Aspire card in April and the spg personal Amex a couple of weeks ago but this would still only be 1 card in last 90 days as april application was well over 120 days ago?

I am trying to apply for the SPG Luxury card, but I’m only getting the option to upgrade my current card. Any thoughts?

If the upgrade offer is for 100K, go for it (unless you really want to keep both cards). Otherwise, try opening the application in a different browser or in private mode

There’s no actual upgrade offer, just an offer to upgrade the card. I ended up having to do just that, but it went into pending review. There’s a consideration number, isn’t there?

I currently have the chase business Marriott(I’ve had it for years), I also have a few of their ink business cards and a freedom & sapphire card. Was thinking of cancelling sapphire to get reserve. I am 1 card away for the chase 5/24 rule.

Currently I have the Amex Hilton card (received it when Citi Hilton switched over). Since I have opened the “Amex every day card” 1 month ago. I do not have any SPG cards, what would you recommend I get (possible to get 2 in same day)?

Any help or suggestion are much appreciated.

I’d recommend the SPG Biz card. It won’t add to your 5/24 count. And then while you’re under 5/24, consider picking up another Ink business card since they have great bonuses.

That really cool of you responding, thank you.

I was thinking of getting the sapphire reserve next, do I need to cancel my sapphire 1st, if so, how far in advance.

Also what other card from Amex would you recommend, I just recently was allowed in with Amex, so wanted to try and get more rewards with them, figured would apply for the spg and another in the same day and cross my fingers. Possibly a charge card

My luxury app was denied because I had more than 5. I’m not sure if business cards count, but I either already have 6 or 7 and was denied for #7 or # 8 respectively.

It’s interesting that they seem to selectively apply the rule to some people but not everyone.

Very interested in your son’s credit card journey. My 18 year daughter recently got the Discover college card. Would be very interesting to know if he had applied for other cards and received a denial? Do you plan on your son keeping these cards? In general, I bet you have a large audience interested in the teenage young adult application issue!

He had applied and was denied for the IHG card, but by the time the denial came in we had learned that the IHG card wouldn’t have uncapped free nights for the long term, so we didn’t pursue calling to see if we could push the app through. I was actually glad he was denied.

Anyway, yes, it’s time for me to do another post about teen credit cards! Here was the previous one: https://frequentmiler.com/2017/12/01/teens-first-credit-card-2/

I got the same decision as your wife and then I called in to The reconsideration line and I was told that it was sent to a special executive team and then I would know in 24 to 48 hours. I called again is go to another erect just to make sure was true and she told me the same thing.

You can have them ‘resubmit’ your original application after 90 days from the other 2 cards applications. The original application day Signup bonus and rules should still be in effect. I did this last year when they were having the temporary Hilton 100k and free night on card anniversary. I had already applied for 2 amex cards within the last 90 days, so application was instantly denied. Called in, and was told to wait until after 90 days from 1st amex card application had passed, they even told me the date. Waited the 30 days or so, called in, and instantly approved. I received the bonus as per the terms on the original application date, even though the promotion had already expired.

Great tip, thanks!

Greg have you completed spend on the personal SPG and get the points or not?

“For those wondering about whether I’ll get the welcome bonus on either card: I don’t yet know. I’ve met the minimum spend requirements on both cards, but haven’t yet received new SPG accounts (I expected to get assigned new SPG accounts since I hadn’t put my SPG membership number in either application).”