2025 has been an exciting year for that small percentage of the population that finds new credit cards something to be excited about, especially in the realm of expensive coupon books…err…ultra-premium credit cards.

Chase and Amex both “refreshed” the Sapphire Reserve and Platinum cards, inching the annual fees closer to four figures and unveiling even more quarterly, semi-annual, and yearly credits meant to convince us that spending $75 a month for the privilege of holding a credit card is actually a no-brainer value.

It hasn’t been just the big dogs, either. Citi finally ended its long-standing tease by finally releasing the $595/year Strata Elite card, while Alaska and JetBlue launched expensive cards of their own (although JetBlue’s was nothing to get excited about).

All of these new (and “refreshed”) credit cards have given us a brand new smörgåsbord of credits, rebates, and discounts to sample. In this post, I’ll give my opinion on the the old standards and recent additions: which ones are welcome arrivals, and which are much ado about nothing.

Credit cards that are discussed in this post

My wife and I have several Business Platinum cards and a couple of consumer Platinums. We each got a Citi Strata Elite, and my wife got a “refreshed” Chase Sapphire Reserve. Given that, I’m going to limit this post to those cards, but also add in the Capital One Venture X.

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card offers annual rebates that easily mitigate the fee for those who travel often. Authorized users are free and also get access to perks like Priority Pass, Capital One Lounges and more. The card earns 2 miles per dollar on most purchases just like the Capital One Venture Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One huge advantage over cash back: Capital One allows transfering their miles to airline miles & hotel points. Click here for our complete card review $395 Annual Fee Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5X miles on flights and vacation rentals booked via Capital One travel ✦ 5X miles on Capital One Entertainment ✦ 2X miles everywhere else Card Info: Visa Infinite issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual credit for bookings made through Capital One Travel ✦ 10,000 bonus miles each year starting at first anniversary ✦ Up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Capital One Lounge access ✦ Priority Pass membership (lounges only) after enrollment ✦ Cell phone insurance ✦ Trip insurance ✦ Primary CDW coverage ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert miles to airline miles & hotel points |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Good all-around card for frequent traveler. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards. Click here for our complete card review $795 Annual Fee Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X Dining ✦ 5X Lyft (through September 2027) Base: 1X (1.5%) Flights: 4X (6%) Portal Flights: 8X (12%) Hotels: 4X (6%) Portal Hotels: 8X (12%) Dine: 3X (4.5%) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $75,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $250 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Transfer points to airline & hotel partners ✦ Up to $500 The Edit credit annually ($250 twice per calendar year) ✦ Up to $300 Dining credit through Sapphire Reserve Exclusive Tables ($150 January to June and again July to December) ✦ Complimentary AppleTV+ and Apple Music through 6/22/27 ✦ Up to $300 in StubHub credits ($150 January to June and again July to December) ✦ Points worth up to 2 cents each towards qualified bookings through Chase Travel ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Excellent portfolio of transfer partners, but mediocre bonus categories and a so-so group of credits. Recommend pairing this with Citi Premier and/or Double Cash. Click here for our complete card review $595 Annual Fee Earning rate: 12X hotels, car rentals and attractions booked through Citi Travel ✦ 6X airfare booked through Citi Travel ✦ 6X dining between 6pm and 6am EST Fridays and Saturdays ✦ 3X dining all other times ✦ 1.5X everywhere else Card Info: Mastercard World Legend issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points to airline and hotel partners ✦ $300 annual (calendar year) hotel credit on a stay of 2 nights or more when booked with Citi Travel ✦ $200 in annual (calendar year) statement credits on your choice of up to 2 of: 1stDibs, American Airlines, Best Buy®, Future Personal Training, or Live Nation ✦ $200 in annual private chauffeur credit with Blacklane ($100 Jan-June and July-Dec) ✦ Priority Pass Select membership with two free guests (no restaurants) ✦ 4 American Airlines Admirals Club passes per calendar year (for one adult and up to three children) ✦ $120 Global Entry® or TSA PreCheck® application fee credit ✦ Travel protections ✦ $145 annual fee rebate for CitiGold and Citi Private Client members See also: Citi ThankYou Rewards Complete Guide |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. $895 Annual Fee Earning rate: 5X points for flights booked directly with airlines or with American Express Travel (limit $500,000 in purchases each calendar year) ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ Up to $600 prepaid hotel credits semi-annually ($300 Jan - June and July - Dec) valid on Fine Hotels + Resorts® and The Hotel Collection bookings ✦ Up to $100 per calendar quarter in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $25 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium and/or YouTube TV ✦ Up to $120 Global Entry/TSA Precheck fee reimbursement ✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ Up to $120 in statement credits each calendar year towards an auto-renewing US Uber One membership ✦ Up to $300 in annual credits for eligible US purchases at lululemon stores or luiulemon.com (up to $75 quarterly) ✦ Up to $209 CLEAR (R) Plus fee credit per calendar year ✦ Up to $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card. Plus UPS not eligible.✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Up to $200 back each calendar year in statement credits when purchasing an Oura Ring through Ouraring.com ✦ Global Lounge Access benefits: Priority Pass membership (Lounges only) with 2 guests, Centurion Lounge access. Also, Delta Sky Club® access (when flying an eligible Delta flight): 10 visits per year February 1 until January 31 of the next calendar year (after 10 visits have been used, additional visits can be purchased for $50 each or earn unlimited visits after spending $75K/calendar year on the card). Access limited to eligible card members ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status ✦ Leading Hotels of the World Sterling Status ✦ Enrollment required for some benefits. Terms Apply. See also: Amex Platinum Guide |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Click here for our complete card review $895 Annual Fee Earning rate: Earn 5X flights & prepaid hotels booked at AmexTravel.com. ✦ 2X points per dollar (on up to $2 million of those purchases per year) for each eligible purchase of $5000 or more, US construction/hardware stores, US software & cloud system providers, US electronic goods, and US shipping ✦ 1X elsewhere ✦ Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Spend $250k+ on eligible purchases in a calendar year, get up to $1,200 in statement credits to use in the next calendar year on flights booked on AmexTravel.com, and up to $2,400 in statement credits for use in the next calendar year on monthly fees for American Express One AP®. Noteworthy perks: Select one qualifying airline and receive up to $200 in statement credits per calendar year for qualifying charges ✦ Up to $600 prepaid hotel credit semi-annually (Up to $300 Jan - June and July - Dec) valid on Fine Hotels + Resorts® and The Hotel Collection bookings ✦ Up to $1,150 a year in statement credits for Dell purchases ($150 + $1,000 when spending $5,000 in a calendar year) ✦ Up to $200 in Hilton credits (Up to $50 per quarter) ✦ Up to $120 in wireless services credits per year (Up to $10 per month) ✦ Global Entry statement credit every 4 years ($120) or TSA PreCheck statement credit every 4.5 years ✦ Global Lounge Access benefits: Priority Pass membership (Lounges only) with 2 guests, Centurion Lounge access. Also, Delta Sky Club® access (when flying an eligible Delta flight): 10 visits per year February 1 until January 31 of the next calendar year (after 10 visits have been used, additional visits can be purchased for $50 each or earn unlimited visits after spending $75K/calendar year on the card). Access limited to eligible card members ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Gold status. ✦ Leading Hotels of the World Sterling status ✦ Up to $209 CLEAR® fee reimbursement annually ✦ 35% Airline Bonus: Get 35% points back after you Pay With Points for flights with your selected airline. ✦ $250 statement credit when spending $600+ on U.S. purchases with Adobe per calendar year ✦ Enrollment required for select benefits See also: Amex Platinum Guide |

Best travel credits

1. $300 travel credit (Chase Sapphire Reserve)

- Benefit Details: Automatically earn $300 in statement credits each membership year as reimbursement for travel purchases.

This is the gold standard of all the various travel coupons, because it’s the easiest to use. The $300 credit is renewed each membership year then is automatically triggered by a wide variety of travel purchases. I never even have to think about it.

Particularly interesting this year was that a $250 booking through The Edit triggered both this credit AND the $250 The Edit hotel credit. YMMV.

2. $300 travel credit (Capital One Venture X)

- Benefit Details: Venture X cardholders get an annual $300 credit towards travel booked through Capital One Travel each cardmember year.

This used to be almost as good as the Chase $300 credit, but then Capital One changed it to a discount on Capital One Travel purchases (as opposed to a rebate), making it more difficult for some folks who used to be able to cash it out through refundable bookings.

However, I find it fairly easy to use by playing it (relatively) straight. I often find rental cars through Capital One Travel to be the same, or occasionally even less, than what I can book through discount sites. The Venture X has primary rental car insurance, so there’s theoretically little lessening of coverage as opposed to using one of my Chase cards.

The last couple of years, I’ve needed extra Alaska Airline wallet funds beyond what I was able to get using my Amex Airlines Credits (see below), so I’ve used this up by buying an Alaska ticket, waiting 24 hours so that it won’t refund to the credit card, then cancelling it so that the funds are deposited in my Alaska wallet.

Currently, Alaska has ixnayed the ability to use wallet funds along with a companion fare (which is how I book most of our domestic airfare), so that might throw a wrench in my 2026 plans.

3. $300 hotel credit (Citi Strata Elite)

- Benefit Details: $300 Hotel Credit (one per calendar year): Only valid on hotel stays of two nights or more. Must book through Citi Travel℠.

Chase, Citi, and Amex all introduced new or improved hotel credits this year, each one applicable only to hotels booked through each company’s own travel portal. Of the three of them, the Citi version is by far my favorite.

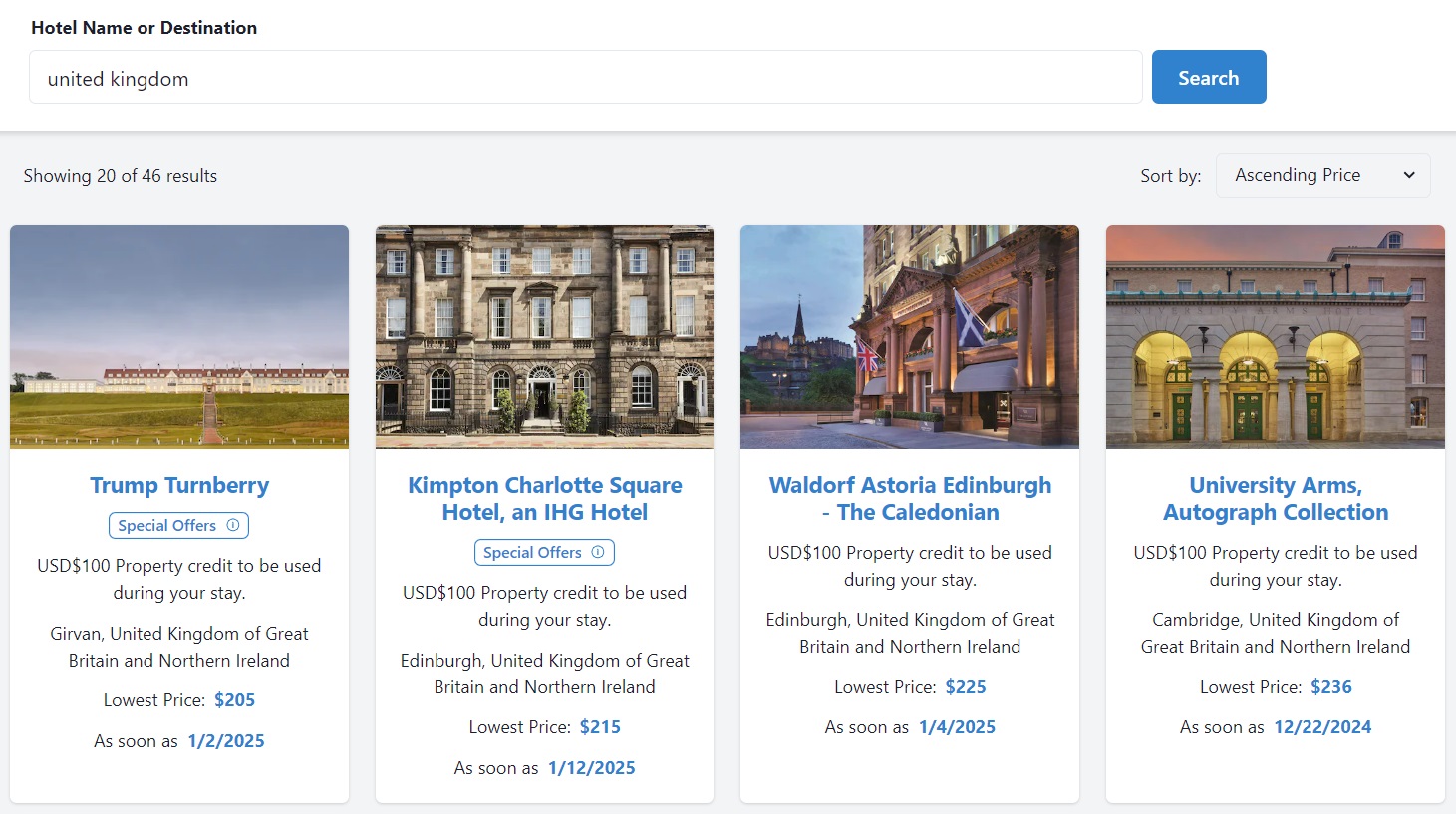

First of all, you can use it to book any hotel on Citi’s platform, not just those that are involved in a “luxury” collection. This means that there are A LOT more options, and the pricing of those options isn’t inflated by the extra perks that come with Chase’s The Edit or Amex’s Fine Hotels & Resorts.

Second, the pricing on Citi’s portal is surprisingly competitive. I’ve already used both my wife’s and my credits for 2025 (towards 2026 bookings in Belize and Canada), and both of them were actually cheaper through Citi Travel than via booking.com or direct through the hotel. In addition, we’re earning 12x ThankYou Points on the overage.

There are a couple of downsides, though. Like the Capital One Travel credit, this is processed as a discount, not a rebate. That means that you can’t make prospective bookings, cancel the ones that you don’t need, and have the credit still apply…it can remain attached to one booking only. That said, I’ve cancelled two bookings that I had used the credit on, each time it was back in my account almost instantly to be used again.

The other negative is that, like Chase’s credit for The Edit bookings, there’s a two-night minimum. However, since it can be applied to any hotel (unlike Chase’s version), I haven’t found that to be a terribly onerous obstacle to using and maximizing the entire $300.

I wasn’t expecting to like this coupon as much as I do…but it’s a good one. You don’t earn hotel points on Citi Travel bookings, but for independent properties where it doesn’t matter anyway, it’s been a fantastic tool.

4. $300 Fine Hotels and Resorts/Hotel Collection credit (Amex Platinum cards)

- Benefit Details: Earn up to $300 back in statement credits semi-annually (January through June, and July through December) on prepaid Fine Hotels + Resorts® or 2+ nights with The Hotel Collection booked through Amex Travel™.

When Amex “refreshed” the consumer and Business Platinum cards, it significantly changed the credit for stays booked via Fine Hotels + Resorts (FHR) and/or The Hotel Collection (THC). Previously, it was $200, limited to consumer Platinum cards, and was only issued once per year. Now, it’s $300, available to all “flavors” of Platinums, and is issued semi-annually.

I was thrilled with those changes, and a little overwhelmed. Increasing the credit from $200 to $300 drastically increases the utility. Remember that, unlike Chase and Citi, Platinum cardholders can use this credit on one-night Fine Hotels + Resorts bookings (The Hotel Collection requires a minimum of two nights). For those of us looking to pay as little as possible out of pocket, there are waaayyy more properties in the $300-$400 range vs $200-$300.

So why was I overwhelmed? Between my wife and me, we now have eleven Platinum cards (nine Business and two Charles Schwab). That meant that we now had eleven $300 credits to use up before December 31st. At first, I didn’t think we could do it, but I’ve been very pleasantly surprised, thanks in large part to the fantastic search tool, MaxFHR. It’s November 3rd, and all of this year’s credits are booked, all on stays that we were planning on taking anyway. Here’s where:

- Kimpton Riverplace, Portland, OR. Average nightly cost after credit: $15.

- The Fairmont Empress, Victoria, BC. Average nightly cost after credit: $36.

- Vogue Hotel, Montreal, QC. Average nightly cost after credit: $75 (during the Montreal Jazz Festival).

- The Pendry, San Diego, CA. – Average nightly cost after credit: $9.

I’m thrilled with being able to use all eleven credits so easily. Keep in mind that we expect to earn hotel points for each stay and will also get the full roster of FHR benefits, including:

- Breakfast for 2

- One-category (minimum) room upgrade

- $100-$150 to use on-property, depending on the location

- 4 pm guaranteed late checkout

So what happens in January, once I have another fresh set of credits to use? I think that I should be able to apply them to stays that we need through the remainder of 2026 and into 2027. By the time the 2nd half of the year rolls around, I’ll probably have fewer Platinums (and thus hotel credits) to deal with. Probably.

5. $200 airline credit (Amex Platinum cards)

- Benefit Details: Amex will automatically reimburse up to $200 per calendar year for airline fees for your selected airline only. Eligible fees include: baggage fees, flight-change fees, in-flight food and beverage purchases, and airport lounge day passes. Enrollment required.

First off, let me say that this benefit is undoubtedly one of the most time-consuming for me to use. It doesn’t have to be. Although the credit is meant to apply to ancillary costs like seat selection or checked bags, in practice, many other charges end up triggering it (see the linked post below for more details).

However, I want to be able to use mine for Alaska Airlines, and because I’m a Titanium Elite member, I don’t get charged for most of those sorts of things. So, in order to create small charges for seat selection, I book tickets for non-elite family members, then choose and pay for their seats in a separate transaction. After 24 hours have passed, I cancel the tickets, and the entire amount goes back into my account.

The problem is that most Alaska charges don’t automatically trigger the credit. So, I have to wait a minimum of 14 days, then contact Amex via chat to have them manually process it. Not a big deal for 3 or 4 charges on one card. But for ~40 across eleven? You get the picture.

So why isn’t this smack dab at the bottom of the list? Because I end up getting ~$2000 worth of Alaska credit that, up till now, I’ve been able to apply towards companion tickets for my wife and me, covering a good chunk of our yearly domestic flight needs. However, Alaska nixing that ability hurts us…a lot. My hope is that it will restore at least some capacity to pay for companion tickets with wallet funds in the near future; of the many changes that were recently made, it seems that’s the most likely one to be walked back. I’ll be crossing my fingers nonstop in the meantime.

6. $250 The Edit hotel credit (Chase Sapphire Reserve)

- Benefit Details: Cardholders earn up to $250 twice per year in statement credits for prepaid The Edit by Chase Travel bookings. Two-night minimum applies.

Chase launched the unbearably-named “The Edit” collection this year to compete with Amex’s Fine Hotels + Resorts. Like Amex, it then added credits for The Edit bookings. Unfortunately, Chase’s coupon manages to combine the worst aspects of Citi’s and Amex’s: it’s only valid on The Edit bookings (which has a much smaller portfolio than FHR), AND it requires a two-night minimum. Because of that, it’s much more difficult to use in a way that minimizes out-of-pocket spending.

The one nice thing is that, unlike Citi and Amex, you can redeem your Chase points at good value for Edit bookings (2 cents per point), which means that you can cover the overages with Ultimate Rewards instead of paying cash. However, for me, it’s still a much less valuable tool than the other two.

I have found a couple of interesting quirks in using it. Like I mentioned earlier, the Edit booking that I made triggered both the $250 credit and $250 of the $300 Chase travel credit. Not only that, but I made the booking on June 29th in an effort to utilize the one that was going to expire on June 30th (Chase changed the expiry rules later). The charge didn’t post until July 1st, and much to my surprise, it not only triggered the first half credit, but the second half as well. So, I ended up getting $750 in credit for one $250 booking. Later, my plans changed, so I had to cancel the stay. I’ve yet to receive a clawback on any of the $750 in credit that I received.

I’m not sure how repeatable any of that will be, especially since both $250 credits can now be used any time throughout the year. However, it may be a sign that The Edit credits are easier to maximize than they might first appear.

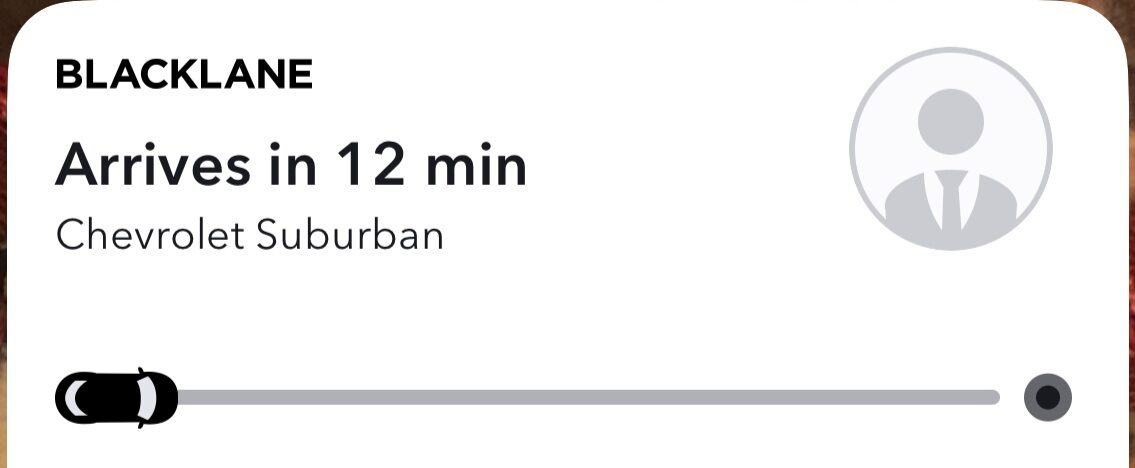

7. $100 Blacklane credit (Citi Strata Elite)

- Benefit Details: $200 annual ($100 Jan-June and $100 July-Dec) in private chauffeur credit with Blacklane.

Of all of the new coupons, the twice-per-year $100 Blacklane was the most out of left field for me. I’d never heard of Blacklane before, and a brief bit of research made me skeptical that a “private chauffeur” service would offer anything close to $100 in value when compared to a normal rideshare.

Having used it twice, I have to say…it’s really handy. My wife and I used it for two one-way trips from downtown Seattle to the airport, and we enjoyed the experience a lot.

You’re able to reserve a ride far in advance, and you’re assigned a chauffeur and car a couple of weeks before the trip begins. On the day of, you get a reminder, as well as updates when your driver leaves to meet you, when they arrive, and where they’re waiting. They’re guaranteed to be at the location 10 minutes before your meeting time, and will track your flight info to know if you’re early or late.

On the outbound trip, our driver met us at the ferry terminal pickup spot, holding a sign with our name on it. When we were picked up from the airport, the driver met us inside the terminal in baggage claim, again with a sign. Each time, they began communicating with us as soon as they arrived. The cars were huge, spotless SUVs and could have easily held 5-6 people. The rides were extremely comfortable, with charging ports, water, and soft drinks provided.

The experience of riding with Blacklane was a significant upgrade from a normal rideshare. Probably the best feature, especially when arriving at an airport, is knowing that a driver is waiting for you, and not having to try to time calling (and waiting for) a car and getting to the pickup point. They’re there waiting for you.

Unlike Uber or Lyft, there’s no tipping mechanism for Blacklane. In fact, they expressly tell you not to tip, as the total fee is supposed to include service. For both of our rides, the total with Blacklane was ~$105, so $5 out-of-pocket after the credit. The same ride using Uber would have been ~ $65-70, or $80-85 after tip. That’s a pretty substantial real-world savings, especially given the upgrade in experience.

Is it enough that I would pay the cash difference to use Blacklane? Probably not for two people. However, I’ll easily (and gladly) find good uses for my wife’s and my credits four times per year.

8. $50 Hilton credit (Amex Business Platinum)

- Benefit Details: Earn up to $50 back per quarter when you use your card directly with a Hilton property. Registration Required.

Ok, most folks are by now tired of hearing me complain about all of the Business Platinum credits that I have to use, and for most normies with only one, spending $50 per quarter at Hilton probably isn’t difficult to do. But this one irritates me, and Amex probably intends for it to be.

A $200 yearly credit or even $100 semi-annual would be much easier to use. $50 isn’t enough to cover even half of a stay at the vast majority of worldwide Hilton properties. Some folks can use it for meals at hotel restaurants, but not only do you have to eat at a Hilton restaurant, you also have to make sure that the charge codes as a Hilton. Then, after all of that messing around, you have to remember to use your card at a Hilton once per quarter.

One saving grace that I’ve found: properties that charge a refundable deposit (not a prepaid rate) will trigger the credit at booking. If your plans change, and you have to cancel that reservation later, the $50 credit seems to stick after the refund.

Best dining and retail credits

1. $200 Splurge credit (Citi Strata Elite)

- Benefit Details: Up to $200 in annual statement credits on your choice of up to 2 of: 1stDibs, American Airlines, Best Buy®, Future Personal Training, or Live Nation.

This is now my favorite of all of the various retail and dining coupons, because it’s so easy to cash out. Best Buy sells a wide variety of 3rd-party gift cards, online and in-store, and buying them triggers this credit. For the first round, in 2025, I bought some DoorDash gift certificates for resale and was able to cash out $400 out of $400 worth of credits (between my wife’s and my cards). In the event that it wasn’t possible, I’d just buy Amazon gift cards, which for us are almost like cash.

Easy-to-use AND easy-to-maximize. Now, that’s a good coupon!

2. $100 Resy credit (Amex Platinum)

- Benefit Details: Earn up to $100 back each quarter after making eligible purchases directly with Resy or for dining purchases at any U.S. Resy restaurant. Enrollment required.

This is another good one, because it’s useful AND easy to use. In contrast to the Chase dining credit (see below), this one can be used at any restaurant on Resy platform…and there are a lot of them.

Four to five area restaurants that we go to regularly are on Resy, and buying eGift cards through any of them triggers the credit. I have a folder in my email for “gift cards to use,” and we just draw from that when we visit one of them. Because we have two cards, we can get $200 in credit each quarter and just rotate the restaurants whose gift cards we buy. We love it.

3. $150 Chase Sapphire Reserve Exclusive Tables credit (Chase Sapphire Reserve)

- Benefit Details: Get up to $150 every six months (Jan-Jun and July-Dec) for restaurants that participate in Chase Sapphire Reserve Exclusive Tables. You do NOT need to make a reservation or pay through Chase or OpenTable in order to earn the $150 rebate. Simply use your card at one of the restaurants listed on this platform.

The Chase version of the restaurant credit slots in below the Amex Resy credit for one reason…there’s a fraction of the available restaurants. I live in a major metro area, and I only have a few.

Luckily, there’s one restaurant that we’ve been wanting to go to for a while, but which will be ~$400-500 for the two of us all-in. Unfortunately, that restaurant sells the gift cards through a platform that I suspect won’t trigger the credit. Because of this, we called up the restaurant as soon as we got the card in June and had them mail us a $150 gift certificate. We did that again in July. Once 2026 hits, we’ll make a reservation and should be able to get the majority of our dinner covered by stacking three $150 credits.

We probably won’t be keeping the card in its current form for another year, so we’ll likely use the credit one more time in July before we downgrade.

4. $150 Dell credit (Amex Business Platinum)

- Benefit Details: Earn up to $150 in credits each calendar year for all purchases at Dell.com, plus an additional $1,000 back when spending $5,000 in a calendar year. Enrollment required.

I imagine that this will be the most controversial ranking of the whole coupon shebang, and it’s very much based on my experience, not the everyperson. There are some folks out there who can’t get Dell to fulfill an order to save their lives. Others, like me, can easily order multiples of many items per year with no issue. Because of that, I do a fair amount of reselling Dell products.

Dell frequently has great rates through shopping portals and offers its own rewards currency that functions as credit towards future Dell purchases. Even though I have a couple of handfuls of BizPlat cards, it’s no problem to use the initial $150 on each one, since you can split a tender on up to three cards per order. Once I work through those, I keep the rest of my Dell purchases on one card, in order to earn the $1K/$5k bonus. Once I hit that, I’ll move to a different card. Combine all of this, and Dell is by far my highest margin resale product annually.

The gravy train may not chug on forever. Some of the double-dipping may be quashed, or more likely, I might lose the ability to order as much as I do now. But until then, it’s Dellicious.

5. $150 StubHub credit (Chase Sapphire Reserve)

- Benefit Details: Get up to $150 in statement credits every 6 months (January through June and again from July through December) for StubHub and viagogo purchases.

StubHub is a despicable interesting company (I sell quite a few event tickets through StubHub and have opinions). The good news is that it’s almost always possible to get great shopping portal returns on StubHub purchases. The bad news is that the prices displayed are almost always inflated because of it. That said, in this bizarre world of event sales, resale tickets can often be had for less than face value.

I was able to use my January-June credit towards Dua Lipa tickets for some family members, while we used the second half credit on a Sigur Rós concert that my wife and I wanted to go to. In both cases, we were able to get better prices on equivalent tickets through StubHub than what was available by buying directly through Ticketmaster. I was able to use gift certificates from Capital One Shopping to pay for what wasn’t covered by the Chase credit, and received another 20% back on the purchase as icing on the cake.

6. $25 digital entertainment credit (Amex Platinum)

- Benefit Details: Earn up to $25 back each month after paying for select digital subscriptions: Paramount+, YouTube Premium, YouTube TV, Disney+, a Disney+ bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

This is one of the easiest “set it and forget it” options for my wife and me. We share several different streaming services among our local family, with each of us paying for a couple. My wife and I cover Disney/Hulu, and Paramount+, which leaves enough left over to cover our New York Times subscription.

7. $15 Uber/Uber Eats credit (Amex Platinum)

- Benefit Details: Get $15 in Uber credits per month ($35 in December) simply by adding your Platinum card number to your Uber account as a payment method.

We receive a total of $50/month in Uber credit each month due to our Platinum and Gold cards. There are 2-3 nearby restaurants that take Uber Eats, so we’ve become pretty good at getting takeout once or twice a month to use it up. All of them charge a premium to order through Uber, so we really only get ~$35 worth of food in comparison to if we placed an order through the restaurant directly. Still, it’s an easy enough win.

8. $75 lululemon credit (Amex Platinum)

- Benefit Details: Earn up to $75 back each quarter in statement credits for eligible purchases at Lululemon stores or Lululemon.com in the U.S. Enrollment required.

This is one of those surprisingly specific credits, like Saks, that doesn’t feel long for this world. Lululemon is giving each Platinum card user the chance for up to $300 in free stuff per year, so long as they remember to visit quarterly…and buying a gift card triggers the credit.

Lululemon resale rates have been hovering in the mid-80% range, so this is an easy ~$125 per month (between my two household Platinum cards). Unfortunately, lululemon has sussed out my nefarious intentions, or just doesn’t like my wife’s account, because I can’t make a gift card order to save my life. They’re cancelled every time.

As a result, I have to stop by a physical lululemon store once each quarter and buy physical gift cards. Unlike Saks (see below), there’s one that’s convenient enough that I can make myself do it. But it’s also enough of a pain to keep this credit towards the bottom of the list, despite the relatively easy cash out.

9. $10 wireless credit (Amex Business Platinum)

- Benefit Details: Earn up to $10 back per month when you use your card to pay for wireless telephone service. Enrollment required.

This has been another easily usable, but irritatingly time-consuming, benefit to use…primarily because I have so many Business Platinum cards. Each month, on the first, I log into my T-Mobile account and make nine $10 payments (or however many BizPlat cards I have at the time).

Unfortunately, T-Mobile doesn’t allow repeat payments of the same amount. Rather, it does most of the time, but doesn’t all the time. So, I end up making 3-4 $10 payments, another 3-4 of $10.01, and so on.

Complicating matters (and making the benefit fall down the list) is that T-Mobile has now put an end to the ability to stack the $5/line autopay discount with credit card payments. In effect, this means that I only get $75 in value for my $90 in monthly payments (because I lose $15 in autopay discounts). That’s not a huge deal for someone like me with a bunch of Business Platinum cards. For a sensible person who only has one, it can make the credit almost useless.

10. $200 Oura Ring credit (Amex Platinum)

- Benefit Details: Earn up to $200 back each calendar year in statement credits when purchasing an Oura Ring through Ouraring.com. Enrollment required.

This was perhaps the most underwhelming new benefit for the consumer Platinum card. Oura Rings are essentially a device that tracks and analyzes a variety of health metrics, including sleep, activity, and recovery. The problem is that, in order to see those metrics and analysis, you have to pay for a monthly subscription. That was a non-starter for me.

However, the day that the new benefits went live, Greg noticed that the website was offering last year’s model for $199+tax. By the time I got around to buying one, the most common ring sizes (7-10) were sold out, so I bought two size 11 rings for ~ $17 each after the credit was applied.

Once I received them in the mail, I sold them both through eBay and netted ~$100 total. Nick was quicker on the draw than I was (no surprise) and was able to get several in more common sizes. Perhaps as a result, he was averaging almost double the amount per ring that I got when I resold.

Was that more effort than it was worth to net $50 per ring? Not really, I just kept each ring in the same box, then taped the label that eBay sent me to the top and dropped it in the mail after it sold. My assumption is that late models will continue to be sold at low(ish) retail prices each year. However, it wouldn’t take much of a price increase (or resale price decrease) for it to lose appeal in future years.

11. $50 Saks credit (Amex Platinum)

- Benefit Details: Earn up to $50 back each January through June, and July through December for purchases at Saks Fifth Avenue online or at locations in the US and US Territories. Enrollment required.

This is my least favorite Amex coupon that I actually use. As far as I know, it’s still possible to buy Saks Gift Cards in-store and trigger the credit, which would make things much simpler. Unfortunately, I don’t live within easy reach of a Saks store, and eGift cards DON’T trigger the credit. So, I’m left to purchase, you know, actual stuff.

I’ve spent waaayyyy too much time over the years surfing Saks’ website trying to find things that end up costing around $50 after shipping…and I have the copious amounts of extra glassware to prove it. Now, I just tell my wife that she needs to use them. The resulting free time has been incredible.

Summary

It’s been a fun few months taking the new round of coupon books out for spin, while trying to learn how to best maximize the value for my family’s travel and spending rhythms. The most pleasant surprise has been the Citi Strata Elite. I love the combination of a lower annual fee (in comparison to the offerings from Chase and Amex) with credits that are easy-to-use AND useful.

Conversely, the Chase Sapphire Reserve gets the award for the biggest “meh.” Its dining coupon is much more limited than Amex’s (or Citi’s Splurge credit), and the hotel credit is hamstrung by both a limited number of expensive properties and the two-night minimum. Of the four that I carry, it’s the card that I would be least likely to keep long-term.

I’d love to hear how other folks have been doing with their credits, whether or not they’ve been finding them useful, or if there’s been nifty tricks that they’ve uncovered. Let us know in the comments!

Regarding the Blacklane credit, does the transaction date (as it appears on Ciit) the day of the ride? I have a ride scheduled on Dec 31, so I’m hoping it counts towards 2025. Thank you for any info you my have!

Which site is best to resell door dash gift cards?

Can I buy $150 gift card with my Reserve at StubHub and receive the credit?

I do not believe that StubHub gift cards count.

You didn’t mention the Walmart+ Platinum benefit, which is no big deal, but it gives you Peacock of Paramount+ as part of that membership. I just wish Walmart+ included Samsclub+ all together.

The Edit and Open Table both suck and will make me cancel my CSR that I’ve had for like 10 years. The nearest Sapphire OpenTable restaurant is about 6 hours away!

I asked this on X – will ask here too. Too many cards and not enough weekends left in the year. What Can I do the booking now for, which will result in the credit being used, but occur next year? My chase has the StubHub, can I book now for a game next year and use up this year’s credit? Same question for all the hotel credits – I’ve got 2 AMEX Business Platinums, a Citi Strata Elite, and Chase Reserve Sapphire. So far as far as hotel credits go, I’ve only used up the $50 quarterly Hilton credits on each of my Amex business platinums.

Yes, all of those can be used for stays booked next year. For Fine Hotels and Resorts, just make sure you select “Pay Now.” not pay “Pay at Hotel.”

Already cancelled my Sapphire Reserve. Went to Preferred. None of the “new” benefits justify the increased costs for me personally. The Edit credit is especially useless. Spending more for an expensive hotel just for savings eaten up by the increased cost of the hotel?

Sax – Amex platinum- we have found that buying cutting knives with credit is the best deal with shopping cost . Less total out of pocket and everyone needs new cutting knives

Uber Amex platinum- use Uber Eats and do pick up. Then eat in . We go to local Chinese rest. Fun times

Also, in some cities there are not that many dining options for Chase.

In some cities, there are not ANY dining options for Chase. If I want to use it, I have to plan it while traveling. I don’t like that it is influencing my dining decisions while traveling.

It is ridiculous to have a card that only works for major cities, and particularly NYC. DC has about ten restaurants, mainly seafood. One restaurant canceled my reservation because I don’t eat fish.

The biggest issue is that hotels are not listed on either Chase or Citi, but they are on Booking.com, Citi’s portal or other portals.

Lots of DPs that the Edit credit is getting clawbacks post Oct 26, sadly.

What’s the issue?

i see oura ring selling $349 on the web site, where did you get $199 ring

It was the Gen 3, not the Gen 4. It’s likely sold out on the website now. When I purchased mine, there weren’t any sizes left smaller than 11.

Once the Gen 5 comes out, the Gen 4 models will likely go on sale, but I don’t know that there will be any more Gen 3 inventory loaded until then.

To use the FHR credits, did you book back-to-back stays at the same hotel? In that case, do you get multiple $100 resort credits? Seems like the hotel (but not necessarily the front desk person) would frown on that because its $100 per stay, not per night, on a multi-night reservation.

Yes, I just book back-to-back stays. I don’t expect to get more than one property credit, but sometimes hotels will give you multiple, especially outside the US.

Best way to use multiple credits is to alternate each nights reservation with your P2. With a single guest, alternate with fully paid stays. We use comp nights to alternate in Vegas.

Perhaps to clarify, I was just curious how Tim used his credits. I don’t have a single Amex Platinum card, and definitely not more cards than fingers.

Just tried the Resy credit for e-gift card that I’ve been loading up. Got an error notification “amex payment not accepted” Anyone else run into this? Notification pops up after entering card number

Hi Tim,

I’m impressed that you have so many amex business platinum cards! It made sense when the Dell credits were more generous. Are you going to keep all your business platinum cards with the recent devaluation of Dell credits? I don’t see how that card can still be worth keepingafter the refresh.

Thanks in advance.

Most of them are in the first year of an upgrade, so once that passes, I’ll downgrade them back down to a Green or cancel.

In terms of the Dell credits, I wouldn’t necessarily consider it a downgrade, since I resell enough merchandise to hit the $1000 credit off of $5000 in purchases. However, like you say, it does reduce the appeal of having multiple BizPlats, since you need to concentrate the spending on one card to hit that $5K.

Why do you keep the Green cards ($150 for no real value) – to avoid credit hits and ride the upgrade gravy train? Presumably NLL? What kind of upgrade offers have you been seeing?

1. You can downgrade at any point during the year and receive a pro-rated refund of the annual fee; you’re not bound by the 30 days after statement close limit like you are for the full refund. If you then still want to cancel the Green, you’re only out the pro-rated portion of that year’s (much lesser) annual fee.

2. Upgrade offers like this are common. They don’t need to be NLL, because it’s an upgrade offer, lifetime language doesn’t apply. The per-dollar of spend earning potential can be as good or better than regular SUBs. And you still get to double-dip credits.

3. When you upgrade/downgrade/upgrade, you run less chance of getting into pop-up penalty prison (although, that’s less common with business cards).

I’ll still cancel cards occasionally, but I try to keep at least some stable of Green cards to take advantage of upgrade offers.

Thanks. Very helpful. The upgrade seems decent and if you get it often enough it may be worth it (say in 1 month the green will only cost $12.50) Though I’m already straining with property and federal tax payments to max out organic offers so I may take a pass on this.