Chase has been steadily hacking away at the value of its Pay Yourself Back (PYB) Program, whittling down both categories and redemption rates on Ultimate Reward(UR)-earning cards. At the same time, it has added PYB options for Southwest, Aeroplan, and United cards, although the value for redeeming Southwest points is poor.

Previously, Ink cardholders could redeem points for 1.1-1.25 cents each towards cable, internet, phone services, and shipping. Those categories are all gone now, leaving “select” charities as the last soldier standing (like it is with the Freedom cards). It’s a shame to see the program for UR-earning cards getting so degraded. I don’t really see much value in anything outside of the Sapphire Reserve or for booking travel through Chase Travel℠.

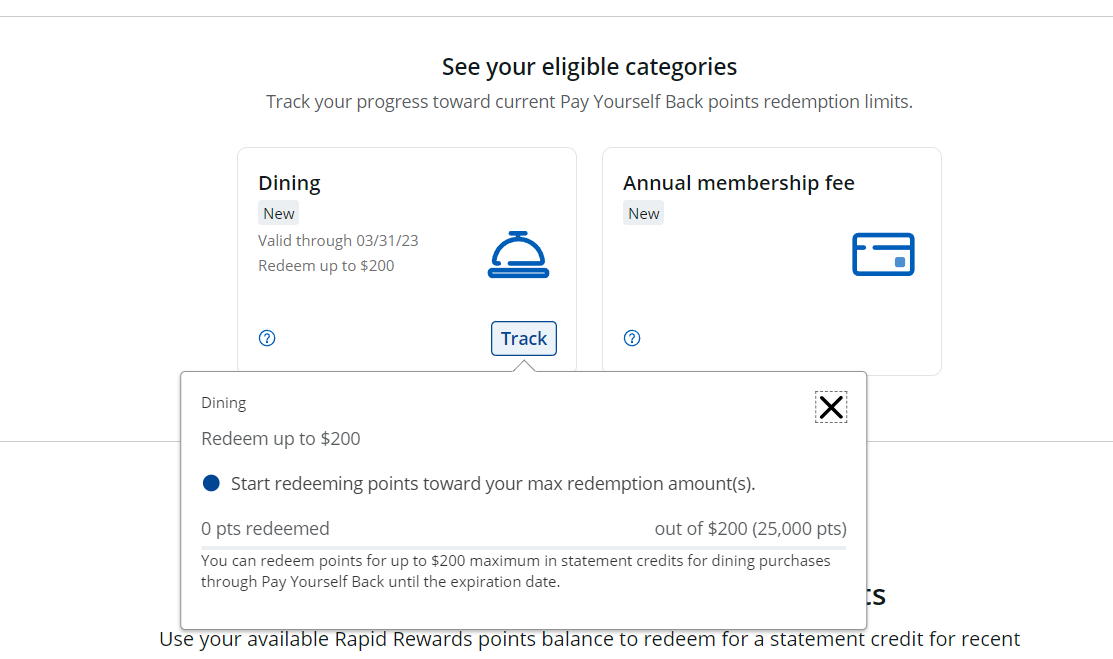

This quarter, Chase has actually added some new, and possibly quite useful, categories to its various Pay Yourself Back cards.

What is Chase Pay Yourself Back?

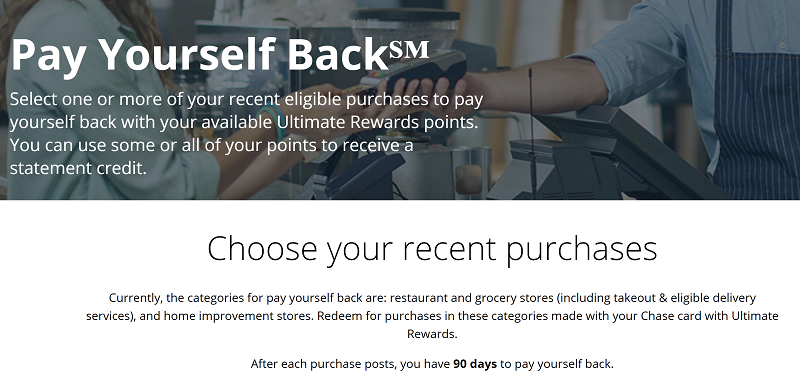

Chase has a useful benefit for select cardholders called “Pay Yourself Back”. The basic idea is that you can exchange your Chase Ultimate Rewards points for statement credits on certain purchase categories. Here’s the link to use this feature yourself.

The Pay Yourself Back feature offers some value for everyday purchases, though it’s somewhat diminished by the new, lower redemption rates. For example, if you’re a Sapphire Reserve cardholder, you can use your card at gas stations and later exchange your points to pay off those charges at 1.25 cents per point value.

Using these Pay Yourself Back categories, Chase’s Ultimate Rewards cards can become more like super-charged cash back cards. You’ll still have the ability to transfer points to travel partners, but you can also cash out points for certain charges instead.

Pay Yourself Back categories for eligible Chase credit cards

Sapphire Reserve

Redeem points for 1.25 cents each to pay back the following charges:

- Fitness Clubs and Gym Memberships: Through 3/31/26

- Gas Stations: Through 3/31/26

- Select Charities: Through 12/31/26 (still at 1.5 cents per point)

American Heart Association, American Red Cross, Equal Justice Initiative, Feeding America, GLSEN, Habitat for Humanity, International Medical Corps*, International Rescue Committee*, Leadership Conference Education Fund, Make-A-Wish America, NAACP Legal Defense and Education Fund, National Urban League, Out & Equal Workplace Advocates, SAGE, Thurgood Marshall College Fund, United Negro College Fund, UNICEF USA*, United Way, World Central Kitchen* - Annual membership fee: Through 3/31/26

- Expired Options:

- Department Stores: Expired 12/31/25

- Grocery Stores (excluding Walmart and Target): Expired 12/31/25

- Home Improvement Stores: Expired 9/30/25

- Pet Stores and Veterinary Services: Expired 6/30/25

- Utilities: Expired 3/31/25

- Insurance: Expired 3/31/25

Sapphire Preferred

Redeem points for 1.25 cents each to pay back the following charges:

- Select Charities: Through 12/31/26

American Heart Association, American Red Cross, Equal Justice Initiative, Feeding America, GLSEN, Habitat for Humanity, International Medical Corps*, International Rescue Committee*, Leadership Conference Education Fund, Make-A-Wish America, NAACP Legal Defense and Education Fund, National Urban League, Out & Equal Workplace Advocates, SAGE, Thurgood Marshall College Fund, United Negro College Fund, UNICEF USA*, United Way, World Central Kitchen*

Freedom Cards (Unlimited, Flex, Visa)

Redeem points for 1.25 cents each to pay back the following charges:

- Select Charities: Through 12/31/26

American Heart Association, American Red Cross, Equal Justice Initiative, Feeding America, GLSEN, Habitat for Humanity, International Medical Corps*, International Rescue Committee*, Leadership Conference Education Fund, Make-A-Wish America, NAACP Legal Defense and Education Fund, National Urban League, Out & Equal Workplace Advocates, SAGE, Thurgood Marshall College Fund, United Negro College Fund, UNICEF USA*, United Way, World Central Kitchen*

Sapphire Reserve for Business, Ink Business Preferred, Ink Plus, Ink Business Cash, Ink Business Unlimited

Redeem points for 1.25 cents each to pay back the following charges:

- Select Charities: Through 12/31/26

American Heart Association, American Red Cross, Equal Justice Initiative, Feeding America, GLSEN, Habitat for Humanity, International Medical Corps*, International Rescue Committee*, Leadership Conference Education Fund, Make-A-Wish America, NAACP Legal Defense and Education Fund, National Urban League, Out & Equal Workplace Advocates, SAGE, Thurgood Marshall College Fund, United Negro College Fund, UNICEF USA*, United Way, World Central Kitchen*

Aeroplan Card

Redeem points for 1.25 cents each to pay back the following charges:

- Travel Purchases: Redemption limit of 200,000 points per year

- Annual membership fee: No end date

Redeem points for 0.8 cents each to pay back the following charges (no limits):

- Gas Stations: Through 12/31/26

- Dining: Through 12/31/26

- Grocery Stores (Excluding Target & Walmart): Through 12/31/26

- Amazon and Whole Foods: Through 12/31/26

Marriott Bonvoy Bold Card

Redeem points for 0.8 cents each to pay back the following charges:

- Airlines and Marriott hotel purchases: Redemption limit of $750 in charges per year: no expiry listed

Disney Cards

Redeem points for 1 cent each to pay back the following charges:

- Select U.S. Disney locations in Disney Parks and Resorts, Disney store and outlet locations in the U.S., shopDisney.com, DisneyPlus.com, Hulu.com and ESPNPlus.com

- Airline purchases, excluding purchases made with third-party providers and travel agencies (Premier Visa only)

Southwest Cards

Redeem points for 1 cent each to pay back the following charges:

- Annual Fee: Through 12/31/26

- Expired Options:

- Home Improvement Stores 0.8 cents per point (9/30/24)

- Internet, Cable, and Phone 0.8 cents per point (9/30/24)

United Cards

Redeem points for 1.35-1.6 cents each to pay back the following charges:

- Annual Fee: Through 12/31/26

Redeem points for 1 cent each to pay back the following charges:

- United flight purchases of $50+: Through 12/31/26

How to use Chase Pay Yourself Back

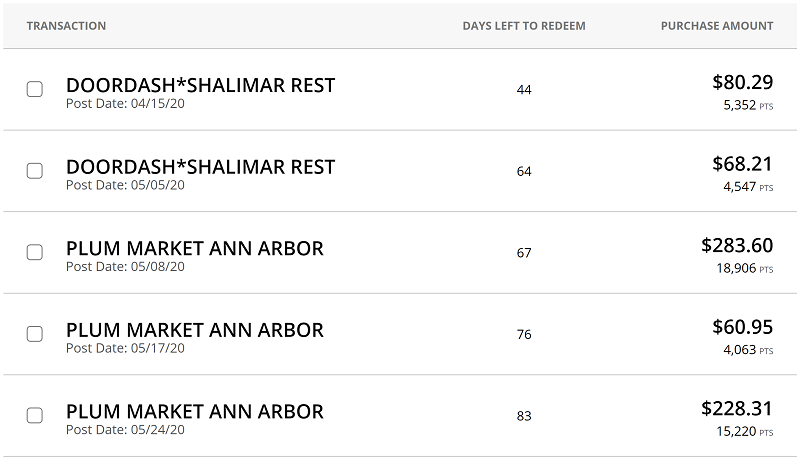

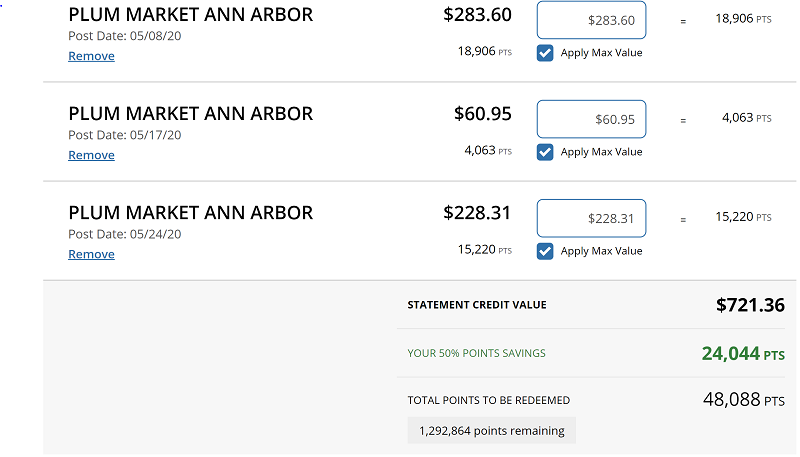

Note: This example is from the time when this feature first debuted. Grocery & dining purchases were both valid categories at that time and the redemption level was still 1.5 cents per point.

When I logged into my Chase account and browsed to Chase’s Pay Yourself Back page, I found a number of qualifying purchases. I had a couple of DoorDash purchases and a few grocery purchases:

I selected each of the above purchases and then had the opportunity to enter how much of each purchase should be paid back with points. In each case, I selected “Apply Max Value”. I was a little concerned that it might be better to pick a round number to get full point value, but that concern was unfounded. Chase rounded up the value of the points in my favor. Take, for example, the $283.60 grocery purchase at Plum Market. 28,360 cents divided by 1.5 = 18,906.67. One would expect Chase to round that up to 18,907 to determine how many points were required. Instead, they rounded down to 18,906. Cool.

Chase Pay Yourself Back FAQ

How often does Chase change the eligible categories?

Originally, Pay Yourself Back was offered only through September 30, 2020. Then it was extended through April 30, 2021. Now, Chase extends the program every quarter, and with each extension, we usually see some changes, such as to which types of expenses can be used.

Can I transfer points between Chase cards to get better redemption value?

Yes. Points earned on other Chase cards can be moved to your Sapphire Reserve or Ink Business Preferred account in order to get more value. So, if you consider that this feature makes it easy to cash out Sapphire Reserve points at 1.25 cents each, then we can calculate the cash back equivalent earnings of each Ultimate Rewards card by multiplying the earnings rate by 1.25. For example, the Sapphire Reserve card earns 3X for dining, so it now earns the equivalent of 3 x 1.25 = 3.75% cash back. Similarly, the Freedom Unlimited card earns 1.5X everywhere (in addition to its 3X and 5X categories), so by transferring those points to your Sapphire Reserve, it now earns the equivalent of at least 1.5 x 1.25 = 1.875% cash back.

Can I use Pay Yourself Back for purchases made on previous statements?

Yes, Chase’s Pay Yourself Back can be used for transactions within the past 90 days.

Do I earn points for purchases that are paid back using Ultimate Rewards?

Yes. Erasing purchases does not cause Chase to pull back the points earned on those purchases.

Where can I find more information about Pay Yourself Back?

Chase’s Pay Yourself Back FAQ Can Be Found Here.

This is way overthought. PYB has very poor value.

Just use the points to Hyatt.

Oops – use the points “at” Hyatt.

PYB… depends on what you are paying back. I bought $1,000 worth of groceries, pains myself back and only used $750 worth of points.

I used the recent promotion to transfer UR points to Aeroplan (1.35X) and used the aeroplan points to pay myself back for Viator purchases (with 50% back from Capital One shopping) at 1.25X. All in, spent about 112,000 UR for $1900 worth of viator tours and $950 back in, most likely, Marriott or hotels.com gift cards, so $2850 of value for 112,000 UR points, or about 2.5 cents per point. Plus I earn on the Aeroplan card spend and on the future Marriott stays. Not amazing but pretty good.

You said “…For example, if you’re a Sapphire Reserve cardholder, you can use your card at wholesale clubs and later exchange your points to pay off those charges at 1.25 cents per point value…”

That is incorrect.

[…] no annual fee Marriott Bold: 0.8 cents per point (CPP) for airline and Marriott hotel purchases (link). I was not expecting this Marriott CC to get the PYB […]

Playing here feels like being part of a family. <a href=”https://erikachongshuch.org/reviews/review-orbit-chron-jul06.html” rel=”nofollow ugc”>mahjong288 login</a> really knows how to build a strong gaming community.

Why do you think the bonvoy bold pyb option will expire in june?

Just back from a trip to Europe where I covered housing for our family + other expenses that coded as travel, using the Aeroplan card. I covered $1106 using 88.5k miles, which was 70.8k UR before transfer (w 20% bonus + 10% bonus for holding the card).

One of the challenges in this game is that an increase in choices makes it harder to decide – and then harder to be happy with our choices. Nick in particular has pointed out how the ability to redeem for cash at decent levels makes it less pleasing to use miles / points. The converse is also true. I’m not happy of course at any devaluation, but it slightly reduces my regret at using Aeroplan miles in this way. Aeroplan is a very good option for flights in many cases (esp biz class imho), but there are other decent options for most partners / classes / regions. Aeroplan is sometimes better, but usually not that much better. By contrast, there’s nothing nearly as good for the ability to cover oop travel costs. Granted, there are other cards that allow PYB with a good percent back; for instance, Altitude reserve @ 4.5%!! But that only works domestically and you’d have to MS a lot to generate major points. I mean, look at what I covered here, to do that with the AltRes, you’d need to MS ~25k. The Aeroplan card lets you do it to scale, quickly, easily, just move over some UR. I can’t enjoy redeeming UR for 1.25cpp, knowing their value with Hyatt etc. But 1.625cpp, when it’s simple and easy? Absolutely.

sounds like a NONE- Benefit!! sasd

Expiration on these categories seems to have been extended to 1/31/25.

What is the actual discount you receive by redeeming at 1.25 points vs 1.0 points. For example is it better to use the bank of america 2.625% credit card or the sapphire reserve and redeem?

But one of these things is not like the others!! Aeroplan 1.25cpp for travel means actual flexibility, paying for travel using a card on any website, through any portal… and while you can’t cash out transfers from MR etc, transfers of UR are fine – and bonused with 10% (w card and 50k transfer) and often more. The current 20% transfer bonus + 10% card bonus means you get 1.625 cpp PYB on travel. That is way higher than the supposed reasonable redemption value, and you can book anywhere, anytime. We’ve stayed in a series of small non brand hotels in Europe this past few weeks, all courtesy of daddy Chase‘s Aeroplan concept.

I know this comment is a few months old but I think this is a really good one to call out. Aeroplan is a good program in itself already, and with their PYB scheme they’ve essentially created another version of the USB AR real time rewards. I don’t fly Aeroplan often but once or twice a year lately where the free bag and status benefits would be a nice little boost, and that with the PYB travel option makes me really interested to try to get back to 5/24 at some point for this card. Hopefully PYB sticks around at a good rate for the long haul on it.

Getting 1.25 cents/point sounds terrible, but in many cases is actually better than 1.5 cents via Chase Travel. Comparing the two the max benefit is a 16.7% discount for Chase Travel. But this can potentially more than be offset by: 1. Chase Travel prices are often higher than alternative booking channels. 2. Shopping portals and cc points earnings that your foregoing by booking with points via Chase Travel. 3. Chase Travel denies you any elite benefits you might otherwise be able to get. I’ve been going through this thought exercise as I find myself relatively flush with Chase URs and solid value transfer partners aren’t serving my upcoming travel needs, so it’s the first time ever I’ve been considered using Chase Travel to cash out points at 1.5 cents and sadly I’m concluding it’s an even worse deal than it sounds on the surface.

This is often true. My main redemption for the 1.5 has been a flight from my home town that stays at a static price, even through every portal. There’s no loyalty / discount options to consider either. It’s niche, but there can be some good uses.

On the Disney Premier card it’s also possible to use PYB for airline purchases.

(hey, I can comment on this article again!)

You should not use examples from expired categories like dining(DoorDash). Yes, I see the disclaimer. But you should use a current example. Lots of folks like me skim these posts and then go back to reread, and then we see we wasted our time.

[…] Another program was “enhanced” smh…if you are keeping notes: Cathay Pacific Flight Reward Devaluation On October 1, 2023. Also, Chase continues to steadily diminish its “Pay Yourself Back” benefit… […]

This is the biggest bait and switch in the points and miles game in the past 5 years. Earn UR worth 1.5c. I mean 1.25c. I mean..