Earlier today we posted about the long-awaited shakeup in the lineup of American Express and Chase Marriott cards, including the release of the new Bonvoy Bevy and Bonvoy Bountiful cards. Now, we are also seeing increased offers on both of the entry-level Chase-issued Marriott credit cards: the Marriott Bonvoy Bold and Marriott Bonvoy Boundless. While these offers are a bit less exciting from a shear numerical value, they are nonetheless worth considering if you’re in the market for a Chase Marriott card.

The Offers & Key Card Details

Click the card names below to go to our card-specific pages for more information and to find a link to apply.

| Card Offer and Details |

|---|

ⓘ $1346 1st Yr Value Estimate5 Marriott 50K Free Nights valued at $1520 Click to learn about first year value estimates 5 x 50K Free Night Certificates ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Earn five 50K free night certificates after spending $5,000 on eligible purchases within the first 3 months (Offer Expires 7/16/2025)$95 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: None Earning rate: ✦ 6X Marriott Bonvoy ✦ 3X gas stations, grocery stores, and dining on up to $6K in combined purchases each year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn Gold status when you spend $35K each year ✦ 1 Elite Night Credit towards elite status for every $5K spent Noteworthy perks: ✦ Annual free night certificate for 1 night at a hotel redemption level up to 35K ✦ Automatic Silver status ✦ 15 nights of elite credit each year ✦ 1 Elite Night Credit for every $5K spent ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit See also: Marriott Bonvoy Complete Guide |

| Card Offer and Details |

|---|

ⓘ $713 1st Yr Value EstimateMarriott 50K Free Night valued at $304 Click to learn about first year value estimates 60K points + Free Night Certificate ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 60K points + 50K Free Night Certificate after $2k spend. Terms apply. No Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: None FM Mini Review: The best use for this card is probably to downgrade from the Ritz or Boundless card to avoid the annual fee. That way, you can always upgrade again when you need the annual free night or other perks Earning rate: ✦ 3X Marriott Bonvoy ✦ 2X grocery stores, rideshare, select food delivery, select streaming, and internet, cable and phone services ✦ 1X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Silver status ✦ 5 nights of elite credit each year ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit See also: Marriott Bonvoy Complete Guide |

Quick Thoughts

These new bonuses on the Chase Marriott cards are good, if not incredible (especially in comparison to the 5x50K certs Boundless offer that Greg nabbed for the 3 Cards, 3 Continents challange). I imagine most readers will be more interested in the Boundless card. The 35K free night certificate should get you around $150-$250 in value domestically if you’re able to use it wisely and 100,000 points are worth ~$700 according to our reasonable redemption values. You should be able to get good value out of the welcome offer.

The release of the the new $250 Bevy and Bountiful cards weas quite underwhelming, in my opinion. I just don’t see how the benefits justify the annual fee difference between those and the Bold and Boundless. However, in the post I said that I could definitely see getting the Bevy or Bountiful for a year in order to get the 125K welcome offer and then product-changing. Now that the Boundless is up to 100K points, there’s even less reason to get the Bountiful (assuming you’re eligible for Chase card and don’t already have the Boundless).

The Bountiful would get you an extra 25K points, but you’d lose out on the 35K anniversary cert, effectively a complete wash unless you need the points ASAP. For $155 a year, you’re getting +1x at restaurants, Gold elite status and an extra 1,000 points per stay at Marriott. I’d take the Boundless, personally. On the other hand, if you’re going to cancel after the first year, it could still be worth it, as you might miss out on the anniversary cert anyway. Otherwise, I think I like this offer better.

I’d be less excited about the Bold unless you’re merely opening it as a means to upgrade to the Ritz-Carlton Visa Infinite card down the road. Those who want the Ritz card will need to wait a year from opening one of these Chase Marriott cards to request a product change, but so far it’s still possible to do it. The Bold card doesn’t otherwise offer much ongoing value and the welcome bonus isn’t very exciting when compared to the other Marriott cards.

|

[…] to $650 of $450! Oh, wait, the banks additionally elevated the Bonus subscription presents for the 2 annual cost playing cards $95 […]

[…] annual fee goes up to $650 from $450! Oh, wait, the banks also increased the Signup Bonus offers for the two $95 annual fee cards […]

Just curious, how much time do you have to spend proofreading and editing these posts because of Marriott’s stupid card names?

I’m surprised you say that the 100k point offer is “good, if not incredible compared to the 5x50k offer that Greg used “. I was skimming through the offers and said to myself, “I’m glad I snagged that 5×50 offer, it’s much better than these “.

Just a differing of opinion or what am I missing?

Must be a typo. Lukewarm offer at best. Over the last year there was 5xFNC offer and 125k + 1 FNC offer, that were way better, even with slightly higher spend requirement.

Hi Tim, a family mbr was approved for the Brilliant card in 2020 when 100k MRs were offered upfront but 25k not until the 1st anniv. In tetms of meeting the req time for a different card, does the wait start from the first bonus or the whole SUB after the 1st anniv? Thanks for your help

I like that chase has the no AF Bold downgrade option. I wish Amex had that too.

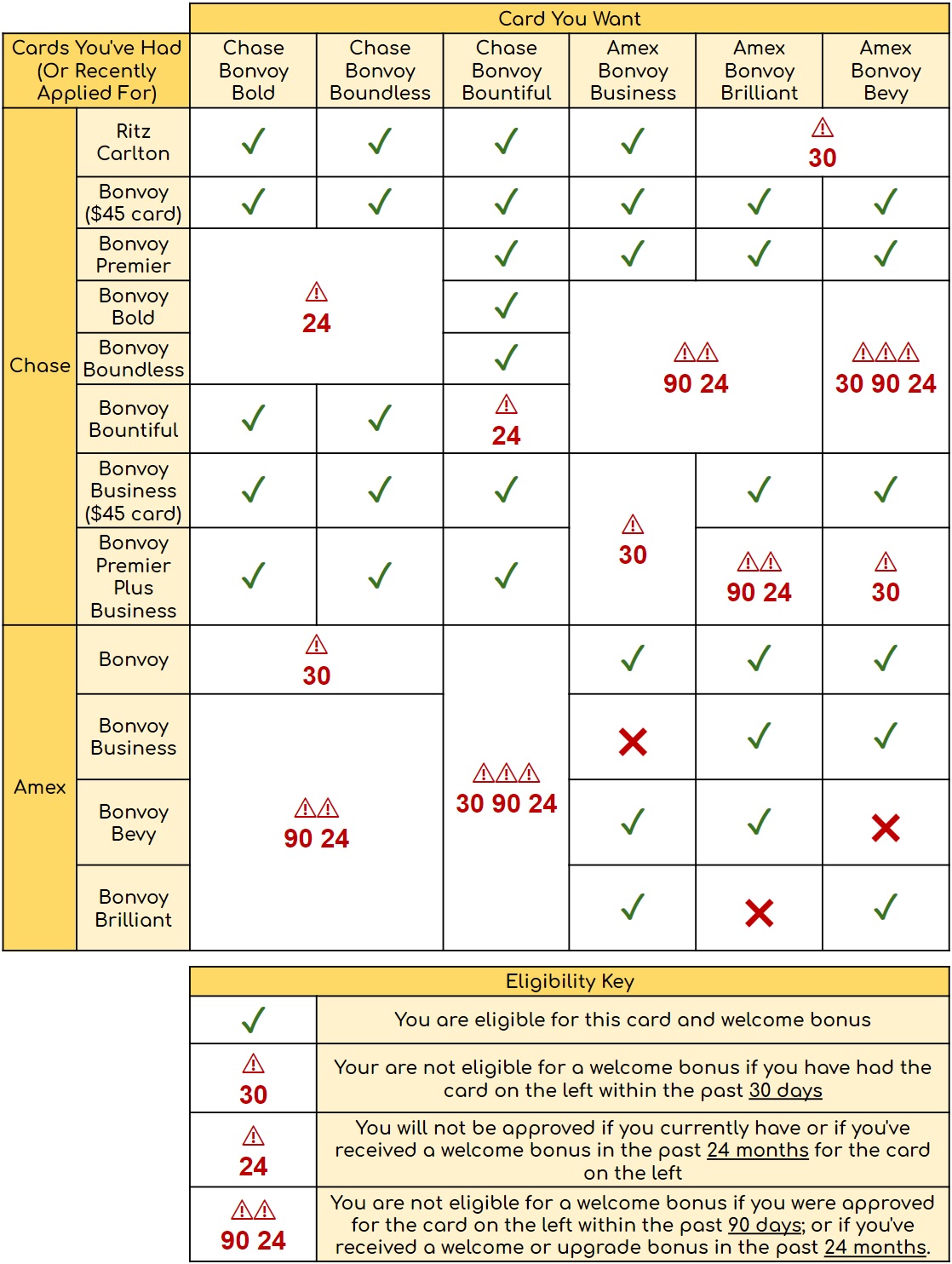

who is eligible?

The chart in the post gives the details based on your card-holding present and past.

When do the dining credit start? Do we get a credit for September or does it start Oct 1?

Do you mean for the Amex Brilliant? Those are live as of today and will reset 10/1.

What do you mean “reset 10/1”? I thought it was on a cardmember year basis?

you get $25 a month, hence reset the $25 counter on 10/1

Already started this month, already got credit of $25 for September restaurant spend. Sweet !