| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

The offers on both the American Express Marriott Bonvoy Brilliant and Marriott Bonvoy Business credit cards increased today and now include both excellent bonuses and statement credits on top to sweeten the deal. If you had one of these cards in mind, these offers are strong with the statement credits included.

The Offers & Key Card Details

For more information and to find a link to apply, see our dedicated Frequent Miler card pages by clicking the card names below.

| Card Offer and Details |

|---|

95K Points ⓘ Affiliate 95k points after $6K spend within the first 6 months. Terms apply. (Rates & Fees)$650 Annual Fee Recent better offer: 185K after $6K in first 6 momths [Expired 5/1/24] FM Mini Review: Decent ultra-premium option for Marriott fans, especially those aiming for lifetime status tiers Earning rate: 3X airfare -on flights booked directly with airlines; 3X restaurants worldwide, 6X Marriott; 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Annual Choice Award with $60K calendar year spend Noteworthy perks: ✦ 85K Free Night Award each year upon renewal ✦ $300 dining credit per membership year ($25/mo) ✦ Platinum Elite status ✦ 25 elite nights credit ✦ Priority Pass membership (Lounges only) with 2 guests ✦ Global Entry fee credit ✦ Free premium internet at Marriott properties Note: Enrollment required for some benefits. See also: Marriott Bonvoy Complete Guide |

| Card Offer and Details |

|---|

Earn 3 Free Night Awards - Valued at up to 50K points each, up to 150K points total. ⓘ Affiliate Earn three 50k free night certificates after $6K spend in the first 6 months. Redemption level up to 50,000 Marriott Bonvoy(R) points for each bonus Free Night Award, at hotels participating in Marriott Bonvoy(R). Certain hotels have resort fees. Terms apply. (Rates & Fees)$125 Annual Fee Recent better offer: 5x50K free night certificates after $8K in spend (expired 3/20/24) Earning rate: 6x at Marriott Bonvoy properties ✦ 4x at restaurants worldwide, U.S. gas stations, wireless telephone services purchased from U.S. suppliers and on U.S. purchases for shipping ✦ 2x on all other eligible purchases. Terms Apply. (Rates & Fees) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn an additional 35k free night certificate (can be topped-up with up to 15k additional points, subject to resort fees) after you spend $60K on purchases in a calendar year Noteworthy perks: Complimentary Marriott Gold elite status ✦ 15 Elite Night Credits each calendar year ✦ 35k Free Night Award every year after card renewal (subject to resort fees) ✦ Complimentary premium Internet access at Marriott properties ✦ Terms Apply (Rates & Fees) See also: Marriott Bonvoy Complete Guide |

Quick Thoughts

Given our Reasonable Redemption Value for Marriott Bonvoy points is 0.72c, these bonuses are easily worth $800-$1,000 or more. That’s a great return that is certainly amplified by the included statement credits.

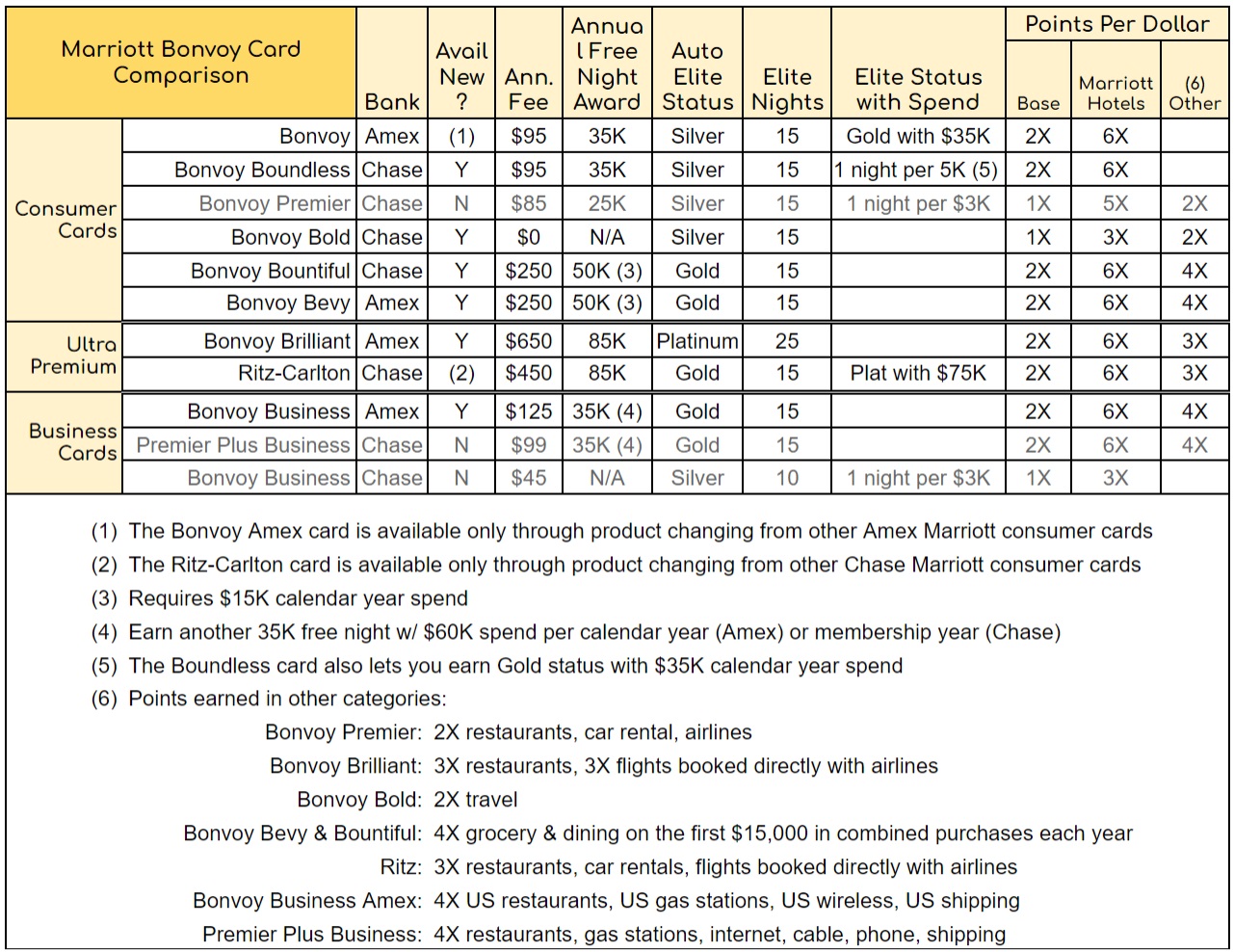

Keep in mind though that Marriott has a complicated system for determining whether or not you are eligible for a credit card. According to our Marriott Bonvoy Complete Guide, here is a comparison of the card offerings from Chase and Amex and the relevant rules.

| Card You Want | |||||||

| Cards You've Had (Or Recently Applied For) | Chase Bonvoy Bold | Chase Bonvoy Boundless | Chase Bonvoy Bountiful | Amex Bonvoy Business | Amex Bonvoy Brilliant | Amex Bonvoy Bevy | |

| Chase | Ritz Carlton | ✅ | ✅ | ✅ | ✅ | ⚠30 | |

| Bonvoy ($45 card) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Bonvoy Premier | ⚠24 | ✅ | ✅ | ✅ | ✅ | ||

| Bonvoy Bold | ✅ | ⚠90 ⚠24 | ⚠30 ⚠90 ⚠24 | ||||

| Bonvoy Boundless | ✅ | ||||||

| Bonvoy Bountiful | ✅ | ✅ | ⚠24 | ||||

| Bonvoy Business ($45 card) | ✅ | ✅ | ✅ | ⚠30 | ✅ | ✅ | |

| Bonvoy Premier Plus Business | ✅ | ✅ | ✅ | ⚠90 ⚠24 | ⚠30 | ||

| Amex | Bonvoy | ⚠30 | ⚠30 ⚠90 ⚠24 | ✅ | ✅ | ✅ | |

| Bonvoy Business | ⚠90 ⚠24 | ⛔ | ✅ | ✅ | |||

| Bonvoy Bevy | ✅ | ✅ | ⛔ | ||||

| Bonvoy Brilliant | ✅ | ⛔ | ⛔ | ||||

| Eligibility Key | |

| ✅ | You are eligible for this card and welcome bonus |

| ⚠30 | Your are not eligible for a welcome bonus if you have had the card on the left within the past 30 days |

| ⚠24 | You will not be approved if you currently have or if you've received a welcome bonus in the past 24 months for the card on the left |

| ⚠90 ⚠24 | You are not eligible for a welcome bonus if you were approved for the card on the left within the past 90 days; or if you've received a welcome or upgrade bonus in the past 24 months. |

| ⚠30 ⚠90 ⚠24 | You are not eligible for a welcome bonus if you've had the card on the left within the past 30 days; or if you were approved for it within the past 90 days; or if you've received a welcome bonus or upgrade bonus for it in the past 24 months. |

| ⛔ | You are not eligible for a welcome bonus if you've ever had this card before (but the system seems to "forget" that you've had the card about 5 to 7 years after you cancel) |

If you are indeed eligible and had the Amex Marriott cards on your mind, now could be a good time to make your move. As you’ll note based on the matrix above, having gotten the bonus on one of these cards will not preclude you from getting the bonus on the other, so the Amex cards are a sound path to getting a total of 30 Marriott elite nights per year (since you get 15 nights from having any Marriott business card and 15 nights from having any Marriott personal card — elite night credits from multiple personal cards do not stack).

I have a Bonvoy $95 card and was thinking of upgrading to Brilliant which I had before downgrade. My wife never had Marriott cards. Thinking of applying for her. Question is how easy it is to transfer points between households ? One can easily transfer points on Hilton website.

Any member can transfer points to any other member. There is no restriction about being in the same household.

A member can transfer Out a max of 100k points per year.

A member can receive In a max of 500k points per year.

You have to call Bonvoy to get it done. They verify your account and then ask you which account # you want to sent the points to. The transfer is instant after they complete it while you are on the phone.

Some details here: https://help.marriott.com/s/article/Article-22159

Nick,

I received a bonus on the Amex SPG business card 7-9 years ago. I cancelled the card 2 years ago. Is it worth trying to apply again with the life time cap?

I wasn’t really planning to get another card (have 9 already with 4 Amex and 3 Chase included) but am lifetime Titanium so stay at Marriotts frequently. One of my Chase cards is the Bonvoy Boundless card but it was a replacement for a previous card I had for years and didn’t get any bonus when that card was replaced with this one well over 24 months ago so didn’t think that would matter. My concern was I have heard that Amex is only allowing a max of 4 cards for some accounts. In any event I applied yesterday for the Bonvoy Brilliant Amex card and was immediately approved (may have helped since my platinum card has member since 1987 on it (original green card upgraded to gold then platinum). I love the 125,000 bonus and have auto/home insurance payments coming up next month so that alone will be the $5000 minimum spend. The $200 additional restaurant credits during first 6 month are gravy (and I value them at 100% since will go to restaurants). As for the AF, $450 seems like a lot but with a $300 credit against practically any Marriott spend (again I value at 100%) that brings it to $150 and a free night in a 50,000 point property can easily cover that.

Now I plan to not get any more cards for quite a while since 2019/2020 were pretty active for me. On the other hand I’m now under 5/24 next January and I’m sure I’ll find something I want to get by then. One thing for sure – no more high annual fee cards since I have the Amex Platinum, Amex Gold, CSR, DL Platinum Amex and now the Bonvoy Brilliant Amex which have combined AFs of over $2000 (even though I get value exceeding that amount). All other cards are low AF and typically have a free night or something easily used to exceed the AF.

FYI in case you are unaware, Amex Platinum and Gold are what Amex now calls “Pay Over Time Cards” (formerly called charge cards). Those do not count against the 4 or 5 *credit card* limit. Unless you have more Amex cards, it sounds like you now only have 2 Amex credit cards – DL Platinum and Bonvoy Brilliant. Doesn’t change the rest of what you said, just wanted to make sure you knew in case a future Amex credit card comes along that you decide you want.

Nick – I understand and am aware of the difference in charge and credit cards. Even though I pay off all my cards every month I did sign up for the “pay over time” option on the Amex Platinum and Gold cards due to incentives I was offered to do so (10,000 Membership Rewards points just for signing up). My understanding is that basically turned them into credit cards.

I’ve seen Amex with a limit of 5 cards and in some cases 4. I got approved for my 5th which I wanted to highlight since it isn’t always the case. Maybe due to my almost 35 year history with Amex and payment record or maybe everyone gets 5. In any event I wanted to document it was my 5th card since there have been a number of discussions recently on Amex limit on the number of cards.

Oh yeah forgot to mention I have the Hilton Amex Surpass card also so that is 3 true credit cards (along w DL Platinum Amex and Bonvoy Brilliant card) plus my 2 charge cards (Platinum and Gold)

I currently have both the Chase Bonvoy Boundless (personal) & Amex Bonvoy (SPG personal) for a long time. I wanted to know if it worth it to switch one of the personal card to a business card so I can get 30 elite nights per year. Which one should I switch? Should I call either Amex/Chase to switch, or apply for a business card out right (then cancel one of the personal card later)?

Thanks,

You have a few separate questions here so let me split them out:

1) Yes, it’s worth having 1 business card and 1 personal card in order to get 30 elite nights per year assuming you’ll do the other 20 nights you need for Platinum status and you value Platinum benefits (free breakfast at most properties and free lounge access at most properties) and can accept Platinum benefit limitations (no lounge access at Ritz, etc). I think it’s well worth having both to get Platinum benefits with only 20 actual nights spent in hotels each year.

2) You can not product change a personal card to a business card or vice versa, so “switching” is not an option for you. You would need to apply new for a business card.

3) The Chase business card hasn’t been available to new applicants since 2018, so you’ll have to apply for the Amex business card if you want to have a Marriott business card. Whether you want to cancel one of the personal cards later is totally up to you. You might find them all worth keeping for the annual free night certificates or you might not want to pay $95 for an additional free night certificate – up to you. I would think that if you stay at Marriotts enough to value Platinum status, the free night certs on the personal cards you have are probably worth more than $95, so you might just want to add the Amex business card. However, if you don’t want to have 3 cards, then I don’t think it matters very much which you keep. Actually, rather than cancel, I would recommend you downgrade the Chase Marriott card to the Chase Bonvoy Bold card — that card has no annual fee. That way, if someday you decide that you really do want the Chase Bonvoy Boundless ($95 fee / 35K certificate) again or you want the Chase Ritz card, you can upgrade to it without burning a 5/24 slot.

Thanks for the detailed answer. I love your blog and the video. They are very informative and fun.

Just got the business Amex 30 days ago. Haven’t even finished the min spend yet. Any chance they would match me to the higher offer?

I know that there is zero chance that they will match you if you don’t ask them :-).

Amex weren’t good about this in the past, but they’ve been better about it over the past couple of years. I would go into it expecting them to say no and being pleasantly surprised if they say yes. Either way, it is a zero chance if you don’t ask and a better than zero chance if you do, so I’d rather ask if I were you.

If I applied for Amex bonvoy business on the same day I apply for chase personal bonvoy, would I get both bonuses? Any data points on this?

You can’t get bonuses on both Chase and Amex Marriott cards within 24 months of each other. My guess is Marriott would consider you eligible for the SUB on the first issuer it receives information about you being approved for a card from (based on the member ID number).