NOTICE: This post references card features that have changed, expired, or are not currently available

When a friend asked me for advice last month about which credit card to get, I explained that you get a premium card for the benefits and another card on which to spend (See: Super credit card duos. What’s in your wallet? for some great pairs). One of my favorite benefits of premium cards are hotel booking programs, where you can get a ton of valuable benefits without any status beyond “cardholder”. Recently, a reader asked me if we’d ever compared the Chase Luxury Hotel & Resort Collection with Amex Fine Hotels & Resorts, so I decided to do a little research and compare to see where there was overlap and what, if anything, separates these programs — along with some comparisons to Visa Infinite Hotels for good measure.

Benefits

Amex Fine Hotels & Resorts

I’ve long loved Amex Fine Hotels & Resorts and I find myself booking through FHR at least once or twice a year. This collection of hotels is accessible if you hold any flavor of the Amex Platinum card (including the Business Platinum). Amex FHR lists luxury hotels in destinations around the world, and when you book through FHR you always receive these benefits:

- Daily breakfast for 2

- Guaranteed 4pm late check-out

- Complimentary Wi-Fi

- Unique property amenity (usually a $100 resort credit, food & beverage credit, or spa credit)

- Noon check-in when available

- Room upgrade upon arrival based on availability

Most of that list is guaranteed — you always receive #1 through #4; numbers 5 and 6 are based on availability. In my experience, all of the above have been honored on most stays. I’ve only once had to wait for a room that wasn’t available for early check-in. The guaranteed 4pm check-out has come in handy a number of times. Breakfast for two at these properties can be worth quite a bit if you would otherwise consider paying the breakfast prices at these luxury hotels. Overall, I’d say it’s a valuable set of benefits.

Chase Luxury Hotel & Resort Collection

The Chase Luxury Hotel & Resort Collection is a roughly similar program to Amex Fine Hotels & Resorts in the sense that it offers a special benefits at a number of luxury hotels. Many hotels overlap between the programs, though Chase did have some exclusives even in the small sample size of a few cities that I checked for this post. The Chase Luxury Hotel & Resort Collection is available on some Chase cards, but not others. Chase doesn’t explicitly say which cards qualify, but according to this post on The Points Guy, it works with these cards:

- Chase Sapphire Reserve

- Chase Sapphire Preferred

- Ink Cash Business

- United MileagePlus Explorer

- United MileagePlus Club

- Chase Ritz-Carlton

The benefits listed by the Luxury Hotel & Resort Collection are as follows:

- Daily breakfast for two

- A special amenity unique to each property such as lunch or dinner for two, a spa treatment, golf green fee waivers, welcome gift, or airport transfers

- Complimentary Wi-Fi (though I don’t see this at all properties)

- A room upgrade (when available at select properties),

- Early check-in and late check-out (when available at select properties)

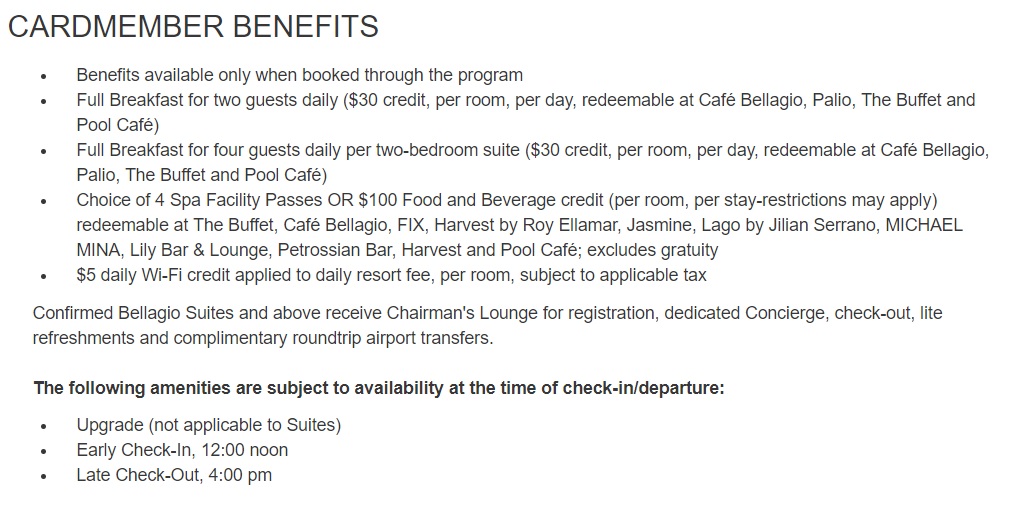

As you can see, only benefits #1 and #2 are guaranteed — and even then, #2 isn’t clearly defined. Unfortunately, benefits appear to be pretty inconsistent. For example, here is the list of benefits at the Bellagio, in Las Vegas:

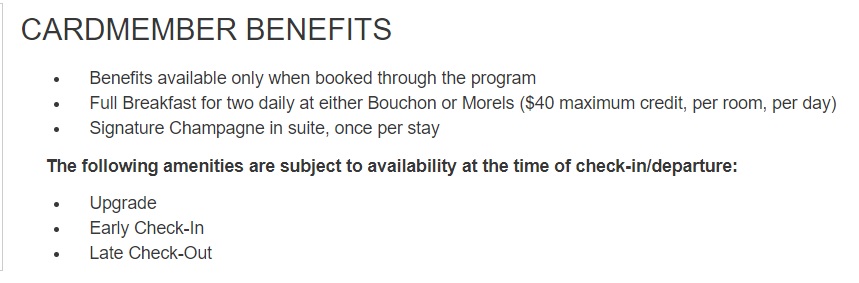

While these are the benefits at the Palazzo:

As you can see, you get breakfast for two at each property (breakfast for 4 in a suite at Bellagio, which is nice) and you receive some sort of property amenity, though the value of “Signature Champagne in suite” at Palazzo probably doesn’t quite match a $100 food & beverage credit at Bellagio. While you get a $5 credit towards the resort fee to cover Wi-Fi at the Bellagio, there is no Wi-Fi credit at the Palazzo.

In addition the variance in benefits, it’s notable that late check-out is subject to availability with the Chase Luxury Hotel & Resort Collection. Both of the above properties are available on Amex FHR, where late check-out is a guaranteed benefit.

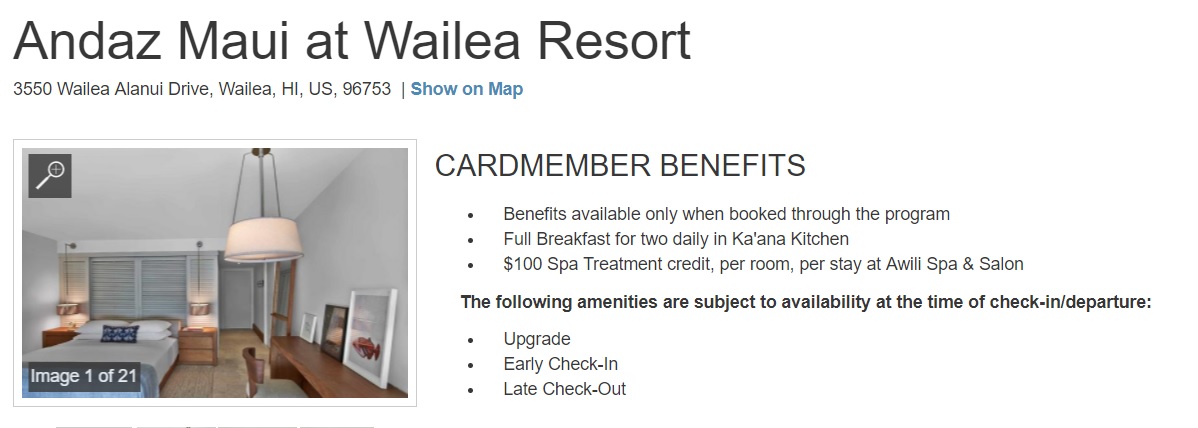

Furthermore, depending on which Chase card you have, you might receive more attractive benefits through Visa programs. For example, the Andaz Maui is available through the Chase Luxury Hotel Collection, where it shows the following benefits:

Through Chase Luxury Hotels & Resorts, your property amenity is a $100 Spa Treatment credit. That’s not bad — especially as a benefit available on cards with $95 annual fees like the Chase Sapphire Preferred and United MileagePlus Explorer or a no-fee card like the Ink Cash business card.

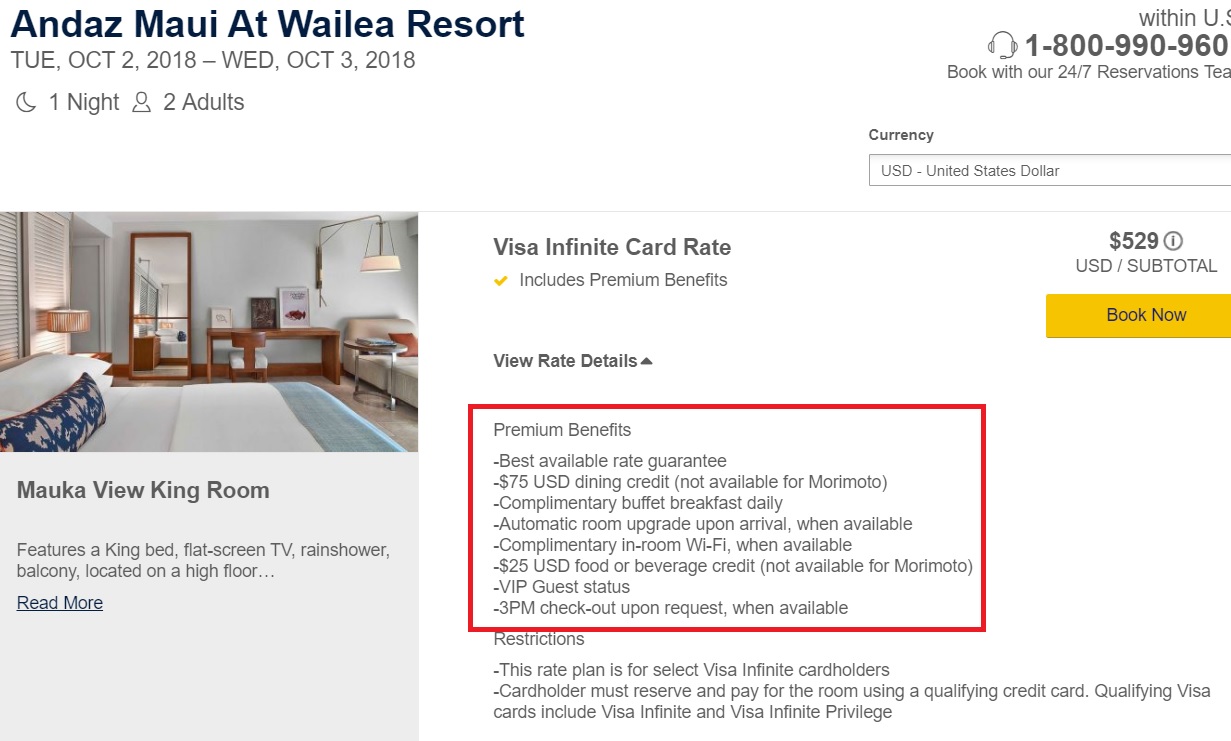

However, if you have a Chase Sapphire Reserve or Chase Ritz-Carlton card, you have access to Visa Infinite Hotels — another similar luxury hotel benefit program. Through Visa Infinite Hotels, you would receive a $100 dining credit, which is more versatile and therefore more valuable to me than a spa credit. While the image below shows this credit split into two parts (a $75 USD dining credit and a $25 USD food or beverage credit), I booked a stay at the Andaz Maui through Visa Infinite Hotels in late 2016 and can confirm that it counted as a $100 dining credit (and we applied it to one meal).

I assume the reason for the odd manner of displaying the credit is due to the fact that this property also shows up through Visa Signature hotels with the $25 food or beverage credit. The display above differentiates the additional benefits of Visa Infinite hotels I suppose.

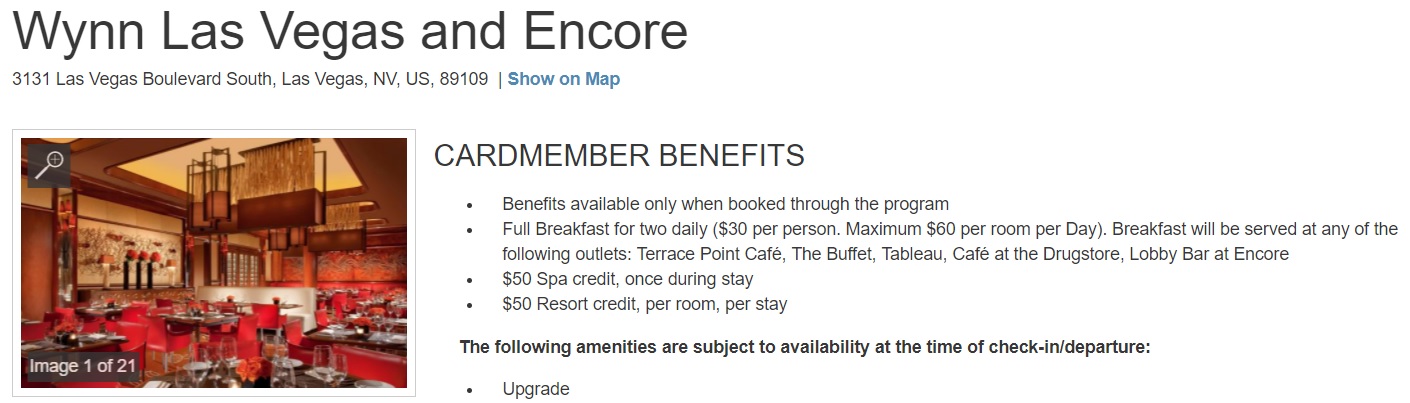

However, it’s not always a clear win for Amex here. In fact, the Wynn Las Vegas is available through both Amex FHR and Chase Luxury Hotel Collection — and while Amex provides a $100 spa credit:

Chase Luxury Hotel & Resort Collection splits that up as a $50 spa credit and a $50 resort credit.

While the dollar value is the same, the $50/$50 split might be preferable to you if you’re looking to get credit towards a meal instead of a spa treatment.

Selection

The choice of hotels available through each program varies. There is a lot of overlap, but there are also a number of properties unique to each program. In my opinion, those unique to Fine Hotels & Resorts are a bit more valuable due to the more consistent suite of guaranteed benefits. For example, you won’t find the Ritz-Carlton Kapalua on Chase Luxury Hotels & Resorts, but you will find it on Fine Hotels & Resorts — where you’ll enjoy breakfast for 2 daily, a $100 resort credit, and guaranteed 4pm late check-out even if they fall short on the early check-in and room upgrade (neither was available on my stay there a couple of years ago).

On the other hand, you won’t find the Hyatt Regency Maui on Fine Hotels & Resorts, but you will find it on the Chase Luxury Hotel Collection site. Benefits are slim, but something is better than nothing:

If you’re looking for breadth of selection, the Chase Luxury Hotel & Resort Collection looks like it wins out in the cities I checked. For example, here is the list of properties available through the Chase Luxury Hotel Collection in Las Vegas:

- Aria

- Bellagio

- Caesar’s Palace

- Delano

- Mandalay Bay

- Mandarin Oriental

- MGM Grand

- SKYLOFTS at MGM Grand

- The Comopolitan

- The Palazzo

- The Signature at MGM Grand

- The Venetian

- Trump International Hotel

- Wynn and Encore

Whereas Amex Fine Hotels & Resorts has these Las Vegas properties:

- Aria

- Bellagio

- Delano

- Four Seasons

- Mandarin Oriental

- The Palazzo

- The Cosmopolitan

- SKYLOFTS at MGM Grand

- Wynn

I found similar results in a number of other cities. Many hotels overlapped, with Chase usually having a couple more properties and Amex having a couple of nicer properties not found on Chase. Overall, I’d give Chase the win here, but you might feel differently if you’re looking for more luxurious properties like the Four Seasons.

Price

I hesitated with whether or not to include price as a category. The truth is that you should always comparison shop — prices vary. Furthermore, I’m working with a very limited sample size. I would limit how much you read into this section with the understanding that I did not do exhaustive research.

However, I started with Las Vegas because that is one of my favorite Fine Hotels & Resorts cities. Luxury properties come cheaply in Las Vegas, and there are enough hotels in these programs to make it conceivable to hotel hop — especially when you have a 4pm check-out at one property and noon check-in (based on availability) at the next.

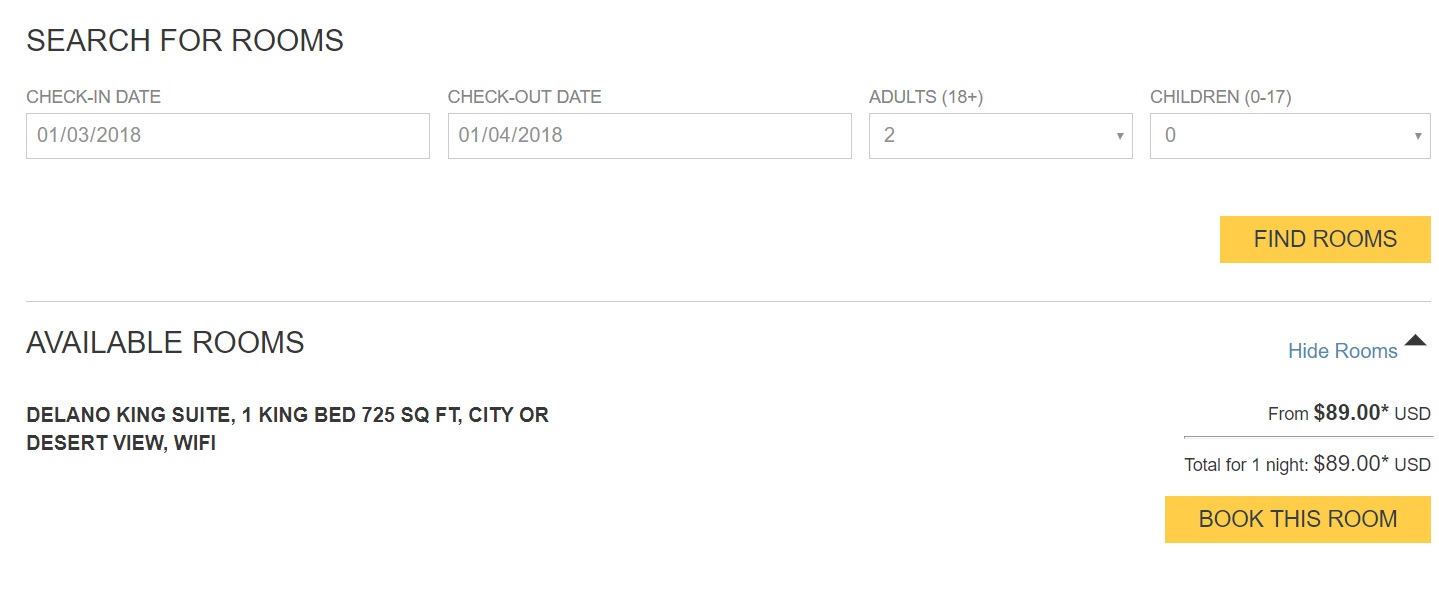

Early January (before CES) is usually a pretty cheap time to visit Las Vegas, so I looked up rooms this Wednesday, January 3rd to Thursday, January 4th. Delano is available cheaply — from $89 via Chase Luxury Hotels:

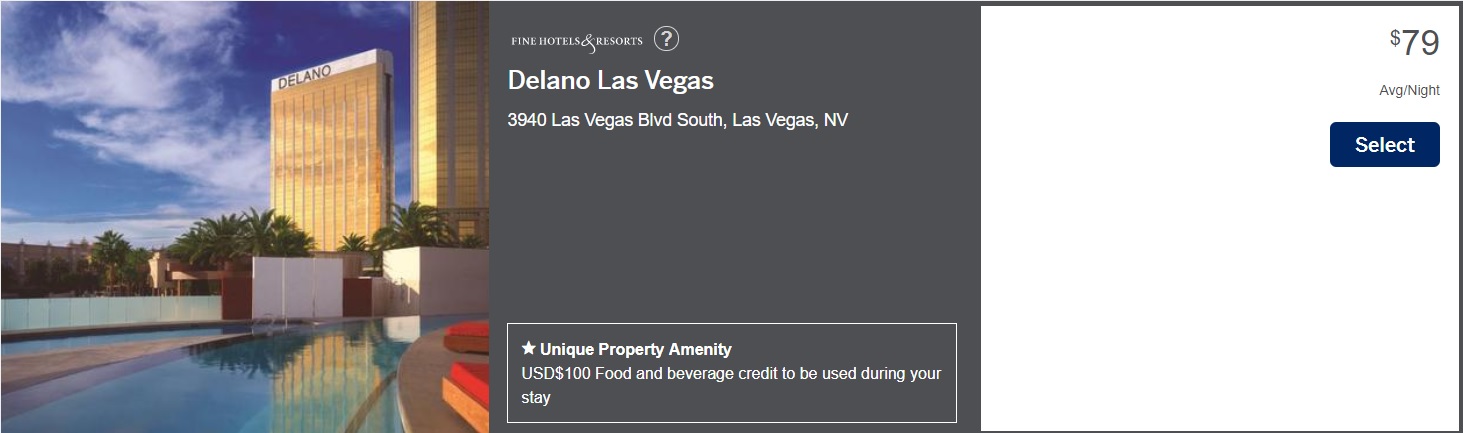

Interestingly, it shows up on Amex Fine Hotels & Resorts for a little less — from just $79:

In this case, the $10 difference is because Amex offers an accessible room that is $10 cheaper than the standard room (the standard king suite is available for the same $89 through Fine Hotels & Resorts).

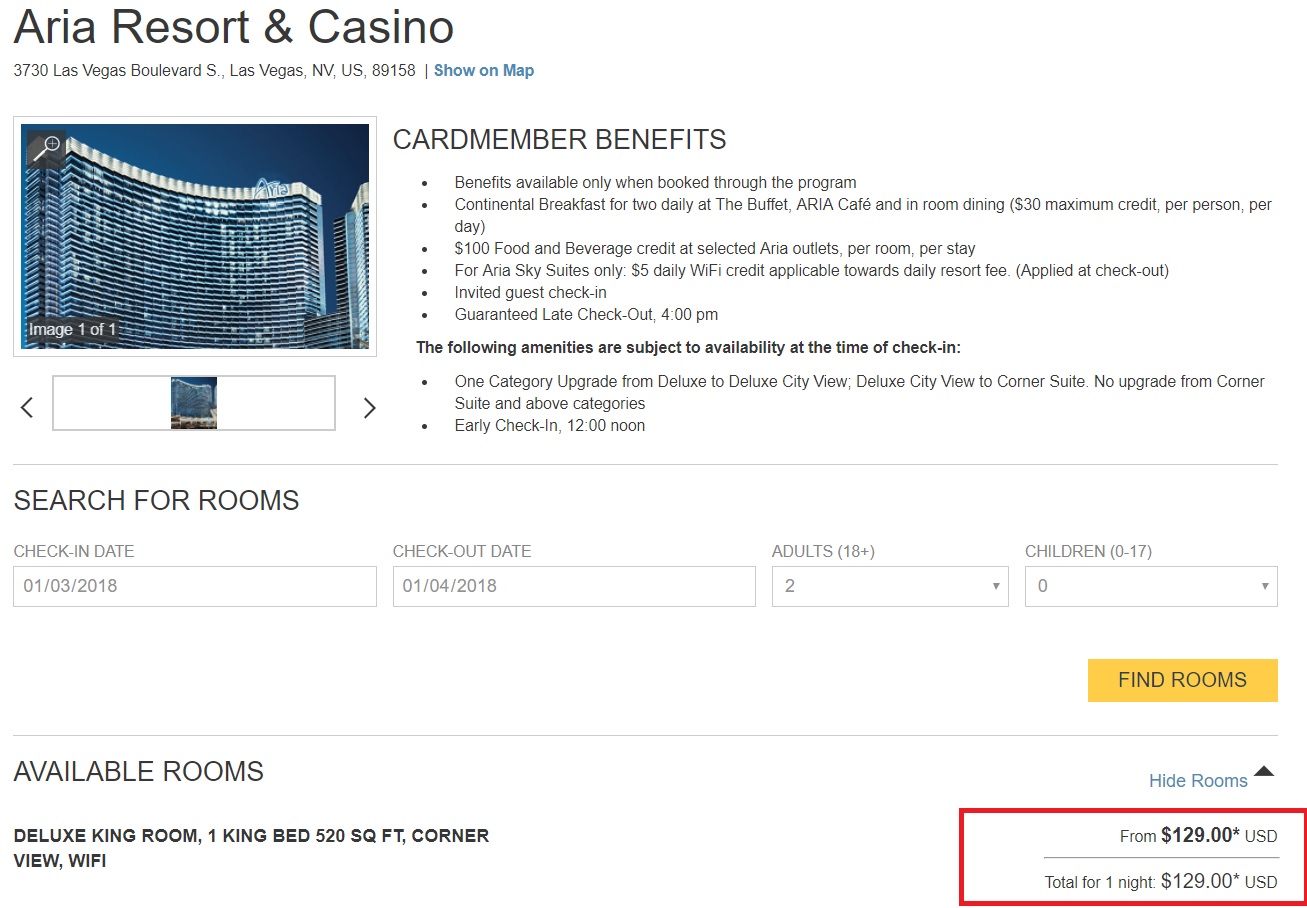

I thought it was interesting that the two programs don’t have access to the same room types. This difference is more glaring with Aria, where you can book a Deluxe King room tomorrow night from $129 through Chase Luxury Hotel Collection:

However, Amex Fine Hotels & Resorts only has access to suites, at a starting rate of $400 per night:

In that case, Chase Luxury Hotel & Resort Collection wins out by a longshot.

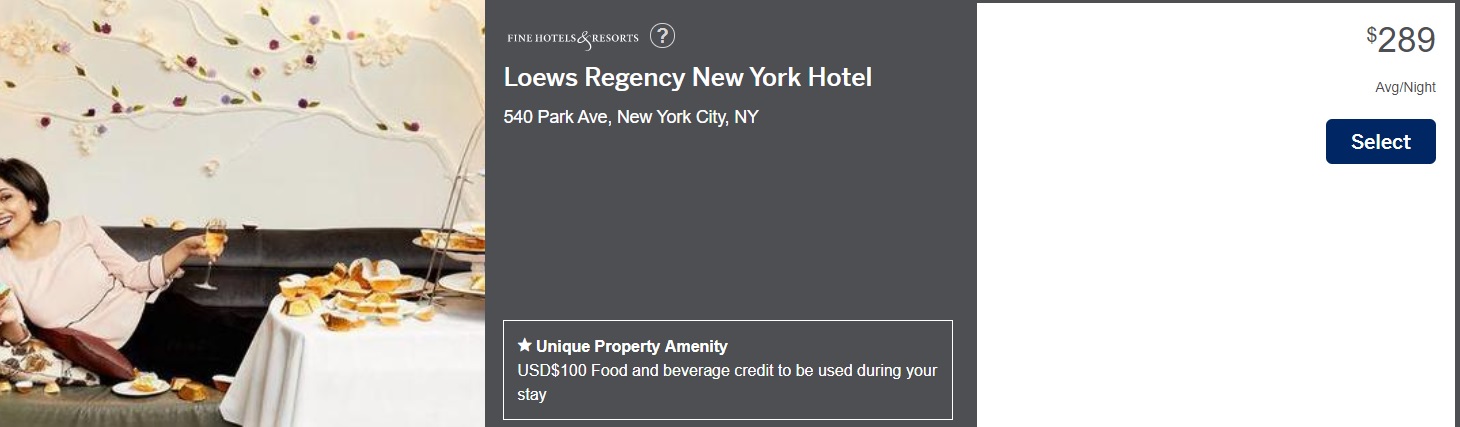

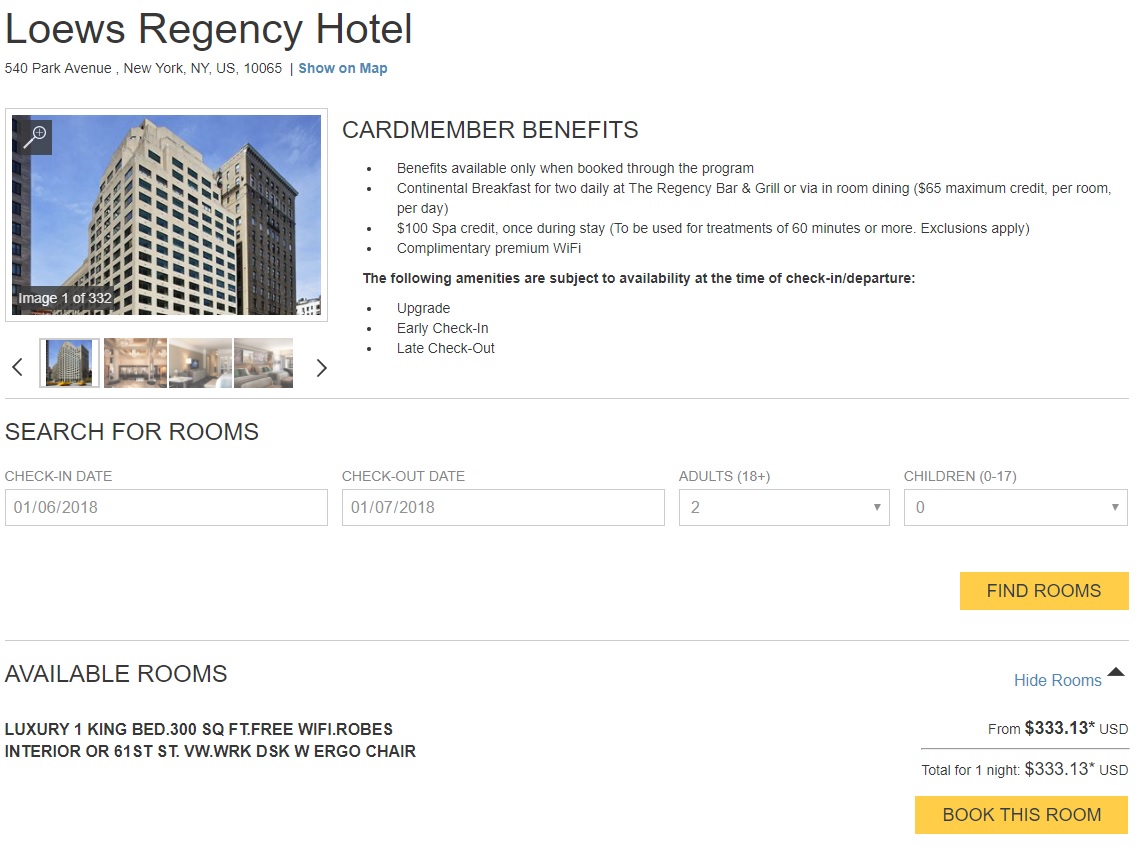

But the pendulum swung back the other way a bit when looking at this Saturday night in New York City, where the Loews Regency is available from $289 with a $100 food and beverage credit (and other standard FHR benefits) via Amex Fine Hotels & Resorts:

But the same property starts from $313 via Chase Luxury Hotel Collection — and it comes with a $100 spa credit that must be used on spa services of 60 minutes or more. That’s worth a lot less to me than a $100 food and beverage credit.

In many cases, prices were identical or within five or ten bucks between the two programs. It’s hard to declare a winner here — the moral of the story here is: you better shop around.

Bottom line

Both Amex Fine Hotels & Resorts and Chase Luxury Hotel Collection are nice programs that offer some great benefits on luxury hotel stays to those who wouldn’t otherwise have access to similar benefits via elite status. Some of these same benefits can be had without any premium credit card at all when booking through a Virtuoso advisor. I’ve never booked through Virtuoso, but it offers a similar set of benefits — the catch is that you have to book through a Virtuoso travel advisor and can’t directly look at benefits/prices/availability online. Years ago, I’d read that classictravel.com was a good search tool for checking Virtuoso prices/benefits/availability, but I have no idea whether or not it’s still accurate and I’ve never booked through them.

Comparing back and forth between programs can be time consuming, but based on the searches I did above (and several more not outlined in this post), it looks like your best bet is to compare between programs if you have access to more than one. If I had to focus on one or the other, I’d probably lean towards Amex Fine Hotels & Resorts because I really value the guaranteed 4pm checkout, as it adds a feeling of relaxation knowing that I don’t have to come back to the room and pack up immediately after breakfast. That said, Chase Luxury Hotels is open to a much wider set of users since Chase Sapphire Preferred and United MileagePlus cards qualify — and that’s a pretty solid deal for people who don’t hold a $450-$550 AF card.

Either way, when booking a cash stay at a luxury hotel, it’s always worth checking these programs to see if you can get additional benefits for the same price.

[…] Elite Mastercard Benefit”. This essentially gives you access to a program sort of similar to Amex Fine Hotels & Resorts or Chase Luxury Hotel Collection with some other benefits sprinkled in (Bethany goes into some depth about why she loves it, so see […]

[…] (a program available to those with select Chase credit cards). I’ve previously written about Chase LHC and compared it to Fine Hotels & Resorts – even specifically comparing Las Vegas hotels and benefits. I was pleasantly surprised when […]

[…] the program before and compared it to the Chase Luxury Hotel & Resort Collection program (See: Chase Luxury Hotel & Resort Collection vs Amex Fine Hotels & Resorts). Amex FHR offers what I’d say is a terrific set of benefits on bookings, but those bookings […]

[…] Hilton Gold won’t matter if I keep an Aspire card. Fine Hotels & Resorts is nice, but Chase has its own very similar Luxury Hotel & Resort Collection and many of the same benefits can be realized via Virtuoso without any specific credit card […]

[…] Access to Fine Hotels & Resorts […]

[…] While this is a cool benefit, it’s certainly not all-encompassing. But if you have paid cash stays in a FoundersCard hotel city, you can get a few extras at places that don’t partner with Amex or Chase and their respective upscale hotel programs (Fine Hotels & Resorts and Luxury Hotel Collection– Frequent Miler has a nice comparison). […]

[…] For examples of what you may expect through these programs, see: Chase Luxury Hotel & Resort Collection vs Amex Fine Hotels & Resorts. […]

Is it possible to book back to back one night stays in Vegas at different hotels such as the MGM on a Friday and the Delano on a Saturday? I know they’re both Mlife, but would you receive the credit for each “stay” of one night? I know checking in/out can be a pain, but seems like a good way to stack and get some great prices.

[…] in Las Vegas (and is one of the reasons I’ve enjoyed MLife status from Hyatt and/or Fine Hotels & Resorts bookings). Waived resort fees, free parking, and room discounts could really add up if you’re a casino […]

Another similar program to consider reviewing is the Visa Infinite Luxury Hotel Collection available to U.S. Bank Altitude™ Reserve Visa Infinite® Cardmembers.

Would love go hear more about that program. Especially what credit cards qualify

I wonder if Chase LHR includes Venetian/Palazzo because IHG partners with them and obviously partners with Chase as well.

I don’t know. FHR also includes Palazzo (but not Venetian).

I have used the Virtuoso website classictravel.com to book hotels a couple of times. Be sure to look for hotels when you get search results that feature Virtuoso benefits, because not all (although most do), hotels in their system have these. Generally benefits between FHR and Virtuoso- classictravel.com are very similar, if not identical.

This might be better for another post, but can someone explain to me the value in booking through these “Fine Hotels and Resorts” channels?

I made several efforts to find value, and while I get that they give you a few perks I don’t see much that is incremental to the perks most of “us” reading these posts already have with status (either earned, or via the cards that provide access to the “Fine Hotels and Resorts” in the first place). I get the enthusiasm around Citi with the 4th Night Free and where (even after the changes) there can be meaningful savings there. But I’m lost on the value from the Amex and Chase portals.

Usually in these cases I’m missing something that’s clear in front of my face – but why would anybody ever book through these channels? Maybe my starting point is flawed? I assume that most of “us” reading these posts are aiming for significant discounts ($100 nights for “free”, or $300 nights for points that cost $50 to aquire, etc). Am I missing something obvious in terms of value? Or am I just not the right target for this post (People excited about some guaranteed benefits at marginal, if any, cost savings)?

Like everything in this game, or business, or whatever we want to call it, some stuff that applies in some cases doesn’t apply in others. So what I offer you here is some specific thinking, which may not apply in other cases.

1. Late check out. For weekend stays in particular, I find that a lot of the value in leisure hotels is when you can more-or-less make a second day of it by holding onto your room until 4pm. Yes, if you are a very top end elite in Hyatt, this will almost certainly happen without FHR. But FHR guarantees it, as Nick notes, and that can help a lot with planning. It can (in some situations) be stressful to have to wait until check-in for this guarantee, and downright counterproductive to have to call in on the morning of departure and go through this dance (I’m looking at you, Andaz Maui). I won’t go through all the other chains here, but for most folks, including Diamonds, Hilton is notoriously stingy about 4pm late checkouts and pre-promises.

2. Length of stay. Because of point 1, and because the benefit (like the $100 property credit) is per stay, the “sweet spot” for FHR is usually a one-night stay. The spot can get sweeter for a couple each of whom has a Platinum Amex, since you can play the alternating nights game, as Nick notes. Then those property credits can add up! Having said that, I’m a person who has also posted here about a situation where even when changing rooms, a hotel (Gran Melia Fenix, Madrid) made us fight for the second FHR property credit, something that was not fun. Now, having noted both the one-day sweet spot and chaining it via the two-person game, let me note something else that I have had success with, although this is clearly a non-guaranteed YMMV situation. At some properties we really want an upgrade (or two) but are putting together longer stays with a combination of instruments including points where explicit terms don’t guarantee (or sometimes supposedly allow) upgrades. In such circumstances, I often like to pay for the first night, to seem a bit less like a complete grifter when later I contact the hotel to ask them to note a set of consecutive reservations — which is indirectly (or, later, directly) a way of seeing if one can keep the same room. On that first paid night, sure, for many elite statuses, you may already be promised-if-available an upgrade; and technically FHR is doing no more; and yet the FHR mechanism (at least in my experience) tends to get them to focus more on the upgrade from the get-go. That is, hotels that are in the FHR program seem to want to stay in it (until they don’t!) and hence go through the mechanics with more zeal than they do with their chain program.

3. Breakfasts. Again, more for the leisure stay situations, and, yes, all elite programs promise some sort of breakfast. But until a couple of days ago, Waldorf-Astoria did not, and even now, like with other Hilton breakfasts, who really knows when they get the continental and what that means? Under FHR, especially in conjunction with late checkout, a real late am (guaranteed) breakfast can be the meal of a day and hence a money-saver.

4. The credit. Flexibility counts, as per Nick’s posts. I am partial to the $100 credit (as opposed to cars from airports, meals without liquor, and spa credits where cost – $100 > anything you would want to pay for the service). But when the bar/restaurant is attractive — think Park Hyatt Washington DC — even as a highest-end Hyatt, when the FHR rate is only $25 higher than the discount Hyatt price, I’m getting $75 in desirable food and liquor that I might well have paid for anyhow. That’s a specific case of FHR still working as a high-end hotel chain elite. As I descend into the nightmare of Explorerist-ism, the value of FHR on a low-price night at a place like PH Washington will — as they say — blow-up (the breakfast, the late check out).

Bottom line: Even with what I think of as the best high-end hotel chain status (Hyatt Diamond/Globalist), and with the Citi Prestige (4th night free) I have gotten some good value out of FHR. It’s an important tool in the toolkit. Less convinced by the other programs Nick discusses, although it is a good reminder that they exist.

Thanks so much for taking the time to lay out those benefits in more detail. Some I could see being very appealing to me in certain situations, others just don’t fit my current travel profile so to speak. But more broadly, it gives me a much clearer picture of where others are finding value in this option and how I might apply those considerations in future bookings. Really appreciate it!

When comparing those “low” Vegas prices, were you also taking into consideration the resort fees?

No — as noted above in the comments, resort fees and taxes aren’t included. That’s the case on every booking site as far as I’m aware. I hate resort fees — but they are a mostly necessary evil if you’re going to stay at a Strip casino in Vegas. In my opinion, even with taxes & resort fees, the Delano is a stellar value. I’ve stayed a few times, alternating nights with my wife (who also has a Platinum card) in order to have the resort credit each night. Even with taxes & fees, the total should be under $140 in the example given (not positive on the taxes off the top of my head). With the $100 resort credit, breakfast for 2 (which can be taken as room service with a value up to $60 for two people), 4pm late checkout, and early check-in, that’s a pretty solid value.

When booking through FHR, you may also get elite member benefits and S&N. What about chase LHR?