NOTICE: This post references card features that have changed, expired, or are not currently available

Good choices and bad ones, we’ve written this week about making choices in your rewards. Sometimes, it’s a no-brainer, but more often than not in this game, the answers are subjective. And in our hobby of miles and points, you really can “choose your own adventure”. Read on for our thoughts on the rewards landscape this week.

Rewards whiplash and my next new cards

Sign up bonuses can undoubtedly be a fantastic way to quickly construct a stockpile of points. But just as some prefer cash and others pick points, some pursue rewards earned the old-fashioned way: through everyday spending. How do you choose your rewards: is it based on a super credit card duo, or are you hoarding a little bit of everything and looking to cherry-pick? Do you focus on a specific goal — like a hotel or airline award or an amassed amount of cash back — or do you just collect what you can and decide where to go based on what you’ve got? Now let me ask you this: what would it take to switch up your strategy? What kind of card would shake it up and send you off in a different direction? Read this post to follow Greg’s reaction to this week’s big new credit card offering.

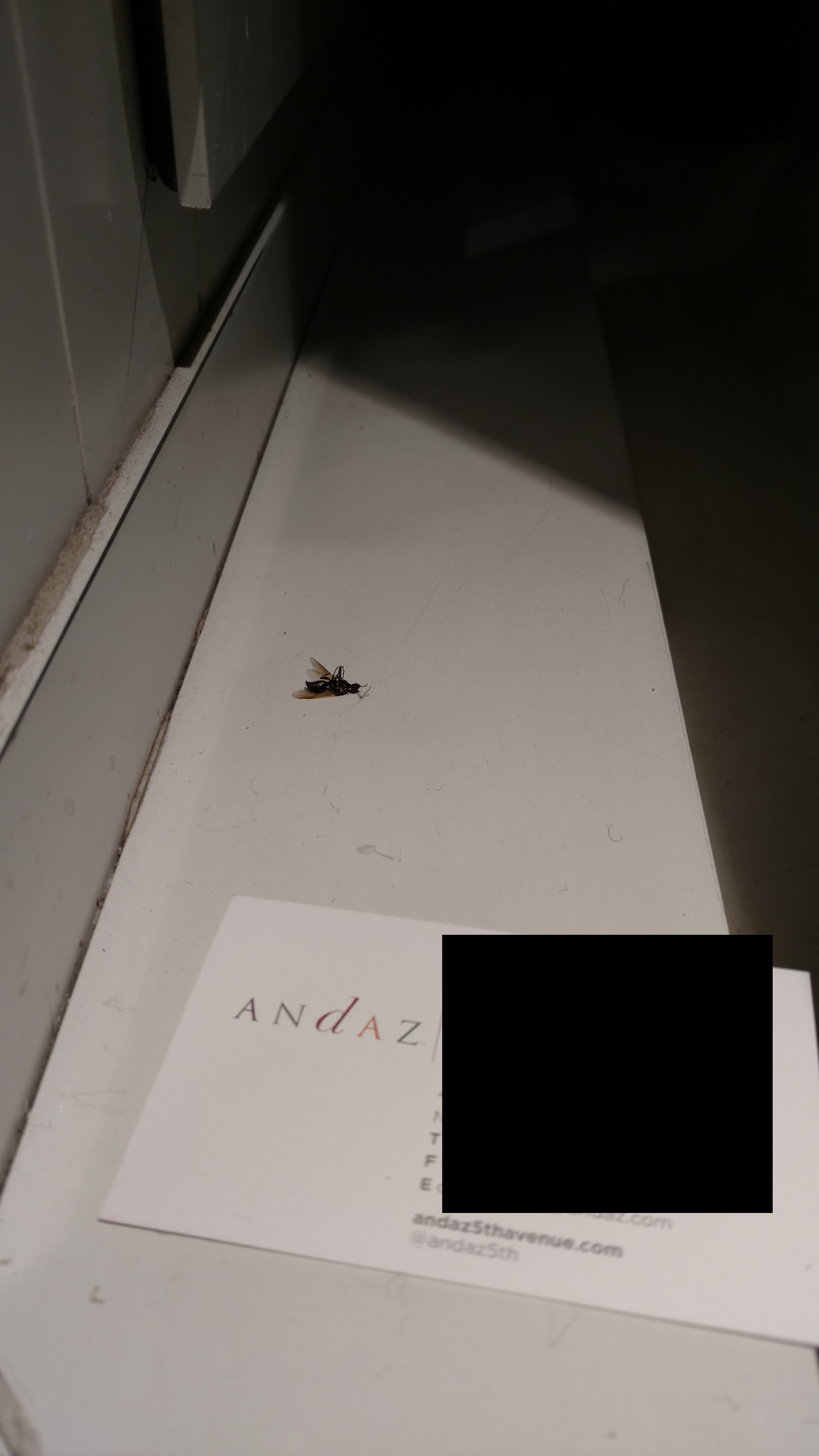

Is the Andaz 5th Ave Overrated?

One of the more heralded properties in the Hyatt portfolio is the Andaz 5th Ave in New York. I recently chose this property for a 2-night stay and put to use one of my Globalist tier suite upgrade awards. I was looking for a nice room in New York with a view of the Public Library. I expected to love it and return again this winter excitedly. Instead, I walked away wondering how this choice justified the price tag (spoiler alert: it didn’t). A large percentage of that price is tied up in the cost of real estate in midtown, but I don’t think it’s unreasonable to expect a clean room (or that management keep its promises in fixing shortcomings). Many readers weighed in with their experiences and recommendations and I plan to consider their advice when choosing my hotel for my next trip to the city.

1.2 million miles available through Top 20 offers

Before working here at Frequent Miler, I was a long-time daily reader. But I have to admit: I somehow missed the “next” button at the bottom of the Top 10+ offers. I also assumed that the top offers were chosen subjectively. I didn’t realize the (mostly) objective mathematics and automation involved in calculating our top 10+ offers page until I got here (I say mostly objective because one has to assign a value to things like 2 free Hyatt nights, though all such benefits are weighed fairly). This post explains not only how to view 20 (or more) top offers, but it also links to an explanation of the mathematics in our spreadsheet that automatically determines which offers you see listed in the top 10 or 20. Rankings are based on the first-year value of each card (considering its sign up bonus, additional bonuses, and the opportunity cost of using each card versus a cash back card for that minimum spend). Read on for more information!

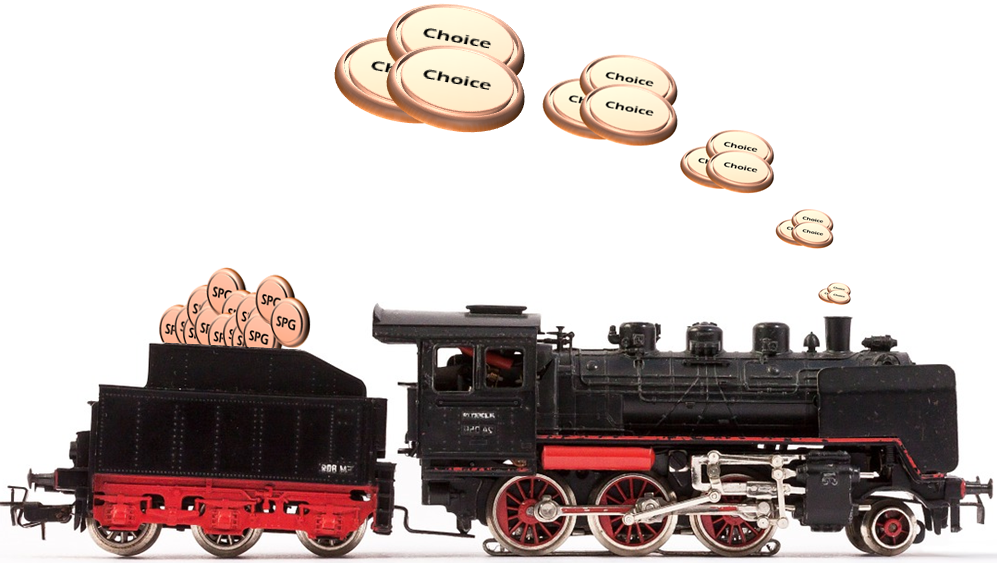

Transfer SPG 1 to 3 to… Choice?

Choice points might be my favorite dark horse currency. While I don’t use them often, the times when I do they tend to provide nice value. Nine times out of ten, I’d rather have SPG points — but on that tenth time, there’s a good chance I’m somewhere that Starwood isn’t — and chances are good that Choice is.

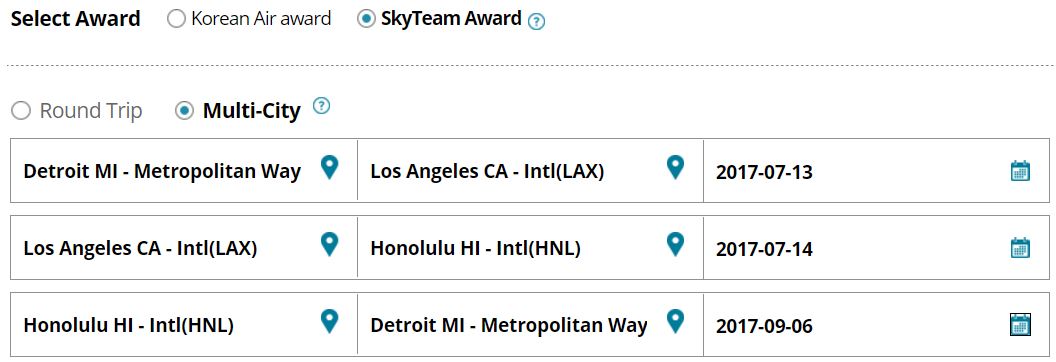

Piecing together Delta awards for great value to Hawaii and Europe

If I could pick only one vacation destination for the rest of my life, Hawaii would be it. You can’t get there via the most glitzy planes, and none of my ten favorite hotels/resorts are located there. It’s certainly not the least expensive tropical vacation destination. But Hawaii isn’t about where you stay or how you get there — it’s about Hawaii itself. From the rugged beauty of The Big Island to the white-knuckled drive to Hana to the laid-back beach towns of Oahu’s north shore, I could go back again and again. Except I can’t — unfortunately, it’s easier said than done since award space on the major US carriers can be scarce. With this handy trick, not only can you find greater saver availability — but you can get it for fewer miles. I haven’t yet been to Hawaii during White Pineapple season — but mark my words, one day I will. And this post outlines how I’ll probably do it. Or if you’re not interested in Hawaii, fill in the blanks differently and exploit this technique to find saver space on Delta to help you get to where you’d like to be.

The United Airlines prepaid card: MileagePlus Go. What to watch for…

Raise your hand if you like the words “reloadable” and “debit card” in the same sentence. Now put that hand back down on your mouse/keyboard/screen and click here. We don’t know much yet — but it looks like a new rewards-earning reloadable debit card is on the way. We’re dreaming of the possibilities, yet expecting reality may fall short of those wildest dreams.

The new king of everyday spend: Amex Blue Business Plus

Who saw this coming? Amex launches a new 2X everywhere card with no annual fee. What?!? Now, I’ll give this to the cash back contingent among us: it’s not cash back. Now that we have that out of the way, I’ll take 2 airline miles per dollar on the first $50K in spend for no annual fee thankyouverymuch. The ability to additionally use the points in conjunction with the Business Platinum’s pay-with-points rebate just sweetens the pot in terms of flexibility. That’s not a knock on cash back at all — cash back makes more sense for a lot of people and there are some great cash back cards on the market (I’m looking at you, Alliant). But I enjoy flying in business and first class when I travel, and the ability to choose between using Membership Rewards as miles or cash means I can pick the pricing scheme that works best for me.

Emirates honoring Maldives error fare! Call to reinstate

Finally, last week, I stumbled on a massive error fare. Someone at Slickdeals posted a cheap round trip from New York to the Maldives. When I realized that it was just the return leg that was massively discounted, we immediately got a quick deal out. We later updated you with more cities. I never expected this one to be honored — but many readers got a nice surprise in their email this week: Emirates is honoring the tickets. Even if your ticket was previously canceled by Emirates or your OTA, you should check this post about how to get it reinstated. Was it bad press, good will, or Dan’s encouragement to contact the DOT that caused the change of heart from Emirates? Who cares? If you chose to get in on this one, pack your bags, folks: you hit the jackpot.

That’s it for this week in review at Frequent Miler. Keep your eyes peeled for our week in review around the web and the end-of-month last chance deals.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

Please take me off of your promotion. I never signed up for anything. I do not want to be on your list.

Please take me off of this promotion. I did not sign up for anything. I do not want this. Please take me off.

We base our cards based on the best offers, public or targeted, available after we meet minimum spend on the last card. A work friend told me “always be working on minimum spend.” He’s been doing that five years straight and has more points than he can use anytime soon.