NOTICE: This post references card features that have changed, expired, or are not currently available

August 2017 has been a month of building resource pages here at Frequent Miler as Greg has worked to pull together quick guides and information for everything you need to know: whether it’s earning miles for college (See: Double-dipping college rewards), which are the best transfer partners in each program and what transfer bonuses are being offered right now (See: The Latest Transfer Bonuses and Partners) – or maybe you just want to know whether or not you’re going to get shaken down for a baggage fee (See: When is your free checked bag free?);we’ve got resource pages for all those things and more. Those resources are meant to be handy pages to bookmark so you can come back when you need to know if your Starpoints can help you book an ANA Award ticket on Aegean Airlines — or if maybe you’re better off transferring to Aegean.

But we also brought you big news on the credit card front: from your last chance at a great signup bonus (See: Last call for Merrill+ $1,000 in airfare) to the latest crushing blow from Chase (See: Chase ends ability to double up Sapphire Reserve and Sapphire Preferred bonuses) and all the rumors that are fit to print (See: What happened to BankAmericard’s Sapphire Reserve competitor?).

On the manufactured spend front, we looked at Automating Spend and glanced at buying and selling (See: My type of MS: Stacking & Reselling Neiman Marcus) while bringing you the semi-monthly reminder of what still works in the field (See: Increase credit card spend (and get most of it back) :What still works August 2017).

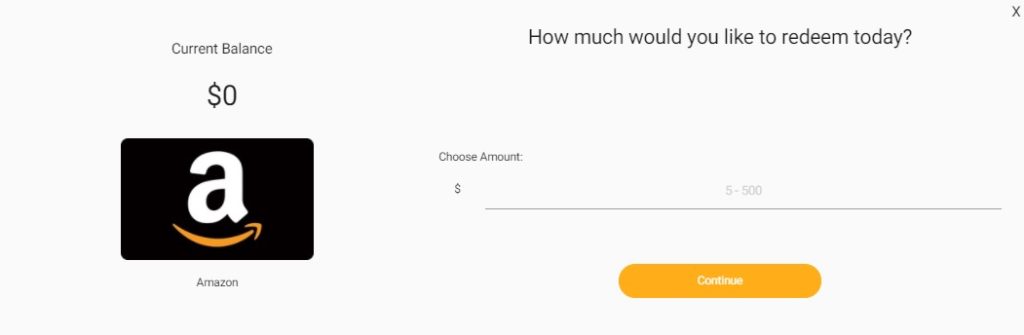

And of course, we continued to bring you some hot deals: whether it’s unlimited movies for $10 a month (See: Great deal: Go to the movies every day for $10 a month,), cheap fares to Europe in business class (See: Wow: Business class to Europe + 28K miles or more from $1410) or economy class (See: Crazy: $114 RT Europe to USA! Also cheap US to Europe and Asia), or a really nice deal with Upside where you can earn a great return ($200 Amazon gift card, eBay gift card, Whole Foods, etc) on a hotel or flight when you book by the time the current bonus ends tonight (See: Great deal back (might be even better): $200 in GCs for $400 travel booking). That last one could work out really well for some people and has been discussed a bit in our Frequent Miler Insiders group.

Read on for more from the Frequent Miler Month in Review, August 2017.

Credit Card News

The biggest news of the month is obviously the above-noted change in policy at Chase, preventing customers from earning the sign up bonus on a second Sapphire product if they have received a bonus on another Sapphire product in the past 24 months — and restricting customers from getting approved for any new Sapphire account if they currently hold a Sapphire product. It remains to be seen how this will affect the credit card landscape, but that surely wasn’t the brightest move of the month. My speculation is that this is a bit of a play to convince people to keep the Sapphire Reserve as it prevents people from opening a Preferred and Reserve in back to back years in perpetuity for the signup bonuses. While that’s not great news, the truth is that many travelers would do well to keep the Sapphire Reserve and this news will really only prevent them from earning signup bonuses on these two cards….for now. Speaking of keeping the Sapphire Reserve, we certainly had a lot of other Sapphire-related posts in the recent weeks as many people are coming up on renewal and trying to decide whether to keep it or cancel it (See: Keep or cancel Sapphire Reserve). We looked at maximizing the travel credits (See; Sapphire Reserve: How to get a 2nd $300 travel credit before cancelling) and travel insurance (See: Sapphire Reserve Travel Insurance).

In non-Sapphire news, the biggest development is also probably the biggest piece of loyalty program news: the fast-track to Hyatt Globalist status for Hyatt credit card holders (See: Hyatt Globalist fast track for all credit card holders).

Loyalty Program News

The fact that Hyatt is out with such a broad fast track to Globalist status is probably the most telling piece of evidence saying that their occupancy must not be meeting forecasts and they think it has to do with the loyalty program. That certainly wouldn’t seem surprising or unlikely. After spending a lot of nights last year going out of my way to stay at that inconveniently-located Hyatt Place so I could qualify for status, I chopped those stays out almost entirely this year in favor of Hilton, where it’s always easy to find a full-service property within a stone’s throw. I must not be alone in making a change as Hyatt is clearly making a strong play to bring people back into the fold. Of course, Hilton lost a little glimmer for me when I found out that they stink at math (See: Hilton stinks at math; book award nights separately). Speaking of math, the numbers worked out so well on Wyndham’s latest offer that not only did Greg book his first mattress run in years (See: 35,000 bonus points: Planning my first mattress run in years…), but he didn’t even walk from the front desk to the room to see it. To be a fly on the wall for that conversation: “Hello, I’m the Frequent Miler. I’m here for my easy points room key.” Any way you slice it, loyalty program news is good news this month as all of it adds up to a net win for customers (as long as you keep your eye on Hilton!).

Best of the Rest at Frequent Miler

Here we list a selection of other posts from the month. Note that limited-time deals may now be expired – check the posts for details.

Credit Cards

- Planning for Citi Prestige 75K and Premier 50K offers

- Debating my 1.67 cents screwed up math

- Virgin Atlantic World Elite Mastercard Deep Dive: Maximize Earnings and Status

- Results from my latest Citi retention call

- How I messed up my 75K application (BOA 5 card limit?)

- Travel Insurance Showdown: Reserve vs Prestige vs Platinum

- New Citi transfer partner: Turkish Airlines

- Surprise: No email, still targeted for 10K per AU

- Wells Fargo caps 5% back at $12.5K in purchases

- 10,000 Starpoints for adding authorized users [Targeted]

- Nice: 60K American AAdvantage miles after a single purchase + fee

- Southwest 60K offers back: Companion Pass after $4K spend

- Not targeted: 10X at Walmart on Freedom & Sapphire cards

- 20% bonus when transferring Citi Thank You to Cathay Pacific Asia Miles

- New 50K offer on Cathay Pacific card

- Highest-ever bonus: 40K miles & 10K MQMs

- Jet Blue all-time high offer of 40K points

Manufactured spend / meet minimum spend requirements

- Bluebird Migration: Is this the next or final chapter in Bluebird manufactured spend?

- Easy 5X: $20 rebate on $300 in Amex Gift Cards

- $20 rebate on $300 Visa Gift Cards + 5X (Expired)

- Easy 5X or 5%: $15 back on $300 in Mastercard gift cards (Expired)

- No-fee Visa Gift Cards at Macerich Malls this week (Expired)

- Easy moneymaker: Spend $30 at AT&T, earn a profit [Targeted]

- $200 Staples Gift Card + $25 eBay GC + 5X (Expired)

Best Current Credit Card Offers

- Chase Ink Business Preferred: 80K after $5K spend

- Citi Prestige Card: 75K after $7.5K spend

- Chase Sapphire Preferred: 55K: 50K after $4K spend + 5K AU

- Citi ThankYou Premier Card: 50K after $4K spend

- Barclaycard Aviator Red: 60K after single purchase and annual fee ($89)

Miles, points, and travel

- 3K-5K+ easy Alaska miles, enter to win 150K

- Finally targeted for a good IHG Accelerate promo

- Travel Insurance Showdown: Reserve vs Prestige vs Platinum

- 20x Alaska Miles at Gilt City, American 21x, other airlines offering similar payouts (limited-time, but still available at the time of writing)

- Stack Hilton offers: new Twitter sync for $50 back on $250 or more

- Hilton Double Up: 2x points Sept 1-December 31st, Diamonds earn more

- Business Class to South America from $648-$1298 round trip

- One Two Free is back: 1 free day after 2 rentals

- Nice business class sale to Europe through summer ’18

- Can you buy IHG points for 0.46 cents per point?

- Awesome: $298 RT New York to Israel

- Free night anywhere with 2 stays

- Amazing: Business Class to Australia under $600 RT! (Expired)

- Half off resort award stays in Mexico & Caribbean / Latin America with IHG

- Ammo for the secret weapon: Up to 45K annually

- Free hotel club membership & chance to win $250 credit (Expires today)

More Deals worth Checking Out

Some of these have expired, but they represent a selection of deals that we have posted lately (and quite a few are still alive at least through today).

- Great deal back (might be even better): $200 in GCs for $400 travel booking

- $160 back on $800 at Delta [Targeted]

- $100 back on $500 at Ritz-Carlton with new Amex Offer

- Make money or more coffee: $10 for $20 Starbucks + 1K Marriott points for new users

- Apple Watch sale at Macy’s, may stack with Discover for 10% back

- Great deal: Go to the movies every day for $10 a month

- Wow: Up to 11 miles per $1 at Apple today

- Business Class to Europe from $1735. Use w/ Delta Amex offer to save more

About Month In Review

Once per month we publish a round up of miles and points related news, highlights of our best posts of the month, and a list of the best ongoing deals. For those who subscribe to our monthly newsletter, this is it. Those who subscribe weekly will find this post listed in the Week in Review section. Those who subscribe to the daily or instant newsletter will receive this post directly, just like any other. Again, we usually publish the month in review at the end of each month — you can expect the next one at the end of June.

How to Fix Your email Subscription

If you find that you are receiving duplicate emails or would like to change the frequency of your emails, please do the following:

- Find the “click here to safely unsubscribe” link at the very bottom of the email. Click the link to unsubscribe.

- Visit our Subscribe to Frequent Miler page to subscribe to instant, daily, weekly, or monthly newsletters.

Long term readers who prefer the old style “Quick Deals Only” emails should visit our Advanced Options subscriptions page.

Nick, in your article you state that Chase’s decision to change the signup bonus policy for the Sapphire cards “wasn’t the brightest move of the month.” Can you elaborate what you mean by that? Sure, it means that churners can’t take advantage of sign up bonuses from Chase as much as before, but I fail to see what is not “bright” about that. In fact, it seems like an appropriate and logical move from a business perspective.