NOTICE: This post references card features that have changed, expired, or are not currently available

Reconsidering my Delta elite future

For many years now, I’ve manufactured high level Delta elite status for myself and my wife using techniques to increase credit card spend and get most of it back. For simplicity, we often refer to these techniques as “manufactured spending” but in reality many techniques are simply ways to pay big bills (taxes, rent, etc.) with a credit card for as small of a fee as possible.

There are significant costs involved in manufacturing elite status through credit card spend such as transaction fees and credit card annual fees. There is also the opportunity cost to consider: how much more valuable would your earned rewards be if you used more rewarding credit cards for the same spend?

In the past when I’ve done the math I concluded that the costs involved in manufacturing top tier Delta status were outweighed by the combined value of the elite status perks, redeemable SkyMiles earned, and credit card perks (such as annual companion tickets). And, I’ve always stressed that the results were specific to me. I live near a Delta hub (Detroit); I highly value nonstop flights (which are most often on Delta when flying from Detroit); I highly value elite perks such as free upgrades, free award changes, and global upgrade certificates; I travel frequently; and I generally prefer flying Delta over any other US airline. The value you would get from elite status, redeemable miles, and credit card perks will vary with your situation. If you don’t fly Delta often and don’t plan to in the future, then there’s not much point in even considering manufacturing elite status. But, again, for me and my wife it has made sense. But the equation changes in 2020.

On January 30th 2020, Delta credit cards issued by Amex will change drastically (see this post for details). For the purpose of this discussion, the most relevant changes are:

- Increased annual fees:

- Delta Platinum cards increase from $195 to $250

- Delta Reserve cards increase from $450 to $550

- Increased limits for MQM earnings

- Old: Delta Reserve cards allowed earning up to 30K MQMs with $60K calendar year spend

- New: Delta Reserve cards allow earning up to 60K MQMs with $120K calendar year spend

- Decreased redeemable miles earned on big spend

- Old: Each time you earned a Miles Boost through high spend, you would earn both MQMs and redeemable miles

- New: Each time you earn a Status Boost through high spend, you will earn MQMs but no bonus redeemable miles.

The rest of the basics regarding earning elite status through spend stay the same:

- Delta Platinum cards earn 10K MQMs with each $25K of calendar year spend (capped at $50K spend)

- Delta Reserve cards earn 15K MQMs with each $30K of calendar year spend (previously capped at $60K spend, but soon moving to $120K)

- Earn an elite MQD waiver with $25K calendar year spend good for Silver, Gold, or Platinum elite status

- Earn a Diamond Elite MQD waiver with $250K calendar year spend

- MQMs earned with Delta Reserve Status Boosts are giftable. You can gift the 15K MQMs earned from each Status Boost to a family member or friend.

So, the question is… Will people like me still find value in manufacturing Delta status once the new card features kick in?

Background

Most airlines offer extra benefits to their most valuable customers. This is usually handled through elite status. If you fly enough with an airline, you can become “elite”. Of course, not all elites are equal. Most airlines have multiple elite tiers to differentiate their valuable customers from their really valuable customers. And, of course, airlines offer the best perks to their highest tier elites.

Delta does the same. They offer elite tiers ranging from Silver status to Diamond status. Silver status perks are only slightly better than those you get from holding a Delta branded credit card. Diamond perks, though, are very nice.

Delta’s top level Diamond Elites can choose global upgrade certificates as a choice benefit. These can be used to upgrade from economy to lie-flat business seats on international flights.Where Delta differs from all other airlines is that they offer a path to high tier elite status that does not require flying. Via certain Delta branded American Express credit cards, it’s possible to spend your way to high level elite status.

You might wonder why bother earning elite status without flying? After all, the only way to enjoy those benefits is to fly, right? True, but there’s a difference between earning elite status through flying and enjoying elite status while flying. Most who earn elite status through flying, hate to book award flights for themselves because it means flying without earning more elite qualifying miles. Those who earn elite status through credit card spend don’t mind using miles to fly. You still get elite perks and you don’t have to worry about losing out on status earning.

Now lets take a look at Delta’s requirements for each elite tier…

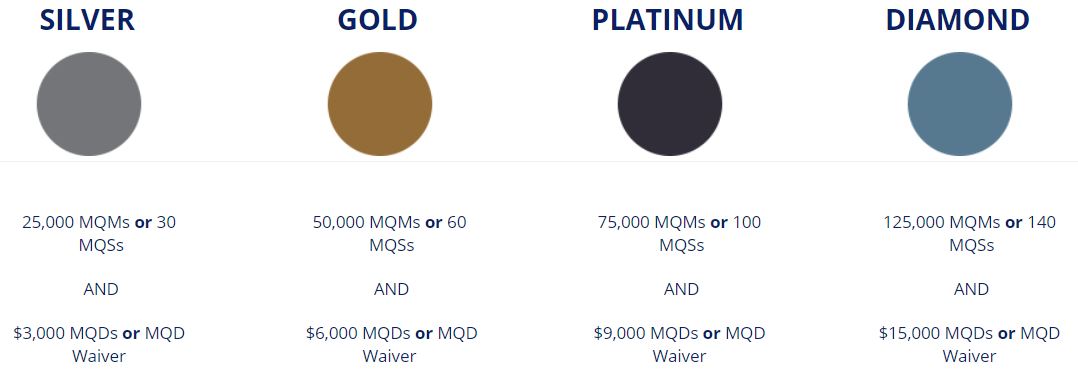

Delta Elite Status Requirements

Definitions:

- MQMs: Medallion Qualifying Miles can be roughly thought of as the actual miles flown. It’s important to understand that these are different from redeemable miles which can be used to book award flights. MQMs are only used for earning elite status.

- MQSs: Medallion Qualifying Segments are the number of segments flown. Unless you fly a very large number of short flights, you are unlikely to earn elite status through MQSs.

- MQDs: Medallion Qualifying Dollars are the sum total of your spend on Delta-marketed flights.

Explanation:

In general, to reach each elite tier, Delta SkyMiles members must earn the stated number of MQMs or MQSs and spend the targeted amount of MQDs. In other words, its not enough to just fly far or often, you also need to spend a lot of money with Delta.

Fortunately, there’s an easy exception to the MQD requirement for Platinum status and below: Simply spend $25,000 or more with Delta branded credit cards and the MQD requirement goes away. Even better, several Delta branded credit cards offer bonus MQMs for high spend, so it is possible to tackle both requirements (MQMs and MQDs) through spend without setting foot on a plane. Unfortunately, Delta requires $250,000 in credit card spend (across all Delta cards you have) to get a MQD waiver for top tier Diamond status.

Rollovers

Most airlines require that you fully re-earn status every calendar year. Delta is mostly that way too, but with one exception: if you earn elite status in a calendar year, any MQMs not used to reach status are rolled over to the next year. For example, if you earn 70,000 MQMs and meet Gold MQD requirements, you’ll earn Gold status (at 50,000 MQMs), and 20,000 MQMs will be rolled over to the next year to give you a jump start towards re-qualifying.

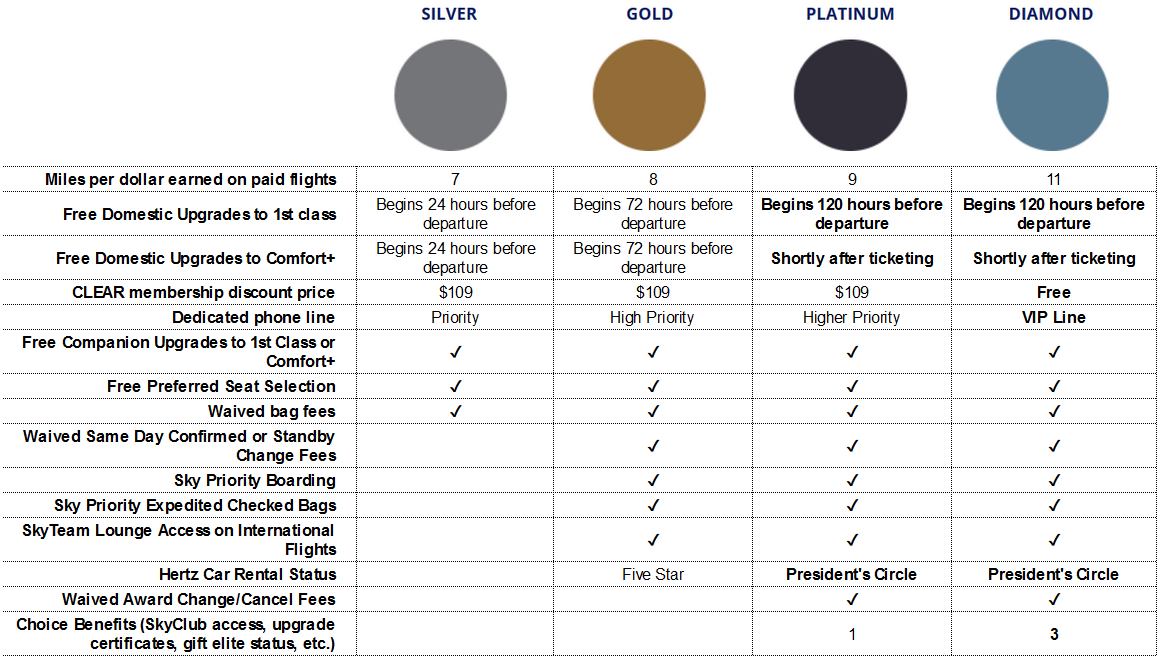

Elite Benefits

Delta’s chart of elite benefits can be found here. Here’s a summarized chart I created:

The elite benefits I’ve personally found to be most valuable are:

- Unlimited complimentary upgrades (when available, upgrade from coach to first class on domestic flights). Higher status leads to better chance of upgrades.

- Waived same-day confirmed fees and waived same-day standby fees (switch to different flight on same day as ticketed flight). Requires Gold or higher.

- Complementary Comfort+ seats (more leg room, free drinks, better snacks).

- Free award changes and cancellations. This is huge because it lets me book awards when I see availability even if I’m not sure I’ll take that particular flight. Requires Platinum or higher.

- Regional upgrade certificates. Puts you to the front of the line for regional upgrades. This is great to use for flights where upgrades are most important to you. For example, I use these for flights of about 4 hours or longer. This is a choice benefit for Platinum and Diamond status.

- Global upgrade certificates. Use these to upgrade from coach to business class on any international flight when upgrade space is available. In many cases the upgrade space won’t be available at the time of booking, but you can then waitlist for the upgrade. My wife and I have had nearly 100% success in upgrading this way, but we’ve been very lucky: most of our upgraded flights have been between the US and Europe where upgrades are much easier to score than with longer distance flights (such as to Asia, South Africa, or Australia). This is a choice benefit for Diamond status only.

It’s Possible to Manufacture Top Tier Status

It is possible to earn top tier Diamond elite status entirely through spend. There are four different Delta cards that earn MQMs and it’s theoretically possible to own all four. So, with enough spend, it’s possible for one person to manufacture up to 160,000 MQMs each calendar year:

- Delta Platinum: Spend $50K, Get 20K MQMs

- Delta SkyMiles® Platinum Business American Express Card: Spend $50K, Get 20K MQMs

- Delta Reserve: Spend $120K, Get 60K MQMs (prior to Jan 30 2020 the cap is at $60K spend)

- Delta SkyMiles® Reserve Business American Express Card: Spend $120K, Get 60K MQMs (prior to Jan 30 2020 the cap is at $60K spend)

What is Delta elite status worth?

To understand whether it is worth it to you to manufacture Delta status, you need to know what Delta elite status is worth to you. In the post “What is Delta elite status worth?” I stressed that the value is completely subjective. Something that I hold in high value may be worth nothing to you, and vice versa. I also stressed that you should estimate how much you’d be willing to spend on a subscription to these benefits rather than how much each benefit may save. Please see the original post for my thinking on that topic. With those caveats aside, here are the values I published:

- Delta Silver Status: $200

- Delta Gold Status Value: $200 (Silver) + $200 (incremental Gold benefits) = $400

- Delta Platinum Status Value: $400 (Gold) + $650 (incremental Platinum benefits) = $1,050

- Delta Diamond Status Value: $1,050 (Platinum) + $1,700 (incremental Diamond benefits) = $2,750

You can use these as a general guideline to the values, but you really should assess each elite benefit yourself.

What are Delta credit card benefits worth?

The Delta Platinum and Delta Reserve credit cards each come with valuable perks. As with Delta Elite status, the value of each perk depends upon your situation and your subjective valuation of each perk. Here are my valuations of the most tangible perks that you get just for having the card, and not counting spend related perks:

Delta Platinum

- Annual economy class companion certificate: $150

- Free checked bag: $0 (I get this benefit with elite status)

- Priority boarding: $0 (I get this benefit with elite status)

- 20% in-flight discount: $0 (I rarely buy things on board)

- $100 Global Entry credit (Everyone in my immediate family already has Global Entry plus other cards that pay for it)

- Total value for holding the card (even without spending anything on it): $150

Second Delta Platinum

It’s possible to have both the consumer and business Delta Platinum card. Most of the above benefits are redundant except for the companion certificate (assuming you can make use of a second one) and $100 Global Entry credit (assuming someone else in the family could make use of it). Personally, I only value the companion certificate.

- Total value for holding a second Platinum card (even without spending anything on it): $150

Delta Reserve

- Annual first class companion certificate: $250

- Delta SkyClub access when flying Delta: $250

- 2 Delta SkyClub one-time guest passes: $0

(I would value this at about $40 if I didn’t get guest access for free as a Diamond Choice benefit) - Centurion Lounge Access for 1 when flying Delta: $0

(I like Centurion Lounges, but I’d simply go to a Delta SkyClub if I didn’t have this perk from one of my cards) - Upgrade priority over others with the same fare class and elite status: $25

- Non-elite complimentary upgrades: $0 (Since I have elite status, this benefit isn’t relevant to me)

- Free checked bag: $0 (I get this benefit with elite status)

- Priority boarding: $0 (I get this benefit with elite status)

- 20% in-flight discount: $0 (I rarely buy things on board)

- $100 Global Entry credit: $0 (Everyone in my immediate family already has Global Entry plus other cards that pay for it)

- Total value for holding the card (even without spending anything on it): $525

Second Delta Reserve

It’s possible to have both the consumer and business Delta Reserve card. Many of the above benefits are redundant except for the following:

- Annual first class companion certificate: $250

- 2 Delta SkyClub one-time guest passes: $0

(I would value this at about $40 if I didn’t get guest access for free as a Diamond Choice benefit) - $100 Global Entry credit: $0 (Everyone in my immediate family already has Global Entry plus other cards that pay for it)

- Total value for holding a second Reserve card (even without spending anything on it): $250

The cost of spend: 2%

To see whether it is worth manufacturing Delta elite status through spend, it is first necessary to estimate the cost of spend. And to do that, we need to decide first whether to look at fees incurred or opportunity cost. It doesn’t make sense to look at both together.

Opportunity cost is most meaningful if you’re looking at regular everyday spend. In that kind of spend, you have to make a choice, for example, of whether to pay with your Delta card or your 2% cash back card. If you choose the Delta card, then it’s reasonable to say that the opportunity cost was 2%. If you had spent $25,000 on your 2% card instead of your Delta Platinum card, for example, you would have $500 in the bank. Instead, you earned 25,000 or more Delta SkyMiles plus 10,000 MQMs, plus a MQD waiver. It is reasonable then to say that those things (the miles, MQMs, and MQD waiver) cost you $500.

On the other hand, if your spend is mostly extra spend done just to hit spend targets, then I think it makes more sense to look at fees involved in manufacturing that spend. For example, if you pay bills with your credit card through Plastiq, then Plastiq’s 2.5% fee is your cost of spend.

The cost to manufacture spend varies widely depending upon how you do it. At the very low end, it’s possible to buy Visa gift cards with very low fees and use them to buy money orders very cheaply. Your total cost then to manufacture spend could be less than half a percent. Unfortunately, Amex does not like when people do this, so there’s a chance that your account will get shut down or that Amex will stop paying rewards for this kind of spend (as they’ve already done with gift cards purchased at Simon Malls). At the other end, it’s common to see fees of 3% or more for the convenience of using your credit card. In the middle, you have federal tax payments that currently cost as low as 1.87% (see: Pay taxes via credit card).

For the purpose of this post, let’s set the cost of spend at 2%. That’s a conservative estimate of the cost to manufacture spend. It’s also a reasonable estimate of opportunity cost. In my specific situation, my real cost to manufacture spend is lower, but my opportunity cost is higher since I have the Bank of America Premium Rewards card with Platinum Honors which earns a minimum of 2.62% everywhere. Anyway, it would drive a person nuts to try to figure out exactly when it makes sense to use opportunity cost instead of fee estimates, so I’m comfortable fudging it and going with this middle number: 2%.

The cost of Silver

Silver status can be earned with 25K MQMs and a $25K MQD waiver. Let’s assume that you earn 5K MQMs through actual flying or through rollover from the year before. In that case, the cheapest path to manufacture Silver status is with a Delta Platinum card and $50K spend (which will give you 20K MQMs). Here are the costs involved:

- Delta Platinum Card Annual Fee: $250

- $50K spend at 2%: $1,000

Value (swap out for your own values):

- Delta Platinum Card Perks: $150

- Delta SkyMiles Earned: 50,000 miles worth $650

(based on Frequent Miler’s Reasonable Redemption Value of 1.3 cents per mile) - Silver status value: $200

Is it worth it?

- Total cost: $1,250

- Total value: $1,000

- No it’s not worth it.

Note that the estimates above assume that you earn only 1 mile per dollar for all spend. Starting Jan 30th 2020, Delta Platinum cards will gain bonus categories. The consumer Platinum card will earn 2X at restaurants and US Supermarkets, and 3X at hotels and on Delta. The Business Platinum card will earn 3X at hotels and on Delta and 1.5X on each eligible purchase of $5,000 or more (capped at $100K spend). With these bonuses, it may be possible to earn many more redeemable miles than estimated above. This could then make the effort worthwhile.

The cost of Gold

Gold status can be earned with 50K MQMs and a $25K MQD waiver. Let’s assume that you earn 5K MQMs through actual flying or through rollover from the year before. In that case, one path to manufacture Gold status is with a Delta Reserve card and $90K spend (which will give you 45K MQMs). Here are the costs involved:

- Delta Reserve Card Annual Fee: $550

- $90K spend at 2%: $1,800

Value (swap out for your own values):

- Delta Reserve Card Perks: $525

- Delta SkyMiles Earned: 90,000 miles worth $1,170

(based on Frequent Miler’s Reasonable Redemption Value of 1.3 cents per mile) - Gold status value: $400

Is it worth it?

- Total cost: $2,350

- Total value: $2,095

- No it’s not worth it.

Note that the estimates above assume that you earn only 1 mile per dollar for all spend. Starting Jan 30th 2020, Delta Reserve cards will earn 3X on Delta spend, so you may earn more miles. If a lot of your spend is on Delta, though, you may not need to manufacture elite status at all since you may earn it through actual flights.

Alternate path to Gold: Two Platinum cards

In 2020, the Platinum cards will have much more useful bonus categories than the Reserve cards. For example, the consumer card will offer (among other things) 2X at US Supermarkets, and the Business Platinum card will offer 1.5X on each eligible purchase of $5,000 or more (capped at $100K spend). If you think that you’ll spend within these categories, it could make more sense to get both Platinum cards rather than one Reserve card. At the extreme end, let’s assume that you spend $50K on the consumer Platinum card entirely at grocery stores and $50K on the business Delta Platinum card entirely with purchases of $5,000 or more. In that case, here’s the math:

- Two Platinum Cards Annual Fee: $250 x 2 = $500

- $100K spend at 2%: $2,000

Value (swap out for your own values):

- First Delta Platinum Card Perks: $150

- Second Delta Platinum Card Perks: $150

- Delta SkyMiles Earned on Consumer Platinum card at 2X: 100,000 miles worth $1,300

(based on Frequent Miler’s Reasonable Redemption Value of 1.3 cents per mile) - Delta SkyMiles Earned on Business Platinum card at 1.5X: 75,000 miles worth $975

(based on Frequent Miler’s Reasonable Redemption Value of 1.3 cents per mile) - Gold status value: $400

Is it worth it?

- Total cost: $2,500

- Total value: $2,975

- Yes it’s worth it (but remember that this assumes all spend earns bonuses)

The cost of Platinum

Platinum status can be earned with 75K MQMs and a $25K MQD waiver. Let’s assume that you earn 15K MQMs through actual flying or through rollover from the year before. In that case, one path to manufacture Platinum status is with a Delta Reserve card and $120K spend (which will give you 60K MQMs). Here are the costs involved:

- Delta Reserve Card Annual Fee: $550

- $120K spend at 2%: $2,400

Value (swap out for your own values):

- Delta Reserve Card Perks: $525

- Delta SkyMiles Earned: 120,000 miles worth $1,560

(based on Frequent Miler’s Reasonable Redemption Value of 1.3 cents per mile) - Platinum status value: $1,050

Is it worth it?

- Total cost: $2,950

- Total value: $3,135

- Yes it’s worth it, but not by a wide margin

This is just one scenario of many possibilities for manufacturing Delta Platinum status.

The cost of Diamond

Diamond status can be earned with 125K MQMs and a $250K MQD waiver. Let’s assume that you earn 5K MQMs through actual flying or through rollover from the year before. In that case, one path to manufacture Diamond status is with two Delta Reserve cards (one consumer card and one business card). Spend $120,000 on one and $130,000 on the other. This way you’ll get the Diamond MQD Waiver with $250K total spend plus 120K MQMs. Here are the costs involved:

- Delta Reserve Card Annual Fee: $550 x 2 = $1,100

- $250K spend at 2%: $5,000

Value (swap out for your own values):

- Delta Reserve Card Perks: $525 for first card plus $250 for second card = $775

- Delta SkyMiles Earned: 250,000 miles worth $3,250

(based on Frequent Miler’s Reasonable Redemption Value of 1.3 cents per mile) - Diamond status value: $2,750

Is it worth it?

- Total cost: $6,100

- Total value: $6,775

- Yes it’s worth it, but not by a wide margin

This is just one scenario of several possibilities for manufacturing Delta Reserve status.

The spreadsheet option

I’ve shown above the math for manufacturing Delta elite status up to various levels: Silver, Gold, Platinum, and Diamond. Thanks to the new higher limits on Delta Reserve MQM earnings, and thanks to new bonus earning options, there are now many more options than ever before for spending your way to status. You can get to Diamond status with just two Delta Reserve cards, but maybe you would do better to throw in a Platinum card as well. If you do have a Platinum card, how much of your spend is 2X at grocery stores with the consumer card, or 1.5X for large purchases with the business card? And what if you have different value estimates than I laid out above? Or, what if you expect to earn Gold status naturally — is it then worthwhile to manufacture Platinum?

I can’t possibly address all of these possibilities in a blog post. Instead, I’ve created a beta version of a spreadsheet for modelling these scenarios. This spreadsheet is currently still in beta. In other words, I don’t consider it fully tested or complete. And there are no instructions. That said, there’s probably enough there and working for a few diligent readers to figure it out and benefit from it.

If you’re interested, take a look at the spreadsheet (here) and make a copy so that you can input your own values. Cells in green are meant to be overwritten. Don’t overwrite any other cells.

Conclusion

It is possible to spend your way to Delta Elite status. Is it worth it? That depends on many, many factors. Do you fly Delta often enough to value elite perks? How much do you value the credit cards you need to do this? How much does it cost you to put extra spend on those cards? The questions go on and on.

Starting January 30th 2020, we will earn fewer rewards from reaching high spend thresholds on our cards. Previously, at each spend threshold, we earned both MQMs and redeemable miles. Now we’ll earn only MQMs. On the other hand, the Platinum cards offer ways to earn more miles through category bonuses. For example, it will be possible to earn 2X at US grocery stores with the personal Platinum card and 1.5X for purchases of $5K or more with the Business Platinum card. So with those cards at least, it is possible to earn more rewards than in the past.

What will I do? I’m still trying to figure out my exact path forward. In 2020, I’ll try to hit multiple spend thresholds before January 30th so as to earn both MQMs and redeemable miles. After that, I’m not sure. In the numbers I presented above, it looks like it costs $6,100 to manufacture Diamond status. By any measure, that’s a crazy amount of money to spend for elite perks and oodles of miles. But that dollar amount assumes a 2% cost of spend. My real cost is significantly lower. Also, it’s hard to put a price tag on the value of having lots of Delta miles at my disposal at all times. I love the fact that awards are fully refundable with Platinum or Diamond status. It gives me the freedom to book awards that I (or other family members) may or may not actually fly. I do this all the time. So while I’m having sticker shock at seeing the total costs all added together, I’m also extremely reluctant to give up the benefits I’ve been earning.

Most likely, I’ll continue manufacturing Diamond status despite the fact that I’ll end up earning fewer SkyMiles in the process than I did before.

Hey love this spreadsheet. It’s super helpful. The only thing that needs to be added is the 2021 EQM boosts, and the new cardholder offer for MQM on the Reserve Personal and Business. Otherwise, it tells me I qualify for Gold when I really made Platinum. 😉

Thanks. I actually forgot all about this spreadsheet. I should go back to it and add a place to put in signup bonus MQMs and promos like this year’s extra 25% MQMs from spend. For now, I think you can add those extra MQMs into the field labelled “MQMs earned through flights or rolled”

Greg I have 12k MQM carried over from last year and hold Gold status carried over. I also have the gold credit card. Is it worth applying for the Platinum /Reserve and spending towards MQD waiver and MQMs to requalify for Gold? Also, does spend earlier in the year on my gold card count towards that $25k spend if I apply for Platinum/Reserve later in the year when they come out with a better sign up bonus?

It’s hard to say whether it’s worth it without any info about how much you’re likely to fly Delta and how much you value Gold elite benefits. It would be a shame to lose the 12K MQMs, but maybe worse to do a lot of spend to get to 50K MQMs (and Gold status) if you then didn’t get much value from that status.

Great question about whether the spend on your Gold card would count for the time before you get a Platinum or Reserve card. I don’t know.

[…] top tier Delta Diamond elite status for both me and my wife through credit card spend (see: Manufacturing Delta elite status in 2020 and beyond). Now, we have until the end of January to choose or lose our 2020 Choice Benefits. Plus, […]

[…] See also: Manufacturing Delta elite status in 2020 and beyond […]

Same situation here.. we will see how it plays out

[…] who earn Delta elite status through credit card spend may have noticed that Amex’s Delta status boost tracker hasn’t been doing it’s […]

Why not multiple Delta platinum business cards? MS at 1.5x to status.

That’s a great suggestion. Just because you can’t get a bonus on a second (or third or fourth…) Delta Plat biz card doesn’t mean that it’s not a good choice. The main limit is that Amex has started enforcing a 4 credit card limit on new applications. e.g. if you already have 4 or more Amex credit cards they’re unlikely to approve you for a new one.

Not too long ago I got a delta biz reserve and a delta biz plat. When my 1st year is up on the biz reserve I’ll PC it to a biz plat. At some point I’ll get a delta biz gold and PC that to a delta biz plat. And I recall that semi-frequently Delta has NLL card offers, so that might be another way to pick up additional delta biz plats, while still receiving SUBs. Lastly, your P2 can still get a referral bonus by referring you to a card you’ve had before.

As for the 4 card limit, my understanding is that folks can still get auto-approved for a 5th card, making that a possible option. 5 delta biz plats and you could MS diamond at 1.5x for the win!

Great tips!

[…] bag thanks to TSA Pre✓. CLEAR is free for me since it’s a Delta Diamond elite status perk (which I get through credit card spend). And Global Entry (which includes TSA Pre✓) enrollment was free thanks to any number of credit […]

What about the costs of MS ing? Particularly the liquidation costs. That brings me to a larger question irking me— how does one like you plan to MS this along with all of the other MS ventures (15k for Hyatt night in that card, in addition to MS Ing globalist; maxing the benefit on Radisson card for free nights with ?30k spend; Chase freedom rotating categories; others)!?!? I can see that the Simon Malls Visas are now quite easy to get, and I see your post on MSing— but the liquidation workflow still baffles me. Maybe a more detailed discussion of this can be done on FM on the Air?

I discussed the costs briefly in this post. For example, I wrote: “The cost to manufacture spend varies widely depending upon how you do it. At the very low end, it’s possible to buy Visa gift cards with very low fees and use them to buy money orders very cheaply. Your total cost then to manufacture spend could be less than half a percent. Unfortunately, Amex does not like when people do this, so there’s a chance that your account will get shut down or that Amex will stop paying rewards for this kind of spend (as they’ve already done with gift cards purchased at Simon Malls). At the other end, it’s common to see fees of 3% or more for the convenience of using your credit card. In the middle, you have federal tax payments that currently cost as low as 1.87%…”

The process of manufacturing spend is definitely outside of the scope of this article though. I realize that’s not a helpful answer, but ms-ing is a very complicated topic. I think that the best way to get into it is to make friends who do it and can help you along. Try to find meetup groups in your area and/or attend frequent flyer seminars.

Sounds like you’re going to continue to keep both the personal and business versions of the Reserve into 2020 and maybe add a Platinum in? It would be great if you could let us know what your final decision will be!

Need some help with thoughts/strategy for 2 of us who hold the Reserve Card and are both Delta Platinum right now. With the upcoming changes, we will close one of the Reserve cards, and give an AU card to whoever closes their account. Both of us will keep Skyclub access since we both will still hold a Reserve card. For MQM boosts throughout the year, we will put all spend into a single Reserve account, and then gift MQMs to the AU as we earn throughout the year. What am I missing or not thinking of?

Don’t forget that the second person still needs a MQD waiver. Also, Reserve AU cards are not free. I can’t remember the current fee though

OMG! Great call! Was not even thinking about the MQD waiver. Now I have to do the math on if it make sense to do Reserve AU card + Gold Card for MQD waiver spend, or if you just leave the Reserve card open. Thank you Greg!

“it looks like it costs $6,100 to manufacture Diamond status. By any measure, that’s a crazy amount of money to spend for elite perks and oodles of miles. But that dollar amount assumes a 2% cost of spend. My real cost is significantly lower.”

No. You’re mixing apples and oranges. It’s not what it costs to MS that’s the relevant comparison, but what your opportunity cost is of making that spend. In your case 2.625%, $250K @ 2.625% is $6553. And that’s tax-free money, so you really should think of it as ~$10K pre-tax.

Converting to pre-tax money is always a great exercise – puts things in apples-to-apples ‘real world’ perspective. So ask yourself, would you exchange $10K earnings for ‘elite status’? I’d much rather dump those after-tax cash dollars into investments. And then use my miles to book front-of-bus tix and enjoy most of the perks status already offers…

I think that opportunity cost is only relevant if I would have to do one or the other. There’s nothing stopping me from putting the same amount of spend on my BOA card so it’s not a real trade off. That’s why I think that the real cost to consider is the actual fees I’ll pay.

The BOA 2.62% opportunity is to me separate.

Awesome article, as always, Greg. One thing that I didn’t see mentioned (forgive me if I missed it, and I don’t think applies to you, Greg) is how the value changes if you earn status part way through the year, say by June, so you have 18 months of status instead of 12. That would make nearly all of these manufactured status methods worth it by quite a bit!

@ Greg — I am the only who finds it strange that DL has not announced 2020 Medallion requirements yet? It seems very late at this point. I am expecting an increase in requirements thanks to our friends at UA. I don’t expect a wholesale change to the structure like UA, but a bump in the requirements from 3k/6k/9k/15k to 4k/8k/12k/20k. Your thoughts?

Honestly I haven’t thought about that. I sure hope they don’t increase the requirements, but if they do increase only the MQD requirements it will only make the MS option more attractive.

Well, I guess technically it is 2021 Medallion status requirements (earned in 2020), but you know what I mean…

You can also book some mileage runs with partner airlines. To maximize your MQD’s &, MQM’S. I fly very often so it’s worth it to me to reach atleast platinum for the past 5 years. Also, I only have a Amex Delta Blue. Now, don’t get me wrong. I fly VERY often for work and a long distance relationship. So i rack up a lot of MQM’s & MQD’s (with a few yearly mileage runs).. With these mileage runs that @RenesPoints.com post. If you have the time for a random flight. The MQD’s & MQM’s that can be earned can be significantly high with a few of these a year. I’ll reach diamond medallion status for the 1st time because of it.

Yep that’s a good alternative. Or, you can do some of each.