With American Airlines announcing last week that they will essentially follow Delta’s lead and make award redemptions on its own flights fully dynamic (with no more “Mile SAAver” or “Anytime” awards on American airlines starting in 2023), gone are the days of domestic airlines offering predictable award pricing for their own flights. An unfortunate side effect of airlines eliminating award charts has been that it is increasingly difficult to find award availability for travel on the major US carriers that can be booked with partner miles. While US-based airlines have largely “simplified” their mileage programs by making them ever more resemble a cash-based system, they have taken the fun out of the game. That’s not to say that I don’t still enjoy playing “the game” in the sense of collecting and using frequent flyer miles in general, but rather that I don’t enjoy much about the major US-based programs. For domestic air travel, I’m leaning much more toward earning cash than miles.

Increasingly simple value propositions

Over the past several years, we have seen each of the major legacy airline programs inch ever closer to making a mile worth about a penny toward airfare on that airline. We saw it first when Delta ditched award charts and began pricing everything dynamically — sometimes charging a hundred thousand miles or more for a domestic flight. It continued as United and now American have ditched the idea of an award chart for their own flights in order to instead price awards “based on demand”.

On the one hand, I “get it”. The average consumer, who probably only books one or two leisure trips a year at maximum, probably wants to fly on a specific set of dates and wouldn’t consider tailoring their trip around award availability (as feels customary to so many of us who enjoy hunting down the perfect award and then making our trip fit that award rather than the other way around). I imagine that many of those average customers were frustrated with constantly seeing no availability for the flights that they wanted to book — and when they compared against Southwest and JetBlue, which offered every seat for sale as an award (but at dynamic rates), I could understand where Delta, American, and United airline executives saw a missed opportunity. They had customers with their in-house currency who wanted to spend it on their own flights, but their customers couldn’t because it wasn’t feasible for them to release every seat for the saver level (and then they seemed like they were offering a poor value proposition when flight prices were low and yet they were still charging a set number of miles based on an arbitrary award chart). So the airlines made it easier by introducing fully dynamic award pricing, giving both the consumer what they wanted (the opportunity to book the flights they wanted using their miles) and the airline a beneficial situation (the ability to collect enough miles for a seat to make it worth not selling the seat for cash).

For that average consumer, the fact that one can redeem their miles for the exact flight they want is simple and seems user-friendly (though I’d argue that the outlandish prices being charged in some cases are rather customer-unfriendly). I feel like simplicity has in many ways been a theme and trend of the current generation: from the rise of popularity of simply-designed Apple products to the KonMari method to many more examples, I think simplicity has become highly valued on the whole. There’s no doubt that as airline programs move toward every seat being available but at varying cost, that makes the award program simpler to understand since it essentially mirrors the cash-based world that we’re used to navigating.

The problem for me is that this takes all of the fun out of the game.

Exciting redemptions are rarely “simple”

I primarily fly Southwest Airlines domestically and Southwest may have been the first to tie the value of its frequent flyer currency to the cost of tickets (I’m not sure). I long loved Southwest for two things: the Companion Pass and the ability to change plans and cancel a flight up to 10 minutes prior to departure. My wife loves Southwest for one more thing: the predictability of knowing we’d fly a 737 every time rather than worrying about taking a puddle jumper (and by extension, I love Southwest for that predictability since, as they say, happy wife happy life). Notice what I didn’t mention loving? The simplicity of the value of their points has never been something I’ve loved but rather something I accepted as part of the trade-off.

And I don’t think I’m looking back and applying my 2022 lens to thinking about flights I took with Southwest in 2015, etc. It’s just that I don’t recall being particularly excited about a Southwest award flight (apart from maybe the first Southwest flight we took to Hawaii, which excited me most because of the chance to reduce the cost of an award with a Companion Pass and because of the chance to have Southwest compete down the price on other carriers rather). It wasn’t the redemption rate that excited me in that case.

The award trips I get most excited to talk about are the situations where I felt like I got far outsized value from my miles. My wording in the previous sentence was intentional — trips where I felt like I got far outsized value. Award travel regulars know that you shouldn’t value your award redemption based on the cash price of the ticket if you never would have paid the cash price, so the time I flew from the Maldives to New York in Emirates first class (with a stopover in Dubai) and the cash price of the identical itinerary came to more than $20,000 I did not assert that I got $20,000 of value from my 90,000 Alaska Airlines miles (those were the days!). But man it was exciting.

Similarly, I’ve redeemed United miles for flights on United and American Airlines miles for flights on American, but those redemptions have only really been memorable the times when they have yielded outsized value to me — whether that was the time I booked a last-minute Mile SAAver award for a funeral or the time I was DJing a friend’s wedding in Chicago and I flew business class on American so that I could check some of the equipment for free thanks to the baggage allowance. In those instances, I felt like I got far outsized value.

But those opportunities to get outsized value for domestic flights are dwindling. The major domestic programs seem to charge ever-increasing award prices (except of course on the cheapest flights). They also seem to be offering less and less availability on their own flights to their partners. Good luck finding a business class seat on United that’s available to partner programs. Even booking American Airlines flights via Avios, which was once a terrific value proposition, has become difficult and often an unremarkable savings since in the rare instances when those flights are available via British Airways they are probably pretty cheap.

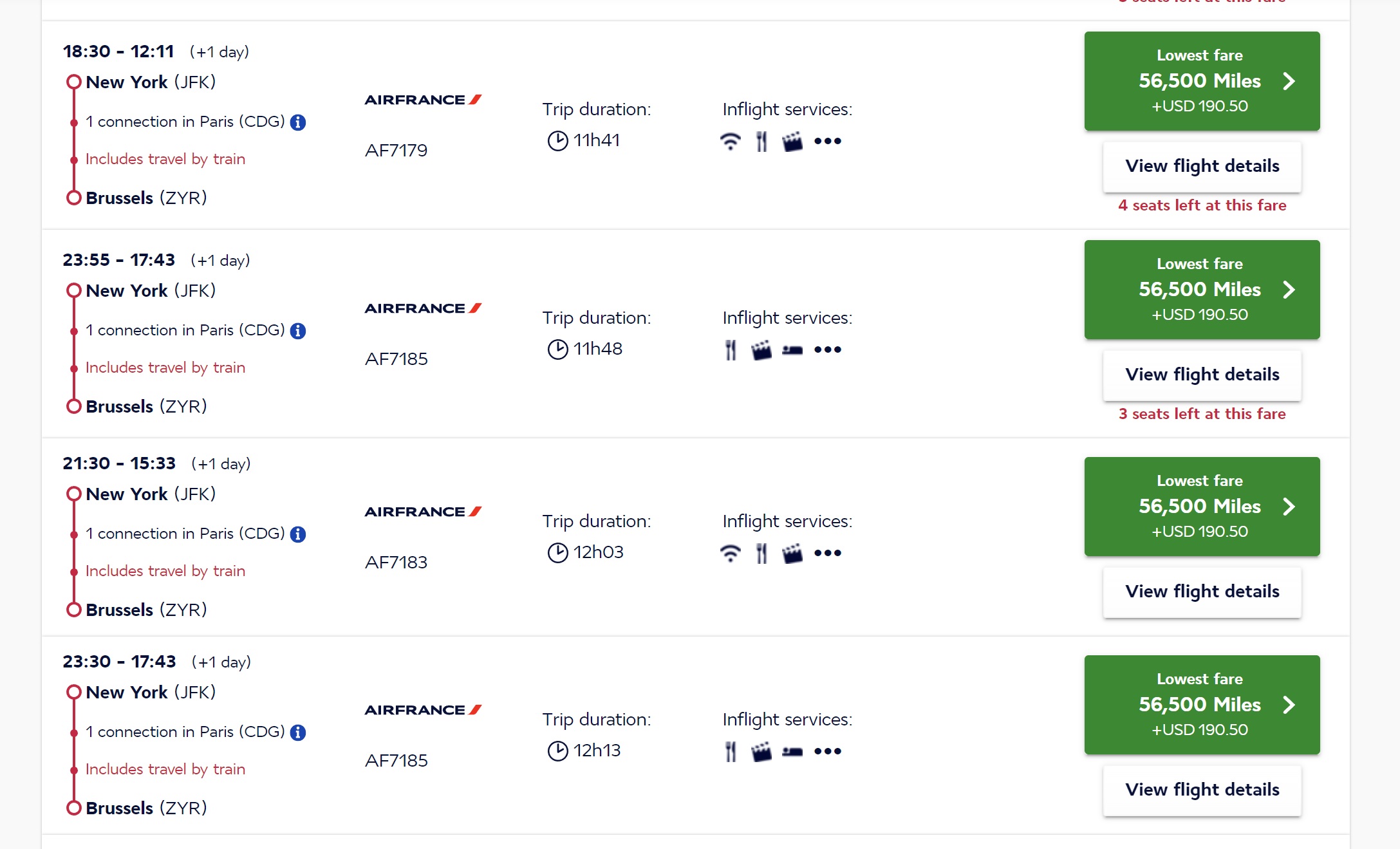

I generally only use American or United miles for travel on their foreign partners. Unfortunately, Delta seems to be attacking even the value proposition of redeeming for flights on partner airlines with ever-increasing partner award rates that now boarding on laughably ridiculous in many cases.

If and when United and American follow Delta’s lead in subjecting partner awards to the pandemic of dynamic pricing, I’ll have lost all interest in the domestic programs.

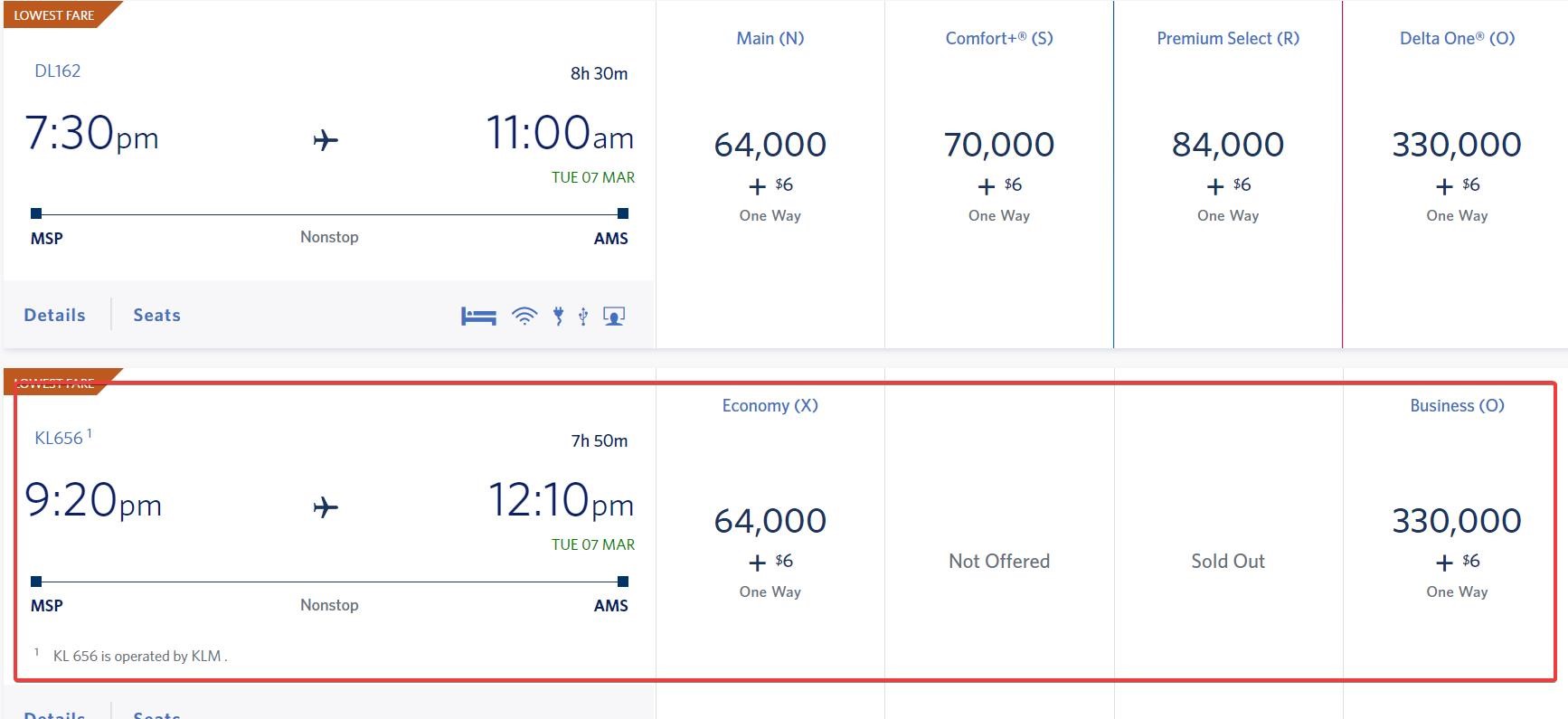

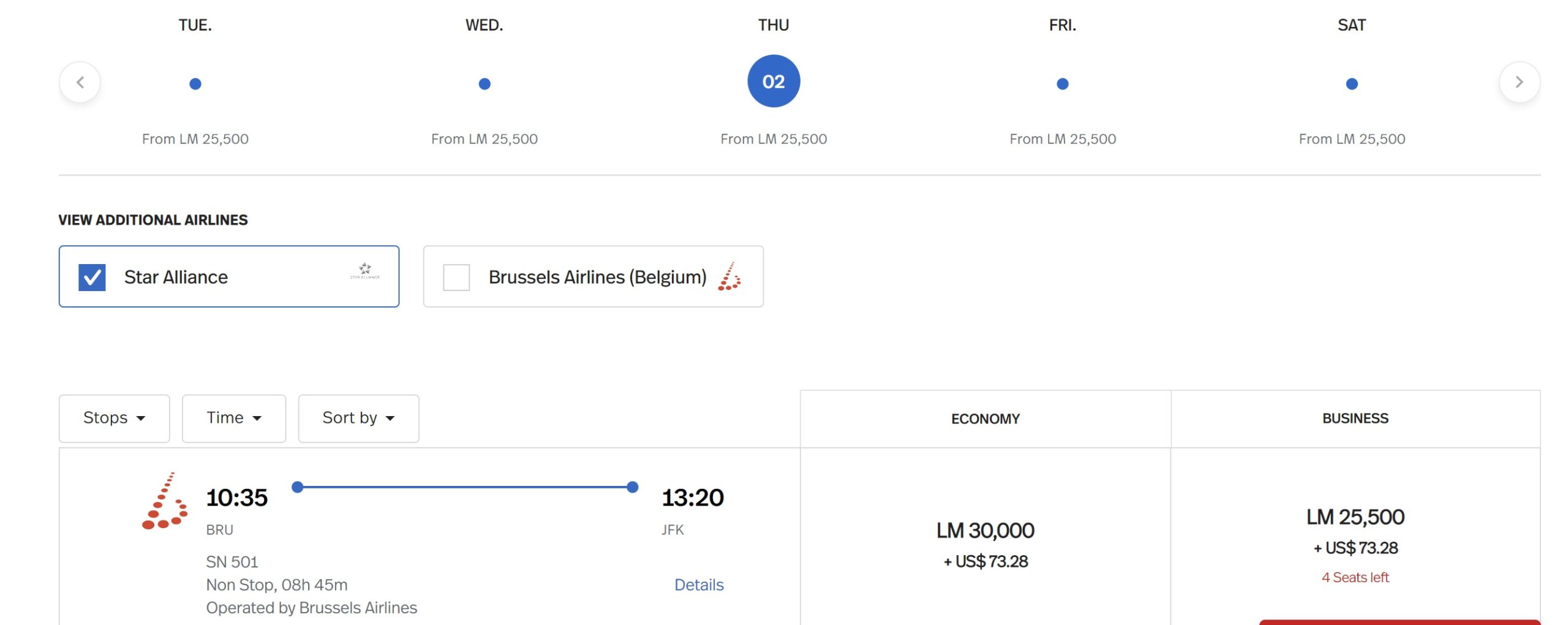

Over these past few years, my interest in foreign programs has only grown. I have redeemed far, far more miles with foreign programs than with domestic programs over the years. The reason I’ve transferred millions of miles to foreign programs is specifically because of their award charts: those charts provide opportunities to get outsized value from miles. I can hunt and peck and find great value flights for far less miles than the US programs are charging.

But most award travel booked by Americans is domestic and at this point, booking domestic awards is not the game it once was. It is downright difficult to find partner availability on many routes, so even though Turkish offers a fantastic price on United awards and Avios would at some times be a preferable way to book American Airlines flights, gone are the days of booking those types of awards in many (most?) instances. The same can be said about using Flying Blue miles for Delta and Virgin Atlantic (partly owned by Delta) made booking Delta domestic awards far less attractive in recent years.

So what’s a traveler to do? I think cash is becoming king for domestic air travel.

Cash back may be king

For domestic travel, cash back may be king. In cases where domestic airlines block partner access to award tickets, you certainly may be better off with a cash-centric strategy and eschews loyalty and award tickets.

Certainly if you would otherwise consider spending on an airline credit card at 1x, you’ll be far better off using cash back cards. That’s because in most situations, you’ll see somewhere between 1c and 1.5c per point in value out of domestic US airlines points when used toward domestic flights. Even just a 2% cash back card out-earns that. For those new to the game, if you want to purchase a flight that costs $200, most US-based programs will charge you somewhere between 13,500 and 20,000 points.

If you were earning your airline miles at a rate of 1 mile per dollar spent, that means you would need to spend between $13,500 and $20,000 on your credit card to get that $200 flight for “free”.

By contrast, if you get a no-annual-fee credit card that earns 2% cash back, then just $10,000 spend on the card would yield the $200 in cash back that you’d need to buy the flight (and you’d earn miles while flying it).

With a little strategy, you can easily average well over 2% cash back on most purchases. The same can be said for airline miles to some extent — you can do better than 1x by leveraging transferable currencies and category bonuses / welcome bonuses. Cash isn’t as clear a winner in all circumstances as my example suggests, but the fact of the matter is that a cash-centric strategy can be quite strong for a traveler whose primary goal is to travel domestically.

Cash back also yields a good deal of flexibility in the sense that you are free to use your cash to book whichever airline offers the best price rather than being stuck with a single airline-specific currency.

How can you average better than 2% cash back for most purchases? There are quite a few ways:

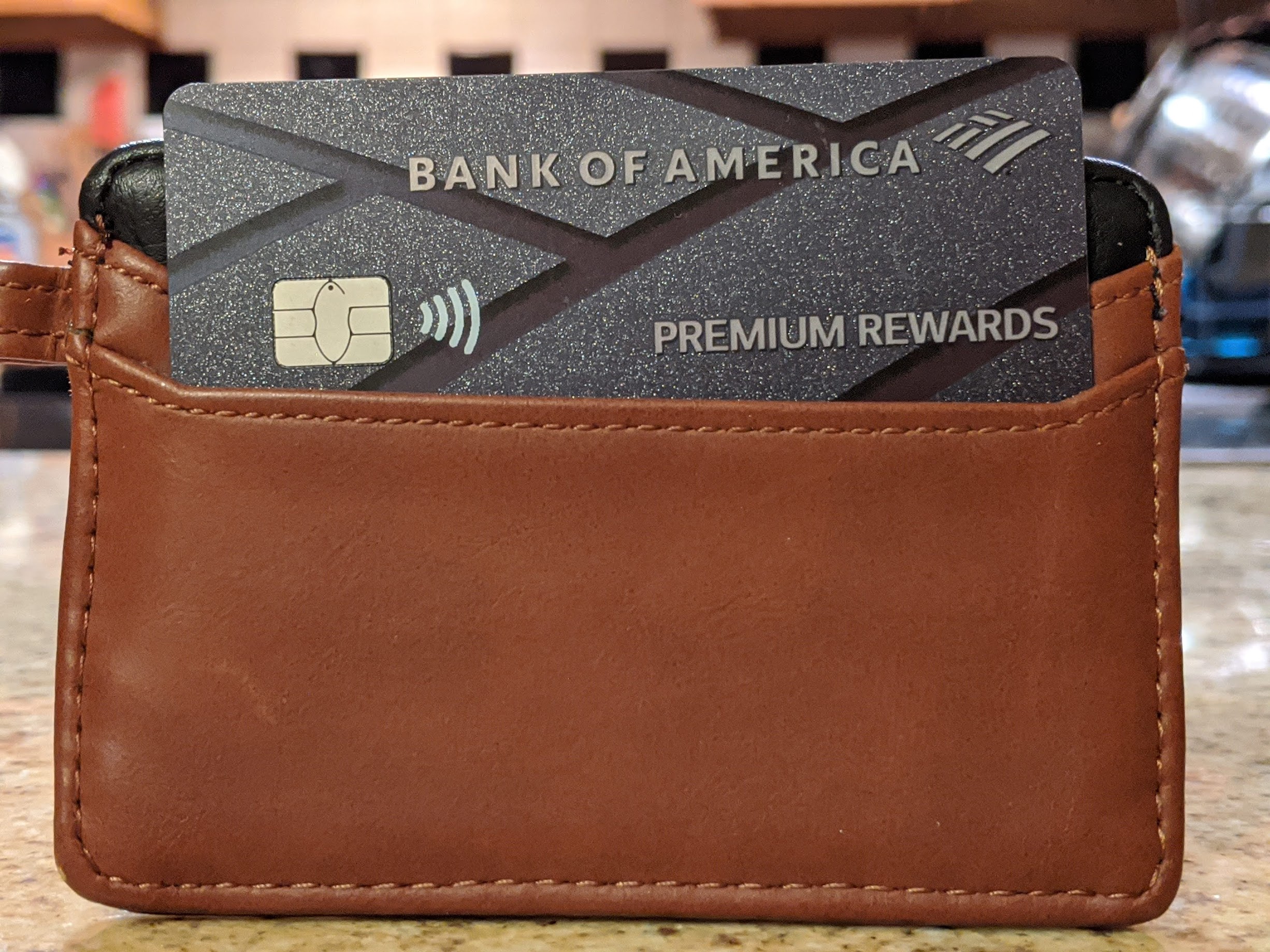

- The Bank of America Premium Rewards card offers 1.5% cash back, but those with Bank of America Platinum Honors status (which requires having $100K+ in cash and/or assets with Bank of America and Merrill Edge or Merrill Lynch) earn a 75% bonus, which means that the card earns 2.625% cash back “everywhere”.

- A glance at our Best Category Bonuses page shows that it is easily possible to earn 3-6% cash back on groceries, 3-5% cash back on gas, and 4% back on dining.

- If you’re willing to utilize those best category bonuses to purchase gift cards at a grocery store, gas station, or office supply store and then use those cards for everyday spend, you could pretty easily get 3-5% cash back everywhere depending on your exact combination of cards.

- You can focus most spend toward a new welcome bonus.

That last point is always a popular one amongst the crowd that constantly opens new cards. I know that not all readers are willing to open multiple new cards each year, but it can certainly be an effective strategy for earning outsized value on every dollar spent.

Of course, you can earn better than 1 airline mile per dollar with good transferable point strategy. For instance, combining a Chase Ink Cash card with a Chase Sapphire Preferred or Reserve will give you the chance to earn 5 points per dollar spent (which could then become 5 airline miles per dollar spent). The same can be true with Amex points (which transfer to Delta). But in most cases, you still aren’t going to get remarkably better value out of those points when used as airline miles though the domestic US based programs than you would if redeeming your points through the airline portal (as would be the case with Chase if you have the Sapphire Reserve since 1.5c per mile is better than you’ll do with United miles in many instances) or cashing them out via a Schwab Platinum card at 1.1c per point or via an Amex Business Checking account with a Business Platinum card at a value of 1c per point rather than transferring to Delta (and paying an excise tax on that transfer!).

But whether considering a transfer to book a domestic award or using the points more like cash, you will in the majority of cases do far better when redeeming those miles through foreign programs than via domestic programs. For domestic travel, the value of having miles in those domestic programs rather than having cash is dwindling in my opinion.

A small irony on the American Airlines Loyalty Points game

Of course, one big irony here is the fact that we’ve been playing the American Airlines Loyalty Points game all year long. I’ve earned Platinum status and should make Platinum Pro before the loyalty year is over at the end of February, which is ironic since I’m calling out the loyalty programs for not being “fun”.

In truth, the “fun” that I’m saying is under attack is the enjoyment of a great award redemption. American thus far commits to keeping its partner award chart, which makes American Airlines miles still valuable to me (unlike Delta SkyMiles, which were never a preferred currency for me and now are a currency I have zero interest in collecting). Furthermore, I like the gamified nature of American’s revamped elite program. I think it’s smart and fun and hopefully trendsetting. At the same time, while I’ll earn some miles for elite status, even if I earn top-tier American Airlines status, the number of miles I’ll earn in a year with American will likely continue to pale in comparison to the number of foreign program miles I use each year.

And even though I’ll enjoy playing the American Airlines Loyalty Points game, I likely won’t use any of those miles for domestic travel on American Airlines. I just can’t bring myself to spend 20,000 or 30,000 miles on a domestic economy class ticket and I don’t find that web specials often exist for the domestic routes I want to book. Even when they do, I would rather book those flights with cash (or using points as cash for greater value through Chase or Amex) given that they tend to be really cheap when redemption rates are lower than historical award chart pricing.

So I’ll keep playing American’s game, but it won’t be because I am excited about getting “free” domestic travel because I know that earning and spending cash is a better tool for booking those domestic flights.

Bottom line

It’s no surprise that US-based frequent flyer programs are becoming more and more revenue-based. While I think Southwest and perhaps JetBlue existed in that arena long before, Delta essentially led the other major carriers in that space. Unfortunately, that makes “the game” far less fun for me: instead, I focus more on getting great cash fares for domestic travel (sometimes booking those fares via a credit card portal to take advantage of higher point value than booking award tickets with those airlines). That’s not to say that frequent flyer programs don’t bring me joy. I am certainly still very much excited about award travel, but my focus for using miles has become almost entirely on international travel since, in many cases, the value for miles is so much higher internationally than it is when traveling domestically. I’m sure that has always been the case to a large extent, but that trend is only becoming more pronounced as US-based programs ditch their award charts. As the game changes, so will the way we play it — and for now, I’ll be playing it with more cash back than ever.

I don’t know what it’s going to look like with AA moving forward but they look real nice in 2022. I used to sit on a huge AA balance and considered AA somewhat useless, mostly due to a lack of a good partner going to Europe (no, thank you, I won’t pay BA surcharges) and high domestic redemptions. Well, that changed. In 2022 I was able to use AA to go to Europe and back in the red-hot summer (temperature-wise but mostly demand-wise). Then I had no trouble finding tickets in F to Japan. And now I’m taking a ski trip and I see 10k OW economy all over. 10k AA vs $300+ ow cash fares.

On the other hand, my love for Southwest has been dwindling. Their cash prices seem crazy this year, to the point when 2 tickets on SW + companion pass are far pricier than 3 tickets on AA or UA. They seem way too comfortable with their market position.

Just like the stock market, when things are hot, every move you make makes you look like a genius.

Right now, there is pent up travel demand. Programs like Hilton, Delta and AA can devalue all they want and people will still put up with it. Let’s see how they do when things cool down and they need to fight for travelers again. It can’t feel good to spend 60k miles to get a one way economy flight. I think even the most basic of consumers can see the how terrible a deal $60k in CC spend for a $600 plane ticket is and will transition to cash back. At least Hilton is giving out their worthless points like candy, none of the airline miles are easy to earn.

The problem is airlines know they can just go to the government for a bailout so there’s no incentive to do better. If a major US or EU airline was allowed to fail, I bet the others will shape up in no time.

Is there value then in building points with an international airline instead? E.g. flying AA but earn points on one of its partners.

I think in addition to cash back it’s also a positive for the CSR as often times you get better value buying a domestic flight at 1.5c per point than using an award redemption.

I’m pretty consistently getting 1.2 to 1.4 cpm on AMEX-Delta transfers, but that is ex-SEA where Delta is trying very hard to match or beat Alaska and Southwest on competitive routes for award prices. As such, this makes AMEX Green/Gold/Platinum spend pretty competitive with cashback on domestic redemptions (and I still have Schwab cash outs AND non-USA programs as ways to get value).

I am figuring on late 2023-2024 being the time I can start hitting Chase up for options and at that point, 1.5 cpp for redemptions might be good.

‘BORDERING on laughably ridiculous”

Nick, the average member of an airline or hotel loyalty program knows quite little about the programs. Recently, Ben at OMAAT (while on a flight) overheard two guys talking about the airline’s loyalty program. Ben thought the inaccuracies in their conversation were representative of the loyalty programs always changing. My sense is that the average person only cares to know a few easy talking points that one can throw out at a cocktail party to appear knowledgeable. And, I think the loyalty programs know this.

I’ve mentioned in comments to other articles that a “loyalty” program exists to generate additional revenue. To the extent the revenue needle moves up, the program is successful. To the extent the revenue needle moves down, the program is not. But, what is it that is actually moving the needle? Whether it is a breakfast benefit, a suite upgrade, or a flight redemption at 2 cents per point . . . how do they know?

Let’s convert the breakfast benefit from a full breakfast to a continental breakfast then to a dollar credit. If the revenue needle doesn’t move, then we (management) have been over-granting that benefit all these years.

Let’s reduce the average flight redemption from 2 cents per point to 1.5 cents per point then to 1 cent per point. If the revenue needle doesn’t move, then we (management) have been over-granting that benefit all these years.

Loyalty program managers are trying to identify where the incremental benefits granted achieve diminishing revenue increases. Alternatively, what are the least amount of benefits we have to grant to achieve revenue of $X? The fact that the airlines and hotels are now flush with revenues, any needle movement incurred by dissatisfied loyalty program members is lost in the noise . . . and, consequently, the loyalty programs don’t care. As long as they are flush with revenues, they will continue on their path of chipping away. Period.

That being said, as you’ve noted, AA’s new Loyalty Point system actually aligns the airline’s revenue interests with the customer’s benefit interests. There will be winners and losers. But, the alignment of interests was a genius move on AA’s part.

Now, to your point, the devaluations seen in some loyalty programs have been to the extent that there is no value-add to the customer/member relative to seeking cash back. Other readers comment that they still find value in points versus cash. There will certainly be some. But, as there is no meaningful resistance to the devaluations, they will continue and your assertion of cash-back strategy will gain relevance to more and more people. Then, of course, the *new* Durbin Amendment will become law, the game will be over, and we all head to the locker room.

In the world of the hourly-billing professional, revenue based earning / redemption becomes a comparison between the time spent to earn points and the lost value of billing that time. To compensate for spending a half-hour to find the best shopping portal deal, or picking up gift cards, I’d need to net 10,000 cost-free miles. It’s rarely worth it.

Dad drives half-way across town to buy gas for 5 cents a gallon cheaper.

So, Dad, how much gas did you use getting over to that gas station?

But, I saved 5 cents a gallon.

Some people don’t get it and will never get it.

Quality is economy and simplicity has value.

Made a round trip booking to Hawaii yesterday from the west coast on Alaska after jumping through all the hoops and matching my itinerary to the partner award availability

Total pax – 2

Fly out day – Sunday

Fly back day – Monday (week after)

Total Alaska miles required – 20k * 2 * 2 = 80k

Total British avios required – 13k * 2 * 2 = 52k

(So Transferred chase ur to avios)

Total saver fare – 189 * 2 * 2 = $756

Total Main fare – 229 * 2 * 2 = $916

Equated the miles purchase with main fare because of the cancellation flexibility

So effective redemption 52k avios/916$ = 1.76c

Not the best redemption but wanted to save the 900$ and also burn the miles when I have them to further prevent devaluation.

I don’t see getting a very good redemption rate for domestic travel on partner airlines because if there’s award availability then the cash price would be equally low

USB Altitude Reserve. 4.5% cash back. If mobile paying. Not too shabby

This, and you can sometimes stack it with category credits or merchant offers as well. There’s a current 2% credit on dining offer via email and merchant offers at stores with mobile payments have stacked for me.

It’s not world beating redemption value but it works pretty well as a catch all card for many odds and ends, and for general domestic travel the redemption options are very flexible.

I continue to favor earning miles/points over cash. Dynamic pricing as implemented by most airlines/hotels (other than Delta, and perhaps Hilton) isn’t as awful as it seems. When comparing award price with cash price, one needs to compare with fully refundable cash fare/rate. I often book with points/miles to lock in the price and then rebook (as often as I care to check prices) when the price drops.

This post is overdue but spot on. The departure from domestic award charts and the inability to use partner programs have dealt a death blow to domestic sweetspots. Transferable currency is more important than ever. My entire focus has been earning MR, UR, and TYP.

Probably makes Citi DC the best all-round, since you earn at 2% and have a choice between points or cash when you redeem

Venture/VentureX would cost the same or less (depending on how you value VentureX credits) as a Citi DC/Premier duo and there’s no foreign transaction fee (pretty important if you leave the US frequently).

The cash proposition might actually be a good argument for the USB AR, earns 3x on pretty much all in person spend since mobile payment options have become so ubiquitous. Redeem for 1.5c = 4.5% cash back towards travel

Read the terms and conditions on your card. Thoroughly. You might be surprised about your expectations.

Like? I’ve used it dozens of times to book hotels and flights..

Great article that exactly reflects what I have been thinking about since AA’s announcement to abolish Milesaaver awards. For the coming year at least, I plan to put far more spend on cash back cards (and set that cash aside in a separate “travel account”), but still some on AA cards to maintain at least PP and hopefully EP into 2025.