NOTICE: This post references card features that have changed, expired, or are not currently available

With the recent enhancements to Capital One’s Rewards miles programs (with the Capital One® Venture® Rewards Credit Card and Capital One® Spark® Miles for Business cards), which now transfer to airline miles, can be combined easily with your other miles-earning cards or even with other Capital One customers, and might even make these cards even better than the old SPG cards), I’ve been putting more spend on my Capital One cards than I had in years. That led me to discover something interesting and relatively unique about Capital One: rewards miles post with your purchases. That is to say that you don’t need to wait until your statement cuts to receive a lump of miles from your month’s purchases, but rather the miles post and are available as soon as your purchases move from “pending” to posted”. That could be useful if you find yourself very close to a valuable redemption — just make your necessary purchases and you should have the miles in a few days.

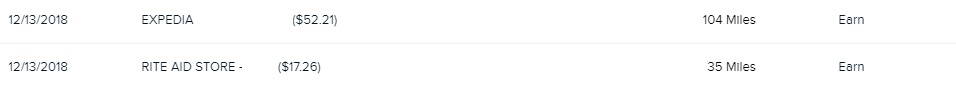

For example, these were a couple of purchases from last Thursday, December 13th. As of Monday, December 17th you can see that the Expedia purchase, for $52.21, earned 104 miles and the Rite Aid purchase for $17.26 earned 35 miles (these purchases were with a Capital One Venture Rewards card, though the earn rate would be the same with a Capital One Spark Miles business card. The statement does not cut for a couple of weeks yet, but these purchases have already posted to the rewards account and are available to be redeemed towards travel or transferred to airline partners.

My most recent purchase to post was from Friday, and I noticed yesterday (on Sunday) that it had already posted, so the turnaround time is quite quick.

That can be particularly useful since Capital One transfers to airline partners are allowed in 100-mile increments. If you’re just a few miles short of a valuable redemption, you could make a small purchase or two and expect that the miles should post in just a couple of days. YMMV of course — it is certainly possible for Capital One to change or restrict this, but I thought it could be a useful piece of wisdom to keep in mind.

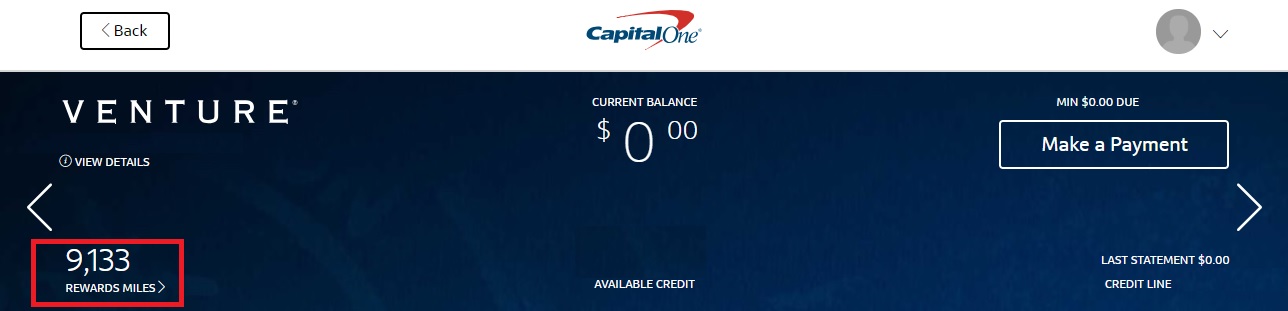

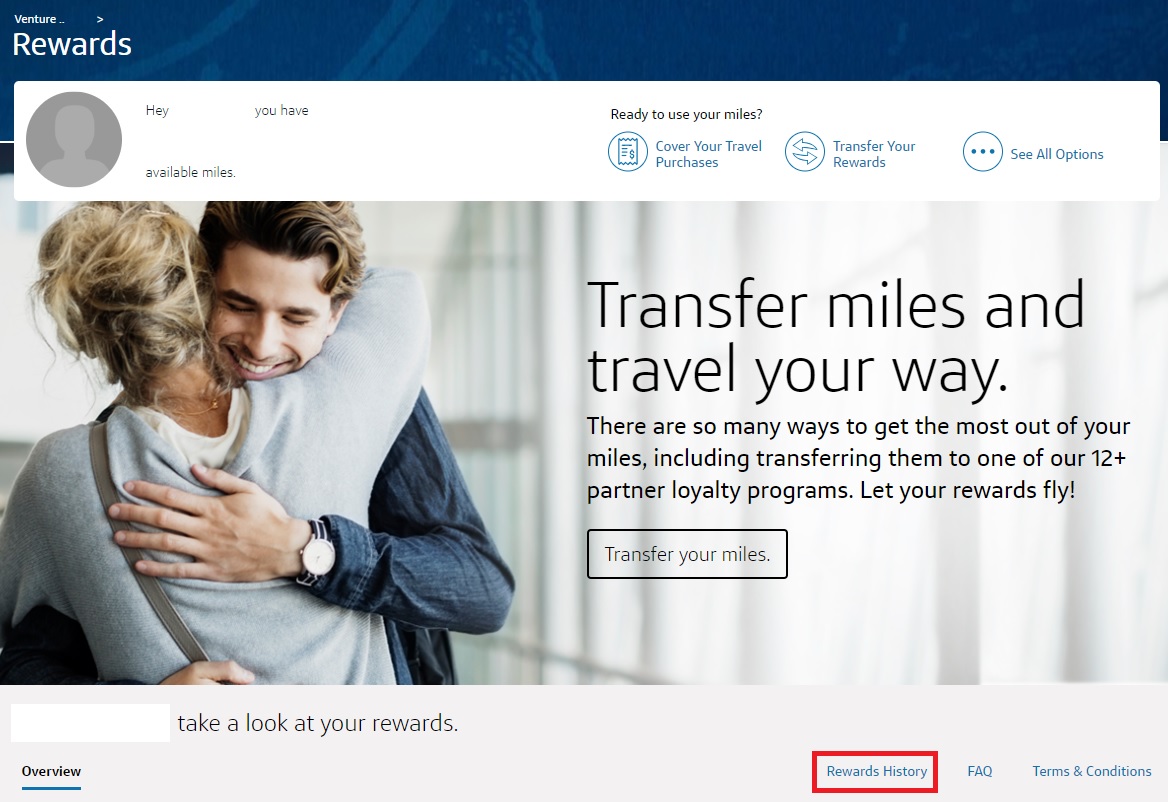

If you’re looking to see your recent activity, you can click where it says “Rewards miles” in red above. Then click “Rewards history” as seen below.

That will show your posted transactions.

I’m not sure what the timeline is for the posting of the welcome bonuses as it has been a while since we last earned one. I wouldn’t expect those bonuses to post mid-cycle, but neither would I be surprised if they did.

Overall, this is really just something to keep in mind if you find yourself just shy of an award as it is pretty easy to top up.

[…] of the hat to Frequent Miler & […]

[…] of the hat to Frequent Miler & […]

I hit a minimum spend on 12/18 and had the 50k bonus post on 12/19.

CapOne posts earned / bonus miles after charges posted. Been like this since the day of Million Miles Match offer almost 10 years ago (the sign up bonus varied based on how many miles in your qualified FFP account with the maximum being 100,000, i.e. $1000 worth) – that was when they introduced Venture.

I believe Barclays’ cards post the same way.

Yeah, I didn’t necessarily think that this was a new thing — but rather Greg and I talked about it and thought it was worth a Quick Tip post as I’m sure there are many readers who (like me) haven’t spent much on a Capital One card in years and as such likely weren’t aware (or don’t even have a Capital One card and thus wouldn’t know). Even some folks who knew it in the past may have forgotten since it was mostly irrelevant before since you could always spend today and earn the miles next month and still use the purchase eraser.

Now that C1 transfers to airlines, this is a key detail to know as you might find yourself close to an award and be able to top up relatively quickly here versus spending on an Amex and waiting a billing cycle or two for the miles to post. It’s also nice since C1 allows transfers in increments of 100 over 1K. So you don’t have to transfer many more miles than necessary — which might make it worth spending a few bucks on your C1 card rather than transferring another 1K miles from other currencies.

I’d avoid the term enhancement. Too many negative connotations from programs trying to make you believe that horrible changes are really awesome.

More commissions mean even the worst prog will become best. As for churners are concerned , cap one is a waste of 3 hard pulls.

If affiliate commissions determined our content, this site would be a lot different. We’ve had affiliate links for Capital One cards for a long time. You’ve only recently noticed an increase in our posts about them because Capital One finally made themselves relevant with airline transfers and the ability to combine “Rewards miles” with others, which creates opportunities like this one:

https://frequentmiler.com/the-best-hotel-credit-card-ever/

I’m pretty happy with earning 2.8% back towards Marriott stays and the option to sell and have gotten 2.39% back on everyday spend or the ability to transfer to airlines with a lower opportunity cost than transferring from Chase, Citi, or Amex (since those points are more valuable per-point) if I don’t need the Marriott stays. Since I earned Platinum status via the Ritz card this year and I redeemed for a Travel Package and another Cat 8 stay at Cat 7 pricing (I’m sure quite a few readers are in the same boat there), I’ve got some Marriott stays coming up that will involve incidental spend. I’m pretty happy with the returns on the Venture card now that they’ve revamped things — and that’s why I’ve written about it.

I’d agree that for most folks going after high-value rewards, Capital One cards in general didn’t present much of a comparative value for the past several years — that’s why you hadn’t seen us write much about them. But now, things are changing. I’m always happy to see banks compete. Competition is good for consumers, and I’ve been one of those a lot longer than I’ve been a blogger. I’m happy to see Capital One finally offering something worthwhile (and glad I held on to the cards I opened years ago).

Been this way for quite a while – rewards post when the purchase posts.

The reason this is now very interesting is that it’s a really quick way of getting airline miles that you might need for an award now that capital one added the ability to transfer rewards miles to airline miles.

My 75,000 bonus posted last week as soon as I met the spending requirement.

MPX also posts right away