American Express features the widest array of desirable rewards credit cards on the market, but which are must-have winners for your wallet? This week on Frequent Miler on the Air, we discuss who should have and hold each of the potential players from Amex’s portfolio.

Elsewhere on the blog this week, we discuss an intriguing offer for double rewards for a year (and why it may not work for you), US Bank cards you should keep in mind, an awful elite status perk, the Turkish Airlines in-flight experience, and a lot more. Watch or listen to Frequent Miler on the Air below or scroll on for more from this week at Frequent Miler.

Subscribe to our podcast

01:23 Giant Mailbag

05:05 What crazy thing . . . did JetBlue do this week?

13:52 25% transfer bonus from Amex to JetBlue

16:42 Award Talk

16:52 JetBlue is enhancing their elite program for 2024 and beyond

17:45 New JetBlue Signature Perks

19:37 Mosaic 4 members will be able to give Mosaic 1 to another member

20:27 Booking the BLADE helicopter transfers for Mosaic 4

23:21 JetBlue credit card approvals

24:28 AAdvantage Aviator card approvals

26:34 Main Event: Must-have Amex cards

27:40 Transferable points cards

27:44 Blue Business Plus card

30:16 Amex Gold Card

32:34 Platinum card

36:18 Amex Everyday card

38:50 Amex Green card

40:45 Pick one Membership Rewards card

43:21 Amex Hotel cards

43:27 Amex Hilton Aspire card

45:51 Amex Marriott Bonvoy Business card

47:23 Amex Marriott Bonvoy Brilliant card

52:33 Hilton Surpass card

55:20 Which is the one Amex hotel card for you?

56:33 Airline cards

57:00 Delta Gold cards

57:32 Delta Platinum cards

59:18 Delta Reserve cards

1:02:22 Which Delta credit card

1:04:27 Question of the Week #1: Is credit card cell phone insurance worth it if you have Apple Care?

1:06:07 Question of the Week #2: For American Airlines partner award bookings, which airlines are not shown on the AA.com website. Can you search Aeroplan’s website? Can you call to book more than 331 days in advance?

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Chase Freedom Unlimited: Uncapped double cashback for one year (but there may be a better offer)

We don’t often include posts about new credit card offers in the week in review, but this new offer on the Chase Freedom Unlimited seemed notable enough to include here. On a recent podcast episode, I said that it generally doesn’t make sense to apply for this card as a new cardholder, rather it would make more sense to get a Sapphire Preferred or Reserve (if eligible for the much larger welcome bonuses on those cards) and downgrade in the future to the Freedom Unlimited. However, this new double rewards offer might be intriguing for someone with an expensive year ahead. You could earn more rewards by opening multiple credit cards, but if you’re not going to do that and you have an upcoming wedding or a home remodel or a lot of other typically unbonused spend, or a lot of dining and pharmacy spend, this offer could be really intriguing.

Stop sleeping on U.S. Bank

Speaking of things that people are rarely encouraged to apply for, let’s talk about U.S. Bank. While U.S. Bank doesn’t offer flashy cards loaded with coupon books or notable co-branded cards or even a transferable currency card, it does offer cards with solid welcome bonuses that you can use to infuse your rewards with a cash component. Whether you’re looking for a $500 bonus on just $2,000 spend, rewards like 4% back on gas and travel or an effective 4.5% back everywhere you can use mobile wallet, U.S. Bank has you covered. Somehow I failed to even mention in this post the US Bank Triple Cash Rewards Business card, which features a $500 welcome bonus, no annual fee, and it won’t add to your 5/24 count. The moral of the story is not to forget that it’s not all about Amex and Chase — pay attention to the other players in the game.

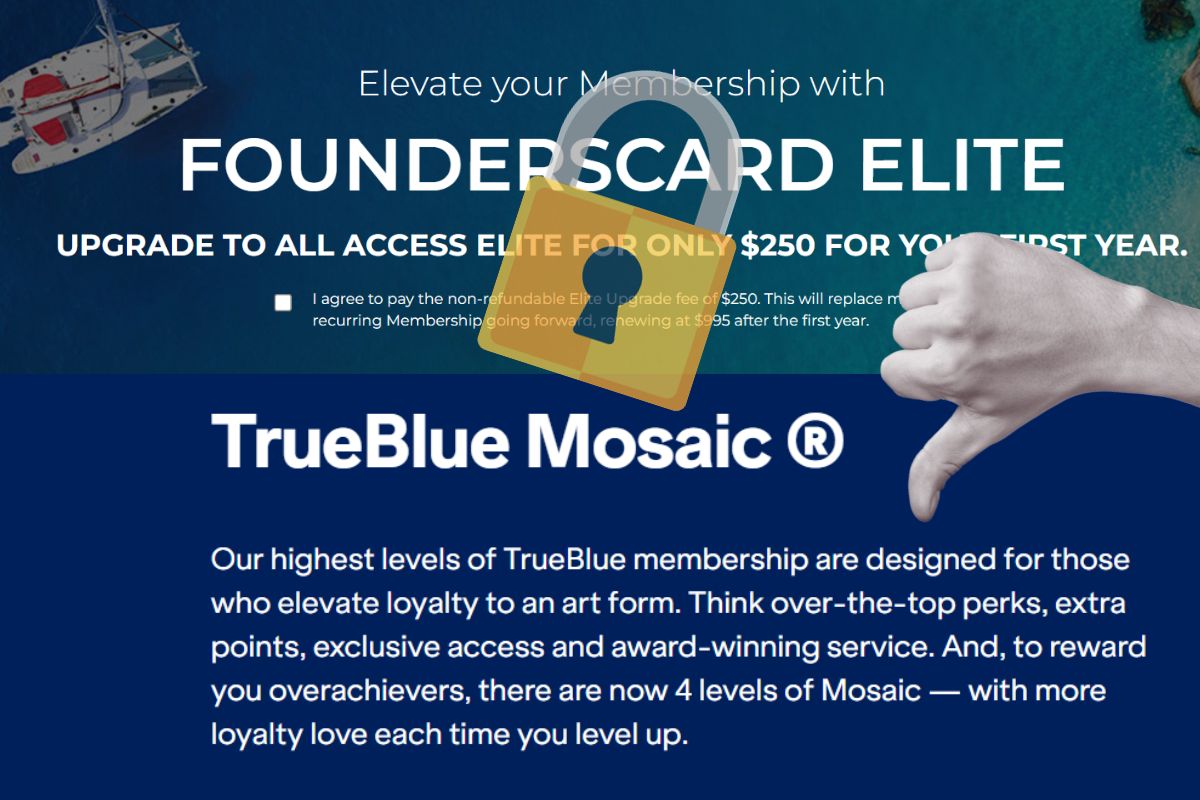

JetBlue’s Mosaic FoundersCard benefit. Is this a joke?

Greg matched to JetBlue Mosaic status and with his tier came a pre-selected choice benefit of FoundersCard Blue. I have to wonder whether JetBlue realized what they were getting here when they made an agreement with FoundersCard to offer this as a choice benefit. While FoundersCard is obviously welcome to offer a version of the card that shows you all the benefits that you can’t get unless you pay more, I can’t believe that JetBlue is offering that as an alternative to benefits that carry actual cash value. FoundersCard may be a good value for some, but the version JetBlue is giving here clearly shouldn’t be an elite status choice benefit.

Turkish Airlines 787-9 Business Class: Bottom Line Review

I read Tim’s review of Turkish Airlines business class with excitement because I have a couple of trips planned that include long-haul Turkish business class, but I’ve only flown them regionally. I was already excited about the lounge in Istanbul, but now I am equally excited about the flight itself. I won’t be on the 787, but I imagine the catering and service should be on par.

12+ tips & tricks for Grubhub orders: Get free food, discounts, free Grubhub+, hotel points & more

I rarely ever even try to use GrubHub (and on the occasion when I open the app, I rarely get beyond initial search results). That’s partly because the areas where I most often try to use GrubHub are much better covered by UberEats and DoorDash. However, with the new Business Gold credit joining the consumer Gold credits that I typically let expire unused, this post from Stephen was a timely way to draw me back into the fold. I don’t really like GrubHub, but I do really like “free” food, so I’m going to take advantage of as many of his tips as I can.

How to get into Delta Sky Club® lounges

I’ve mentioned plenty of times that I rarely fly Delta (they just don’t have flights that fit my needs from my home airport), so I’ve only been in a couple of Delta Sky Clubs before. However, my impression was that they were clearly head and shoulders and most of a torso above the Admirals Clubs and United Clubs I’ve visited, so you’re going to want access if you’re flying Delta. In this post, Greg collects information about all of the ways to access Delta Sky Club lounges, along with when and how those options will change in 2024 and 2025.

Favorite European Airlines | Ep 60 AUA

The Frequent Miler team goes live on Youtube on the first Wednesday of the month at 9pm Eastern for an Ask Us Anything. As always, this month’s AUA featured some excellent questions and you can watch our completely off-the-cuff unscripted answers in the replay. You never know in advance what you’re going to get with an Ask Us Anything, but now in hindsight you can look back at the questions in the timestamps and jump around to what interests you.

That’s it for this week at Frequent Miler. Keep your eye on this week’s last chance deals as a number of deals will end within days.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

FYI – I have TMobile autopay setup for a credit card and have continued to receive the autopay discount. I received the notice from TMobile several months ago (June?), but they’ve never acted on pulling my discount.

Just finished this episode. American Green Card: Who is it for? People who spend a lot of money on cruises. (including onboard spend) Along with the Chase Sapphire Reserve 3x is the best in class bonus category spend for cruise. It is just a matter if you want MR or UR. For MR, I would say the Green Card is best. 🙂

Don’t have time to listen to the podcast but would definitely appreciate an article on the must have AMEX cards

Yeah, I don’t do podcasts but I guess some people like them since they can listen while doing other stuff. Personally I’d rather just skim an article.

https://www.youtube.com/watch?v=_uBdYUpQZtc

Click the … and select Show Transcript

So, if you’re starting at square one with Amex and the unfortunate new rules…does it make sense to start with Platinum and get the higher bonus, then downgrade to Gold? The Gold is what I would keep. I don’t see a need for Platinum, but the bonus is always higher than the Gold.

No, you start with cheaper cards and collect all the bonuses. Close the ones you don’t want.

From what I understand if you start with the platinum card, you will not be eligible for the bonuses for the gold card anymore. Therefore, you start with the gold and you can work your way up to the platinum if you would like to have that.