The Southwest Companion pass has undoubtedly long been the most valuable companion ticket benefit of any airline program, and it continues to be so in 2025. The key value lies in the fact that this benefit is repeatable an unlimited number of times and it is not subject to the availability of any special fare class. As long as there is a seat available for sale on the plane, a Southwest Companion pass holder can add his/her companion to their reservation and pay only the taxes ($5.60 one-way on domestic flights within the US). If you travel in a pair from an airport served by Southwest, it is hard to ignore the value of this pass.

Traditionally, the best time to open Southwest Airlines credit cards is after October 1st because of the ability to time the spending requirements and earn 135,000+ points after January 1st, securing a Companion Pass for nearly 2 full years (see the next section for full details). Given limited-time offers on Southwest credit cards that are due to end soon, now is a great time to consider the value of the Companion Pass and to plan your strategy to earn the pass through December 2026. We have therefore updated this Southwest Companion Pass Complete Guide with everything you need to know for 2025 in order to earn a Companion Pass valid from early 2026 until the end of 2027.

How to qualify for the Southwest Companion Pass

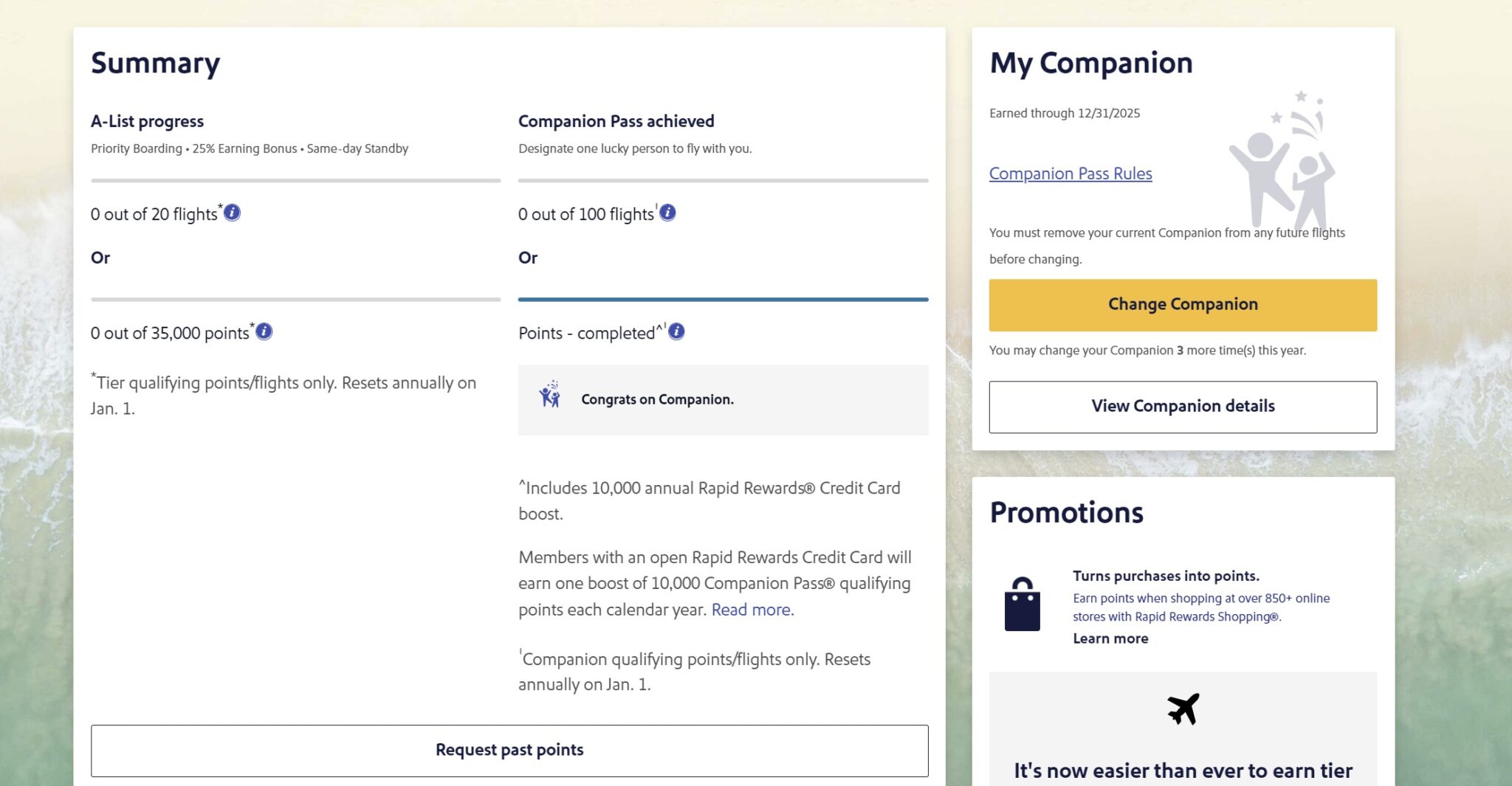

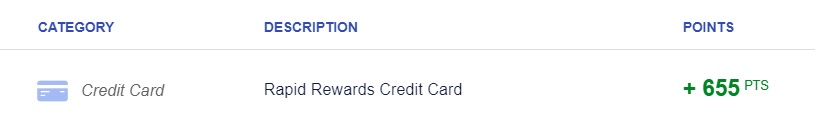

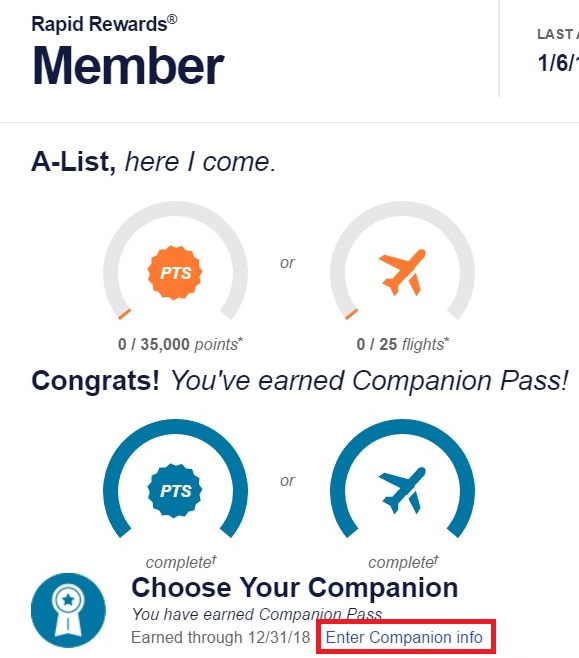

Those who want to earn the pass need to earn 135,000 Companion Pass-Qualifying Rapid Rewards points in a calendar year. However, credit card holders get a boost of 10,000 Companion Pass-Qualifying points (not redeemable miles), which means that those with a Southwest Credit Card effectively need to earn an additional 125,000 qualifying total points in a calendar year to qualify for the Companion Pass. See more in this post: Southwest Airlines increases companion pass qualification to 135K points starting 1/1/2023.

Once the member has earned the required qualifying points, the companion pass will be valid for the remainder of the calendar year in which it is earned and all of the following year. For example, if you earned your 135,000th point on November 1st, 2025, your Companion pass would be valid until December 31st, 2026. Therefore, earning the pass as early in the calendar year as possible will enable a member to maximize the length of validity of the Southwest Companion Pass. To illustrate: if you earned all 135,000 points in the first week of January 2026, your Companion Pass would be valid until December 31st, 2027.

Keep in mind that all qualifying points must post in the same calendar year (i.e. January through December of the same year). The timing of points earned is therefore of utmost importance. Consider the following two examples:

Example 1: Morgan

- Morgan earned 65,000 points in January 2026

- Morgan earned 70,000 points the following month in February 2026

- Morgan earned a Companion Pass (135,000 points earned in a single calendar year) valid through December 31, 2027

Example 2: Jamie

- Jamie earned 65,000 points in December 2025

- Jamie earned 70,000 points the following month in January 2026

- Jamie did not earn a Companion Pass (while Jamie has earned 135,000 points, they were not earned in the same calendar year)

While both Morgan and Jamie earned 135,000 qualifying points within just two consecutive months, only Morgan would earn a Companion Pass. Jamie would not have a Companion Pass because the points didn’t post in the same calendar year.

Note that you do not need to “buy” the Companion Pass. That is to say that you do not need to accumulate points and trade them for the pass, but rather just have earned the points within a single calendar year. In the example above, Morgan could use those 65,000 points to book travel as soon as they are earned in January; Morgan doesn’t need to wait until the additional 70,000 points are earned in February in order to use the points. Once Morgan earns the 135,000th qualifying point of the calendar year in February, it will be possible to add a named Companion to any existing reservations.

It is also possible to qualify for the companion pass by taking 100 flights with Southwest in a calendar year. That’s a lot of flying on Southwest. For this guide, we’ll concentrate on earning the Companion Pass through points.

Shortcuts to a Southwest Companion Pass without spending a lot of money: Which points qualify?

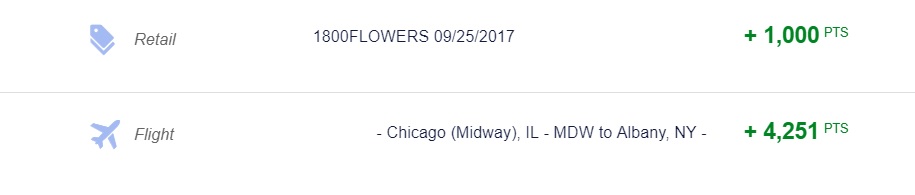

There are many ways to earn Companion Pass qualifying points. Rapid Rewards points earned from flying and those earned from the Southwest credit cards (including those from new credit card welcome bonuses) count towards the requirements. Most points earned through the Southwest Rapid Rewards shopping portal count towards the companion pass, as do those from partners like rental car agencies.

In practice, we have found that the following things do count:

- Paid flight activity

- Points earned from credit card spend, including the initial intro bonus points

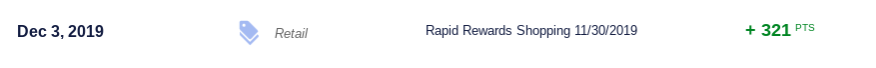

- Points earned from the Southwest Rapid Rewards Shopping portal (however, seasonal bonuses from the portal do not count)

- Most (but not all) points earned from partners

For things that do not count toward the Companion Pass, see the following section of this post: Stuff that doesn’t count towards a Companion Pass.

Are there any shortcuts to earning a Southwest Companion Pass? What is the easiest way to earn a companion pass? As of 2025, there are several main shortcuts that work. Keep in mind that you do not need to earn all of the points from a single source — mix and match points from each of these shortcuts as you please.

Credit card bonuses

Chase frequently offers valuable welcome bonus points for new cardholders of their Southwest cards after meeting the minimum spending requirements. There are several versions of the Southwest credit cards.

There are three consumer/personal Southwest credit cards: the Southwest Rapid Rewards® Premier Credit Card, the Southwest Rapid Rewards® Plus Credit Card, and the Southwest Rapid Rewards® Priority Credit Card. On the business side, there are the Southwest® Rapid Rewards® Premier Business Credit Card and the Southwest® Rapid Rewards® Performance Business Credit Card. Each card is a separate product, though keep in mind the eligibility rules outlined below.

Welcome bonuses on these cards increase and decrease throughout the year and have historically ranged from 40,000 points to 120,000 points, which means that it is often possible to earn enough points for a companion pass, or very close to it, by opening one or two credit cards and meeting the minimum spending requirements (note that the only way to open two of these cards is to open one business card and one consumer card). The new cardmember offer sometimes alternatively includes fewer points combined with a temporary promotional companion pass upon meeting minimum spending requirements.

Here is the current offer information on each of the Southwest credit cards:

| Card Offer |

|---|

ⓘ $651 1st Yr Value EstimateClick to learn about first year value estimates 80K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K points after $5K spend within first 3 months your account is open$299 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

ⓘ $577 1st Yr Value EstimateClick to learn about first year value estimates 60K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 60K points after $3K spend within first 3 months your account is open$149 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). |

ⓘ $201 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 40K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Companion Pass valid through 2/28/27 + 40K points after $5K spend in the first 3 months$229 Annual Fee This card is known to be subject to Chase's 5/24 rule. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. |

ⓘ $169 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 30K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 30K points after $4K spend in the first 3 months$149 Annual Fee This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) |

ⓘ $107 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 20K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Companion Pass valid through 2/28/27 + 20K points after $3K spend in the first 3 months$99 Annual Fee After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. |

It is important to note that Chase added rules on the Southwest credit cards in recent years. Each of the Southwest credit cards now carries 24-month language. In a nutshell:

- You are ineligible for the welcome bonus on a Southwest personal credit card if you currently have any Southwest Rapid Rewards personal credit card or have earned a new cardmember bonus on any Southwest personal credit card in the past 24 months

- You are ineligible for the welcome bonus on a Southwest business credit card if you currently have that specific Southwest Rapid Rewards business credit card or have earned a new cardmember bonus on that specific Southwest business credit card in the past 24 months. This is a key distinction: the verbiage on the application page does not preclude you from earning the welcome bonus on a second business credit card; it just needs to be the other product.

In short, the easiest path to earn the Companion Pass via credit card welcome offers requires opening at least one business card.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Ideally, you would time the applications and spend so that the points would be earned as early in a calendar year as possible. That way, you’ll have the Companion Pass for nearly two years.

The best time to open Southwest credit cards is after October 1st, since your 3-month window to meet the spending requirement will extend into January of the following calendar year. For instance, if one opened a Southwest consumer credit card and a Southwest business credit card on October 15, 2025, your spending window would extend until January 15, 2026. If you waited to meet the minimum spending requirement until after your December 2025 statement cuts, the welcome bonuses on both cards would be earned in early 2026. With a combined total of more than 135,000 points earned in 2026 from those welcome bonuses alone, that cardholder would earn a Companion Pass that is valid through December 31, 2027.

Southwest Rapid Rewards points post to your Southwest Airlines account upon statement close. Timing out purchases to earn points from welcome bonuses at the appropriate time is relatively easy to do. For example, if you would like to earn the welcome bonus on a card in January, be sure to wait to meet the minimum spending requirements until after your December statement closes (since purchase activity after your December statement has closed should post to your Southwest account upon the close of your January statement). The safest bet is to wait until January to meet the minimum spending requirement to avoid the risk of points posting early. Almost every year, we hear from someone who inadvertently met the spending requirement too soon, so proceed with caution.

Southwest’s website now confirms that points will be earned based on statement date, not purchase date, so waiting until after your December statement has posted should ensure that any further points earned will count in January:

Points earned through spending using the Rapid Rewards Credit Card will count toward Companion Pass qualification based on when they are posted to your Rapid Rewards account and NOT based on spending date. The points post to your Rapid Rewards account after your statement closing date.

If you open more than one Southwest credit card in close proximity to each other for the purposes of earning the Companion Pass, be sure to time the spend so that you earn both bonuses in the same calendar year. If you choose to pursue such a strategy late in the year to earn welcome bonuses in January, be careful not to meet the spending threshold early.

Unfortunately, Chase does apply its 5/24 rule to these cards. That means that you most likely won’t get approved if you’ve opened 5 or more cards (with any bank) in the past 24 months.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Credit card spend

If you’re a big spender, then another way to get the Companion Pass is to simply charge $135,000 worth of expenses on a Southwest credit card (or cards) during a single calendar year.

Since the Southwest cards only award 1 point per dollar on most spend, this wouldn’t be the fastest way to earn the Companion Pass, nor the cheapest in terms of opportunity cost. However, if you know you’ll use the Companion Pass many times, it might be worth it to you.

Note that points earned from credit card spending bonuses usually also count as Companion Pass qualifying points. For instance, when there is a targeted offer for cardholders to earn more points per dollar at certain types of stores, those additional points typically count toward the companion pass.

1-800-Flowers

1-800-Flowers lets you earn 1,000 Companion Pass qualifying Southwest points per order with promo code RR22. To qualify, orders must be $29.99 or more and only one promo code can be used per order. The terms of this deal have been updated to indicate that you can only receive these points a maximum of 12 times per year (i.e. max of 12,000 points).

Unfortunately, you can no longer stack a Celebrations Passport membership for free shipping on these orders, likely killing the deal in terms of earning cheap miles (See: 1-800-flowers-kills-cheap-miles). For full details on 1800Flowers, please see: 1800Flowers Extreme Stacking promo codes, portals, gift cards, and more.

Online Shopping

You can earn points that qualify for the Companion Pass by shopping through the Southwest Rapid Rewards shopping portal. The portal offers different point bonuses for different stores. It is often possible to earn 5 or more points per dollar for shopping at some popular merchants.

Note that points from seasonal portal bonuses (such as “Spend $300, get 500 bonus points”) do not count towards the Companion Pass.

With some retailers, you may be able to take advantage of a double dip — whereby you shop through the portal to buy a gift card, earning miles on the gift card purchase, and later go through the portal again and use the gift card to buy merchandise and earn points once again. This type of double dip has mostly stopped working, but there may be exceptions.

Hotel partners

Southwest Airlines has several hotel partners (as seen on this page). Some hotel partners only allow for points transfer, but others allow you to earn Southwest points for your stays. These points are Companion Pass-qualifying.

For example, Southwest has a partnership with MGM Rewards whereby you can earn 600 Rapid Rewards points per stay at most of the MGM hotels in Las Vegas. As shown above, these points count towards the Companion Pass.

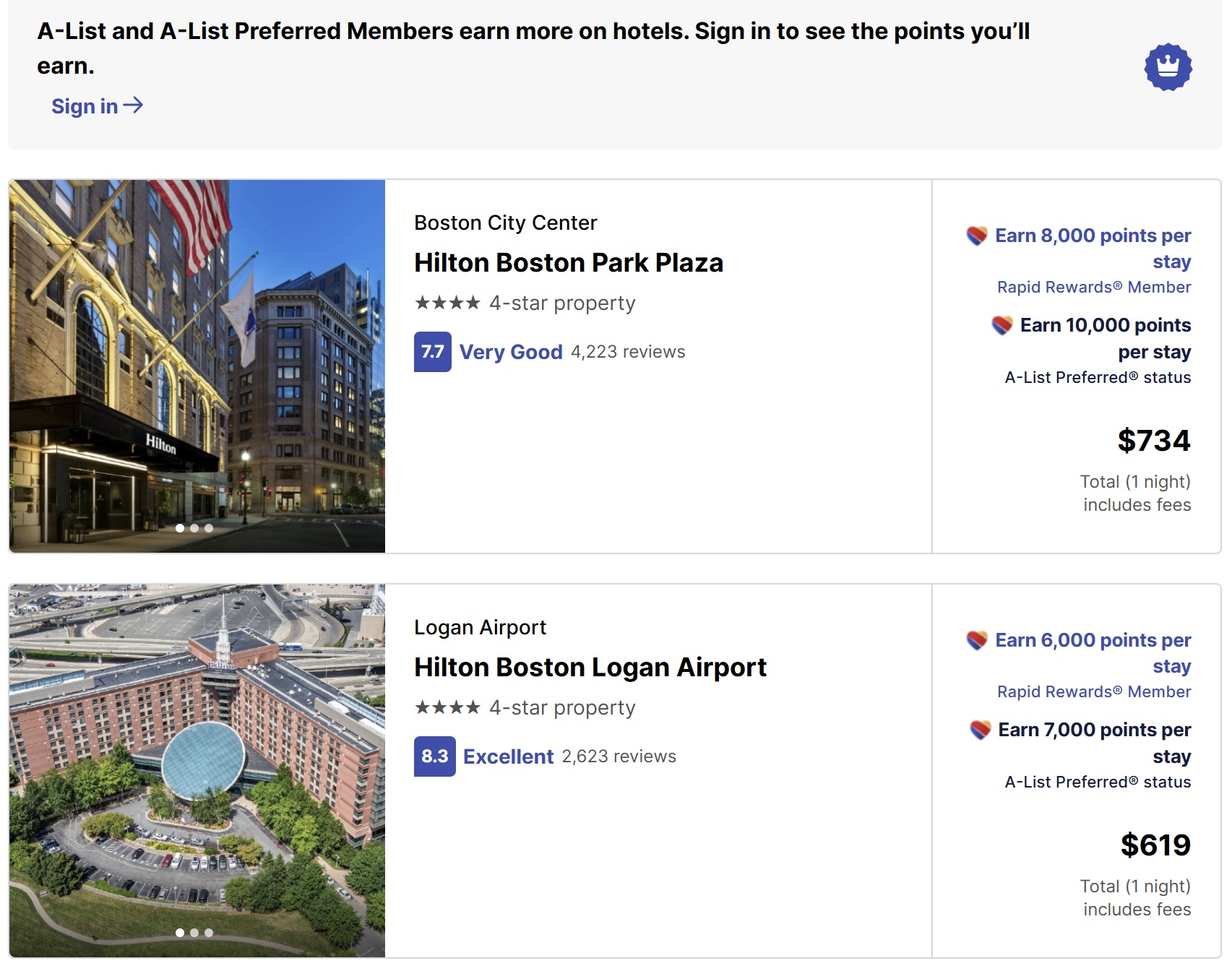

Book hotels through Southwest Hotels

Southwest Hotels is a hotel booking site that rewards you with airline miles in lieu of earning hotel points, elite credit, etc. Search for your date and city, and the search results show the price of the hotel per night and the number of points you can earn. You should expect to earn an equal number of Companion Pass qualifying points for your stay.

Keep in mind that you will not earn hotel points or elite credit for bookings made through Southwest Hotels. If you have elite status with the hotel chain, it will probably not be recognized, so you will not receive the benefits of your status, like free breakfast.

Rental Cars

Southwest Airlines partners with a number of rental car companies to offer points for renting through Southwest (see the current list here). Always be sure to compare the cost using any associated rate codes. Base points earned from car rentals do count toward the Southwest Companion Pass, but be aware that additional bonuses beyond base points may not.

Referring friends

Chase sometimes offers credit card holders bonuses for referring friends to apply for a credit card. You can check to see if you have any referral offers by entering your last name, billing zip code, and the last four digits of your Southwest card here.

You can currently earn 20,000 points per referral up to 100,000 points per calendar year from each card.

The nice thing is that your Southwest credit card referral link can now be used to refer someone to any Southwest credit card. In other words, if you have the Southwest Airlines Rapid Rewards Premier credit card, you could refer someone to the Southwest Airlines Rapid Rewards Performance Business credit card or vice versa. This opens up more possibilities in terms of earning referral points.

It is furthermore noteworthy that referrals collected late in the year can be an interesting way to earn toward the pass. We discovered that referrals earned after your December statement closes but before December 31st will count toward the current calendar year’s Chase referral cap, but will not post to your Southwest Rapid Rewards account until your next statement cuts (in January). One could therefore essentially double up on Companion Pass-eligible points by doing the following:

- Make sure your Southwest credit card statement cut date is set for early in December. As an example, let’s say your December statement posts on December 10th

- Refer 5 friends between December 11th-December 31st (for the current 100,000 point cap for this calendar year)

- Refer 5 more friends between January 1-January 9th (100,000 point cap for the new calendar year)

- When your statement cuts again on January 10th, your Southwest account would theoretically be credited with 200,000 referral points from a single credit card (100K “earned” the previous calendar year from Chase’s perspective and 100K “earned” from the current calendar year, but all posted to your Southwest account in the same calendar year — in this example, you’d earn a Companion pass from referrals alone)

Again, the trick here is to make sure not to refer people to apply until after your December statement cut date. For more information on this method, see: An unexpected path to the Companion Pass.

Referring businesses

SWABIZ is a program for small businesses to book and manage flights for their employees. SWABIZ sometimes offers points for referring new businesses to this program. Always check the terms carefully, but this could be a way to earn points quite easily for those who know small business owners / travel managers for small businesses. More detail can be found here. Also see this post for my experience with the program (though note that points were not Companion Pass qualifying when I did it, but they are now).

Stuff that doesn’t count towards a Southwest Companion Pass

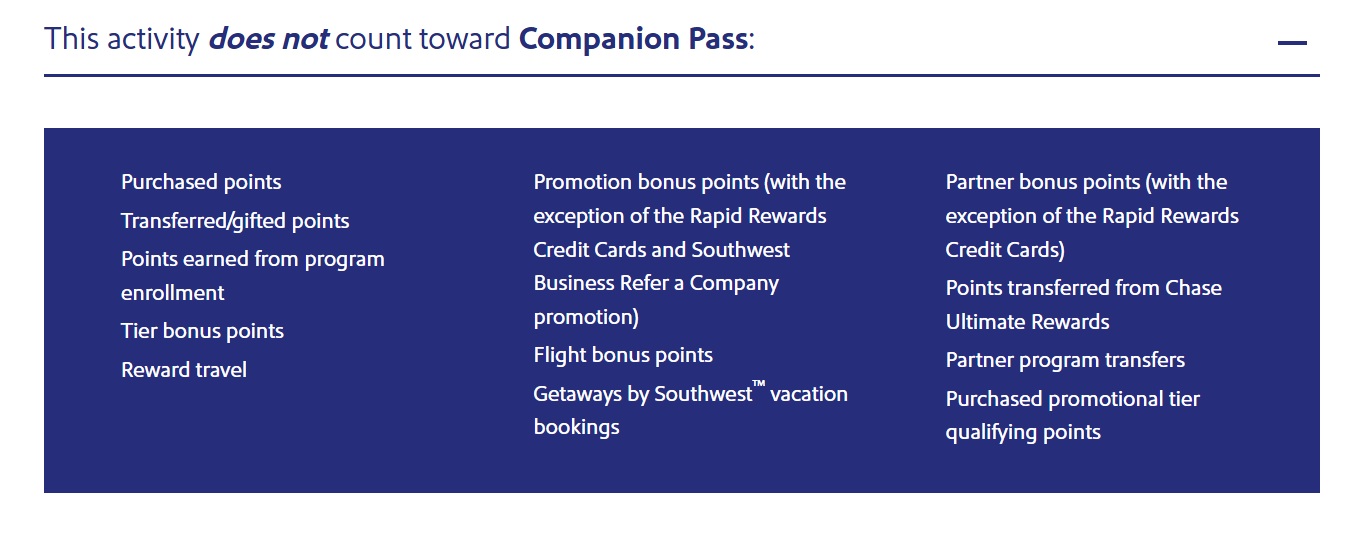

The most notable sources of non-qualifying points include: transfers from hotel partners (which ended March 31, 2017) and those transferred from Chase Ultimate Rewards or Bilt Rewards. These points will NOT count towards earning a Southwest Companion Pass.

Purchased points, transferred points transferred between members, points converted from hotel and car loyalty programs, and e-Rewards, e-Miles, Valued Opinions and Diners Club, points earned from program enrollment, tier bonus points, flight bonus points, and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase) do not qualify as Companion Pass Qualifying Points.

They further offer this chart indicating things that do not count toward the Companion Pass. Interestingly, Getaways by Southwest vacation package bookings are excluded.

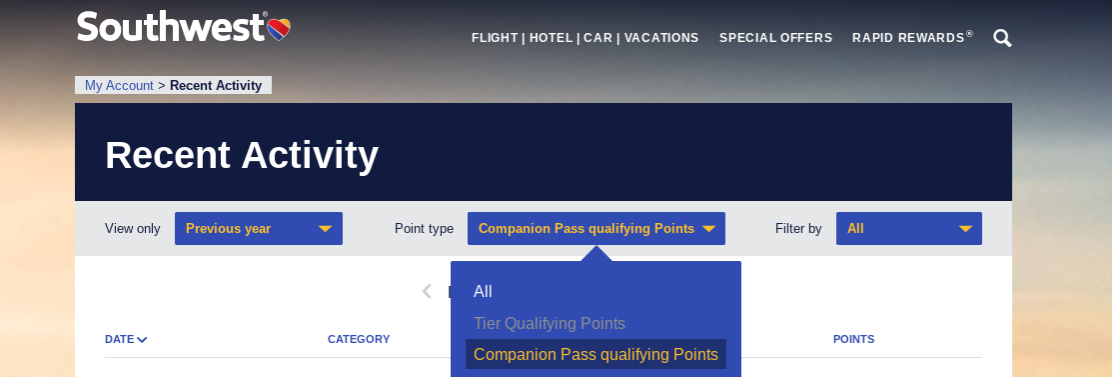

It is also important to note that bonus points at many partners do not count. Base points earned from partners do count in many instances — such as the 1,000 points with the 1800Flowers coupon code above, base shopping portal points, etc. However, an extra added bonus may not count. You can easily go to your Southwest Airlines Rapid Rewards account and click “Recent Activity”, then filter by “Companion Pass qualifying points” to verify which transactions count toward your current total.

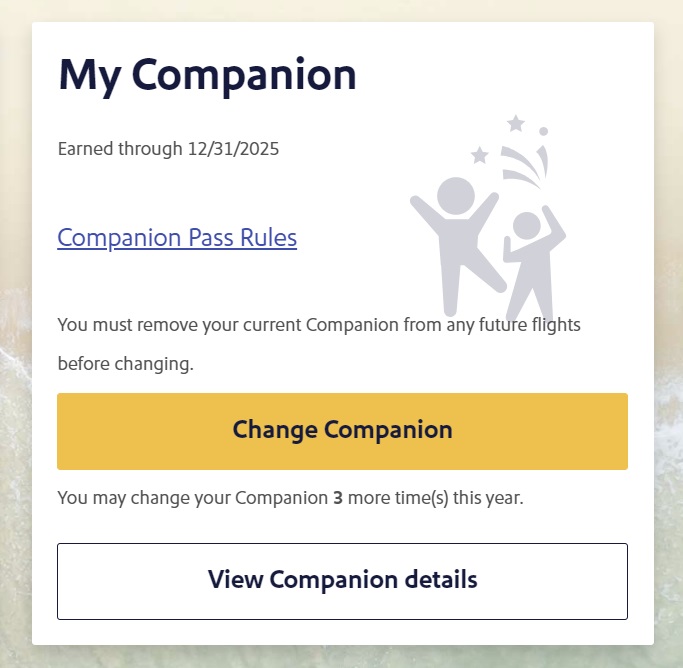

Choosing and changing your Southwest Companion Pass companion

Once a member has earned the required Rapid Rewards points, he or she can designate a companion to fly with the pass holder for free. Note that this companion can be changed 3 times per calendar year. Both the initial companion selection and subsequent changes can be done online through the “My Account” section at Southwest.com, or by making a phone call to Southwest Rapid Rewards at 1-800-435-9792.

The terms on Southwest.com state that you should “allow 21 business days for processing” after calling to change your companion in order to be able to add your new companion to bookings. In my experience, it hasn’t taken any time at all — I have been able to add my new companion to my reservations the same day I made the call to change companions. I’ve had the same experience after changing the companion online; I was immediately able to add that new companion to existing reservations. Note that you will need to cancel any existing companion reservations before changing your companion.

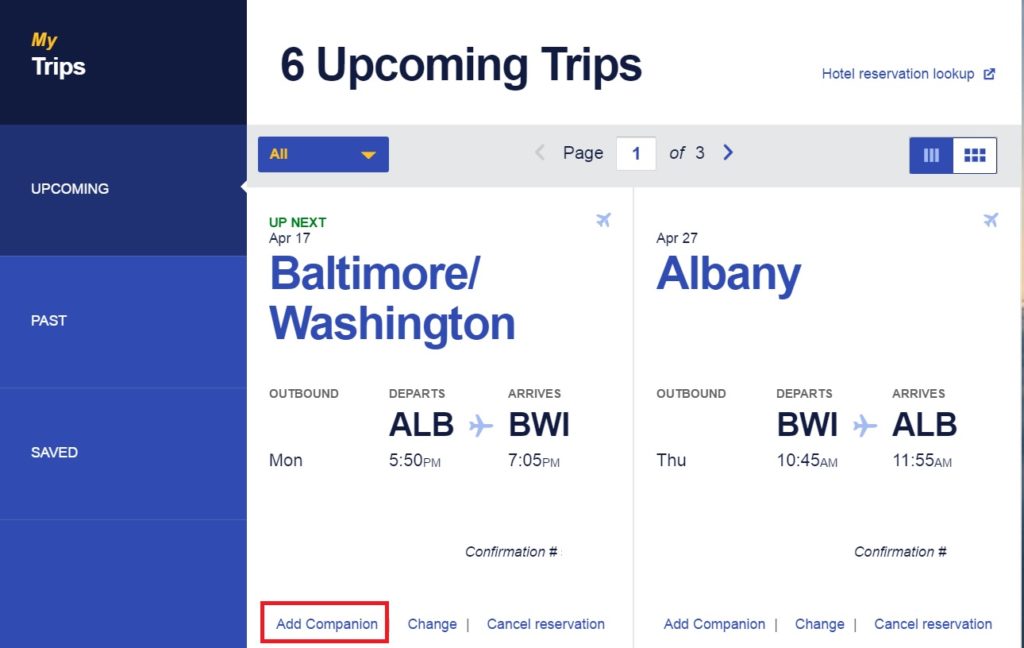

Adding a companion to a Southwest Companion Pass holder’s reservation

The process of adding a companion is quite easy and can be done at any time until tickets are no longer sold for the flight in question. The companion pass holder simply needs to log in to Southwest.com and view My Reservations. From the reservation view, he or she will see a link that says “add companion”.

From here, it is straightforward. The system will charge only taxes for the companion ($5.60 one-way for domestic flights within the US. Taxes to international destinations vary).

Again, this can be done until Southwest stops selling tickets. It doesn’t matter if you paid $59 for your ticket and the only seats left are selling for $590 — if there is a seat available for purchase, you can add your companion.

Pro tip: if you add your companion and later want to cancel your flight, you must first cancel the companion’s itinerary before you can change or cancel the itinerary for the primary traveler.

Common questions about the Southwest Companion Pass

Here are a few other common questions that people ask about the Southwest Companion Pass:

How many times can I use a Southwest Companion Pass?

You can use a Southwest Companion Pass an unlimited number of times for travel though the final date of validity.

Can I change my Southwest Companion Pass companion?

Yes. You can change your companion up to 3 times per calendar year. Changes to your companion can now be done online in your account or via a phone call to Southwest Rapid Rewards.

Do cardholder or tier member seat selection benefits apply to a Southwest Companion Ticket?

Southwest’s site indicates that for flights on or after January 27, 2026, the most favorable seat options available to either the pass holder or the companion will apply to both:

For flights on or after January 27, 2026: Boarding group will be assigned for Companion Pass holders and Companions based on their seat location or Credit Cardmember/Tier boarding benefit, whichever is higher. Companion Pass holders and their Companions will both be eligible for the most favorable seat options conferred by their individual Tier status, Credit Cardmember status, or fare. Sequential boarding is not guaranteed.

Note that a seat will not be assigned automatically. After booking the companion’s ticket, you will need to go back into the reservation and select “modify seat” to select a seat (if eligible).

Do cardmember, tier status, or fare class checked baggage benefits apply to a Southwest Companion ticket?

Yes. If a Companion Pass Member qualifies for one or two free checked bags (based, for example, on tier status or the type of fare purchased), the benefit applies to their Companion (weight and size limits apply).

Can you add your Southwest companion if your company bought the ticket?

Yes, you can.

Can you add your Southwest companion if you bought your ticket using your Rapid Rewards points?

Yes, you can. It doesn’t matter whether you booked your ticket with a credit card or with Rapid Rewards points; you can add your companion.

Can you add your companion if someone else bought your ticket with their Rapid Rewards points?

Yes, you can. It doesn’t matter whose Rapid Rewards points are used to book the primary traveler’s ticket. In fact, it is even possible for the designated “companion” to use the companion’s points to book a ticket for the primary traveler, and then the primary traveler can add the companion to the reservation and only pay the taxes.

Can you fly to Hawaii with a Southwest Companion Pass?

Yes, you can. There are no destination restrictions on the use of a Southwest Companion Pass; you can use your Companion Pass to travel to any destination served by Southwest as long as there are still enough tickets for sale on the flight for the passengers in your reservation.

Can you add your Southwest companion if you bought a Choice fare and now there is only Choice Extra available?

Yes, you can. As long as there is a seat available for sale on the flight you would like to book, you can add your companion. It does not need to be in the same “fare class” as the one you originally purchased.

Are there any situations in which you can not add your Southwest companion?

Yes, but not many. One example of a situation in which it would not be possible to add a companion is this: You can not daisy-chain companions. In other words, let’s imagine Bob earned 135,000 Rapid Rewards points and earns a companion pass. He designates Shelly as his companion. Shelly also earns 135,000 Rapid Rewards points in a year, and she earns a companion pass of her own. She designates Billy Jean as her companion. Bob buys a ticket. He adds his companion, Shelly. When traveling as Bob’s companion, Shelly can not add Billy Jean to the reservation.

Can I change my flight on a Southwest Companion Pass booking?

Yes. You will first need to cancel the companion’s reservation. You can then change the primary traveler’s flight. The system will not allow a change without first cancelling the companion’s reservation.

Can I cancel the companion’s reservation if he/she cannot travel with me?

Yes. You can cancel their reservation and either receive a refund of the taxes or keep them as a credit to use on a future flight. Note that you need to choose the option to refund to your credit card rather than as travel funds if that is what you prefer.

Can my companion travel without me?

NO! The terms of the program explicitly forbid the companion from flying without the primary traveler, and Southwest may revoke your companion pass if you try to do this.

Does my companion earn Southwest Rapid Rewards points?

No, they do not. The primary traveler does earn points on a paid reservation (not a reservation made on points).

Do I need to carry the Southwest Companion Pass card with me?

A: Southwest used to issue a physical Companion Pass card. I don’t believe they do this anymore, and even when they did, it wasn’t actually required in my experience.

What happens to my companion’s reservations if I change my companion?

You must first cancel your companion’s reservations before changing companions.

Can I book a round-trip flight that begins before my Companion Pass expires on December 31st, but returns after the pass has expired?

This isn’t possible. Southwest won’t let you add a companion to a reservation that extends beyond the pass validity period. You would have to book a one-way in December (you could add your companion to this reservation) and then a one-way return in the new year, where you pay for both seats.

Is there an advantage to booking one-way flights or round-trip flights with the Southwest Companion Pass?

It makes more sense to book one-way flights with Southwest in general. In the vast majority of cases, the round-trip price (at least on domestic flights within the US) is simply the cumulative total of the two one-way flights. You will enjoy greater flexibility in making changes to one segment or the other if you book one-way flights.

What happens if you take a voluntary bump on a Southwest Companion Pass ticket?

Officially, Southwest no longer overbooks flights, but there are probably still occasions where they need to adjust for weight and balance or crew needs. We are therefore keeping this section intact based on old policy as a guideline of what to expect should you find yourself in this situation.

In the event that Southwest overbooks a flight, they may offer travel vouchers in the gate area to volunteers who agree to switch to a later flight (known as “voluntary denied boarding compensation” — or, more colloquially, as a “bump voucher”). If you agree to take a “bump” to a later flight, this has at least in the past been Southwest’s official voluntary denied boarding compensation policy:

If you volunteer to give up your seat in an oversale situation and we can rebook you on a Southwest Airlines flight that will arrive within two hours of your originally scheduled arrival time, we will give you a travel voucher in the amount of $100 plus an amount equal to the face value of your one-way flight coupon(s).

If we cannot confirm your travel within two hours of your originally scheduled arrival time, you will be placed on a priority standby list, and your compensation will increase to a travel voucher in the amount of $300 plus an amount equal to the face value of your one-way flight coupon(s). If you are not accommodated as a standby Customer, we will confirm you on a later Southwest Airlines flight(s) with seats available to your destination. You will not incur an increase in fare.

To summarize/simplify the old policy:

- If your new flight gets you to your destination within 2 hours of your original arrival time, you get $100 + the price of your original one-way ticket

- If your new flight gets you to your destination more than 2 hours later than your original arrival time, you get $300 + price of your original one-way ticket.

How does that work if you paid with points? What about for your Companion?

If you paid with Rapid Rewards points, Southwest has a formula whereby they figure the cash value of the points. In my experience, this was roughly similar to the cash price of the ticket had I paid in cash instead of points — meaning that my voucher was worth $300 + the rough value of my one-way ticket.

Reports of the compensation for the companion vary. Your companion should receive a $300 voucher at a minimum. In my experience, I was offered an additional $100 for the companion’s ticket — meaning that my companion received a voucher for $400 total. Reports online vary from no additional money for the companion’s ticket up to the $100 I was offered. YMMV here — and your friendliness/charm may play a role here.

What are some of the best uses of the Southwest Companion Pass?

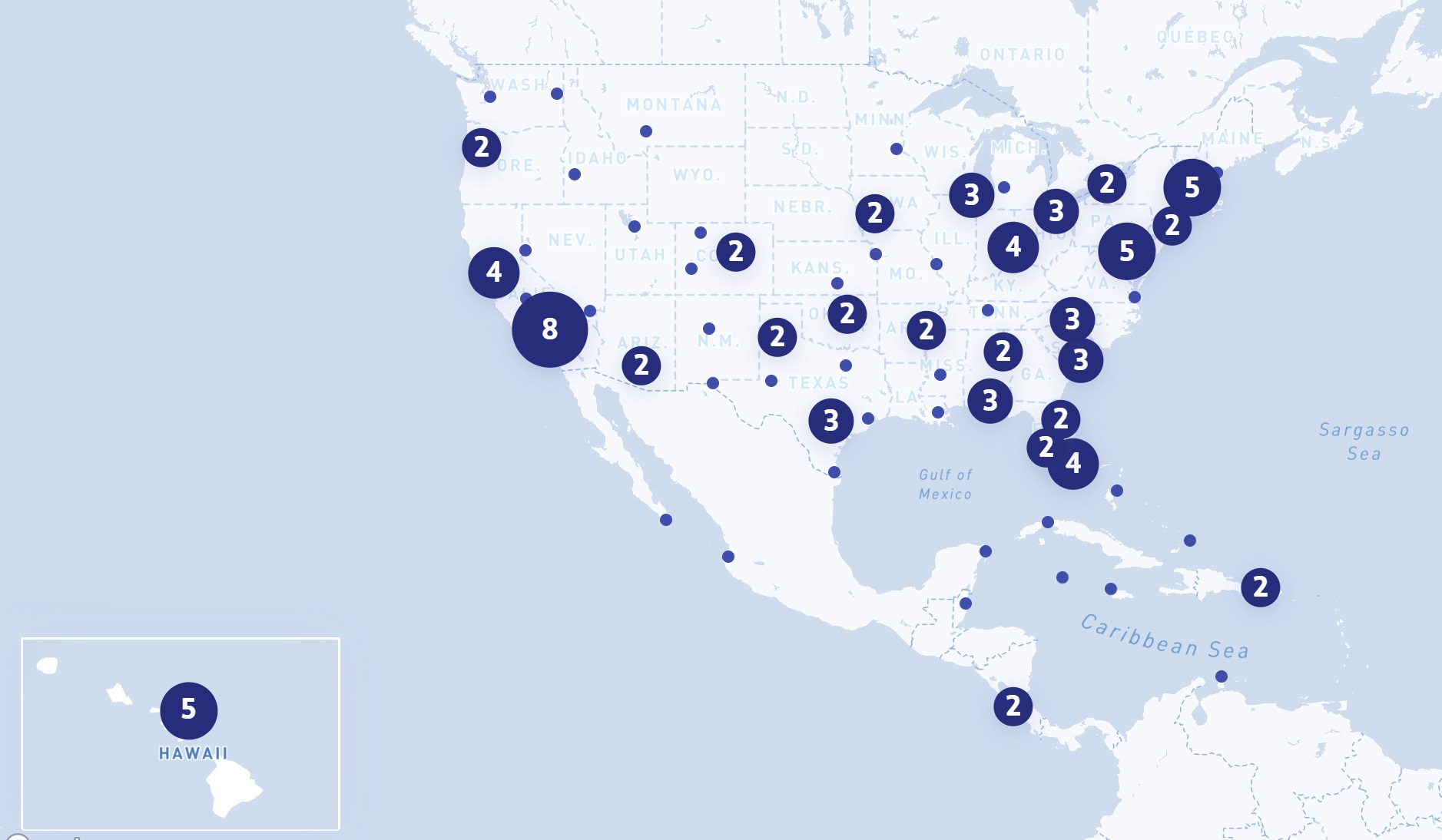

This is obviously completely subjective. Obviously, you can enjoy some cheaper trips around the US. Southwest also flies to a growing number of international destinations, including:

Aruba

Belize

Cabo San Lucas/Los Cabos, Mexico

Cancun, Mexico

Cuba

Grand Cayman Island

Liberia, Costa Rica

Montego Bay, Jamaica

Nassau, Bahamas

Providenciales, Turks and Caicos

Puerto Vallarta, Mexico

Punta Cana, Dominican Republic

San Jose, Costa Rica

Additionally, you can use Southwest to position for an award flight or for a cheap flight deal out of a different city. This can be a great option when saver-level awards on American/United/Delta are not available from your city.

Check-in process for Southwest Companion Pass holders

One of the most polarizing features of Southwest has been the check-in and boarding process, though the old process of needing to check in 24hrs in advance to get a good boarding position will no longer be applicable when flights begin operating with assigned seating starting in late January 2026.

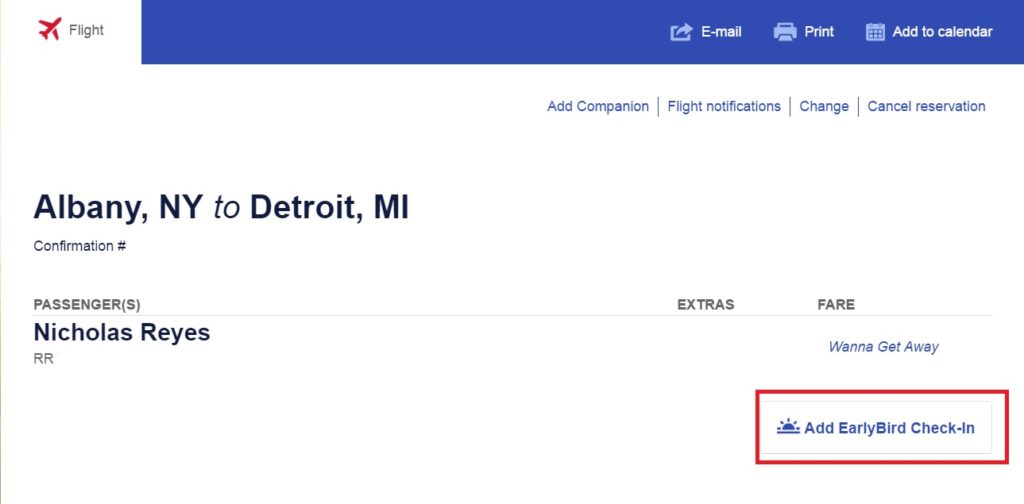

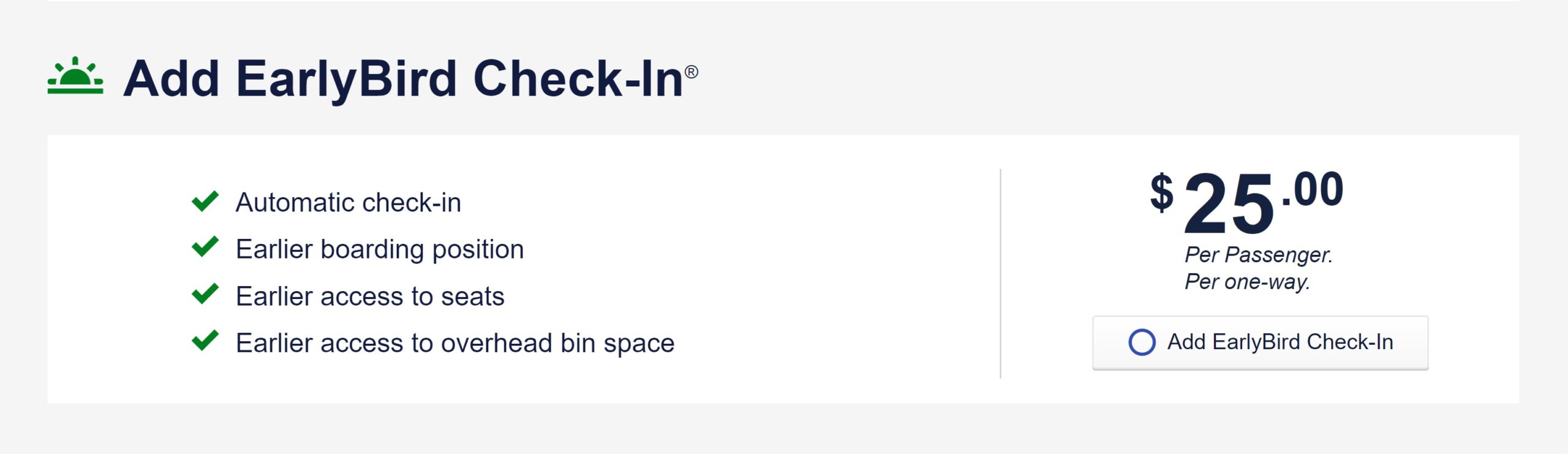

Early Bird Check-In

Update: Southwest has begun selling assigned seating (See more info here: Southwest assigned seating live for 2026 travel), so Early Bird Check-In will become obsolete when flights begin operating with assigned seating in late January 2026. This section is no longer applicable to flights departing after late January 2026, and it will be removed once Early Bird check-in is gone.

For a fee of $15-$99 each way per passenger, Southwest will automatically check you in beginning 36 hours before your flight — 12 hours before general check-in opens. They will prompt you to add Early Bird Check-in on the booking confirmation page:

Alternatively, you can always add it later on by clicking on a reservation in your account and then clicking the button to add early bird check-in.

However, there is one notable problem with early bird check-in: If you cancel your reservation, you will lose the money you paid for early bird check-in (note that if Southwest cancels your flight, they will refund the fee). Normally, if you cancel a paid reservation with Southwest, you receive a travel credit (the expiration of which now varies based on fare type). If you booked your ticket on points, you can choose to have the taxes refunded to your original payment method. However, if you paid for early bird check-in and you choose to cancel your ticket, you get neither a refund nor a credit for the Early Bird Check-in fee, as that fee is totally nonrefundable. If you simply change your flight, you keep Early Bird Check-in. For this reason, I never add Early Bird Check-in until I’m sure that plans are firm. Also, I typically only add Early Bird Check-in to my ticket (the primary traveler, not the companion). There are a few reasons for this strategy:

- If ticket prices drop, Southwest will allow you to change/re-book at the lower fare and receive a refund of the difference in points or a credit if you paid the cash price. However, in order to change your flight, you must first cancel the companion ticket. This means that if you have paid for early bird check-in on the companion’s reservation, you will lose that early bird check-in fee (and have to pay it anew if you want to add it to the new reservation).

- While some fellow passengers might not like it if you save a seat for your companion, I’ve never been told I couldn’t do it. Southwest’s “official” policy on this, which you can read about here, is to not have a policy either way. I always board the plane with a $50 bill in my pocket, figuring that, in the worst-case scenario of a passenger or flight attendant raising a complaint about me saving a seat, $50 would probably be enough to get someone to switch with me if need be. We’ve saved $15 this way plenty of times that I’ll still be well ahead of the game the day that I have to pay out. This strategy might not work for you, but it has worked for us.

- If you get bumped from your flight, you will lose early bird check-in and will not get a refund of that fee.

- The utility of early bird check-in can depend on your origination point.

Usefulness of Early Bird Check-in varies

The usefulness of Early Bird Check-in will likely depend on two main factors: whether or not you have a seat preference and your point of origin.

Southwest only flies the Boeing 737, though they fly several different variants of that plane. The smallest version they fly has 23 rows. Assuming that aisle seats and window seats are equally desirable, that means that there are about 92 “preferred” seats on even the smallest planes (23 aisle seats and 23 window seats on each side of the aisle). Each Boarding group has 60 people. Therefore, everyone in Boarding Group A will get a preferred seat if they want it. Since at least some of the people in Groups A and B will be traveling together (and therefore someone in the party will take a middle seat next to their companion), I think it’s generally true that nearly everyone in Group B will have access to a preferred seat as well. By the time Group C gets on board, it is much more likely that only middle seats are left. In my experience, checking in exactly 24 hours before the flight often (though not always) produces a Group B boarding pass.

However, that may vary a bit depending on the second factor: your point of origin. Southwest normally allows you to check in 24 hours before your scheduled departure. When you check in for your first segment, you are automatically checked in for all of your segments that day. This results in an advantage for those passengers who are not based in Southwest hubs.

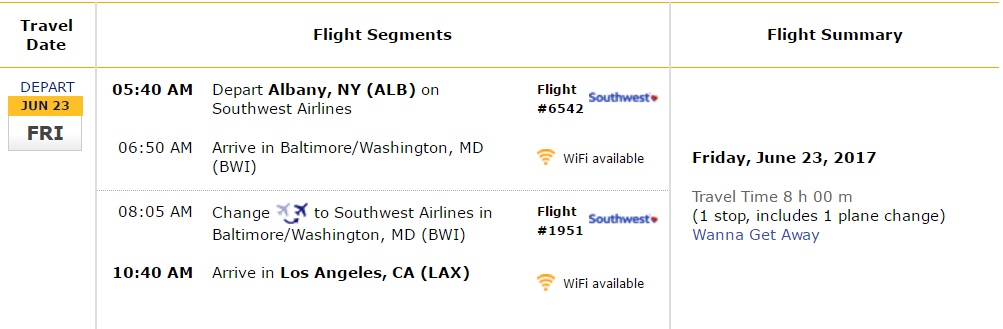

Let’s consider that you are based somewhere in the Northeast — like Albany, NY. Southwest only flies a couple of direct routes out of Albany. Most itineraries from Albany connect in Baltimore, Chicago, or Orlando. So let’s take this Albany, NY to Los Angeles, CA itinerary as an example:

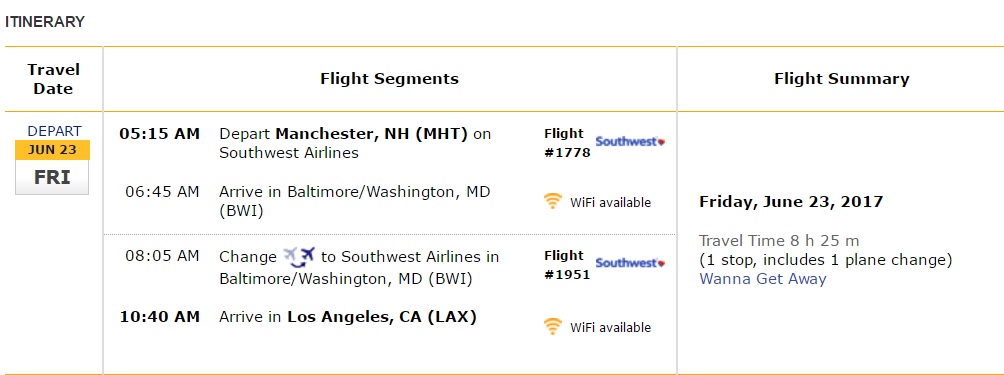

The initial flight (Southwest Flight #6542) leaves Albany at 5:40am on Friday morning. There is a connection in Baltimore to Southwest Flight #1951 — that flight leaves Baltimore at 8:05am. Since passengers can check in 24 hours before their initial flight, a passenger starting in Albany can check in for both flights together at 5:40am on Thursday. This means the Albany passenger will be checked in for that second flight from Baltimore to Los Angeles 2 hours and 20 minutes before someone originating in Baltimore is able to check in online. Of course, it’s not only passengers from Albany that have an advantage. Passengers originating in Boston get a 10-mintue head start on Albany — their first flight is at 5:30am (based on the schedule when this post was originally written). Those folks starting in Manchester, NH would beat Boston and Albany with their 5:15am departure:

The point here is that if you live in Manchester, NH, you probably don’t need Early Bird Check-in. If you can check in right at 5:15am 24 hours in advance, you only have to contend with folks originating in Manchester on your first flight and you will be among the first checking in on the Baltimore segment. You have a nice head start on the people who live in Baltimore.

Of course, on the flip side, this means that people who live in Baltimore may need to pay for Early Bird Check-in to have any chance at a decent boarding position. The people in Manchester, Boston, and Albany who also paid for Early Bird Check-in will continue to have a head start. However, those originating in Baltimore can put themselves ahead of the 24-hour check ins from Albany, Boston, Manchester, etc by paying for Early Bird Check-in. Therefore, if you live in a Southwest hub city, you may want to consider paying the premium.

What else?

This Complete Guide, like all of our resource pages, is a work in progress. We will add to it as necessary and adjust it as situations change and develop. If you have further questions or suggestions, please reach out in the comments and/or via our Contact Frequent Miler page.

[…] decision tree, based on data from expert sources like an analysis of issuer policies, is your guide to timing these important […]

I have a business and a personal card. I appreciate the info about earning both SUBs in January – that is an easy one to mess up. I earned the SUB last January and the companion pass will expire at the end of 2026. When is a good time to close the cards so that I can get them again for a companion pass in 2027 (if it still exists)?

Hi Nick- Great stuff as always, thank you!

Regarding the 24 month rule…..

When does the clock start/reset? Had 2 SWA cc’s two years ago, looking to apply for 2 new cards. Does my 24 month period start/end on the day the card(s) was approved OR when the points were posted to earn the companion pass bonus? Thanks

[…] your questions. We also recommend the Companion Pass info provided by our friends at 10x Travel and Frequent Miler. (We don’t want to recreate content others do a good job of […]

Can you add a note that companion pass does NOT work with Getaway bookings? Thanks!

I just sent this in as a question to the mailbag, but how does it work for seat booking and checked luggage if the Companion is the one with a the credit card? I have Companion Pass already for 2025/2026.

I am thinking of canceling my Southwest cards since my Companion is the one working on earning Companion Pass for 2026/2027 (fearing that the program will change if we wait until 2027 to earn Companion Pass again and because my Companion has a couple flights in 2026 that he will be flying with friends). If the primary flyer no longer has a Southwest credit card, but the Companion does have a Southwest credit card, do the seat booking and checked bag benefits apply to the primary flyer once the Companion is added?

I added this section to the post because I had recalled seeing that question, so I looked it up and put it in this latest version of the guide:

Do cardholder or tier member seat selection benefits apply to a Southwest Companion Ticket?

Southwest’s site indicates that for flights on or after January 27, 2026, the most favorable seat options available to either the pass holder or the companion will apply to both:

For flights on or after January 27, 2026: Boarding group will be assigned for Companion Pass holders and Companions based on their seat location or Credit Cardmember/Tier boarding benefit, whichever is higher. Companion Pass holders and their Companions will both be eligible for the most favorable seat options conferred by their individual Tier status, Credit Cardmember status, or fare. Sequential boarding is not guaranteed.

Note that a seat will not be assigned automatically. After booking the companion’s ticket, you will need to go back into the reservation and select “modify seat” to select a seat (if eligible).

My assumption is that checked bags will be handled the same way, though I didn’t find something explicitly outlining that in the same way as seat selection.

Awesome. Thank you for looking that up for me. That’s how I hoped it would work.

[…] your questions. We also recommend the Companion Pass info provided by our friends at 10x Travel and Frequent Miler. (We don’t want to recreate content others do a good job of […]

I found one thing this guide doesn’t cover: whether I can use my companion’s flight credits to pay the taxes and fees for their companion ticket. I took the risk that it would work and transfered my flight credit to my companion. Sure enough, it did. Good to add this to the guide. Better to use a credit card for my fees so I get travel insurance and then use the credits for my companion.

When do most people get the 10,000 points from the credit card posted to their accounts? I’m about to get 132k points as soon as my Chase statement closes (Jan 3) but I just saw on the SW site that the 10,000 qualifying points will post “by Jan 31.” That means Jan 31 at the latest, but do those points usually post sooner or do I have to wait until after Jan 31 to get the companion pass? I thought I would get it instantly but now I’m worried I will have to wait another month.

I haven’t tracked it in years past, but we’ve definitely earned the Companion Pass before the end of January. I would assume these would appear within the first ~week of the month. I’ll keep an eye on my own each day this week. In the meantime, I’ll ask in our Frequent Miler Insiders group to see if anyone knows when they posted in years past (I can’t view previous-year activity in my Southwest account right now).

Thanks Nick. BTW, I successfully pulled off the Companion Pass for 2 yrs w the one biz credit card. Opened ~Oct 10, changed statement due date to the 27th (closing date 2nd of the month) and completed all spending (both tiers) between Dec 2 and Dec 10. Shows that I now have 132k pending points which should close out and post tomorrow. Had to do it carefully but this worked out great. Only hitch was that I didn’t know I would also have to wait for the 10k threshold reduction to post (assumed it just lowered the threshhold automatically to 125k instead of having to wait for the 10k to post). That’s a pretty minor thing considering that off one credit card I got 120k points plus 2 yrs companion pass. Already booked trip to Hawaii and other places and should get more than $3k out of it over the next 2 yrs. Will probably focus travels more on the Caribbean and Costa Rica. That’s not our usual preference but will see it as an opportunity to explore new places. Already looking at the SLH places near PLS (combining SW points, companion pass, and three Aspire FNCs).

I also accomplished the one biz card route – just got my companion pass and ~132K miles today. Very excited – trips to Denver for skiing and one to Maui to visit a son already booked. Wonderful deal.

Update: the 10k credit for having a credit card posted on Jan 3 or 4. Now just waiting for the 132k points from bonus plus earn to post. Statement closed Jan 2 and still hasn’t posted as of Jan 6 but seems it should be within a day or two. Last time it only took a day to post but maybe this one is slower bc it includes two 60k bonuses (from the two-tiered business card bonus, 60k each).

I earned by companion pass in February 2024 and it says it expires in February 2025; any idea why it wouldn’t continue through end of 2025?

I am not even sure who to reach out to in order to have this checked.

That sounds like one of the credit card offers that included a promotional companion pass. The credit cards have sometimes had an intro offer of a promo ~12-month companion pass plus 30K points after qualifying purchases. There was an offer like that earlier this year:

https://frequentmiler.com/southwest-companion-pass-30000-bonus-points-now-on-all-3-personal-cards/

re: “note that the only way to open two of these cards is to open one business card and one consumer card,” what is the rule that prohibits opening 2 biz cards or 2 personal cards?

sorry, I understand now why personal can’t be done – but what about 2 biz?

If I fly confirmed same-day standby (WGA+fare), I assume that I would lose my boarding position regardless of upgrade boarding or early bird, correct? Technically early bird would transfer but it wouldn’t matter bc it would be less than 24 hours to checkin. Or would they give me a better position anyway? I know I could wait to buy upgraded boarding, but flying to BWI means they probably would not be available same day.

What about booking a wanna get away plus fare and doing same day confirmed change? Can I also bring my companion onto that new flight, assuming there are two seats available? I remember you talking about same-day confirmed change trick w WGA+ but don’t know if that works with a companion. Thx.

[…] The latest edition of one of the best deals amazingly still alive after so many years: 2024 Southwest Companion Pass Complete Guide. […]

I used to always book my flights as one way, but have recently started to book as round trip, especially if booking months in advance. Southwest has frequently adjusted flight time by as little as 5 minutes and this will trigger the ability for you to rebook for any flight within14 days for outbound AND return (even if one of the segments not impacted). If I book as one way flight, I can only change impacted segment.