On this week’s Frequent Miler on the Air, Greg and I had a conversation about a speculative transfer to take advantage of the coming Bilt Rent Day transfer bonus (available 2/1/26-only). Specifically, Greg asked me at which level of status I’d be willing to go all-in and speculatively transfer all of my Bilt points.

He asked that question because the standard advice in this hobby has always been to avoid speculative transfers in favor of keeping transferable points flexible until the moment when you need them. I’ve generally subscribed to that school of thought, breaking with it only on rare occasion.

However, in a post-Mesa world, I’m looking at things a bit differently. I continue to collect many transferable points and keep most of them flexible, but the fact that I’m maintaining stashes in the major transferable currencies has me leaning in favor of prioritizing high-value transfers from less-established currencies. I’ll continue to cherry-pick with Amex, Capital One, Chase, and Citi points, but I’m more likely to lock in some easy wins where possible with my Bilt points, Rove miles, and whatever the next big thing may be. Does that mean I’ll transfer all of my points speculatively as soon as they come in? Not necessarily. I think I’m going to move some points to Accor on 2/1, and after my next Rakuten transfer comes in, I may similarly lock in some of the win by transferring at least part of that infusion to Hyatt or Alaska. I’ll probably keep some points on hand in the hopes of hitting a great future point transfer bonus, but I’ll also be satisfied with an above-average transfer to a program where I have a good chance of using points to solid value in a reasonable amount of time.

On the blog this week, learn how to maximize your Airbnb stays, stack a transfer bonus with a discount while timing a subscription, earn miles without flying and more.

This week on the Frequent Miler blog…

Bilt Rent Day for Feb 1: Accor transfer bonus & more free rent winners

For one day only, Bilt will be running a transfer bonus to Accor Live Limitless. This is an interesting bonus as even Bilt members with no elite status can get themselves $0.02 per Bilt point in value; those with Bilt elite status can do even better yet. That beats our Reasonable Redemption Value for Bilt points and can be a great deal if you’d like to stay at Accor properties, which include brands like Fairmont and Raffles at the top end as well as value options like Ibis and many others in between. On this week’s Frequent Miler on the Air, Greg asked me about speculatively transferring, and I think I might have talked myself into transferring enough points to buy a couple/few hundred dollars in Accor stays. Knowing that we have the next Rakuten payout coming soon and a Palladium welcome bonus up soon thereafter, I think I’m willing to make a speculative transfer while the deal is good.

For one day only, Bilt will be running a transfer bonus to Accor Live Limitless. This is an interesting bonus as even Bilt members with no elite status can get themselves $0.02 per Bilt point in value; those with Bilt elite status can do even better yet. That beats our Reasonable Redemption Value for Bilt points and can be a great deal if you’d like to stay at Accor properties, which include brands like Fairmont and Raffles at the top end as well as value options like Ibis and many others in between. On this week’s Frequent Miler on the Air, Greg asked me about speculatively transferring, and I think I might have talked myself into transferring enough points to buy a couple/few hundred dollars in Accor stays. Knowing that we have the next Rakuten payout coming soon and a Palladium welcome bonus up soon thereafter, I think I’m willing to make a speculative transfer while the deal is good.

65+ Ways To Earn Miles Without Flying

Consider Stephen’s post here to be an epic starter course on how to earn loyalty awards without flying around. The truth is that there are so many ways to earn miles without flying that there is room for many different strategies to get outsized value for your efforts.

How we increase spend to earn big card bonuses | Frequent Miler on the Air Ep343 | 1-30-26

Greg and I have talked before about ways to increase spend in order to meet spending requirements for new card bonuses, but this week we specifically talked about techniques that the two of us use and how we use them to achieve our spending goals and earn new card welcome bonuses and/or big spend bonuses.

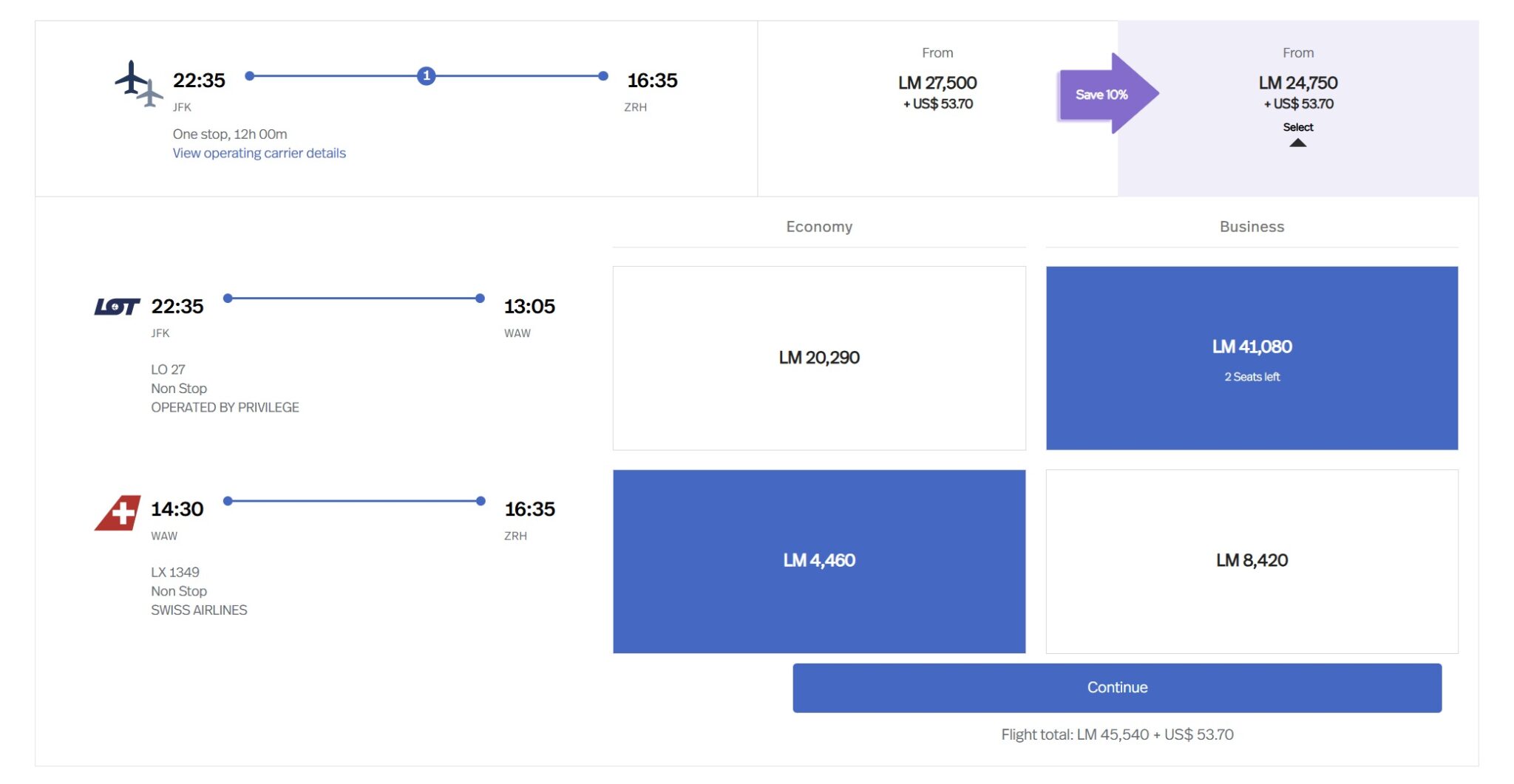

Another dance with a Lifemiles sweet spot and a Lifemiles+ subscription

Avianca Lifemiles long had a number of pricing anomalies on award tickets to/from Europe. At least one has returned (or maybe it hung around for a while), and I recently had occasion to make use of my Lifemiles+ subscription to save a nice chunk of miles on a business class award to Europe. However, I didn’t want to be on the hook for the Lifemiles cancellation fee if plans changed. In this post, I outline both what I booked and how I’m handling the Lifemiles+ subscription from now until we travel.

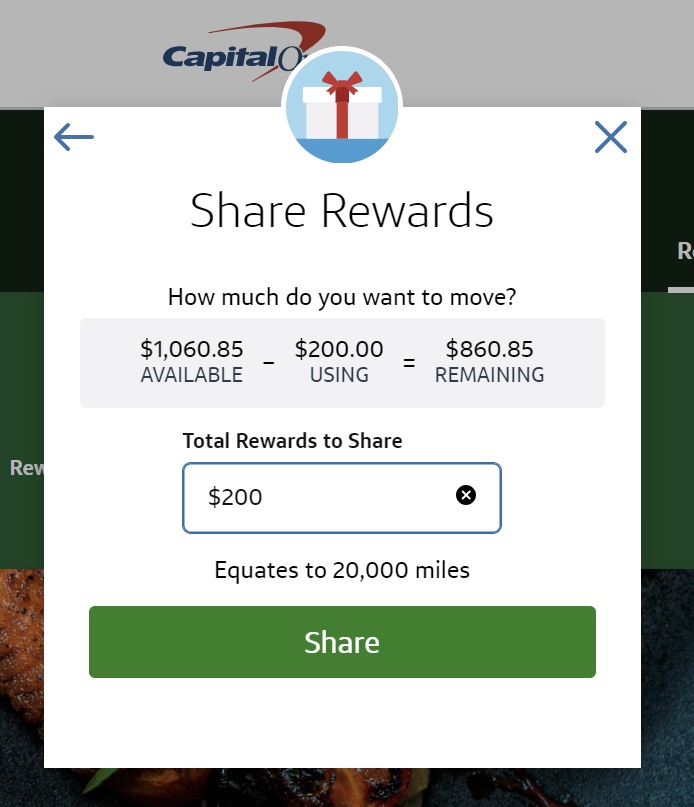

How to convert Capital One cash back to miles by moving rewards

Capital One offers cards that earn miles and cards that earn cash back. The cash back cards have a bit of a superpower in that, in addition to the ability to redeem rewards for cash, rewards can be converted to miles at a rate of $0.01 to 1 mile. Note that you can’t make that conversion in reverse. Still, with the right card, this makes it possible to effectively earn 3x miles on grocery and entertainment purchases if you want (while retaining the ability to instead redeem those rewards for cash back at full face value if you prefer).

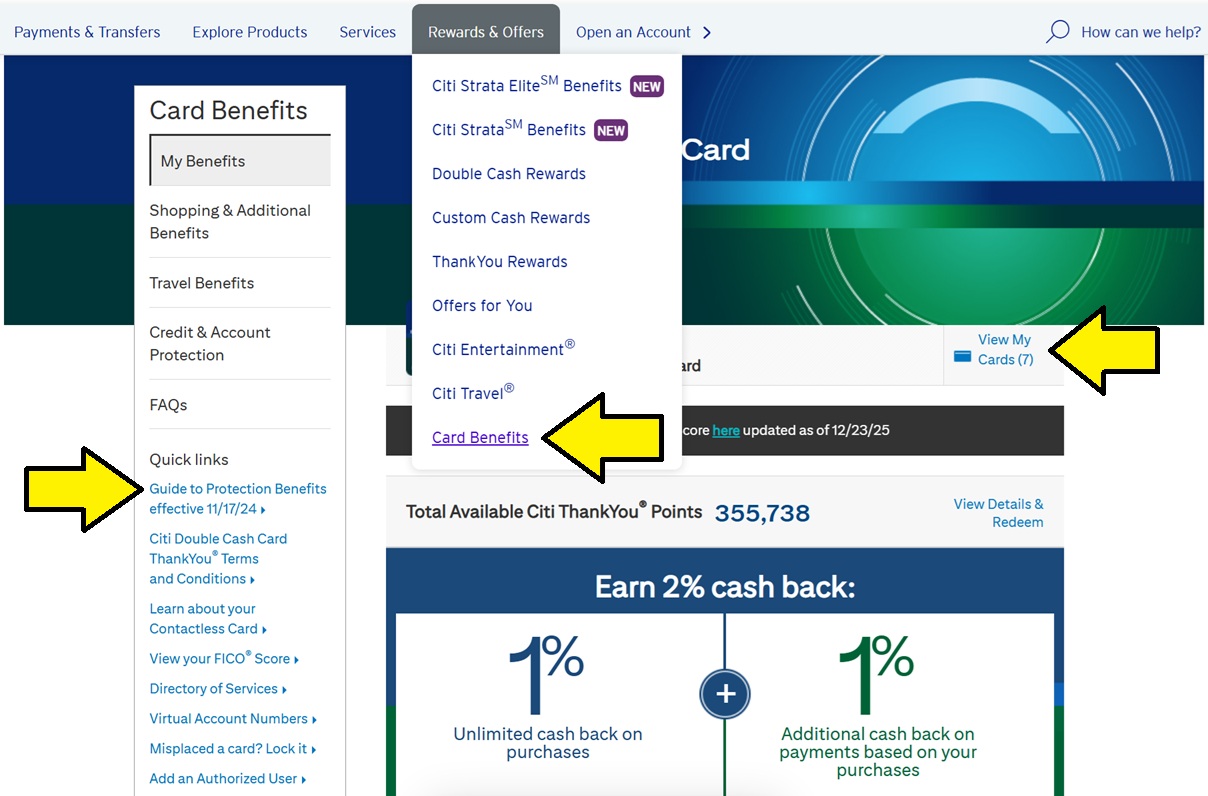

How to find credit card Benefit Guides online

When you get a new credit card, you’ll frequently get an accompanying guide to benefits in the mail. However, finding a card’s guide to benefits online can be much harder than you might expect. In this post, Greg has collected the various guides to benefits for most of the popular rewards cards on the market as well as instructions for how to find the guides to benefits for most of the major banks. This can be especially useful when you need to check the details to know whether there are any exclusions or other card terms.

London Hilton on Park Lane in a Deluxe Park Lane Suite: Bottom Line Review

Stephen’s review of the London Hilton Park Lane made for a fun read. While this property probably won’t fit into my plans any time soon, it was nonetheless cool to read about how both rooms enjoyed Diamond-level benefits, one was upgraded to a suite, and the lounge had free-flowing sparkling wine for hours on New Year’s Eve. All in all, this sounded like a very customer-friendly hotel.

How to earn rewards on Airbnb stays: Delta SkyMiles, BA Avios, Qantas points, or ANA miles

We commonly get questions from folks looking to maximize return on Airbnb stays, so in this post, Stephen has collected the various ways to earn miles on those stays as well as some gift card tips. While I rarely book Airbnb stays (I highly prefer a hotel), when I do book them, I always go through British Airways for the double Avios per dollar spent.

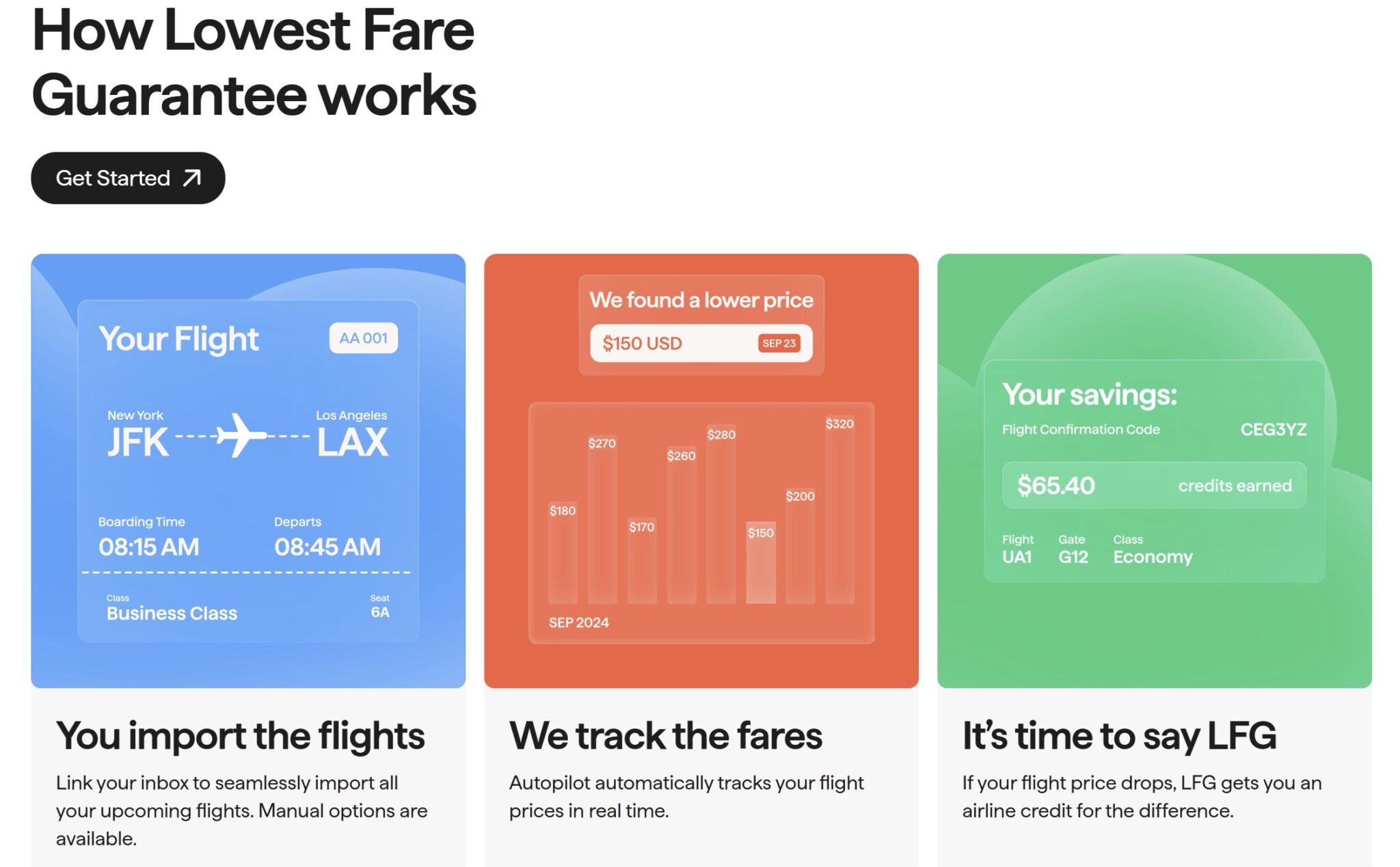

A first look at Autopilot: Automatically reprice flights when the price drops

Someone recently put a tool called Autopilot on my radar. This is an automated tool that searches for better deals on your already-booked flights and then automatically re-prices them when possible. There are downsides to this model: you’ll end up out of pocket for more money in exchange for more airline credit if the cost of your flight drops, and if you aren’t sure that you’ll be able to use the credit before it expires, then you’d surely not want to pay for that credit. But for some folks, I think this could work out to be a really useful tool.

Bilt Cash: Couponization to the Max | Coffee Break Ep90 | 1-27-26

We finally have a clearer idea of what Bilt Cash looks like, and, as we kind of expected, it is a pile of coupons, each with various limits and restrictions. Nonetheless, some of these will be useful for some folks. As we note during this coffee break episode, it’ll certainly make sense to use your Bilt Cash in situations where you know you’ll be spending the money otherwise, since that will be the best way to get full value out of Bilt Cash. However, it is also clear that 4% back in Bilt Cash won’t quite be like cash. Nonetheless, I’ll be happy for those times when a good use converges with natural spending patterns.

Uber: How to earn Avios, Aeroplan points, Flying Blue miles, & more on rides internationally

I hadn’t realized that Uber has so many partnerships that allow for the earning of miles based on rides taken in specific foreign countries. I’m not sure that I spend enough on rides for the return to be consequential for me in any of these countries, but I could see the partnership with Air Canada Aeroplan being of particular value for regular visitors to our northern neighbor.

Bilt 2.0 rewards you most when you spend less

When Bilt launched its second rewards option, I had to question whether the calculus as they determined the numbers on the newer option. Oddly, as Tim points out very well in this post, the system is designed to be most rewarding for those whose spend is 25% of their housing payment or less. That made me laugh since, presumably, the idea here was to get consumers more engaged with the program — rewarding them less generously as they engage more is an odd choice. Still, as Tim shows, there are opportunities to earn outsized value for those willing to crunch the numbers.

How to navigate Frequent Miler’s Best Offers (Video)

Our Best Offers page can be a bit overwhelming to those who aren’t familiar with the format and formulas. In this how-to video, Greg and I explain how to use and make sense of the information on the Best Offers page, from the value of spending category bonuses to the valuation of first-year benefits and the determination of first-year value.

Shortcuts to Marriott Elite status (2026)

This post has been updated for 2026 with all of the known shortcuts to achieve Marriott elite status. With the right two credit cards, you can be reasonably close to meaningful Marriott elite status before your head has touched a bed, though this post also outlines other easy paths to Marriott status.

That’s it for this week at Frequent Miler. Keep a close eye on this week’s last chance deals as we enter a new month.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)