NOTICE: This post references card features that have changed, expired, or are not currently available

You were never supposed to be able to load the same Amex Offer to multiple cards in the same person’s name, but for years we’ve been able to do so either by creating separate log-ins for each card, or by doing the “multi-tab trick” where you would open multiple tabs in the same browser and load each tab with a different card’s Amex Offers before loading the offers one at a time to each card.

I think it may have been Doctor of Credit that first covered the news early in July that the separate log-in approach had stopped working in cases where each card shared the same person’s name and SSN.

Next, a couple of days ago, several blogs reported the death of the multi-tab trick. Nick followed up with “Not totally dead: Some Amex Offers still loadable to multiple cards.” It seems that Amex has coded things so that the multi-tab trick doesn’t work with new offers, but it continues to work with old offers… mostly. In a follow-up post (Amex Offers multi-tab trick still not dead, but deader than before), I showed that some older offers are still working, but others are not. I also looked into the theory that the terms & conditions are the key to understanding this. Unfortunately, I found inconsistent results there too.

There may still be a few loopholes for loading offers to multiple cards in your name (try loading an offer via the mobile app to one card, while loading it to another card via desktop, while standing on your head and singing “I’m a little teapot”), but I think it’s likely that going forward this particular game is over.

What’s Left?

Fortunately, there are still options available for getting the same offer onto multiple cards:

- Multiple different authorized users

- Variations of the same offer

Multiple different authorized users

Most Amex cards offer the option to add authorized users for free. Each AU (authorized user) gets their own card number and their own set of Amex Offers. So, if you have a primary account with 4 authorized users, it is possible to load the same offer to all 5 cards. This is true as long as each authorized user is a different person.

Note that while it’s possible to get multiple authorized user cards for the same person from the same primary account, that’s no longer helpful with respect to using Amex Offers. For example, my wife has previously added me multiple times as an authorized user to one of her cards. That can still be helpful when you get a targeted offer for bonus points for adding AUs, but it’s no longer useful with Amex Offers.

When adding authorized users, Amex now requires their social security number. As a result, authorized user consumer cards will show up on the AU’s credit report. This can be good or bad depending upon the situation (see this post for details), so make sure to get permission before adding anyone as an AU.

The best option when adding authorized users, in my opinion, is to add them to your Amex business cards. Amex business cards, including AU cards, are not reported to the credit bureaus. They won’t affect the AU’s credit in any way, and won’t hurt their 5/24 count when applying for Chase cards.

Caution: When adding offers to an AU card, you may be taking those offers away from that person’s own primary Amex accounts. This approach is best when the other person either doesn’t have Amex cards of their own or is not interested in Amex Offers. (Thanks to “Florida Person” in the comments for pointing out this issue).

Variations of the same offer

Often, offers have multiple variations. In each of these cases, each variation of the offer can be loaded:

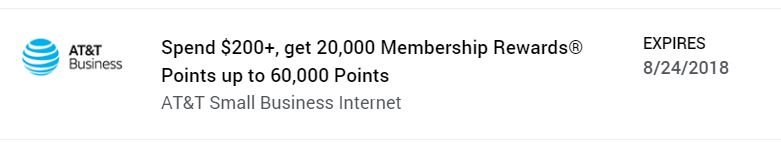

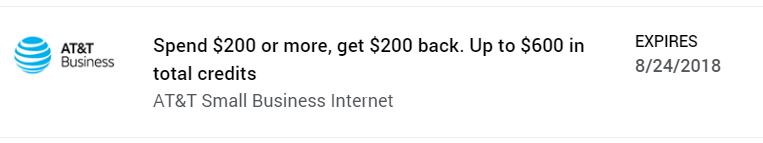

Membership Rewards vs. Cash Back:

Similar But Different Rebates:

Having multiple types of Amex cards is still useful

In the now slightly outdated post “Awesome Amex Offers and how to get them,” I detailed how to increase your chances of getting the best targeted Amex Offers. I recommended the following:

- Get every type of Amex card (e.g. consumer, business, credit card, charge card, etc.)

- Get more Amex cards

- Enroll in Amex Offers quickly

- Consider creating separate online accounts for each card

I still recommend items 1 to 3, above, but the details of my recommendations are now a bit different…

1. Get every type of Amex card

Amex treats consumer cards and small business cards very differently. They also treat cards that earn Membership Rewards points differently from those that earn other types of rewards. Frequently, offers are available for one type, but not another.

Fortunately, there are no-annual-fee options in each of these categories:

- Consumer Membership Rewards cards.

- Options with no annual fee include: Amex EveryDay, Morgan Stanley Credit Card

- Consumer Non-Membership-Rewards cards.

- Options with no annual fee include: Hilton Honors, Blue Cash EveryDay

- Business Membership Rewards cards

- Options with no annual fee include: Blue Business Plus (this also happens to be my favorite card for Everyday Spend)

- Business Non-Membership-Rewards cards

- Options with no annual fee include: SimplyCash Plus

Note that Amex limits cardholders to 5 primary credit card accounts. Charge cards (such as Amex Platinum cards, Premier Rewards Gold, Business Gold Rewards, etc.) are not similarly restricted, but I believe they all have annual fees.

2. Get more Amex cards (via authorized users)

Suppose you have permission from four family members to add them as AUs to your Amex cards. In that case, it would be possible to load the exact same offer to up to 5 cards (assuming all 5 cards were targeted with that offer). And when there are multiple variations on the same offer (such as one for membership rewards points and one for cash back), you could add the offer to up to 10 cards. That’s pretty good!

3. Enroll in Amex Offers quickly

The best Amex Offers have limited enrollment. If you don’t add the offers to your account in time, you may lose out. These offers can appear at any time, so your best bet is to check your account daily and/or subscribe to blogs like this one so that you’ll be alerted when desirable new offers have been spotted.

You can also subscribe to the comments on our Current Amex Offers Page. When we find new offers, we add a comment to this page saying so.

Moving On

Part of me is actually relieved by the latest developments. I currently have 17 Amex cards showing up in my online account (mostly AU cards). As a result, the multi-tab trick has been a huge pain in the butt. I’ve had to duplicate the first tab 16 times before loading offers one tab at a time. And I had to keep track of which cards had which offers. And when trying to use these offers, I had to keep very careful track of which ones had already been used and which had not. I also didn’t relish facing the line that formed behind me at Lowe’s when buying $500 gift cards by splitting the charge across 10 different Amex cards.

Going forward, Amex Offers will still be lucrative, but less than before. And there’s a consolation: our brain’s won’t explode. For more on keeping brains un-exploded, see: How to prevent your brain from exploding.

[…] the recent Amex Offer changes, this Walmart Online Grocery Amex Offer can’t be loaded to each of your cards. You can load […]

Another data point. Tried the multi-browser trick this morning and got the following: “Sorry about that! The offer you selected has already been added to one of your Cards.” It had still been working for me as of a couple days ago.

[…] to the recent negative changes to Amex Offers, it’s important to be selective when choosing which card to load a new Amex Offer to seeing […]

A new era? Oh com on. This is the right way of doing things. If anything it was a loophole before and not sustainable. Amex offers are great and I’ve earned tens of thousands of extra points and saved hundreds in cash back offers. I’m sure we all have.

[…] A new era for Amex Offers […]

I met be missing something here. If you sign up for the ATT cash offer and the MR points offer, how does Amex know which offer to credit to your account?

Rationalization, to be sure, but count me in the “relief” category. Memory is tricky on this kind of stuff, but I feel like it has been a long time since there were some “good as cash” offers that made me want to do all the work involved (opening all the tabs, scanning through the mind-numbing offers for things I can’t imagine buying at half their price). I’m talking about the good stuff, like Staples or Newegg $10 or even $20 off $100 spend, gift card eligible, since that was like picking up $10 (or $20) bills off of the floor. (Not to mention my favorite, the $30 off on Amtrak.) Lately I find that when I do (or did) go to the trouble of harvesting all of the offers off of the cards, it was mostly so I didn’t have to worry about which one my wife and/or I used on the one or two times we were using something.

Not to say that there hasn’t been a loss of something, just to say that the real loss was, first, good offers that repaid volume consumption.

Well at least one personal and one business charge card can go.

[…] Frequentmiler reader points out that if you add an offer to an AU card, that person will then lose their own Amex Offer deal on […]

If I stand on my head I don’t need to know the words to “I’m a little teapot” because I lose consciousness quickly.

It was only 4 dogs licking me that brought me around.

Sad day as the AMEX news gets even worse…the old interface is now officially dead

Ha – I felt the same – “ok the stress of that game is over.” Still . . .sigh.

I only have one 2 cards (UK Gold and SPG credit cards) feeling a little behind the curve. Is it really ok to have so many cards, especially if you aren’t using them except for offers? Don’t amex monitor your usage or if you look like you’re only signing up for the bonus?

Amex hasn’t historically had any issue with people signing up for lots of their cards. When people were adding dozens of AUs, they did crack down on that, but if you were to open a few accounts and add a few AUs to each, that shouldn’t be a problem.

It only looks like you’re signing up only for the bonus when you cancel soon after receiving the bonus. I specifically highlighted no-fee cards because these are great ones to sign up for and keep forever.

Thank you Greg, i understand now. So get a few more, hit the sign up bonus, put them in a drawer, and monitor the offers page for when one comes handy. Thank you again.

I added my kids to my gold Amex many years ago when they were young, and now my oldest is 29 and has her own Amex Accounts. So, as usual, I added all the offers to all the gold accounts last week including her gold account, and they disappeared off of her other accounts, which she wasn’t happy about. So the AU gold account we have for her is essentially dead now that I can’t use the offers anymore and we can’t close it as it’s her oldest account. It’s almost as old as she is.

Thanks for sharing that. I didn’t think of that downside to letting people add you as an AU!