NOTICE: This post references card features that have changed, expired, or are not currently available

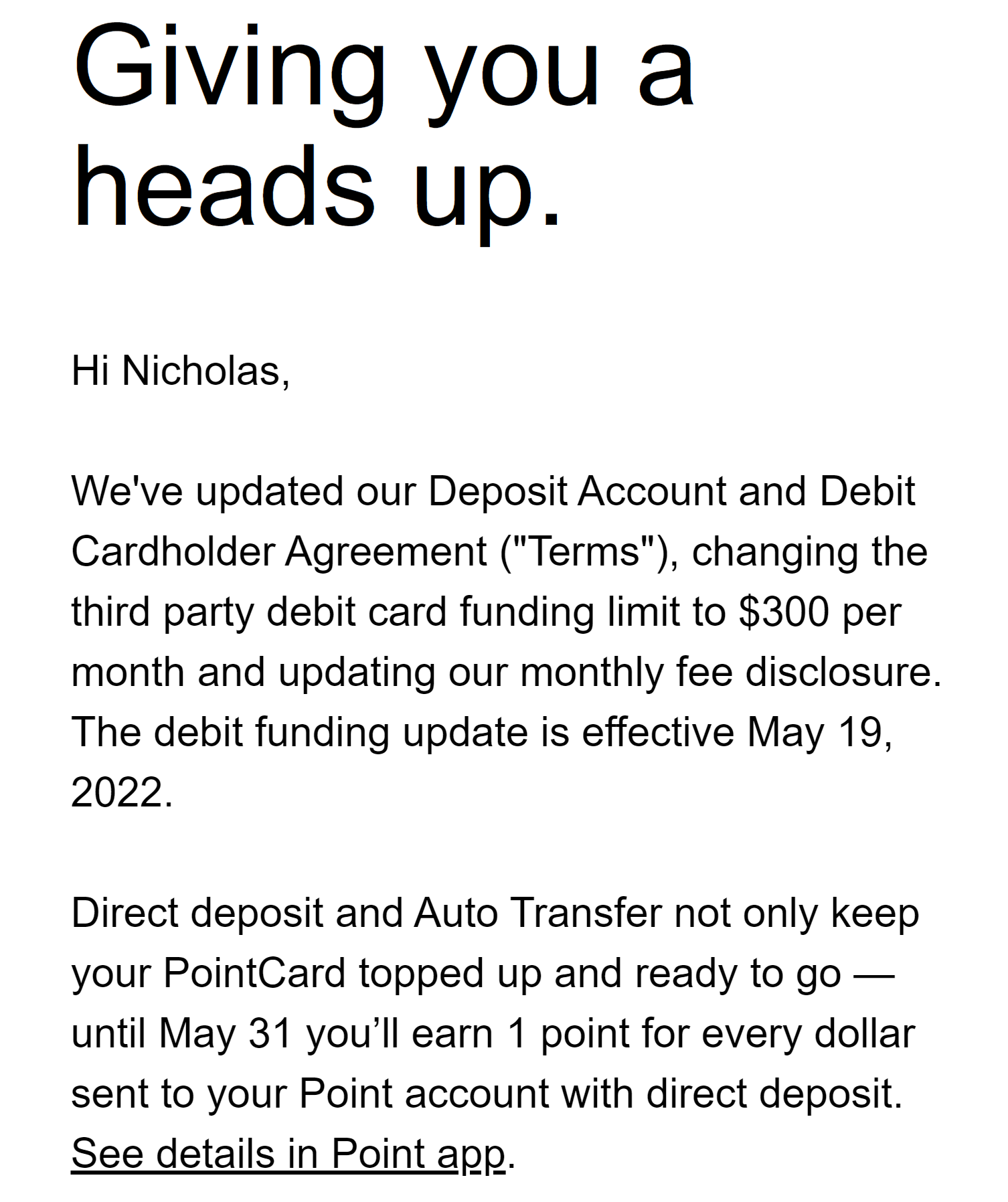

The PointCard debit card has sent notice to cardholders that, effective May 19, 2022, debit funding will be limited to $300 per month. That is a huge decrease from current limits and I find it quite disappointing since the instant nature of debit card deposits has been very convenient for me.

As noted in the email above, this new change begins on May 19, 2022.

At present, the PointCard offers base level users the ability to fund up to $2,500 per day and $10,000 per month. I can’t find it right now, but I had previously found a chart indicating that some users would be able to load far more based on account history. I recall that there were two more levels and limits exceeded $10K per day, but at present the only reference I find to the limit is the $2500/day and $10K/month, which is noted on the PointCard website as of the time of writing.

I don’t necessarily find this change surprising, just disappointing. This change won’t make much of a difference to those who either fund their PointCard account by direct deposit or ACH transfer. However, I’ve really appreciated the ability to fund via debit card since those transfers are instantly-available. There is no secret point-generating play that I’m using it for, I’ve just found that the PointCard is accepted in some places where I’ve had trouble with other debit cards, like online sportsbooks (don’t read further into that sentence than intended — note that those transactions earn 0 points). In those cases, I’ve wanted to be able to fund the PointCard right away to then use the money via the PointCard without right away. I’m less interested in transferring money into the PointCard proactively without a near term to use it, especially since there have been a couple of past issues with ACH transfers out of the PointCard.

I will at least give PointCard credit for communicating this change weeks in advance rather than after instituting a limit. If you intend to fund your PointCard with a debit card, do so sooner rather than later.

This is a shame. My (admittedly niche) use for Point was to do 10 small transfers from T-mobile money each month to earn the 4% interest rate.

Realize I’m approaching the one year (renewal) point and the value proposition of the card has pretty much gone away since they ditched most of their 5% partners (Whole Food, Trade Joe’s etc) and their streaks have gotten lamer and lamer. Hey I get it, they ultimately need to make a buck.

I’ll see if there is a way to request a retention offer (i.e. waived fee) but pretty sure this is going to end up being canceled. Was a fun year. If anyone has had any luck/advice getting the renewal fee waived please chime in.

Can the point debit card be funded with simon mall debit cards to pay larger amount of estimated taxes in a single transaction (getting around the 6 transactions limit of income tax payment processors) prior to May 19?

Not that it matters anymore, but was it possible to use PPDK for Point card debit funding?

Thanks for sharing this useful information Nick. I got really sad when got to know that they decreased the limit

Anyone know if Nearside debit cards earn 2.2% with PointCard reloads?

@Grant In early April I moved $100 from Nearside to Point – did NOT earn 2.2% on Nearside.

Hi Neal, thanks for letting me know 🙂

Can you fund it with a debit gift card?

Not the one I tried.