NOTICE: This post references card features that have changed, expired, or are not currently available

This week at Frequent Miler, we launched new Reasonable Redemption Values to help you determine a baseline for the value of your points that helps you decide what to do both on the redemption side and now on the earning side as well. We also talked about how to get excellent value from your points, whether by using Virgin Atlantic miles to book Delta or by taking advantage of Citi ThankYou sweet spots. All that and more in this week’s Frequent Miler week in review.

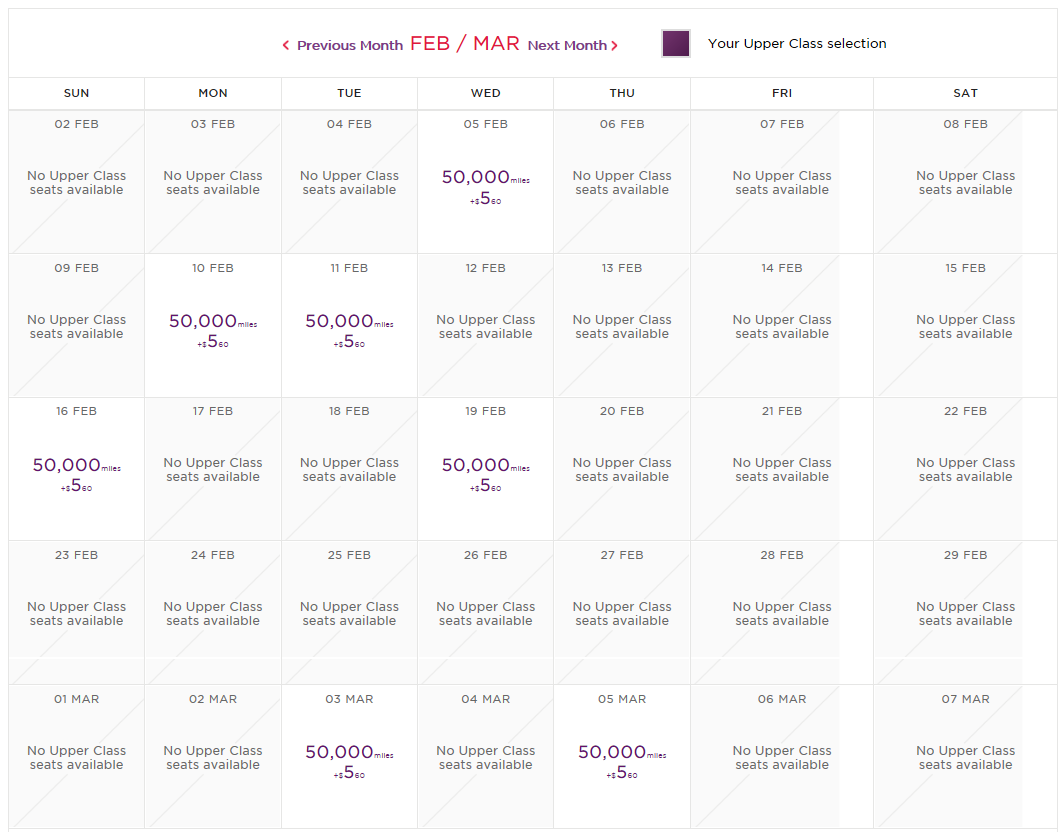

How to book Delta flights using Virgin Atlantic miles

One of the top sweet spots out there is booking Delta flights with Virgin Atlantic miles. That’s because Virgin Atlantic charges fewer miles and tends to have great availability for Delta flights. Stack a good deal like the current transfer bonus from American Express Membership Rewards, and you can save miles and fly up front for less. See this post for the complete guide about how to do it, with a handy table of contents at the top.

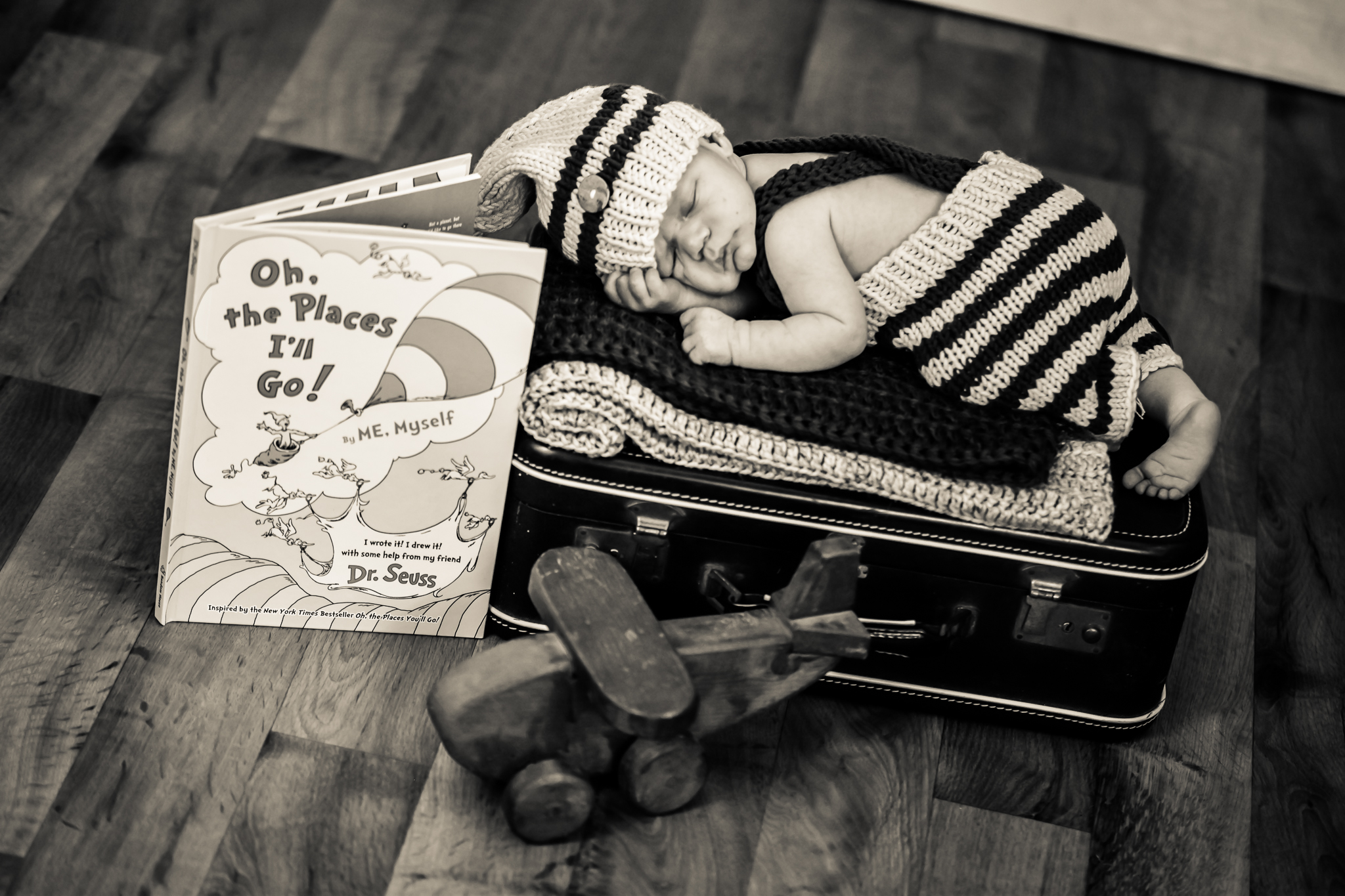

Aeroplan: a great program for lap infant award tickets [sweet spot spotlight]

If you’re planning to book lap infant award tickets, Aeroplan should be near the top of your list in terms of preferred rewards programs. That’s especially true if you intend to fly in business or first class, where Aeroplan offers one of the best deals for lap infants. See this post from more about how to do it.

Easy ways to get good value out of Citi ThankYou points

Citi ThankYou points are often dismissed as the little brother to big boy programs like Ultimate Rewards and Membership Rewards. However, Citi shares a number of top transfer partners with Chase and Amex. This post has a list of easy ways to get great value for travel within North America and to Hawaii, Europe, Asia, Africa, and the Caribbean. There are even more ways to get good value from Citi ThankYou points than those listed here, but here you have the quick and easy story for some simple methods.

Why I like using kiva for earning rewards and doing good

We live in a time when it has become easy to latch on to a hot fact or statistic to make an emotional argument rather than examining something fully. One of the things I love about this post from Greg is that he looks at multiple angles and provides research sources to give us further information to consider. Truthfully, I don’t know whether or not Kiva is doing any good in the world. However, the rational side of me can look at the cost of doing business in lending and how that cost has to be significantly higher (proportionally speaking) as the amount of a loan becomes significantly lower (and that’s to say nothing of the challenges that lenders face in developing countries in terms of currency fluctuation, travel to reach borrowers, etc). Most banks in the US won’t give you a business or personal loan for $250 (credit cards notwithstanding). Why not? My guess is that it’s because even if they charged nearly 30% interest, they can’t make enough profit to make that worthwhile. So high relative interest rates for Kiva’s micro lenders aren’t surprising to me. But forget about my layman’s opinion and check out this post to appreciate the time Greg took in reading the research as to whether or not micro lending is doing more harm than good and come to your own conclusion.

Did Amex drop the bomb on Simon Malls?

Reports indicate that purchases at Simon Malls are no longer earning any rewards on Amex cards. The new news is that it applies across the board to all Amex cards according to all the data points I’ve read starting from approx the first week of April. If you’re going to Simon Malls, I’d recommend leaving your Amex cards at home for now.

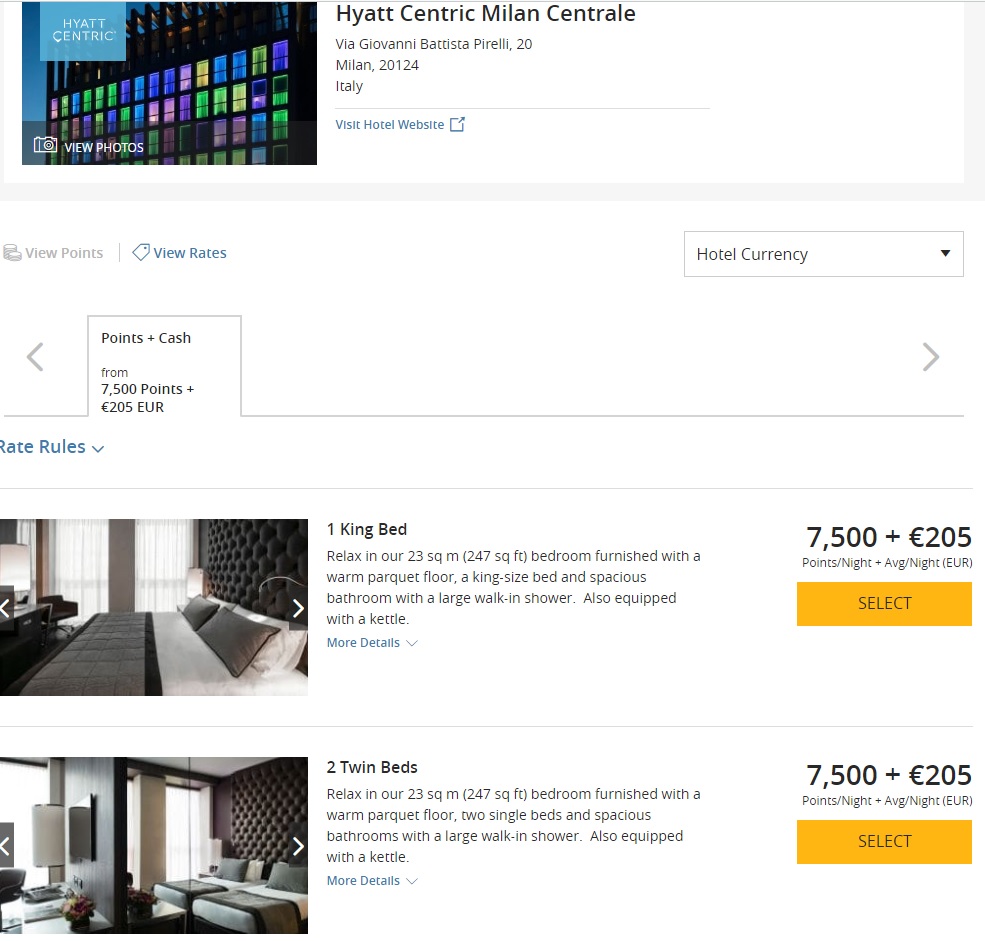

New Hyatt properties a reminder of an old trick

It’s always good to keep an eye on basic program rules so you can take advantage of opportunities to get good value. In the case of Hyatt, award rooms should be available for booking with your points if there is a standard room available at the Hyatt daily rate. This post shows an example of Hyatt’s website not showing those rooms available as award stays — but sure enough, rooms were bookable for Twitter (or over the phone).

A big change to Frequent Miler’s point values.

Our Reasonable Redemption Values have long been as objective a resource as I’ve seen in terms of determining how much your points are worth. So when Greg emailed me last weekend to say that we needed to have a video conference about an immediate need to change them, I was resistant. Then I got a preview of what he was working on and I understood why we needed to do something. Then it was a matter of figuring out how to make the necessary change in a way that didn’t result in too much wishy-washy subjective reasoning. Personally, I want those values to be numbers you can count on being reasonable without having to wonder where we got them. And in the end, I think we settled on a solid methodology that creates numbers that just made sense — and it’s always nice when the numbers support the theory.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

I follow your daily emails, however I would like to opt out of your Facebook group. How do I do that? Thanks.

Google is your friend…

Google is not anybody’s friend.