The Capital One Venture X card was Capital One’s first entrance into the world of “ultra-premium” cards and created quite a splash when it was launched in late-2021. At the time, the combination of a gaudy initial welcome offer, 2x everywhere earning and excellent travel protections made it a very attractive card. While it’s not quite the “it” card it was when it first came out, there’s still a lot to like about the Venture X.

Capital One Venture X Current Welcome Offer

| Card Offer |

|---|

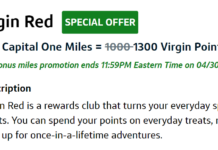

75K Miles ⓘ Affiliate 75k miles after $4k spend within first 3 months. (Rates & Fees)$395 Annual Fee Recent better offer: Expired 3/14/22: 100K after $10K spend in 6 months + $200 credit for vacation rental spend in first year |

Capital One Venture X Review

The Capital One Venture X is a valuable all-around card. Its travel and purchase protections are excellent and it offers an excellent array of complimentary lounge access. Incredibly, up to four free authorized users receive many of the card’s best perks: lounge access, primary rental car insurance and travel/purchase protections. Over the last couple of years, Capital One miles have become a much more useful currency that can now transfer 1-1 to a decent selection of travel partners or be redeemed for 1 cent each towards travel. The $395 annual fee is effectively offset by a $300 annual travel credit and a 10,000 mile anniversary bonus. Combine that with the card perks, generous authorized-user benefits and 2x everywhere earning and this card could be a keeper for many.

- Annual Fee: $395

- Authorized User Annual Fee: Free (Up to four)

- Foreign Transaction Fee: None

- What points are worth: The Capital One Venture X earns Capital One Miles. Our current Reasonable Redemption Values pegs them at 1.45 cents each.

- Best Use for Points: Capital One Miles can be transferred to travel partners at a 1:1 ratio and this will usually yield the most value. Our favorite hotel transfer partner is probably Wyndham Rewards, because of the terrific redemptions that can be had with Vacasa Vacation Rentals. Airline partners can be an excellent value as well, and include Air Canada Aeroplan, Air France/KLM Flying Blue, British Airways Avios and Turkish Miles and Smiles. Venture X cardholders can also redeem miles to erase travel purchases or redeem miles them directly through the Capital One Travel Portal at 1 cent per point.

- Earning Categories:

- 10X hotels and car rentals booked through Capital One Travel

- 5X flights booked through Capital one Travel

- 2x everywhere else

- Credits:

- $300 annual travel (must be booked through Capital One)

- $100 Global Entry/TSA PreCheck (once every 4 years)

- 10,000 bonus miles each year at renewal, starting with the first anniversary

- Additional Perks:

- Priority Pass Lounge Membership: Cardholder and unlimited guests. Like many other card-linked Priority Pass memberships, this one does not include restaurants in the Priority Pass network. Applies to authorized users.

- Plaza Premium Lounge Access: Cardholders (and up to two guests) get complimentary access to a subset of Plaza Premium Lounges. Applies to authorized users.

- Capital One Lounges: Cardholders and up to two guests get complimentary access to a Capital One Lounges. including the cardholder and up to two guests. Applies to authorized users.

- Premier Collection: Get access to Capital One’s “premium hotel collection. When booking through Capital One, get a $100 experience credit, daily breakfast for two and other benefits (see terms and list of properties here). Applies to authorized users.

- Complimentary Hertz President’s Circle Status. Applies to authorized users

- Travel Protections (applies to authorized users):

- Auto Rental Coverage: Primary auto rental CDW (collision damage waiver). Provides reimbursement for theft and collision damage for rental cars in the U.S. and abroad.

- Trip Delay Reimbursement: Covers delays of more than 6 hours or that require an overnight stay. Cardholder and family are covered for up to $500 per ticket.

- Trip Cancellation / Interruption Insurance: Up to $2,000 per person.

- Lost Luggage Reimbursement: Up to $3,000 per passenger.

- Travel Accident Insurance: Accidental death or dismemberment coverage of up to $1,000,000.

- Purchase Protections (applies to authorized users):

- Cell Phone Insurance: Coverage applies to all lines listed on the account. Up to two claims/year, $800/claim and a $50 deductible/claim.

- Extended Warranty: One additional year, on eligible warranties of three years or less (US warranties only).

- Damage and Theft Protection: 90 days against damage or theft; up to $10,000 per claim and $50,000 per year

- Return Protection: Within 90 days of purchase, up to $300 per item, $1,000 per year. U.S. purchases only.

- Who’s this card for? Travelers, families and folks that can take advantage of the perks and terrific authorized user benefits.

- Is the Capital One Venture X a keeper? The $300 travel credit is a little irritating as it has to be used through Capital One Travel (I often use it for rental cars), but, combined with the 10,000 anniversary miles, this card more or less pays for its itself. Given that, I think it’s an easy keeper as a 2x-everywhere backstop for the lounge/travel benefits and the ability to share those benefits with authorized users for free.

Capital One Venture X Pros and Cons

Pros

- 2x everywhere

- Free authorized users get an impressive suite of benefits

- Card effectively pays for itself with anniversary miles and annual travel credit

- Excellent travel protections, including primary rental car insurance

- $300 travel credit applies to cars, hotels and flights booked through Capital One Travel

- Nice variety of transfer partners

- Good mix of lounge partners

- Points can be redeemed at 1 cents each for travel if you don’t want to hassle with transferring partners (although, as a rule, we don’t recommend doing it)

Cons

- Outside of Capital One Travel, no bonus categories

- High annual fee ($395)

- Annual travel credit has to be used through Capital One Travel, oftentimes with higher pricing (or possible headaches when dealing with irregular operations)

- Can be difficult to get approvals for multiple Capital One cards

- Transfers to Choice Privileges at 1/2 the rate of Citi

- Some folks won’t like the lack of domestic airline transfer partners

Capital One Transfer Partners

| Rewards Program | Capital One Transfer Ratio | Best Uses |

|---|---|---|

| Accor Live Limitless | 1000 to 500 | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia |

| Aer Lingus Avios | 1 to 1 via BA | Fuel surcharges are sometimes lower when booking with Aer Lingus (Avios.com) rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| AeroMexico ClubPremier | 1 to 1 | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. |

| Air Canada Aeroplan | 1 to 1 | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | 1 to 1 | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| Avianca LifeMiles | 1 to 1 | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. |

| British Airways Avios | 1 to 1 | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Cathay Pacific Asia Miles | 1 to 1 | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. |

| Choice | 1 to 1 | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. |

| Emirates Skywards | 1 to 1 | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. See: Emirates Sweet Spot Awards - First class from 30K miles round trip. |

| Etihad Guest | 1 to 1 | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. |

| EVA Air Infinity MileageLands | 1000 to 750 | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. |

| Finnair Plus+ | 1 to 1 | Award prices are quite high compared to competing programs. Interestingly, miles can be exchanged for tier points (towards elite status). |

| Iberia Avios | 1 to 1 via BA | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Qantas Frequent Flyer | 1 to 1 | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) |

| Qatar Privilege Club Avios | 1 to 1 via BA | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | 1 to 1 | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| TAP Air Portugal | 1 to 1 | |

| Turkish Airlines Miles & Smiles | 1 to 1 | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. |

| Virgin Atlantic Flying Club | 1 to 1 | Virgin Atlantic offers a few great sweet spot awards including US to Europe on Delta One business class for 50K points one-way. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

| Wyndham | 1 to 1 | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Additionally, you can book Vacasa vacation rentals for only 15K points per room per night. Wyndham Earner cards offer automatic 10% discount on award stays. |

Related Cards

Capital One Consumer Cards

| Card Offer and Details |

|---|

20K miles ⓘ Affiliate Earn 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening. (Rates & Fees)No Annual Fee FM Mini Review: Decent welcome bonus for a card with no annual fee, but other cards offer better rewards for ongoing spend. Click here for our complete card review Earning rate: 1.25X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

75K Miles + up to $200 in statement credits ⓘ Non-Affiliate Earn 75,000 bonus miles after $4K spend in 3 months + up to $200 in statement credits when you make an Avelo purchase in your first year + priority boarding on Avelo flights for the first year. (Rates & Fees)$95 Annual Fee Alternate Offer: Airport Kiosk offer of 80K miles after $4K spend in the first 3 months See this post for details. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card earns 2 "miles" per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees |

75K Miles ⓘ Affiliate 75k miles after $4k spend within first 3 months. (Rates & Fees)$395 Annual Fee Recent better offer: Expired 3/14/22: 100K after $10K spend in 6 months + $200 credit for vacation rental spend in first year FM Mini Review: This card offers annual rebates that easily mitigate the fee for those who travel often. Authorized users are free and also get access to perks like Priority Pass, Capital One Lounges, Plaza Premium lounges, and more. The card earns 2 "miles" per dollar on most purchases just like the Capital One Venture Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One huge advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5x miles on flights booked via Capital One travel. ✦ 2X miles everywhere else. Card Info: Visa Infinite issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual credit for bookings made through Capital One Travel ✦ 10,000 bonus miles each year starting at first anniversary ✦ Up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Capital One Lounge access ✦ Priority Pass membership w/ unlimited guests (lounges only) ✦ Plaza Premium lounge access ✦ Cell phone insurance ✦ Trip insurance ✦ Primary CDW coverage ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

Capital One Business Cards

| Card Offer and Details |

|---|

50K Miles ⓘ Affiliate Earn a one-time 50K miles bonus when you spend $4,500 in the first 3 months. (Rates & Fees)$0 introductory annual fee for the first year, then $95 Note: Most Capital One Business credit cards (including this one) DO count against Chase's 5/24 Rule FM Mini Review: This card is similar to the Spark Cash Plus card, but it has the advantage that "miles" earned with this card can be transferred to a large number of airline & hotel programs. Earning rate: 2X Miles everywhere ✦ Earn 5X miles on hotel and rental car bookings through Capital One Travel Base: 2X (2.9%) Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees ✦ Up to $100 fee credit for TSA Pre✓® application fee or Global Entry application fee |

50K Miles ⓘ Friend-Referral 50K after $4,500 spend in 3 months from account openingNo Annual Fee Note: Most Capital One Business credit cards (including this one) DO count against Chase's 5/24 Rule Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card is similar to the Spark Cash Select for Business, but rewards are intended to be used to offset travel purchases. This is a good option for business owners who prefer simple rewards with no annual fee, and who value free travel over cash back. If you spend more than $19K per year, though, go for the 2X Spark Miles card. Earning rate: 1.5X miles everywhere ✦ Earn 5X miles on hotel and rental car bookings through Capital One Travel Base: 1.5X (2.18%) Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees |

150K Miles ⓘ Affiliate Earn a one-time bonus of 150K miles after $30K spend in the first 3 months$395 Annual Fee Recent better offer: Expired 3/31/23: 250K Miles after $50K in spend. FM Mini Review: Similar to the Venture X consumer card, the business version offers annual rebates that easily mitigate the fee for those who travel often and could be worth it for the lounge access and travel protections given the cost/benefit ratio. Unlike the Venture X, free authorized users do not get Priority Pass access. The card earns 2 "miles" per dollar on most purchases just like the Capital One Venture X Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5x on flights booked via Capital One travel. ✦ 2X everywhere else. Card Info: Visa issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual credit for bookings made through Capital One Travel ✦ 10,000 bonus miles starting at first anniversary ✦ Up to $100 application fee credit for Global Entry or TSA PreCheck® ✦ Capital One Lounge Access ✦ Priority Pass w/ unlimited guests (includes restaurants) ✦ Plaza Premium lounge access ✦ Cell phone insurance ✦ Trip insurance ✦ Primary CDW coverage ✦ Redeem miles for travel at 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

thanks. you wrote “The $300 travel credit is a little irritating as it has to be us.ed through Capital One Travel (I often use it for rental cars),”,Given that the VentureX credit card includes primary rental car insurance, my question is whether utilizing the $300 credit for this booking would still provide me with the same benefits, particularly the primary rental car insurance, as if I had used the credit card directly without the travel credit?

Yes, you would. Using the travel credit doesn’t affect any of the coverage benefits that you receive through the card.

Thank you for a great quick summary of the Venture X. I have this card and the biggest and probably only reason I have continued with the card is the benefits to AU… but I am also considering going the RC way. It seems that one offers better AU perks in terms of lounge access etc… Is there any chance you can do a head to head comparision sometime…. Also in which case, what would you downgrade the VentureX to but still keep the points alive and transferable??

I am starting to keep eye out for transfer bonuses as I am not sure the points can stay alive

You may want to revise on the part of $300/yr credit?

How do you mean? It’s still a $300 annual travel credit that has to be used through the C1 travel portal.

One thing that’s worth noting:

When traveling in Europe, any online transaction (train tickets, museum timed entry reservations, etc.) that I tried to make with my Venture X, Capital One wanted to text an SMS code. Well I couldn’t receive an SMS while abroad. So all that spend had to go on my CSP, and Chase approved the transactions no issue. Annoying, because the VX is my go-to card for most spend other than restaurants because I don’t have to worry if something will code as travel or not, it’s just a flat 2X everywhere.

So if I rent a car via the capitol one portal and the rate is cancellable, and I cancel, will I get a refund to my card or a travel credit?

CapOne products offer the best point earning opportunities for anyone who works or travels abroad often, in my

opinion.

However, their offshore customer service and fraud reviews are horrible. Imagine being told the don’t accept Real IDs or even a Passport to validate your identity.

Buyer Beware with this company!

How does Greg compare the Venture X with the (discontinued but accessible) Ritz Carlton card that he likes so well? Mostly interested in the lounge access and primary rental insurance for adult children who don’t own cars.

I’m eligible to upgrade to the RC (got the Boundless a year ago for the excellent 5-night SUB, thank you FM for the tip). Am wondering if I should upgrade my Boundless to the RC -or- get the Venture X (it would be my first points-earning Cap One card) and downgrade the Boundless to a no AF Marriott? If I get the Venture X, then contemplating having P2 get the AmEx Marriott Business (125k points) or the Chase Boundless (5-FNC).

Thoughts?

I think it’s worth noting that it’s pretty easy to trigger an unexpected 1099 with the venturex card. Gary at VFW and DoC have covered this. Based on my research that turned up those resources it appears capital one will issue a 1099 if the sum of the following meets or exceeds $600:

* TSA GE/Pre Check credits

* $300 annual travel credit

* 10k anniversary points

* Even a report of any goodwill points (one report of 10k pts awarded due to a web site failure)

* Similar one-offs such as launch benefit of $200 toward Airbnb/VRBO.

* And referrals of course.

* The sign up bonus does NOT count.

Their inclusion of items beyond the referral bonus is unusual and inconsistent with other card issuers.

A single referral may trigger the 1099 easily. E.g. $300 travel credit and 35k pts (25k referral + 10k anniversary).

But another scenario without a referral may easily also… Benefit limits are per membership year while 1099 is based on the calendar year. Imagine the following w a person that keeps the card (I do) with a jul 2 renewal:

$300 : travel credit in March

$300 : travel credit in September

$100 : 10k anniversary pts awarded approx Aug.

= $700 : 1099 issued

Although it’s a hassle to deal with the 1099, officially -besides for the referral -none of this is taxable correct?

I’m not a tax professional. Gary at VFTW has expressed some thoughts on that. As do the professionals at Chase and Amex. If you’re thinking through disregarding or contesting it, I’d spend some time getting comfortable with how. Do you just omit it at filing? Include a letter explaining and file on paper?

FWIU a sub is a rebate and thus not taxable. As for the 1099 I’ll be giving it to my accountant with the rest of my papers with the above disclaimer

Nice Summary. I have the Venture X and is my main non bonus card ( catch up card). That 2x is fenomenal. I personally use the travel portal for hotels , I’m not a hotel status earner, I 90% used non brand hotels because they fit better for what I need and locations. So the $300 is an easy credit for me.

Nice summary. Like that 2x with no foreign transaction fees feature.

I’m one of the Venture X rejected, fitting the traditional credit model citizen profile. Any truth to the rumor Chat GPT has broke the Capital One approval algorithm or should we just wait for the release of the quantum personal computer?

-Ventureless in DFW

Getting approved for the Venture X tends to be hard for seasoned veterans of the credit card rewards space. From experience, they tend to approve people in the early to mid game but tend to reject people who already have quite a few cards.

It’s also possible that their approval policies are almost completely random. I’ve been a long time churner and Cap 1 loves me—Approval after approval!

OTOH, Chase closed all my cards without warning a few years back, and I’m not sure if they’ll ever approve me again. I’ve also been in Amex jail for years, with no sign of ever getting a new Amex card ever again.

At the end of the day, we can speculate all we want, but I don’t think any of us really know the magical criteria for approval. All we can do is press “apply” and cross our fingers…

I have repeatedly received targeted pre-approved offers from Capital One. Upon application, repeatedly declined . . . with three hard pulls. There’s nothing unique and compelling about Capital One that I need it. No thanks.

I was approved and have 8 other cards. With my newest applications, I’ll have 11, and maybe 12 depending on the pending status of my Hyatt application.