NOTICE: This post references card features that have changed, expired, or are not currently available

Rapid Travel Chai recently spent a fun filled day in New Jersey signing up for credit cards in-branch (read his post here). His prime target was the Citi Prestige 60K offer. He had learned about the offer from this Frequent Miler post. I, in turn, had learned about the offer from this MileCards post. And now, I’m finally giving the card the attention it deserves…

Why sign up now

Speaking of the MileCards post, they did an excellent job of highlighting why this may be the best time to sign up for the Citi Prestige card. To summarize:

- Many card benefits are changing on October 19th:

- Benefits going away October 19th: Flight points, Airport Angel lounge access, annual $200 airline fee credit, annual companion ticket, and the Relationship Bonus.

- New benefits as of October 19th: 3X points on air and hotel; 2X points on dining and entertainment; $250 air travel credit; Priority Pass Select lounge access; and Complimentary 4th night hotel stays

- By signing up before October 19th, it may be possible to take advantage of both the card’s current benefits and future benefits with one annual fee:

- Before October 19th, use tricks of the trade to get $200 in airline fee credits.

- After October 19th, but before the end of the year, it may be possible to get $250 in air travel credit. Starting January 1 it will be possible to get another $250 in air travel credit since that is a calendar year benefit.

- Use the worldwide companion pass within a year of applying (details here). Travel must be completed by October 18th 2015.

And, to summarize my summary, by signing up now it might be possible to get $700 in travel credit and maybe a companion pass too, with one annual fee. The companion pass can be a big money saver, but not necessarily so (you have to book through a specific travel agency (Spirit Incentives) and the companion is charged all fees, taxes, and charges.

It’s a pretty good card too

The Citi Prestige card has a number of nice benefits to justify its hefty $450 annual fee ($350 for Citi Gold members). The following are its post October 19th benefits:

- Bonus categories: 3X points on air and hotel; 2X points on dining and entertainment

- Lounge Access: American Airlines AAdmiral’s Club and Priority Pass Select lounges

- More Valuable ThankYou Points: By owning this card, your ThankYou points become more valuable. Redeem for 1.33 cents per point value toward any flights or 1.6 cents per point value on American Airlines and US Airways. Also, this is one of just a few cards that give you the ability to transfer ThankYou points to airline miles.

- $100 Global Entry fee credit: Global Entry gives you faster screening when arriving back in the US after an international flight. Better yet, it gives you access to TSA_PRE for faster domestic security clearance (no more removing shoes or laptop!)

- Complimentary 4th night stay:

Up to twice per year,Book at least 4 nights through the World Elite Luxury Hotels and Resorts Portfolio, pay with the Prestige card, and you will be credited the rate of the 4th night on the reservation. There might be a fun opportunity here to find a hotel that is cheap during the week, but crazy expensive on the weekend such that the 4th night price dwarfs the rest of the stay. - Free golf benefits: This is a weird one, but yes the card gives you three complimentary rounds of golf each calendar year. From the T&C: “Complimentary rounds are for the primary cardmember only. The Citi Prestige card must be used to reserve the rounds, and if the round is eligible for the complimentary offer, the cardmember will not be billed. After the 3 free rounds of golf are used, the cardmember will need to use their Citi Prestige card to book and pay for additional rounds. Cardmember must book at least 3 days in advance of tee date.”

Should I go for it?

The prospect of a 60,000 point signup bonus and $700 in travel credits to more than offset the first year $450 annual fee is tempting. And, there’s a small chance I can even put the companion ticket to good use. Most of the other benefits of the card overlap with benefits from other cards, though. So, for me, it’s about the 60K signup bonus + $250 ($700 in airline fee credits minus $450 annual fee). Until recently, though, I had given up on the idea because the 60K offer is in-branch only and there are no Citi branches anywhere near me.

More recently, I took a closer look at the 60K offer: 30K points after $3K spend + 30K points after $15K spend. Whoa! $12K extra spend is required for the second 30K points?! That’s a lot. That extra $12K “signup bonus” spend only earns an extra 2.5 points per dollar. If you were going to spend that much anyway on this card, it would be well worth it. If you just want the signup bonus points, though, you might be better off tacking on another signup bonus via the Premier card (up to 50K bonus) or Preferred card (20K bonus). If I signed up for this Prestige card, I would stop at $3K spend for 30K bonus points.

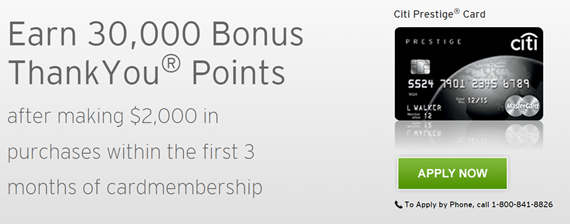

In that case, let’s look at the public online offer:

The public offer is 30K points after $2K spend. In my mind, that’s better than the 60K offer which requires $3K spend for the first 30K points. I’m going to do it. I’m looking forward to testing out the idea of raking in $700 in airline travel credit. And, I’m hopeful that I can actually make use of the companion ticket in some meaningful way. And, maybe I can even make use of that 4th night free hotel benefit.

From 30K to 70K 30K + $400 (see Update) with one bank account

Citibank is currently offering a 40K bonus for signing up for Citigold Checking (details here). There are some downsides:

- You have to jump through a few hoops to get the bonus points: initiate one direct deposit, and complete one electronic bill payment for two consecutive months

- You have to pay $30 per month for Citigold Checking unless you maintain a very large balance ($50K)

- You will most likely be taxed on the 40,000 points

Despite all that, the value earned would be decent. Remember that with the Prestige card ThankYou points are worth at least 1.33 cents each towards airfare. So, 40,000 points becomes $532 in flights. That’s pretty good! And, on top of that, the presence of the Citigold account should reduce the annual fee on the Prestige card by $100.

UPDATE: As Kevin mentions in the comments, I goofed and referred to an old Citigold offer. There is a current Citigold offer for $400 (details here) instead of 40K points. This one requires depositing $50K to qualify

My Plan

Here’s my plan in a nutshell:

SignConsider signing up for Citigold checking onlineFulfill requirements for 40K point bonusConsider fulfilling requirements for $400 bonus- Sign up for Citi Prestige card, hopefully with a $350 annual fee (thanks to the Citigold account)

- Make sure to incur $200 in airline fees on the card before October 19th

- Use the card for at least $250 in airline charges on or after October 19th and before the end of the year.

- Use the card for another $250 in airline charges in 2015

- Look for opportunities to make good use of the 4th night free hotel benefit

- Look for opportunities to use the companion pass

- Look for opportunities to make use of other card benefits

I’ll keep you informed as to how it all goes. What are your thoughts about the Prestige card and the CitiGold offer? Please comment below.

Why weren’t you approved for citi gold checking account? Is it hard to get?fl

I don’t really know why. I don’t think it should be hard to get

The Citi T&C about the companion pass say that the ticket must be booked on or before 10/18/14, which is today.

Not for people who signed up recently. For recent applications prior to October 19th, you have a year from the application date.

Hey, so what is the cut off for receiving the $200 credit? I remember reading somewhere that it takes 10 days for the credit to post. I applied in branch and it is taking forever for the application to process. Will I just need to make my ‘in-flight’ purchases before the 19th or will I need to make them 10 days before the 19th(before the 9th)? What do you think?

My understanding is that as long as you incur the charges before the 19th, they should be reimbursed as part of the $200. That said, keep in mind that there is no guarantee that we’ll get another $250 in reimbursements this year. Its just a hope at this point.

So have you applied the card yet? Online or in branch? What is the annual fee?

I applied this morning. Approved pending manager sign-off given my high credit limits across multiple cards. My annual fee will be $450 since I wasn’t able to get approved for the Citigold account.

Sorry if I’m late to the party here. Already CitiGold (got AA miles a year or two ago I think) and kept it since my mortgage was sold to Citibank. If I apply for the online offer, will it actually adjust the annual fee down to $350? Seems unlikely since I was Citigold when I did the 100k mile AAdvantage Executive card and still got billed $450.

I have a branch 10 min walk from my office, so seems like my best bet to guarantee the lower annual fee is to visit in person? Yes it will be $1k more spend for the first 30k points which kinda stinks. The next $12k in spend shouldn’t be too hard at 3x points for airfare and hotels that I normally put on my Amex Preferred Gold card.

Agreed. Seems safer to apply in-branch

Called in a week or so ago to activate my $200 airline credit and although I didn’t ask if I could spend $200 before 10/19 and $250 after 10/19, a pretty knowledgeable representative automatically mentioned that I could spend $200 now and that I would get another $50 starting 10/19 then another $250 starting 1/1. Based on this, I’m thinking it’s $500 rather than $700. Just FYI but who knows how it will really play out until 10/19 onwards.

Yep, we’ll see soon

Just a quick note about the complimentary hotel benefit too–after 10/19, you can get a fourth-night-free credit an unlimited (at least, not limited to two) times a year if you book through their “designated travel advisor” Carlson Wagonlit, to wit (from https://online.citibank.com/US/JRS/portal/template.do?ID=GACTermsBenefits):

The International Complimentary Night Hotels and Resorts Program Terms and Conditions are effective starting on October 19, 2014

You will enjoy a complimentary fourth night with no black-out dates, when you book four consecutive nights at any hotel booked by a personal travel advisor designated by MasterCard (the “designated travel advisor” is Carlson Wagonlit Travel). Bookings made through other methods such as, travel agents, websites or directly with a hotel will not qualify.

To receive your complimentary night (via a statement credit) you must:

Make a reservation for a minimum, consecutive four-night stay by contacting the Citi Prestige Concierge, to book directly with a designated travel advisor

Fully pay for your stay with a Citi Prestige Card

Thanks Chris. Updated.

I was looking for a Citi card to replace the World Elite Master Card and move that LOC over to but this isn’t tempting me……

Will the airline credit reimburse GC, like the Amex Plat? Anyone with experience on this please chime in!

It’s even better than that. Before 10/19, the $200 benefit is similar to Amex in that it is intended to be for fees but works for almost any airline (whereas the Platinum card requires that you pick just one). I’ve heard that they’ll reimburse gift cards up to $99.99. After 10/19, the $250 benefit is for anything, including airfare.

How do you get reimburse for GC with airline credit for Amex plat?

With an Amex Platinum card, you have to pick your preferred airline in order to get fees reimbursed. Once done, buying small denomination gift cards ($100 or less, usually) directly from the airline with the Platinum card usually results in an automatic statement credit (up to total of $200 per calendar year).

Hard pull for citi checking account?

Supposedly soft pull. I’ll find out soon for sure.

The post Oct 19th card doesn’t provide Airport Angel, it gives you priority pass.

Thank you. Fixed

There’s no 40k Citigold bonus. Your link points to a post from 2011. There is a $400 Citigold bonus, however. The main hoop for that is depositing $50,000. You seemed to have missed that requirement in your summary. That said, the first two months of Citigold have waived fees, so if you met the requirements on 10/1/14 (the earliest you could do that), you would be credited the $400 bonus within 90 days costing a total of $60 in monthly fees if you didn’t maintain the $50,000 balance at Citigold.

Oh crap. THANK YOU Kevin. This is what I get for writing a post late at night. I’ve updated that section of this post.

No taxes paid on $400?

I’m pretty sure Citi policy is to send the IRS a 1099 if you have received bonuses totaling or exceeding $600.

I found the $400 offer here.

.

It requires both $50K in deposits and two months of at least one bill payment. Then, the cash bonus will be credited within 90 days from the end of the month in which all requirements are met. I think that means we need to expect it to take about 5 months from account opening to get the $400 assuming conditions are met as soon as possible (2 months to complete requirements + 90 days).

One other note about your plan, others have not cited eligibility for an extra $250 on 10/19, only on 1/1. If they are correct in omitting that reimbursement, the options would be $200 before 10/19, $0 the rest of the calendar year, and $250 after 1/1, OR, $250 between 10/19 and 12/31, and another $250 after 1/1.

Thanks Kevin. I guess we won’t know until its too late whether Citi will really enforce that choice. If so, obviously it would be better to wait until after 10/19 to get the $250 credit. I might roll the dice just as a blog experiment, but I wouldn’t recommend that to others.

I can confirm, now that I have received the card, that my annual fee is $350 even though I have no Citi checking relationship.

did you sign up at a local branch? thinking about doing this deal, but $50k min balance is steep. Greg can you confirm you only need to pay for 2 months ($30) and get the 40k bonus then cash out without them retracting like chase does (assuming because this is rewarded in thank you points they wouldn’t?)?

hdawg, see Kevin’s comment. I goofed about the 40K promo. As to the $400 promo, I’ll investigate to see how long the money needs to stay there.

You plan to apply for the CC online and the checking account in branch since you’re not displaying an offer code to get $400?

Sorry, saw the link further down.

One may consider 30k AA points with offer code DR5MG904XE (until 9/30/14)

Thanks ABC. I’ll probably go with $400 anyway, but its good to know that there’s another option!

RTC, thanks, great to know!