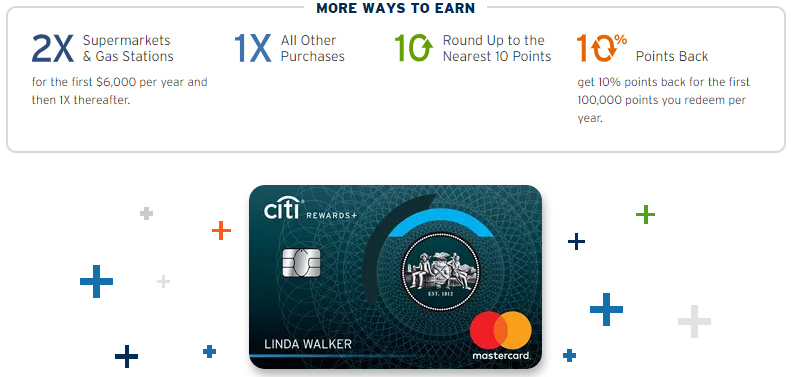

When Citi introduced the no-fee Rewards+ card recently, we were surprised and confused. The card rounds up rewards to the nearest 10 points. This means that a $1 purchase earns 10X rewards, a 10 cent purchase earns 100X rewards, and a 1 cent purchase earns 1000X rewards. Those numbers sound awesome until you think more about it. How many tiny purchases do you really make? Even if you make two small purchases every single day for a year, we’re only talking about 7K points earned. The only way to make this into a big deal is to game the system. Does Citi really want us doing that? Today’s post isn’t about that subject, but you can read our thoughts in these posts:

When Citi introduced the no-fee Rewards+ card recently, we were surprised and confused. The card rounds up rewards to the nearest 10 points. This means that a $1 purchase earns 10X rewards, a 10 cent purchase earns 100X rewards, and a 1 cent purchase earns 1000X rewards. Those numbers sound awesome until you think more about it. How many tiny purchases do you really make? Even if you make two small purchases every single day for a year, we’re only talking about 7K points earned. The only way to make this into a big deal is to game the system. Does Citi really want us doing that? Today’s post isn’t about that subject, but you can read our thoughts in these posts:

- Nick wrote: Earn up to 100x w/ new Citi Rewards+ card. No, really. Ok, maybe not?

- And I followed up with: Perk abuse, coming soon

10% rebate, for the win

The real value with the Rewards+ card is as a companion to the Citi Premier or Prestige card. The Rewards+ card rebates 10% of points redeemed, up to 100,000 points redeemed. In other words, you can get up to 10K points back per year. Out & Out has confirmed that the rebate works with pooled points. He combined his ThankYou accounts, including the Rewards+ card, and transferred points earned on other ThankYou cards to an airline program. The result was that he earned a 10% rebate on that point transfer. See the “Combine points across cards” section of our Complete Guide to ThankYou Rewards.

10K points per year is hardly a huge win, but it does make the annual fees on the Premier and Prestige cards easier to swallow…

What this means for Premier cardholders

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Very strong earnings for spend. Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Double Cash Click here for our complete card review $95 Annual Fee Earning rate: 3X grocery ✦ 3X dining ✦ 3X gas stations & EV charging ✦ 3X flights, hotels, travel agencies ✦ 10X hotels, car rentals, and attractions booked through Citi Travel℠ Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline partners ✦ $100 Annual Hotel Savings Benefit ($100 off a $500+ hotel stay, excluding taxes and fees, when booked through Citi Travel) ✦ Travel protections See also: Citi ThankYou Rewards Complete Guide |

The Citi Premier card costs $95 per year. In exchange, you get excellent category bonuses, 1.25 cents per point value towards travel, and the ability to transfer points to airline miles. If you also have the Rewards+ card, you’ll get back up to 10,000 points per year just for redeeming ThankYou points. For example, if you use 100,000 points to purchase $1,250 worth of travel through the ThankYou portal, you’ll get back 10,000 points. Those 10,000 points then can be used to purchase $125 worth of travel. That more than makes up for the Premier card’s $95 annual fee! If you have the Premier card and were thinking of cancelling or downgrading due to the annual fee, you might want to rethink it.

What this means for Prestige cardholders

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The Prestige card's best in class 5X rewards for dining, airfare, and travel agencies is hard to beat. Sadly, this travel card doesn't provide any travel protections. $495 Annual Fee Earning rate: 5X airfare, dining, and travel agencies ✦ 3X hotels and cruise line ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: $250 travel rebate per calendar year ✦ Free lounge access: Citi Properietary Lounges; and Priority Pass Select with free guests ✦ $100 Global Entry application fee credit ✦ 4th night free hotel benefit See also: Citi ThankYou Rewards Complete Guide |

The new Prestige card costs a whopping $495 per year. In exchange, you get an annual $250 travel rebate, awesome category bonuses, lounge access, 4th Night Free (2 times per year), the ability to cash out points at 1 cent each, and the ability to transfer points to airline miles. The card currently lets you get 1.25 cents value for flights (not travel in general, just flights), but that benefit goes away in September. Still, whether you cash out points for a penny each, transfer points to airline programs, or book 4th Night Free hotels through the portal, the Rewards+ card will give you up to 10K points back.

To make the math easy, let’s assume that you regularly spend at least 100K points per year. And we’ll generously value the travel rebate at it’s full face value, but we’ll value the 10K rebate at only 1 cent per point. We then can see that the net annual fee for the Prestige card drops to only $145 ($495 – $250 – $100). That’s not bad at all for an ultra-premium card that offers 5X rewards for dining & airfare plus excellent perks.

Citi Rewards+, sign up new or product change?

| Card Offer and Details |

|---|

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None This card is not currently available to new applicantsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: The fact that you can get 10% Points Back when you redeem, up to the first 100,000 points redeemed per year, makes this a great choice to pool with ThankYou Premier, Prestige, and/or Double Cash Click here for our complete card review Earning rate: 5x on travel booked through Citi Travel℠ Portal through December 31, 2025 (excludes air travel) ✦ 2X at supermarkets and gas stations on up to $6,000 per year ✦ Round up to nearest 10 TY points on all purchases Card Info: Mastercard World issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Round up to the nearest 10 points on all purchases with no cap. ✦ Get 10% Points Back when you redeem, up to the first 100,000 points redeemed per year. See also: Citi ThankYou Rewards Complete Guide |

You might think that it’s a no brainer to sign up new so that you can get the signup bonus, but there are some reasons to prefer product changing from another ThankYou card:

- Have you earned a welcome bonus or closed another ThankYou card in the past 24 months? If so, you won’t qualify for the Rewards+ signup bonus. Here are the current terms: “Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+℠, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi Premier℠ or Citi Prestige®, or if you have closed any of these cards, in the past 24 months.”

- Do you have plans to sign up for other ThankYou cards? At the time of this writing, the Premier card has an excellent signup offer with the first year fee waived (found here). If you want that card, you can get it at the same time you sign up for the Rewards+, but not once you earn the signup bonus.

- Do you have plans to sign up for other non-Citi cards? Some card issuers won’t approve your applications if you’ve opened up for lots of cards from any bank recently. The most famous example is with Chase’s 5/24 Rule (you won’t be approved for a new Chase card if you’ve opened 5 or more cards in the past 24 months).

If any of the above are issues for you, and if you have another Citi card sitting around that you can product change to the Rewards+, then that may be your best bet. Note, though, that if you change from an American Airlines card, Citi will treat the change as if you cancelled that AA card and you’ll then have to wait 24 months before you can sign up for a new AA card (other than the MileUp card or the CitiBusiness card, neither of which is affected).

In my case, I’m considering ditching my quest to get under 5/24 for Chase (I’m still about a year away). If so, I’ll sign up new for the Rewards+. My wife, though, is only a few months away from getting under 5/24. In her case we’ll look to product change a Preferred card to the Rewards+.

Can you get two new ThankYou cards at once?

For those who are eligible, it would be awesome to open both the Premier or Prestige and the Rewards+ card at once in order to get both bonuses. Citi won’t let you open the cards on the same day, but they will let you open them within 9 days of each other. And since Citi’s bonus rules for these cards have changed, it is at least theoretically possible to get both signup bonuses. See: New Citi application rule might be a net win.

Here’s the relevant signup bonus language again:

Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+℠, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi Premier℠ or Citi Prestige®, or if you have closed any of these cards, in the past 24 months.

A risk of signing up for two at once is that once you earn the signup bonus on one card Citi may determine that you are then ineligible for the bonus on the other card. I don’t think that’s likely, but it is possible. If I were doing this I’d make sure to get the bigger bonus on the Premier or Prestige card first, and then complete the minimum spend on the Rewards+ card.

So just to clarify, if I have the Premier card that has been open one year (AF about to post again), and I product change to the Rewards+, then it WON’T reset the 24 month clock? Premier is currently my only Citi card.

Thanks!

It depends. When you call to product change, ask if you’ll get a new card number. If they let you keep the original card number then it shouldn’t reset the clock.

[…] One way to make your rewards go farther is to get a Rewards+ card and combine it with your other accounts. The Rewards+ card offers a 10% rebate on redeemed points, up to 10,000 points rebated per year. By combining the Rewards+ ThankYou account with your Premier or Prestige ThankYou account, for example, you’ll get that rebate when you convert points to airline miles or when you book travel. See this post for more: Citi Rewards+ is a great companion to Premier or Prestige. […]

[…] An easy way to keep your points alive and to avoid an annual fee is to simply downgrade to a no-fee ThankYou card. At the time of this writing, the options that will preserve your points are the ThankYou Preferred Card and the Rewards+ Card. For most people, the Rewards+ card is the far superior option. See: Citi Rewards+ is a great companion to Premier or Prestige. […]

Hi Greg. None of this affects the “separate pots of points/expirations” Policy, does it? This one – Whenever you close a credit card account you have 60 days from date of closure before they are forfeited. Bank account points are forfeited immediately upon closure. If you share the points with another family member, they have 90 days to use them.

I ask because that policy genuinely scares me because it’s so unlike the other companies and it’s nearly impossible to keep track of if you have multiple cards.

Correct that it doesn’t change any of that. To keep your points alive, never close a Citi ThankYou account. Simply downgrade to a no-fee card instead.

Will product-changing from a Premier to a Rewards+ keep my Thank You points alive?

Yep

[…] Double Cash card doubles as a 2X everywhere ThankYou Rewards card (see what I did there?) and the Rewards+ card rebates award redemptions, I realized that it was high time to revisit this guide. ThankYou Rewards may now be the most […]

[…] the post “Citi Rewards+ is a great companion to Premier or Prestige,” I explained why I think that the Rewards+ is a great companion card. It’s not a […]

I couldn’t really justify the AT&T Access More card with its fee (even offset by online shopping), but the AT&T Access card was pretty boring. Glad that they let me product change to the Rewards+, especially now that the BoA card with preferred rewards can get me 5.25% on online shopping.

That you can use this with the prestige points is interesting, it might make for a good offset for the fourth night free changes.

I used to love that Prestige card. Unlimited 4th night free. I guess still for a while. But now they’re sweating me about the reservation is in my name, made for one person, then when we arrive it’s switched over to my husband because he’s the primary on our Hilton diamond mutual fund account. Then Citi tries to say I never checked into the hotel. They almost stiffed me on a suite rebate last fall. I just stopped using it now.

Also their price rewind . First they lowered the yearly cap. Ok. Use a second Citi card…but now you can’t match to any auction site even on a buy it now price. I know people were putting their own items up…but I wasn’t. Does anyone know a workaround or another card that allows matching to an auction site?

@Greg- What cards from Chase are you trying to get for your wife when she gets under 5/24? Which cards in your opinion are ones to get from Chase. Thanks!

Get cards that Work for your travel needs not Greg’s .

CHEERs

As CaveDweller points out, my wife’s situation is almost certainly very different from yours so I don’t think my plan will help you. She already has almost all of the Chase cards we want but with one exception: the World of Hyatt card. So that’s the one she’d get.

[…] Citi Rewards+ is a great companion to Premier or Prestige […]

I’m testing this feature with 2 Rewards+ cards. Will see if I get 2x 10% back. So this brings the value of TYP to 1.85cpp, if you have Premier, Prestige and Rewards+, and book 4 nights stay with points for the first 100,000 points.

Good luck! I was thinking of testing that too 🙂

For anyone else reading this, FM did try this and it didn’t work. Although I wonder if have two different pools with one card in each would work.

My bet is that two different pools would work, but I can’t test it since my cards are all pooled at this point.

5/24 is fools gold. Far better to ride hard and fast with the other banks.

I agree get CHASE cards then go looking I have Ink & Prestige . Just posted 65k on my Hawaiian AL card Inter Island Flts. True Love..

CHEERs

I find a more valuable argument can be made for keeping a slot open with Chase at any given time with somebody in the household. In the last year alone, for example, we have been able to get: 1. 3x CFU on all spend (& hoping it rolls around again soon when last April’s expires next month); 2. 3x & 5x bonus spend Ink Cards (along with 150,000 UR bonuses worth $2,250); 3. Ritz Carlton – 120,000 Bonvoy Points towards their best properties, worth $1,080, coupled with Plat status while using them; 4. World of Hyatt – 60,000 bonus points worth $1,080 5. Chase Sapphire Banking 60,000 URs worth $900

I took AMEX up on both Aspire & Brilliant upgrades (worth $1,800) but other than that I really haven’t found much else out there apart from Chase as valuable as all of the above. I only use Citi cards for odds & ends spending because their travel partners & system is not as valuable as Chase.

(along with other banks now also being cautious in their own right with hard & fast)

Interesting find. So I have this & the Preferred. I can’t pool points without a Citi AF card – do you think I would still get a rebate when redeeming TYPs from each acct?

I like my R+ card for maximizing small purchases & am glad the rebate is applied on the statement earned.

No, I don’t think it would work without combining. You should be able to combine them.

I have Thank You Preferred and Premier cards w/accounts pooled. Planning to product change the Preferred to a Rewards+.

Also, my wife plans to transfer Thank You points to me soon. Do you believe the 10% rebate will be valid when redeeming these transferred points?

Great question. My guess is that the rebate will still apply but I’m not sure.

I read in the terms that points transfers do not apply, I believe. It’s in the benefit booklet. However, I haven’t tried it to see if that’s how it really works.