NOTICE: This post references card features that have changed, expired, or are not currently available

Update 5/17/21: After reaching out to Capital One, we were told the following:

Select network benefits on Capital One Visa Platinum products will no longer be available to customers beginning September 1st. Capital One Visa Signature products will not be affected.

Capital One has notified some cardholders that they intend to drop some key travel benefits from their cards as of September 1, 2021 including rental car CDW, travel and emergency assistance, and travel accident insurance. While these are likely not frequently-utilized benefits, the change here certainly drops Capital One down a rung in its quest to compete with the major travel card issuers.

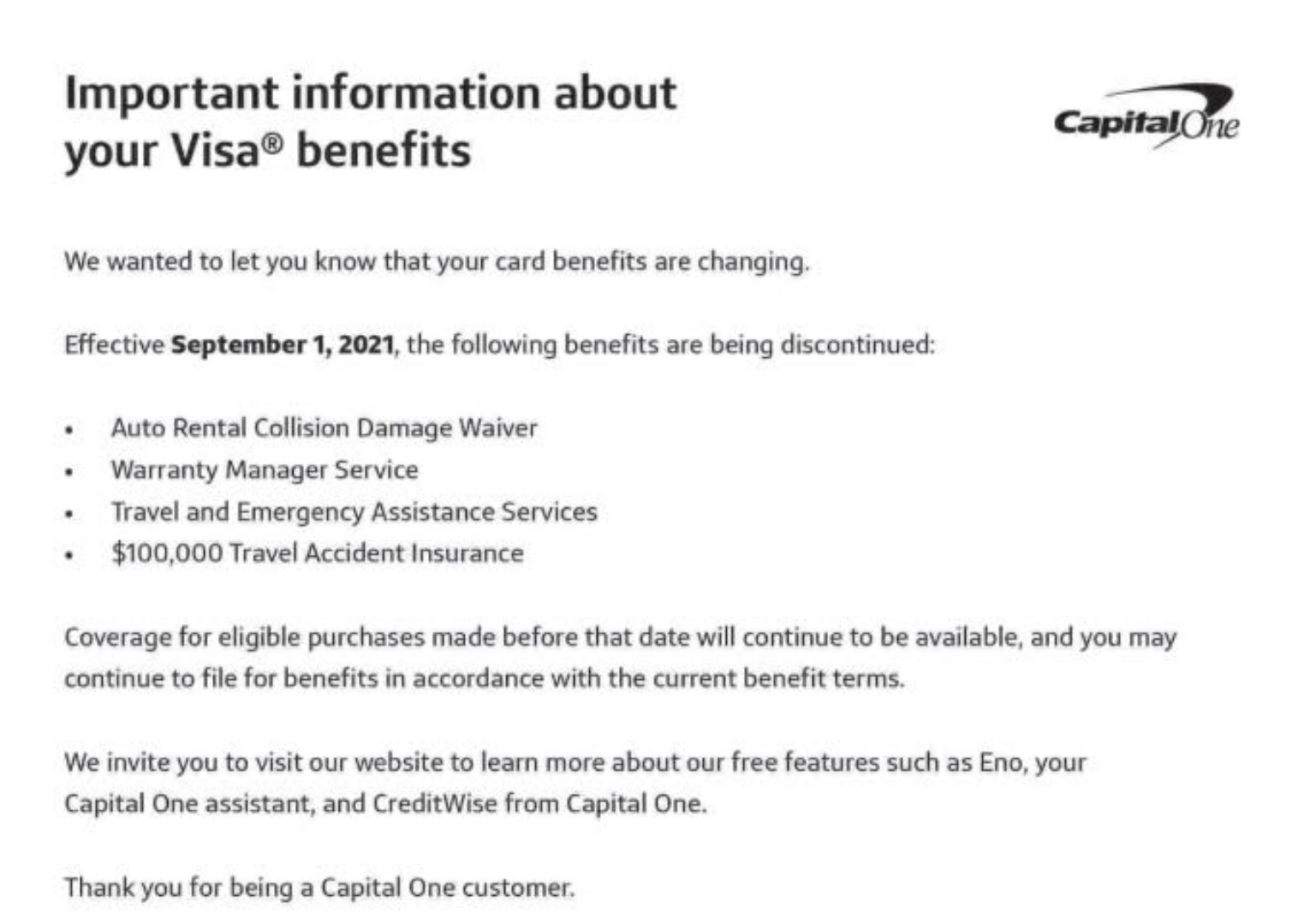

HelpMeBuildCredit.com passed along the following screen shot of a letter sent to some Capital One Quicksilver cardholders (note that my wife and I are both Capital One cardholders and neither of us have received this notification at the time of writing on our Venture, Venture One, or Spark Cash cards):

It isn’t immediately clear to me whether this change will only affect some cards or whether this is a change being made to all Capital One cards, but either way it is disappointing to see benefits dropped. This would run contrary to Greg’s wish list for how to make the rumored Capital One premium card a dream card to rule his wallet.

This is the only article I found about the services being dropped. We also never received notification about the trip of rental car coverage. Now that we are actually needing to make a claim for rental card damage we are finding out. We did not get the emails they claim to have sent. The worst part is that before our car rental in November and in December of 2021 we called to verify that the CDW was still there AND BOTH TIMES WE WERE TOLD YES! Additionally, after we first hear this yesterday we called a few other times and we’re still told that the coverage is in place!!! Today, a supervisor verified the service is canceled and told us that he can not (re) send the letter that was supposed to go out. Thankfully I’m terrible about my emails and can go back years. There is nothing. A change that big should be on the statement and sent via email and snail mail along with a notice on the app or account holders account online. We are very disappointed and will likely pursue legal action. Also, know that they generally do not notate notes on the account when you call customer service. We are not sure that er have a way to prove we called and verified the CDW benifit in November and December 2021. Beware!

I cancelled my card because of this.

Well, I have 4 capital one cards, and I got the notice today. I’ll be dropping them as soon as I find something else.

Same here, well as I only have one with them, ill still be dropping it.

Sad to say after all these years, me too.

Does the Capital One Visa Platinum have any benefits left? It looks like they have taken them all away.

https://www.capitalone.com/media/doc/credit-cards/Visa-Platinum-guide-to-benefits.pdf

CDW isn’t often used? You’re kidding me, any time you rent a car you would use it. It is a massive loss.

You’re right – the way I wrote that was lacking context. As I typed that, I was thinking “not often used” because using a Capital One card in any of those types of situations is almost always going to be suboptimal. Other cards provide a better return on travel purchases and other cards provide primary CDW rather than Capital One’s secondary and have fewer restrictions (Capital One only covers domestic rentals up to 15 days or international rentals up to 31 days, has country restrictions on CDW insurance, etc). I have Capital One cards, but I always put car rentals on a Chase card with primary CDW as I’ve known of plenty of reports of Chase’s benefits administrator taking care of car rental claims with little hassle.

I have once spoken to a owner of a rental company and he told me that Chase is by far the best when push comes to shove

Car rental coverage is a big loss. Citi dumped it a few years ago (I think BOA did too). That was sorta an “automatic” coverage for a long time and was a big money saver when renting, especially outside the United States where one’s personal car insurance did not cover them.

I have a feeling this will apply to all Capital One cards but we’ll have to see.

Citi: “We will cover You up to $50,000 toward the cost of repairs or the cash value of the car, whichever is less, if a covered accident or theft occurs when You pay for a rental car with Your Citi® Card and decline the rental company’s collision loss/ damage insurance.”

Not great but better than nothing.

“…rental car primary CDW…”

The CDW isn’t primary, is it?

You’re right – I believe it is secondary on all Capital One cards. I edited that to just say CDW.