It’s time to take off the rose-colored glasses.

Last month, I wrote a post essentially saying that Chase Ultimate Rewards are great for Hyatt but would be very weak if and when Hyatt ever devalued (See: Chase needs to stop banking on Hyatt). I followed up with a post on easy foreign transfer partner programs and challenging foreign partners that are worth some effort. A reader who goes by the name Dugroz Reports, who I know has a Youtube channel advocating for the “Regular Joe” in miles and points, commented on my post about the challenging foreign airline programs — and I’m going to pick a fight with him (sort of). I’m going to challenge Dugroz Reports to take off his Rose-colored glasses and examine his redemption strategy.

Don’t worry, I don’t really have anything against him — he’s a regular reader / commenter with whom I’ve interacted before and I cleared this topic with him before posting it, so I’m not really picking a fight with Dugroz Reports. But I am picking a fight with an idea….and I’m sure he’ll let you know why I’m wrong in the comments below this post!

In the comments of my post about challenging foreign transfer partners that are worthwhile, reader PeterSFO started a train of thought when he mentioned:

I’d rather have 4 good airline transfer partners and 1 good hotel transfer partner than 10 good airline transfer partners and 0 good hotel transfer partner.

That comment is a close approximation of the Chase Ultimate Rewards vs Amex Membership Rewards argument. Dugroz Reports agreed with that sentiment and expanded his feelings on it a bit:

Put me also in the camp of “I’d rather have 4 good airline transfer partners and 1 good hotel transfer partner.”

I think a lot of that comes down to frequency of travel and flexibility of travel. Somewhere in here is an argument about how flexible your life and job are. Nick can more easily “drop everything” and fly to XYZ destination when a good deal comes along or cabin space opens up, even if it’s in February. As a regular old 9-5er, with a wife who teaches, and kids in school, it’s pretty much June-August for me; the peak seasons.

Hyatt offers very predictable, good (if not outsized) value year-round. And without impacting my family budget at all, I can use something like [Chase Travel℠] or Southwest, United, etc many times to fit my life. I don’t pay for hotels or airlines, so “just do paid travel” isn’t an option. It has to be points.

Having said that, I do Amex and Chase; so the axiom of “why not both?” seems to apply.But Chase in an integral part.

Loved the article, BTW.

There are a lot of good points there. There’s no doubt that a blogger like me enjoys outsized flexibility in terms of when to travel. I worked a job in a past life where we bid our vacation schedule about a year in advance, so I can certainly understand the situation that some have in terms of fixed inflexible dates and times. And that can make it a lot harder to take advantage of the sweetest sweet spots.

But one line in particular of his comment stood out to me:

I don’t pay for hotels or airlines so “just do paid travel” isn’t an option. It has to be points.

Well Dugroz Reports, if this is the case, can you please book all my hotels and flights for me this year? I’m sure you won’t mind since you don’t pay for them! 😀

Of course I’m being facetious to make a point: there certainly is a cost involved — and recognizing that Dugroz Reports’s points about flexibility are absolutely true, as much as I love Hyatt, the savings achieved through hotel points don’t compare to the savings achieved through using airline miles to top value unless you’re staying at the lowest category hotels (where points often yield more outsized value) or the very tippy tippy top of the highest-end hotels.

Many times before I have used 20K or 25K Hyatt points to stay at a hotel that otherwise would have cost $500 or $600 a night. I’d have never paid the $500 or $600 to stay at such a property and so I was thrilled to get a swanky hotel for 20 or 25K Hyatt points (and let the record show that I often still do that).

But I think it is important to remember that the 20K or 25K points per night that I have transferred from Chase to Hyatt in those cases could alternatively be cashed out for $200 or $250 in cold hard cash, so in essence, I am “paying” for the hotel when I do that (an old argument I won’t rehash in full).

My point in saying that I’d rather have 10 good airline partners than 4 airlines and 1 hotel is that if we take away Hyatt, I’ll probably still be willing to spend around $150 a night for a hotel (obviously this number varies wildly from person to person, this is just my approximate number). Paying $150 per night in cash is arguably paying less than paying 25,000 Hyatt points per night if those points come from a Chase transfer. If paying cash for the hotel saves me $1,000 worth of points over what I’d have paid for the same flights with that 4 + 1 combo, it will have been a good trade. If that concept doesn’t make sense, I’ll come back to it in a second.

Like I said, I’m not swearing off Hyatt — really, the point of my post about Chase was that Hyatt is what makes Ultimate Rewards worthwhile. Hyatt is great and I’ll continue to enjoy transferring there. But without Hyatt, Ultimate Rewards would be a really weak currency. And more importantly here, if I had to choose whether to have Hyatt as a transfer partner or whether to have airline transfer partners that offer better sweet spots, I’d take the better airline partners because the amount I will save by using better airline partners is far more significant than the amount I will save with Hyatt points over my alternative options.

Let me give you a clearer comparison that illustrates why I would sooner accept 10 good airline partners and 0 good hotel partners than 4 good airline partners and 1 good hotel partner (note that I’m not really arguing that Amex has 10 good airline partners or that Chase has only 4 good ones, I’m just illustrating that a really good airline partner makes a more significant difference than a really good hotel partner).

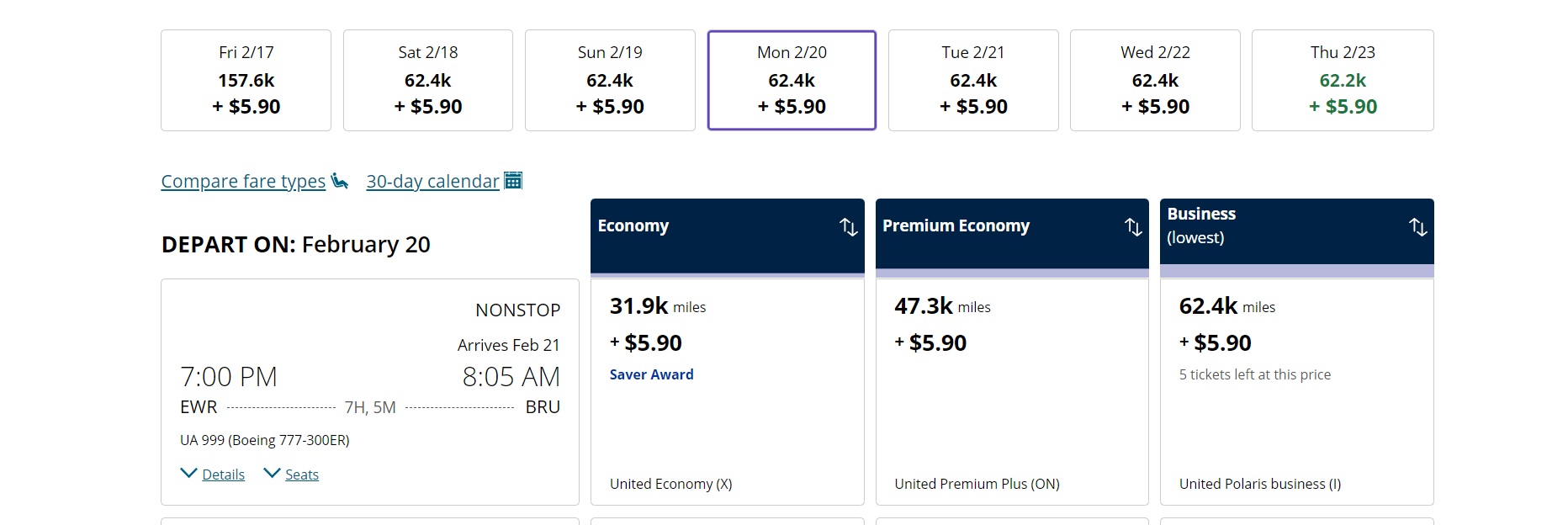

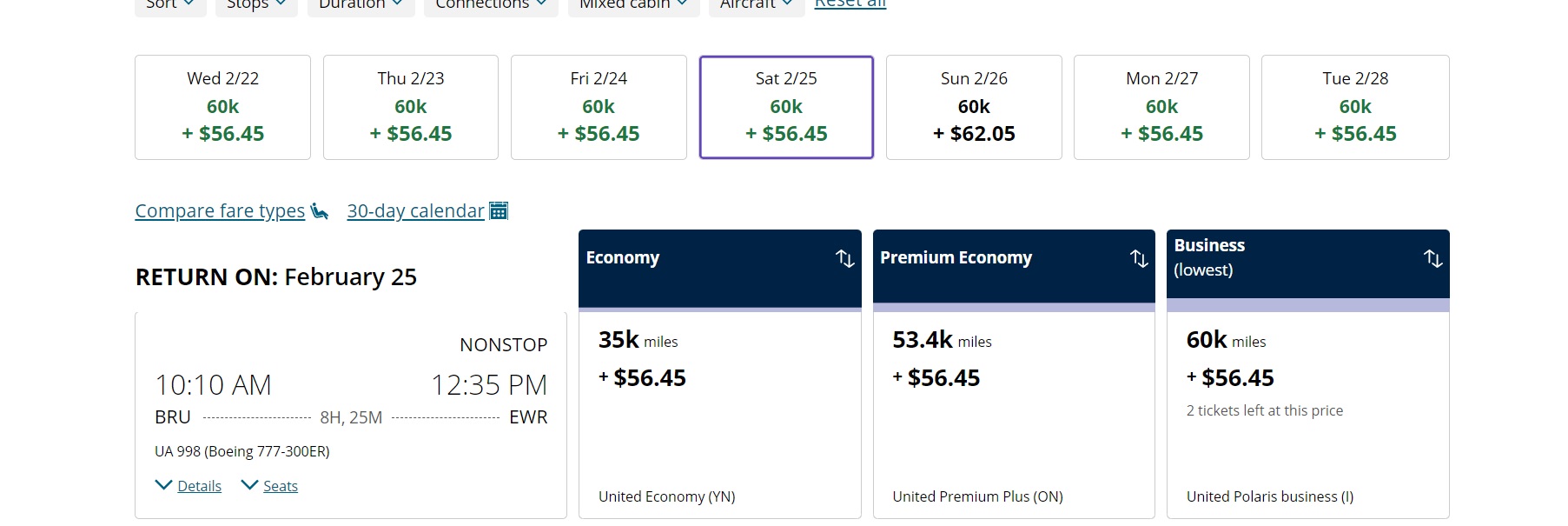

Let’s say you want to take a trip for 2 passengers from New York to Brussels, Belgium from February 20th to the 25th (yes, it’s close-in, but it’s during President’s Week, which is a week off of school here in New York State. Planning this close-in or during off-season to Europe may not be practical, but for the purposes here it’s mathematical). United has Polaris business award availability at 62.4K miles each way per passenger on the way to Brussels and 60K miles per passenger on the way back.

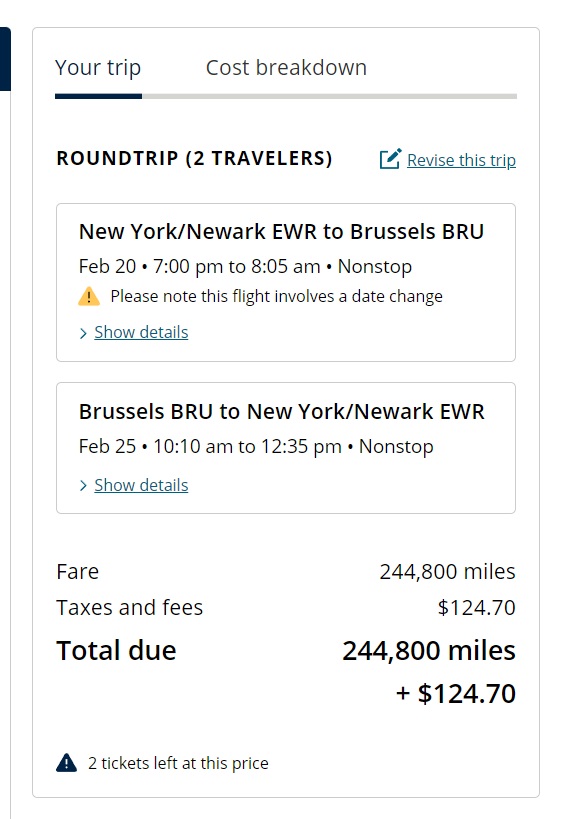

For two people, that’s 244,800 points.

There is a Small Luxury Hotels of the World property in Brussels, the Juliana Hotel Brussels, that is a Category 6 Hyatt and is available for 21K points per night (against a room rate of 343 Euro through Hyatt).

Four nights there would cost 84,000 points. Assuming you would transfer from Chase Ultimate Rewards to United and Hyatt to book that trip, it would cost a total of 328,800 total points. I fully understand that Dugroz Reports might not fly business class and/or he might not consider blowing that many points on a two-person trip, etc. But it illustrates the comparison I’m making. Cashed out, that’s $3,288.00 worth of Ultimate Rewards points — can we agree to call that the opportunity cost of this redemption? With the cost of taxes, that’s $3,412.70 out the door instead of in the bank (as it could be if the points were cashed out).

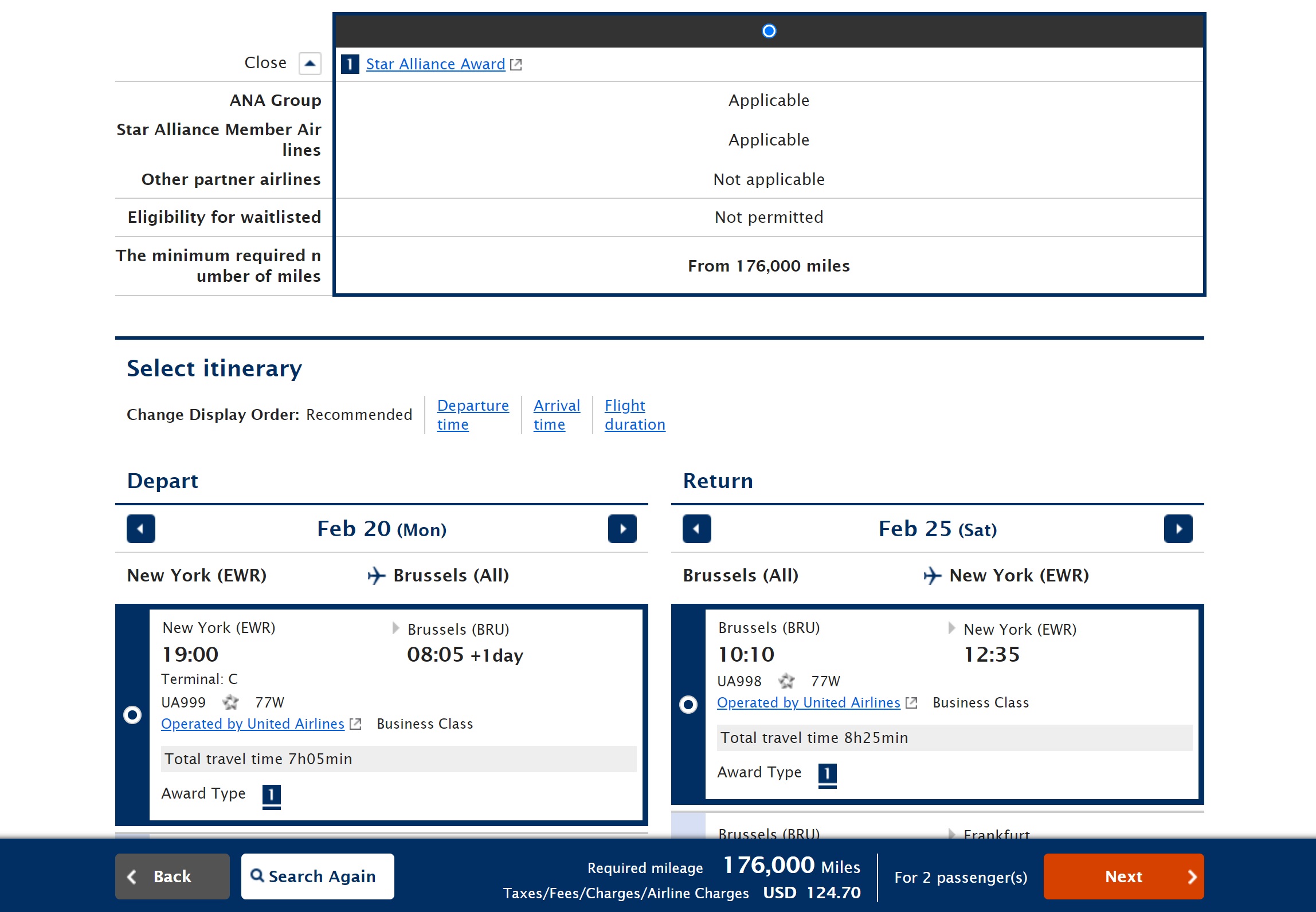

Instead, thanks to Amex transfer partner ANA, those same United flights to and from Brussels could be booked for 88,000 miles round trip per passenger.

That’s 176,000 points spent on the flights (plus the same $124.70 in taxes).

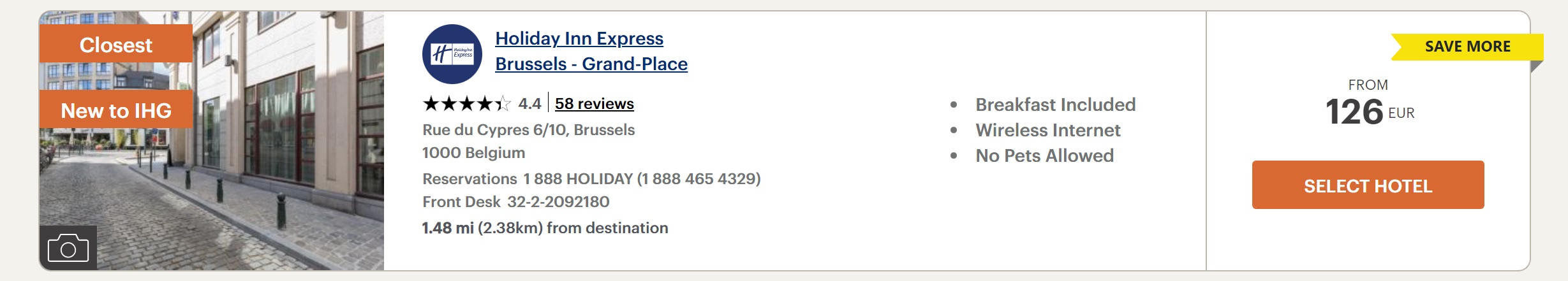

There is a Holiday Inn Express in the city that is listed “from 126 Euro”, but in reality the cheapest flexible rate (a fair comparison point) is 152. It comes to 624.22 Euro for those 4 nights at the flexible rate. Based on today’s exchange rate, that’s $672. If I didn’t have access to a good hotel transfer partner, that’s a price I might consider paying.

Understanding that Amex points can only be traded for cash with a Business Platinum card and Amex Business Checking account (at $0.01 per point) or the Schwab Platinum card (at $0.011 per point) but looking to keep the math simple, let’s assume Dugroz Reports would value Amex points at the same 1c per point floor value that we gave to Chase points. That redemption “cost” $1,760.00 plus $672 plus $124.70 in taxes on the flights = $2,556.70 in total between points and money.

Better yet, there is a Hotel Indigo that would cost a total of 128,000 points for 4 nights. If you bought your IHG points on sale at half a cent each (a price at which they frequently go on sale), that’s $624 worth of points — dropping your net cost down to $2,508.70.

If you had the IHG Premier card with its 4th night free benefit on awards, it would cut the award cost to 100,000 points (ironically, the 4th night is the cheapest in this case at just 28K points). That’s $500 worth of IHG points purchased on sale, bringing the net trip cost to $2,384.70.

In any of the above cases, I would argue that transferring to United and Hyatt wouldn’t really “save” Dugroz Reports money.

The reality is complex: if he earned only Amex points instead of earning any Chase points, for instance, he couldn’t cash out those Amex points at $0.01 per point to pay cash for hotels (or hotel points) unless he also had an expensive Platinum card (though that may be worth it since, even with the cost of a Platinum card, booking the Hotel Indigo or Holiday Inn Express and using ANA for the flights would still have a lower opportunity cost than the Chase to United and Hyatt transfer). Of course, nothing stops Dugroz Reports from earning cash back (like with a Chase Ink Cash card) and using that cash back to cover “paid” hotels (rather than cash from his family budget). I’d argue that transferring points to book a Hyatt hotel and then thinking that you “didn’t pay for the hotel” is looking at your redemption through rose-colored glasses.

In the examples above, Dugroz Reports may have used Hyatt points and stayed at a nicer property (I’ll just assume that the SLH property is nicer), but having access to a better airline transfer partner — even after using cash for the hotel — saves nearly a grand over being stuck with a lesser airline partner and transferring to that “good” hotel partner when you slice and dice hotel cost as shown above.

But wait — it isn’t really fair to compare apples and oranges, right? I have never stayed at the Hotel Indigo in Brussels or the Juliana Hotel Brussels (the SLH property), but based on my limited SLH and Hotel Indigo experience, I think it is probably fair to assume that the SLH property is much nicer. Dugroz Reports may argue that he really wants to stay at the Juliana Hotel and he likes his Chase points to transfer to Hyatt for the fancypants hotels (probably not an argument he would actually make if you watch his Youtube channel, but let’s imagine that he would make that argument).

Good news for Dugroz Reports: The Juliana Hotel Brussels is available for those dates for a total of $1,136 (including taxes & fees) via Hotels.com when signed in to a Hotels.com account.

One could probably book through a shopping portal and/or use discounted Hotels.com gift cards to pay even less — and if you value Hotels.com rewards, the deal above could get significantly better.

But let’s imagine you don’t use a shopping portal or get discounted gift cards or value Hotels.com rewards. Again valuing Amex points at a penny each, the flights and stay at that same property come at a total combined cost of $2,896 ($1,760 worth of points valued at 1c per point for the flights + $1,136 for the hotel). I’d argue that using Amex points saves $392 worth of cash / rewards.

This may seem like a cherry-picked example, and to some extent it is in the sense that I knew Brussels would have easy award availability based on recent trends in my Seatspy award searches and you will sometimes find Hyatt properties with much better award prices or during peak seasons cash prices for competing properties may be much higher. And I need to recognize again that the entire comparison is flawed in the sense that Amex points are not as easily traded for cash as Chase points and if the flights in the example were on Lufthansa, Amex wouldn’t have had a cheaper transfer partner than United (unless they were offering a transfer bonus to Avianca LifeMiles, which does happen now and then).

But the fact is that I originally wrote the meat and potatoes of this post a month ago with a different city pair and different hotels — and the difference between Amex and Chase came out similarly (in fact, the spread was even wider because in that other city there were even cheaper IHG award options, but due to availability changes in the time since I put together the initial example, I wanted to update with a current example before I published this).

If one were really considering whether to focus on only Chase points or only Amex points, there would be a lot of other factors to consider. There’s the fact that Amex offers more frequent transfer bonuses, offering chances to pay even fewer points for flights — but then there’s the fact that Amex cards are not as widely accepted (especially overseas) and that many Amex Offers for hotel chains are limited to US properties. There’s the fact that Chase’s partners likely offer more options for US domestic flights since the US-based airlines are releasing such little award availability to partners and Chase has both United and Southwest. Amex has more welcome bonuses to earn, but Chase has the Ink Cash card for great rewards at office supply stores. And for someone who primarily travels domestically, it’s hard to beat the value of a Category 1 or Category 2 Hyatt. I think Chase would likely be my program of choice for primarily domestic travel. There are lots of complexities to consider. I’m not really suggesting that you should earn Amex points instead of Chase points but rather I found it interesting to consider whether the savings of great airline partner programs outweighs the savings of the one great hotel transfer program.

The heart of my point here is that, at least for those who value premium cabin international travel, the savings possible with the best airline transfer partners can far outpace the savings of a good hotel transfer program. This example was based on 2 passengers, but the gap would widen substantially over 3 passengers (assuming the hotels allow for an occupancy of 3).

Bottom line

At the end of the day, I have no plans to choose whether to collect only Chase Ultimate Rewards points or only Amex Membership Rewards points — I’ll keep collecting both and taking advantage of the best opportunities that each has to offer. And I have no plans to stop redeeming Hyatt points to pay cash for the Holiday Inn Express. And I think that Dugroz Reports has a viewpoint that is very common: better to not pay for travel than to take away money that needs to go for more important budgetary concerns. I really picked a fight with Dugroz Reports here to reiterate that using points isn’t free and paying cash can sometimes cost you less (in the examples in this post, Dugroz Reports would be better off cashing out Chase points to “pay” for the hotels than transferring to Hyatt and either having points left over to use for another day or cashing out the difference in points and using it to cover other travel expenses like food and activities.

I refuse to choose between 10 good airline partners or 4 good airline partners and 1 good hotel partner because it isn’t necessary to do so — you can play this game and have your cake and eat it, too. And I think Hyatt is great — but I think it’s important not to overstate the value that Hyatt provides. I love it in conjunction with flight awards booked with my Amex (and Capital One and Citi) points — but I’d like it less if having it meant that I couldn’t have access to great airline transfer partner programs to pair with it.

[…] Update (Feb 10, 2023) – There was a comment at FM regarding these cards, which makes sense. “Likely in late April, Citi will restart the Prestige […]

[…] Update (Feb 10, 2023) – There was a comment at FM regarding these cards, which makes sense. “Likely in late April, Citi will restart the […]

Conclusion of this piece: the best credit card points program for hotels is the USB Altitude Reserve. That $150 you would spent instead of 20k Hyatt points is only 10k USB points. And it works on any hotel, boutique, chain, upscale, downscale. I stay at the big chains only because of free nights, but when paying cash I get so much more value from independent hotels, and they are usually in better locations (not biz districts or big resorts). Plus I get 4.5% back on all spending I do with the USB card.

[…] 2/9/23: A commentator on FM states this card will launch in late April and earning rates will surprise some. As always an […]

[…] 2/9/23: A commentator on FM states this card will launch in late April and earning rates will surprise some. As always an […]

Occasionally, my pants are rather fancy … 🙂

If I were forced to choose between only Chase or only AMEX, I’d still pick Chase based on my “Hamburger Joe” life of only intermittent travel, and mostly domestic. Paying 5,000 points per night to stay at something like the Hyatt Place in Normal, IL is going to come in handy way more often than something like using ANA to book round-trip business class to Europe.

HOWEVER … I feel like the big takeaway is that the “why not both?” mindset is the winner. And yes, I am willing to cash out points at 1 cent each to cover fees or make some other epic redemption possible!!!

Great discussion! Thanks Nick!

Anyone who has to say that much in order to prove a point has already lost the argument imho

I always enjoy these thought exercises about miles/points. Value is subjective with all things. That said, I do like the cents per point/mile expression of value, but I think this is only a fair valuation if it is assumed that the person would have otherwise paid cash for the thing if miles/points wasn’t an option.

That mode of calculation pretty much eliminates me from being able to assign a value to business class seats because I’d almost never buy one in the absence of an absolute fire sale (which itself would likely lower the cents/mile if that seat were booked with miles).

However, with my family enjoying and pretty much expecting one luxury beach resort vacation annually, there’s a real threat that I could end up paying cash for such a stay if I can’t manage something on points, so hotel point value is very real to me in this situation.

Also, frequently omitted from hotel points value is their tax savings. It’s not uncommon to see north of 20% taxes in some countries for resort stays. Folks calculating hotel points value on posted nightly room rate before taxes are vastly undervaluing the hotel points.

These are good points.

For example, I’m taking my Family to Europe this summer (for the 1st time!) and used 56,750 points per person one-way in business to get there. The flight costs $9,408 in cash. That’s over 16 cents per point!!!!

Is that awesome? YES!!! Would I ever in my life pay $9K per ticket one-way? Absolutely not!!!! 🙂

If you’ve never wanted to cash out (only) 331,506 URs for a $4,972.59 exclusive hotel stay on the Chase portal (that is not a Hyatt or other lp chain), I don’t think you will ever understand the real value Chase brings to the table that AMEX can’t at only 1:1 on their own

I think this is one of those objectively speaking, my subjective preferences are best met by x arguments.

Not all think biz/first class is worth paying extra. Just like not all people want to spend extra for nice cars. Like Sam Walton and other crazies.

Not all travel regularly or have a lot of excess cash flow, so fake currency should be spent broadly and comprehensively.

You guys do better than other blogs. I recommend hiring a kid out of college and making him/her travel the low end with a backpack. Like Insider does, but with points.

Someone mentioned that in this example there are more hotel options than flight options. It isn’t even close, from NYC to BRU there are only 3 airlines, so it becomes increasingly important to have point flexibility to have a comfortable flight and/or good value. Miles also help break up a round trip fare into segments which can work to one’s advantage. On the flip side one does not have to stay at a Hyatt. In fact, it is rare when a Hyatt (or chain) is located exactly where one needs it. As someone that likes to book a hotel close to the restaurants I go to, or places I visit, it is rarely that the best points value hotel is the closest. I have better options using a Hotels.com map view or even Airbnb to stay.

Lost in all this discussion is Nick’s original point: that it’s better to have 10 option for flights than to lose half of those options in order to gain the only good option for hotels. I’d argue that it’s specifically because Chase is the only transferable currency that still has a widespread hotel sweet spot that makes UR so valuable. BILT doesn’t count since there’s no way to generate large amounts of BILT pts.

You also don’t always have the option to pay the cash rate for hotels. I think examples have been made on this site of things such as using points to book during an event like a concert, college football game or Superbowl. Or using points to cover a last minute emergency stay in a pricey city. With Amex, there is 0 hotel options since you are better off buying Marriott or Hilton points rather than transferring from MR.

Again, choosing the ability to make a hotel redemption doesn’t mean forsaking all business class award redemptions. Nick’s article lists 4-5 good options for Chase… just not the 10. So I go back to my original point that having the ability to redeem for airfare and hotels offers more flexibility than just airfare alone. If CITI came out with a 3 cent per point value redemption on restaurants, would their points not have gained a lot more flexibility than if they added another airline?

Put it another way, if you wanted more airline redemption options, you can go with CITI, capitalone or Amex, if you want the single good alternative to paying cash rates at a hotel, you have Chase and that’s it. (I’m not familiar with Choice and Vacasa so I’m mainly talking Marriott, Hilton and IHG).

That being said, Chase is one Hyatt devaluation away from falling to 3rd or 4th place.

The bottom line though is that everybody has different travel priorities. Right now, for me, nearly all of my travel is domestic. I have enough points to fly across the world, but I don’t have vacation time (yay small business). I can work remotely, but that’s not easy to do from around the world when I’d have to work on normal time back home. It’s hard enough when I go two time zones away to the west coast,

Yes, you can max out better with Amex than UR. But for me, in my current situation, UR is better by a mile because of Hyatt…and I’ve even gotten worthwhile redemptions out of (rare) Marriott and IHG transfers for domestic stays.

Great post, but I don’t really get why these reflections neglect to include the ease and cost of acquiring miles in the analysis. There’s no point talking about which program is better to spend miles if, as part of the equation, you also don’t talk about which program is better to acquire miles.

Here, Chase wins hands down in my opinion. With a fairly achievable amount of spend ($6K in 3 months), you can get 110K UR (with referral from P2) every 3 months for $0 with the Inks. No hoops to jump through, no coupons to clip. I admit the value proposition will go down when they drop the offer back to its regular amount, the cost will still be $0, the MSR will still be lower than the Amex equivalents, and the haul of points will still be substantial.

With Amex, your only good, repeatable options are NLL Biz Golds and Biz Plats. The first problem with Amex is that the most achievable MSR option for most people is going to be the Biz Gold, and here I would say $10K in 3 months is starting to push the spending limits of most people who don’t/can’t MS. It’s even worse with the Biz Plat at $15K. Yes, maybe you can do that once or twice a year when it is tax time or you have some other huge bill, but it will be a stretch for regular people to do that once every 3 months.

Then you have the hassle of trying to negate the annual fee. For the Biz Gold, that’s not really possible. You have to eat $295 for your 100-140K MR. For the Biz Plat, you have the hassle of dealing with Dell and the restrictions placed on the airline incidental credits. You have to put in a fair amount of work to get your 150K MR down to $0, compared to Chase where it comes standard.

Great point! I ride the all of the trains, especially the INK train, and even the Biz Plat train.

This is my biggest issue with Cap1, Citi, and even Marriott.

So much noise around the Venture X…

Ok, ya got your sub, now what?

How are you going to replenish?

Wait, how are you generating “110K UR (with referral from P2) every 3 months for $0 with the Inks”? Those are insane numbers. That would buy an annual trip for both me and my girlfriend with almost no money out of pocket

Right now Ink Cash and Unlimited bonus is 90K plus you can get 20K for referral if going back and forth between P1 and P2. No AF, $6K spend in 3 months.

That offer isn’t there all the time, but it’s been going strong for months now.

This is a great discussion, and I’ve been thinking about it all day. For a minute, forget all the points analyses. I think it all boils down to this. What do you value more: 6-12 hours of great comfort in business class on the plane, resulting in a much better first vacation day, or 6-12 days of staying in a great hotel. Of course, the best answer is both, but it doesn’t always work out that way. Usually, we pick the latter (you know, the fancypants hotel), although I must confess to enjoying being spoiled in that business class section. But it’s really a personal decision, and it will drive your choice of cards and how you use your points.