We’ve seen a number of reports over the past few days about increased offers that are available in-branch for the Chase Ink Business Unlimited and Ink Business Premier cards. The Business Unlimited is giving 120k Ultimate Rewards points (advertised as $1,200 cash back) after spending $6,000 within the first three months, while the Ink Business Premier has an offer for $1,500 cash back after $10,000 spend within the first 3 months. Note that, while both of these bonuses are awarded as Ultimate Rewards points, those that are earned via the Ink Business Premier cannot be combined with other Chase cards that allow for points transfers to partners. The points earned from the Ink Business Unlimited, on the other hand, can be combined with other cards.

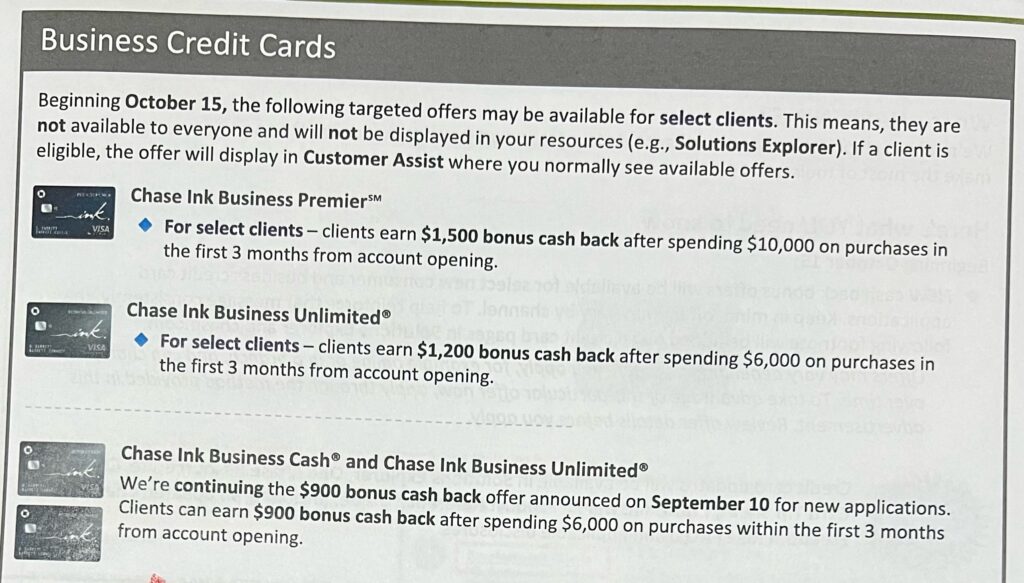

We first got news of this earlier in the week from reader Kirsten via Instagram and now Doctor of Credit has published an internal Chase memo which shows the increased bonuses and their start date of 10/15. Our assumption is that this will be available at all Chase locations. However, as always with these in-branch offers, it can pay to call and confirm before going.

The Offer and Key Card Details

- There are in-branch offers available for the following two Chase business cards:

- Ink Business Unlimited: Earn $1,200 cash back (120k Ultimate Rewards) after spending $6k within the first 3 months of account opening.

- Ink Business Premier: Earn $1,500 cash back (150k Ultimate Rewards that are non-combinable) after spending $10k within the first 3 months of account opening.

Card details are below. Note that if you click the card names below, you’ll be taken to our card-specific page, which has the current public online offer information. These are NOT the 90K in-branch offer that will be starting soon.

| Card Name w Details No Review (no offer) |

|---|

No Annual Fee Earning rate: 1.5X on all business purchases ✦ 5X Lyft through September 2027 Base: 1.5X (2.25%) Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

| Card Name w Details No Review (no offer) |

|---|

$195 Annual Fee Earning rate: 2.5% cash back on purchases of $5,000 or more ✦ 5% back on travel purchased through Chase Travel(SM) ✦ 2% cash back on all other spend ✦ 5x Lyft through September 2027 Base: 2% Portal Flights: 5% Portal Hotels: 5% Card Info: Visa Signature Business Charge Card issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Purchase protections ✦ Cell phone protection (up to $1K per claim) ✦ Travel protections |

Quick Thoughts

It’s worth emphasizing that the Ink Business Premier, although sharing the “Ink” moniker, is a very different product from the rest of the Ink cards. First off, it’s a charge card, not a credit card. That means that there’s no explicit credit limit and that you must pay the bill in full each month. This card is a reasonable choice for those with large business spend who are looking for a single business card with decent cash back rewards for all spend. The card earns 2.5% cash back for purchases of $5K or more, and 2% back everywhere else. Unfortunately, unlike other Chase Ink cards, you can’t move rewards to other cards in order to make them more valuable, nor can you product change it to an Ink credit card (since this is a charge card). Think of this card as being exclusively good for cash back.

We see better in-branch offers for many Chase cards now and again — sometimes the online offer eventually increases as well, but not always. Both of these current in-branch offers would be the best that we’ve seen for each card.

Currently, referral links go to the 90K Business Unlimited offer. However, a household referral would add another 40,000 points to the total haul. So, if you’re in 2-player mode and have the Business Unlimited, a referral could actually be a better option than the in-branch offer.

Chase Application Tips

- 5/24 Rule: You most likely will not get approved for a new card if you have opened 5 or more cards (with any bank) within the past 24 months. Most business cards do not count towards that five card total. Business cards that DO count include: TD Bank, Discover and the Capital One Spark Cash Select, Spark Miles and Spark Miles Select.

- 24 Month Rule: If you’ve previously had a card before, you can only get a welcome offer on that card again if you no longer have the card AND if it has been more than 24 months since you last received a welcome offer for that card. This rule does not apply to the Sapphire Preferred and Reserve cards (see below). There can be exceptions with some business cards.

- Sapphire cards: The Sapphire Preferred or Sapphire Reserve cards no longer have a family rule that prevents you from getting one if you currently have the other. However, both now have significant limitations that may prevent you from being eligible for a welcome offer if you've previously had the same card. In that event, you'll get a pop-up window that tells you that you're not eligible before you get a credit check and will ask whether or not you want to proceed with the application without the welcome offer attached.

- Southwest "Family" Rules: Chase applies additional "family" rules to the Southwest cards. You're not eligible for the welcome offer on a personal Southwest card if you currently have one, or if you've received a welcome offer on any personal Southwest card within the last 24 months. This doesn't apply to business cards. You also can't be approved for the Southwest consumer card if you already have one open.

- IHG "Family" Rules: You're not eligible for the welcome offer if you've received a welcome offer on any personal IHG card within the last 24 months. You also can't be approved for another IHG consumer card if you already have one open. You can have both an IHG personal and an IHG business card.

- Ink "Lifetime" Rule: You "may not" be eligible for the welcome offer on an Ink no-annual-fee card if you have ever had the same card or any other Chase for Business card without an annual fee. In addition, you may not be eligible for a welcome offer on a Chase Ink Business Preferred card if you currently have the card or have had it in the past. We don't know how often this is enforced.

- 2 per month Rule: Most applicants are limited to 2 new cards per 30 days. Business cards are usually limited to one per 30 days.

- Marriott cards: Approval for any Marriott card is governed by a labyrinthine set of unintuitive rules. You can see the full eligibility chart here.

- Card Limits: Chase doesn't have a strict limit on the number of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. Because of this, reconsideration can sometimes be successful by moving credit from one existing card to the new card that you want.

- Application Status: Call (888) 338-2586 to check your application status.

- Reconsideration: If denied, call (888) 270-2127 for personal cards, or (800) 453-9719 for business cards, and ask for your application to be reconsidered.

[…] If you live near a Chase branch bank, it may be worth checking with a Chase banker to see if you are targeted for an increased offer. Although this information is from 2023, Chase has offered increased Ink Business Premier® Credit Card bonuses in-branch to select customers. Frequent Miler has details on a previous offer from 2023. […]

[…] is also $10,000 in 3 months. You may also see this offer online via pre-approval (targeted). HT: FM. This is a fantastic offer, and worth a visit to a local branch if you are interested in this […]

[…] is also $6,000 in 3 months. You may also see this offer online via pre-approval (targeted). HT: FM. This is a fantastic offer, and worth a visit to a local branch if you are interested in this […]

[…] is also $6,000 in 3 months. You may also see this offer online via pre-approval (targeted). HT: FM. This is a fantastic offer, and worth a visit to a local branch if you are interested in this […]

[…] $10,000 in 3 months. You might also see this supply on-line by way of pre-approval (focused). HT: FM. It is a incredible supply, and value a go to to an area department if you’re on this […]

[…] is also $10,000 in 3 months. You may also see this offer online via pre-approval (targeted). HT: FM. This is a fantastic offer, and worth a visit to a local branch if you are interested in this […]

[…] is also $6,000 in 3 months. You may also see this offer online via pre-approval (targeted). HT: FM. This is a fantastic offer, and worth a visit to a local branch if you are interested in this […]

[…] FM. […]

[…] 【2023.10 更新】现在实体店有$1,500的开卡奖励,消费要求是一样的3个月内消费$10,000。也有一部分人在Chase网站上看到pre-approval那里有这个offer。HT: FM. […]

Does the 24 month rule apply to the INK cards? I think I heard that it doesn’t?

Why is the Ink unlimited listed twice on that flyer? Is it a typo and it’s actually the unlimited preferred with the 120k offer (which is also fine by me)

There’s the normal offer that’s available to anyone for 90k. The increased offer is only for “select clients,” meaning you have to get it in branch via a Relationship Manager.

Ah I see. Hope this offer is still available in 90 days…

The phone number listed for application status took me to Capitol One

Thanks. Fixed.

Regarding the 5/24 rule – does that apply to business cards opened? If my personal card count is 3/24, but I’ve opened 9 business cards in 2022 + 2023, do I have a chance at opening another business card? I opened a 2nd Ink Cash in Sept, but just got a mail solicitation for the IHG Business card that is good until 12/3. Do I have a chance of opening the IHG as it is one on my wish list. The fact that I got a mail solicitation is making me wonder if I can do it now rather than wait. I prefer not to waste an inquiry. Thanks.

Business cards don’t affect your 5/24 total, but some business cards can be subject to the 5/24 rule when applying. I applied for the IHG business a little while ago for both my wife and I, we were instantly approved despite being over 5/24. YMMV, of course.

Regarding the 24 month rule for the bonus. I applied for and received a card in Nov of ’21 I received my SUB in Jan of ’22. Do I have to wait until Jan of ’24 to apply for the card or just make sure I don’t finish the spend towards the SUB until Feb?

Thanks

Keep in mind that the referral bonuses are taxable. Depending on your tax bracket the extra 10k UR might not be worth the extra $400 taxable income. Additionally, the referral bonuses have annual caps. For these reasons the in-branch offer might be preferable even in 2p mode. Definitely not a major factor though and the convenience of just doing it online is definitely something to consider as well. (also, referrals are safe from accidentally not hitting the MSR if you are nervous about that).