NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

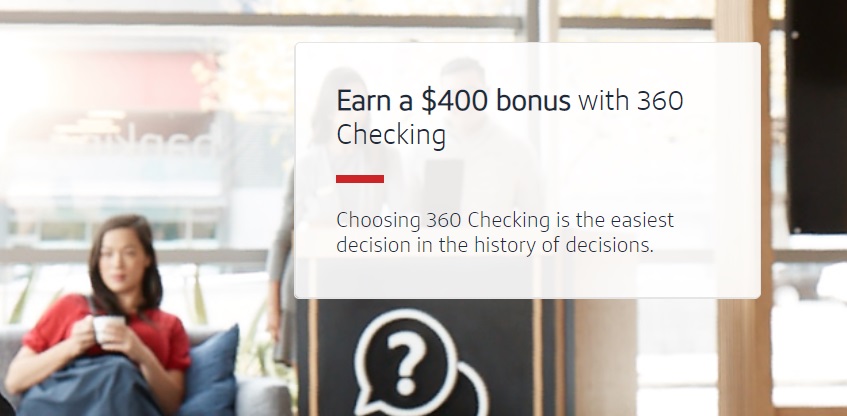

I’ve written several times this year about the value of checking account bonuses — including information on thousands of dollars we’ve earned this year in my household thanks to bank account bonuses. While we don’t cover every new checking account bonus that comes out, a new offer for $400 with a new checking account and two direct deposits of $1,000 or more from Capital One looks like a great deal for those eligible.

The Deal

- Capital One is offering a $400 bonus when you open a Capital One 360 checking account with promo code BONUS400 and have two direct deposits of $1,000 or more in the first 60 days

- Direct link to this deal

Key Terms

- Must enter the promo code

- Must Open a 360 Checking account between 12:00 a.m. ET on November 9, 2020, and 11:59 p.m. ET on January 26, 2021. When you open your account, enter your promotional code—BONUS400.

- Must Receive at least 2 direct deposits totaling $1,000 or more to your 360 Checking account within 60 days of account opening. A qualifying direct deposit is an Automated Clearing House (ACH) credit, which may include payroll, pension or government payments (such as Social Security) by your employer or an outside institution.

- This account is subject to approval. This offer cannot be combined with any other 360 Checking account opening offers. Only one promotional code is accepted. Bonus is only valid for one new 360 Checking account.

- If you have or had an open 360 Checking account as a primary or secondary account holder with Capital One on or after January 1, 2018, you will be ineligible for the bonus. If your account is in default, closed or suspended, or otherwise not in good standing, you will not receive the bonus.

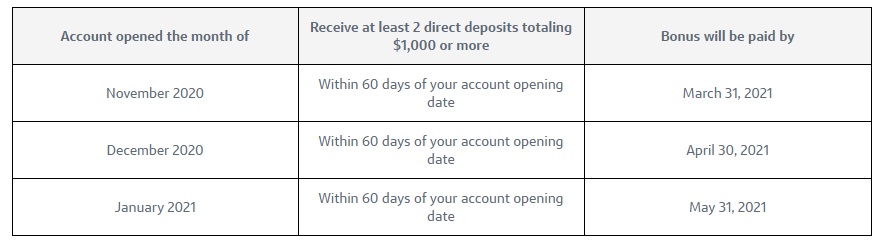

- Bonus will be paid out on the following schedule:

Quick Thoughts

There are two main reasons why I thought this Capital One bonus was post-worthy:

- It’s a great bonus: $400 in your pocket that requires no spend and relatively low direct deposit requirements is an excellent deal. This beats many credit card bonuses and requires less effort.

- A Capital One 360 account can be useful long-term when opening other bank accounts for bonuses

The first point above is clear. Four hundred bucks is no small potatoes. If you have a 2-player household, that could pretty easily be $800 in your pockets with very little effort. Who can argue with eight hundred bucks in easy money? It isn’t as big a win as that HSBC account that could put $1300 in the collective pockets of a 2-player team, but given that the HSBC bonus may require a bigger direct deposit, this Capital One bonus will likely appeal to more folks (and if you’ve done the HSBC bonus and collected $1300 in 2-player mode, there’s no good reason not to pick up another $800 here).

The second point is that I’ve found Capital One 360 to be a great account to have for pushing deposits to other banks. I’ve often found that an ACH deposit pushed from Capital One has triggered new account requirements for me at many other banks. YMMV as it won’t always work, but I’m not saying this is a useful account for no reason. See this resource for more.

If not for the fact that my wife and I already have Capital One 360 accounts, I’d definitely go after this one. On that note, it looks like you aren’t eligible if you’ve had a Capital One 360 checking account open on or after January 1, 2018 as either a primary or secondary account holder.

H/T: Doctor of Credit

I just saw this offer on my CapitalOne account, but for $350 after at least 2 direct deposits, each of $250 or more, within 75 days of account opening. Open a new account by October 18, 2023, using the promo code BONUS350.

Thanks for the heads up. We posted about that more than a month ago, but it’s always good to get a heads up in case we miss something: https://frequentmiler.com/350-checking-bonus-with-capital-one-360/

And here I thought I was being clever! LOL! Two new Capital One checking accounts opened and $700 just a few months away. Keep up the good work!

Data point: Opened account in Nov 2020. DD x2 in November 2020. Called 2021.05.16 regarding $400 bonus. Agent said that the promo code was not applied, but that she would request an exception. That request will take 20 days.

Signed up P1/P2 on Nov 14. Did two 1k DDs for each of us (4 DDs total across the two accounts) and was supposed to get the SUBs by tomorrow. Called CapOne today and they said promo code was not on either account. Luckily I took screenshots of each signup clearly showing account number and promo code applied, so we’ll see if they honor it. Anyone else have this experience?

I’m curious if anyone has received their $400? I met the requirement in early December, with a greater than $1000 DD in late November then a $200 in early December. The table shows I am receive it by end of April, but haven’t received it yet (still 2 days left :)).

FM just tweeted “If you opened a Capital One 360 checking account in the past couple of months for a $400 bonus, you need to complete the direct deposit requirements by tomorrow – here’s more about that offer. #LastChanceFM”

Terms listed above just say 60 days after account opening though. What am I missing?

You’re absolutely right. I’ve edited the Facebook post and we’ll get the tweet deleted / re-posted. Thanks for bringing this to our attention!

Hey troops, I’ve employed the “throw everything but the kitchen sink” methodology to get bonus for capone 360. I’ve transfered money in from four banking entities. They all document the transfers differently by means of memo.

HSBC: P2P

Wells business account: dda to dda

sofi: transfer

schwab: p2p

Obviously won’t know if I’ll get the bonus at all in a couple of months, but if you had to guess, which of these are what we want and which aren’t?

Schwab should work (according to DoC’s DP’s)

Less than 5 minutes to open account. Now we wait for the eight hundred clams….

Do I have to keep the deposit a certain amount of time to get the bonus?

No

Does anyone know if having an existing Capital One account, but NOT an existing Capital One *360* account, would preclude you from taking advantage of this offer?

If you mean a Capital One credit card account, no – that will not preclude you from earning this bonus to my knowledge (both my wife and I had credit cards with Capital One when we earned bonuses on the 360 accounts).

If you mean a Capital One bank account, I’m not sure.

Possibly the easiest bank account I’ve ever opened. Took me less than 5 mins. Just be sure to add the promo code for the bonus when they ask for a deposit!

I signed up myself and my wife. I skipped funding from an external account, which is apparently the only opportunity to add the promo code. I called and spoke to a rep, and they stated it was now too late to apply the promo code to my account. She indicated my only option was to complete the direct deposit requirement and then call back, at which point they will make an exception and apply the bonus.

TL;DR: Go through with external funding – it’s the only way to apply the promo code!

Given that I’ll have to manually call in… Anyone know if ACH’s are working to trigger this?

Nick, how hard/easy is it to move money out of this account? I did the recent suntrust bonus, but was surprised that they wanted to charge me a fee to move my money back to my “main” credit union. I ended up using their Zelle connection, but even that is annoying with daily/monthly limits. I’m having my paycheck sent to suntrust for the time being to satisfy their fee waiver requirements.

Didn’t see a place to put in the promo code. By just opening the account through the link am I eligible for the promotion?

The bonus payment schedule is a bit of a bummer for making sure that some of the older methods of making a deposit reported on the DOC site actually still work. I have to try Fidelity for my P2’s account and I’m hoping it really won’t be until March 2021 to find out if it still works.

Doesn’t opening bank accounts decrease your credit score for a while?

My score is pretty high but I’ve noticed it has dropped a few points because I’ve had a lot of stuff going on, and the only negative thing has been opening some bank accounts to store money from a home sale (didn’t want to go over the FDIC limits).

Generally speaking, no. The vast majority of bank accounts do not require a hard credit pull — rather, they do a soft pull that has no effect on your score. Exceptions sometimes occur when you opt in to overdraft protection — sometimes that requires a hard pull. I always opt out of overdraft protection when given the choice. Between my wife and I, we’ve opened at least a dozen accounts this year with zero hard pulls.

Is it 2 deposits totaling $1000, or 2 deposits amounting $1K each?

Looks like it’s two deposits totaling $1,000 or more (2-$550 deposits) not two deposits of $1,000 or more (2-$1,000 deposits). Big difference if I’m reading it right.

do you know yet if you are right? It sounds like that to me too. I would hate to change my DD to go into only my personal for 2 pay periods then change it back to go between personal and joint. Just such a hassle

Confirmed that 2x $550 deposits works to get the bonus

from which bank?