At Frequent Miler, we keep a database of point valuations called “Reasonable Redemption Values.” These are estimates of the “worth” of airline miles, hotel points, transferable points, and more. The idea is that we try to identify the point at which it is “reasonable” to get that much value or more from your points.

This information is critical for making informed decisions. In fact, it’s a key component of the First Year Value information shown on our Best Credit Card Offers page, and it’s similarly used to show which cards offer the best value for everyday spend and which offer the best category bonuses.

Wyndham charges either 7.5K, 15K, or 30K per night for their hotels, making them one of the rare chains that still has fixed prices for their hotels, with no peak or off-peak modification. Having only three award categories, combined with Wyndham often making multiple room types available for the same points price, means that there can be quite a bit of variation in award value.

When we first started looking at the value of hotel points, we used a laborious process that involved manually comparing the cash and award prices of hundreds of stays each year, then using those results to create RRV estimates. However, we now have a much better way of pinning down the value of Wyndham points.

Gondola is a terrific free hotel search tool that shows prices of properties both in cash and in points, and it keeps data of both for searches done via its platform.

The kind folks over at Gondola have made this data available to us for the purpose of identifying hotel program point values. Thanks to them, we now have access to the results of around 3.2 million domestic and international Wyndham award searches at over 7,000 different properties, and each one notes both the cash and award prices for the same room. Using this data, we can provide a far better estimate of the “Reasonable Redemption Value” of Wyndham points than we were ever able to obtain by using manual calculations.

Background

When collecting points and miles, it’s always a good idea to have a general idea of what points are worth. Let’s say, for example, that you have the opportunity to either earn 2,000 Wyndham points or 3,000 Hilton points. Which should you go for? If you don’t know what the points are worth, you’d likely go for the Hilton points. But, in our analyses, we’ve found Wyndham points to be worth almost twice as much as Hilton points. Therefore, on average, 2,000 Wyndham points are worth considerably more than 3,000 Hilton points. In this post, you’ll find our best current estimate of the value of Wyndham points.

Methodology

In order to determine the value of Wyndham points, we looked at Gondola’s collected, real-world cash and point prices for over 7,000 properties. Since Wyndham award bookings are fully refundable, we excluded data from all cash rates that were non-refundable in order to make it a complete apples-to-apples comparison. We also used the Total Cash Rate, which includes taxes and any local fees.

Hotel Programs that Waive Resort Fees on Award Stays

Hilton, Hyatt, and Wyndham waive resort fees when you book stays using points or free night certificates. For these chains, the resort fee does not have to be considered separately from the Total Cash Rate (which includes the resort fee). So, the RRV calculation is as follows:

RRV = Total Cash Rate ÷ Point Price

Hotel Programs that Charge Resort Fees on Award Stays

IHG, Marriott, and many other hotel programs impose resort fees on award stays. For these chains, the resort fee must be specifically taken into account in the calculation. We do that by having Gondola subtract it from the Total Cash Rate. The RRV calculation is as follows:

RRV = [Total Cash Rate – Resort Fee] ÷ Point Price

Gondola Data

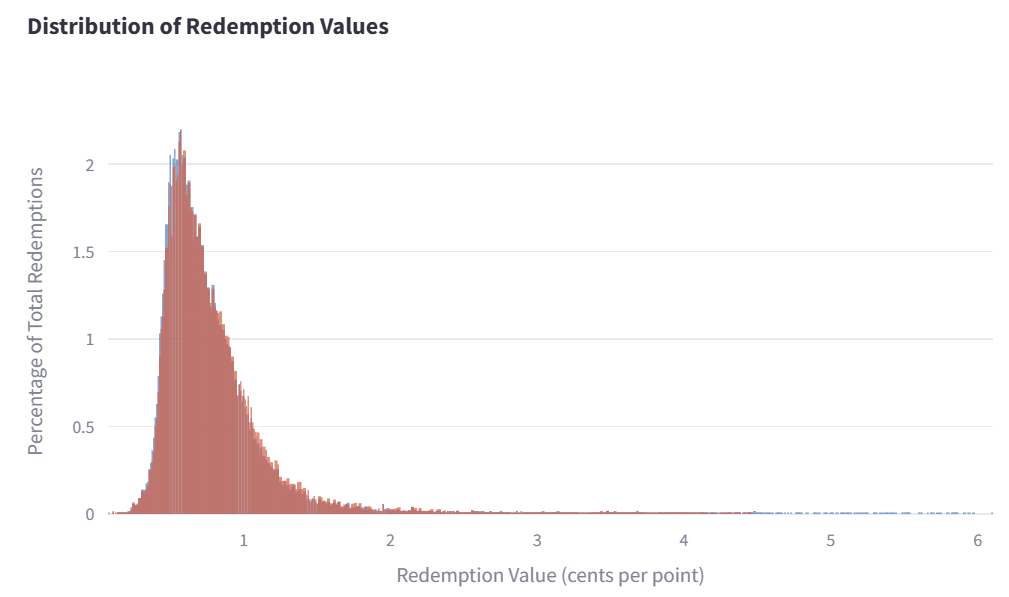

For our hotel RRV values, we use the median value we see based on the data from Gondola. If the median is 1 cent per point, meaning that half of all searches produced a value of less than 1 cent per point, and the other half above 1 cent per point.

- Gondola Median Observed Value for Wyndham Hotel and Resort redemptions: 0.7 cents per point

(based on data as of August 8th, 2025) - Range: .24 to 3.78 cents per point

Again, the red line indicates data for refundable rates, while the blue line shows data including non-refundable rates.

Brand Comparison

Another cool feature of the data set that Gondola provides for us is that we can actually see how point values vary across a program’s different brands. There’s some variance among Wyndham’s brands. Here are some of the most notable examples, with brands that ranged from 0.65-0.75 cents per point left out:

| Brand: | RRV | Difference |

|---|---|---|

| Dolce | 0.94 | +34.2% |

| Wyndham | 0.82 | +17.1% |

| Ramada | 0.80 | +14.2% |

| Wingate | 0.76 | +7.9% |

| Baymont | 0.64 | -8.6% |

| Days Inn | 0.64 | -8.6% |

| Super 8 | 0.62 | -11.5% |

| Fën | 0.52 | -25.8% |

There’s not a massive amount of variation among the major Wyndham brands. However, it’s worth noting that, among the big ones, Wyndham, Ramada, and Wingate on average offer around 25-35% better value on points redemptions than the (even more) budget-oriented Baymont, Days Inn, and Super 8 brands.

The biggest negative outlier is Fën Hotels, which is a South American brand that Wyndham acquired in 2016. On the flipside, the brand with the most outsized value is Dolce, which has 18 higher-end properties scattered around the world. Most Wyndham customers have probably never darkened the door of either one.

Results

Wyndham Rewards Point Value

| Analysis Date: | 8/8/25 | 7/17/24 | 3/7/23 |

|---|---|---|---|

| Point Value (Median) | 0.7 cents | 1.01 cents | 0.88 cents |

| Minimum Point Value | 0.24 | 0.48 | 0.29 |

| Maximum Point Value | 3.87 | 1.80 | 1.45 |

* Analyses starting 8/8/25 include international properties.

The median observed point value for Wyndham points was 0.7 cents per point. This means that half of the observed results offered equal or better point value, and half offered equal or worse value. Another way to think about it is that, without trying to cherry-pick good awards, you have a 50/50 chance of getting 0.7 cents or better value from your Wyndham points when booking free night awards.

Of all the hotel loyalty programs that we’ve examined using Gondola’s data, Wyndham shows the largest discrepancy from our previous values…by far. Part of that is undoubtedly due to the addition of international properties into the analysis, but we suspect that an even larger factor is that we limited our manual analysis to properties rated four or higher. Anyone who’s searched Wyndham’s website will quickly find that there are a LOT of properties with guest ratings below four. By selecting higher-rated properties, we likely left out a lot of lower-priced options that offered worse value for award redemptions.

Also, Wyndham has expanded the ability to book multiple room types for the same cost. In some cases, oceanfront rooms and suites are the same award price as the standard king. When we manually looked at properties, if a better room was available for the same points cost, we would factor in the cash price of that room. Now, we’re strictly comparing the lowest refundable standard room rate to whatever the points cost is.

It’s worth re-emphasizing that we love Wyndham Points, but we almost exclusively use them for vacation rental redemptions through Wyndham Vacation Club, or Cottages.com. Any of these will routinely provide greater than 1 cent per point value, making the awards much more appealing than what we’re seeing here with Wyndham’s own hotels.

Pick your own point value

| Analysis Date: | 8/8/25 | 7/17/24 | 3/7/23 |

|---|---|---|---|

| 50th Percentile (Median) | 0.7 | 1.01 | 0.88 |

| 75th Percentile | 0.9 | 1.23 | 1.09 |

| 90th Percentile | 1.15 | 1.48 | 1.21 |

* Analyses starting 6/9/25 include international properties, as well as Mr & Mrs Smith.

When we publish Reasonable Redemption Values of points (RRVs), we conservatively pick the middle value, or the 50th percentile. The idea is that just by randomly picking hotels to use your points, you have a 50/50 chance of getting this value or better.

But what if you “cherry-pick” awards? Many people prefer to hold onto their points until they find uses that represent good value. If that’s you, then you may want to use the table above to pick your own point value. For example, if you think that you’ll hold out for the best 10% value awards, then pick the 90th percentile. If you cherry-pick a bit, but not that much, you might want to use the 75th percentile (for example). We’re guessing that most cherry-pickers will land around the 75th percentile: 0.9 cents per point.

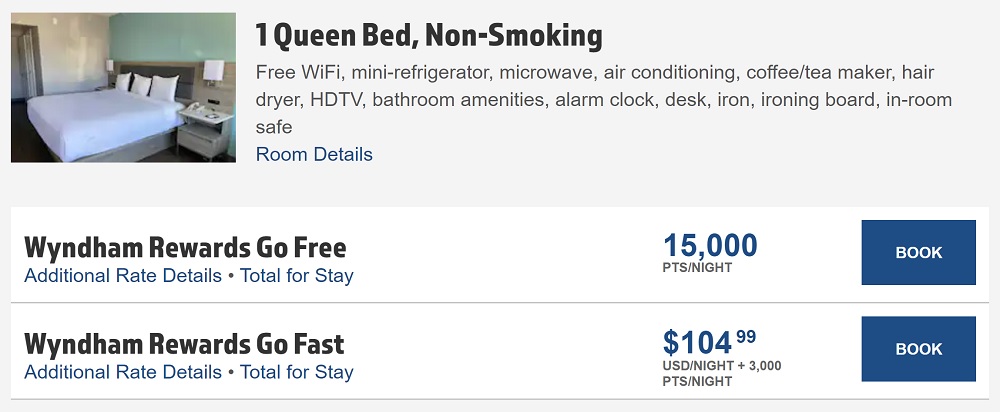

Go Free vs. Go Fast Rewards

Note that Wyndham offers two types of award bookings: “Go Free” and “Go Fast”. Go Free rewards are where you book a hotel entirely with points. Wyndham charges either 7.5K, 15K, or 30K per night for Go Free Awards. Go Fast awards are where you spend either 1.5K, 3K, or 6K to get a discount off the room rate. In the past, we’ve calculated both of these rates separately and found them to be broadly equivalent in terms of point value.

Note that Wyndham offers two types of award bookings: “Go Free” and “Go Fast”. Go Free rewards are where you book a hotel entirely with points. Wyndham charges either 7.5K, 15K, or 30K per night for Go Free Awards. Go Fast awards are where you spend either 1.5K, 3K, or 6K to get a discount off the room rate. In the past, we’ve calculated both of these rates separately and found them to be broadly equivalent in terms of point value.

New Reasonable Redemption Value: 0.7 CPP

Our Reasonable Redemption Value (RRV) for Wyndham points was previously set to 1.01 cents per point. RRVs are intended to be the point at which it is reasonable to get that much value or better for your points. Therefore, we believe that the median observed value for Go Free Awards is a good choice for our RRV.

- Reasonable Redemption Value for Wyndham: 0.70 cents per point

- Reasonable Redemption Value for those who cherry-pick awards: 0.9 cents per point

Overvaluing vs. Undervaluing Points

There is no perfect way to estimate the value of points. Decisions we made here in some ways overvalue points and in some ways undervalue points. The hope is that these things roughly offset each other…

Factors that cause us to undervalue points

- With hotel programs that offer 4th Night Free Awards (IHG, with some credit cards), or 5th Night Free Awards (Hilton & Marriott), or award discounts (Wyndham), we do not consider the point savings in our analyses.

- With hotel programs that offer free parking on award stays to top-tier elites (Hyatt), we do not factor this in.

- In Wyndham’s case, we don’t include the 10% rebate on points redemptions that’s available to Wyndham credit cardholders.

Factors that cause us to overvalue points

- We do not use discount rates (other than member rates) in our analyses. In real life, many people book hotels cheaper (and sometimes far cheaper) by using AAA rates, government & military rates, senior rates, etc.

- We do not use hotel promotional rates. Often, individual hotels have deals such as “Stay 2 Nights, Get 1 Night Free,” which can greatly reduce the cost of a stay.

- We do not use prepaid rates in our analyses. Sometimes these rates are significantly lower than refundable rates.

- We do not factor in rebates, which can be earned from booking hotels through shopping portals.

- We do not factor in extra points earned on paid stays for those with elite status.

- We do not factor in rewards earned from credit card spend at hotels.

- We do not factor in hotel loyalty program promotions: Most promotions, but not all, only offer incentives for paid stays. We often see promos offering bonus points, double or triple points, free night awards, etc.

- With hotel programs that waive resort fees for top-tier elites on paid stays (e.g., Hyatt), we do not factor this in.

Conclusion

Based on the latest analysis, we’ve decreased our Wyndham Reasonable Redemption Value to 0.70 cents per point. This is a fairly sizeable decrease, especially compared to other programs that we’ve looked at recently that have broadly stayed the same in value. We believe that is primarily due to our previous reliance on highly-rated properties AND inclusion of better room types, when available.

For a complete list of Reasonable Redemption Values (and links to posts like this one), see: Reasonable Redemption Values (RRVs).

0.7cpp sounds about right based on my experience. The best deals are usually for special events (New Years Eve in Times Square, football weekends, etc.) or Club Wyndhams, which can get you well over 1cpp. Otherwise I prefer Choice for budget properties.

Don’t forget transferring up to 30,000 points per year to Caesar’s. If you’re staying in one of that group’s resorts, that’s a guaranteed 1cpp off of your folio.

Does this include the all-inclusive resorts that you can book with Wyndham points (TRS, Grand Palladium, Alltra, etc)? Those seem to generally be a decent value as well.

for me wyndham points were the most valuable currency until their vacasa devaluations by far. the properties that i got on hawaii allowed me 3 amazing family vacations.

And you can still go to Hawaii for cheap on Wyndham points. Honestly, the Club Wyndhams there are often nicer than $500/room Vacasas.

thank you.

will have to look into, but at least on Kauai none of their 5 locations are in the south near Koloa/Poipu which is the only place i would stay for winter trips.

The solution to that weather issue is to go to Kona instead. I stayed at Club Wyndhams in Kona and in a Vacasa in Poipu earlier this year and the Wydhams were a better experience. You’d need more than $500/room for a truly nice 1 bedroom Poipu Vacasa.

is this how i would search for availability?

https://www.wyndhamhotels.com/wyndham-rewards/locations?ICID=IN%3AWR%3A20190408%3ANTLB3%3ALOCATIONS%3ANA%3ANA

Idk, I guess I get unicorn valuations in Montana in summer. Yeah it’s a super 8 near Bozeman airport on travel days but 13.5k with earner card beats 280 cash price all summer long as family in and out of there a bunch. With prices elsewhere usually even worse, yeah I’m all in on Wyndham

Right, because you won’t get close to that value redeeming points at any other chain in Bozeman. A Holiday Inn Express could be 50,000 points. Would it be nicer? Sure.But the Super 8 will be fine for the night and a much better value.

The problem with your methodology is that while Wyndham has thousands of cheap (and mostly bad) properties, few are going to redeem points at these properties (unless perhaps they are in the lowest 7500 point tier). Heck, in most towns, there is a decent Wyndham hotel for the same 15000 (13500 for their credit card holders) so why would you stay at the bad property? I would guess that fewer than 20% of Wyndham’s hotels would be good enough to be in Hyatt’s portfolio, but that’s probably still more hotels than Hyatt has in total! And Wyndham is far more likely to have a hotel at your destination. I’m both a Hyatt Globalist and a Wyndham Diamond member, and unless you can get to Globalist status, I’d recommend getting an Earner credit card and making Wyndham your primary hotel loyalty program.

Yep, that’s a good point and part of the downside of using the median redemption value as the RRV. That’s also why we break it down into percentiles. 25% of all Wyndham redemption had a value of 0.9 or greater. 10% were 1.15 or greater. If you’re good (and selective) enough to only choose better-value rewards, you’ll easily do better than .7 cents per points.

That said, all of those thousands of “bad” properties where no one redeems points still manage to stay in business.:)

I personally use Wyndham points almost exlusively for vacation rentals, where I usually get at least double the 0.7 RRV. So, the points are worth much than that to me. However, in the grand scheme of the program, that’s a very niche use of Wyndham points.

If you are using Wyndham points primarily for Vacasa, I would say you are not getting the most out of the program. With the $250 room cap, Club Wyndham redemptions are a better deal, but do require some research and flexibility. If you travel internationally, Wyndham now offers the best hotel values of the loyalty programs. Like the TRS Coral is the best Cancun redemption. In Europe, the Middle East, and Asia/Pacific, there are many four-star hotels for 13,500 points. No other hotel loyalty program is competitive with this.

By “vacation rentals,” I meant either Vacasa, Club Wyndham or Cottages.com. You’re right, in some places Club Wyndham can be a great deal if you can find availability. I have also found Club Wyndham redemptions that weren’t as good value as nearby Vacasas, so it’s not always a better deal. They are always better than 1cpp, though.

“Most IHG customers have probably never darkened the door of either one.”, “Another way to think about it is that, without trying to cherry-pick good awards, you have a 50/50 chance of getting 0.7 cents or better value from your Hyatt points when booking free night awards.” — You probably mean Wyndham in both cases?

Ha! You’re probably right!

I must be working on too many RRV posts back to back. 🙂

Change the first paragraph. Waldorf points are no longer worth twice as much as Hilton anymore and Hilton is now more valuable with SLH as well…it used to be true with .01 v .005 value but no more.

That’s a great point (I’m assuming you mean Wyndham and not Waldorf). Interestingly, as a tease, we just redid our RRV for Hilton points and found that, even with SLH included, they are actually closer to 0.4 than 0.5 now. Even with the new 0.7 RRV, 2,000 Wyndham points are still “worth” more than 3,000 Hilton points.

Tim, that is probably true on average but we players (I have played the game since Sept 2011 and earned and burned more than 10,000,000 points/miles) and have used free nights/Hilton points at Grand Victoria (6 nights this past June/July and have Marquis Faubough Paris reservations for next summer) so for the experienced players we get far more value from Hilton than Wyndham. Some Wyndham properties I regularly stayed at went form 15k/13.5 to 30k/27k. I don’t imagine the experienced players get anything close to the reasonable redemption value. I do appreciate your posts and articles over the past couple of years. I loved Wyndham when the first 50 reservations could get an unlimited number of rooms (Castle) for 15k a night. Probably my favorite limited promotion I got into (other than mint coins back in the day and Emrites First for 90k Alsaska miles and $20…

Hi FM team, I think you should consider a second much simpler method for “real” value – the price to purchase the points. Wyndham commonly sells points for 0.81 cents and in December went as low as 0.72 cents. It’s great that typical redemptions net a higher rate (yeah arbitrage!) and I understand this is a Reasonable Redemption Value, but the number is used to determine SUB value and return of spend. And for that purpose it really doesn’t make sense to value the points higher than their sale price. Wyndham is probably an outlier higher, maybe it’s just something you can flag at introduction of the RRV page about such programs – it’s definitely notable that they offer consistent arbitrage opportunities, but it means the SUBs and spend return rates are inflated beyond their real value – in Wyndham’s case significantly.

Nice to see WR points increase in value 🙂

Some of the best value I have found is in Thailand and Vietnam. They treat you like royalty when you are a diamond member and the prices are fantastic – especially with points. I found a 4-bedroom, beachfront villa WITH pool for 15,000 points that would cost over $500 per night.

Is there a guide on how to extract good value from these points? I’ve piled some up with the Business Card, but when I go the website I just see a lot of low tier places that I would probably not take my family, and I prefer a professionally managed hotel experience to a home rental like Vacasa.

I’m in the same boat. Do they have any nice properties in the US?

AwardWallet estimates Wyndham point value at 1.17¢

Oy Vey! You lost me

me too, right after “Wyndham charges either 7.5K, 15K, or 30K “

Thanks Greg. How often do you see transfer bonuses from Citi or Capital One to Wyndham?

This is the type of question that’s easy to answer by looking at our Current Transfer Bonuses page and going to the Expired Transfer Bonuses section. It shows that there has only ever been a single transfer bonus to Wyndham. Capital One offered a 20% bonus in March 2022.

Oh cool. Thanks!