NOTICE: This post references card features that have changed, expired, or are not currently available

It’s no secret: LifeMiles excite me. I’ve written about The secret LifeMiles award chart, asked Does LifeMiles play favorites? and I’ve been Trying to crack the LifeMiles secret code to Europe. Greg has written about Avianca LifeMiles’s awesome mixed-cabin award pricing. First class for less. While not without some drawbacks, LifeMiles can be really interesting. As an Amex transfer partner, Capital One transfer partner, and Citi transfer partner, it’s easy to rack up miles. What’s more, all three of those programs have now offered transfer bonuses to LifeMiles (in fact, a look at our current point transfer bonuses resource page reveals that both Citi and Capital One are currently offering transfer bonuses to LifeMiles). I love more miles as much as anyone, but I don’t find a LifeMiles transfer bonus compelling enough to transfer unless I have an immediate use for the miles. While that advice generally rings true for most programs, it rings a little louder for LifeMiles. I didn’t bother with last week’s short-term chance to get a 30% bonus because there are multiple ways to buy LifeMiles cheaply.

LifeMiles often sells miles cheaply….but…….

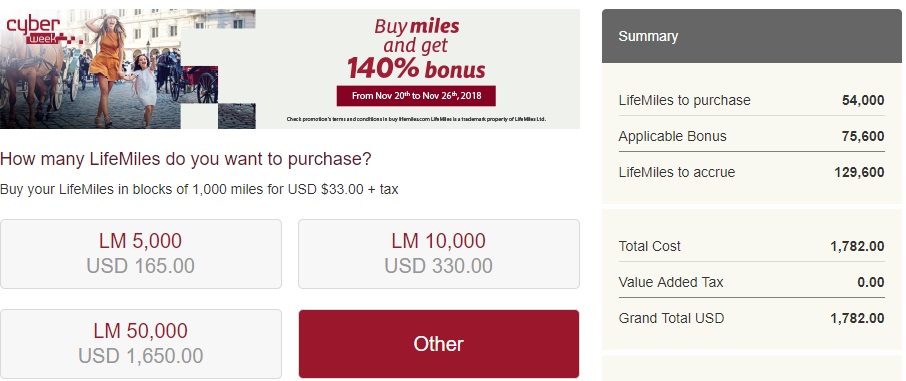

The obvious reason not to feel pressure to transfer points to LifeMiles is the fact that Avianca LifeMiles often sells miles quite cheaply. You’ll see bonuses ranging between 125% bonus miles and 140% bonus miles every month or two. In those sales, you can most often buy miles for around 1.5c each — or sometimes as low as around 1.375 cents. I’ve previously said that this makes an argument for earning cash back rather than transferable points since you could effectively earn around 2 miles per dollar on all spend with the right cash back cards and mileage sales.

However, the problem with that strategy (that readers rightly bring up when the topic is raised) is that in order to unlock the best bonuses and therefore cheapest cost-per-mile, you’ll have to buy en masse: usually a purchase north of 100,000 miles must be made for the top-tier bonuses, coming at a cost well over a thousand dollars. That’s a large outlay at once.

Furthermore, you may not want 100K+ Avianca LifeMiles. The shaky financial condition of at least the Avianca Brazil and Argentina divisions has been widely reported. Personally, I’m not frantically concerned about the solvency of LifeMiles, but neither would I speculatively transfer or buy far more miles than I intend to use in the near future. In my case, I don’t have much trouble spending LifeMiles as quickly as I transfer them, but if I purchased a large quantity of miles I imagine I may find myself under the kind of pressure to get far outsized value out of redemption that causes analysis paralysis and ironically causes more hesitation in burning those miles. If you want to buy just a few thousand miles, the everyday price is 3.3c per mile, which comes down as low as around 1.63c per mile when a sale is running.

By contrast, when I transfer miles from Citi or Amex, I feel like I’m not buying miles (even though I’ve argued that you’re always buying your miles).

In short, even though LifeMiles offers frequent mileage sales, you may not want to buy in the type of quantity necessary to get a great deal.

However, if you need just a few thousand LifeMiles, your better bet is probably to buy during redemption.

Avianca offers to sell you miles during the redemption process, and it can offer prices as good as sales

Over the weekend, I had occasion to redeem Avianca LifeMiles. I was redeeming for two passengers on an itinerary within a single US region, so the tickets were 7,500 miles each plus $5.60 in tax and the $25 booking fee per passenger (charged on all tickets, whether booking online or over the phone).

The total price in terms of miles for two passengers was 15,000 miles. However, LifeMiles gives you the option to split payment between miles and cash.

I was somewhat surprised to find that the rates offered for various small amounts of miles were quite a bit better than what I expected. Here were my options:

- 15,000 miles + $0

- 14,000 miles + $32.84 = 3.28c per mile

- 13,000 miles + $58.29 = 2.91c per mile

- 12,000 miles + $75.75 = 2.5c per mile

- 11,000 miles + $85.95 = 2.15c per mile

- 10,000 miles + $90.93 = 1.82c per mile

- 9,000 miles + $94.06 = 1.57c per mile

- 8,000 miles + $105.00 = 1.5c per mile

- 7,000 miles + $120.00 = 1.5c per mile

- 6,000 miles + $145.89 = 2.43c per mile

That led me to run tests on a number of other routes. Interestingly, in all of my experiments, I found that it was possible to buy LifeMiles for exactly 1.5c each when you used about half the number of miles needed for your trip (or a bit less) and bought the rest. While that means you won’t be able to buy a quantity as small as 1,000 quite as cheaply as you may like, it is possible to buy just a few thousand miles at a pretty competitive price.

Key Note: I’m referring to buying LifeMiles at a cost of 1.5c each above and below this section, though note that I don’t think you’re actually buying miles but rather paying not to use them. If you cancel your itinerary, I expect you’d get your money back, not miles in your account. In other words, I don’t think this works like IHG cash & points — you’re buying the opportunity not to use so many miles rather than buying miles themselves.

What does this mean for the value of a transferable currency?

I’m always a bit conflicted when it comes to transferring points to Avianca LifeMiles. While our Reasonable Redemption Values peg Citi ThankYou points at just under 1.5c each and Amex Membership Rewards points a bit higher than 1.5c each, the truth is that I aways try to redeem for more, especially when transferring to partners.

It’s worth noting that the ability to buy LifeMiles at 1.5c each shown above relies on you already having about 40% of the miles required for the itinerary (in the example above, the itinerary costs 15K miles and one would need to have at least 7K miles already in your account in order to buy at 1.5cpm, which is about 46% of the total required mileage).

Still, one only needs to transfer in about 45% of the mileage required for an award in order to be able to purchase the remaining miles at 1.5cpm. That’s pretty close to the purchase prices that normally require a purchase of 100K or more LifeMiles — yet you could bridge the gap of just a few thousand LifeMiles at that same rate for a small redemption. That certainly takes the pressure away in terms of feeling a need to buy when LifeMiles runs a bonus knowing that I could always pay around 1.5c per mile needed provided I have about half the miles I need for my chosen redemption.

But also important for me is asking how this ability affects the value of my transferable currency points — in this case, my Amex points or Citi points.

Let’s consider an incredibly unlikely scenario: let’s say that you want to redeem for an award that costs 15,000 miles and you have exactly 7,000 LifeMiles in your account. Your choice is then whether to transfer 8,000 points from Citi or Amex or pay $120. Put differently, you are being offered the chance to keep 8,000 transferable points in exchange for $120. LifeMiles is essentially giving you the opportunity to hold on to ThankYou or Membership Rewards points at a cost to you of 1.5cpp. One could look at this as “buying” Membership Rewards or Citi ThankYou points at a rate of 1.5cpp (in reality, you’re paying 1.5cpp to keep them transferable by purchasing LifeMiles instead of transferring). That’s an interesting dilemma.

At that point, I think it becomes questionable whether to use cash or points. Our RRVs certainly suggest that it is reasonable to accept a redemption value of 1.5cpp for your Citi ThankYou points (and it isn’t all that unreasonable to accept the same for Membership Rewards points). But how much would you pay to keep your points flexible rather than transferring to a partner? While many would espouse the “earn and burn” philosophy, telling you to burn as quickly as you can for fear of a future devaluation, I’ve agreed with Greg’s rationale behind hoarding and cherry picking in order to get maximum value from your points. If I feel fairly confident in my ability to transfer ThankYou points for more than 2cpp in value in the future, might it make sense to hold my points for longer and pay LifeMiles at 1.5cpm to use fewer LifeMiles? I can certainly buy that argument.

In my case, I had more than 15K LifeMiles in my account. I ended up redeeming the full 15K rather than buying. But I questioned that decision.

How does a transfer bonus affect value?

Right now, LifeMiles is offering a 25% transfer bonus on miles transferred from Citi ThankYou points until July 5th, 2019. In other words, for every 1,000 Citi ThankYou points transferred, you’ll receive 1,250 LifeMiles. Capital One is now also offering a 25% transfer bonus, which brings its rate up to 938 miles for every 1.000 points transferred. To keep the math easier, I’m going to stick with comparing to the Citi ThankYou bonus for the purposes of illustrating my feelings on a transfer bonus in this post.

Let’s revisit the above scenario where you have 7,000 LifeMiles and are faced with a choice of whether to pay $120 or transfer 8,000 miles from Citi ThankYou points. Due to the 25% transfer bonus, one would need transfer only 7,000 Citi ThankYou points in order to receive 8,750 LifeMiles. The choice now becomes whether or not to pay $120 for the opportunity to keep 7,000 transferable Citi ThankYou points. Your new cost to hold points is 1.71cpp. Would you pay 1.71cpp to keep your ThankYou points flexible rather than transferring to LifeMiles?

In that example, the transfer bonus would leave you with an excess of 750 LifeMiles. If we “value” LifeMiles at 1.5c each (the lowest day-to-day cost at which to buy them), and we include the value of those excess (and possibly orphaned) miles, the transfer bonus is giving you just over an additional third of a cent per point in LifeMiles (1.875 cents vs 1.5 cents). Neither number is quite as much value as I generally like to get out of a transferable point, and neither is the difference so large as to force my hand in making a redemption.

Paying cash out of pocket in order to keep transferable points is a questionable decision at best since anyone who engages in manufactured spending techniques could likely use that cash to generate more miles than what is being offered here for the same $120 cost.

However, this also eliminates the time cost of MS and all of the associated inconveniences and risks. If MSing Citi ThankYou points usually costs you around 1 cent per point, there might be a reasonable argument to be made in terms of paying 1.71c to keep your points flexible rather than paying 1c each plus time and risk to generate more ThankYou points when you need them next.

Bottom line

Don’t get me wrong, I like transfer bonuses. Of course I would like to get 25% more miles than normal if I have a good use in mind. And I may well take advantage of the Citi transfer bonus as part of our #40Faraway challenge. But if my alternative is to buy miles at 1.5c per mile in the future vs get 1.25 miles per Citi ThankYou point now, I don’t feel a major sense of urgency to transfer unless I come across a good redemption. I’ve already made one good LifeMiles redemption this week and I’m certainly eyeing a couple of other possibilities before the bonus ends on Friday, but I’ll rest easy knowing that even if I don’t take them up on the bonus now, I can still pay a reasonably low cost later if I just need a few thousand miles to top off a redemption.

[…] post Why LifeMiles transfer bonuses don’t excite me….much appeared first on Frequent […]

What ever happened to the Joy of Free!?

Not important, but for your last option “6,000 miles + $145.89 = 2.43c per mile” you miscalculated. You divided by 6,000 rather than 9,000 miles. The actual rate is 1.62c per mile.

[…] Lifemiles is offering a 115% transfer bonus which doesn’t excite Nick Reyes […]

Avianca Argentina and Avianca Brazil were/are completely independent airlines that used the Avianca name under a license agreement with the Avianca Group – their failures shouldn’t be extrapolated into concern about Avianca or LifeMiles.

I’m actually concerned about the health of the LifeMiles program. The short expiration and the relative difficulty to extend it is also a big concern for me. LifeMiles program owes its place in mileage redemption primarily due to the ease with which one can buy its miles more cheaply than other comparable mileage currencies. I can duplicate or better almost any LifeMiles redemption with either Aeroplan or MileagePlus miles depending on the specific redemption, so I have very little need for LifeMiles.

As for the difficulty of extending, you just have to transfer miles in from any of the partners once every 12 months. That’s obviously more stringent than programs that require activity every 18 months, but a lot better than those that expire miles regardless of activity (like Singapore). Here’s a post on keeping them alive:

https://frequentmiler.com/how-to-keep-your-avianca-lifemiles-alive/

In terms of duplicating or bettering almost any LifeMiles redemption w/ Aeroplan or MileagePlus, I’d love for that to be the case, but here are a few that come to mind where I don’t think that’s possible:

-JFK to Zurich in economy for 16.5K miles

-North America to Europe from under 50K in business class by adding a long throwaway leg

-Lufthansa first class to Europe with no fuel surcharges for under 80K with a long throwaway or 87K without

-LAX to Auckland for 35K in econ

-7500 each way within a single zone in the US in econ

-15K each way in biz between US 1 and US 2

-4500 each way in econ between DEN-IAH (and other similar anomalies in the US)

There are lots more, but those are a few that came to mind immediately that I at least think can’t be matched with MP or Aeroplan. Don’t get me wrong — I like MP and Aeroplan for their strengths and I recognize that LifeMiles has weaknesses (at least one of which is that sometimes their site does not show matching availability for no explicable reason). I’m not arguing that you shouldn’t like MP or Aeroplan, just that I think it’s a stretch to say that you can duplicate or better most LifeMiles redemptions with them.

Yes, there’re some sweet spots with LifeMiles and you listed some very good ones. But aren’t they too specific to be useful for most users? And are they by themselves worthwhile to be worth maintaining another program? Especially with its miles expire in a short year and the only ways to extend them are by flying or transfers more points to it? I’m certainly aware that all Asian airlines have hard expiration dates but I generally don’t accumulate miles in them unless I have specific redemptions in mind, which I often do with ANA to take advantage of its sweet spots. With LifeMiles selling miles and offering transfer bonuses almost every other month (and perhaps even more frequently), isn’t that a danger sign? Last time an airline did this frequently was US Airways and we all know what happened. US Airways had much better and more sweet spots back then.

I agree with Nick. In addition to throwaway (and this no baggage) you can sometimes book the domestic or inter European leg in coach to save miles as well. I did not book LifeMiles until recently but am glad to have another airline in my tool box. With the Us big three all go I going to variable pricing I will take access any any decent award chart foreign airline I can. Also not mentioned are some sweet spots based on super big region definitions.