Believe the hype: the used car market is hot right now. I just beat the heat by buying a car with a credit card and I earned so many points on my used car purchase that I could turn around and sell the car tomorrow (and I’ll show you how) and turn a profit. Alternatively, I could use the points I earned to cover an entire vacation with a retail price higher than the cost of my vehicle (See: Incredible vacations with half a million Membership Rewards points). Here’s how I did it, what I learned, and how you can do the same. This post is long, but you can get the short summary in the next section and you can easily skip around to the sections that interest you using the table of contents below.

Summary: I bought a car with a credit card and raked in more than 500,000 points

The bottom line summary for this post is:

- I shopped the Internet looking for a deal on a used minivan. I ultimately purchased 9 hours away from home in Columbus, Ohio.

- I bought my van at a car dealership that I was confident would code as an Amex Shop Small business (most dealerships likely do) and I put $24,000 of the purchase on a credit card. It is worth noting that I was initially told that the dealership had a $2,000 limit on credit card payments. That proved to be negotiable.

- I earned 360,000 points at 15x for a $24,000 Shop Small purchase (this offer has since expired – bummer!), 96,000 points at +4x because of a referral offer, and 125,000 points from the welcome bonus for a grand total of 581,000 points by paying for the majority of the cost of the car on a credit card.

- Because of the hot used car market, I could potentially sell the car for nearly what I paid and come out with a bucket of cheap Membership Rewards points. If you shop really well, I think you could make an easy profit. See more in this section.

- The points I earned from this purchase could nearly cover my entire $17,600 vacation to Europe planned for later this year – and it could get far better than that (See: Incredible vacations with half a million Membership Rewards points). This was well worth the effort.

The truth is that there was some effort involved and I learned some important things along the way. With the lessons I learned, hopefully your approach can be more streamlined and you can also walk away with a boatload of points that makes it worth buying a car even in the current ridiculously hot market.

The Resy offer for the Amex Platinum card: Buying a car with a credit card never yielded so many points

For months now, the most incredible welcome offer we have ever seen on a single credit card has been available on the Platinum card from American Express (and it has now expired as noted above). The catch is that the absolute best offer was only available by applying through a link at restaurant reservation website Resy. Since Resy is offering the indisputable best offer on the Platinum card, our Platinum card page has linked to it and we have referenced it many times in posts and on the Frequent Miler on the Air podcast. To be clear, we don’t earn any sort of affiliate commission or bonus on this card, the offer is just so good that it feels necessary to shout about it from the rooftops.

This is the offer:

| Card Offer and Details |

|---|

ⓘ $2259 1st Yr Value Estimate$200 Fine Hotels & Resorts credit valued at $100, $200 airline incidental fee credit for select airline only valued at $140, $200 Uber credit ($15 per month, $35/December) valued at $100, $100 Saks credit ($50 per six months) valued at $25 Click to learn about first year value estimates As high as 175K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer As high as 175K points after $8K spend in 6 months. Welcome offers vary and you may not be eligible for an offer. Terms apply. Rates & Fees$695 Annual Fee Recent better offer: 175K points after $8K spend in 6 months. FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ $200 prepaid hotel credit per calendar year valid on Fine Hotels & Resorts and The Hotel Collection bookings ✦ Up to $20 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and/or The Wall Street Journal ✦ Up to $120 Global Entry/TSA Precheck fee reimbursement.✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ $199 CLEAR (R) Plus fee credit per calendar year ✦ $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card ✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Global Lounge Access benefits: Priority Pass membership (Lounges only) with 2 guests, Centurion Lounge access. Also, Delta Sky Club® access (when flying an eligible Delta flight): 10 visits per year February 1 until January 31 of the next calendar year (after 10 visits have been used, additional visits can be purchased for $50 each or earn unlimited visits after spending $75K/calendar year on the card). Access limited to eligible card members ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status ✦ Enrollment required for some benefits. Terms Apply. See also: Amex Platinum Guide |

While the 125,000 points after $6,000 in purchases in the first 6 months would be a monster offer on its own in a normal world, what made the now-expired previous offer so unprecedented was the ability to also earn 15x on up to $25,000 in purchases during the first 6 months at Shop Small businesses in the US and at restaurants worldwide. Ordinary credit card category bonuses are 3x, 4x, or 5x. Getting 15x — even as a temporary category bonus – is bananas.

If you were able to spend the full limit of $25,000 at Shop Small businesses / restaurants in the first 6 months, you would have ended up with 500,000 Membership Rewards points. That is broken down as follows:

- 25,000 x 15 = 375,000 + 125,000 points (welcome offer) = 500,000 points.

In my case, I did even better thanks to a temporary referral bonus that was available last year: by opening my new Platinum card in November 2021 and referring someone else to a new card before December 1, 2021, I triggered a referral bonus of +4 points per dollar spent on up to $25,000 in purchases for 3 months. That stacked.

In total, I was able to earn 19x on my purchase (15x small business plus 4x from the referral bonus) plus the 125,000 welcome offer points. I put $24,000 on my card and as such I earned 581,000 points.

- $24,000 x 15 = 360,000 points (Shop Small offer)

- $24,000 x 4 = 96,000 points (referral offer)

- Welcome offer = 125,000 points

- Total = 581,000 points

Redeemed for a cash deposit to a Schwab brokerage account, that would be $6,391. That represents a 26.6% return on my $24,000 purchase.

To be clear, I would need to also have the Schwab Platinum card to do that (or to open the Schwab Platinum before I close this current Platinum card). However, I use this as a baseline cash value for the points since it is possible to get that value in dollars and cents.

Alternatively, I showed yesterday how these points could be used to cover a vacation with a retail cost of $17,000-$30,000 or potentially far more. If I just used this welcome bonus for four round-the-world business class tickets as you see in the example in that post, we would get north of $64,000 worth of business class flights with our $24,000 used car purchase. No, I would never spend sixty four thousand dollars on those flights, but it sure seems like a nice pot sweetener to soften the blow of accepting my middle-aged-dad-who-drives-a-minivan status.

And in fact the points are why we purchased. We have talked about getting rid of our SUV in favor of a minivan for the past year or two, but with used vehicles commanding high prices right now, we thought we would hold off on purchasing until prices came back down to Earth. However, with the unprecedented chance to earn more than half a million Membership Rewards points with our used vehicle purchase, we just couldn’t justify not buying now.

Thanks to how hot the market is right now, it might even be worth buying a vehicle speculatively to try to resell just to pick up the points if you got the Shop Small offer. You can easily test the market in terms of what kind of price to expect, but more on that in a bit.

Is a car dealership a small business? Yes! Maybe.

I long expected car dealerships would code as small businesses for the Shop Small component of the former offer. That may seem counterintuitive since names like Toyota, Chrysler, Ford, and Chevrolet clearly aren’t small businesses. However, apart from Tesla, most car manufacturers don’t sell directly to customers. Instead, locally-owned entities sell the cars. Notice someone’s last name on the marquee of most dealerships. They are usually family-owned small businesses.

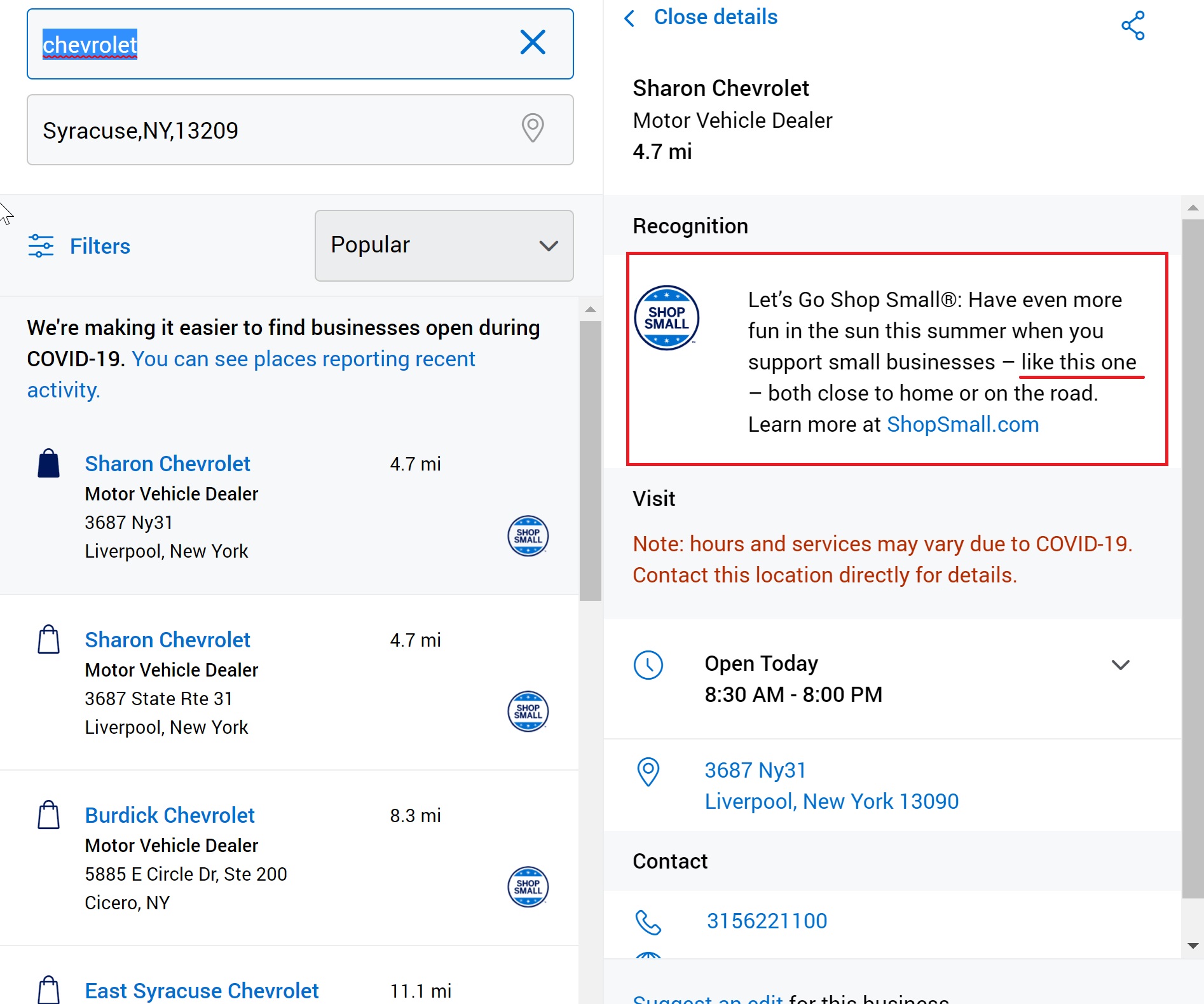

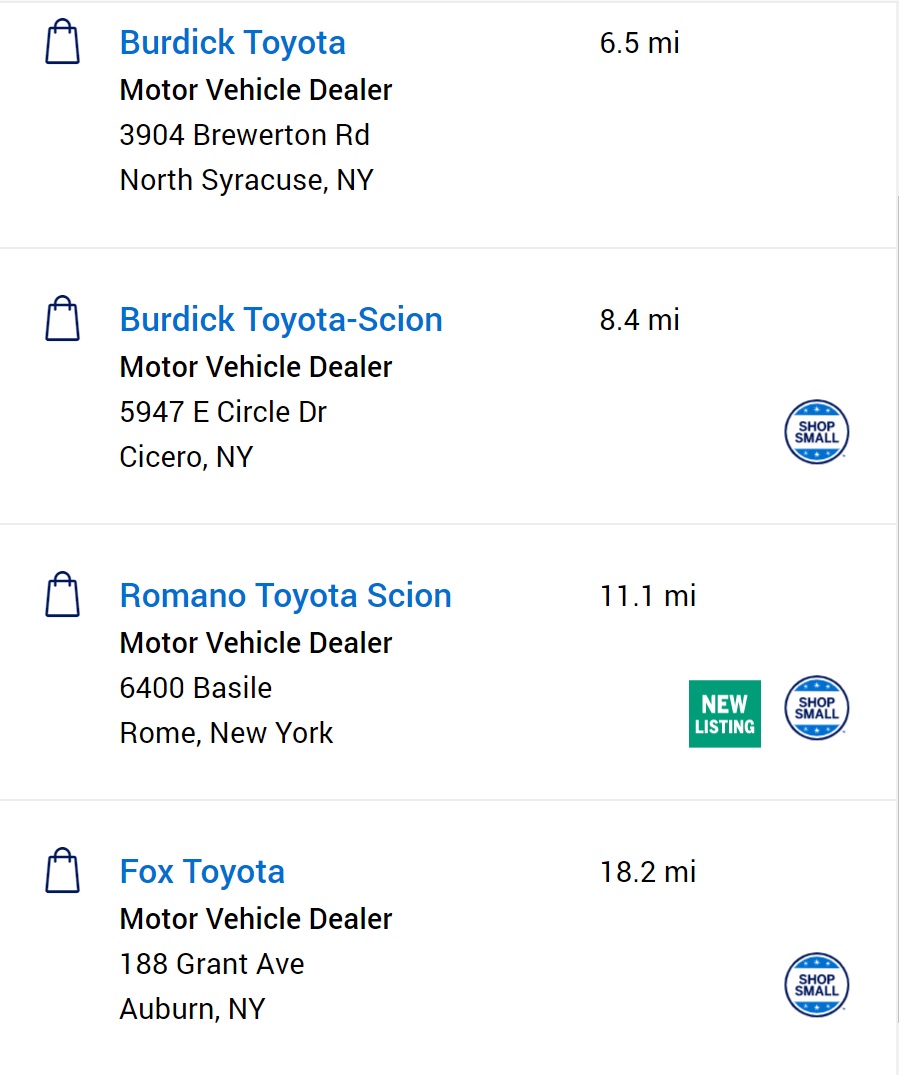

I therefore wasn’t surprised when I found car dealerships listed on the Amex Shop Small map on Day 1. Indeed most car dealerships I’ve searched show up on the map with the small business icon. Here were some examples I previously shared:

In the picture immediately above, you can see that Fox Toyota, Romano Toyota, and the Burdick Toyota-Scion dealership in Cicero all have the Shop Small icon. That is an indication that they probably participate in the Amex Shop Small program. However, the Burdick Toyota dealership located on Brewerton Rd in North Syracuse does not have the Shop Small icon.

Most retailers that appear with the Shop Small icon should code as Shop Small businesses (and in my experiences they have), though we’ve had a few reports from readers who spent at businesses that have the Shop Small icon but did not code as a Shop Small business. I have also spent at businesses that did not have the Shop Small icon on the map but successfully coded as small businesses.

My point here is that you can’t read too deeply into the Shop Small map. I wrote an entire post about the usefulness and uselessness of the map here: Ways I’ve earned 15x at small businesses.

However, the map is the best you can do in terms of trying to predict businesses that will probably code for the Shop Small bonus. To be absolutely sure, you’ll need to make a small test purchase. I don’t know how often Amex updates their site when businesses join or leave the Shop Small program and in some cases I imagine that a small business might make a payment terminal or coding change on their end that Amex would have no way of knowing. The Amex Shop Small Map Frequently Asked Questions suggest that vendors who have accepted Amex cards for at least a year must have taken at least 1 payment with an Amex card in the previous 12 months. There is some element of gamble unless you make a test purchase.

Unfortunately, that whole test purchase thing is hard with a car dealer. The dealer where I eventually purchased my car was in Columbus, Ohio, about a 9 hour drive from where I live. It was a new and used car dealership (affiliated with a major car brand) and it showed up on the Shop Small map with the Shop Small icon, so I felt pretty confident that this would all work. Still, I was hoping to make a deposit first to know before I showed up.

I agreed to a deal with them on a Monday, but they wouldn’t hold the car until Friday even if I put down a $24,000 deposit. Truthfully, that put me off some, but it’s a hot market. One dealer wouldn’t even give me a cash price, telling me, “We don’t do cash sales. We prefer financing”. You know it’s a hot market when they aren’t even interested in naming a price for someone who walks in with a fistful of dollars.

Of course, dealers do prefer financing. Let there be no doubt, the car business is less about selling cars and more about selling loans. If my experience is any indication, don’t expect much negotiation if you’re not financing through the dealer.

Anyway, the dealership finally agreed to take a deposit on Wednesday contingent on me picking up on Friday. I drove out Thursday and picked up my van on Friday morning. Unfortunately, points from my deposit didn’t post until Saturday, so I just had to cross my fingers and hope for a pile of points.

Still, if you can get five or six thousand bucks back on a $25K purchase (or a vacation worth thousands more), the ability to negotiate a little bit off the price might not matter much to you.

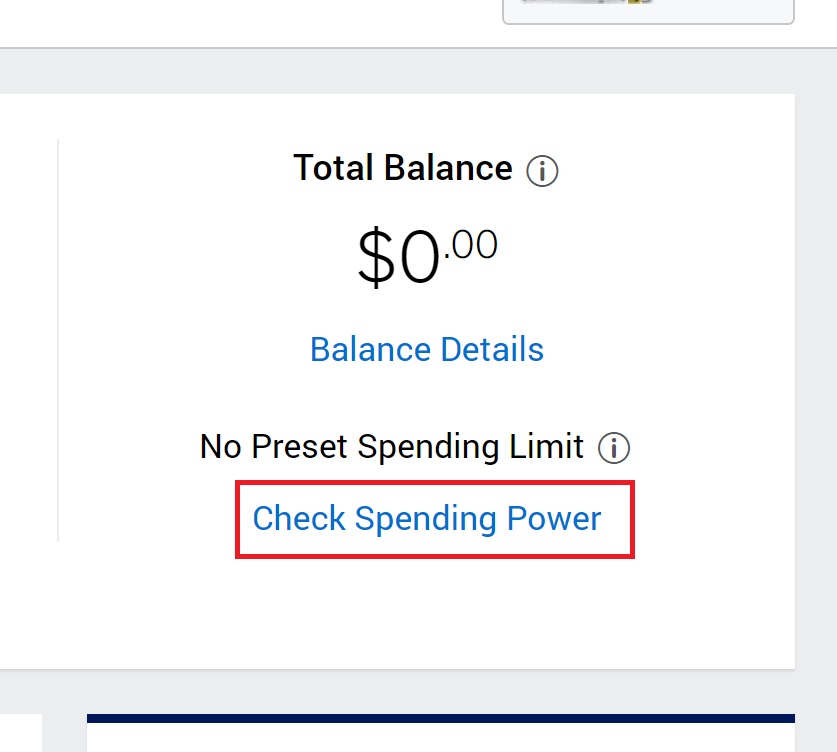

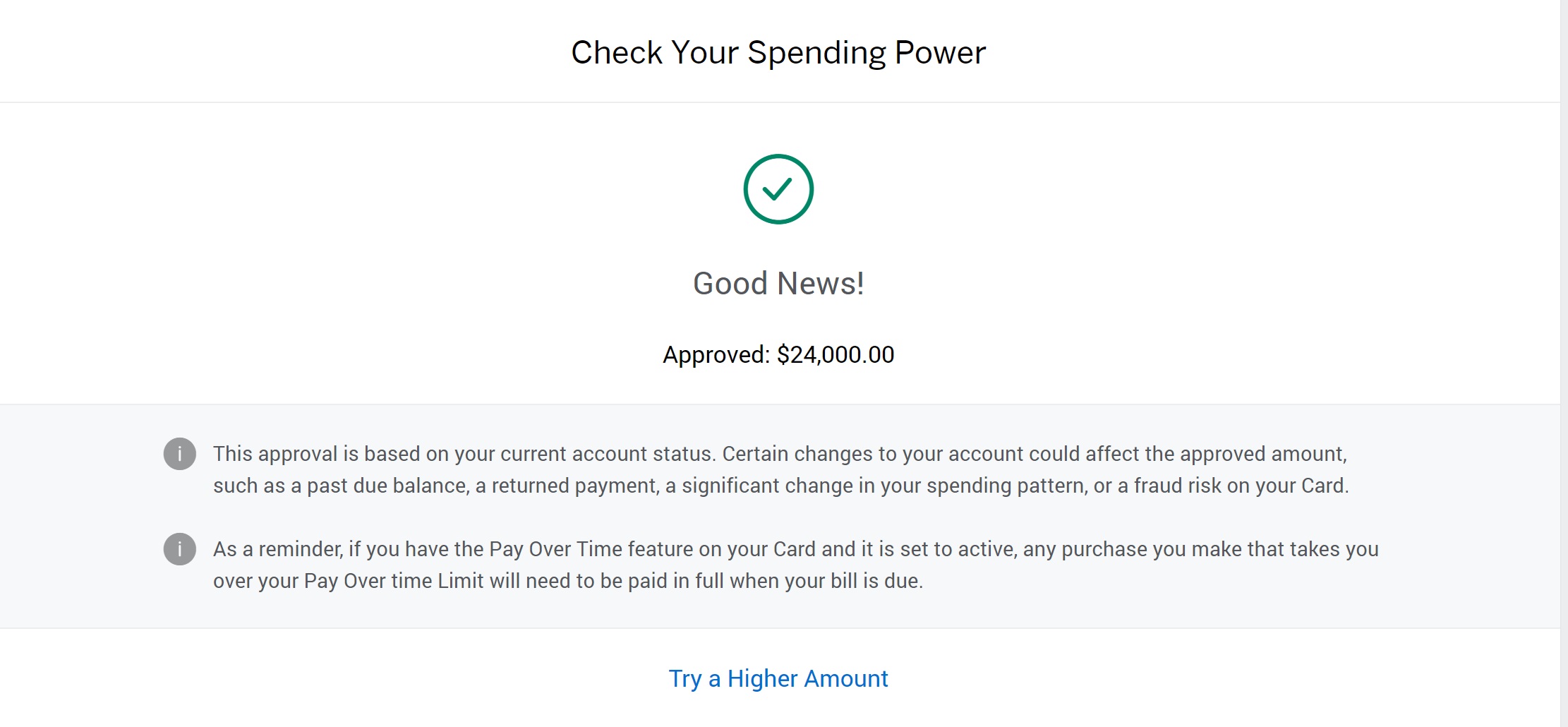

Will Amex approve a charge to buy a car with a card?

The short answer is yes. The Platinum card has no preset spending limit. That doesn’t mean you can purchase anything and everything you want, but it does have a flexible spending limit.

That said, when I first started shopping, I hit the “Check Spending Power” button in my account and picked a large enough amount to cover the high end of my car shopping budget. I got a message saying to call to speak with a representative.

I called and explained that I was looking to buy a car with my Amex card. The rep told me that as this was a new account, they couldn’t approve a charge at the amount I was requesting. I asked whether I could pre-pay the charge and he said that I could absolutely schedule a payment. At the time when I originally called, I thought I would buy a vehicle within the week. The phone rep was able to schedule a payment for the following week and then immediately approve the amount I was requesting so that I could purchase the car (with the payment set to automatically occur to cover my balance).

As it turned out, I didn’t buy that week. The automatic payment still processed for the small (few hundred dollars) balance I had on the card.

Then, when I found the car that I did want, I realized that it didn’t make sense to put more than $25K on the card because of the 2% fee. Once I maxed out the welcome bonus and referral offer (both capped at $25K spend), I’d only be earning 1x. I didn’t want to pay a 2% fee to earn 1 point per dollar. I decided to put less than $25K on my Platinum card because I had already done a little bit of qualifying small business and restaurant spend.

When I used the “Check Spending Power” link in my account, it said that a $24,000 charge would be approved.

I later called to be sure that I was all set and to see if I needed to provide any more info, but the phone representative assured me the charge would be approved.

I made a $1,000 deposit with the dealer over the phone with my Platinum Card two days before pickup. At the dealership, I paid an additional $23,000 to buy a car with my Platinum Card (and paid the rest via check). Sure enough, it all went through without a hitch. The day after picking up the van, the bonus points from my $1,000 deposit (both 14x Shop Small and 4x from the referral bonus) posted to my Membership Rewards account. Then it was just a matter of waiting a few days for the rest to roll in (and they did).

How I hunted down a dealer and a deal to buy a car with a credit card

Years ago, I read some articles on how to negotiate a car deal via email. I contacted more than 200 dealerships in my process of finding the vehicle that I bought and I can confidently say that most of what I read a few years ago is outdated or doesn’t work quite as well as you would hope.

Here are my key takeaways from contacting more than 200 dealerships:

- First, keep in mind that all the usual car shopping caveats apply. Do your research both on the vehicle and the dealership. This post isn’t about how to check the Carfax and do your due diligence on the dealer and so on. If you’re new to car shopping, give that process a Google before you get into this.

- Going to the dealership website to find a specific person to email was a waste of time. It seemed smarter to go directly to a specific person, but I rarely got responses that were any better than what I got sending a message through a site like Autotrader or the button on the dealer website that says “check if this car is available”. An exception is probably if you have been referred by a specific past customer or mutual friend.

- Don’t waste much time on the initial email because in 95% of cases nobody is going to read it. You’ll get automatic drip email campaigns with form emails, but very few personalized responses. The instances where anyone actually read my initial email and responded directly to anything in it were few and far between — that happened maybe 5% of the time. Just send a simple “I’d like to email with someone about this vehicle” type of message and wait to get the automatic email asking you when you have time to come to the dealership in person. Respond to that with your actual questions.

- While we’re on the email thing, create a dummy email. You’re going to get junk email forever, so don’t use your primary email address. I created one just for car shopping.

- Speaking of junk mail, you’ll also get calls and texts nonstop. I recommend either using Google Voice or one of those prepaid Verizon numbers you recently opened.

- Don’t expect much negotiation in the current market. I spent a lot of hours shopping both via email and over the phone and I was frequently told that the price is the price. Surely this will vary and negotiation is an art, but my strong sense is that a lot of dealers don’t feel a need to negotiate right now.

- Expect to do most of the work. This was a bit of a challenge for me at the beginning. I typically expect a little hustle out of someone working for a commission. But it’s a hot market and it quickly became obvious that what I envisioned as a chance to make an easy sale was actually viewed by the salesperson as a sale they were going to make with me or without me. While I definitely came across a few exceptions, I had a lot of situations where getting answers to questions or getting a return call or email was like pulling teeth. I even got a few outright rude responses. Don’t expect Singapore Airlines service in most situations.

- Don’t lead with the fact that you want to use a credit card. Conventional wisdom will tell you that you need to negotiate the price before negotiating payment, but I didn’t really want to waste time with multiple emails with dozens of dealerships that ultimately wouldn’t take my credit card for the amount I wanted. On my first rounds of emails, I led with the fact that I wanted to put the entire purchase on a credit card. The very first dealer to respond was willing to take the full purchase price on a card for a 3% fee. After that, many, many dealerships cited a card limit of $2500-$5000 and I immediately eliminated them. That was a mistake. I would have gotten more helpful responses without leading with the credit card angle and those credit card limits were probably negotiable in at least some situations. In my final negotiation, I waited to mention the card until the end. Upon hearing that I wanted to put $24K on a credit card, the salesperson from whom I purchased my van initially told me that the dealership only accepts $2,000 on a credit card. I asked him to talk to his manager and let them know that I was willing to pay the interchange fee. I said that I understood that dealers who took a large payment on a card typically charged something like a 3% fee and I was fine with that. Less than 10 minutes later he called back saying they could take $24K on the card for a 2% fee ($480). I don’t doubt that he’d been told of the $2K limit before, but clearly that wasn’t set in stone. I probably missed out on another deal or two I could have made early on.

If you want to do this process yourself, keep those tips in mind and be ready to invest some amount of time for a great payoff.

It won’t be without some bumps. The expectation of the industry on the whole is still that the customer will take their free time driving dealer to dealer to test the same car again and again and sit in an office waiting for a salesperson to run back and forth with some “manager” in another room to determine a price and deal. Personally, I wasn’t going to take time I could spend with my kids on my day off to do the old-school dealership dance negotiating a price. That whole process feels so antiquated to me. I wanted to fire off an email to a bunch of dealerships and work with those interested in making a deal. Be aware that will inherently limit your options for better or worse.

The hot used car market might make this an opportunity to resell

The hot used car market right now might make for an opportunity to resell a car for a profit or cheap points.

Before I purchased my van, I was looking up the Kelly Blue Book value of my current vehicle and I noticed the option to get an “instant cash offer” through Kelly Blue Book.

This is essentially a service that hooks you up with local dealers who agree to offer a “guaranteed” set price. You submit your vehicle information and pictures and Kelly Blue Book gives you a price and shares your contact info with a few local dealerships who will honor that price.

I tested it out with my SUV. I submitted for an instant cash offer at 12:46pm one afternoon. One of the local dealerships called me at 12:47pm. I kid you not.

We bought our SUV 4 years ago (we bought it used) and we have put a little over 50,000 miles on it. The instant cash offer was about 80% of our original purchase price. However, on the private sale market, I think I can get closer to 90%. Considering the fact that we triggered some welcome offers with that last car purchase also, I feel like we’ve done pretty well with that.

I wondered whether there may be an arbitrage opportunity with our new van. We essentially paid the low end of the trade-in value given at sites like Kelly Blue Book or NADA Guides. Out of curiosity, I submitted for an instant cash offer with Kelly Blue Book, Vroom, and Carvana.

Unfortunately, the instant cash offer from Kelly Blue Book was a couple thousand bucks lower than I hoped. I responded to the first dealer to reach out saying that I wasn’t interested in selling at that price and they told me to come in and let them check it over and maybe we could make a deal.

Carvana seemed very low both on my van and SUV. Vroom was very close in price to the Kelly Blue Book offer in both cases.

I got a deal with which I was very happy on my van. A dealer much closer wanted $6,000 more for an almost identically equipped van of the same year and mileage. Another closer to me with fewer miles was $9,500 more. Still, after sales tax, I don’t necessarily think that I could sell this van for more than the total I’ll have paid including tax, the one-way rental to pick up, etc. On the other hand, I don’t really need to sell it for more. Even if I sold it for $3,000 less than my total cost, I could cash out 272,728 points via Schwab to make up that $3,000 and still be 300,000+ points ahead.

Had I focused entirely on finding a $25K car that I could resell, I feel like there is a reasonable chance that I could have been closer to breaking even or even coming out ahead without much effort. If you cash out 500,000 points for $5,500 via Schwab, that allows for a lot of margin of error in picking a resale car.

In fact, I’ve just begun searching for such an opportunity and in my initial searches I’ve found some potential arbitrage with vehicles priced in the ~$25K range that ring in cash offers close to $24K via Kelly Blue Book (all you really need is the VIN and options to submit for offers and you could do it outside of your home area if you just want to test the waters). Obviously there are a lot of question marks there regarding condition of the vehicle, market conditions / fluctuations, float, etc. Reselling a $25K car isn’t a slam dunk nor is it without risk, but neither is it impossible to do and the big bonus on the Platinum card creates a nice buffer for a margin of error for those who can stomach the risk.

I might personally be tempted to take a swing at reselling a car if the Shop Small bonus continues for long (I could still get the Schwab or Morgan Stanley Platinum cards with a slightly lesser but still decent 100K + 10x intro spend offer). In the meantime, if I could sell the van I bought for enough, I’d probably consider selling it, pocketing the points, and shopping around again without being tethered to using a credit card to pay for my new car.

Bottom line about buying a car with a credit card

I am incredibly excited to both have a nice new ride in the driveway and a huge stash of points that appeared along with it. The massive Shop Small bonus being offered on the Platinum card (particularly with the offer that is only available via Resy) forced my hand into buying a car right now because the return on spend was just too valuable to ignore (when am I ever going to get half a million points on a car purchase again without buying a Ferrari?).

It is astounding that it is possible to buy a car with a credit card and earn enough points to book travel worth more than the cost of the car. I’m not saying we should value the points at the retail cost of travel, but the bottom line is that the rewards here made it worth buying a car now rather than waiting for “someday” later.

My wife and I had long resisted the idea of a minivan, but driving off with half a million Membership Rewards points certainly had us all smiles for the long ride home as we daydreamed about where this van could take us — both on the road and in the sky.

![Amazon: Save up to 40% when redeeming at least 1 Membership Rewards point [Targeted] a laptop on a table](https://frequentmiler.com/wp-content/uploads/2022/07/Amazon-Laptop-Featured-Image-218x150.png)

Just discovered that one can make payments with debit cards through the BMW financial site — purchased a car in the last year partially financed through them — just liquidated 2 Visa GCs from Office Max. No fee to do so (!). Only limitation is have to wait 10 minutes between payments. Wish I knew at the time of purchase

In the process of buying a new car — the dealer will allow $5K on a credit card (which I plan to do with Amex Bus Plat to meet SUB [‘expand your business’]) and I am going to ask them to do $5000.01 to get 1.5x.

I asked about debit cards, and they indicated they have no limit on how much can be paid via debit card…enter Simon, right?

Going to take advantage of the current 75% off fees to gather a bunch for the purchase.

I do have a reliable way of liquidating otherwise (son’s tuition payments) if for some reason that falls through

And will of course not use an AMEX for Simon as that does not work…will use my Hyatt card to help push towards the 15K needed for free night (and picking up elite nights along the way)

That’s awesome. Note that paying exactly $5k will earn 1.5x, you don’t need them to charge $5000.01

Update: was unable to use the Simon Cards for the vehicle purchase. However this dealership was all over the board, not transparent and generally slimy in the end for numerous reasons not related to card use. Regarding card use they were inconsistent in the max allowable for credit card purchase (though I was able to do $5K on the Amex after showing them emails) and then they decided against allowing the Simon Cards — first by saying it bundles into their $5K max on using a card, then saying no due to them being prepaid debit cards, etc. So given this I would not rule out someone else trying with a dealership that is even remotely forthcoming and honest. Good luck there these days.

ok great post but is everyone on here a moron or just missing the biggest question of all:

how did you repay the $24K balance on your Amex?

that’s the most important question and no one has asked it yet. you talked about prepaying the charge but only paying a small balance on the card (few hundred), so I don’t get it.

so you bought a minivan on a Platinum card? check!

you earned a bunch of miles. check!

you got multipliers and the miles are 10x or 25x. check!

but you now have a $24K balance on your credit card. what’s the APR and how did you pay it off?

that’s the bigger issue, not all the points!

if your APR is 10-15%, then was it worth it to buy a car on your credit card? no way if you have good credit. and what’s the cost of driving 9 hours both ways? what is that worth if you make $50 an hour or higher?

so, I ask again, how did you pay off the $24K balance?

thanks.

The Amex Platinum card is what was traditionally called a charge card (they now call it a “pay over time” card). Unless you have Pay Over Time enabled, you can’t carry a balance on the card — you have to pay it off. That said, these days I think they do automatically turn “Pay Over Time” on for new approvals. I recommend turning that capability off because Amex is known to offer bonuses eventually to turn it back on. At any rate, I couldn’t tell you the interest rate on any of my credit cards because I don’t carry balances on them.

Of course I paid it off in full (and just a few days after buying the car actually). There are no rewards cards at all that are worth using if you can’t afford to pay off your purchases in full each month. If you’re going to carry a balance, rewards credit cards is not the game for you — work on low APR cards (perhaps from a local credit union) until you pay things off and only get into rewards cards if you can spend within your means.

I apologize for not being clearer about this in the post. Regular readers of this blog surely know everything I said above (and that’s why there are no questions about that — those of us who play this game know that paying credit card interest is a non-starter), but I’m sure that many people may have stumbled on this post who were not familiar with the blog and rewards cards and perhaps it would be worth adding a note to make this clear for them.

ok thanks for clarifying.

I would also include what you spent on that 9-hour trip. what did that cost in terms of real dollars? example, at $50 or $75 an hour, that’s $900-1350 + hotel + food. Only reason is because people forget to factor this in thinking that time spent on driving somewhere is not real work. so in essence you spent $24K + another $1500 in travel time and lodging/food to buy this car.

either way, I’ve learned from this post and may be applying for this card tomorrow. thanks.

Thanks for your thoughts on that. A few things, but first don’t plan on applying for this card for the purpose of buying a car — as noted at the top of the post and within, the offer on this card changed the day I posted this last month and it now no longer includes the small business bonus component.

As to the value of time / “cost” of the trip:

1) My wife actually did all of the driving. We rented a car one-way to drive out (paid $189.80) and drove the van home. We also booked a hotel that was just over $100 with tax, but booked it with the Capital One Venture X card through Capital One Travel because that card offers $300 in statement credits annually for travel booked through Capital One, so the hotel stay got rebated. I would have used points, but the hotel was cheap and walking distance from the dealership (alternatively I could have stayed about 11 minutes away from the dealership for 5,000 Hyatt points).

2) The reason we rented a car one-way was so we both had company in the car both ways and also so I didn’t lose productive time. I didn’t take any time off of work at all and did the trip on work days — I worked from the car in both directions. As someone who works online, that’s not atypical for me — I often work from the car. So in my case, it wouldn’t make sense to count the drive in terms of hourly cost.

3) That said, I have an unpopular opinion on the value of time. I think many people overvalue their time when it comes to putting a dollars and cents value to it. That’s not to say that time isn’t valuable, just that few people have a job where they can choose to work at a rate of $50 or $75 per hour for unlimited hours and at any time of day, so doing something in your free time and then valuing that time based on the salary you earn in your working hours just isn’t realistic. Most people who have a $50/hr or $75/hr job don’t have the ability to continue doing that job at that hourly rate on their days off. Obviously you could do something in your time off that generates income, but there are fewer people doing side gigs at those types of rates. Obviously not impossible, but I think that in general it is unrealistic to value your non-working hours based on a salary that (for most people) is only available to you for 40 hours per week unless you’re someone who does have a lucrative side gig and you’re choosing to do “Thing X” instead of “Lucrative side gig Y”. Again, this is an unpopular opinion of mine, so I don’t expect you to agree with it and in this specific instance it is irrelevant since I was working for all of my regular hours (except the time I spent at the dealership I guess, which I will admit was longer than I felt like I should have been there, but because my job as a blogger is flexible I was still able to get my full 8 hours in without a problem.

4) In my unique situation, the drive to get the car and back felt like the opposite of a cost. My wife and I took one trip without our first son when he was only few months old almost four years ago and we took one overnight trip to New York City just before the pandemic hit. We now have a 4yr old and a ~1.5yr old and haven’t taken a trip by ourselves since that night in New York City about 2 years ago. My in-laws and sister-in-law graciously offered to take care of the kids while we went to get the van. I love my kids beyond description in the same way that all good parents do, but 18hrs in the car for us to talk and pick the music we wanted and *sit in silence* while I worked was worth every penny of that $189 car rental, $100 hotel room, and a stop at Panera on the way out and a pizzeria on the way back. (Uber Eats credits from our household Platinum and Gold cards covered dinner at the hotel). So while I completely understand your point that we should include the cost of going to get the van against what we earned for getting it, they didn’t feel like significant costs here.

And all of that out of the way, there were vans closer to me on which I could have used the card to pay in full. We drove 9hrs each way because the price was so good. There was a van almost identical in every way (it had 2 fewer minor options and 2K more miles) and they wanted $6K more for it. Another one with about half the miles of the one I bought was about 3 hours away from me, but they wanted $9500 more than what I paid. The price was right in Columbus in this case. If I were willing to settle for a subpar deal or a van in subpar condition, I could have had a deal an hour away from home. The difference in the deal was enough for me to make the drive in this instance, but if there were a similar deal available close to home I would obviously look at the the cost of food and hotel and gas and all that more closely. In this case, there wasn’t a deal remotely close available in my nearby area.

Trust me, I’m not running out there and buying a car w/an AMEX platinum just because of this post. but I do like the idea of having points that can be used for travel and creating memories.

The best life is one that you can look back on because you built great memories. I’m a big hard rock fan, but I never liked Kiss. I liked the outfits but I thought their music was average at best. But guess what? my college friend at the time said let’s go see them in 96′ and I was blown away. They put on one of the best concerts I’ve ever seen. To this day I don’t follow Kiss nor would I ever buy their merch but that show was amazing!!!

So great experiences create great memories. that’s where this card comes in to play for me. If used wisely it’ll lead to great trips that w/be etched in my brain forever 🙂

Glad I found your website.

This is cool. Could you please share which dealership it is?

Thanks Nick for the great idea. Just so happens I’m looking for a new car and got in on the Resy Platinum offer literally a few weeks before it ended (unfortunately missed the +4… but you can’t win em all).

Here’s a data point for others:

Put a $500 deposit at a Toyota dealership with my Amex. Posted the next day, but only got 500 MR points with it. Incidentally, many other Toyota dealerships in the area are listed as SHOP SMALL through their search, but this one IS NOT.

I messaged on the chat, and the rep confirmed (I asked 3 times in different ways just to be sure) that it is classified as shop small, but it takes 8-12 weeks for the remaining 14x to post because it is part of the welcome bonus. I assume it will be quicker than that though…

Lucky for me, I’m getting a new car (not much more expensive than the used cars out there these days). So I have probably 6-8 weeks until I have to put the balance because it takes FOREVER for them to get a new car. I briefly mentioned to the salesman I want to use a CC for the majority of it, he seemed resistant but I have a feeling once we get everything else moving if this is the only thing holding it up, he’ll get manager approval.

I get that you earned 581,000 points but what airline is offering 4 round-the-world business class tickets for only 581,000 miles? That’s barely one person roundtrip on Delta these days. I don’t know any airline that is offering that for 145,250 miles per person. Please explain.

ANA Mileage Club (Star Alliance). See the link in the first paragraph or number five in the summary to the post about incredible vacations with membership rewards points for more details.

I didn’t realize you lived in Columbus; go bucks!

I don’t – I had to drive 9 hours each way to buy there, but it was worth it!

I don’t understand American Express’s definition of a small business. You absolutely need to use the locator to see if a particular business is coded. 99 Ranch which has 55+ full size supermarkets throughout the US is a Small Business per Amex. One local Ace Hardware store in Silicon Valley is not.

They list their definition in the FAQs (there’s some limit on number of employees and dollar figure in annual CC transactions), but regardless of their definition the business also has to participate in the small business program.

Used the offer to buy a new Civic 22 Ex at MSRP put $26000 ($875 in cc transaction fees) on the card and made 291,000 amex points only had to drive 4 hours the deal was around if you searched the small business listing Amex provides a search for,

Nick also alluded to pursuing this deal a few weeks back so don’t blame him!

This is really awesome stuff.

So, Nick, using all your best points and miles acumen and taking literally everything you can into account, what would you say is your true savings here? I’m assuming that you really were going to make this purchase and that the allure of the cash back did not compel you to make a purchase higher than you would have. So put that to side.

But starting with the genuine baseline — the dollar per point at which you truly are ambivalent about having or not having MR at this moment in time — what are your true hidden and not hidden costs and opportunity costs?

My ballpark guess is you’re about $5200 to $5500 to the good.

“Because of the hot used car market, I could potentially sell the car for nearly what I paid…”

Assuming there’s somebody else out there who isn’t ashamed to drive a minivan.

bdum-psshhhhhhhh

[JOKEJOKEJOKEJOKE]

😀

Maxed out my 25k resy (15+4x) as well. The last 15k wanted to buy a car, but the ford maverick was not in stock, went used car route found a car, but used dealer threw 1.5k theft tracker. Gave me bitter taste in mouth, so I maxed the rest with Swappa cell phones 3 for family the rest for resell.

Now want to see best way to get MS plat 10x and maybe put an order on Maverick if the orders open up again or leave info to dealers and pay over MSRP. Anyone else getting the MS plat card?

Also great tip on offering to cover the 2% dealer fee, I forgot to throw that out there in the conversation. But was able to find dealers that would take card.

Woah – you single-handedly took advantage of and killed the deal! That’s impressive. This is why we can’t have nice things, LOL

Congrats on poking the bear and killing the deal !

Bravo Nick! The Walgreens pizza hack is still my favorite though.