Back in the Mach-April-May time period, Greg and I predicted that we would probably see issuers pull back a bit at first and then eventually come out with strong credit cards to entice people back into the game eventually. When we said that, never did we imagine that we would see a week with a credit card offer that’ll buy $1500 in flights and an all-time-high 75K offer on a card with no annual fee — and that neither of those would get much air time because of a monstrous offer on the Amex Platinum. Let there be no doubt that it is a buyers market in terms of credit card bonuses right now. On this week’s Frequent Miler On the Air, we talk all about how to get the best Platinum card offer (which could turn you into a quarter-of-a-millionaire in Membership Rewards points with a single card). I also challenge Greg on his assertion that the Marriot spending offer was a snoozer, we talk hotel credit cards, the Amex pop-up, and more.

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe (if we get enough people to subscribe, we might be able to earn some income from this someday. So far, the podcast is just a labor of love).

Our podcast is available on all popular podcast platforms, including:

Apple |

Spotify |

You can also listen here in the browser:

This week at Frequent Miler

In credit cards:

Incredible: 125K + 10x Platinum offer for some [targeted]

Stop the presses: This is the best new credit card offer we’ve ever seen. While relatively few will be targeted for the headline offer of 125K points plus 10x at US gas stations and US Supermarkets fir the first 6 months on up to $15K spend, many readers have been able to successfully pick up the 100K + 10x offer, which is in itself an amazing deal. With either of those options, you could end up with more than 200,000 points. In six months. With a single credit card. And $1100+ in statement credits in the first year. Wow! On the show this week, we talk about how even if you don’t want to use the points for travel this offer is still worth considering because you could pick up this bucket of points now and then cancel next year and pick up the Schwab Platinum to cash it all out for money in the bank. Don’t get me wrong, I’ll be using these points for first and business class flights, but it’s hard to argue with thousands in cold hard cash either. This post breaks down all five current offers for the Platinum card and how to be sure you get one of the best of the bunch.

My plan for maximizing the incredible Amex Platinum offer

Greg went for the 100K + 10x offer this week. Read his success story, why he was tempted to wait until December (but didn’t), and how he plans to maximize both statement credits and spending power to pile on rewards with this show-stopping offer.

Stop over-valuing 5/24 slots (On Nick’s mind)

A number of readers asked whether the Platinum offer noted above is worth a 5/24 slot. My response was: “If this isn’t worth a 5/24 slot, what credit card is?” I think we’re too often blinded by the allure of maybe getting a somewhat desirable Chase card down the road. I get it, Chase has some good cards that you want — but my goodness, don’t turn your back on a few thousand dollars so that you can pick up 50K points down the road.

Big new 75K offers: Pick 5x office supply or 1.5x everywhere

In any week in which Amex didn’t go certifiably insane with the Platinum card offers above, the dominant headline of the week would have been the 75K Ultimate Rewards offers on both the Chase Ink Cash and Chase Ink Business Unlimited cards. Earning 75K super-valuable Ultimate Rewards points on cards with no annual fee is another show-stopping opportunity. When you also consider that these are great cards to have (the Ink Cash card for 5x at office supply stores on up to $25K in purchases per year and the Ink Business Unlimited for 1.5x everywhere), it should be clear that anyone under 5/24 should be considering one of these cards. Indeed, these offers are so good that I made sure to put in an application for an Ink Cash before the Platinum card. It took a day to get approved, but it was well worth the wait — both in terms of waiting for that approval offer and the luck of having waited until the first time we’ve ever seen an increased offer on these cards. It’s worth noting that readers who recently applied under the 50K offer have reported getting matched. It’s worth a secure message to ask.

Huge New 100k Offers On JetBlue Plus & Business Cards

An airline comes out with offers worth $1500 in flights on two of their credit cards and the story becomes the 5th headline down in this week’s email — can you believe that? As we discuss on the show this week, our relative lack of enthusiasm here is because these points have such little flexibility, really only being useful for JetBlue flights (which is a big limitation as compared to the Amex and Chase offers above). That said, if you live in a city well-served by JetBlue, it’s hard to argue with the chance to get about $1500 worth of travel.

The 8 Best Hotel Credit Cards

I take issue with Geg’s title here: as he admits in the post and during the post roast segment of this week’s Frequent Miler on the Air, he approached this post with the unspoken perspective of looking a the 8 best hotel credit cards that require no spend to be rewarding. Nobody can argue with his #1 choice, but leaving out what is arguably the best card for spending toward free nights (the Hilton Surpass) and ordering cards that come with expiring certificates above those that come with points worth more than the annual fee are decisions with which I disagree. On the show, I made the argument for why the Wyndham card should be listed higher, and I think it should, but look no further than the comments to get good perspectives that demonstrate why a list like this is almost impossible to compile.

In loyalty news:

Great News: American Airlines Removing Award Change & Redeposit Fees

This is huge: you can now book freely and change and cancel as you please with American Airlines miles. This even applies to Web Specials! This can make it much easier to book a backup flight or trip and/or to have the peace of mind to actually use your American Airlines miles during these crazy times when you can’t really predict whether or not you’ll be able to travel to your destination. This is a huge win for members (and another blow to the relative value of Southwest given that American now matches the ability to cancel up to the time of departure of your first flight).

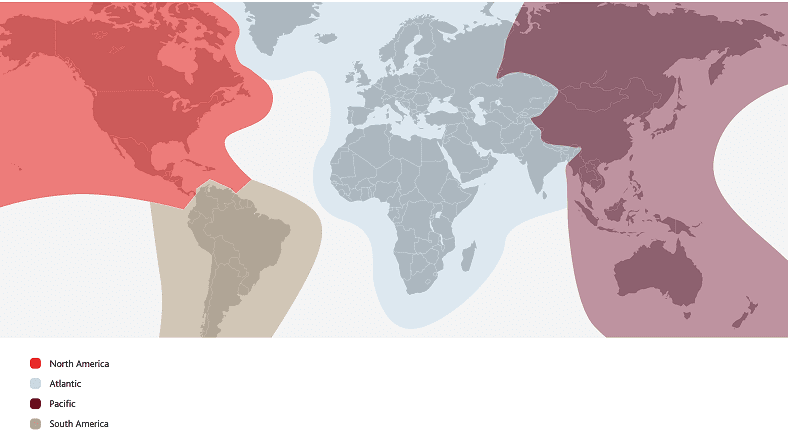

Air Canada Aeroplan: The all-new program is now live. Here’s what you need to…

Aeroplan’s new program has debuted. The current website / booking tool are not yet the final versions, so there are some limitations (for instance, you can’t book a stopover online), but more importantly there is a lot to wrap your mind around. Gone are the old award charts and in is a much more complex yet incredibly intriguing system. In this post, Greg breaks down everything you need to know — from earning points to spending points, change fees, elite status, lap infants, and more.

Credit card cell phone insurance compared

Last week, I shared my experience filing a cell phone insurance claim with our Chase Ink Business Preferred card. Part of my conclusion in that post was that the Ink Business Preferred just isn’t the best choice for me in terms of paying my bill. In this post, I created a quick-reference chart to compare cell phone coverage across issuers so that you can determine the best option to suit your needs.

In hotel discounts:

Wyndham Credit Card Discounts In Action: Sometimes Good, Sometimes Not

Stephen Pepper picked up the Wyndham business card and took its cardmember discount benefit for a spin. While I don’t think the hotel discount is the marquee benefit for this card (indeed, getting 8x at gas stations and Wyndham Diamond, which matches to Caesars Diamond, are the things that would draw me in), it is nonetheless good to know how it works (or doesn’t). Here, Stephen shows that this benefit isn’t much to get excited about in most instances, but that it could come in handy now and then.

Save On Choice Hotels Stays With Capital One Spring (No Capital One Card Needed)

I previously covered Capital One Spring a few months ago, but it looks like they have added some new benefits. Here Stephen shows that the Choice Privileges discounts can be worthwhile; if and when international travel resumes, I’ll keep this in mind for stays in Europe (as Choice can sometimes be a particularly good, erh, choice there). But aside from that, I’m glad to see Capital One adding useful benefits to this free program that’s open to anyone.

In updated resources:

Greg’s Top Picks: Showstopping credit card offers! (Nov 2020)

Greg had to re-vamp this resource in light of the huge new offers out this week. See what his picks are now and why.

Amex Platinum Complete Guide

Whether you just got a new Platinum card and are wondering “What’s next?” or you are wondering about the benefits before deciding whether or not to apply, this complete guide has the answers to all of your questions. It has been updated to reflect current benefits and help those new to the card.

That’s it for this week at Frequent Miler. Check back soon for this week’s last chance deals.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

![Prices rise, benefits cut: The new normal coming for ultra-premium cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Increasing-fees-218x150.jpg)

![Juicy rumors, but how far will cardholders be squeezed? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Juicy-rumors-218x150.jpg)

[…] 8) The amazing 250K offer […]

@Greg The Frequent Miler @Nick Reyes Thank you for the shout out guys!

As an aside, even though the Hilton biz doesn’t have the grocery bonus category like the Surpass does, it has other advantages in being a biz card (doesn’t add to 5/24, doesn’t affect utilization)…and its bonus categories aren’t too shabby either: gas, shipping, wireless, etc.

One big advantage that the Surpass has (and Aspire), which hasn’t been mentioned yet, is that it’s great for upgrade offers! An option, sadly, not available to the biz version.

Anyways they’re both really good cards (if you like Hilton), in my opinion.

[…] the comment we received from […]

And, can I just add — all other well-known blogs are going with the 75K offer only and don’t mention the higher offers.

I just received the consumer platinum card in Sept 20 with 100k bonus through cardmatch. I called Platinum customer service and they were able to add the 10x gas and groceries for 6 mo starting now rather than from Sept 20. Thought this might help someone else who recently applied for Amex Platinum

Can’t wait for amex to claw back or not give all the grocery points of people thinking they will buy VGC over and over. Lol

At this point, I don’t think anyone expects to do that.

Question: If you use the pre-qualified search, even logged out / incognito but giving your correct name and last 4 digits of your SSN, do you think there’s any chance at all of receiving the 125K offer if you already have a gold card?

If you check your offers while logged in, it appears to me you get a very inferior upgrade offer if you have the gold card.

Any DP of someone who currently holds the gold card getting an offer for the SUB on a platinum?

I’m not sure.

I would recommend logging in incognito and not using pre-qualified search. I have a Gold card and saw the 100K offer in Chrome and Edge incognito today (but not Firefox). Applied and was approved. But I agree with you that when I logged into my account, I could only see a very inferior upgrade offer for Platinum.

I think Larry is trying to see if he is targeted for 125K offer, which is only available through pre-qualified search.

Just so. The 100k offer is super-shiney but just a little less so since I heard about the 125k offer!

After not pulling up the 100K offer multiple times I fig that I would never get the 125K offer either. When the 100K offer did FINALLY come up I jumped in before it disappeared. But the blogs get our blood boiling bcz it ALWAYS seems there might be a better offer out there. LOL.

My impression is that, while the 100K offer is random and you might see it on a different browser / at a different time, the 125K offer is fixed — you either have it, or you don’t (you have to enter identifying information into the pre-qualification tool).

I just pulled the trigger on the 105K offer. My calculation assumes that P2 will get the 30K referral bonus listed on the Gold card referral screen, even though I changed the referral from a Gold to a Platinum card.

I had some weirdness applying for the referral offer. I first tried in an Edge InPrivate window and saw the 75K offer. When I tried to apply the application page got an error message I’ve never seen before. When I went back to the referral page I only saw the 60K offer (the original page did include a note that said “This offer may not be available if you close this web page”).

Then I did the whole thing again on a Chrome Incognito window, saw the 75K again, and was able to complete the application with immediate approval.