It’s that time of year when you’ll see a list of “Great deals you must buy right now!!!” advertised everywhere you look. In my experience, getting the best deals is a combination of being able to recognize which deals are actually any good and being able to stack outsized rewards by paying attention to shopping portals, card-linked offers, and other shopping tools to reduce your cost beyond the advertised price.

Always start with a shopping portal

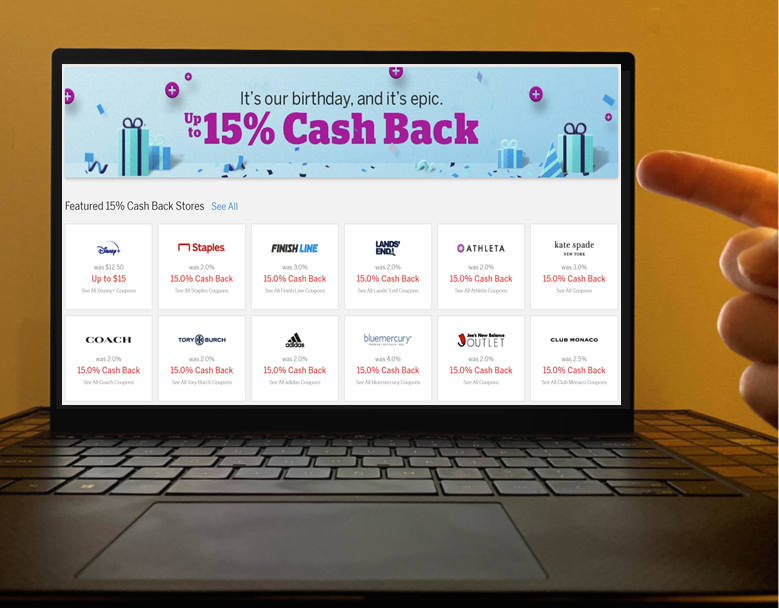

You always want to start your holiday shopping trips at a shopping portal, clicking through a site like Rakuten, TopCashBack, AAdvantage eShopping, etc, in order to earn some part of your money back (or earn miles / points).

Compare Portal rates

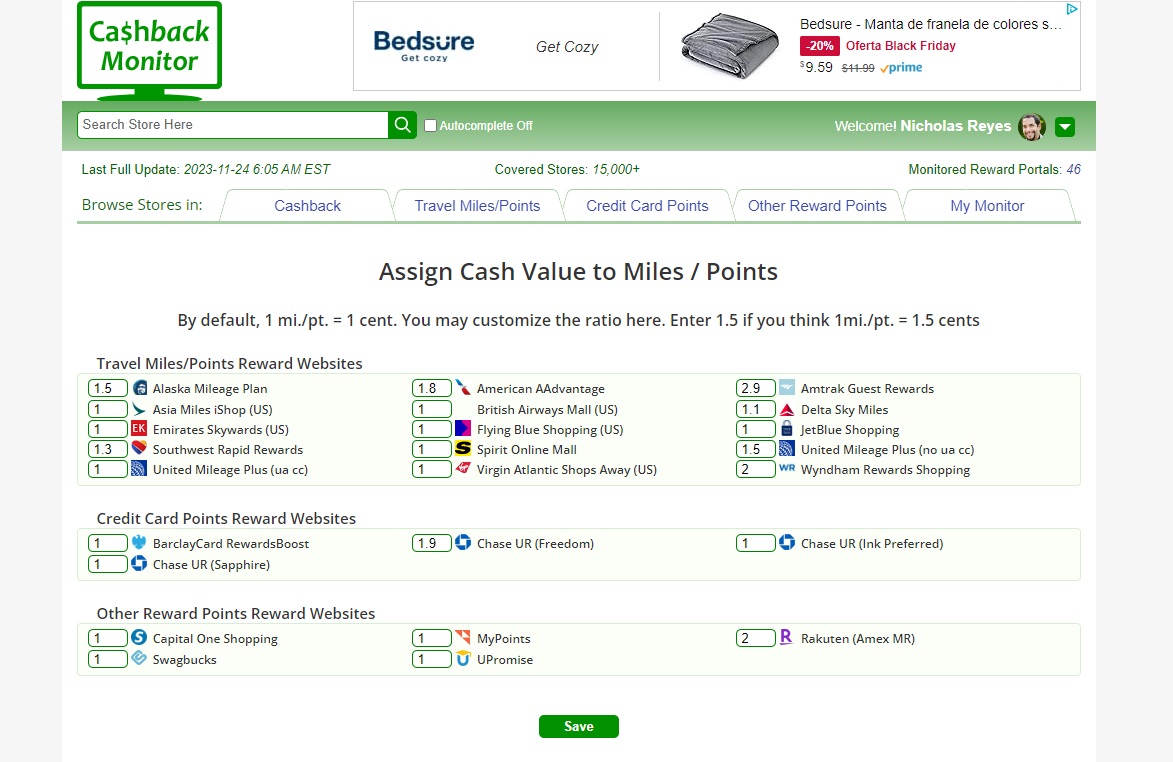

CashBackMonitor is a shopping portal comparison tool that helps it easy to compare rates at a range of shopping portals (and to also view the 15-month best rate history) with a couple of clicks. If you sign in, you can even assign a value to various airline miles and credit card points in order for it to customize your search results a bit further.

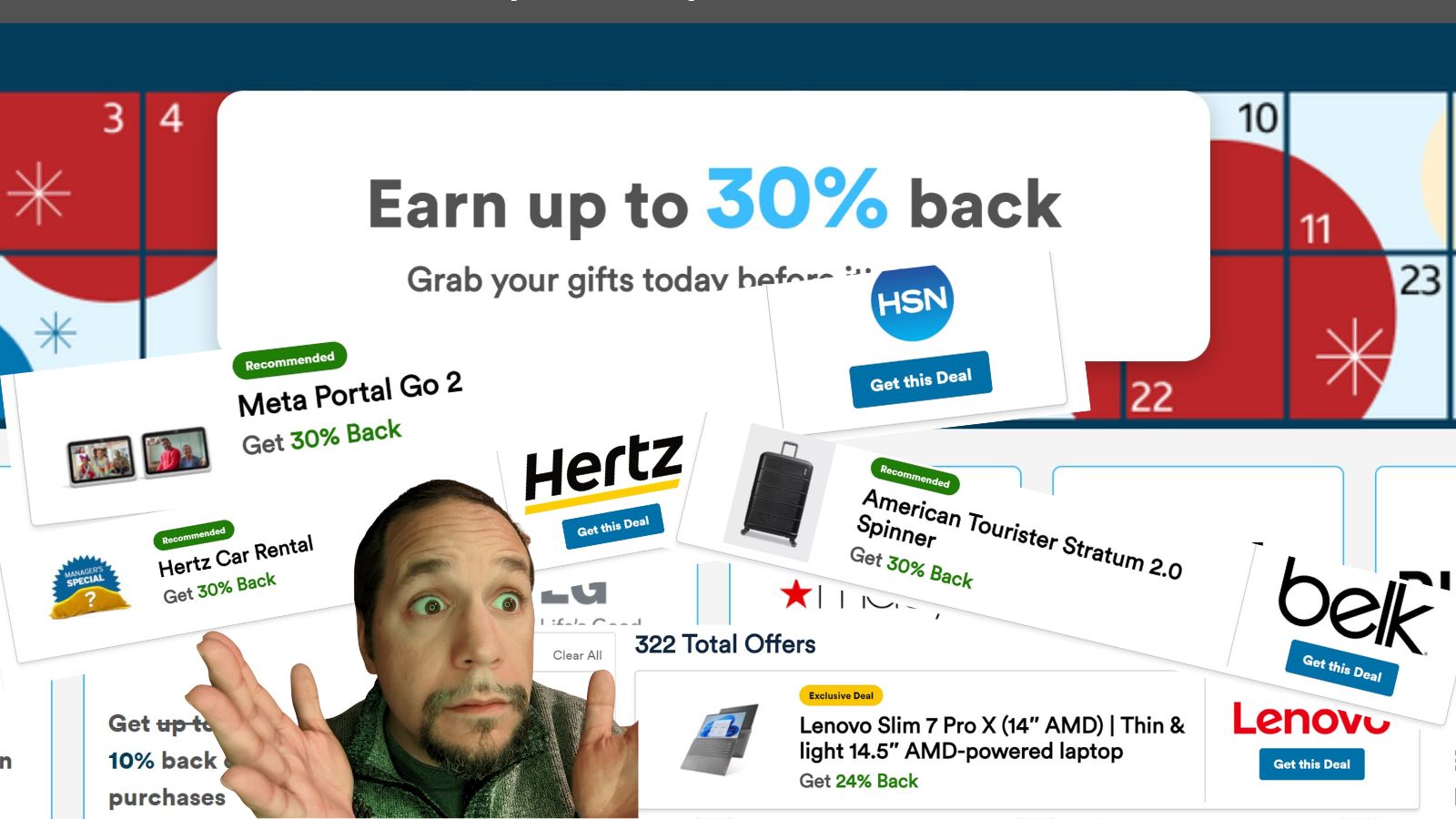

Don’t ignore Capital One Shopping

We’ve written a lot about Capital One Shopping over the past year. While cash back rates had cooled for some months, I continue to see fantastic targeted offers when visiting their website, with rates many times offering from 12-30% cash back at many popular stores. As I’ve noted before, you don’t just want to go to to the website or app and search for a store, but rather you want to scroll the targeted offers on the home page and/or use the filter tool on the home page to see the very best rates. Some stores will show more than one button with different rates, so you obviously want to choose the best rate.

Also keep your eye on emails from Capital One Shopping. I frequently get even better targeted email offers than those seen on the website. For example, within the past week, I’ve received offers for 12% cash back at GiftCards.com and one for $80 back on $450 at GiftCards.com. In recent times, I’ve also received targeted offers for as much as 18% back on IHG, 21% back on activities booked via TripAdvisor, and high rates at many department stores. It’s worth keeping an eye on this portal for its non-public offers.

It is also well worth checking out Capital One Shopping right now given the generous sign up offer they are running ($75 for both sides at the time of writing when you sign up as a new customer and spend $10 within 30 days).

Sign up for new portal offers (and do it in multi-player mode!)

You can earn a substantial return just by signing up for and trying out new shopping portals. As noted above, Capital One Shopping is currently offering $75 back when you sign up through the right referral link and spend $10 or more through the portal. That’s a fantastic offer, but it isn’t the only one. We’ve also recently written about a $40 offer for both sides from Rakuten and a $30 offer for new accounts from BeFrugal. In two player mode, this can add up quickly to a substantial return on your holiday shopping (particularly if you’re also stacking the referral bonus by referring Player 2). You could easily wind up with $300 or more just from signing up for portals.

And don’t forget to get the other players in your household involved. That $75 bonus for both sides means that now may be a good time to teach your adult children / siblings / in-laws about shopping online!

Before the shopping portal: Know portal best practices

Any time we write about shopping portals, we get a comment from someone who has sworn off one portal or another over an order that failed to track. In my personal experience, which includes having earned thousands of dollars in cash back and millions of miles from multiple shopping portals, I rarely ever have an order fail to track properly when I’m following shopping portal best practices.

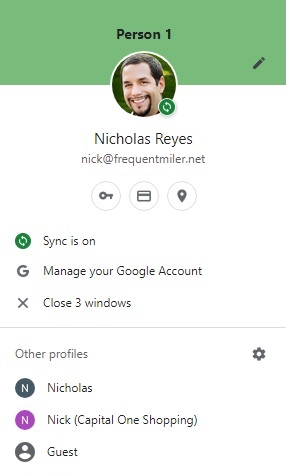

For me, that includes using one browser to shop / search for coupon codes / etc and a fresh browser when I’m ready to actually buy. When I am ready to buy, I go to that fresh browser, I click through from the portal, add the items I want to my cart, and check out in one smooth movement. My “buying” browser does not have any shopping extensions or buttons installed (except for the browser instance where I use Capital One Shopping — and I only use that browser profile when I’m going through Capital One Shopping. Google Chrome lets you set separate profiles, so I only have that extension installed in a profile that I only use for Capital One Shopping).

I do this to make sure that a click doesn’t accidentally get “stolen”. Many of the shopping buttons and browsers are designed to get you to click on something during checkout to “check coupons” or compare prices — and clicking on that button will likely move the tracking cookie to that button, eliminating your intended portal return. The same often happens when you click a box to “reveal” a coupon code on a coupon site — the commission for that sale often goes to whichever site you clicked last (which can steal the click from your chosen shopping portal — and if your chosen portal doesn’t get paid, you won’t be either). When making an especially large purchase through a portal, I’ll often take screen shots of the rate I saw before clicking through and perhaps one during or after the check out process. I don’t tend to worry much about this in situations where the expected rewards are very low, but if I’m spending a large sum of money and I expect to earn a substantial return, I keep screen shots. I’ve heard of others taking a screen capture video. In at least one case, those screen shots helped me when following up about $400 in cash back that had gotten clawed back (I think because my order shipped in multiple shipments).

Keep in mind that tracking issues and speed often have more to do with the merchant than the portal itself. It is very unlikely that a shopping portal is going to the trouble to try to prevent you from earning ten bucks in cash back than it is that there was a breakdown in the communication process. The portals make money by customers repeatedly visiting them and clicking through to merchants (they earn a commission and pass along a piece to the customer). They stand to make a lot more money in the long run if everything works smoothly. I try to do my part in the equation by shopping with a fresh browser, ec.

Before you click through and buy, check for card-linked offers

Before you even get to the shopping portal, you want to look for card-linked offers that might help you save more on your purchase. Some examples that come to mind include:

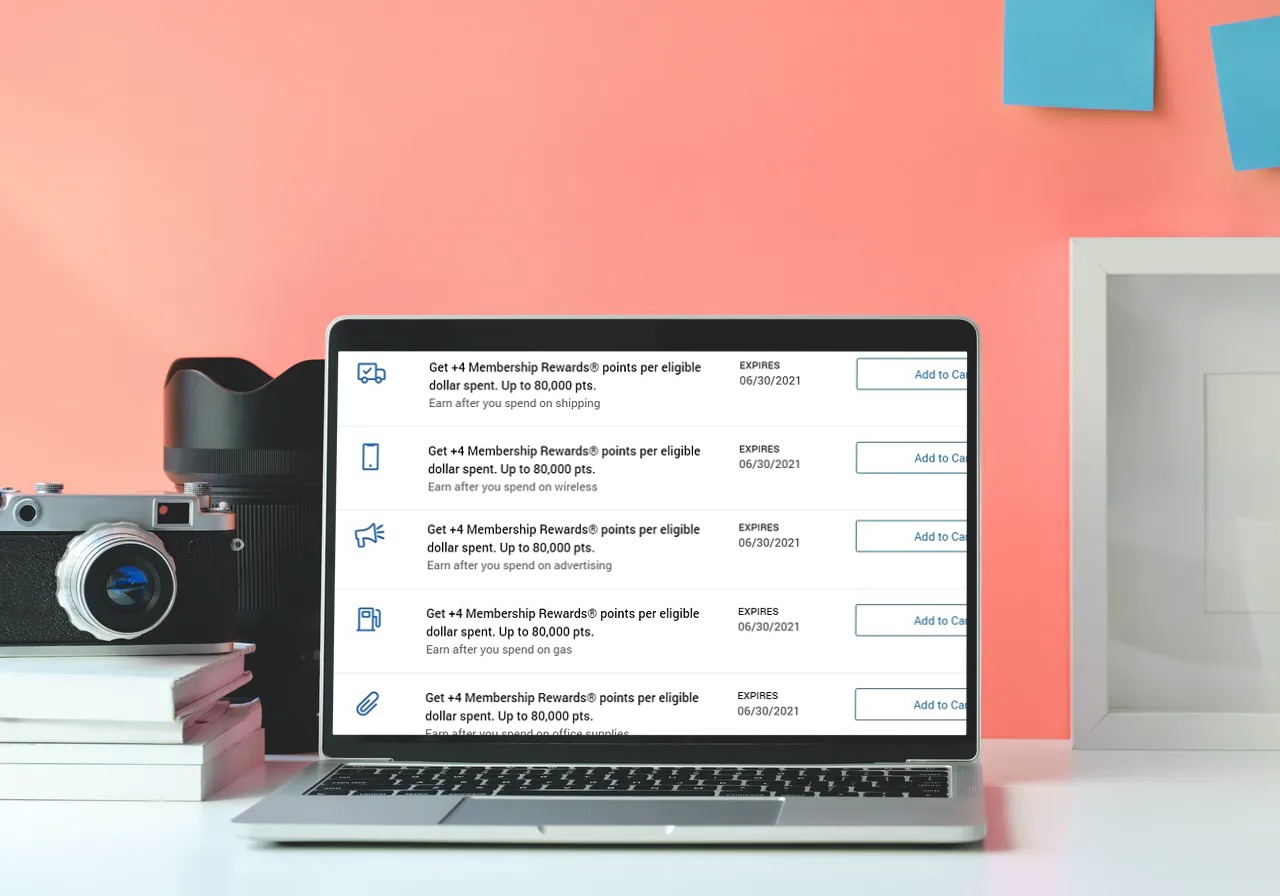

- Amex Offers

- Chase Offers

- Citi Merchant Offers

- Bank of America, Wells Fargo, US Bank, and others have card-linked offers as well

- American Airlines SimplyMiles

- JetBlue card-linked offers

- Major airline portal in-store offers (sometimes work online)

- Rakuten in-store offers

- Visa Savings Edge

- Dosh

- Many more

Stephen has written an entire resource post about card-linked offers and which ones stack. I can’t possibly rehash that entire post here, so it’s worth reading that one if you’re passionate about maximizing your stacking.

However, the gist of things is that you can sometimes stack multiple card-linked offers. For instance, you may be able to trigger both a Citi Merchant Offer and an American Airlines SimplyMiles offer on the same purchase (sometimes these two do not stack).

Sometimes, “in-store” offers are just linked to making a purchase processed by a given store and they will work whether shopping in-person or online, which can create an extra layer of stack (along with a shopping portal).

A tip I’ll circle back with later in this post is to look for opportunities to buy the things you want from stores with overlapping opportunities. For instance, do you want a new Tumi carry-on bag? Almost every major department store carries those, so check for which one offers the maximum opportunity to stack a portal with card-linked offers.

There are also sometimes opportunities to stack card-linked offers with gift card purchases, but proceed with caution. For instance, we’ve seen Dosh lock up accounts over too many Office Depot gift card purchases. Along the same lines, we reported a Rakuten in-store offer for Staples the other day, but I have heard occasional reports of people receiving warning letters for too much in gift card purchases. The JetBlue card-linked offer for Lowe’s earned me a nice cushion of JetBlue points whenever Lowe’s would run their in-store offers for a $15 Lowe’s gift card with a $200 Visa Gift Card purchase, but Lowes was sadly removed from their program entirely eventually.

Shopping portals and card-linked offers often say that they exclude gift card purchases. Your mileage may vary in terms of the enforcement of terms. We frequently find that gift card purchases work.

It’s not too late for a new card

I made a number of gift card purchases this week for resale and I was momentarily kicking myself for not having opened a new credit card in anticipation of this week’s sales. But the truth is that it isn’t necessarily too late to stack a new card bonus with your shopping portal and card-linked rewards for a great return on holiday shopping.

Some issuers provide an instant card number upon approval. Doctor of Credit maintains a list, but the most relevant options that come to my mind are Amex cards and the Bilt credit card.

In most instances, Amex will offer an instant card number upon approval (note that this isn’t guaranteed; it usually works, but I’ve also had times when it didn’t). While there were some concerns for a while about purchases on the instantly-generated number not counting toward welcome bonus spend, I used the temporary number to make property tax payments on a new card earlier this fall without any issue (I got the welcome bonus as expected). Do keep in mind that you may not have access to your entire credit line with the temporary number.

The Bilt Mastercard also offers an instant virtual card number in the app upon approval. Keep in mind the current Rent Day offer to earn double points on non-rent purchases between 11/23-11/27/23, which could make these few days a good time to open a Bilt card if you already had it in mind.

Finding Deals

This year is the first year in a while that I haven’t been glued to the screen looking for deals, but I have been using several tools to browse offers.

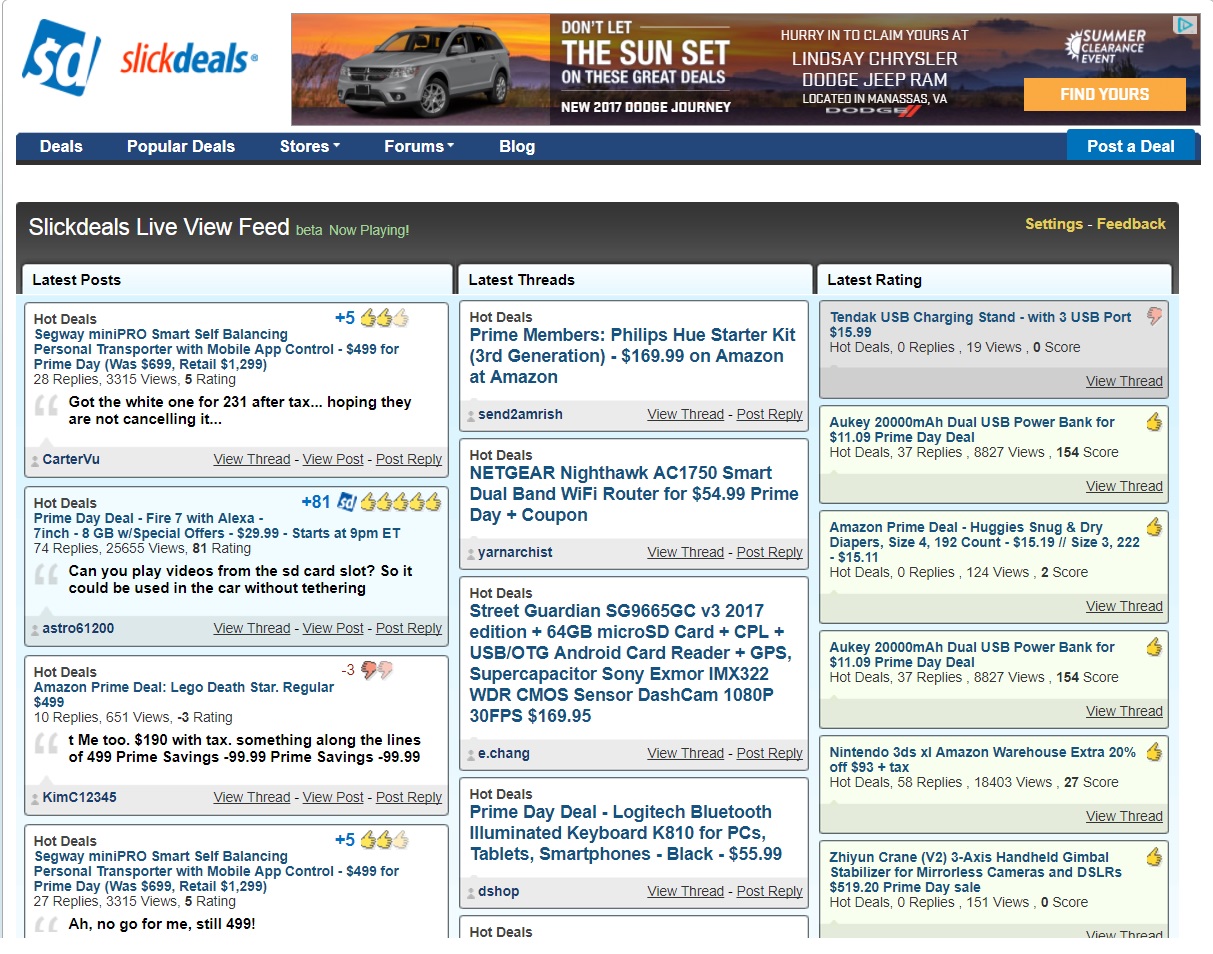

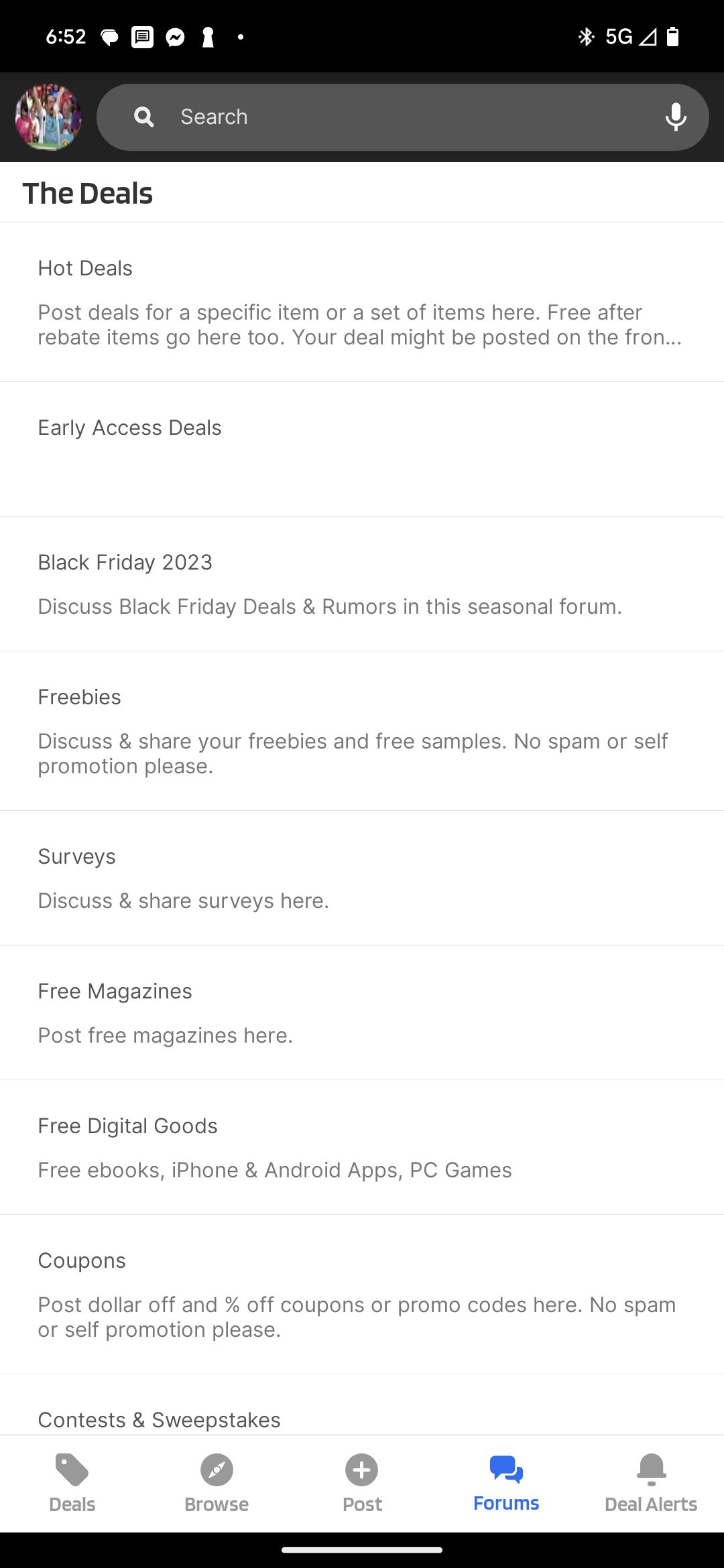

Slickdeals Live View and App

I have been using Slickdeals for around a decade to find crowd-sourced deals (and, crucially, to read comments about the deals from users — this often helps me quickly evaluate deals and/or find hidden gems that go beyond the headline).

The two main ways I use Slickdeals are Live View and the app.

The Slickdeals Live View can be a little overwhelming, but it can be a great way to get the pulse of what’s going on regarding deals. You can find it at this link. You can customize which feeds you want to access, but I leave it on the default “hot deals” forum. The page refreshes every few seconds with the latest comments on deals in one column along with columns for the most recently posted threads and thread ratings. I find this useful because I’ll sometimes see a comment within conversation about a deal that alerts me to something I’d have missed by just browsing titles (like if a coupon applies in an unexpected way or a retailer sells an item I wouldn’t have considered, etc).

I also use the Slickdeals app, almost exclusively visiting the “Hot Deals” forum shown at the top here. I find that to be an easy way to visually scan headlines by quickly scrolling through. I’ll refresh periodically.

I should note that I mostly ignore front-page deals on any shopping site. I know that many (most? all?) of the deals found on a shopping home page may only be there for the purpose of generating commission for that site. There are of course exceptions where an exceptional user-generated find makes its way to the front page, but I’d rather check on forums entirely driven by user-submitted and user-evaluated deals rather than “staff-curated” deals. To be clear, that’s true with plenty of other shopping sites as well (certainly not just Slickdeals).

Twitter / “X”

I don’t use Twitter (er, “X”) nearly as much as it is an increasingly abandoned platform, but I still subscribe to alerts from Dan’s Deals and Doctor of Credit here and I like that this continues to alert me to new posts from both. Sometimes there are so many notifications that I inevitably miss many of them, but I like having quick access to them nonetheless.

While Dan’s Deals posts many, many deals that aren’t relevant or of interest for me, I find it very easy to scroll past the deals that aren’t applicable to me. Now and then, I first learn of some real gems here. For instance, I have long mostly ignored the Virgin Atlantic 33% off sale that happens a couple of times a year (including right now). But yesterday, I learned that awards departing South Africa have more reasonable surcharges — and there happened to be four seats from Johannesburg to New York on a day that was almost perfect. Yes, I was that family member sitting at the Thanksgiving dinner table with my laptop booking a flight while others were picking after up the desserts :-). I should add that I noticed that Dan’s Deals just recently launched an app, but I haven’t yet checked it out.

Doctor of Credit also posts many great deals and I find the Doctor of Credit Twitter feed to be easy to scroll at a quick glance to determine which headlines might be of interest. I like having both feeds in one place and I’ve never gotten accustomed to an RSS reader, so “X” has become my RSS reader of sorts for deals.

Checking rarely discounted stores / brands

I’ve mostly moved past the Black Friday doorbusters (in many cases, I know that I can find similar deals at other times of year or that the ultra-discounted Black Friday model may be missing features I’d like to have). However, I find the Black Friday / Cyber Monday period to be a great time to score a deal on rarely-discounted items.

Many retailers that rarely discount their products do participate in the Black Friday / Cyber Monday marketing push, so it can represent a rare chance to get a discount on certain products.

I find that to be particularly true when considering some of the stacking opportunities and/or portal rewards at various stores. When I see a store with a great portal rate or card-linked offer, I’ll often check through the assortment of items they sell looking for any unexpected opportunities. Did you know that Bloomingdale’s sells car seats? Or that Neiman Marcus sells massage guns? Or that Home Shopping Network sells donations to St. Jude Children’s Research hospital? (no, I don’t know if that last one stacks with a shopping portal)

As an example, I saw a targeted Capital One Shopping rate of 24% back at Home Shopping Network earlier this week. My wife and I had been considering the purchase of a Nintendo Switch, so when i saw the 24% cash back rate, I checked whether HSN sells the Switch. It turns out that they do. They only sell it in bundles you won’t find elsewhere, but as I did the math, I found that we could get the system and more games for less money by taking advantage of the portal rate at HSN. We ultimately decided not to buy a Nintendo Switch right now, but the bottom line is that I never would have thought to shop for one there if not for a great cash back rate — and I was surprised when I found that their bundle, combined with 24% cash back, beat what I could find via other Black Friday deals.

I am therefore always on the lookout for a great portal rate and any stacking card-linked offers….and then for what that store sells that I may not have associated with it.

Accept that if you’re just starting, you’re too late (but not for the reason you think)

No, I don’t mean that you’re too late to get a good deal. Goodness knows that we will continue to see (and report here on the blog) plenty of great deals today, all through the weekend, on Cyber Monday, and beyond. If there is one thing I’ve learned in this game over time, it is that there is always another deal coming along.

Instead, what I mean is that one’s ability to find a great deal is often largely influenced by how long one has spent looking for it. That’s not because finding the best deals requires incessant hunting to uncover the hidden opportunity — it’s because regular searching will build the familiarity with “normal” deals to help you recognize when a deal is truly special.

In my years of deal-hunting, the skill I have come to appreciate the most is the ability to recognize a hot deal when I see it. If you don’t ever search for airfare to Europe and you start looking for airfare deals on “Travel Tuesday”, how will you know whether Travel Tuesday has a slamming deal on airfare…..or if it’s entirely a marketing gimmick with the same fare you could get any day of the week all year long…..if you don’t have a solid handle on what makes for a “normal” deal?

Many of the best deals I’ve ever gotten have simply been because I recognized it was an incredible deal that wouldn’t last and that I may not see again. But I also have plenty of memories of deals I missed because I didn’t recognize how phenomenal they were in the moment.

So when I say that you’re “too late” if you haven’t started looking for a deal, I don’t mean that you are too late to get a deal — but rather that you are late in the game for building the ability to recognize which deals are worth pouncing and which are all marketing fluff. You’re not really too late — but in preparation for the future, I recommend familiarizing yourself with prices over time for major purchases, whether that’s airfare or hotels or cars or houses or just about anything.

Bottom line

You’ll see tons of deals advertised as “must-buys” in the coming days. Some of them are indeed must-buys, but you can make a good deal a great deal or turn a great deal into a truly memorable one by looking for the right stacking opportunities. And then, by practicing those skills throughout the year, you can wade through the marketing fluff and find those deals that you truly must get — whether on Black Friday or a random Tuesday in March.

It would be nice if Cash Back Monitor could provide historical data for a given store on a specific portal (as opposed to the overall best). My shopping is focused on specific points currencies. I don’t particularly care about Retail Me Not or Swag Bucks (for example).

While not often useful for portal or card offer stacking I want to echo what Nick said about rarely discounted stores/items running sales just to join in on the Black Friday marketing. It’s one of the only times of year I can find discounted hardware for hobby robot building and a local HVAC contractor is running specials on ductless mini-split installs.

More related to this site, you can sometimes find good discounted rates on independent or boutique hotels. I remember getting somewhere in the 40% – 50% discount range on rates at the Royal Palms in Phoenix for an anniversary booked years ago on Black Friday before they became a Hyatt property.

Is there a site or app that aggregates all known card-linked offers?

For example, lets say I want to buy something at say Macy’s and have cards with many banks but I value my time so don’t want to check each card account every time I have a new purchase in mind for possible offers. If there was a way to know that say only Citi currently has targeted Macy’s offers, then I could just check my Citi cards to see if I am targeted for the Macy’s offer and don’t need to check 5 different places.

Does anyone know if this exists?

I’m only aware of the Amex link which lists current Amex deals, but I would sure love something like you’ve described.

Amex link in case someone doesn’t have it: https://frequentmiler.com/current-amex-offers/

Anyone know how long it takes for shopping trips to show on the capital one shopping portal? I forgot to screenshot the activated walmart deal through cap one, but I do have the order #.

Cashbackmonitor is all messed up today… can’t even search for merchants.

Lots of great stuff here – thanks! But I don’t think I saw the word “stackery” anywhere! Don’t give up on that word yet! 🙂

Would’ve definitely signed up for Bilt for black friday shopping if they hadn’t taken away 5x signup bonus. Just not worth burning a 5/24 slot, even though I pay $35k a year in rent.