NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

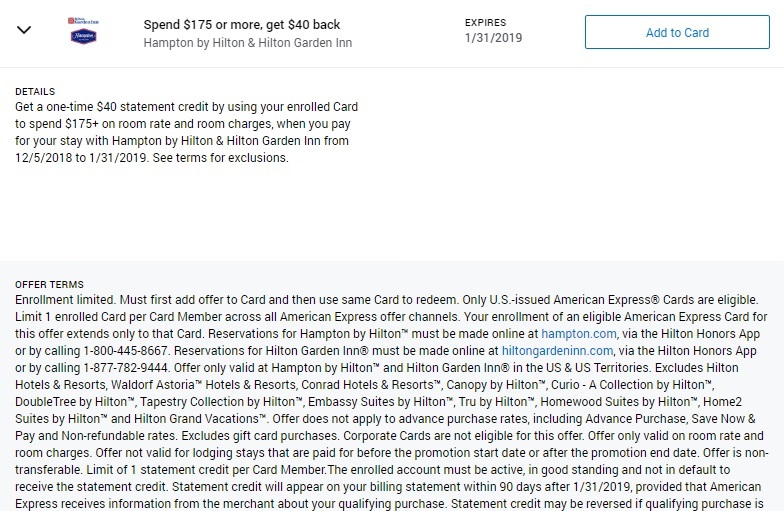

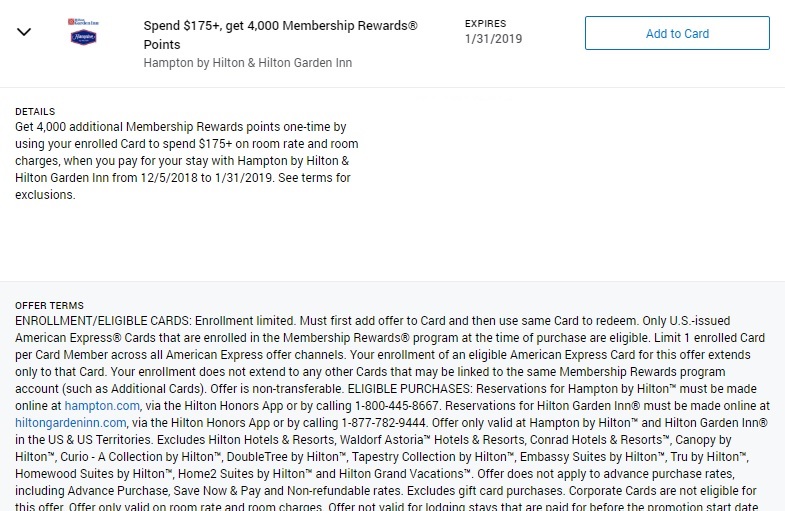

There are a couple of new Amex Offers out today for Hampton by Hilton and Hilton Garden Inn good for either 4,000 Membership Rewards points or $40 back (depending on your offer) when you spend $175 or more. That’s a decent return on spend, and it’s even showing up on Hilton cards for some people, which makes it an even better deal as you may earn 7-14 points Hilton points per dollar on top of the statement credit depending on which card you’ve synced with the offer.

The Offer

- There’s a new targeted Amex Offer out: Spend $175+ at Hampton by Hilton or Hilton Garden Inn and get 4,000 Membership Rewards points or $40 back (see your offer for details

Key Terms

- Expires 1/31/19

- Only valid at hotels in the US & US Territories

- Not valid on any kind of advance purchase rates

- See your offer for full terms

Quick Thoughts

Again, this is a decent little offer for some money back on a Hampton Inn or Hilton Garden Inn stay. I love to see offers like these around the holidays, when many of us will drive to see family and may need a hotel overnight on the way there or back. The low spend threshold makes this one pretty easy to hit with just one or two paid nights, and my experience in the past has always been that cumulative spend triggers the offers (i.e. if you spend $175 or more over 2 separate stays, that usually triggers the offer).

Keep in mind that this is only valid in the US and US territories and it excludes prepaid rates. I rarely book a prepaid rate since the savings don’t outweigh the flexibility of changing plans if someone gets sick, you want to jet off to London on 8hrs notice, etc.

I haven’t had any luck syncing an offer to multiple cards lately, but you should at the very least be able to sync one card with the Membership Rewards version and one card with the statement credit version (assuming you were targeted on both types of cards).

If you were targeted on one of the Hilton cards, you can also stack a good earn rate from your card. As a reminder, these are the current earn rates for Hilton hotel spend on the various Hilton cards (see the “brand” earning in the table below):

| Card Name w Details No Review (no offer) |

|---|

$550 Annual Fee Earning rate: ✦ 14X Hilton spend ✦ 7X US restaurants, flights booked directly with airlines or amextravel.com, select car rental companies ✦ 3X on all other eligible purchases ✦ Terms & Limitations Apply. Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Additional free night awards after $30K and $60K in eligible purchases in calendar year Noteworthy perks: ✦Annual Free Night Reward every year upon renewal ✦ Free Diamond Status ✦ Up to $400 Hilton Resort Credit per calendar year ($200 semi-annually) ✦ $200 Flight Credit (Up to $50 per quarter for purchases directly with airlines or via Amex Travel) ✦ Up to $209 CLEAR (R) Plus fee credit per calendar year ✦ Up to $100 on-property credit w/ Aspire Card package ✦ Terms Apply. See Rates & Fees See also: Amex Hilton Aspire In-Depth Review |

$150 Annual Fee Earning rate: ✦ 12X Hilton spend ✦ 6X U.S. restaurants, U.S. supermarkets, and U.S. gas stations ✦ 4X U.S. Online Retail Purchases ✦ 3X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: ✦ Free night award after $15K in eligible purchases in calendar year ✦ Hilton Honors™ Diamond status with $40K in eligible purchases in a calendar year ✦ Terms apply Noteworthy perks: Automatic Hilton Honors™ Gold status. Hilton Honors™ Diamond status w/ $40K in eligible purchases in a calendar year. ✦ Up to $200 in Hilton credits ($50 per quarter) ✦ Terms Apply. |

$195 Annual Fee Earning rate: ✦ 12X Hilton spend ✦ 5X on other eligible purchases (on the first $100K in purchases per calendar year, 3X Points thereafter). Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Hilton Honors™ Diamond elite status with $40K in eligible purchases in a calendar year Noteworthy perks: ✦ Automatic Hilton Honors™ Gold status. Diamond status w/ $40K in eligible purchases in a calendar year. ✦ Up to $240 in annual credits for eligible Hilton purchases (Up to $60 per quarter) ✦ Complimentary National Car Rental(R) Emerald Club Executive(R) status (enroll through the link on your American Express online account) ✦ Terms Apply. (Rates & Fees) |

No Annual Fee Earning rate: ✦ 7X Hilton eligible Hilton purchases ✦ 5X US restaurants, US Supermarkets, and US gas stations ✦ 3X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Gold elite status with $20K in eligible purchases in calendar year Noteworthy perks: ✦ Free Silver status; Gold status with $20K in eligible purchases. ✦ Terms Apply. |

Overall, this won’t drive me to book a stay I wouldn’t have otherwise, but I’m always game for picking up a few extra points or some cash back when possible.

[…] are frequently Amex Offers for Hilton brands, such as spend $175 at a Hampton Inn or Hilton Garden Inn and get $40 back or 4,000 Membership Rewards. These can be a great way to save money on hotel stays, but there’s one issue with […]

[…] HT: Frequent Miler […]

[…] Hat tip to Frequent Miler […]

[…] Hat tip to Frequent Miler […]

[…] Hat tip to Frequent Miler […]