NOTICE: This post references card features that have changed, expired, or are not currently available

When I saw the new offers on the Chase Freedom and Chase Freedom Unlimited cards last week, I was pretty excited. We had the ability to add one of these cards in my household and the offer and timing were right for us. The key question for me to answer was Freedom or Freedom Unlimited? The truth is that you can’t really get this one wrong in the sense that Chase makes product changes and credit limit reallocation so easy that it really won’t matter much which you choose in most cases. However, I had to make a decision and wanted to share the logic I followed in making it.

The Offer

Both the Freedom and Freedom Unlimited credit cards recently unveiled new welcome offers as follows:

| Card Offer and Details |

|---|

ⓘ $296 1st Yr Value EstimateClick to learn about first year value estimates $200 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn $200 (*awarded as 20,000 points) after spending $500 in the first 3 monthsNo Annual Fee Alternate Offer: Rakuten is offering bonus cashback or bonus points for this card This card is likely subject to Chase's 5/24 rule (click here for details). Recent better offer: Unlimited Double Cash Back for 12 month (expired 1/11/24) FM Mini Review: Great for 3x categories and 1.5X everywhere else. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5x travel booked through Chase Travel℠ ✦ 3x dining ✦ 3x drugstores ✦ 2% cash back total on qualifying Lyft products and services purchased through the Lyft mobile application through 09/30/2027 ✦ 1.5X everywhere else Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ $10 quarterly credit for non-restaurant DoorDash orders See also: Chase Ultimate Rewards Complete Guide |

| Card Offer and Details |

|---|

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer availableNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great for 5X categories. Good companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Earning rate: 5X Lyft through September 2027; 5X in rotating categories on up to $1,500 spend per quarter Base: 1X (1.5%) Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ $10 quarterly Instacart credit ✦ 3 months free Instacart+ See also: Chase Ultimate Rewards Complete Guide |

These cards have featured a welcome offer with 20K points after $500 in purchases for a while, but the additional inclusion of 5x groceries for a year (on up to $12,000 in purchases) is a huge bump. Ever since the debut of the Chase 5/24 rule, applying new for the Freedom cards has been hard to justify: while they are a good fit for those just starting out with credit cards, the welcome bonuses were just too low to be worth a coveted 5/24 slot to long-time rewards enthusiasts. One could get a more valuable bonus with a Chase Sapphire Reserve or Chase Sapphire Preferred and later product change to a Freedom or Freedom Unlimited. Alternatively, those who would consider applying for a business card would likely find the Chase Ink Business Unlimited more appealing than the Freedom Unlimited thanks to a much larger welcome bonus and identical earning structure.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Unfortunately, Chase made the Sapphire-then-downgrade-to-Freedom path a lot more challenging when they instituted the 48-month restriction on Sapphire cards a couple of years ago. If you want a Freedom or Freedom Unlimited card, this leaves you to choose between getting a Sapphire card every four years that you can eventually downgrade, or biting the bullet and applying new for a pretty low offer on a Freedom variety. That’s what makes the new offers exciting in my opinion: it doesn’t feel like you’re giving up much if you can earn up to 60K points on grocery purchases in the first year (in addition to the initial 20K bonus) and you gain a valuable card in either the Freedom or Freedom Unlimited. Given that many families spend around the $12K cap on groceries over the course of a year and that many in our rewards community spend even more than that at the grocery store each year, the new offers look like easy wins for many people.

The key differences

Both the Freedom and Freedom Unlimited cards are advertised as earning cash back, but the “cash back” comes in the form of valuable Ultimate Rewards points that could be moved to a Sapphire Preferred or Reserve card if you have one in your household. We therefore talk about the cards in terms of the number of Ultimate Rewards points earned with them.

The key differences between the Freedom and Freedom Unlimited cards is of course the earning structures:

- The Freedom Unlimited card offers 1.5x Ultimate Rewards points everywhere

- The Freedom card offers rotating 5x categories each quarter on up to $1500 in spend per quarter

This means that there are technically more “bonus points” added to the Freedom card for this new offer: given that the Freedom card ordinarily earns 1x at grocery stores (unless grocery stores are a quarterly bonus category), this new offer adds 4 bonus points per dollar spent on grocery store purchases. The Freedom Unlimited card ordinarily earns 1.5x everywhere, so the new offer adds 3.5 bonus points per dollar spent on grocery store purchases.

Update: It’s worth noting that the grocery bonus stacks with quarterly bonuses on the Freedom. For example, during the current quarter (2020 Q3), Whole Foods and Amazon are the quarterly bonuses. Since Whole Foods is a grocery store, I tested a purchase at Whole Foods and can confirm that I earned the base 1x + 4x for the quarterly bonus category + 4x for grocery store purchases in the first year for a total of 9x. I had purchases to make at Amazon, so I bought Amazon gift cards at Whole Foods to get a total of 9x. Note that this doesn’t make any difference in the overall numbers if you would otherwise max out the quarterly bonuses and the grocery bonus, but it does mean that you can max out both with less spend during quarters in which grocery stores are a bonus category. We typically see at least one category with a grocery bonus each year. I have updated our post about the Freedom card bonuses accordingly.

That difference is likely academic. Either way, you’ll earn the same 60K Ultimate Rewards points with $12K spend at grocery stores in the first year — how much of those points are a “bonus” doesn’t matter practically-speaking (though for Freedom card holders, it might mean the chance to get 9x if the 5x quarterly bonus includes grocery stores and this extra 4x stacks with it – we don’t yet know if it will).

More pertinent to the decision as to which card to apply for now is what the difference would be in your annual point totals depending on which card you choose. Both cards will earn up to 60K points in grocery purchases in the first year, but which card will yield you more points apart from that bonus?

With the Chase Freedom card, if you were to avoid all 1x spending and you were able to magically spend exactly $1500 each quarter in the Freedom card’s 5x categories, you would earn a total of 30K points:

- $1500 each quarter at 5x = 7,500 points per quarter x 4 quarters = 30K points

The question then becomes this: Would you earn more than 30K points in non-bonused purchases on the Chase Freedom Unlimited? If you spend more than $20K per year on purchases that you’d make at 1.5x, you would earn more total points with the Freedom Unlimited. If you’re not sure that you’ll max out the 5x categories on the Freedom card every quarter, the Freedom Unlimited breaks even at a lower threshold. For instance, if you would only max out 3 quarters of 5x spend on the Freedom card, you’d earn 22,500 points in a year. The Freedom Unlimited would therefore yield more points if you spent more than $15K on it in a year (on non-grocery spend or beyond the $12K cap).

In our case, the Freedom Unlimited fits our spending pattern much better given that we do a lot of unbonused spend. That is not to say that we wouldn’t enjoy the easy 5x categories on a Freedom card from time to time (indeed, I’ve often wished I had a Freedom card at times when the bonus category would have fit a purchase just right; with a baby on the way soon, getting 5x on diapers and wipes and baby stuff at Amazon this quarter looks appealing). But in years past, the Chase Freedom has sometimes featured a quarter with bonus categories like restaurants and movie theaters that would be more challenging for us to utilize fully. Of course, I doubt we’ll see a movie theater quarter any time soon given how things are going right now. The 2019 and 2020 quarterly bonuses would look good for us, so the Freedom may be a better fit now than before. Still, the Freedom Unlimited would likely yield us more total points each year — albeit with much more spend.

Leaning toward 1.5x everywhere

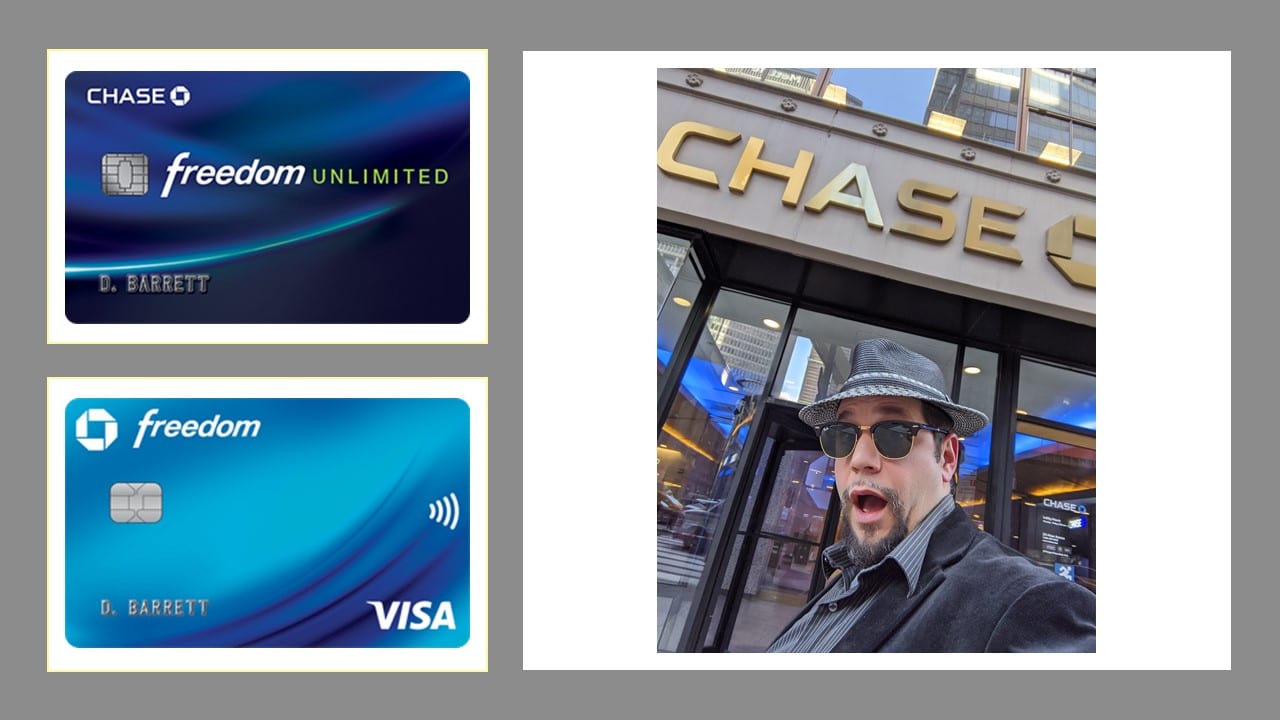

For our situation and spending pattern, I was leaning toward the need for a Freedom Unlimited card for my wife. I already have a Freedom Unlimited card, but she doesn’t. Given occasional large purchases for each of us, it would make sense for each of us to have a card that earns 1.5x Ultimate Rewards points per dollar spent.

However, Greg reminded me about the Chase Ink Business Unlimited that I mentioned above: in an ideal world, we would have that card for earning big chunks of rewards on large purchases and a Freedom card or two for easy points on low spend when quarterly bonus categories are convenient. That makes a lot of sense: The Ink Business Unlimited comes with a nice welcome bonus, there are some advantages to it being a business card, and it offers the same 1.5x everywhere that the Freedom Unlimited offers. Unfortunately, Chase has anecdotally tightened up considerably on business credit card approvals. That isn’t surprising given the current economic environment. We’ve heard a report or two of success with Chase Ink credit cards recently, but for every approval there have been dozens of denials. That said, my wife has a Chase Ink Business Preferred that could be downgraded to an Ink Business Unlimited for its preferable earning structure (albeit without a welcome bonus).

In other words, we already have a pretty easy downgrade path to 1.5x everywhere. The only downgrade path we have to the Chase Freedom card would be via my wife’s Chase Sapphire Reserve. I have certainly talked about getting rid of the Sapphire Reserve when the annual fee comes due this fall, though we aren’t there yet (and I’ve also said that while tempted to axe it, I’d likely keep it because it’s convenient to have from a blogging perspective despite the fact that I think the increased annual fee would not otherwise be worth it for us). Looking forward, Chase’s Pay Yourself Back feature certainly has me intrigued and I think we’ll likely keep the Sapphire Reserve for at least one more year, but it is possible to consider a product change on this card.

How does the pandemic affect the choice?

In an ideal world, it makes sense to have a high credit limit on a card that earns an excellent return everywhere. Whether my wife ultimately has a Freedom Unlimited or Chase Ink Business Preferred card in her wallet, we would want her 1.5x-everywhere card to have a sizable limit for large purchases.

On the other hand, the Freedom card is only likely to see $1500 in action per quarter in a normal environment. The first year grocery bonus means that the card will likely get a bit more exercise in year one, but beyond the first year the Freedom likely won’t need access to much of a credit line.

My wife’s Sapphire Reserve card has a pretty healthy credit limit. If we were to product change that card, it wouldn’t make a lot of sense to have that credit limit associated with a Freedom card. Of course, Chase makes it pretty easy to reallocate credit limits, so we wouldn’t have to keep that limit associated with that card if we product changed to a Freedom card — but at the same time, she doesn’t have other Chase personal cards where we’d want/need to shift that limit at the moment (keep in mind that Chase only allows you to reallocate limits consumer card-to-consumer card or business card-to-business card — you can’t move credit limit from a Sapphire Reserve to a business card or vice versa). I think her Sapphire Reserve could be a good candidate for an eventual downgrade to a Freedom Unlimited as that’s the card on which we would ultimately want the type of limit she currently has. If we were to downgrade her Sapphire Reserve to a Freedom Unlimited, we would downgrade her Ink Business Preferred to an Ink Cash rather than the Ink Business Unlimited.

Another consideration is that given the current environment, I thought that Chase may be stingier than usual. If they were going to be stingy with an extension of more credit, it would make sense to have that lower limit associated with a Freedom card. Of course, if she was approved with a limit that didn’t satisfy our needs, we could easily call Chase and move some limit from one of her other Chase personal cards.

Ultimately, my wife decided to keep it simple: we figured Chase would be stingy given the pandemic (and the fact that my wife has several other Chase credit cards) and we’d rather save ourselves from a phone call to reallocate limits if possible (with a very active and talkative toddler at home, avoiding an unnecessary phone call is a win). We decided that the Freedom card was the right call for now: it would give us long-term access to the quarterly categories and my wife would retain two easy downgrade paths to 1.5x everywhere.

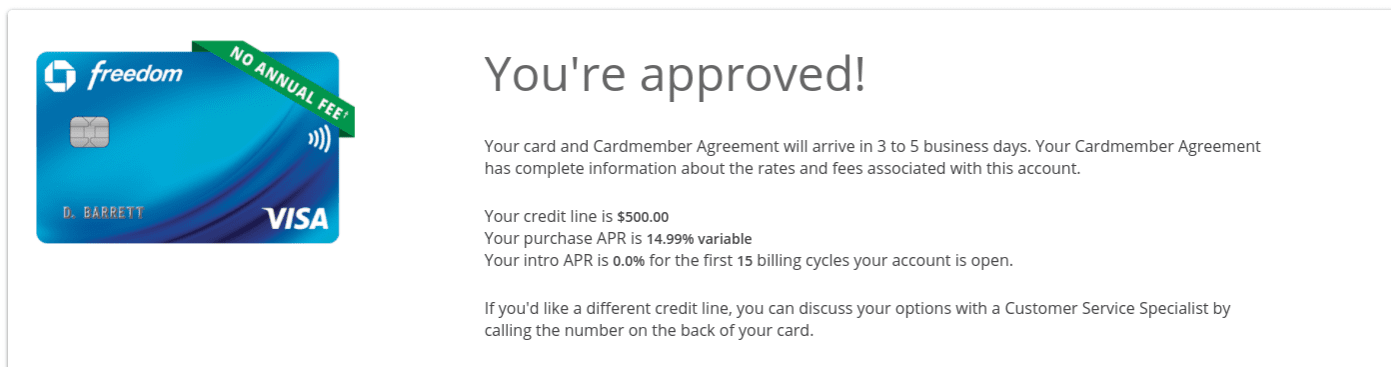

I was right. Chase was super stingy on the approval. In my post about the new Freedom offers last week, I noted that these cards tend to be easier approvals for many folks in normal times and in the current times may be a good choice since they can be approved with lower credit limits (thus likely an easier approval). I almost mentioned in the post that I think you can be approved with a limit as low as $500 on the Freedom cards, but I didn’t look it up to confirm that Chase does approve them quite that low. Well, now I can indeed confirm that.

The good news is that the card was approved and immediately showed up online. The inconvenient news is that she’ll still have to call to reallocate limits because the $500 limit will make it hard to take advantage of quarterly bonuses and will make it impossible to make $12K in grocery purchases in the first year without cycling the credit limit. Since cycling is a common trigger of account shut downs, I’d rather have a limit of at least a couple thousand dollars on this card. Again, that’s easy enough with Chase – we’ll just move some from another card — so the low approval is no big deal even if surprisingly low.

Update: A couple of readers commented below to note that you may be able to reallocate limits via secure message and save yourself a phone call. We tried that after publishing this post. It took 13 minutes to receive a response that the limits were reallocated as requested. That’s terrific and meant no phone call after all!

Bottom line

In our case, the 1.5x earning structure of the Freedom Unlimited would probably yield us more points in a year, but we still ultimately added the Freedom card instead since we have easy downgrade paths to 1.5x everywhere (and one such card in the household already) and expected a lower credit line that would more suitably fit the Freedom card. We didn’t anticipate just how low that credit line would be, so we ultimately didn’t save ourselves from a phone call to reallocate limits after all. Still, it will be good to have access to some easy 5x quarterly bonuses. If we decide that we really like having access to those, we can consider downgrading her Chase Sapphire Reserve to another Freedom card in the future (and picking up a Chase Ink Business Unlimited for 1.5x-everywhere). If we don’t think we’ll max out a second Freedom card, we can product change the Reserve to a Freedom Unlimited and have a useful credit limit straight out of the gate. Any way you slice it, the ability to pick up a Freedom card without feeling like we’re wasting a 5/24 slot feels like a win — and as noted at the top, since we ultimately have so many product change and reallocation options, there really wan’t any wrong answer to which one to get right now.

[…] multiplier. However, given the fact that the Citi Premier now offers 3x at grocery stores, the Freedom cards come with a limited-time first year bonus of 5x on up to $12K, and the Sapphire Reserve will now offer 3x on up to $1K per month through April 30, many of us are […]

My partner was declined immediately upon his application for CHase Freedom. He is under 5/24.

Is there DP that Chase has tightened their approval amid the pandemic?

It really caught me off guard.

Anyone gets approved again by Chase?

Should he open a Chase banking account first?

All banks have tightened up to some extent during the pandemic. Has he called the reconsideration line? You can find the number on our Best Offers page under the section about Chase. Assuming he has other Chase cards, I bet he can call and move credit limit from another card to get the Freedom open. It’s worth a call.

I have CSR & CFU among others including a Amex Green dated [sic] member from 1958. 90% of my charges are from overseas. The forex loading is a killer and I use CSR (rather than SDFCU & USAA which also have no loading) for nearly all my non-US purchases.

What is the expiration date for the increased offer?

None has been indicated.

Thanks

Is there a general rule of thumb for how long increased offers typically last? 4 weeks? 6 weeks?

Just trying to time my application with some other things I have going on.

by the way, love the podcast….though my family won’t let me listen to it on drives.

Unfortunately, there isn’t any solid rule of thumb. I’d say that we rarely see an issuer make an official change to an offer like this for less than a month, so I would guess that it would last at least that long, but I don’t know for sure. It’s certainly possible that it would last longer.

When we have been provided an offer end date that we can share with readers, we always include that in the offer information. In this case, we weren’t told when this would end (and when we aren’t told, that indicates that the issuer isn’t going to share that info far in advance of the end date). If we do get an official end date that we are able to share, we’ll certainly post that — but if that happens it likely won’t be until sometime near the end date.

When i saw the new sign up bonuses I started thinking the same thing. I even looked up all the previous years’ bonus categories to get an idea of how often I’d have a category i could max out.

However, i think deciding based on which card you’d be less likely get by downgrading probably isn’t applicable to most of your readers. I think judging how valuable the CF bonus categories are works better.

CFU offers 0.5% more on unbonused spending vs CF offering 3.5% more on bonuses. 1500×3.5% = 10,500×0.5%. So for each CF category a user can max out, he/she would need to spend $10,500 on unbonused spending on CFU to get to breakeven. For me, that is a heckuva lot of unbonused spending, even though I put my health insurance on my credit card.

i already have the 2% Citi DC/TY combo, but that is of limited use because Citi gives me credit lines that are only a fraction of my Chase credit lines.

Everyone’s welcome to disagree.

I already have two freedom rotating cards on my account, both well over two years old. Can I still get the signup bonus for either the unlimited or a third rotating freedom, or would I first have to close those two? Bad idea to get a third? I’m well under 5/24 lately so I’ve been itching

You can’t get a card that you currently have open, so you can’t get approved for a Freedom. You *can* get a Freedom Unlimited – that’s a totally separate card. It’s fine to get that with two Freedoms. Plenty of people have a setup like that.

Thanks Nick, looks like I’ll signup for an unlimited then!

Does 5/24 go by date or month?

in other words if my 5th card was Opened July 15 2018 am I good to go or should I wait until August 1?

by month. Wait until August 1

Mike is right.

If P2 uses my referral link (which doesn’t mention the extra grocery benefit), do you think P2 will still be able to take advantage of the new grocery bonus for the 1st year?

This is the kind of thoughtful comparison I’m always looking for but can’t find. The most important thing is what is the MAXIMUM you can earn in a year in points. You can max out 3X/5X categories (then what do you do with your life?), and this year, those same categories became a LOT less desirable, not to mention harder to accomplish.

Everyone needs a card for the stuff that doesn’t fit into grocery, office store, etc. brick and mortar categories. Those cards force you to spend money in places for things that’d be cheaper literally anywhere else. Think about it.

I was approved for the Freedom in June 2020 with a low credit limit too. Chase said it would honor this promotion (haven’t used the card anywhere besides Whole Foods yet), so when I’m ready to try it (doubt I’d really spend more than $500 in groceries per month right now though), I can move some credit from my Freedom Unlimited or Sapphire Reserve. Easy to do with Chase!

Definitely the right decision going with the Freedom. The Unlimited had/likely will continue to have ongoing notable sign-up bonus offers the Freedom generally doesn’t. You leave yourself a path to a better CFU bonus in the future the route you are taking.

I don’t know whether Chase limits product changes between Freedom and Freedom Unlimited in the first year. If not, I don’t think Nick’s decision changes his future sign-up options since he could have always product changed away from the CFU in order to apply for it again (if he had chosen CFU now)

Didn’t know you could immediately product change, thought Chase had a waiting period – if that’s the case than yes, no difference.

There is definitely a waiting period on changing to/from a card with an annual fee. Between cards without annual fees, I’m not sure on a new account. I have product changed Sapphire–>Freedom Unlimited–>Freedom all within one week before (and then eventually back to Freedom Unlimited before ever using the Freedom lol).

@Nick Reyes,

Given your comments about business cards, I’d advise most that can get a business card to use the Ink Business Unlimited + Freedom cards. The Freedom unlimited becomes unnecessary at that point. In practice though, I use the American Express Blue Business Plus for non-bonused spend. Someone without access to business cards is likely better off with the Citi Double Cash for the same reason, 2x > 1.5x. I suppose you may want this set-up if you are solely within the Chase UR ecosystem though. One other option is the Bank of America Travel/Premium Rewards for those who qualify for Platinum Honors and prefer cash.

Nick, why would you want the Freedom Unlimited for unbonused spend? Dont you have a Citi Double Cash, so are you saying you would prefer the 1.5x UR points to 2x TY points?

It’s not a one-or-the-other for me. Simon allows a lot of volume. If I had to pick one card, I’d be with Greg — the Bank of America Premium Rewards card with Platinum Honors. But in my case, it’s usually a matter of needing to spread the love around. I do get good value out of Ultimate Rewards points, so I’m happy to collect some of them along with some of everything else.

You can move credit using SM.

I thought they had stopped doing that via secure message, but after seeing your comments here I found DPs indicating that they may not have. Going to try this today.

I have definitely lowered my credit limit on cards multiple times this year via SM.

Yup, you guys were right. It literally took 13 minutes to get a response that the limits were reallocated as requested. Awesome. Thanks! Updated the post.

Your post reminded me I needed to move some credit on my Chase cards. I called literally just now–3 minutes, done right away, no questions. In the past sometimes I would get asked why, but the customer service rep didn’t want any further info.

Even though the SM disclaimer said it would take up to a week to get a response, they got back within a couple hours and had already moved CL from my Marriott Bonvoy to my newly approved CFU, per my request. Very cool :). Thanks for sharing the data points!

I have been able to reallocate credit limits in the past by IM. Just a thought.