Update 11/26/23: My wife and I applied for the 65K Alaska Business card offer and we were both auto-approved. This means that our matched Alaska MVP status will be bumped up to MVP Gold 100K and extended through the end of 2024! The remainder of this post is unchanged from its original publication on November 8th…

A bit over a month ago I detailed the credit cards I was planning to get next. In the original version of the post I said that I’d apply for an AA card and the Morgan Stanley Platinum card. In a revision to the post, I wrote that my updated plan was to get the JetBlue Business card, then the Chase Ink Cash, then the AA card, then the Morgan Stanley Platinum card. A few things have changed since then and I’ve revised my plans again…

Here are the things that have led me to an altered card plan:

- My JetBlue status match came through. The status match extends through 2024 if you have a JetBlue Plus or Business card before the end of this year. In order to extend my newfound status, I applied for the business card. The application said that it was under review, but I received an email a week later thanking me for going paperless with my JetBlue card, and the next day I got a congratulations email. Strange sequence, but I’ll take it. My wife was also approved for the same card.

- A once-in-a-lifetime opportunity to secure Delta Diamond status for many years for my wife and for me means that I’ll be focusing all of my card spend on Delta cards until the end of this year. This reduced my appetite for the Chase Ink card, for now.

- My Alaska status match came through. The status match extends through 2024 if you have an Alaska card before the end of this year. I don’t yet have one and so that is now on the top of my list. I’m currently matched to MVP Gold 75K, but if I get the Alaska card before the end of the year they should bump me up to top-tier MVP Gold 100K (based on the rules of the status match as I understand them). My wife’s in the same situation.

And so now, here are my altered plans:

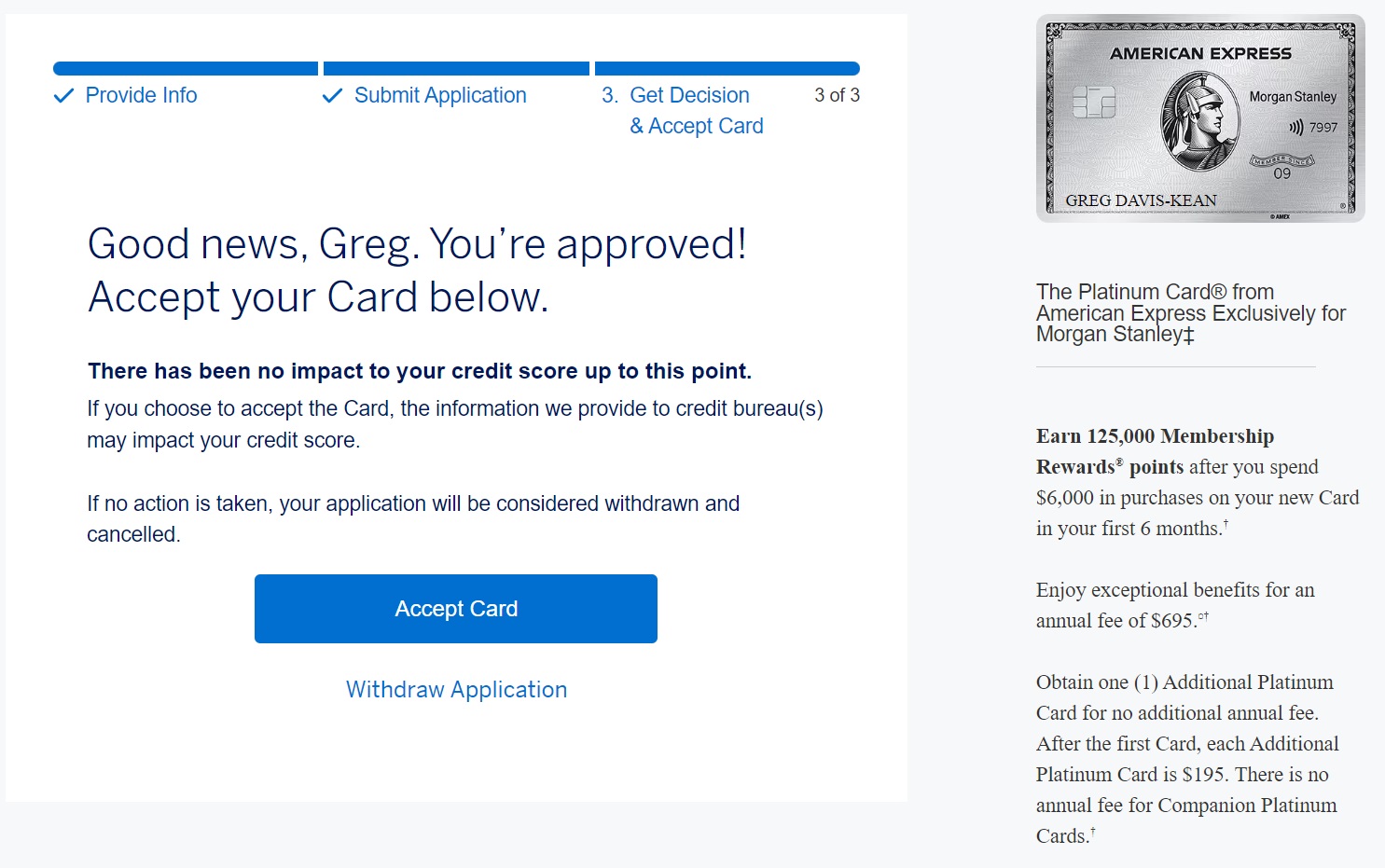

- My wife and I each applied for the Morgan Stanley Platinum card on the final day when it was offering 125,000 points after $6K spend in 6 months. Both applications were instantly approved. Fortunately, we can wait until January to start the spend since we have 6 months to complete it.

- I am waiting to see if the Alaska Business Card offer increases from its current 50K low. I don’t want to use up a 5/24 slot for the personal Alaska card if I can help it. I figure that I’ll wait until early December and then apply for the card as-is if the offer hasn’t increased by then. If i have any trouble getting approved for the Alaska Business card then I’ll still have time in December to apply for the Alaska consumer card as a backup plan.

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

- I’m still very interested in the AAdvantage Aviator Red card especially while it has an offer for a total of 75K points after first spend on both the primary card and an authorized user card. That said, I don’t want to jeopardize the chance of getting approved for the Alaska card so I intend to wait to see what happens with the Alaska card. If I get approved for the Alaska Business card and if the 75K AAdvantage Aviator Red offer is still available, I’ll go for it then. If I end up getting the Alaska consumer card, I’ll hold-off on getting the Aviator card since I don’t want to get to 5/24 if I can help it (I’ll be at 3/24 in December, but the combo of the Alaska consumer card plus the Aviator card would push me up to 5/24).

- If the Ink Cash 90K offer and 40K referral offer are still in-play in late November or early December and after I get the Alaska card, I want to attempt another round-robin application spree within my household where I’ll refer my wife, she’ll refer our son, and our son will refer me. We stand to earn a total of 390,000 bonus points that way! This is the same idea as what we did in the summer with the 100K Ink Business Preferred offer. See: 3 Inks approved again. 420K points “in the bag”.

You might notice that my card plans of late have been driven more by elite status considerations than by the desire to get more points. This is ironic because my interest in airline elite status is actually at an all-time low. In most cases I think that I’d be better off paying for first class (with cash or points) rather than hoping for an elite upgrade. That said, the three elite status situations are once-ever opportunities: The ability to earn multiple years of top-tier Delta Diamond status through spend will never happen again (and it’s only available to my wife and me now because we will have a huge amount of rollover MQMs). And the Alaska and JetBlue deals are just too easy: in both cases all I need to do is open a new card account in order to secure status for a whole year. With JetBlue, in particular, there are tangible benefits (like Mint business class upgrades) that make it a no-brainer. With Alaska, there may be fewer tangible benefits, but I’ve been interested in earning more Alaska miles anyway and so this kills two birds with one stone.

I’m surprised that you buried the lede here with Alaska Visa Business card at 65,000 miles. I was looking at it couple weeks ago and saw 50,000 miles so I didn’t apply waiting for a better offer. Then this article popped up and I’m glad that I opened it (OK, I read every article here anyway, LOL) and read about the increased offer on the business side. Applied and approved! You should create/renew a separate article about this so people don’t miss it.

Honestly I didn’t realize that we hadn’t published a post about the 65k offer before I published this one. Luckily we have published it since then.

Do you have any existing relationship with BofA that helped with your approval? I FINALLY got the 75K match and want to get the business card … but have read that having an existing banking relationship with BofA helps. I closed my accounts years ago and only have a fee free Merrill card that I use once in a while to keep the credit history.

Look up BofA’s 3/12 rule, 7/12 rule, and 2/3/4 rule. The 7/12 rule answers your specific question.

AMOL…..YES,YES,YES……..OPEN an account with BofA and enjoy

I guess my next question would be if having a business checking account helps with the business or if a personal checking helps. Haven’t found a specific data point. Luckily the business checking account I applied for just got approved so hoping that helps for the Biz AS card. I would definitely hit 3/12 without it.

I have no qualifying accounts at BofA. I’ve been under 3/12 for a while. Was approved for the Alaska business card immediately. Fund your checking account. BofA’s algorithm should spot it. If you get a decline, call in for reconsideration and bring attention to your newly opened account for 7/12.

I have all kinds of accounts with BOA but my wife only had a single consumer credit card. Both of us were instantly approved. I think this one is easy on approvals.

Thank you! Just took the plunge and applied and was approved! Alaska MVP 100K here I come 🙂

Why not get the Citi AA business card? When that recently bumped up to 75k, it was a no-brainer for me over the Barclays aviator to avoid the 5/24 for myself and P2. Yes, I know the AU card won’t count against 5/24 if you call chase, but that can be a very long phone call and I value not having to make it. Since you seem to have a magical method to create almost unlimited spend, wouldn’t you prefer the Citi card despite the $6k spend?

Great suggestion, but I got that card in June. I mentioned it here in July: https://frequentmiler.com/plans-for-rebuilding-my-point-fortune/

Makes sense!

Plus Citi requires actual spend vs two purchases of any amount for the Aviator biz.

“With JetBlue, in particular, there are tangible benefits (like Mint business class upgrades)”

Don’t forget the excellent Founder’s Card benefit 😉

LOL!

So I see you are going forward with your spend-to-Diamond plan. Are you concerned that doing so much spend in so little time, and thus I assume having to cycle your credit limit multiple times a month, might put your amex accounts in jeopardy? I also still think there is a significant chance that your assumptions about Diamond status being honored for 5 or whatever years are off. Delta has been known to change their policies after all. So much opportunity cost for all that spend too, imagine how many signup bonuses you could have. Still, curious how this all works out.

I used to frequently cycle my credit with Amex and so I’ve built up a history there that will hopefully work in my favor.

I have no doubt that the muti-year status extension will be honored. I can’t remember Delta ever going back on an explicit offer like that before.

True about your history, but probably a fair warning to others attempting to replicate.

This is not so much an explicit offer as it is a policy change…which they have already done twice in as many months…so certainly not unprecedented. It’s also based on your reasonable interpretation of the wording, but wording that to me seems to have been sloppily written and possibly not their intention. Also, I’ll bet that Delta’s systems have no way of even tracking multi-year status extensions. It all resets annually unless you are lifetime. I suspect you’ll have to fight for it 14 months from now…but we’ll see if I’m right then.

Greg,

They are giving out 65k + companion pass Alaska Business Card applications on my flight out of Seattle.

Ooh, can I have one? 😉

try bankofamerica.com/AKBuscard65k

hope this works.

I applied to the Alaska Staus Match before the end of October but havent heard back.

How can I check before I apply for the Credit card?

Have you logged in to see if you’ve been matched? While I received a congratulations email, my wife didn’t and yet she was matched.

No match yet but I did email customer service.

Fingers crossed

I don’t think the Morgan Stanley plat is a good deal unless I’m missing something. In my case, I have to leave $25k in a non interest account with Morgan Stanley in order to get the card. (my wife had one last year). The opportunity cost is ~$1250 (@ 5% interest) to save $695. I guess you could justify it saying you’re “buying” MR points at a penny each.

He already has Access Investing account which costs him about $1.50/month,so he isn’t tying up any funds at Morgan Stanley except for $5,000 required to open Access Investing (no longer available).

Correct anyone who did not get the $5,000 account faces a very different math problem. I am also grandfathered in with the $5,000 account. The value for me is the free auth user for my better half. I simply pay the annual fee as I get more benefit from it with our travel patterns.

What would be the best new way to be eligible for the morgan stanely card?

Arthur, I’m not certain if this is still a benefit of the Morgan Stanley version but there used to be a ???$500??? statement credit if one puts $100k or more in charges on the card per calendar year. So, even if one doesn’t park the $25k at zero interest and does incur the annual fee, there is/was a separate means to at least partially mitigate the annual fee. Then, P2’s card is gratis. Then, there’s the coupon book.

The unstated lesson that Greg is imparting is that this game is always changing. Each person will continuously reassess things based on one’s own circumstances. Some changes are small. But, some changes are large enough for us to recognize that we need to change our plan. If only temporarily. Greg, through his example, is teaching us how to fish (it’s a parable).

Guru vibes!

I still have my Alaska 100k status. I love Alaska and they really treat the 100ks well. I’ve almost never missed out on a free upgrade!

No chase freedom unlimited at 3x pts for a whole year?? If you charged 100k-that would be 300K UR!

He said in the post that he needs to focus spending on delta cards to lock in several years of elite status. Plus with the cards he mentioned in the post he’s probably looking at 250k MR + at least 50k AS + 75k AA for only $15k in spend which is a far better deal

Perhaps Mary Jane is chiding Greg.

That’s why I love this hobby! You can individualize it to fit your needs/wants.

Actually I am thinking of having my wife sign up for that. She is well under 5/24. We’ll wait until it looks like the offer is nearly done though so as to be able to max earnings in 2024. That would be a terrific single card for almost all spend (except when working on welcome bonus spend)

Gonna make my life (esp my husband’s) a whole lot easier for 2024 – everything on CFU except Travel & Groceries!

Because a round of 3 Ink cards nets 390k UR for $18k spend. And you can do that 3-4 times per year.

I’m conservative. I don’t want to get shut down. My points are too important to me.

That’s not the way I’d calculate it. I’d calculate it as the extra points I’d get vs what I’d get from my current cards.

In fact I did calculate it that way and with my spending it’s around 90K UR points, but only about 30K more than I’d get with my current cards. (This works only if you consider City Thank You and American Express Member Rewards as approximately equal value with Chase UR as I do.)

I considered the Citi route but I personally just don’t like Citibank. Is there something that they do that UR and MR doesn’t do?

How do you derive the 30K/90K numberd?

I had to make assumptions on my spending.

For example I assumed $400 a year on Drugstores (Low for most, but prescriptions are filled through my Insurer and it doesn’t code as drugstore). That would give 2400 pts for the double point card, but since I have the Citi double Cash it’s only 1600 more points than thru Citi.

Restaurants I guessed $3,000 a year. I wouldn’t use the normal Unlimited card at all because I have the AmEx Gold, The double point Unlimited I’d get 18,000 points a year but only 6,000 more than with the AmEx gold.

I carried it through for my bonused points categories then added in my ‘everything else’ category where I figure I’d put $20,000 of spend. Nothing on the regular Unlimited since for me 2 citi points are worth more than 1.5 UR points, but all of it on the double point Unlimited which would yield 60k UR points but since I value the 40K Citi points as equal to 40k UR points my net gain would only be 20K points.

Each person would need to do this for his own circumstances and the cards that he has.

Etrade count or only Morgan Stan?

Morgan Stanley only.