NOTICE: This post references card features that have changed, expired, or are not currently available

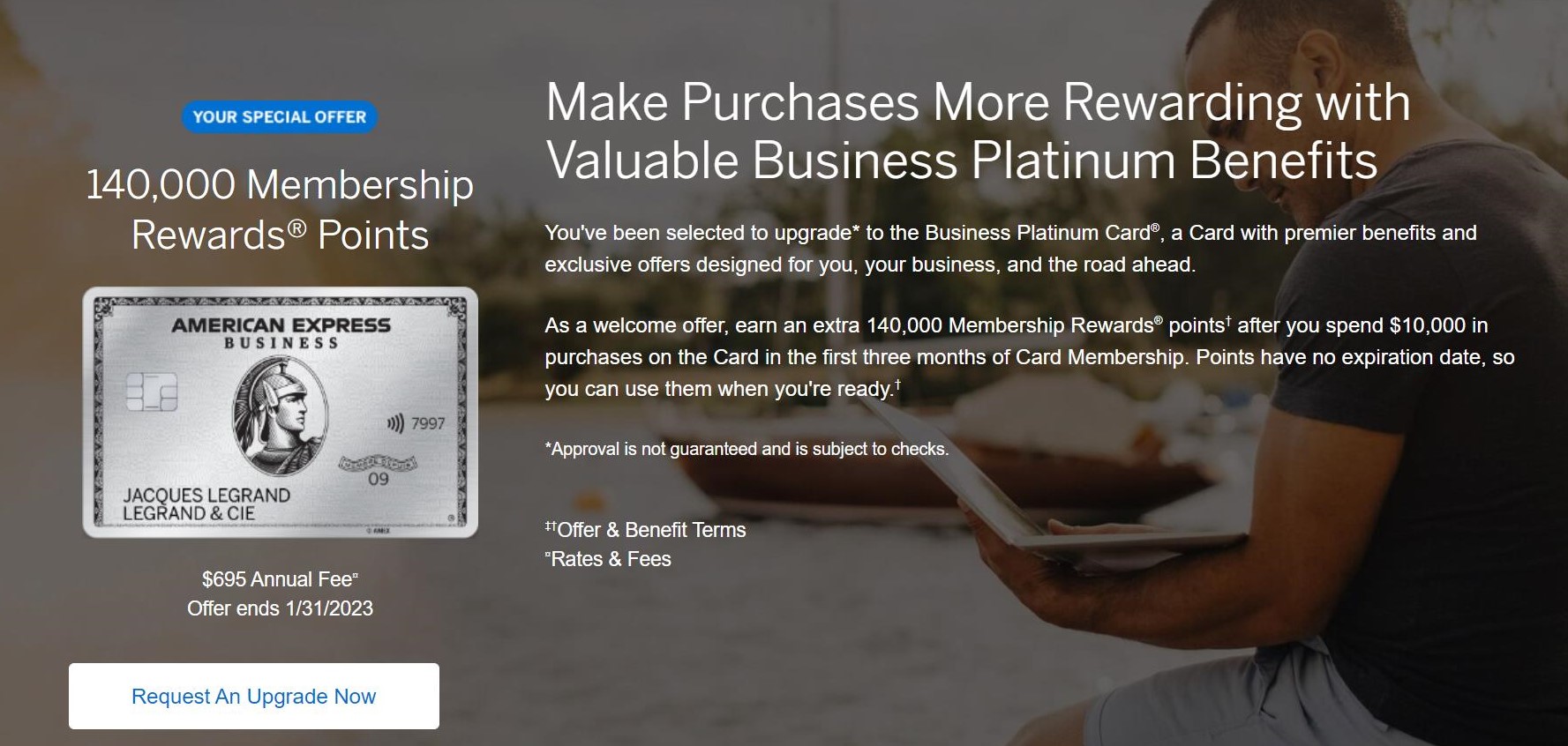

There is a massive targeted upgrade offer for the Amex Business Platinum that started appearing on some Amex business cardholders’ accounts over the weekend. It seems to be targeted just at Business Gold cardholders (although it could be that some Business Green cardholders are targeted as well) and offers 140,000 points for $10K spend within the first three months. I believe that this would be the best upgrade offer that we’ve come across for Business Gold to Business Platinum.

The Deal

- Targeted upgrade offer for American Express Business Gold Cardholders: Upgrade to Platinum and earn 140,000 Membership Rewards points after spending $10,000 in first three months of card membership.

If you get a screen like this (or a screen that says that this offer is no longer available), it means you’re not targeted:

Quick Thoughts

Here’s yet another entry in the steady stream of crazy Amex offers on consumer and Business charge cards. We’ve seen 150,000 Membership Rewards points after $6K spend for the consumer Platinum, 130,000 points for the Business Gold after $10K spend, another Business Gold offer for 180,000 points after $20K in spend and 250K after 30K spend for the Business Platinum.

But this is an upgrade offer, as opposed to a welcome offer on a new card. It’s been fairly common over the years for Business Gold cardholders to get targeted for an upgrade right before or after their first cardholder anniversary. But, in recent times, we’ve seen folks targeted for upgrades as soon as 2-3 months after completing the minimum spend on the Business Gold welcome offer. I don’t recall ever seeing an upgrade offer above 120,000 points, so this would be a new all-time high.

This upgrade offer should only be considered if you’ve already had, or currently have, the Business Platinum card. Otherwise, upgrading will cause you to become ineligible for new enrollment welcome offers on the card for at least the next 4-5 years.

However, if you’ve already had the Business Platinum (or have one now), this is a great deal. There is no hard-pull on the upgrade and neither your card numbers nor your card anniversary will change. You will be charged a prorated annual fee for the new card based on the time remaining until your next account anniversary. It effectively allows you to get a new cardholder welcome offer without actually opening up a new card.

There’s also several links floating around with offers for the Business Platinum that don’t have Amex’s “Once in a Lifetime” language (NLL offers). There is a 150K offer as well as a 160K link (that adds 10K for an employee card). Neither one should result in a hard pull if you’re targeted and current or previous cardholders of the Business Platinum will be able to get them. So, even if you’re not targeted for this upgrade offer, there’s still other avenues to take part in the Amex Points Parade.

(h/t: DDG)

[…] Replace 7/25/22: Extra focused now at this hyperlink, this time the bonus is up from 13,000 to 140,000 with the identical $10,000 spend requirement. Provide out there via 1/31/23. (ht FM) […]

[…] saw Frequent Miler post about this upgrade offer last month – and was not targeted for it. I didn’t really […]

[…] Check this link for a targeted upgrade to the personal American Express Platinum card from the Gold or Green with 140,000 Membership Rewards after $10,000 in spend in three months. (Thanks to FM) […]

I’m curious why “This upgrade offer should only be considered if you’ve already had, or currently have, the Business Platinum card.” 140k for $10k spend can be better for many people than 150k/160k for $15k spend, right?

Accepting an upgrade would make you ineligible for a new cardholder welcome bonus. Currently, with the year of NLL offers we’ve had, that would be less important, but I still wouldn’t want to burn a chance at a new bonus or a household referral for an upgrade (that you’d still have a shot at after signing up brand new).

Just FYI – this one is several months old, so I’m not certain this upgrade offer is still valid.

Received this 140k after $10k upgrade offer on P2’s Business Gold card today (opened 6/13/22), just two days after opening her first Biz Plat (12/19/22). Went for this upgrade, but the Amex online account is still showing the Biz Gold card, no confirmation email either – we’ll see what happens in a day or two. Maybe a Christmas miracle, or maybe too good to be true.

It went through! Now to spend $25k in the next three months. Estimated tax loan?

By the way, I found the same upgrade offer on my biz gold card yesterday as well, so the offer seems to be alive and kicking.

P2 has the offer (until 1/31/23) but I’d want to do it today to take advantage of the end of year credits. She has never had the Biz Platinum, but even with a referral offer from me, that would be 175k total MR for $15k spend. That rate isn’t as good as 140k for $10k spend, so I still think there’s a strong argument to be made that the upgrade offer is better even if it burns the new cardholder bonus. We also are getting endless 160k NLL biz platinum offers right now, so wasting a new cardholder bonus doesn’t really matter.

That said, 175k is better than 160k, and I am on the verge of pulling the trigger on the referring her (25k ref bonus + 150k biz plat welcome bonus) and then having her immediately accept the 140k for $10k spend upgrade and hope it goes through. We also had approvals for another biz platinum 160k NLL, an ink cash, and a Schwab platinum earlier this month, so are going to really have to push the MS to pull this off ($46k in 3 months, not including Schwab)!

Mulling over same… Tim’s point caught me up short — we were about to pull the trigger for P2, who has never had the Business Platinum card.

And, while I am greedy — I really liked your attempt to thread the needle on both, described below (did you try? did it work?) — I think we will probably just stick with the upgrade offer. We are running out of bandwidth on spend, and with short-term CD yields over 4.5% and rising, I am continually reminding myself that the cost of floating the IRS money for 3 to 12 months on tax payments that are likely to be refunded is definitely lowering the value of these offers. Which makes a $10K nut more appealing than a $15K nut.

(Technical detail: Say your “real” quarterly payment is around $6K. Paying an additional $9K vs. $4K in late 1Q or early 2Q is the difference between $405 and $180 [at 4.5%], or an extra $225 toward the cost of 20,000, maybe 30,000 points. Thinking might differ if you could get another 30,000 for Px as a referral.)

I ended up referring P2 to a new biz platinum (150k + 25k referral) then she immediately accepted the 140k gold card upgrade. As far as I can tell, everything is going according to plan. I think we should be able to meet the $10k upgrade spend through MS and organic spend (same goes for the $15k on my NLL biz plat, the Schwab Plat, and the ink cash), but we will basically need to put the entire $15k spend of the referral biz plat toward a tax payment. From my experience, I always get that tax payment back very quickly (before even having to pay the bill), but obviously I need to plan as if it could be many months. So, in terms of your math, I’d also incorporate a relatively conservative estimate that there’s a 75% chance that I don’t even have to float that $15k because I’ll get the tax payment back before I pay the bill.

P2 and I had a record month in December. We signed up for over 860k in MR points and 116k in UR points (including referral bonuses, bank bonuses (240k MR), SUBs, and minimum spend to meet them at 1x). If we had tried just a tiny bit more, we could’ve pulled off a Greg The Frequent Miler 1M points in a month! We actually might still with the spend in bonus categories. Anyway, now we just need to meet all the spend, but we have a plan to do it.

Wow. Color me impressed. Very impressed.

Also curious. Is your plan to get the money back quickly predicated on the fact that it is mid-January now and you are planning on filing your 2022 taxes soon? I agree with you that the IRS is actually very good these days about issuing refunds, timing-wise. That is why we just gladly did a referral-based Business Gold and also the Ink Cash (phenomenal return rate with referral, especially for Hyatt-lovers). But as we slip into 1Q 2023 for Estimated Payments, I am starting to do the numbers on money I don’t think I can see back until March or April 2024. Or is there another way to get the money back that I do not know about (but would like to learn)?

Thanks Biggie. Yea, we are going for it! We are pushing all the MR’s to a Roth IRA via Schwab. Hoping to put in $48k between the 2 of us over the next 2 years or so ($12k/yr for 2022-2025) and potentially cash out more via brokerage, then let it ride for a couple of decades in stocks. Ultimately, my goal is for us to make a million dollars from amex credit card points as a couple normal middle-class nobodies. Obviously we are also doing our own investments and 401k’s, etc., but I’d love to be able to eventually claim that we made a million dollars from amex points.

To answer your tax question, yes, these are over payments on our 2022 return. Here’s my plan: When the card closes on Feb. 24, I’ll have our taxes ready to file. On Feb. 25 I’ll make the ~$14k charge, add it into our taxes, and then submit them. That will give us almost 2 months of amex floating the charge. IMO, as long as you use a filing program that checks your taxes for errors (and you clear them), you should get your taxes back relatively quickly. We don’t do quarterly estimated payments because we both have w2 employers and I don’t want to float the money for a year when it could be used for bank account bonuses, etc.

This makes for a nice situation with amex though: Sign up for lots of NLL cards in December for the triple dip, and then make tax payments in Q1 that you *should* get back quickly. Honestly, I probably would’ve gone even harder in December, but we might be in the market for a house this summer and I didn’t want to loan the government like $50k without a definite return date.

Wow captain greg, there is some really good planning there.

You mentioned, On Feb. 25 I’ll make the ~$14k charge, add it into our taxes, and then submit them.

I don’t quite understand that. how is the $14k charge add to the tax? are you charging the ~$14k as tax payment for 2022 through one of tax processor, and include that to claim any excess refund when filing the tax for 2022? what i usually read is people paying the estimated tax in year 2022. i didn’t know one could still pay for tax year 2022 in year 2023 before filing tax for 2022 and claim the refund. has that works for you in the past? because that is very smart.

“are you charging the ~$14k as tax payment for 2022 through one of tax processor, and include that to claim any excess refund when filing the tax for 2022?”

Yes, that’s exactly what I do. It has worked since I started doing it a couple years ago. I think more people actually do this than the quarterly thing since you (hopefully) get the money back immediately. I believe you can pay up until at least April 15th. I’m pretty sure I’ve paid on April 14th before, and I think I also paid in May for the year they extended the tax deadline by a couple months.

Great, thanks for the clarification.

Captain greg, just one more follow up question. Were you using 1040 tax or 4868 extension option (something i just learnt from other commenters) when making these type of overpayment through tax processor? I was under the impression it is just 1040 tax option, but I came across this 4868 extension comments few times. Would like to see how you did it since you are familiar in this.

Again, very useful – great food for thought. We do have to pay some estimated taxes. Until recently – Fed Reserve raising interest rates, ability to get 4.5% and above on short-term CDs – I had not been fretting too much about how much extra we were dumping in to make SUBs and upgrade offers. Now (as my verbosity, here and above, attests) I am. But I like your emphasis on the Dec to Feb happy hunting season, and will likely change my strategy as a result: Hold off for “big game” until next December, and concentrate on cards for natural spend in the interim.

After we do this upgrade from Gold to Platinum, which I just can’t resist.

On a different note, my Schwab Plat is due for renewal, the AF posted on Friday.

Chatted with AMEX rep, current retention offer is for 3K spend in 3 months you either get $175 statement credit or 20K MR points. Do these offers keep changing every month. I have until 23rd August to cancel.

Thanks

Raghu

0/3 for upgrade.

DP: I received under amex offers the 150k + 10K biz plat NLL one. So i applied and was rejected. Reason given bec i was recently approved for another biz plat NLL 2 weeks ago (also under my amex offers).

While i understand their reason, why would the amex system offer me this NLL deal, if they’re going to reject me anyway??

if I take the offer, can I apply for another gold biz , i like the 4x bonus?

Is this the right order?

Of course you can also mix in the employee card offers.

I received the offer and have only had my biz Gold 2 months and have 2 other biz Platinum cards.

[…] Update 7/25/22: More targeted now at the same link, this time the bonus is up from 13,000 to 140,000 with the same $10,000 spend requirement. Offer available through 1/31/23. (ht FM) […]

See Amex Chat transcript

“The eligibility for upgrade is 12 months on existing card. So if you make a change to your card, the welcome bonus on Business Gold card will forfeit.”

I’m not surprised that you got this from a CSR. Many will tell you that you can’t have more than one of each flavor of charge card as well (as that’s the rule). The official rule is that you can’t upgrade until after 12 months, but I’ve never heard of any instance where someone had a bonus clawed back for accepting a targeted offer (emphasis on targeted). Not saying it hasn’t happened, just that I’ve never heard about it…and I’ve heard of a lot of folks doing it (including me).

But that said, if you’re not comfortable with the upgrade, try one of those targeted NLL links in the post. There’s so many ways to get a lot of Amex points right now, there’s no need to to put yourself in a situation that you’re not comfortable with.

That said,

Thanks Tim. When you say targeted, I clicked on the link in the blog post you provided, and I was logged in into my Amex Account , and the offer showed up.

Does that mean I was targeted, or I should actually get a flyer or email from amex directly for me to be considered targeted

Thanks

Raghu

Did you click on the “request an upgrade” button? That will show you whether or not you’re targeted

Yes, when I say targeted, I mean that an offer is showing to you when you are logged into your account. If you aren’t targeted, it won’t show and you won’t be able to apply (that’s what happened to both my wife and I when we checked the link, as well as everyone else on the FM team).

Thanks Tim. When I clicked on Request an Upgrade, I knew I was not target. Will try close to Jan 31, 2023

I got the 140k upgrade offer with 10k spend on the Gold Business card. My existing business platinum is up for renewal this month, 2nd anniversary. I got the entire fee waived last year.

If I take the upgrade offer could I close the existing platinum? Hate to pay 695 twice in 2 months!

Tim

My wife’s Biz Gold card got this offer. She barely completed 3 months and min spend on the biz gold card. So upgrading this early will not trigger clawback of he 90K Biz Gold offer? Just confirming

I have a biz gold that hasn’t yet hit its 1 year anniversary. AmEx takes back your welcome offer if you cancel within a year correct? Would this operate differently because it’s an upgrade? Something to ponder

Yes. You’d want to keep the upgraded card until at least the first anniversary, but I would keep it until 12 months after the upgrade.

I have seen people get an upgraded card before the first anniversary, complete the upgrade offer spend and then still get a retention offer on the first anniversary…not sure how common that is, though.

You can upgrade prior to anniversary without any issues, but not cancel.

Interesting. When I went into the AmEx chat and asked to speak about an upgrade offer, their language there was you had to wait until a year to upgrade a card. Regular theme on Frequent Miler podcasts about information not always being accurate! Just wanted to make sure I wouldn’t be forfeiting my Biz Gold bonus from when I opened the card.

Difference is you want the upgrade, not Amex offering. If Amex offers, different situation. A couple of years ago I took out the business gold. Then after about six months, I received an invite from Amex to upgrade for the platinum. In the end I received about 140K points (70K gold + 70K upgrade) in less than a year. The spend was nothing as high as today. And they will prorate the AFs too. This was when the platinum was $595 I think. As to FM, they and DOC are my go to for correct and very timely info. Just saying!