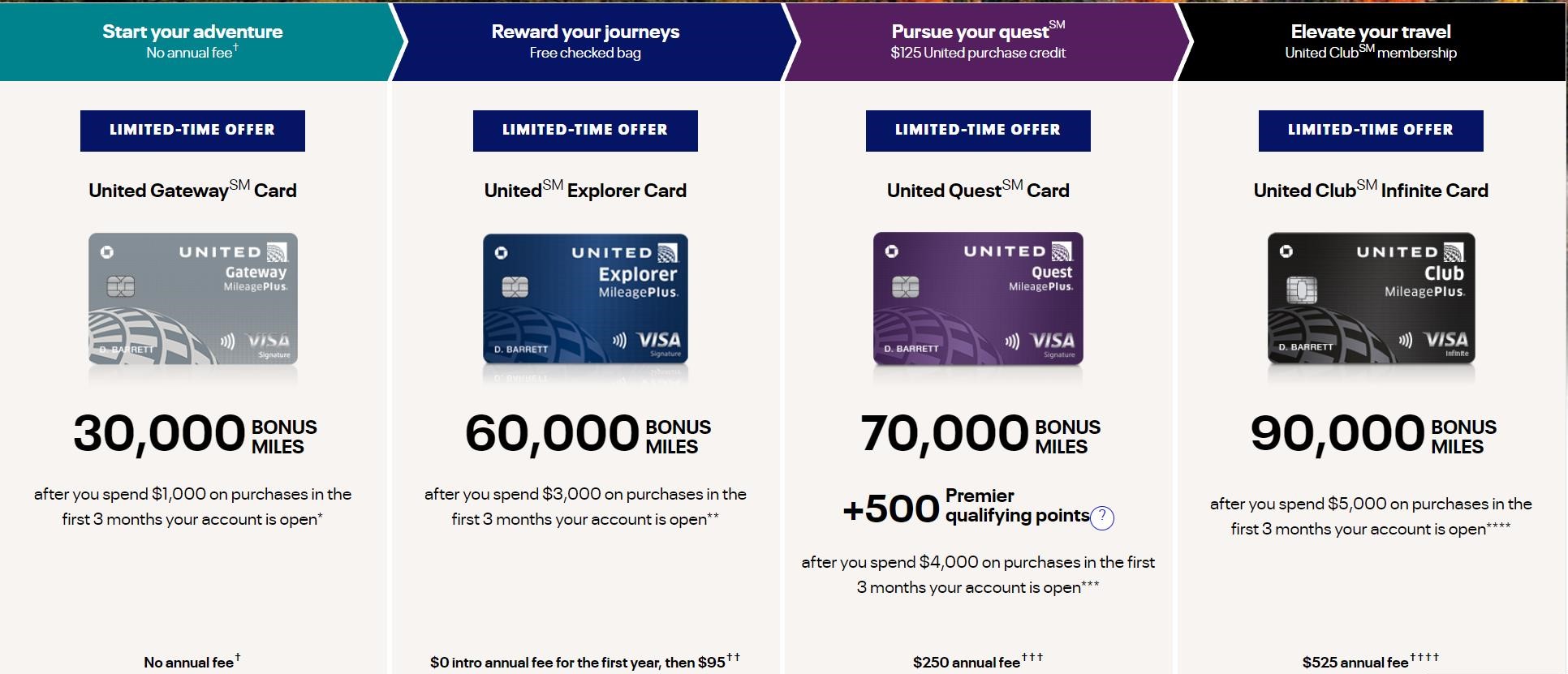

There are improved welcome offers available on the Chase United Airlines Gateway, Explorer Quest and Club Infinite cards. The Club Infinite has the biggest offer with 90,000 miles earned after $5,000 in spend. \If you value the United Club access that comes with it, that’s a decent deal. If not, the 70,000 mile offer on the United Quest card with $275 less in annual fee may be more appealing.

All of these represent a 10,000 mile increase from the previous welcome offers.

Note that all of these cards with the exception of the Gateway offer an additional 5K miles when adding an authorized user within the first three months of card membership. Chase has added a 24-month rule with it’s AU cards: in order to get the 5K, the AU can’t have had the card or received a welcome bonus within the last 24 months. We’ve elected to leave this off of the best offer info since it’s not automatically available to everyone who applies.

The Offers and Key Card Details

| Card Offer and Details |

|---|

ⓘ $372 1st Yr Value EstimateClick to learn about first year value estimates 30K Miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 30K miles after $1K spend in first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open.No Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: None Earning rate: 2X United ✦ 2X on United Hotels ✦ 2X gas stations ✦ 2X local transit and commuting Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn 2 checked bag certificates after $10K spend in a calendar year Noteworthy perks: 25% back on United in-flight and Club Premium drink purchases |

| Card Offer and Details |

|---|

ⓘ $856 1st Yr Value EstimateClick to learn about first year value estimates 70k miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 70K miles after $3K spend in the first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open.$0 introductory annual fee for the first year, then $150 Alternate Offer: There is currently an in-flight offer for up to 75K. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 80K Miles after $3K spend in the first 3 months (expired 5/8/25) FM Mini Review: Decent perks such as free 1st checked bag and 2 annual club visits makes this a keeper for some. Earning rate: 2X United ✦ 2X restaurants ✦ 2X on hotel stays Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: $100 Travel Credit after spending $10,000 in a calendar year ✦ 10,000-mile award flight discount after spending $20K ✦ Earn up to 1,000 PQPs per calendar year: 1 PQP per $20 spend Noteworthy perks: Two United Club passes per year on your anniversary ✦ Improved economy saver award availability ✦ Free first checked bag for primary cardholder and one travel companion when you pay with the card ✦ Up to $100 in credits for United Hotels ($50 each on your first two bookings per cardmember year) ✦ Up to $60 per year in rideshare credits (up to $5 per month) when using your card to pay for rideshare services.(requires annual enrollment) ✦ Up to $50 in Travel Credit for Avis or Budget car rentals per cardmember year ✦ One $10 Instacart credit per month when you have Instacart+ membership ✦ Priority boarding ✦ One year of complimentary Dash Pass (Must activate by 12/31/27) ✦ Primary auto rental collision damage waiver ✦ Up to $120 Global Entry, TSA Pre-check or Nexus credit ✦ 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card ✦ Up to $100 as a statement credit each anniversary year for JSX flights booked directly |

ⓘ $788 1st Yr Value Estimate$200 TravelBank cash valued at $170 Click to learn about first year value estimates 80K Miles + 3,000 PQP ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K miles and 3,000 PQPs after $4K spend in the first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open. (Offer Expires 4/1/2026)$350 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 100K miles and 3,000 PQPs after $4k spend in the first 3 months (Expired 8/21/25) Earning rate: 5X Renowned Hotels & Resorts for United Cardmembers ✦ 3X United ✦ 2X restaurants including eligible delivery services ✦ 2X on all other travel ✦ 2X select streaming Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 18,000 PQPs per calendar year: 1 PQP per $20 spend ✦ Earn an additional 10,000-mile award flight discount after $20K in purchases in a calendar year ✦ Earn 2 global Economy Plus seat upgrades after $40K in purchases in a calendar year ✦ 1,000 bonus PQPs each year Noteworthy perks: $200 in United® TravelBank cash each membership year - terms apply ✦ Up to $150 in statement credits per cardmember for Renowned Hotels and Resorts ✦ 10K award flight discount per cardmember year ✦ First and second checked bag free for cardholder and one companion when you purchase your tickets with the card and include your MileagePlus number ✦ Up to $120 Global Entry, TSA PreCheck or Nexus reimbursement ✦ Up to $100 in rideshare credits per year (up $8 per month January to November and up to $12 in December, re-enrollment is required annually) ✦ Up to $80 in Travel Credit for Avis or Budget car rentals per cardmember year ✦ One $10 and one $5 Instacart credit per month when you have Instacart+ membership ✦ 25% back on United inflight or Club Premium drink purchases ✦ Get a jump start on earning Premier status with 1,000 Card Bonus PQP each year, awarded within 6 to 8 weeks after February 1 each year ✦ Up to $150 as a statement credit each anniversary year for JSX flights booked directly |

| Card Offer and Details |

|---|

ⓘ $788 1st Yr Value Estimate$200 TravelBank cash valued at $170 Click to learn about first year value estimates 80K Miles + 3,000 PQP ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 80K miles and 3,000 PQPs after $4K spend in the first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open. (Offer Expires 4/1/2026)$350 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 100K miles and 3,000 PQPs after $4k spend in the first 3 months (Expired 8/21/25) Earning rate: 5X Renowned Hotels & Resorts for United Cardmembers ✦ 3X United ✦ 2X restaurants including eligible delivery services ✦ 2X on all other travel ✦ 2X select streaming Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 18,000 PQPs per calendar year: 1 PQP per $20 spend ✦ Earn an additional 10,000-mile award flight discount after $20K in purchases in a calendar year ✦ Earn 2 global Economy Plus seat upgrades after $40K in purchases in a calendar year ✦ 1,000 bonus PQPs each year Noteworthy perks: $200 in United® TravelBank cash each membership year - terms apply ✦ Up to $150 in statement credits per cardmember for Renowned Hotels and Resorts ✦ 10K award flight discount per cardmember year ✦ First and second checked bag free for cardholder and one companion when you purchase your tickets with the card and include your MileagePlus number ✦ Up to $120 Global Entry, TSA PreCheck or Nexus reimbursement ✦ Up to $100 in rideshare credits per year (up $8 per month January to November and up to $12 in December, re-enrollment is required annually) ✦ Up to $80 in Travel Credit for Avis or Budget car rentals per cardmember year ✦ One $10 and one $5 Instacart credit per month when you have Instacart+ membership ✦ 25% back on United inflight or Club Premium drink purchases ✦ Get a jump start on earning Premier status with 1,000 Card Bonus PQP each year, awarded within 6 to 8 weeks after February 1 each year ✦ Up to $150 as a statement credit each anniversary year for JSX flights booked directly |

| Card Offer and Details |

|---|

ⓘ $385 1st Yr Value EstimateClick to learn about first year value estimates 90K Miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 90k miles after $5k spend in first 3 months + 10K bonus miles after you add an authorized user in the first 3 months. $695 Annual Fee This card is available to you if you do not have any United Club card and have not received a new Cardmember bonus for any United Club card in the past 24 months. Recent better offer: 95k miles after $5k spend in first 3 months (expired 5/8/25) FM Mini Review: While pricey, the Chase United Club Card is a great choice for those who want a United club membership and other perks like a 10% discount on saver awards. . Earning rate: 5X Renowned Hotels & Resorts for United Cardmembers ✦ 4X United ✦ 2X dining & travel Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 28,000 PQPs per calendar year: 1 PQP per $15 spend ✦ Earn a 10K award discount after $20K spend in a calendar year ✦ Earn an additional 10K award discount after $40K spend in a calendar year ✦ Earn United Club All access membership after $50K spend in a calendar year or achieving Premier Gold status or higher + 4 United Club passes when you also have an authorized user. Noteworthy perks: United Club membership ✦ Unlocks complimentary elite upgrades on award tickets, including companions on the same reservation ✦ 10% discount on saver level economy awards within the continental US and Canada ✦ Up to $120 for Global Entry, TSA Precheck or Nexus fee credit ✦ Priority check-in, security screening, baggage handling, and boarding ✦ Free 1st and 2nd checked bags ✦ Up to $200 in statement credits per cardmember for Renowned Hotels ✦ Up to $150 in rideshare credits per year (up $12 per month January to November and up to $18 in December, re-enrollment is required annually) ✦ Up to $50 in Travel Credit for Avis or Budget car rentals per cardmember year up to two times ✦ Avis President's Club Status ✦ Primary auto rental collision damage waiver ✦ Free Instacart+ membership through 12/31/27 ✦ Two $10 Instacart credits per month through 12/31/27 ✦ IHG Platinum status ✦ 1,500 bonus PQPs each year ✦ Up to $200 as a statement credit each anniversary year for JSX flights booked directly |

Quick Thoughts

Last year year, we saw a best-ever offer for 120,000 miles on the United Club card, albeit with an extra $1,000 in spend compared to the current 90K bonus. While this doesn’t quite reach the same heights, if you value the United Club membership, 90K is still a decent haul.

The Quest offer adds an additional 10,000 miles from the 60K offer that we saw before, while the spend stays the same at $4k in 3 months. The 500 bonus Premier Qualifying Points (PQP) will be attractive for some as well. The card has $125 in annual United credits and 2x 5K Mileage Plus award rebates to take some of the sting out of the $250 annual fee.

The Gateway offer gives an additional 10,000 miles on $1k spend for a total of 30,000 miles. That’s OK for such low spend, but not earth-shattering. I think the other two are more interesting.

Each card falls under Chase’s 5/24 rule, so check out Greg’s post on ways to check your status if you’re uncertain of where you stand.

United peso miles aren’t worth all that much anymore. They need to increase these cheapskate offers or else hard pass.

Interesting that business card SUB didn’t also increase. I’m waiting for 100k offer to return on that one.