| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

Update 5/17/22: Ever since this improved referral offer went live a couple of months ago, we’ve rotated through reader referral links each day. Many have reported maxing out their allowance of 55,000 bonus points which means we’ve potentially helped people earn more than 3 million Membership Rewards in that time.

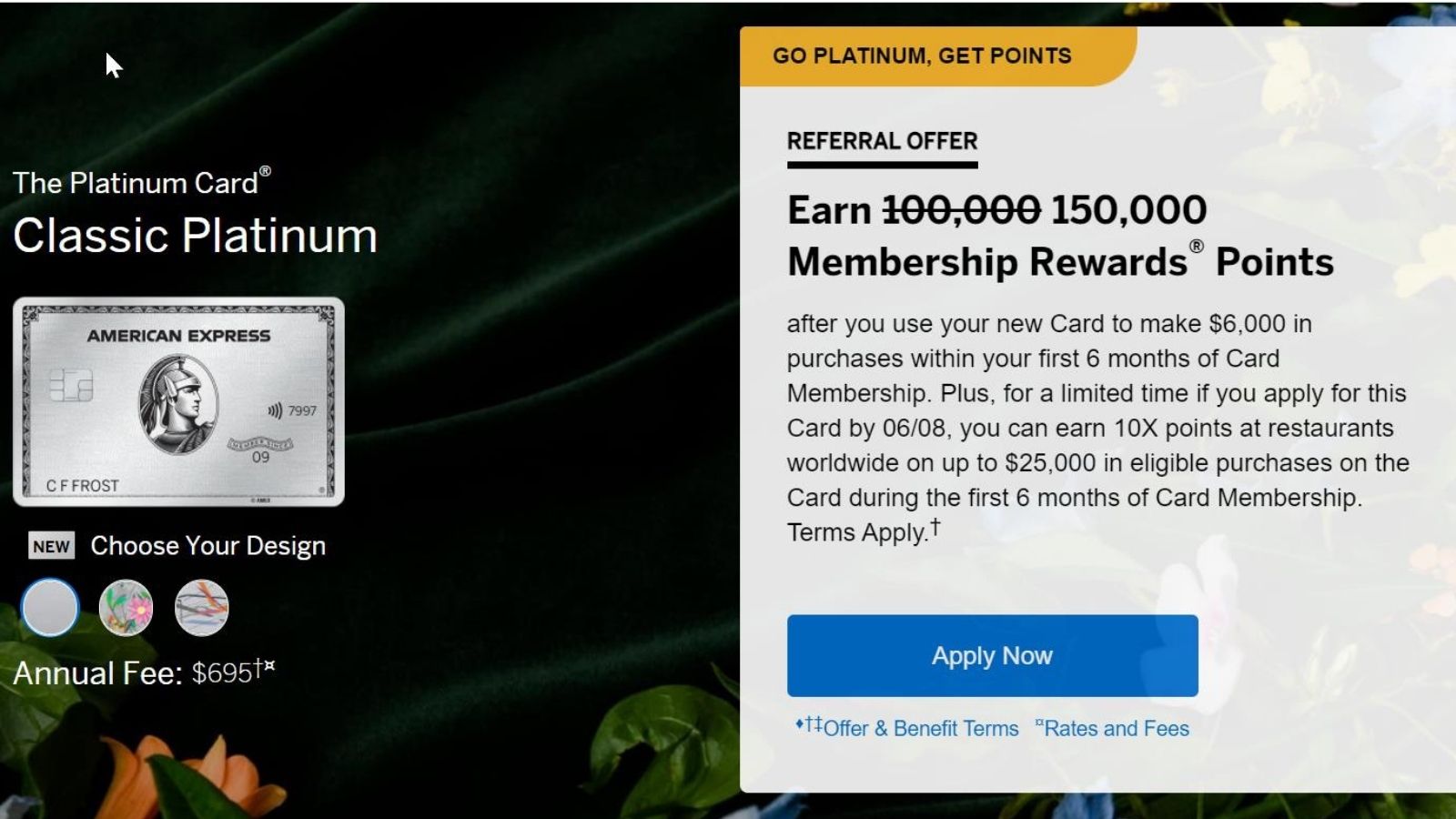

We’re not done though. We’re getting to the end of the current list of people’s links which means we need more. If you have a referral from a personal Amex Platinum card that provides the referee with 150,000 bonus points and the 10x dining offer, please share your link on the specific thread in the Frequent Miler Insiders Facebook group – instructions can be found at the end of this post how to do that.

Important: Please only share referral links that meet these terms and only on the specified thread on Facebook. Links that don’t generate the 150k + 10x offer won’t get used and your link will be removed from the thread.

~

Update 3/11 – Just when you think the offers can’t get any better, Amex outdoes itself. Again. There is a new referral link out that makes the previous 150,000 points welcome offer even better. This new targeted offer gives the same 150,000 Membership Rewards points on $6,000 spend, but also adds 10x on all spending at restaurants for the first 6 months, up to $25,000 total spend. This is the offer you’ll find on our Best Offers page since it is the best offer out there.

This was obviously a fantastic deal even before the 10x at Restaurants addition. Now, the offer is simply one of the best out there for a personal card. We’ll be collecting reader referral links for those who were targeted so we can share them with others. The details on how to participate with your link (if you are targeted) are below.

The Offer & Key Card Details

Click the name of the card below to go to our dedicated card page for more information and a link to apply.

| Card Offer and Details |

|---|

100K Points ⓘ Non-Affiliate 100K points after $8K spend in 6 months + 10x on dining for 6 months (on up to $25K in purchases). Terms apply.$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 175K after $8k spend (referral only, expired 4/8/24) FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ $200 prepaid hotel credit per calendar year valid on Fine Hotels & Resorts and The Hotel Collection bookings ✦ Up to $20 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, SiriusXM, and/or The Wall Street Journal ✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ $189 CLEAR fee reimbursement per calendar year ✦ $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card ✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status Enrollement required for some benefits. Terms Apply. (Rates & Fees) See also: Amex Platinum Guide |

Quick Thoughts

While I was thrilled with the previous welcome bonus and leveraged it to earn more than half a million points when buying a used car, there were some who were not interested in that previous offer since they may not have had enough small business or restaurant spend to maximize it.

If you were in that camp, this new referral offer may interest you since it represents a fantastic offer for a huge sum of transferable points after a relatively reasonable amount of spend. Before late 2020, this offer would have been considered show-stoppingly good. It would be fair to argue that it still is that good in comparison to similarly-positioned cards from other issuers, especially when you consider the many Amex Membership Rewards sweet spots.

This referral offer is targeted in that only some Platinum card holders have the ability to generate a link good for this offer — but the offer itself is publicly available to anyone applying through a qualifying referral link (like the one on our Platinum card page). Those Platinum cardholders who have the ability to generate a 150K + 10x link will see it advertised in the “refer a friend” section of their login — it shows the bonus that you’ll get as a Platinum cardholder and that your friend will get 150,000 points + 10x at Restaurants (whereas most of us only have a referral offer for 100K points for our friends). This is similar to a situation we saw in late 2020 where only a relatively small number of Platinum cardholders had the ability to refer to the very best offer.

Keep in mind that the Platinum card welcome bonus is not available to those who have or have had the vanilla Platinum card before. If you’ve only had the Schwab or Morgan Stanley version of the Platinum card, you would be eligible, but if you’ve had the vanilla Platinum card before you likely would not be.

We want your 150K + 10x offer referral links

Here on Frequent Miler, our Best Credit Card Offers page always links to the best available welcome bonus, even if that’s not an affiliate link. The Best Offer for the personal Amex Platinum card through affiliate channels is for only 100,000 Membership Rewards points. That’s why you’ll see many other points and miles sites hawking that inferior version.

However, we always present the offer that allows new applicants to earn the best available bonus, even when it doesn’t benefit our site through affiliate commissions. Seeing as referral earnings are limited to 55,000 points per person and that’s maxed out after just a couple of referrals, we wanted to share the wealth by using readers’ referral links on the site. We need reader links for the 150K + 10x offer.

If you’d like to have your referral link shared on the Best Offers page, here’s what you need to do:

Step 1: Check your referral link

You can find your referral link here, or by logging in to your American Express account and scrolling down to the ‘Refer A Friend’ link at the bottom of the page and clicking on that. Note that you might need to change your card at the top of the referral page so that your Amex Platinum card is selected.

Before sharing your referral link, please ensure that it generates a link to the offer giving new applicants 150,000 Membership Rewards points after $6,000 in purchases in the first 6 months with 10x at Restaurants. Not all Amex Platinum cardholders can generate that superior offer, so it’s worth checking first. A good rule of thumb is that if you’d earn 30,000 points per referral from the link generated by your Platinum card, then your offer will likely be for the better offer…but please check regardless.

Step 2: Join the Frequent Miler Insiders Facebook group

If you’re already part of our Facebook group, you can skip this step. If you’re not a member though, you’ll need to join this group. Note that you’ll be asked a question or two (depending on if you try joining on mobile or desktop) to ensure you’re not a bot. Please answer that question(s), otherwise you won’t get admitted to the group in order to do step 3.

Step 3: Share your link on the dedicated thread

We have a dedicated thread set up to share your 150K +10x referral links, so please only share your referral links here at the bottom of the thread. We’ll then work our way through the links for as long as this increased offer is only available via referrals. We will rotate through links there regularly to try to give as many readers as possible a chance at picking up a referral bonus.

Please don’t share your referral link as an individual post in the group as it’ll just get deleted. Please also don’t share a non-150K + 10x referral link as that’ll get deleted too.

Comments on the blog with links automatically get caught in our spam filter and will not post, so do not share your links in the comments here. Instead, that Facebook thread is the only place we’ll be accepting referral links (sorry if you’re not on Facebook).

![175,000 Membership Rewards points consumer Platinum card offer for some [Targeted] a hand holding a credit card](https://frequentmiler.com/wp-content/uploads/2019/01/Amex-Platinum-Card-in-Hand-218x150.jpg)

[…] May 17, 2022 … If you have a referral from a personal Amex Platinum card that provides the referee with 150,000 bonus points and the 10x dining offer, … Visit Site […]

Great, just requested to join the group to share my 150K + 10x referral link. Awaiting approval.

Great! Just posted my 150k + 10x Amex referral link on the Facebook page.

Are links that only show the offer in incognito mode allowed in the Facebook thread?

Have also submitted a request to join the FB group to share my 150k points + 10x at restaurants referral link. Waiting for approval.

Do you mind sharing the link with me : D

I have the link for 150,000 and 10x at restaurants. I submit the request to join your facebook group. but my approval is still pending. Please take a look at it. Thanks.

For some strange reason both my account and P2’s account can only refer business cards and cannot seem to get any referral links for personal. Is this a known problem?

Interesting- I just noticed that my Plat Personal referral is 100k + 10x dining. I won’t be sharing that but I guess it is yet another AMEX variation on a theme.

I have the link for 150,000 and 10x at restaurants, but my approval is still pending.

I have the magic link! I posted it to the fb group yesterday! If I get 55k points I will be the happiest girl in the world! My 15x shop small bonus ends on 5/25 It was a good run, but I didn’t even come close to maxing it out. Thanks so much for sharing that offer! It’s only because of you guys that I knew about it! Frequent Miler is awesome!

If I’ve already gotten 55k MR pts this year thru referral, don’t add my link even tho the referral opportunity is there when I log on, yes?

If the terms say you cannot earn more than 55K MR per year through any referral offers, then will you be able to earn more than 55K per year?

Yesterday I submit the request to join your facebook group. Today it’s still in pending status. Please take a look at it. Thanks.

too bad I don’t use Facebook. Deleted my profile in 2010.

When I tried to make a new account a couple years ago, I was blocked.

I didn’t get the elevated referral offer on my own card (and still don’t have it — I just checked) but P2 and P3 both had it. Spurred by this update I went back to check their accounts and they’re each 55k points richer! Thanks, Frequent Miler!

Pending FB group approval, I’ve got a link to post to get one or two more folks on board!