Just over a year ago, Doctor of Credit published a deal where you could get a $117 bonus when opening an Ellevest online investing account and funding it with $100.

In case you’re not familiar with Ellevest, it’s a company that provides online financial services and is targeted at women, although anyone is able to sign up. It therefore works much in the same way that AARP is set up to benefit people over the age of 50, but people of any age can become a member.

My wife and I both took advantage of that offer, so we’ve each had $217 sitting around in our Ellevest accounts. A couple of months ago we received an email with the subject line “A Debit Card With Cash Back Rewards?”

I initially figured it was going to be similar to the Discover Checking Account which offers 1% cashback on up to $3,000 of debit card purchases per month, but the email made their offering sound far more intriguing:

You don’t need a credit card to earn rewards. In fact, you can earn 5% or more cash back when you shop select brands locally and nationwide with the Ellevest debit card. Fund your money goals and reward your own damn wish list this holiday season.

5%+ cashback sounded very interesting and the small print in the email gave more information about how it would work:

The Ellevest Rewards program is powered by Dosh, an unaffiliated third-party provider, which offers Ellevest banking members cash back on Ellevest debit card purchases from select merchants.

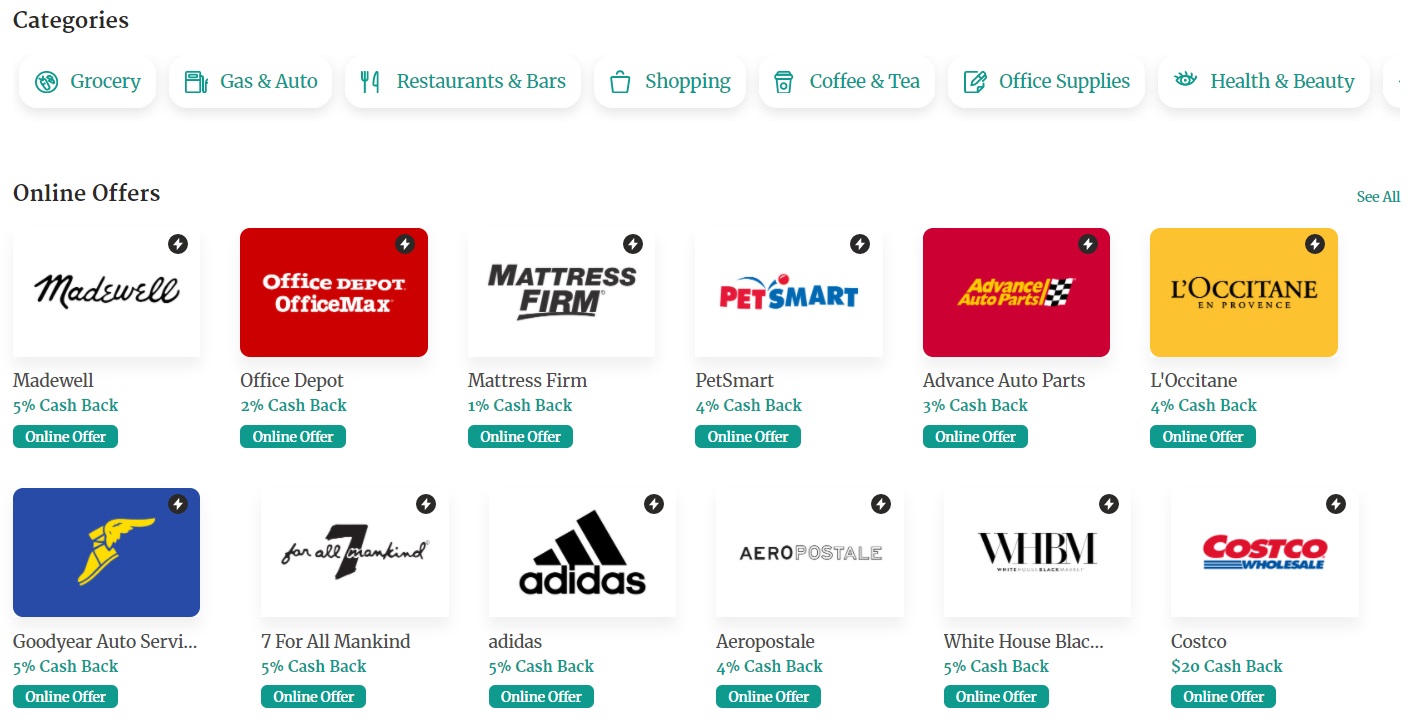

Dosh is a card-linked program which offers cashback at a variety of retailers. Some deals are online, some are in-store and others are valid at both (you can find past deals here). In-store offers are card-linked, while most online deals state that you have to tap through to the retailers from the Dosh app and pay with a linked card, thereby working more like a shopping portal. In reality, online offers sometimes track even if you haven’t tapped through from Dosh which means you can stack with a different shopping portal, but that varies by retailer and sometimes changes, so it can be trial and error.

n.b. If you’ve recently applied for a Betterment checking account due to the great cashback rate being offered by Rakuten, this post will apply to you too. Betterment’s checking account also has a rewards program run by Dosh which is presumably set up in the same way as Ellevest’s offering. Betterment declined my application though, so I haven’t been able to check that for sure – let us know in the comments below if their Rewards program by Dosh runs differently.

Ellevest’s bank account doesn’t charge a monthly fee, has no overdraft fees and reimburses ATM fees for withdrawals in the US, so I decided to sign up in order to check out their card-linked program. My debit card didn’t show up for several weeks, so I emailed them to ask for a replacement card; it seems like the USPS delays in November/December affected this as both the original and replacement card showed up one after another.

How Ellevest Cash Back Rewards Works

After activating my debit card, I clicked the link to ‘Start earning cash back’ to check out what my new card would offer.

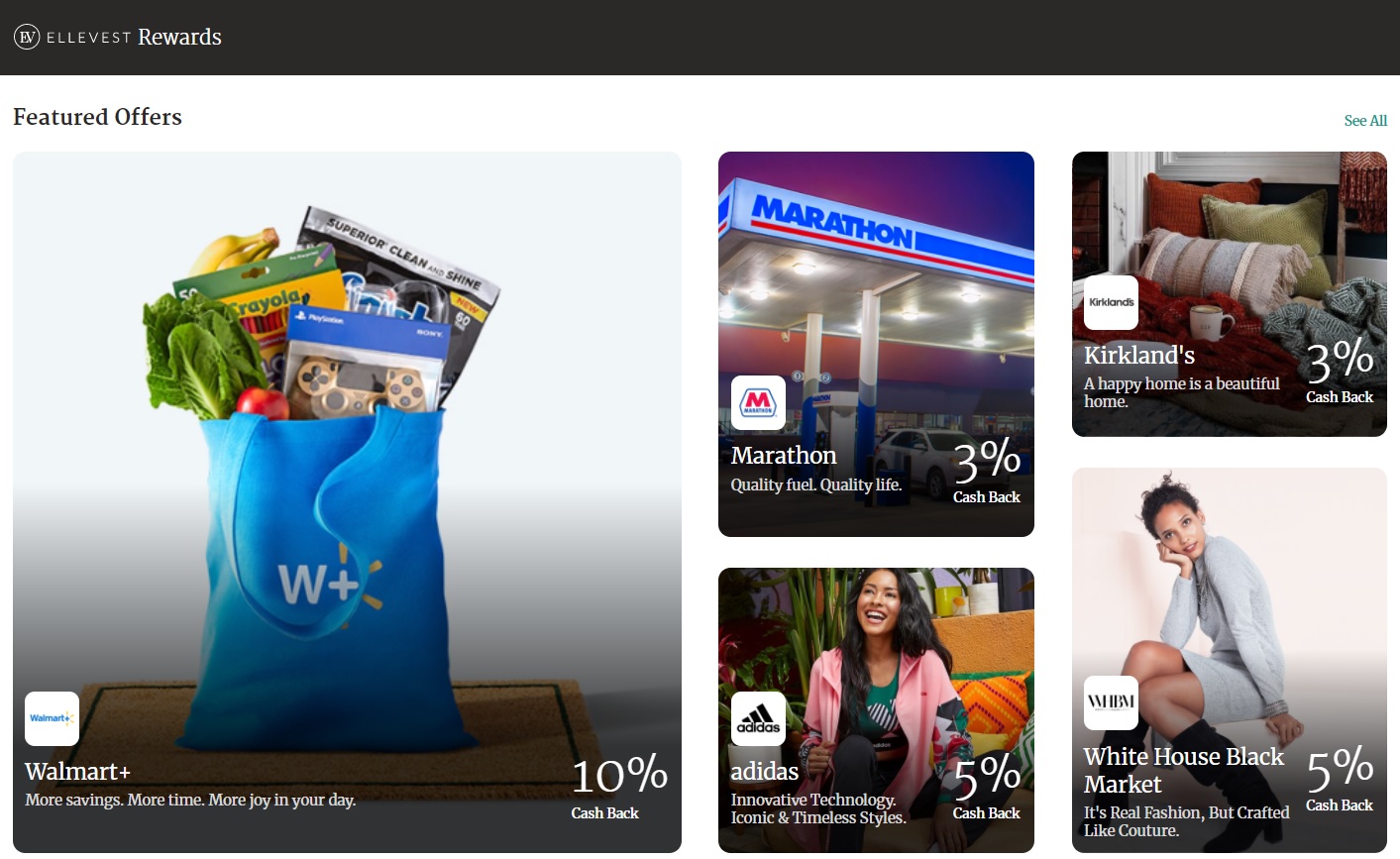

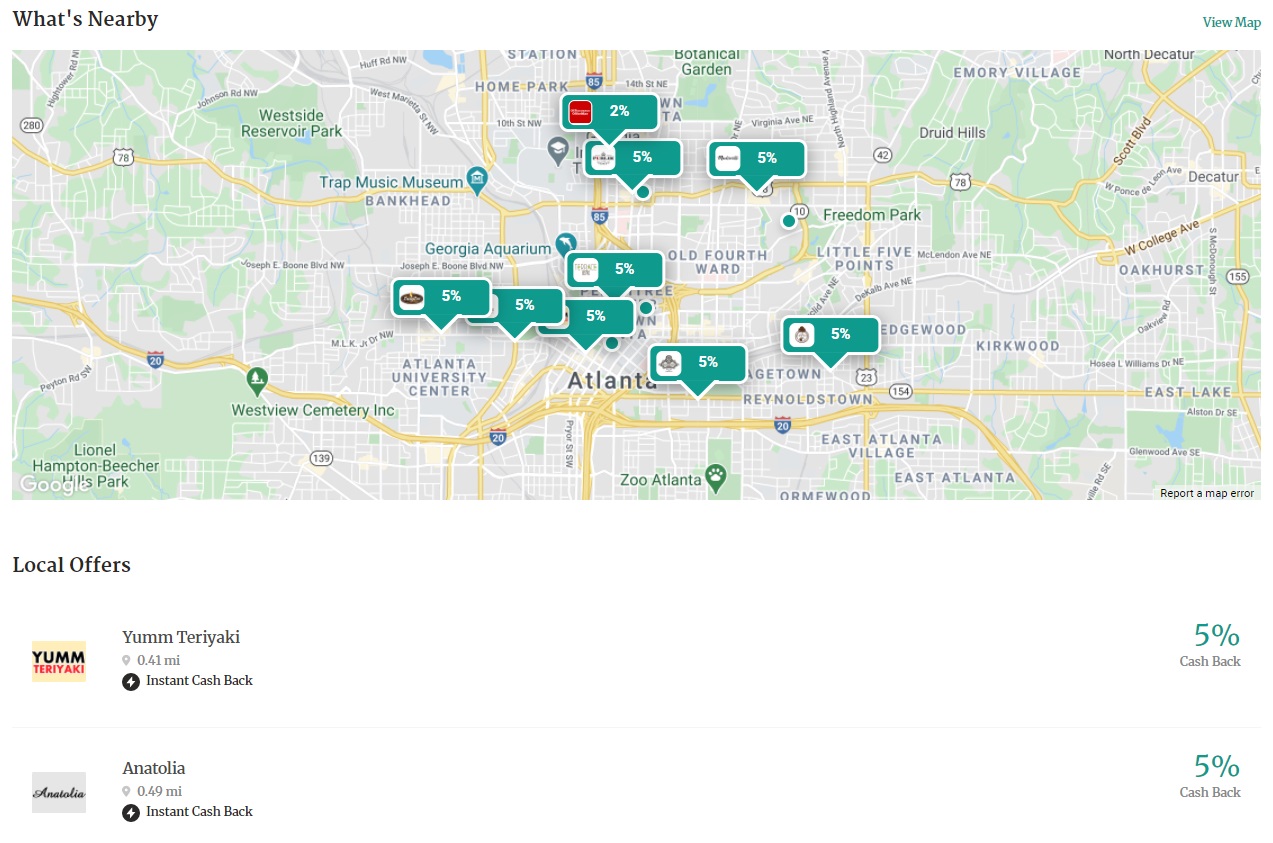

Perhaps unsurprisingly, the landing page was a white-labeled version of Dosh with the same deals being offered to Ellevest clients.

As with the Dosh app, there was a variety of eligible retailers, along with Local Offers. All of the cashback rates offered to Ellevest account holders exactly matched those on offer in the Dosh app itself.

When opening an Ellevest bank account, they open a Save account at the same time which also carries no monthly fees. When using your debit card at one of the eligible retailers, the cashback shows up as a pending reward in the Rewards section of Ellevest’s app (their website appears to have limited functionality, so it seems worth downloading their app).

Once the cashback has been confirmed by Dosh, it’ll be listed under your ‘Recent Transactions’ in the Rewards section. At the start of the next month, all confirmed cashback gets transferred to your Save account.

Testing Ellevest Cash Back Rewards – Stacking Opportunity?

In the FAQs on Ellevest’s website, the following question and answer is listed:

Why can’t I add my Ellevest debit card directly in the Dosh app?

Ellevest members who have the Ellevest Debit card are automatically enrolled in Ellevest cash back rewards program powered by Dosh. Because you’re already earning cash back with the Ellevest debit card through the Ellevest cash back rewards program, you’re not eligible to earn cash back with the same card in the Dosh app.

The way that question was worded made it seem like the Dosh app simply wouldn’t let you add an Ellevest debit card in the app. I was therefore somewhat surprised when I was able to add it without any issues and so figured that maybe you could double-dip rewards with both Ellevest and Dosh after all.

In many cases, you wouldn’t want to stack Dosh with Ellevest’s rewards program powered by Dosh. For example, you can earn 2% cashback at Office Depot/OfficeMax with Dosh when paying with a linked card; you’d be much better off paying with an Ink Plus or Ink Cash card to earn 5x Ultimate Rewards rather than doubling up that 2% cashback by paying with an Ellevest debit card.

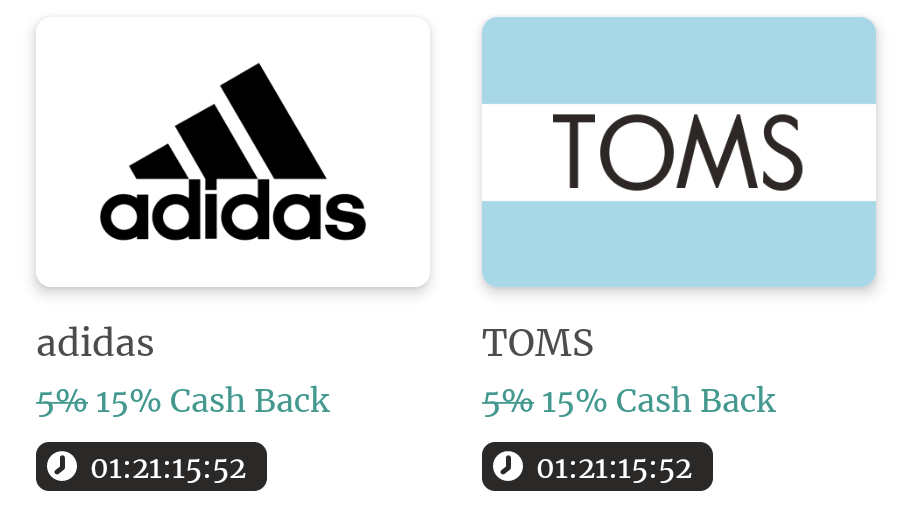

There are some exceptions though, especially when Dosh (and, by extension, Ellevest and Betterment) offer flash deals. For example, at the time of publishing this post Dosh – and Ellevest and Betterment – are offering 15% cashback at a number of different stores. If you could earn 15% cashback from Dosh and 15% cashback from your Ellevest or Betterment debit card, that would represent a great deal.

Unlike the Cash App where you can instantly fund your account using a debit card from another checking account, Ellevest’s bank account has to be funded by ACH. I therefore had to wait a few days (in fact, almost a week) for the funds to arrive before I could give it a whirl.

In order to test out other stacking opportunities (which I’ll cover in a moment), I decided to use my new debit card at PetSmart.

Ellevest + Dosh Test = Fail

I’d added the Ellevest debit card to my Dosh account a few days before conducting my test just in case there was some kind of lag in transactions on newly-added cards being tracked.

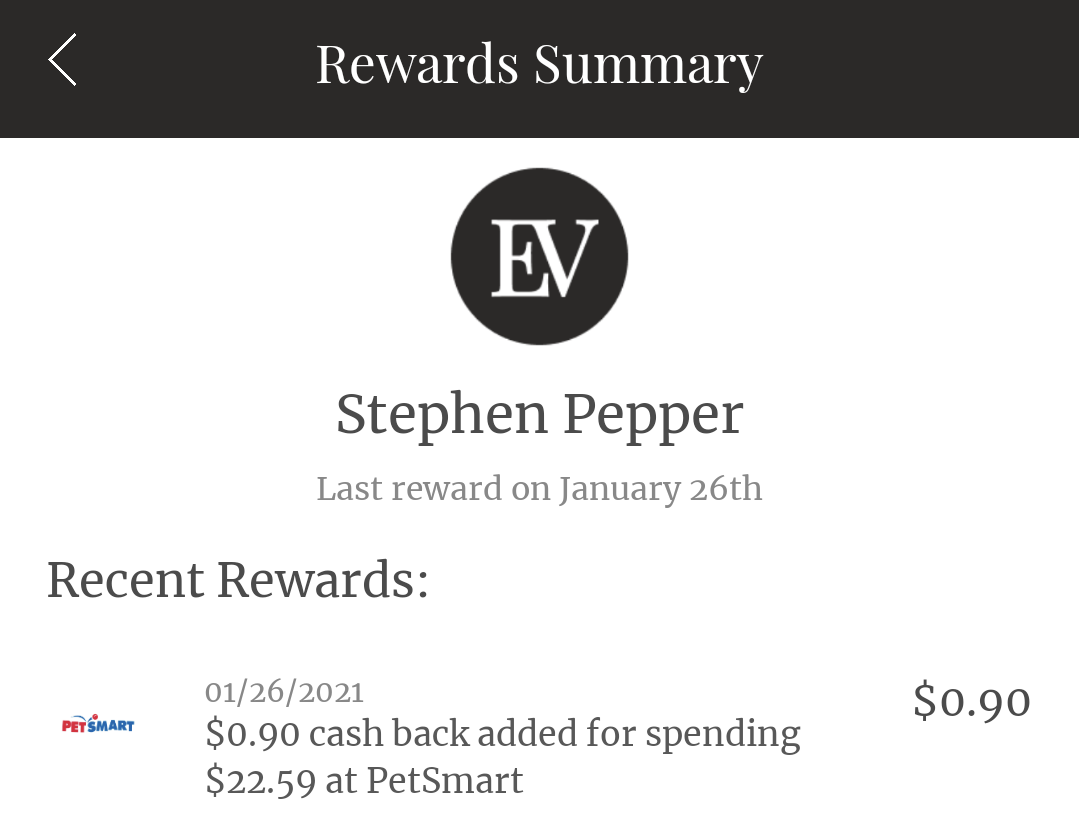

I spent $22.59 and eagerly awaited a notification from Dosh that I’d used a linked card at PetSmart, but to my dismay no notification came. No notification came from Ellevest either, but I figured they might not send push notifications in their app, so I wasn’t unduly worried.

I did start to get a little duly worried (well, as duly worried as you’d get over less than a dollar cashback) when even Ellevest wasn’t showing any cashback for my purchase though. Thankfully a few days later the transaction showed up in the app.

Stacking With Other Card-Linked Programs = 1 Success, 1 Failure

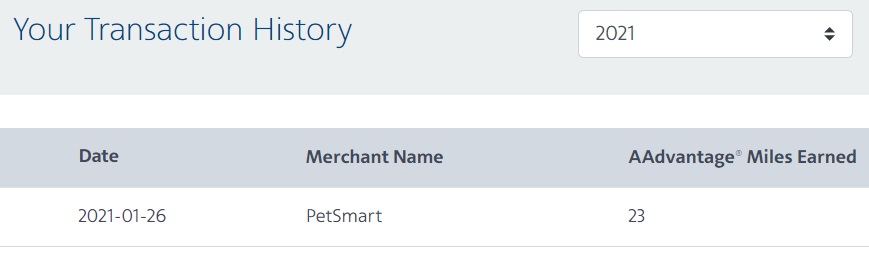

Dosh isn’t the only card-linked program offering cashback for PetSmart. SimplyMiles – the card-linked program which offers bonus American Airlines AAdvantage miles – and the recently relaunched Google Pay app both offer rewards/cashback for purchases at PetSmart when paying with a linked card.

SimplyMiles only works with Mastercards, while Google Pay works with Visa, Mastercard and American Express (but not Discover right now). The Ellevest debit card is a Mastercard, so I figured it would stack with both.

It turns out that it only stacks with one or the other – not both. At the time, I thought SimplyMiles used their own backend to track offers as their website had no mention of RCLON (Rakuten Card Linked Offer Network), Empyr, etc. which other sites and apps use. I learned last night though that SimplyMiles does use RCLON.

Unfortunately that’s the same tracking network that Google Pay uses. It therefore shouldn’t come as a surprise that only one of these card-linked programs tracked. Sadly, it was the offer which wasn’t as good. SimplyMiles was offering one bonus mile per dollar, while I think Google Pay was offering 2.5% cashback – SimplyMiles was the one that tracked.

On the positive side, I did learn something else from this. I’m fairly sure that I linked the offer in SimplyMiles before Google Pay, so it looks like whichever RCLON program you link an offer to first, that’s the one you’ll earn cashback/points/miles on. That’s something important to bear in mind for the future seeing as RCLON powers the following card-linked programs (and possibly others):

It’s also the opposite of how Rewards Network – the platform behind dining programs – deals with a card being activated on more than one problem. For example, if you, register a card with Delta’s dining program and then add that same card to United’s dining program, Rewards Network will unenroll it from Delta’s program to leave it on United – the most recent registration. Unless I’m misremembering whether I enrolled my Ellevest debit card first with SimplyMiles or Google Pay, linking an offer on a card with one program won’t activate it if you’ve already activated that offer elsewhere.

If you find yourself in a position where you discover that a different program using RCLON is offering a better return than one you’ve already activated an offer for, the safest way to activate the better offer will likely be to delete the card from both programs, then add it back on and activate it on the better offer – hopefully that’ll work.

Summary

Ellevest and Betterment – and possibly some other new banking products – have partnered with Dosh to offer customers cashback with certain retailers. Unfortunately it’s not possible to stack earnings from the white-labeled version of Dosh from these banking products with cashback from Dosh itself.

There’s therefore no real benefit to these Dosh-lite-but-not-lite rewards programs. You can add any debit or credit card to Dosh and earn cashback in their app anyway, so these Dosh-powered offerings don’t provide anything you couldn’t already get. The only real benefit is for your everyday person who isn’t aware of Dosh in the first place. At least now they’ll hopefully become more intrigued about earning rewards on their debit card purchases which will in turn hopefully lead them to explore other ways they can be rewarded on purchases, thereby realizing that credit card rewards – not debit card rewards they could get elsewhere – are far more rewarding.

Thanks for detailing this, Stephen. There’s a lot to keep track of these days!