NOTICE: This post references card features that have changed, expired, or are not currently available

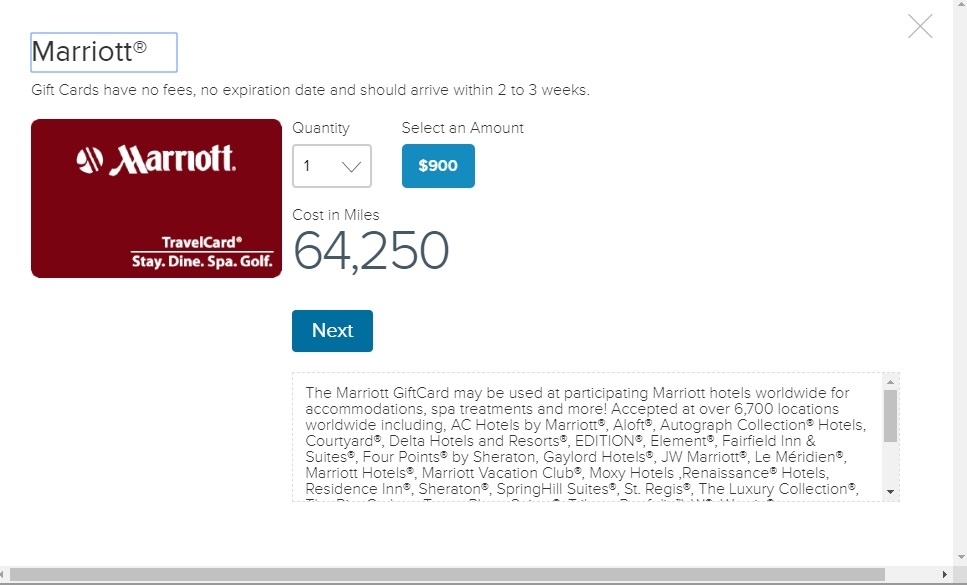

Last year, I wrote about what at the time seemed to me like an awesome redemption: some people have the ability to redeem just 64,250 Capital One “miles” from cards like the Capital One® Venture® Rewards Credit Card or Capital One Spark Miles for Business card for a $900 Marriott gift card. That makes the effective return on everyday spend on a Venture or Spark Miles card 2.8% when used towards Marriott – one reason I crowned the Venture card the king of hotel cards (See: The best hotel credit card ever). I am one of those chosen few who has the magic Marriott gift card option in my account and last week I made the redemption. Having gotten 2.8% back towards Marriott should have filled me with a sense of excitement for a card we’d mostly sock-drawered for years, but instead I was immediately filled with regret: had I made a horrible mistake? Here’s why I did it and why I might have really messed up.

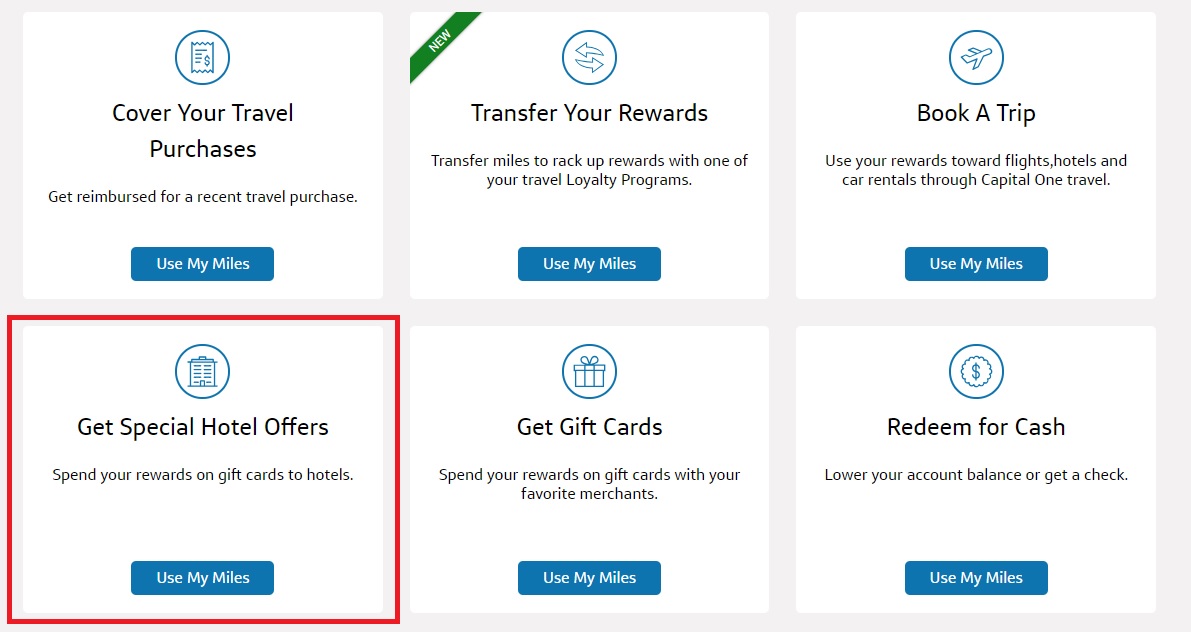

The “Get Hotel Special Offers” option

As I wrote about last December, some Capital One members have the ability to redeem 64,250 Capital One Rewards miles for a $900 Marriott gift card. From what I understand, this was some additional benefit that was available to new applicants for a limited window years ago. If you have the ability, it shows up under the various ways to redeem your rewards (note: it’s not the “Get Gift Cards” section, where you only get a penny a point).

Those who happened to have opened their cards during that limited-time window (still unclear exactly when that was, but it had to have been at least six or seven years ago) still have the ability to make this type of redemption today. I get the sense that this option is rare, but keep in mind that Capital One will allow you to transfer miles to anyone. You only need to find one friend or family member with the capability in order to take advantage of it.

When I wrote about this last December, I was excited about it for a few reasons:

- Traditionally, 64,250 Capital One Venture Miles were worth $642.50 when redeemed for travel. This special gift card capability essentially added a 40% bonus when redeeming for a Marriott Gift Card since you could redeem that same amount of points for a $900 gift card.

- This makes for excellent return on everyday spend: with $32,125 in spend required to earn these miles (since Capital One Venture and Spark Miles cards earn 2 Capital One miles per dollar spent), a $900 gift card represents a 2.8% return on spend. That’s shaky math as it would be valuing the Marriott GC at full face value, but even at resale value it came in over 2.3% return (and if you keep the gift card and use it, you also earn Marriott points on your paid stay).

I made the case in more detail in the post The best hotel credit card ever, so it’s worth reading that if you previously missed it.

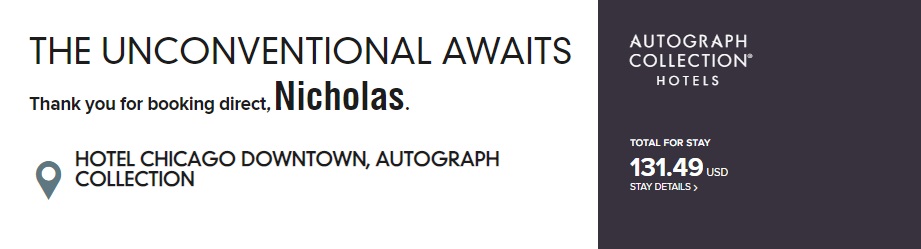

To add a real-life example that helps illustrate why I’ve been so excited about this redemption, take one of my recent stays for example. I spent a night earlier this month at the Hotel Chicago Downtown, an Autograph Collection property. For a one-night stay with family, we were looking for a reasonable option downtown and found it in the Hotel Chicago. With tax, the AAA rate came to $131, which didn’t seem bad for a downtown hotel with a club lounge (breakfast was good, the lounge was otherwise very weak but did provide access to water and soda throughout the day).

If I had paid for that stay with a Marriott gift card redeemed through Capital One, that $131 would represent 14.55% of the value of the gift card ($131 / $900 = 0.1455).

We can therefore figure that manufacturing a “free night” at the Hotel Chicago at that rate would have required 14.55% of the spend necessary to earn my $900 gift card.

14.55% of $31,125 = $4,530.42

In other words, $4,530.42 in spend on the Capital One Venture card could have gotten me enough rewards to cover my night at the Hotel Chicago Downtown (and note that I also earned 15 points per dollar on the room rate as a Platinum member by paying the cash rate and triggered a targeted bonus for 1500 Marriott points). Of course, that’s an oversimplification since the $900 gift card redemption requires $31K+ in total spend. But still, when you consider that the Hotel Chicago Downtown is a Category 5 Marriott that would ordinarily require 35,000 points per night, it would seem that manufacturing free nights via Capital One looks like a pretty solid deal — at least when you’re lucky and rates are incredibly low as they were for me. Rates certainly aren’t always that low.

But that was part of the premise of spending on my Capital One Venture card: sometimes rates are low and I’d rather pay the nightly rate than use points at poor value. Redeeming for a $900 gift card gives me the flexibility to choose to use points or “cash” — while getting outsized value on spend since I’m earning that Marriott “cash” at a decent rate with the Venture card.

In my specific situation, I had further motivation to redeem for a Marriott gift card: I have a stay booked at the St. Regis Bora Bora. I understand that food at the St. Regis isn’t cheap. I redeemed for the Marriott gift card in part to ease the sticker shock at prices since we will (hopefully) be able to use our gift card to pay for incidentals. Using it to pay for meals that I otherwise would have needed to pay for with cash would make it feel like I really did get close to 2.8% back in return on Venture card spend since I’m likely to be somewhat captive to resort prices. That seemed like a better deal to me than using cash cash.

So I made the redemption….and immediately regretted it

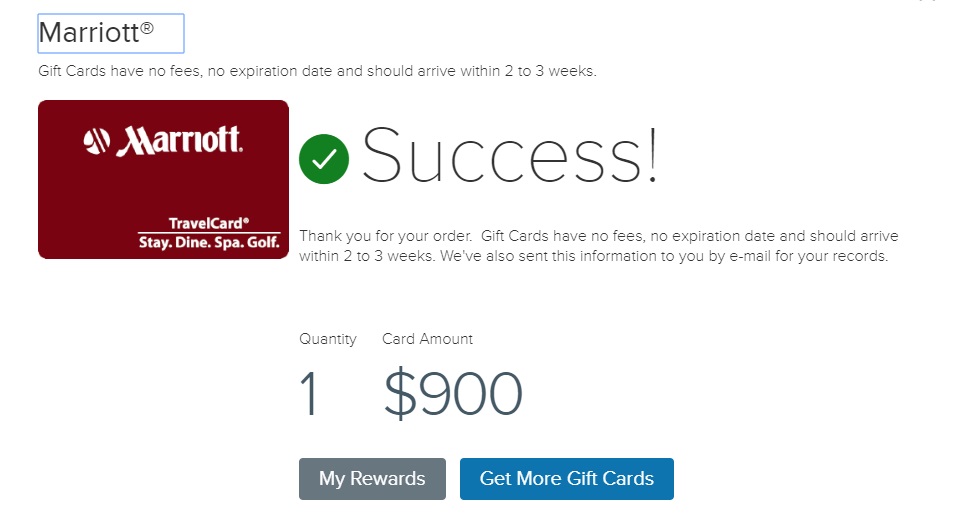

Last week, I finally took the plunge and ordered up my first Marriott gift card through Capital One, redeeming 64,250 Capital One miles for a $900 Marriott gift card.

It takes 2-3 weeks for the gift card to arrive, which is more time than I needed to feel buyer’s remorse. Almost immediately after hitting the “submit” button to redeem my miles, I felt a wave of regret.

The reason for my regret: Capital One’s transfer bonuses.

Since Capital One first added transfer partners to the fold late last year, they have been added a couple additional partners and run four separate point transfer bonuses (the latest of which is a 25% bonus on transfers to LifeMiles). See current point transfer bonuses here (and scroll down the page to search expired bonuses).

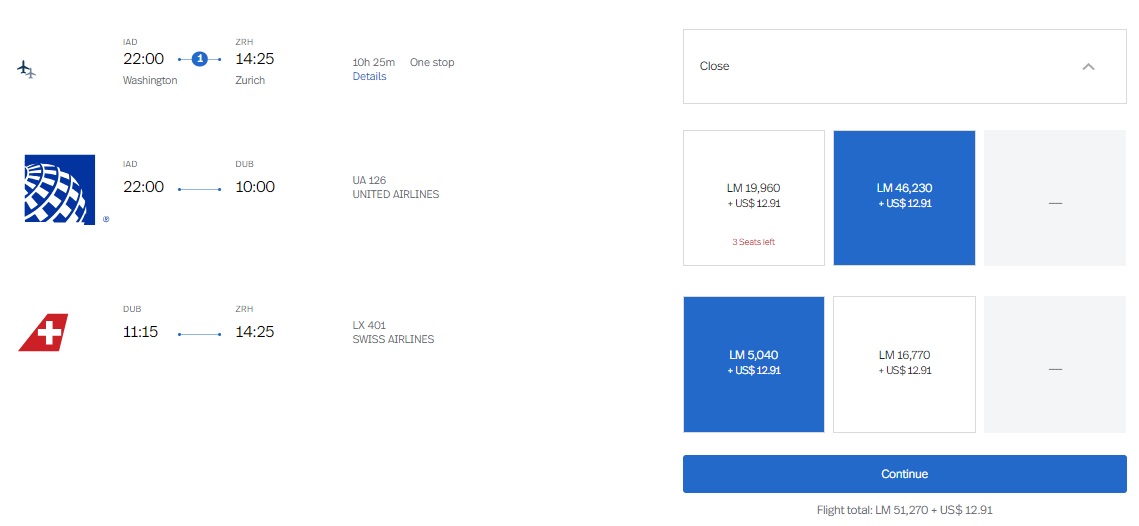

With the current bonus on transfers to Avianca LifeMiles, the transfer ratio bumps up to 2 Capital One Venture Miles to 1.876 Avianca LifeMiles. In my case, the 64K Capital One Venture miles I just redeemed would transfer to just under 60K LifeMiles.

LifeMiles charges 63K points each way in business class to Europe, though that’s hackable when you add a throwaway additional segment in economy class (See: Avianca LifeMiles’ awesome mixed-cabin award pricing. First class for less.). The short story is that I could have gotten a business class flight across the pond for fewer Capital One Miles if I instead took advantage of the LifeMiles transfer bonus.

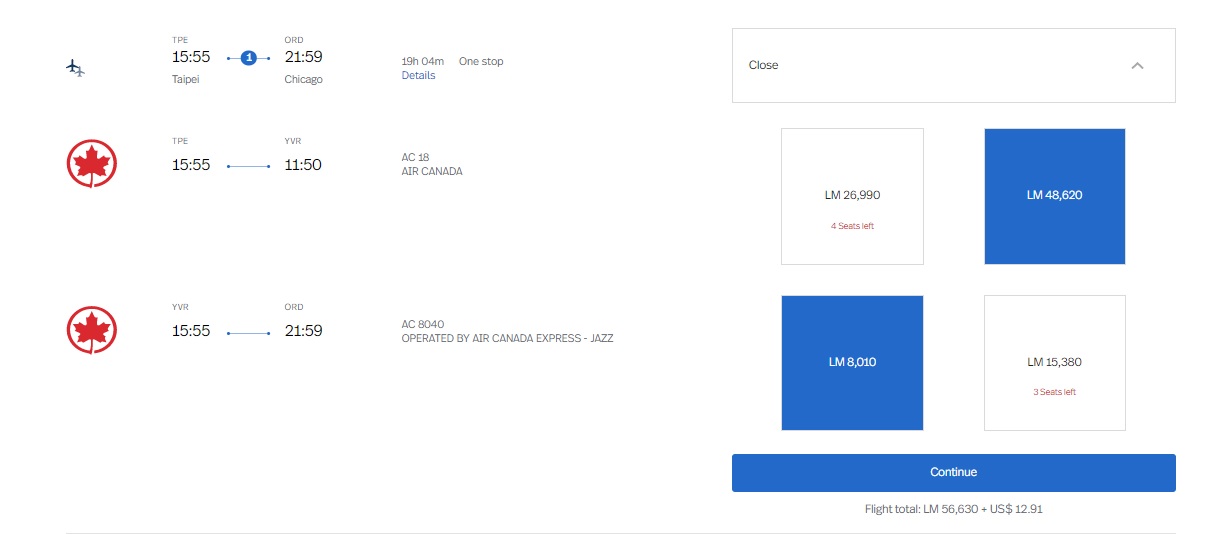

Lest you think the hacks are limited to hops across a single pond, I assure you that awards are hackable just about every which way. Seen here is a flight over the pacific in business class with an economy class leg added for just 56K LifeMiles.

Yet again, that would have cost fewer Capital One Venture Miles — requiring a transfer of just 61K Venture miles with the bonus.

In short, I traded enough miles Capital One Venture Miles for a flight across either the Atlantic or Pacific in flat bed business class for a $900 Marriott gift card. Youch.

Bottom line

Don’t get me wrong, I don’t feel like my Marriott gift card redemption was awful when I consider it in a vacuum. It will save me real cash during my stay in Bora Bora. But the current transfer bonus to LifeMiles alone made me rethink it. Capital One hasn’t been shy about the fact that they intend to continue to offer bonuses like this and between last month’s bonus to Flying Blue and this month’s to LifeMiles, I’m feeling like I may have done much better to have waited until I could find a use for one of the transfer bonuses. Indeed, I also transferred 8K Capital One Venture miles to LifeMiles last week in order to book an expensive one-way flight within my region at the last minute for a family member (7,500 miles one-way plus the newly reduced booking fee of $10 and the $5.60 in taxes). I’ve been constantly getting excellent value from LifeMiles. Some cards on the market earn better category bonuses or more than 1.876 transferable points per dollar spent (mostly Membership Rewards earning cards). However, unlike those cards, rewards on the Venture or Spark Miles cards are uncapped. While I definitely feel some regret for my redemption here, it has at least been mitigated by a couple of trips to a Simon Mall this week. While I originally expected to feel very excited about the Marriott gift card redemption, I think I’d have a hard time justifying it again if Capital One continues to offer good transfer bonuses — they are simply too valuable to ignore. That’s a surprising sentiment for a currency I had as little interest in as anyone else at this time last year. To think that I’m disappointed in getting $900 in Marriott stays for what used to be $642 worth of miles on my Venture card is an outcome I never would have expected — but I guess that’s ironically kind of exciting. If a quasi-2.8% return wasn’t good enough, the Capital One miles cards are stronger than even I anticipated.

Do you anticipate any issues using your USD gift card at non-USD hotels?

I hope not. The Marriott site indicates that they should be accepted at most properties.

https://gifts.marriott.com/faq.html

Cool, hopefully that is correct in practice. I’m going to send an email to ask the hotels i’m staying at in europe / or ask at the front desk before buying food / dinner at the hotel with the gift card

You could have gotten 60k LifeMiles instead of your $900 GC. Assuming you value the GC at face value (fair since you have an immediate use for it), that’s 1.5 cents per LifeMile.

LifeMiles frequently sells points for 1.5cpp and less. Wait until you need them and buy them.

The cash you save by buying and using the GC now will earn interest (or otherwise be deployed), and you’ll be better off.

Okay I received $30 virtual gift card by email from Marriott. I tried to use at a Courtyard for snacks. Was told I had to use total balance in one purchase?

The card says on Marriott website I couldn’t use to book reservation with number.

Have you been able to make purchases with gift card?

I think you’re talking about some sort of promo that Marriott ran where they randomly gave people gift cards. I don’t know if those promo gift cards had some special terms.

That said, I use a gift card at check out to pay the room bill. In other words, charge those snacks to your room and pay for your room and anything charged to it at check out.

You can’t book an advance purchase rate with a gift card — you need to be booking a rate you pay at the hotel (member rate, AAA rate, AARP rate, corporate rate, etc). I usually find that the AAA rate meets or beats the advance purchase rate anyway. Then you have to put in a credit card number when you make the reservation, but you can pay any way you like at check-out — same credit card, different credit card, cash, gift card, whatever you want. You definitely do not need to use the entire balance of a regular Marriott gift card in a single purchase. Again, I don’t know if the ones they sent out as surprises had special terms.

So Helpful

7

Meh, if you play this game well, you’ll have more airline miles than you can use. I find hotel points more valuable since I need a lot more of them.

I don’t understand why people keep saying LifeMiles redemptions are hackable by adding a throwaway segment in economy… you guys don’t check a bag when you fly to Europe? Or never encountered IROP?

Irregular ops is a legitimate concern, so that’s a good point. I wouldn’t necessarily book a throwaway leg if I weren’t willing to risk that. Having healthy miles and points balances, I worry less about that kind of thing as I can most likely solve a problem if I end up in the wrong city. Additionally, I’ve been pretty darn lucky: I can’t think of an international flight where I had any notable delay or cancellation…like ever I think. Hopefully I didn’t just jinx myself. I’ve definitely run into issues domestically before, but not really internationally.

As for checking a bag, my family usually does check stuff, so we’d pick a European economy segment to a place we want to visit. Doesn’t really matter as the difference between intra-European business and economy is just a blocked middle seat. I’ll take a sizable mileage savings and not have a blocked middle seat.

If it were just me traveling, I definitely wouldn’t check a bag going to Europe or anywhere else. I can totally fit what I need in a carry-on and personal item and be more agile. But when traveling as a family we sure do check stuff, so that would certainly be an issue with a throwaway leg.

Note that in some cases, and you’d have to research where you’re going, you’re going to need to pick up your bags at the destination and re-check them. In that case, it may be less of a risk to book a throwaway. But the risk of irregular ops is still real.

Love the way you analyze your redemptions, and I guess it is a part of the hobby to wonder if we could have done better. Guess it is what good coaches do every Monday morning after both wins and losses.

Not all that bad if you ask me.

Interesting that you bring this topic back up. I don’t have the venture card (or the better Marriott gift card redemption) but I did complete the $50k Spark Miles spending challenge, as I call it, so I’m sitting on 300k Capitol One miles. I too was planning to do a massive food and beverage redemption next year as $3k is no small amount out of pocket even when the travel is otherwise free or very cheap.

I know I can get better value in transfers but since we can only take one or two major trips a year, I’m not sure when I will use them. Adding to that is the fear that Capital One may claw those miles back when they realize I MS’ed $40k of it, so I kind of want to get them out of there.. Decisions, decisions…