NOTICE: This post references card features that have changed, expired, or are not currently available

Update 2/8/2021: More people have reported finding offers that bypass 5/24. It’s worth checking yourself!

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

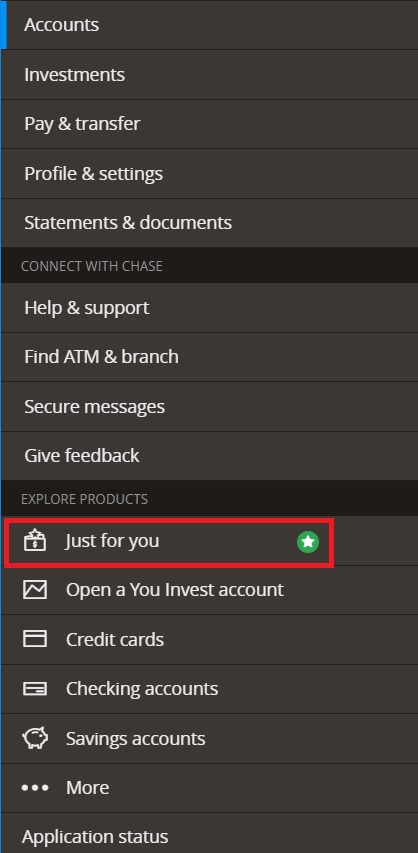

In the time since Chase instituted the 5/24 rule, there have been various opportunities (some which have come and gone) to get around the inability to be approved if you’ve opened 5 or more new credit cards with any bank in the past 24 months. One of those opportunities has been through pre-selected offers that show up under the “Just for you” section of your Chase online account with a green star. Reports have since come in that offers with a black star also bypass 5/24 — and in some cases, people have even been approved for more than one card.

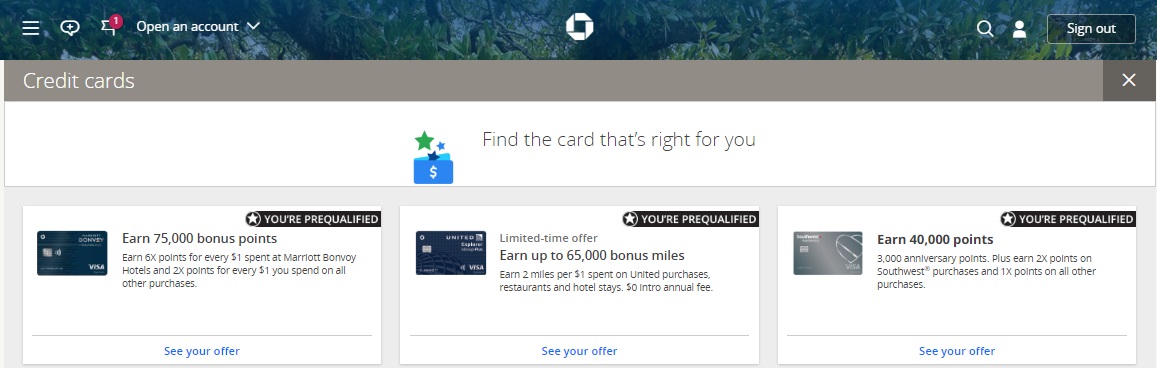

The reports thus far indicate offers for business cards showing up under personal account logins. You’ll find these offers when you log in to your personal Chase account and click either “Just for you” or “Credit cards” in the left menu bar.

Offers on the following page with a green star or black star have been known to bypass 5/24. These offers will be for specific cards / standard new card bonuses (i.e. 75K Ultimate Rewards after $7,500 spend in the first 3 months on the Ink Business Cash, etc). Another key in knowing that these are pre-approved offers is if they show up with a fixed APR rather than a range as a fixed APR typically indicates that an offer has been targeted to you.

Most people reported that the offers disappeared after applying for one card. However, there have been a few reports of the offers remaining and then being approved for a second new account. I’d recommend exercising some caution on that (See: Why Chase shutdowns have increased and how to avoid them) — two applications in close proximity appears to be one of the triggers that has led to some shut downs. That said, others have surely opened two accounts within 30 days without issue, so YMMV.

The reports I’ve seen for multiple starred offers have all been offers for business cards. Again, these business card offers have only been appearing in personal Chase logins, so log in to your personal account and take a look.

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

H/T: Doctor of Credit

Any idea of how you get on the list for a black/green star? Was way over the 5/24 when I found FM so would love not to wait a year to be under the limit to get an Ink or something. Credit score 8s. I have an Amazon and Disney Co-Brands but I don’t use them heavily given the rewards aren’t the best (except for Amazon.com purchases).

Thanks!

Will Chase tell you if you are elegible for a sign up bonus before you sign up?

Does the Freedom bonus make you ineligible for a Sapphire Reserve bonus?

No and No.

Question for Nick/Greg. I like to travel. I like FREE stuff. I need to pay Property Taxes by Dec31 of about $22,000. I did the Southwest Companion Cards last year. Already have Sapphire Reserve. I’m heavy in Chase cards but not AMEX. What ideas of new cards would be good for this massive purchase? Thoughts?

Do you have a good way to use a credit card to pay your property taxes? Or are you thinking you’ll pay 2.5% with Plastiq?

One good card offer for your situation is the United Business card which requires a total of $25K spend for 100K bonus miles: https://frequentmiler.com/UAbiz/#Goto

Or, if you foresee a lot more potential spend coming up, consider the Cap One Biz card: https://frequentmiler.com/C1SMbiz/#Goto

Best bet would be to get several cards with spend requirements of $5K or less from the top of our Best Offers list. Currently, the Ink Business Preferred, a couple different AA cards, and a couple Delta cards top the list of offers with lower spend requirements ($5K or less)

LOL/24. Had the SW, United and Marriott offers. Went into review, not instant. Wahwahwahhhh. Income is 200+, FICO is 8s.

Wow! Both my husband and I are so far over the 5/24 rule that it’s been forever since we’ve been approved for a Chase CC. However we each just got the 65,000 United Explorer CC. Now we can start dreaming about that safari trip to Vietnam we’ve talked about for years. Thanks so much~

Had 3 black star offers, only one application pulled up, filled in with exception of business data, showed fixed 0% for 12 months and then variable. Rolled the bones, shocked to be approved. Have 7 personal and 2 other business cards with chase. Personal savings, checking and business checking with Chase for 5 years. Early xmas present for me

If 0% APR for `12 months then variable should I assume approval chances are slim? I have personal login that has business cards linked and a business checking account under different login. Black star offers at personal login go to error messages, black star offers at business checking show 0% APR and then variable thereafter. At LOL/24, really want a new card but wary of denial and wasted pull

Black-Star “Pre-Approved” offers show up in my Chase Personal login under the Credit Cards. They don’t show under “Just for You”. SW, Marriott and UA Explorer all showed. So tempted to try but I’ll be under 5/24 soon and don’t want to mess anything up with any non-biz cards now. UA card shows fixed APR. Sadly no biz cards show up. Thanks for the tip!

I got immediately denied on CIP black star ‘just for you’ offer.

applied for Black Star Just for You Offer yesterday. DENIED

Me too!

I have offers for UA, SW and Marriott cards. However, it shows “Application Unavailable

We appreciate your interest. Due to a system issue, the application is unavailable. Please try again later.” when I click on any offer.

@CJA Did you click thru ‘Just For You’ ? I saw the same error when I did that. However, after reading this post, I clicked ‘Credit Cards’ and saw many more ‘Pre-qualified’ offers. They all came up without any issue.

That was under ‘Credit Cards’. I have no offers under ‘Just for you’

My personal card offers all show fixed APRs and only ask for total income and phone number. So those offers are pre-approved? The bonuses are all standard.

Business card offers show a range of APRs and require business information. I guess they are not pre-approved.

I was only asked for income and phone number, too.

Thanks! I’m at LOL/24 and just got approved for the United personal card.

I had “You Are Pre-approved” offers for the Southwest card, United, and Bonvoy. I just went back to look and they are all gone.

I already have Sapphire Preferred, Unlimited, Freedom, Hyatt, IHG, a checking account and investment account.

can you share (email me) the link? I dont see that offer for united

The offers all disappeared after I applied. So no link to send. Sorry.

Not true at all. Had a “black star” offer on the CIP card. Denied. Chase plays dumb and says there is no such thing as a “black star program.” The only way to guarantee getting approved is if a letter in the mail says you are “PRE APPROVED.” Anything else, they do not honor. Can’t escalate it to anyone. Cannot remove the inquiry. They’re real jerks about all of it.

Above is very true. I got denied because I am still over 5/24 apparently. Couldn’t escalate. Hard pull on my report now. I asked why did you give me an offer I couldn’t get approved for? CSR had no good answer.

Call the Executive Office. 888-214-7712. Extension 6548068. Leave a voicemail and they will call you back. The more people who bring this to their attention, the better. Everyone declined should be calling that number. It’s the only way to fix things.

I have an update… Recently got another black star offer with a fixed APR and pre-filled application. Applied. Denied yet again for being over 5/24. Called for reconsideration. Once again, the reps and supervisor refuse to even acknowledge the term “black star offer.”

Called the Executive Office this time. Tired of being jerked around. Launching a formal investigation. Posted all this on Doctor of Credit as well. Someone laughed. And they are convinced I’m “trolling” them — whatever that means.

[…] opened 5 or more credit cards in the past 24 months, they won’t approve you for new cards (except when you are targeted for a “Just for You” offer). This obviously makes it very difficult to take advantage of all of the great Chase credit card […]