Offers detailed in this post have expired

The $450 annual fee on my Business Platinum card just came due. For years I’ve been cycling through different versions of the Platinum card in order to get a new signup bonus each year along with a total of $400 in airline fee reimbursements ($200 for the current calendar year plus $200 the next). This year, though, I kinda wanted to stick with the same card. Partly its because I like the card’s free Gogo Inflight Wifi that works on international flights (the personal Platinum cards do not have that feature). Partly its because I’ve regularly found incredibly lucrative Amex Offers on the card. Mostly its just laziness.

People have been getting Business Platinum retention offers from Amex out of the blue. A number of people reported getting emails stating “We value your Business Platinum membership, so… [here’s a bunch of points].” The offer was for 40,000 points after $5K spend, and then another 10,000 points after an additional $5K spend. If I had received an offer like that I’d keep my Business Platinum for sure. But I didn’t. I guess they don’t value my Business Platinum membership.

Via email and through the Frequent Miler Insiders Facebook Group, I’ve learned that some Business Platinum cardholders have called to cancel and have been offered $300 or 30,000 points to keep the card and there was no spend requirement whatsoever. Sweet. I’d like that!

I called and told the computer that I’d like to cancel my card. The computer suggested that it could handle my request itself. Was that OK? Absolutely not. “No.” I was transferred to a person who then transferred me to a retention specialist.

The retention specialist had three offers for me. The first was an offer to let me sign up for the Blue Business Plus card. No thanks. I already have it.

The second offer was a $100 statement credit. The third offer was for 10,000 points.

“Any other offers?” I asked. Nope. “Are you sure?” I’m sure. “Can you check in the back?”

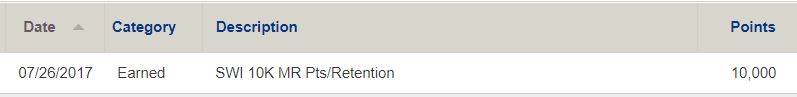

I took the 10,000 points.

Next Steps

At this point I do think I’ll keep the card since I get a lot of value from it, but Amex seems to be trying to change my mind. I just got a 60K offer in the mail for the personal Platinum card and it does not have the lifetime language on the offer. In other words, even though I’ve had that card before, I could get the signup bonus again. Hmmm. Tempting, very tempting…

![[New links needed] Amex Business Platinum 150K referral offer is back & we need your links Amex Business Platinum 150k referral offer](https://frequentmiler.com/wp-content/uploads/2024/01/Amex-Business-Platinum-150k-referral-offer-218x150.jpg)

I bought airline tickets on AmexTravel.com and should’ve gotten the 5x, but I didn’t. How long does it take to post? It’s been almost 2 months now.

Also, how much are points worth now that the 50% rebate is ending? 1.67?

1) MR points sometimes take two billing cycles to post

2) 1/65 = 1.54

Yup, 5x points posted a few days ago. Thanks.

1.54 is still better than Prestige since I can’t get a CSR due to 5/24. I think my 2% on my Biz Plat ends late Nov for my chosen airline.

I had a Chase Southwest Airlines card. A few days before the annual fee was due I called up to cancel and to see if they had any interest in retaining me as a client. The answer to that question is, no they don’t, absolutely not. The rep I spoke to said there is nothing they can do for me. Desperate to salvage something out of the time spent on the phone call, I asked if they could at least wave the 99.00 annual fee. Their response as, “we can’t do that either, but I’d be happy to cancel your card” So there you have it. It was either a brutal customer service rep holding the company line, or just bad luck on the phone rep draw. Either way, they showed me just how much they “value” me as a customer, which is very little.

I called AMEX today about my Platinum Business card renewal next month. They let me cancel without making any offer whatsoever. The rep asked me “What are you going to do charging your business expenses?” To which I replied, “Ill put them on my Business Gold or one of my Delta cards”. She said, “Oh yeah, I see them now”. She asked me why I was cancelling and I told her I was unhappy about AMEX not even making it a year with the 50% point rebate. She quickly launched into a rambling lecture about how they really listened to their customers and the point rebate used to be 30% and now it’s 35% and how there is a 5x point bonus for booking with AMEX Travel. The second she finished reading her script she said she would cancel the card and had a disclosure to read. My cell phone dropped the call midway through the disclosure. She called me back and left a voicemail saying that even though we were disconnected halfway through the disclosure she went ahead and cancelled the card. I was pretty stunned they made no attempt to convince me to keep it since the $450 AF comes due next month.

Was going into year 3 with my Ameriprise Platinum. At the first anniversary I called and was offered $200 credit if I spent something or other (can’t remember spend amount).

This year I called and received no offers. CR said it was because I got the $200 last year and that they don’t make retention offers 2 years in a row.

As a result I relied on backup plan of cancelling and applying for Schwab Platinum. Not a bad tradeoff… since there are several Platinum iterations it’s generally more profitable to swap cards every 2 years if the above is their policy. I do like the Schwab though since I get an extra $100 credit at anniversary and because MR points are worth 1.25 in cash to the Schwab account if I want to cash them in for some reason.

Thanks for the intel on the Schwab account. It looks like a Schwab checking account is pretty easy to sign up for and the platinum bonus is 60K points which easily offsets the $550 fee!

I just cancelled the MB platinum after cancelling the standard platinum. I hate not having a platinum card since I live near an airport which has a Centurion Lounge which is a GREAT benefit of platinum cards.

So I am debating canceling my Mercedes Platinum right now. AF is due. ($475) I want the Business Platinum, but cannot see any of the better offers I read about. Gonna see what retention will get me before canceling. I do like the Uber deal as well as the $200 annual travel credit, admittedly.

BUT! My big question is why I never, EVER, get offers in the mail for ANY cards from Amex, nor by email, nor in my various card log-ins (Each card is a separate account on line). No upgrade or downgrade or new cards or anything. I used to get them and they just stopped.

Does anyone here have an idea of where I should look online? Does anyone have any tips or thoughts? I hesitate to call unless absolutely needed on any of my cards as so not to “draw eyes” onto what I do or do not do with the card.

Hoping for some good advice here.

My wife and I were each offered 30,000 MR retention points back in April for our Personal Platinums. That was after we got the 100K offer a year ago. Feeling fortunate.

I have canceled several cards in the past and I’ve always to told the computer to handled it but it always redirects me to an actual person which in those cases I didn’t want to talk to. ZERO to $25 retention offers is just not worth an additional step to cancel a card.

I am always skeptical about those offers without the once in a lifetime or Citi’s without the 24 month language. Do you think they are aware of this and trying to lure you back or you will have to fight tooth and nail? Given that it’s often the case that I have to fight for offers that there is no reason I shouldn’t get, this just seems like a lot of effort that may or may not lead to success.

The Personal has the Uber/UberEats credits. That’s worth something too…

Just called yesterday regarding my personal platinum:

$150 statement credit

or

5k now plus 15K with $3000 spend over 3 months (I took this one)

I called last week and received the same three offers. I took 10k as well.

At 50% back using MR points for airfares, I was almost certainly going to hold onto this card, even without any sweeteners. At 35% back, it is starting to seem frivolous to hold onto at a net $250/year annual cost (after $200 back for airfare stuff). In fact, I have been thinking about letting the card go, accumulating MR points until a good deal comes along (Insider Fares and/or those idiosyncratic Amex Travel special deals), and then getting the card again (I know, no sign up bonus) for the 35% rebate. (Is that crazy …? Or is holding it crazier …?) Anyhow, 10,000 MR points would certainly help my decision. You did the right thing.