Want to “free” up a companion to move about the country — and maybe even a few other countries, too? This week we talk about what I’ve often called the best deal in domestic travel, the Southwest Companion pass. From what it is to how you can potentially get two companion passes in your household with just 3 new credit cards, this week on the podcast we talk about why now is the time to consider this (and why we aren’t going after it right now).

Want to “free” up a companion to move about the country — and maybe even a few other countries, too? This week we talk about what I’ve often called the best deal in domestic travel, the Southwest Companion pass. From what it is to how you can potentially get two companion passes in your household with just 3 new credit cards, this week on the podcast we talk about why now is the time to consider this (and why we aren’t going after it right now).

Elsewhere on the blog this week, read about why you probably shouldn’t book your Southwest flights via Chase Ultimate Rewards (whether or not you have a Companion Pass), how you can stack for big savings on your holiday purchases, how to get outsized rewards for your charitable gifts, the boss move that Greg’s wife pulled to get to New York City in style, and a lot more. Watch or listen to the podcast or read on for more from this week at Frequent Miler.

This week’s podcast

00:00 Intro

01:45 Giant Mailbag

04:04 Card Talk: Southwest Rapid Rewards credit cards

05:10 Southwest Rapid Rewards Plus card

08:00 Southwest Rapid Rewards Premier card

08:30 Southwest Rapid Rewards Priority Card

14:41 Southwest Rapid Rewards Premier Business

15:26 Southwest Rapid Rewards Performance Business

19:28 What crazy thing . . . did Capital One Shopping do this week?

25:20 Mattress running the numbers: Which is better: the 15% Avianca LifeMiles transfer bonus or 165% purchase bonus

33:38 Award Talk: Should you book Southwest flights via Chase Travel℠?

44:14 Main Event: Your companion is now free to move about the country

44:32 Overview of the Companion Pass

1:16:48 Question of the Week: Help! How do I find partner awards bookable with my airline miles?

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

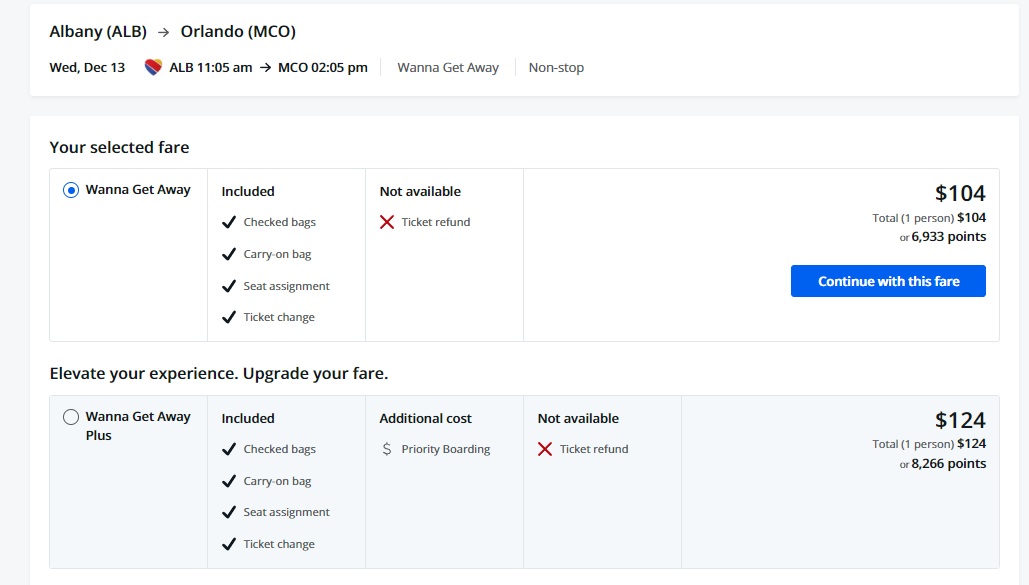

Booking Southwest Airlines flights via Chase Travel should be a great deal, but isn’t

Southwest Airlines flights can now be booked via Chase Travel. Unfortunately, it isn’t a very pleasant experience. Chase is overcharging for cheap fares and if you have to change or cancel, even if you’ve booked a fare that offers more flexibility, you can’t rebook it yourself. You’ll have to call Chase to find and use your Southwest credits, which eliminates a lot of the advantages of booking some of the more expensive fares.

Extreme stacking for holiday purchases

There are endless opportunities to stack great deals at this time of year, though it isn’t all dependent on Black Friday, Cyber Monday, Travel Tuesday, Water Bottle Wednesday, Thermos Thursday, or whatever new marketing gimmick comes up this year. Savvy shoppers have two key tools at their disposal: enough practice searching to recognize a great deal and the ability to stack great portal rates with card-linked offers (and maybe discounted gift card deals in the next section!) to save big when opportunity strikes.

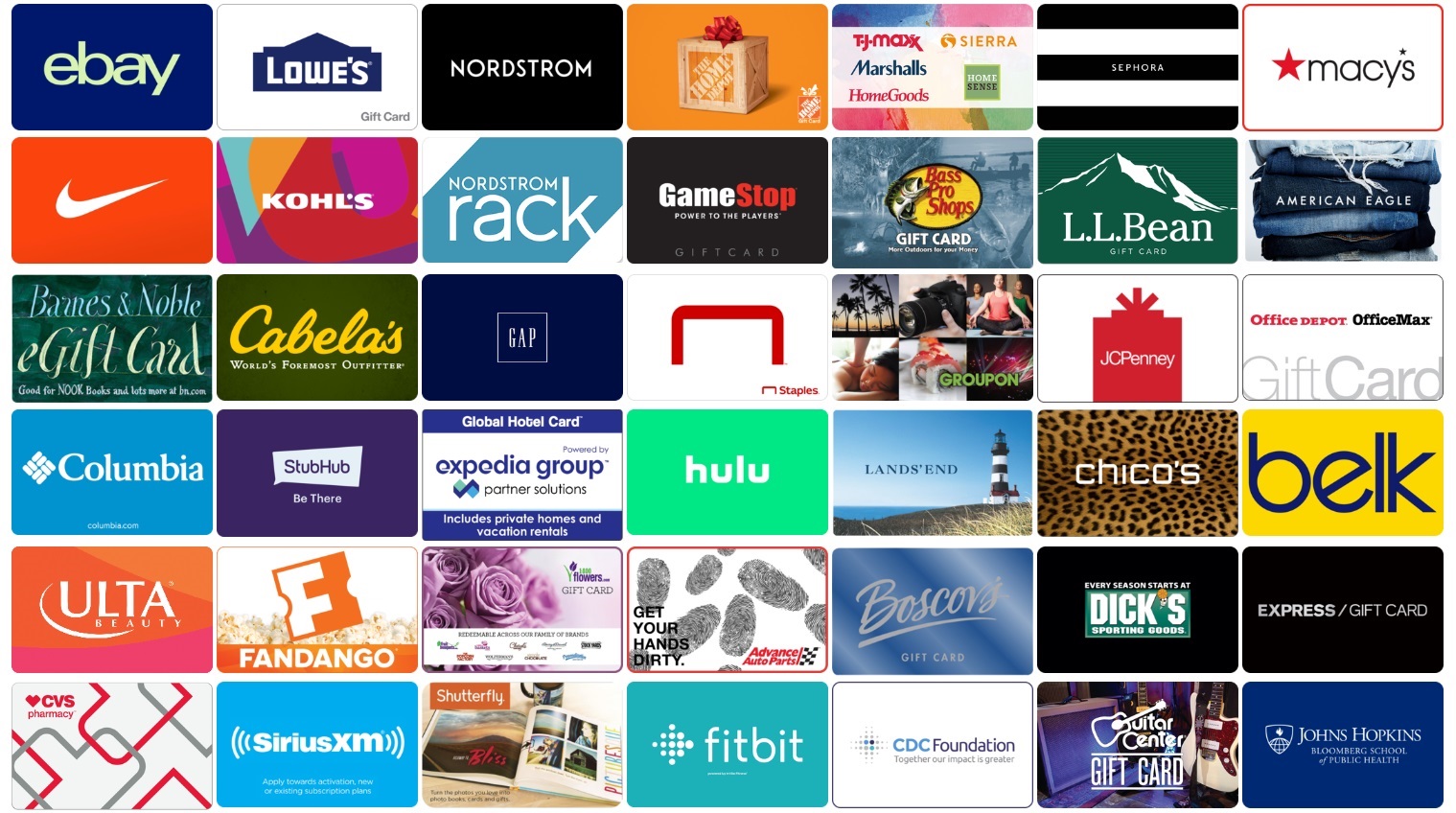

Instant Gift Card Deals: Save Money & Get Rewarded

Speaking of stacking for big savings, you can sometimes increase your savings or your return on spend (or both!) with instant gift card deals. If you’re buying something that you know you won’t return, it can certainly make sense to buy a gift card and earn miles and then go through a shopping portal and use that gift card and earn miles on that spend again. Stacks like that can help you score a good deal on any given day.

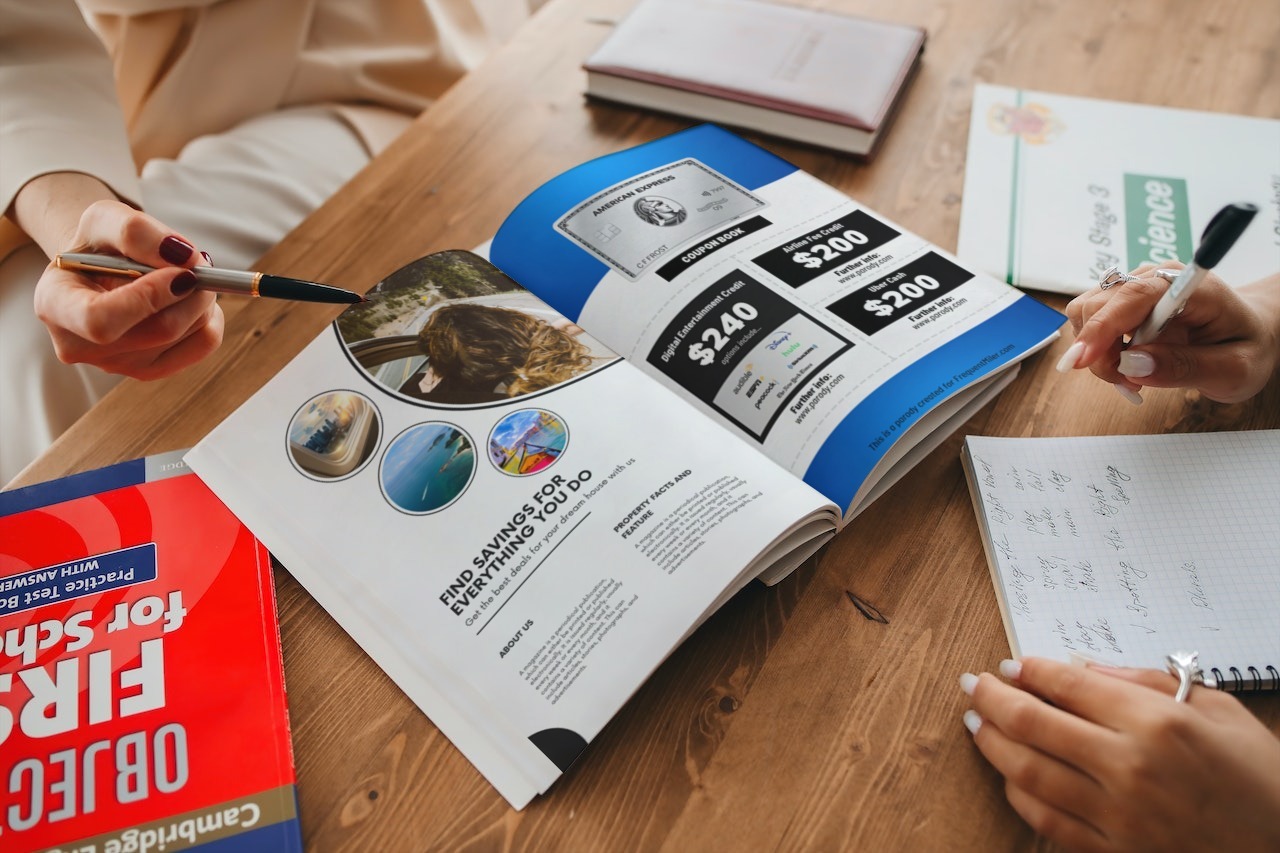

Credit card coupon book cheat sheet

Another way to maximize your holiday shopping is by understanding what works to trigger various credit card “coupon book” credits. Whether it is office supply credits or department store credits or airline incidentals and more, this cheat sheet shows you how to leverage these benefits (in some cases “paying it forward” in the sense of storing up credits for future use.

Hyatt Regency Greenville: Bottom Line Review

I have some family in the Asheville, NC area and so I’ve looked at flying into Greenville before, but this review of the Hyatt Regency Greenville tells me that if I ever choose to fly in, I probably shouldn’t stay here. What I found most off-putting in reading the review were the various $3 or $4 charges for valet parking (which is free for Globalists on award stays) and the fact that nobody could explain why they were there. If they were a disclosed (and optional?) service charge (and the same amount every time), that would be one thing. The random differing amounts that couldn’t be explained seems like the hotel trying to sneak small charges onto a bill hoping that they go unnoticed….which makes me wonder how often they do. Yuck.

Rewards for Charitable Giving

If you intend to open your heart by opening your wallet this holiday season, check out this post about ways to earn maximum rewards for your generosity. Whether that makes it feel like a win-win or it makes it possible to give even more generously, this post is definitely worth a read for anyone who intends to give (whether at this time of year or any other). We talked about this on a recent podcast, but this post is an excellent written reference resource that you can (and should!) return to when you’re ready to make a charitable gift.

Blade Helicopter Review (JFK to Manhattan)

In a total boss move, Greg’s wife got top-tier JetBlue elite status (thanks to the temporary offer they ran for disaffected Delta elites) and generously agreed to share her complimentary Blade helicopter transfer benefit with him. This. Looked. Awesome. It looked so awesome that I’d almost like to do it one day just for fun. The fact that top-tier JetBlue elites get four of these a year would certainly make me more excited about chasing TrueBlue Mosaic 4 status.

Amex offering downgrade bonuses to some

Amex has long offered targeted upgrade bonuses, sometimes incentivizing current cardholders to move up to a more premium card. And Amex is also known to offer retention bonuses to encourage cardholders to keep their cards open. But we are now seeing reports of some cardholders being offered a bonus to downgrade to a less expensive card rather than cancel. This is especially notable now given the family language that may prevent you from opening a less premium card and getting a welcome bonus — one of these downgrade bonuses might be a way to at least get some points with the downgraded card. To be clear, there is absolutely no guarantee that you’ll be offered this and you’ll probably have to be ready to cancel before you’ll be offered a downgrade bonus.

Wow: Both sides now can now get up to $75 when referring to Capital One Shopping

We don’t usually feature shopping portal sign up bonuses in the week in review, but this Capital One Shopping offer is the most lucrative one I ever remember seeing. Some members have been targeted with the ability to refer someone else and both sides will receive $75 in rewards once the new portal customer installs the Chrome extension and clicks through the portal to spend at least $10 within the first 30 days. That’s a really easy bonus and one that I’m encouraging my family members to check out as they do their holiday shopping. If you’re playing in two-player mode, Player 1 should sign up for the $75 offer. New accountholders are usually reporting only having an offer of $50 for each side, but if Player 1 refers their Player 2 (spouse / partner) for the $50 offer, that’s a total of $175 in bonuses for two $10 purchases. That’s hard to beat!

What I learned from watching Greg find Qatar QSuite award flights [Video]

Carrie is back with another “What I learned by watching Greg’s video” post. I love seeing these posts because Carrie helps break down the key learnings for someone who has a base level of award travel knowledge but who is still learning the finer details. I think these companion pieces really make for a great way for a novice or intermediate award traveler to digest the information in the video, so this one is worth a look even if booking Qsuites isn’t on your immediate radar since these types of skills become applicable in other award booking arenas.

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to be sure that you don’t miss any before they are gone.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

In the question of the week y’all discussed a “basic” question. It would be awesome if there was a short “back to basics” section in each show for those new to the hobby.

If my wife is an authorized user on my Southwest Priority, can she apply for her own Southwest Priority and get the bonus? TY!

Yes! She can get her own! 🙂

When you add “suggested downgrade card” to your credit card pages, Can you also add “When do the points earned with this card expire?” and “”When can you get (churn) this card again?”

You guys are dressing like a matching couple now?

Tom said that it’s okay for you to talk about Southwest.

Interesting discussion on transferring vs. buying Avianca LifeMiles. The opportunity cost of transferring a finite stash of AMEX MRs is the more common higher transfer bonuses on other great programs. Purchasing LifeMiles on AMEX Platinum can yield 5x MRs.

They highlight a flaw in many people’s analysis. A person might see 1.3 cpp on Delta SkyMiles redemption. A person might see 1.54 cpp on a Amex Business Platinum redemption. Gotta go with the ABP. Wrong. Because maybe those points could have been used on an Emirates first class redemption at 3.4 cpp. That’s the real trade-off.