Two ultra-premium Marriott Bonvoy credit cards offer annual free night certificates good for any hotel that is available for 50,000 points or less. One is the Bonvoy Brilliant Amex Card. The other is the Ritz Card from Chase. The Ritz card is no longer available to apply new, but it may still be possible to product change from another Chase Marriott consumer card. Both cards cost $450 per year. Each card offers $300 in statement credits to partially offset the annual fee: the Brilliant card offers $300 in annual credits for any Marriott spend whereas the Ritz card offers $300 in airline fee reimbursements. At $450 per year, I’d argue that the annual free night should be worth considerably more than $150 to consider these cards a good value. Of course, that’s dismissing other perks like Gold status and Priority Pass, but Gold status isn’t worth much, and many of us have Priority Pass from other cards.

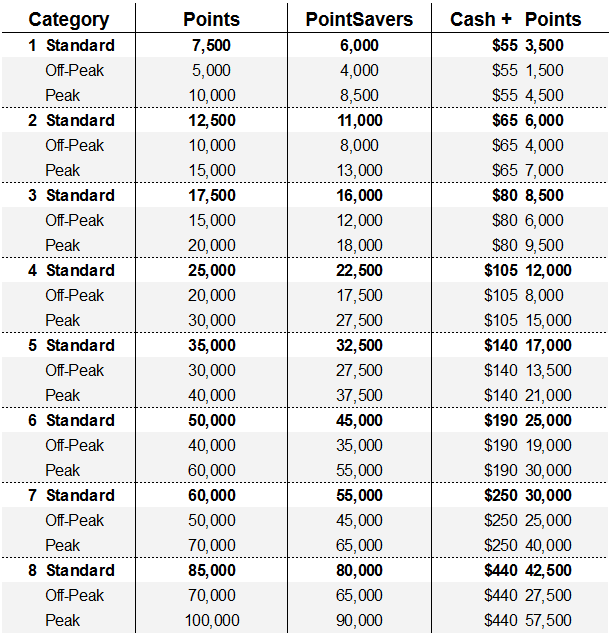

Two recent developments have made the Marriott 50K certificates less valuable than before. One is the introduction of Peak pricing. Category 6 hotels cost 50,000 points standard, but their price jumps to 60,000 points during peak pricing. The 50K certificates can’t be applied to 60K award nights. The second development was the announced March 4 2020 category changes. On that day, 94 hotels will move from category 6 to 7 while only 9 will move down fro category 7 to 6. Category 7 hotels can be booked with 50K certs only when they are priced off-peak.

Before these two changes, I’d argue that 50K certs where extremely valuable. I used mine at hotels that would have cost nearly $500 per night. Now it’s obvious that the value has declined, but by how much? Let’s dig in and find out…

The value of Marriott 50K certificates

I found that 50K certificates are worth approximately $300 as of March 4th 2020.

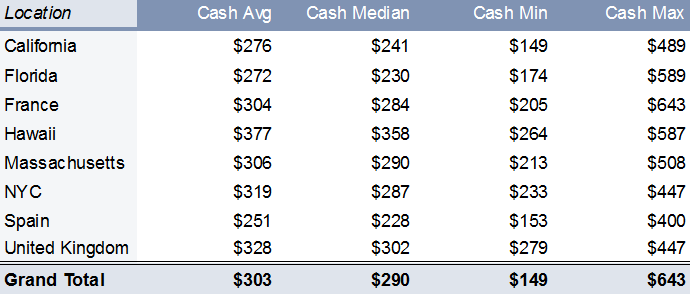

Across a number of locations and dates, I found that 50K certificates were worth an average (mean) of $303. The median (central) value was $290.

Where did these numbers come from?

I picked a number of locations and dates to find the best hotels bookable with 50K certificates and recorded the cash prices of each…

Locations

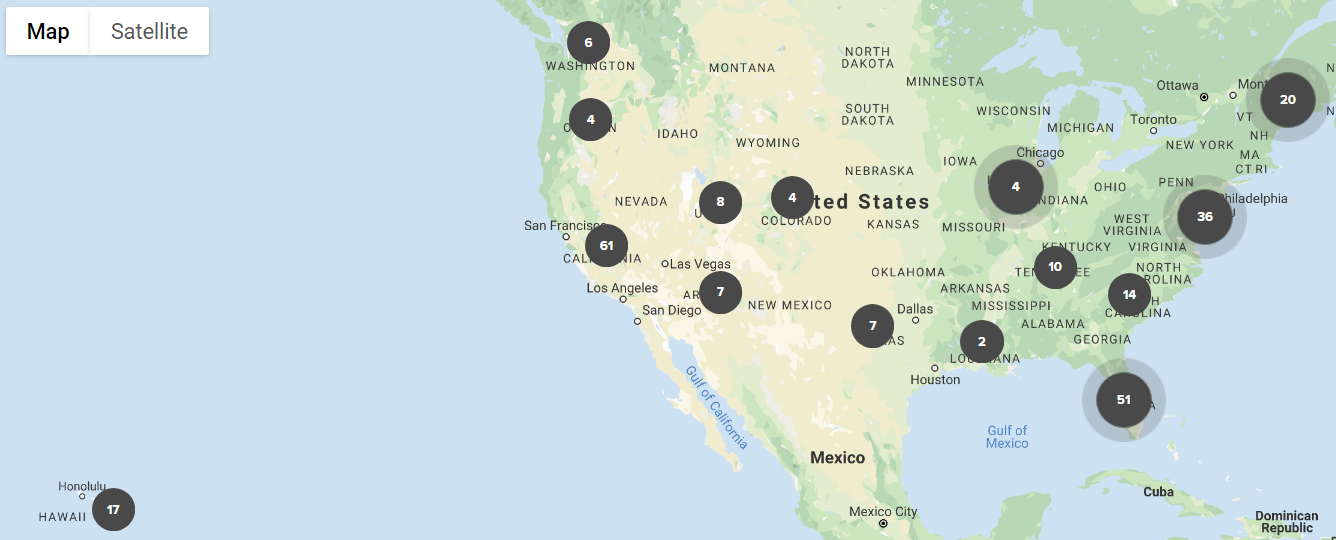

I used Marriott’s “Browse by Destination” page to find which locations in the United States and Europe had the most category 6 hotels. I did this because category 6 hotels cost 50K points standard.

Even though the current list represents hotels that are category 6 prior to March 4th, I figured that this still gave me a good idea of where the most category 6 hotels will be even after March 4th. Plus, those that change will move to category 7, whereupon they’ll still be bookable with 50K certs when priced off-peak.

Here are the locations I selected:

| State or Country | Property Count |

| California | 61 |

| Florida | 45 |

| New York | 18 |

| Hawaii | 17 |

| Massachusetts | 16 |

| United Kingdom | 15 |

| France | 10 |

| Spain | 10 |

Note that when I did a similar experiment with 35K certs, I searched for properties in the New York City area rather than New York State. To keep things comparable, I did the same here.

Dates

Following the precedent set in my 35K cert analysis, I picked the following dates for check-in and I looked only at one night stays:

- Friday May 1st (shoulder season weekend)

- Saturday July 4th (high season US holiday weekend)

- Wednesday October 14th (ordinary business day in the US)

Inclusions

As you can see in the above award chart, 50K certificates are best used for category 5 peak priced hotels (40K), category 6 standard (50K), category 6 off-peak (40K), and category 7 off-peak (50K). As a result, I included categories 5, 6, and 7 in my search criteria, but only recorded an eligible property when it was available on points with a price above 35K and equal or less than 50K.

Procedure

For each location, I searched Marriott’s website for category 5, 6, and 7 hotels and recorded the point price and cash price of the three best user-rated hotels bookable with a 50K certificate. I didn’t include hotels priced 35K or lower since those are bookable with 35K certificates. I also didn’t include hotels that will increase to a price above 50K on March 4th, but I did include hotels that will decrease.

Here are the steps I followed on Marriott’s booking page:

- Enter location, date, and select “Use Points / Certificates.”

- Sort results by Guest Rating

- Find first three hotels that match this criteria:

- Point price is 50K or less, but greater than 35K (and currently bookable with points)

- Hotel will not increase in price to above 50K on March 4th*

* To determine whether hotels will increase above 50K on March 4th, I used the following heuristic: If the current price is 40K or less, then I assumed that it won’t cost more than 50K starting March 4th. For example, if it is a category 6 property that is priced off-peak (40K), my assumption is that even if it moves up to category 7 it will still be priced off-peak (50K). With any property priced 45K or 50K, I checked to see if the property was going to move up to category 7. If so, I eliminated that property from the results and moved on to the next qualifying property.

Random Notes and Findings

- Most hotels that met the criteria were priced at 40K. Here are the counts:

- 42 40K hotels

- 28 50K hotels

- 1 37.5K hotel

- In Hawaii I only found 2 properties that met my criteria on July 4th.

- One hotel in Paris, Renaissance Aix-en-Provence Hotel, appeared to be available for points but was sold out for cash so I didn’t include that datapoint. Weird.

Methodology Issues

There’s no perfect way to calculate things like this. Here are some issues with the way I did it…

- Limited locations and dates: More data is always better.

- Rough approximation of hotel cost:

- I didn’t use any special rates (AAA, senior discount, etc.)

- I didn’t factor in the extra cost of taxes and fees which aren’t shown in the initial search results

- I didn’t factor in that you would earn Marriott points on paid stays (I like to think that this issue and the one above offset each other)

- I didn’t factor in rebates from credit card rewards or shopping portals

- I didn’t weed out category 5 peak priced hotels that are going up to category 6: I included all 40K datapoints that met my search criteria. Unfortunately, in many cases these were peak priced category 5 hotels. The reason that’s an issue is that some of these hotels will move to category 6 and may still be peak priced (60K).

Despite the issues indicated above, I think that the results are good enough to estimate 50K certificate value.

Conclusion: Marriott cards offering 50K certs are still an OK deal if you can find 40K-50K hotels where you want to stay

If we concede from the above results that 50K certs are worth about $300, then we can say that both of the ultra-premium cards offer about $600 in travel value each year: $300 from statement credits plus $300 from the 50K cert. Looked at that way, the $450 annual fees are worth paying.

That said, in some cases I had to scroll way down the results to find eligible datapoints. After having sorted by guest rating, this meant picking some properties with poor reviews. It’s hard to argue that the 50K certificates are worth $300 if you have to stay in terrible hotels to get that value. I intend to follow-up with new analyses that include only hotels in good locations and with good reviews. Until then, I think it’s fair to say that you can get $300 in value from your certificate, but maybe not if you’re picky about where you stay.

More Information:

Mini Rant: We’ve been #Bonvoyed again.

Marriott’s peak pricing has made their free night certificates far less valuable than before. 60% of the properties that met my criteria were priced 40K or less (one was 37.5K). The vast majority of these were category 5 hotels with peak pricing. The reason there were so few 50K properties is that most of the good category 6 hotels were peak priced during the random dates I had chosen!

This means that in most real world cases, you’ll be using your 50K certificates for a good category 5 hotel rather than a category 6 hotel. In other words, the 50K certificates are now worth approximately what the 35K certificates were worth before peak and off-peak pricing was introduced. That sucks. We have the same problem with 35K certs but it seems a little less severe in this price range. That is, I found more standard priced 35K nights than standard priced 50K nights. But in some locations (Florida and California, for example), the peak pricing issue is just as bad or worse at 35K.

This is just one of the many reasons I prefer Hyatt over Marriott. When Hyatt announced peak and off-peak pricing, we learned that their free night certificates would continue to be category based rather than point based. This means, for example, that their category 4 certificates can still be used at category 4 properties even when peak priced. Marriott kept their travel package certificates category-based, but not their credit card free nights. That was a bad move.

Marriott can fix this issue easily. Either go back to issuing category based certificates or allow people to mix certificates with points. For example, when category 6 hotels are peak priced, Marriott could let us apply a 50K certificate plus 10K points to book that 60K night. In fact, it would be great if they would simply treat the certificates like points so that we can use a 50K certificate to book one 50K night or two 25K nights or one 85K night by adding 35K in points.

[…] I separately determined that 35K certificates are worth about $200 and 50K certificates are worth about $300. In researching the value of 50K certificates, about 60% of the best uses for those certificates […]

[…] above, I previously found that 50K certs are worth about $300 each towards free nights (see: What are Marriott 50K certificates worth?). For the purpose of estimating the welcome offer’s first year value, though, I estimated […]

[…] What are Marriott 50K certificates worth? […]

[…] wrote on FrequentMiler about Marriott 50K free night certificates and what they’re worth. While his calculations are based on a set number of dates and properties, it will give you an idea […]

[…] How Much Are Your 50K Marriott Certificates Worth?: With a couple of Marriott premium cards offering annual 50K free night certificates, what value would you assign to them? Throw in the fact that Marriott has Peak pricing… does that change the value of your free night certs? […]

I wonder when (and if) Marriott will realize the economic benefits of brand loyalty. There is an expiration date on these certificates (even if some are extended) and that is a negative for the consumer but a positive to Marriott. If Marriott doesn’t change to allow their certificates to be used by category, instead of points, they are making it much less of an incentive to keep their cc. We have two business Marriott cc in our household and I’m seriously considering canceling them when it comes up for renewal. I’m paying $95 for the opportunity to be locked in to use a free night within a year for a room that at max might go for $300. It is just not worth it. We’ll see what Marriott does….

On a separate topic, but involves Bonvoyed.

If you buy the current points at 0.0083 and then wait for the hotel transfer sale of 30% to United miles (35,750), then you, in essence, are buying United miles ~0.014?

By far better than the best United miles sale @ 100%?

This is based on the last 2 years where United has a hotel transfer rate of 30% around October of each year (you probably have better stats?). This last year, United had the sale @ 30% transfer and Bonvoyed had a 30% sale making buying United miles @ ~0.0146.

What is your take?

Does $300/50,000pts = ~0.006

So can we say that Bonvoyed are now worth ~0.006?

If so, that is a huge devaluation and make the current points sale @ 50% (~0.0083) very expensive?

If this holds water, then like I have been saying all along, the Bonvoyed points are only good for airline transfers?

Unless, you can find a needle in the hay stack, like the one in Philadelphia?

Don’t confuse the value of the certs when used to their full potential for the value of their points equivalent when used as you normally use them.

I prefer setting a points valuation based on past stays snd how much it’d cost – after deval – in points and cash under similar circumstances (booked close-in or far ahead, in-season dates or not, etc.). Set a preferred value of the cert based on what’d make the card worth keeping (not forgetting things like the Amex 5-card limit – that slot is worth something). Then when you book:

Say you have the following properties available:

Cat 1: 7,500 pts / $80

Cat 2: 12,500 pts / $110

Cat 3: 17,500 pts / $130

Cat 4: 25,000 pts / $160

Cat 5: 35,000 pts / $220

You are looking to book 2 nights. Your budget is $150/night, and you would be happy at the Cat 3 or 4 here. You have a Boundless, are Silver Elite, and have a 35k cert. You normally get 0.8cpp from points and want at least $150 from a 35k cert, and so are using those numbers as your opportunity costs when using them.

The total costs (including earnings and opportunity costs) for all your options are:

Cash only (assuming 0% tax):

Cat 1: $80×2-80×2×11×$0.008=$145.92

Cat 2: $110×2-110×2×11×$0.008=$200.64

Cat 3: $130×2-130×2×11×$0.008=$237.12

Cat 4: $160×2-160×2×11×$0.008=$291.48

Cat 5: $220×2-220×2×11×$0.008=$401.28

Points only

Cat 1: 7,500×2×$0.008=$120.00

Cat 2: 12,500×2×$0.008=$200.00

Cat 3: 17,500×2×$0.008=$280.00

Cat 4: 25,000×2×$0.008=$400.00

Cat 5: 35,000×2×$0.008=$560.00

Cash & Points:

Cat 1: $80-80×11×$0.008+7,500×$0.008=$132.96

Cat 2: $110-110×11×$0.008+12,500×$0.008=$200.32

Cat 3: $130-130×11×$0.008+17,500×$0.008=$258.56

Cat 4: $160-160×11×$0.008+25,000×$0.008=$345.92

Cat 5: $220-220×11×$0.008+35,000×$0.008=$480.64

Cert & Points:

Cat 1: $150+7,500×$0.008=$210.00

Cat 2: $150+12,500×$0.008=$250.00

Cat 3: $150+17,500×$0.008=$290.00

Cat 4: $150+25,000×$0.008=$350.00

Cat 5: $150+35,000×$0.008=$430.00

Cert & Cash:

Cat 1: $150+$80-80×11×$0.008=$222.96

Cat 2: $150+$110-110×11×$0.008=$250.32

Cat 3: $150+$130-130×11×$0.008=$268.56

Cat 4: $150+$160-160×11×$0.008=$295.92

Cat 5: $150+$220-220×11×$0.008=$350.64

Best for Cat. 1: $120 (points only)

Best for Cat. 2: $~200 (cash, points, or cash & points)

Best for Cat. 3: $~237 (cash)

Best for Cat. 4: $~291 (cash), $~296 (cert & cash)

Best for Cat. 5: $~351 (cert & cash)

Your Cat. 3 and Cat. 4 are under budget. I’d book the Cat. 4 to get rid of the cert and keep more cash in my pocket.

The $50 extra to stay the Cat. 5 sounds good, but $55 is what you added to the AF to arrive at the value of the cert. And that’s how they get ya!

Since points are best used on lower-category properties and certs are best used on higher-category properties, you can’t use the face value of certs as the basis for points valuations – unless that’s the category you normally stay at.

Thank u Greg for this valuable analysis!

I see your point and agree.

U R the man!

No, this is Patrick.

(Actually, this is George… who is definitely not Greg.)

My apologies George. Thx!

Was just looking at options in Paris to use my 50k certs in October and the value was dreadful compared to only a year ago 🙁

It’s becoming a challenge (Kinda headache) using these certificates including Hyatt and I like the idea of supplementing the difference with points. We used to like to use the 50k Cert at RC Ft Lauderdale but that increased so last year stayed at Marriott Harbor Beach Ft Lauderdale. Also hate that expiration date even when we extend it!

I found points prices also change during the week which can put you over or under the 35k/50k threshold. Marriott should let us top up a certificate when this happens. Otherwise people will equate them to nothing.

The certificate should be treated as a financial option. The option, if exercised, can realize certain intrinsic value (a range of outcomes as described in the article). However, this option has a number of restrictions (expiration date, non-transferability, etc.) that limit its value. On the other hand, it also has so-called “time value” (i.e. its holder has some flexibility when to exercise it), like almost all other financial options.

A redditor scraped the site for data and put it in a spreadsheet to find the value of 35k (not 50k) certs, doing some light data analysis of their own. I took it and did some more analysis.

AFAIK it’s limited to US properties.

Some averages from that:

Cat 5 Std (35k): $227 (n=44)

Cat 5 OP: $168 (n=18)

Cat 4 Peak: $225 (n=63)

30k: $212 (n=81)

30-35k: $217 (n=125)

[what it gets you that the (old) 25k cards don’t]

0-35k: $173 (n=586)

————————-

Cat 6 Std: $398 (n=12)

Cat 7 OP: $475 (n=1, so heavy grain of salt)

50k: $404 (n=13)

Cat 6 OP: $416 (n=4)

Cat 5 Peak: $318 (n=26)

40k: $331 (n=30)

40-50k: $353 (n=43)

[what it gets you that the 35k cards don’t]

0-50k: $186 (n=629)