Update 11/6: We’ve received word that these 90K offers will be ending at 9 AM EST on 11/13/2025. One week left to jump on board the Ink train.

~~~

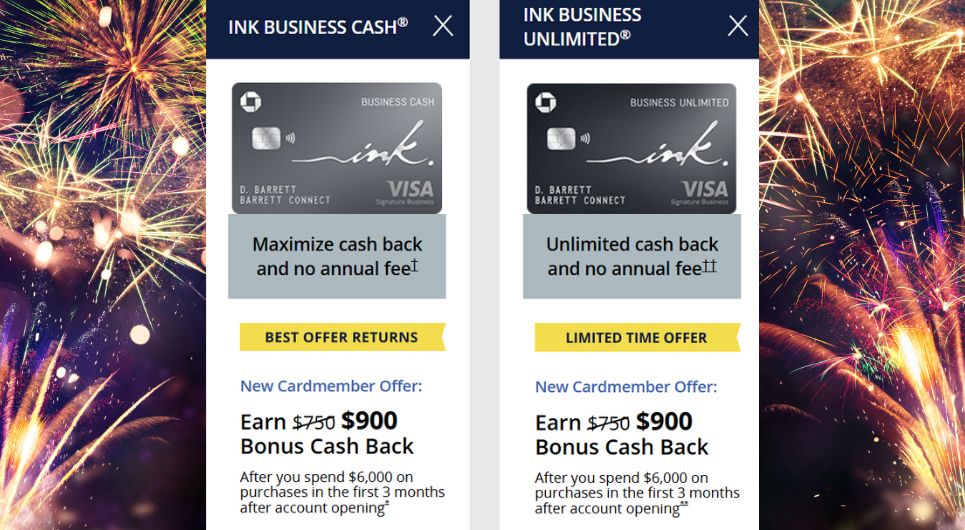

If you are looking for 90,000 reasons to pick up more transferable points, you now have two opportunities to do so, as the 90K offers for the Chase Ink Business Unlimited and Ink Business Cash cards are back again.

While the welcome offers have increased, the minimum spend required to achieve them is unchanged at $6,000 each. These are now two of the top six business cards on our Best Offers Page, and each one matches the best welcome offer that we’ve ever seen on both cards.

Referral links are showing these increased offers, so if you already have a household Ink card or a friend who does, it’s an easy way to add another 20K to the total haul.

We’ve received many successful reports from folks who applied for these cards when there were still 75K being matched to the higher 90K offer. If that’s you, contact Chase and give it a shot.

The Offers & Key Card Details

For more information about these cards and to find a link to apply, click the card information below to go to our individual card pages.

| Card Offer and Details |

|---|

ⓘ $1029 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750(*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: This one should be in everyone's wallet. Incredible welcome offer for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5x Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

| Card Offer and Details |

|---|

ⓘ $1074 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750 (*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: Great welcome offer for a no annual fee card. Good option for earning 1.5X everywhere. Good companion card to Ink Business Preferred, Sapphire Reserve or Sapphire Preferred. Click here for our complete card review Earning rate: 1.5X on all business purchases ✦ 5X Lyft through September 2027 Base: 1.5X (2.25%) Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

Quick Thoughts

I’ve made no secret about my love for the Chase Ink Cash. Our household has four of them and they’re stalwarts of our credit card portfolio due to the 5x earning on office supply stores, internet, cable and phone services. By taking advantage of some office supply stores’ constant sales, you can effectively use them to earn 5x on many expenses.

But pushing that aside, these offers are absolutely bonkers for no-annual-fee cards. Our Reasonable Redemption Values pegs Chase Ultimate Rewards at 1.5 cents each, making each of these 90K bonuses worth over $1300 without factoring in the additional rewards that can be earned from the minimum spend.

Note that Chase advertises the Ink cards as cash back cards, so they advertise $900 cash back — but that bonus is awarded as 90,000 Ultimate Rewards points. If you only have one of these Ink cards, then you would be limited to using those points for a statement credit at $0.01 per point (or similar redemptions for gift cards / travel), but if you have a card that allows transfers to partners (like the Sapphire Preferred, Sapphire Reserve, Sapphire Reserve for Bujsiness, or Ink Business Preferred), then you can move points to that card from one of these Ink cards and then onward to partners.

Chase Application Tips

- 5/24 Rule: You most likely will not get approved for a new card if you have opened 5 or more cards (with any bank) within the past 24 months. Most business cards do not count towards that five card total. Business cards that DO count include: TD Bank, Discover and the Capital One Spark Cash Select, Spark Miles and Spark Miles Select.

- 24 Month Rule: If you’ve previously had a card before, you can only get a welcome offer on that card again if you no longer have the card AND if it has been more than 24 months since you last received a welcome offer for that card. This rule does not apply to the Sapphire Preferred and Reserve cards (see below). There can be exceptions with some business cards.

- Sapphire cards: The Sapphire Preferred or Sapphire Reserve cards no longer have a family rule that prevents you from getting one if you currently have the other. However, both now have significant limitations that may prevent you from being eligible for a welcome offer if you've previously had the same card. In that event, you'll get a pop-up window that tells you that you're not eligible before you get a credit check and will ask whether or not you want to proceed with the application without the welcome offer attached.

- Southwest "Family" Rules: Chase applies additional "family" rules to the Southwest cards. You're not eligible for the welcome offer on a personal Southwest card if you currently have one, or if you've received a welcome offer on any personal Southwest card within the last 24 months. This doesn't apply to business cards. You also can't be approved for the Southwest consumer card if you already have one open.

- IHG "Family" Rules: You're not eligible for the welcome offer if you've received a welcome offer on any personal IHG card within the last 24 months. You also can't be approved for another IHG consumer card if you already have one open. You can have both an IHG personal and an IHG business card.

- Ink "Lifetime" Rule: You "may not" be eligible for the welcome offer on an Ink no-annual-fee card if you have ever had the same card or any other Chase for Business card without an annual fee. In addition, you may not be eligible for a welcome offer on a Chase Ink Business Preferred card if you currently have the card or have had it in the past. We don't know how often this is enforced.

- 2 per month Rule: Most applicants are limited to 2 new cards per 30 days. Business cards are usually limited to one per 30 days.

- Marriott cards: Approval for any Marriott card is governed by a labyrinthine set of unintuitive rules. You can see the full eligibility chart here.

- Card Limits: Chase doesn't have a strict limit on the number of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. Because of this, reconsideration can sometimes be successful by moving credit from one existing card to the new card that you want.

- Application Status: Call (888) 338-2586 to check your application status.

- Reconsideration: If denied, call (888) 270-2127 for personal cards, or (800) 453-9719 for business cards, and ask for your application to be reconsidered.

If one applies with a targeted invitation code, will the pop-up always appear if one is over 4/24?

My chase card history (real small business):

ink biz cash – opened in 2017

ink biz cash – opened Sep/23 . (spent 6k in 3 months, got 90k pts)

ink unlimited – opened Dec/2024. (Spent 6k, got $600 cash bonus). This card still has some balance as it’s at 0 APR, which I can pay too if that helps in approval.

I see both these cards (cash and unlimited) with roughly $900 bonus are available and want to make use of it.

Will I be eligible for another card now? Will I have better chances if I open the biz cash this time as I opened unlimited some 11 months ago?

Is the welcome offer tied into the date that you applied or the date that you are approved? (in case the sub drops during the time between application and approval)

It’s always tied to the date you apply.

I am assuming the sign-up bonus is Taide into the date that you applied not the date that you were approved. So if I apply while the 90 K offer is still available, but it takes a few days or weeks to be approved and in that timeframe the offer drops to 75K I will still have the 90 K offer honored

Yes

Dropping to 4/24 in Dec. Any chance applying last minute and calling recon in Dec for reconsideration once I am under 5/24?

I’m in the same boat. Anyone above 5/24 try applying recently? I remember seeing reports a few months back of selective approvals above 5/24 but nothing recent.

I just cancelled/closed my two Business Inks on Oct 29, 2025. Do I need to wait 60 days before trying again? I want to do one of them now but I don’t know if its a good idea or just be safe and wait till the next $900 cycle.

History

Unlimited Opened 2/9/2023. Bonus received on 4/14/2023.

Cash Opened 3/12/2023. Bonus happened on 05/11/2023.

Thoughts? Would I be approved?

As they say in this game, YMMV…I opened a new CIC at the very beginning of September with a first purchase date of 9-08 and just got the bonus with a large purchase on 11-1. It was my 7th Ink. When the news broke that the 90k was ending soon I went to the branch and opened a new CIU on 10-30. I now have 8 inks. I know, as a group, we despise walking into branches but my experience is that person at the desk can get approvals that the online app might say no to.

If you have a branch nearby and want to get one more bowl of gravy… Just my experiences.

do you have a banking relationship with chase? or will the bankers be as willing to help if you only have CC’s with them and no bank accounts

I have a personal checking with just enough to not get fees and now 4 business accounts with just enough not to get fees. I use one for sending direct deposits to bank account bonuses but that’s about it. The Banker I was going to in the past moved to Texas so my last visit was to a new to me person.

This was the first checking account I couldn’t get a bonus for (less than 24 months since the last checking bonus) but the credit card was the actual target of the visit. For what ever reason they do seem to be easier with being the first card for a new business. My EIN letter was 2 days old.

several times I’ve noticed, on recon, that they do not see closed cards at all. Also a couple times i closed one and reapplied for the same card and got instant approval.Last month I was refused for a 5th Ink on recon before learning the # limit so I applied for a new United business card.Upon denial I relizied I had forgotten to close my old one. I closed it and phoned recon minutes later and was approved for the new one. So, from my experience, I certainly don’t think they see a card once closed in recon. They do however see all the cards you’ve been approved for the the past 18 months from my experience. ymmv but how my experiences have been.

Update, it worked. I went ahead and applied for both cards and got approved.

How long is too long to wait to call reconsideration? I am almost certain I applied for CIU on Sep 30 (because I got a Barclays Aviator Red on the same day, the last day it was available). I also got a Triple Cash that day, so I had that SUB to spend towards and did not get back around to calling recon. I also tried for P2 a few days later on a CIC. Mine was rejected, P2 they wanted “more information” which I never followed up on.

30 days

If p2 has two ink cards should he cancel one first before applying?

anyone have any info on when this offer might be ending?

Also adding a negative data point. Applied 9/1/25, asked via secure message to match the 90k offer, received denial response.

Another negative data point on matching the higher offer. I was approved for the 75K offer Monday 9/8. Messaged Chase on Friday, response today is no dice on matching to 90K, will only get the 75K SUB.

P1 and P2 denied.

P3 approved the morning of at the lower reward amount and no match to 90k.

Has Chase eased up on Ink approvals? They went super tough a little while back if you already had some Ink cards. It’d be great if they became more reasonable.

Can we expect e an increase for Ink Preferred?

I am hoping so! The only Ink I don’t have….

I sent a message via the secure message portal yesterday and was turned down for a match. I also called in to Ink customer support, and they told me that a memo went out saying that there will be no “enrichment of offers” (and that her supervisor told her the same thing this morning). I had received my card acceptance on August 15 for the Ink Cash card. So hopefully someone knows the secret incantation to get an offer match, because “pretty please with sugar on top” wasn’t doing the trick.