There are many card-linked programs ⓘAn app or website which offers rewards when making purchases at participating retailers with a credit or debit card you’ve linked with their program. out there which can be a great way to earn cashback and rewards with little-to-no effort beyond their initial setup.

It can be daunting though trying to get a handle on all of the different programs, plus not all of them stack with each other which is why we put together this guide: Card-Linked Programs & The Networks They Run On (AKA Which Programs Stack).

With so many card-linked programs available, are there some which are better than others? Beauty is in the eye of the beholder cardholder, so here’s a list of the card-linked programs that are most attractive to me.

In no particular order…

1) Shopping Portals

There are several shopping portals that have a card-linked in-store offer program:

These all work in a similar way. You register one or more of your credit and debit cards with the portal, then you activate the retailer(s) you’re interested in shopping at. When you make a purchase in-store using one of the payment cards you’d linked, you’ll earn bonus points/miles.

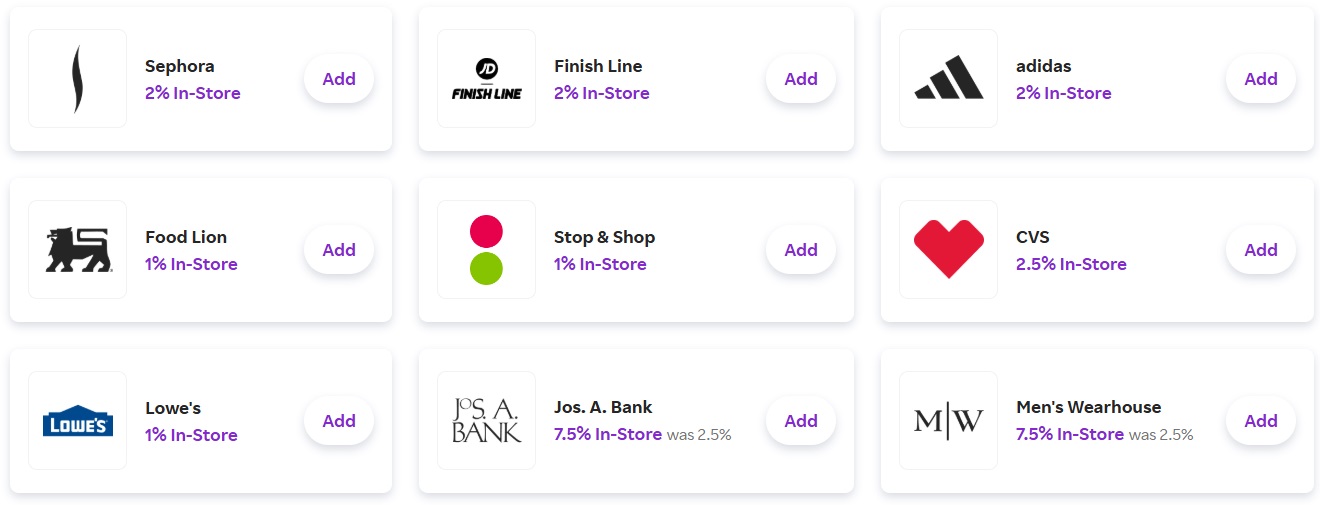

Some of these portals are more interesting than others. My favorite is Rakuten for a few reasons. One is that it features what feels like a wider range of retailers, plus they often offer double or triple rewards, or 10x or 15x. Considering these are valuable Membership Rewards points, that’s an excellent return for in-store purchases you might have been planning on making anyway. Another interesting feature is that Rakuten has some retailers you don’t always find on other card-linked programs such as grocery stores like Food Lion and Stop & Shop, other popular stores like CVS and Lowe’s and more.

The Alaska Airlines and United portals can be interesting for a different reason. Both of those airline portals are run by Cartera and each month there tends to be some kind of bonus spending offer (e.g. Spend $200 & earn 1,000 bonus miles). Those spending offers are valid for both online spend as well as in-store spend when paying with a card you’ve linked to the program. That means that even if you’re not planning on making any online purchases, you might still be able to earn the bonus miles via in-store spending. Unfortunately the card-linked program isn’t available on the other airline Cartera-run portals (American Airlines, Delta and Southwest).

With regards to Alaska Airlines, they updated elite qualifying requirements on January 1, 2025. For every 3,000 redeemable miles you earn through the shopping portal, you earn 1,000 Elite Qualifying Miles (EQMs). Your in-store spending can therefore help you get closer to seat upgrades and more when up in the air.

Another benefit of these in-store offers from shopping portals is that they stack nicely with other card-linked offers like Amex Offers, Chase Offers, Citi Offers, etc. Which leads me to…

2) Amex Offers, Chase Offers, Citi Offers, etc

Amex Offers, Chase Offers, Citi Offers, etc. can be extremely useful card-linked programs. BankAmeriDeals used to run in a similar way, but nowadays most of its offers function as a shopping portal rather than a card-linked offer program.

These work differently to other card-linked programs because they’re offers you link to your card, rather than you linking your card to another program. However, they can offer great savings and frequently stack nicely with other card-linked programs and deals.

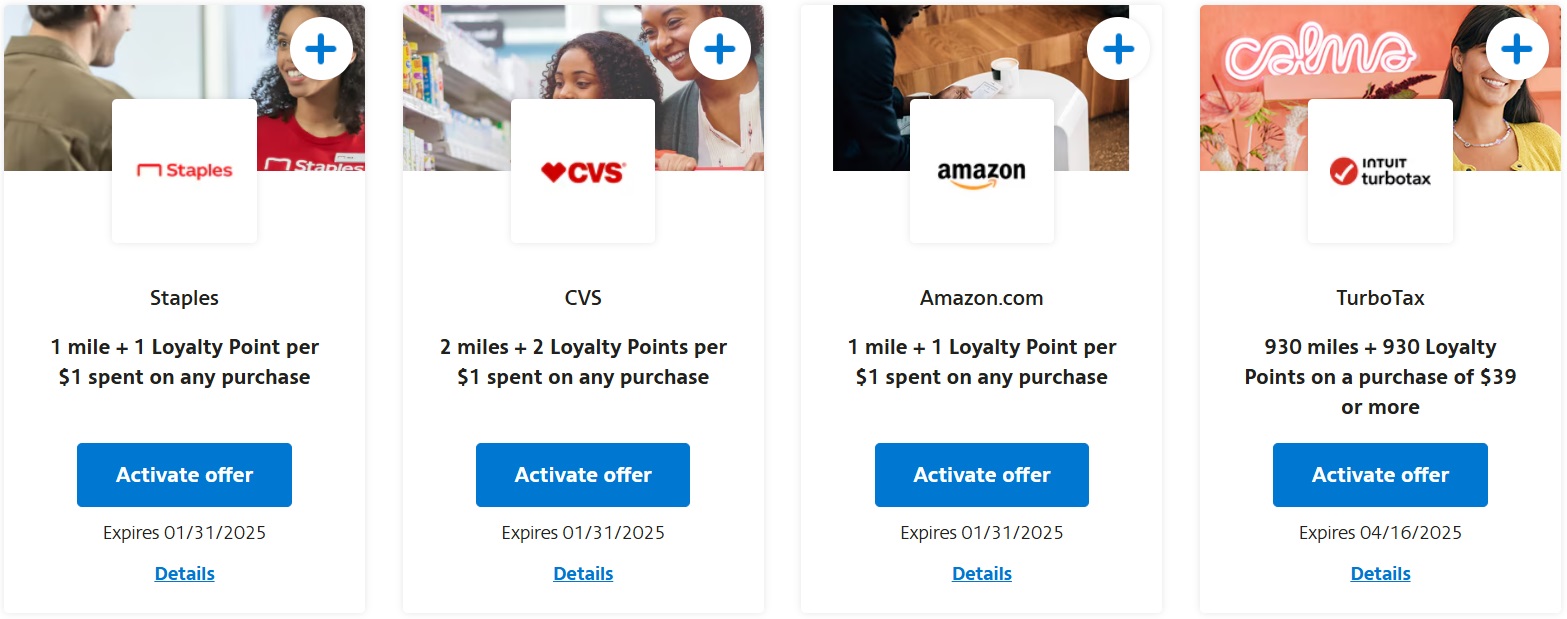

For example, I mentioned Rakuten’s card-linked in-store offer program above. They often have CVS available through that, with rates sometimes going as high as 15% cashback or 15x Membership Rewards.

Chase frequently has Chase Offers for CVS giving 10% back as a statement credit on up to $50 spend. Chase Freedom Flex and Freedom Unlimited cards offer 3x Ultimate Rewards on spend at drugstores, so here’s just one potential multi-layer stack when it comes to card-linked offers like Chase Offers:

- Rakuten in-store for 15x Membership Rewards

- CVS Chase Offer for 10% back on up to $50 spend

- 3x Ultimate Rewards on that spend if the Chase Offer was loaded to a Freedom Flex or Freedom Unlimited card

- Manufacturer’s coupons

- CVS coupons

- CVS ExtraCare savings

- CVS weekly ad discounts

3) SimplyMiles

SimplyMiles is a card-linked program which awards American Airlines AAdvantage miles rather than cashback. It runs on RCLON which means that it doesn’t stack with other programs that run on the same network such as the Rakuten, Alaska Airlines and United in-store offer programs.

Many of the offers in SimplyMiles aren’t particularly compelling due to them only offering 1 mile per dollar; Rakuten has many of the same card-linked offers but awards cashback or Membership Rewards at higher rates, so that’s often a better option.

One of its biggest downsides is that fact that you can only link Mastercards. That therefore limits the ability to stack with other offers (like Amex Offers) and being able to maximize purchases by putting the transaction on a card which offers bonused spend in that category. Having said that, Chase Mastercards that have overlapping Chase Offers should work. In the past Citi Offers stacked with SimplyMiles, but in most cases now you can only earn with one or the other – not both.

With poor earning rates in many cases and being limited to only working with Mastercards, why would this program merit a place on among my favorites? Well, in addition to earning redeemable AAdvantage miles, you also earn Loyalty Points towards status with American Airlines. For anyone seeking status in the AAdvantage program, that could prove to be very useful, especially for offers that earn more than 1x.

American Airlines’ Loyalty Points Rewards (think Milestone Rewards) also include boosts on partner spending at some levels too. For example, when you earn 60,000 Loyalty Points in an elite qualifying year, you get a 20% bonus on Loyalty Points earned from partners including both the American Airlines shopping portal and SimplyMiles.

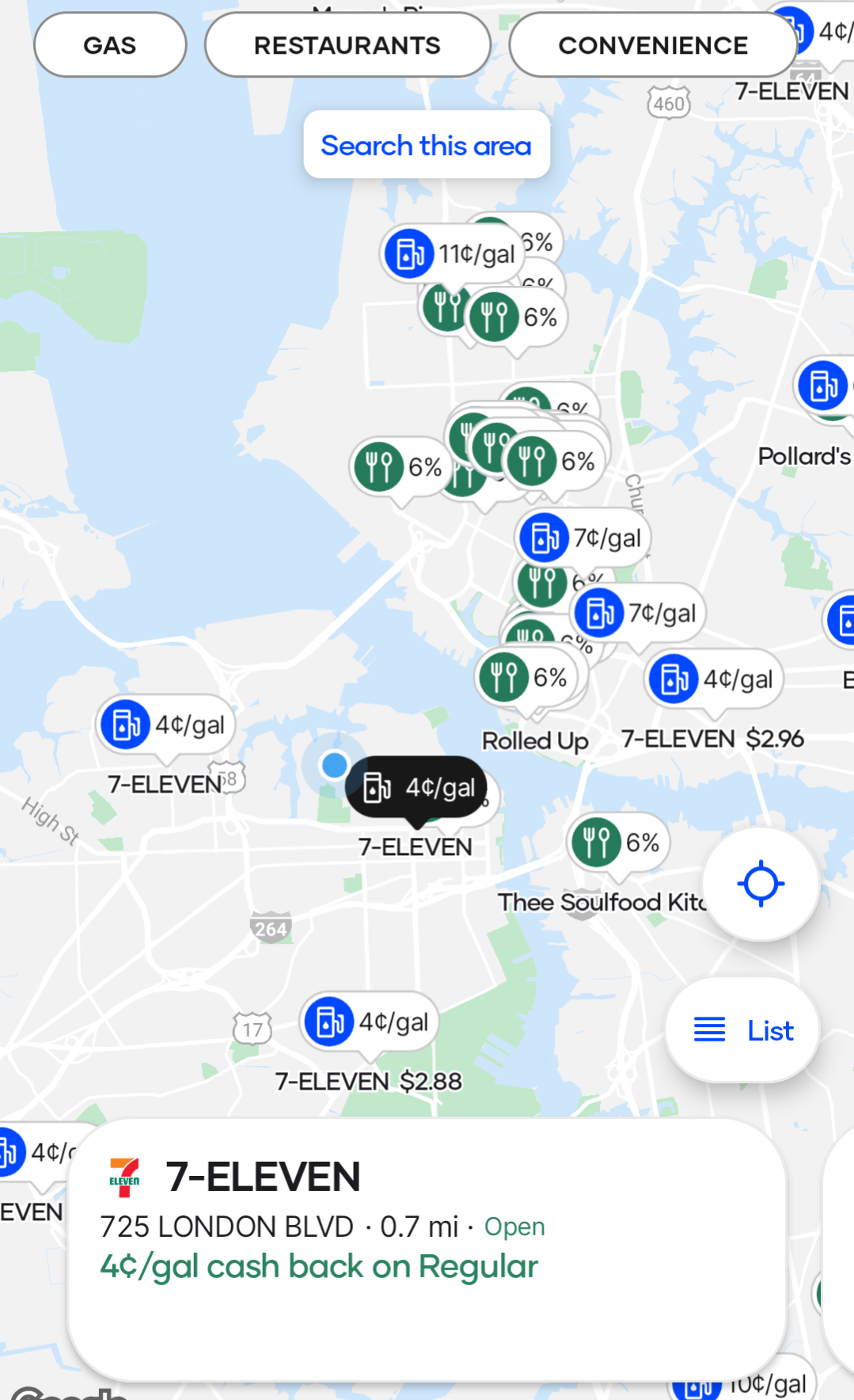

4) Upside

The main focus of the Upside app (read more about it here) is saving you money on gas by offering cashback when filling your tank at participating gas stations. (n.b. The app was once called GetUpside, but rebranded as Upside a couple of years ago.)

Fuel points programs from grocery stores can often provide much greater savings on gas, but Upside can be useful if your local grocery store doesn’t offer that kind of program and/or you don’t have a warehouse club membership. Upside has expanded its network over the last few years, so there are thousands of participating gas stations around the country including Exxon/Mobil, Shell, BP, Circle K, Casey’s, etc.

In the past you had to upload your receipt in the app to claim the cashback, but they’ve made it easier in recent years. Now you just have to claim the offer at whichever gas station you’re filling up at and pay with a card you’ve linked in the app. Due to the fact that you earn the cashback afterwards rather than getting an instant discount, that means you earn even more points on your card as your initial spend is higher.

In addition to the main gas savings part of the app, there are tabs for restaurant and grocery offers too. Those offers are only available in certain markets and seem to run on Figg/Empyr. If you have those available near you though, there can be some very generous offers at times such as 30% back at Burger King and more. That could be stacked an overlapping Amex Offer, Chase Offer, Citi Offer, etc.

5) Rewards Network Dining Programs

There are many dining programs run by Rewards Network. While you can only have any given card enrolled in one of the programs at a time, each program offers bonus miles/points when signing up for the first time and, in most cases, spending $30 for the first transaction and writing a review. The more transactions you have each year, the more miles/points you earn per dollar.

Back when we had a home, our favorite local bar participated in the program. It had a pet-friendly patio and the weather in Portsmouth, VA meant it was usually warm enough to sit out there with our pup from April to November. As a result, we’d earn a few dozen miles or points at a time with zero effort which is always a nice way to increase your balances.

Rewards Network dining programs can therefore be nicely rewarding and are worth registering for, especially if you dine out (or order take out) a lot. Unfortunately I’m often lazy and/or forgetful and so don’t end up linking new cards to one of these programs which likely means that I’ve missed out on rewards over the years.

If you’re looking to earn status with American Airlines, miles earned through its dining program earn an equivalent number of Loyalty Points. At certain Loyalty Points Rewards levels, you can also get a bonus on the number of Loyalty Points you earn, helping boost your status quest further.

6) Bilt / Walgreens

In August 2024, Bilt launched a partnership with Walgreens. You don’t have to be a Bilt cardholder to take advantage of this partnership. Instead, you just have to ensure you have one or more payment cards added to your Bilt wallet and that you pay for your transaction with one of those cards.

Bear in mind though that for drugstores there might be a more rewarding approach. For example, earlier on I listed a bunch of potential ways you could stack offers at CVS, so that stackage could be better than this Bilt/Walgreens partnership if you have multiple drugstore options near you. That said, if you ever shop at Walgreens then adding your usual payment card(s) to your Bilt wallet in order to earn bonus points is a no-brainer if you want to earn points with no future effort.

Past Top 6

This is a new version of this post as the previous version was no longer valid as so many of the apps and services had since closed. In case you’re interested, here’s what my previous list was when originally publishing this post in 2021. In no particular order:

1) Google Pay – Google retired Google Pay on June 4, 2024, replacing it with Google Wallet. They also retired the card-linked offers at the same time.

2) SimplyMiles – This is still going and mentioned above.

3) Amex Offers/Chase Offers – These are still going and mentioned above.

4) Dosh – This app is closing on February 28, 2025.

5) GetUpside – This app has been rebranded as Upside and is still going and mentioned above.

6) Bumped – This app closed in December 2022.

Question

Those are all my favorite card-linked programs, but how about you? Do you feel the same or are there other card-linked programs you prefer? Let us know in the comments below.

[…] You may get some value out of this I guess: Beauty In The Eye Of The Cardholder: Stephen’s Top 6 Card-Linked Programs. […]

Stephen, great post. Question: On the United and Rakuten card-linked programs (#1 above), they do not stack, correct? Meaning that you’d only get miles (United) or cashback (Rakuten) but not both? If they do not stack, do you have any idea which currency (miles or cashback) I’d receive if I have the same cards and offers saved at both options? Thank you in advance!

That’s correct, they don’t stack as the United portal card-linked offers run on RCLON (Rakuten Card Linked Offer Network) which is the same backend that Rakuten uses.

As for which you’d receive if you have the same cards and offers saved at both options, I think it’s whichever one you saved most recently rather than the one that was saved first. I might be wrong on that as I don’t think I’ve been in that situation before myself, but I think I remember hearing someone report it working that way.

Yes, in my experience, the one saved most recently sticks

Stephen and CJA, thank you both for your replies. Much appreciated.

Any insight into the offers on paypal? Are they worth a scroll through and a click. Are they stackable?

I think it depends on how the PayPal offer is set up. If it’s simply that you have to pay via PayPal, those offers should be stackable with a shopping portal. In most cases they won’t be stackable with things like Amex Offers as those require payment directly with the retailer, but sometimes PayPal payments do count for those too.

RIP Dosh, we hardly knew you

Great post! One that’s not on the list is the Seated app. Can give pretty huge cash back at a lot of restaurants (I’ve gotten 22% before), though typically it’s only available in major U.S. cities, meaning it won’t be beneficial for everyone. Sometimes I’ve been able to visit a restaurant that earned Seated cash back, Upside cash back, airline dining portal miles, Dosh cash back (R.I.P.), a Chase offer, and Bilt miles! (By the way, your post didn’t mention that you can earn Bilt miles at some restaurants too, though I believe they’re now on the Rewards Network so it’s harder/impossible to earn both Bilt AND airline dining portal miles if a restaurant participates in both.)

Given that almost all BankAmeriDeals now require clicking through a link I’m not sure I would put them in the same category as Amex, Chase, and Citi any longer because of limited stackage.

That’s a great point – I’ll make a note about that in the post.

Glad you are doing more posts this year!

Thank you!

Bonus Offers from Sam’s Club – where else can you earn 30% back on Peacock every month? #samsclubemployee

I recently started checking Shop Your Way portal also. Not sure if it’s elevated right now, but it offers 2.8% back at Safeway and associated grocery chains which is better than any other portal I’ve seen. It also offers missions to earn extra rewards (paid in gift cards with good choices…Amazon, Target, Walmart etc)

Newbie to this: how does one activate, for example, recruiting, when in the store? Does one need to open the app or if you use the card linked to recruiting a bonus will be automatic? Thank you.

Sorry, not recruiting but Rakuten. Pay attention Siri.

Hi Abby, activate the in-store offer in Rakuten before you shop; pay with the linked card(s) you added in the app. You do not have to use the app while you are shopping/paying in-store.

Thanks Laura. Is it the same with inKind, for example do you use a c/c linked or only inKind cash?

If you go to https://www.rakuten.com/in-store, you should see an option to ‘Add Card.’ You can then add as many payment cards as you like.

Next, scroll through the list of retailers on that in-store offer page click the ‘Add’ button next to them for any you’re interested in. All you then need to do is pay at that retailer with one of the cards you linked.

Bilt Walgreen 500$ purchase didn’t get any points , when it got first introduced

I imagine that Bilt is blocking people from earning on transactions for $500, $505.95, $506.95, etc.as gift card purchases are excluded.

Great post Stephen!

Stephen, what’s your top 6 looking like in 2024?

Hmmm…..good question! Bumped is no longer around and Google Pay offers don’t seem to be as useful nowadays. SimplyMiles, Amex Offers/Chase Offers, Dosh and Upside would still likely be on the list. Rakuten’s in-store program and either the Alaska or United shopping portal in-store programs would likely be the other two.

If you have one card on multiple RCLON card link apps, how do you know which one will track? Also is it best practice to activate all offers to see if all track?

To be honest, I’m not sure how to know which one will track. I suspect it’s whichever program was the most recent one you linked your card to.

I doubt it would track with all RCLON programs, but you could always test it out in case it does work. If there’s a particular program you’d prefer it to track with if you could only choose one, I’d activate the offer with that program last of all.

Can Gpay offers be used for gift cards? I am looking at the Panera offer, but don’t see any maximum? Also, does “you can earn a maximum of one reward with this offer” mean you can use it once? Thanks! (oh, used your referral–thanks for all the good info)

Yep, you can buy gift cards provided the payment is processed by the company you’re buying a gift card for. In-store is fine, online will depend on if someone like CashStar takes payment. For example, with Panera you can buy a gift card in-store but not online.

As for the maximum on the Panera offer, I’m afraid I’m not sure – unfortunately Google Pay hasn’t listed a maximum cashback limit in many cases.

With regards to “you can earn a maximum of one reward with this offer”, yes – that means you can use the offer once on your account.

And thanks for using my referral link 🙂

[…] I no longer bother with these. But maybe you will, this is a good roundup: Beauty In The Eye Of The Cardholder: Stephen’s Top 6 Card-Linked Programs. […]