NOTICE: This post references card features that have changed, expired, or are not currently available

Last fall, I published a post about trying to slim down my collection of ultra-premium cards. In that post, I concluded that the most expendable ultra-premium cards in my household are the Chase Sapphire Reserve and the Business Platinum. After the recent announcement of an annual fee increase on the Business Platinum card, there is no doubt that card is going to make an exit at next anniversary, But is the Prestige a keeper over the Sapphire Reserve for 2020?

Rocking Prestige softly

Greg recently wrote about how the Citi Prestige is rocking his wallet in 2019. It’s rocking mine as well. The annual fee increase on that card is not scheduled to take effect until the next anniversary date after September 1. 2019. That gives me until Spring 2020 to decide whether or not to keep the card….sort of.

One of the key enhancements on the Prestige is that it now offers 5x on airfare and at most travel agencies. While Amex beat Citi to the punch in offering 5x on airfare a while back on the Platinum cards, Citi’s trip delay / interruption / cancellation protections offer far more reason to book flights with the Prestige. I’ve only had to make one such claim, but I received the full $500 reimbursement when I did (though I’m confident that my claim would be denied today based on the way Citi seems to be gaming the definition of delay). Still, trip delay protection matters to me and is a factor whenever I book flights. I always pay for my airfare or award taxes with a card that will cover me if things go wrong.

And that’s why I think the Citi Prestige card will only rock my wallet softly for the time being. It is my go-to card for restaurants for 2019 I think. While I’m not sure I have my mind made up as to whether 5 ThankYou points per dollar is better than 4 Membership Rewards points per dollar, the lack of certainty in how restaurants will code on the Amex Gold will keep my Prestige on top for dining.

But will the Prestige be my go-to card for flight booking? It will be for flights I intend to take this year. As long as we hold a Sapphire Reserve, the Prestige may get edged out by the CSR on itineraries that have a lot of connections or short connection times simply because Citi is unlikely to cover expenses when the airline makes you miss your connection. But for simpler itineraries, I’ll take 5x ThankYou points over 3x Ultimate Rewards.

However, things get murky for 2020. Award travel enthusiasts know that booking windows typically open between 330-360 days in advance of departure. Some of the most desirable awards and/or those for travel during peak periods often need to be booked a year in advance. That means I’ll be booking 2020 travel during 2019. I will of course want that 2020 travel to be covered under trip delay / cancellation / interruption benefits. While it isn’t immediately clear to me that canceling my Prestige account would nullify those benefits, I would rather book with a card that I intend to keep open — whether that’s the Prestige, the CSR, or the Ritz. I therefore think that I need to make at least a tentative decision this year as to whether or not I intend to renew the Prestige in 2020. Of course, if I decide not to renew it in 2020, it will not be my card of choice for 2020 flight bookings.

If I’m only going to rock the Prestige softly, is it worth keeping in 2019 at all? Since Citi’s 4th night free is still useful for bookings made by September 1, 2019, I think I’ll keep the Prestige this year. I’ve made use of that benefit several times now and when considered along with earning 5x at restaurants, I think there is enough value to justify keeping the card for 2019.

Is the CSR’s 1.5c per point towards travel big enough to keep that card?

In Greg’s post earlier this week about contemplating the future of his Sapphire Reserve card, he concluded that he will keep it in order to spend down some of his Ultimate Rewards fortune at good value.

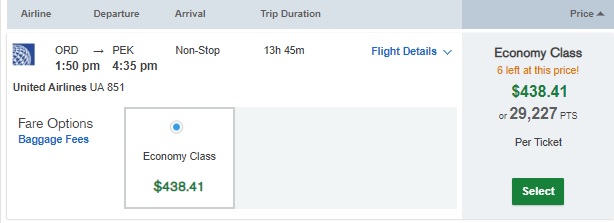

While I don’t have Greg’s stash of millions of Ultimate Rewards points, I run through a healthy amount of earn-and-burn in terms of Ultimate Rewards. I’ve noted previously that I’ve used Chase Travel℠ to book travel more than I ever anticipated I would. Cheap airfare means it is sometimes possible to book a flight for fewer points than an award would cost and still earn miles on that flight when you book through Chase Travel. Most of my Ultimate Rewards points are earned at greater than 1x, so I’m not getting a bad deal at 1.5c per point and I get to experience the joy of free.

Greg justified keeping the CSR based on the 28,000 points he would save if he spent $2,100 per year on flights through Chase Travel (as compared to how many points he would use at 1.25c per point with his Ink Business Preferred). I think my difference would likely be fewer points, especially based on my intended travel for this year. How much would I need to book via Chase Travel to justify keeping the Sapphire Reserve?

While I understand the argument against valuing the Sapphire Reserve’s annual travel credit at face value, I almost always use the entire $300 in month 1. To keep the math simple, let’s say that I value that credit at face value since I’ll spend that $300 whether or not I have the CSR. That means my net cost to keep the CSR is $150. Since you can cash in 15,000 Ultimate Rewards points for $150, I should keep the CSR if booking through Chase Travel will save me more than 15,000 points.

The math on that comes out to $1125 in travel purchased through Chase Travel. If I have the CSR, $1125 in travel will cost me 75,000 Ultimate Rewards points (at 1.5c each). If I instead book with my Chase Ink Plus / Ink Business Preferred, it would cost me 90,000 Ultimate Rewards points to book the same amount of travel. Keeping the CSR saves me enough points to justify its fee if I use 75K points or more to book travel through Chase Travel. While I don’t have millions of Ultimate Rewards points to spend down, I do intend to make a booking today that will cover about half of that. I expect that I’ll likely eclipse 75K in points redeemed through Chase Travel this year, so I should keep the CSR. I’ll note that I do not share Greg’s emotional attachment to the CSR — I’ve actually figured each year that we would downgrade it, but it keeps making more sense to keep it.

So where does that leave my Prestige card?

If I know I’m going to keep our CSR, that card will be used to book 2020 travel. Between a less valuable rewards system and an increasing annual fee, I don’t think I can justify keeping the Prestige for 5x dining alone. I further don’t think there is room in my wallet for both the Prestige and the CSR — too many benefits and transfer partners overlap. I’ll keep the Prestige card in 2019 for a couple more 4th night free bookings and 5x at restaurants and on flights I intend to take this year. I’ll rock it softly and likely say goodbye in spring of 2020 in favor of the CSR.

I’m confused. If your AF posts in September 2019, how will you have til spring 2020 to decide if you want to keep it?

Sorry, I didn’t word that section clearly. The new annual fee takes effect at your next anniversary after September 1st. My anniversary date is in spring, so I won’t be hit with the increased fee until spring of 2020.

Nok, not sure why you tend to pay for more meals with family just because Citi Prestige offers 5x points at restaurants. 5x points is nowhere near repaying the cost of the meal.

Having said that, if you were going to pay any way the points certainly are nice.

I think you are fighting too far ahead of yourself. And it won’t be impossible to get value from 4 th night free if you are staying at top shelf hotels. They are a great combo with Relais and Château and other luxury hotels. I love Chase points but I love 5X better and with a stockpile of Citi 5X you will feel like a vulture when they bonus their partners which Chase NEVER does. Stockpile the Citi and report back in a year.

Nick,

You wrote: “Still, trip delay protection matters to me and is a factor whenever I book flights. I always pay for my airfare or award taxes with a card that will cover me if things go wrong”.

As the Frequent Miler article https://frequentmiler.com/ultra-premium-credit-card-travel-insurance points out, the Prestige’s trip cancellation and interruption insurance only covers you for the amount paid with the card, whereas the CSR covers you for the full travel expense even if you only use it to pay the award taxes. Using the Prestige to only pay award taxes is a bad idea, unless you only want $5.60 (or whatever) in coverage.

Great point. My main concern is actually trip delay — I’m more concerned with getting stuck in an expensive city for the night and having to pay for an expensive room, get back and forth from the airport, etc. The Prestige covers that if you’re just paying the taxes. It doesn’t cover you for cancellation / interruption beyond what you paid on the Prestige card. In most cases, I’m booking awards with foreign programs that have very low change/cancel fees, so I’m not so worried about cancellation coverage (but I did lump it all in together in this post).

But your point stands — it’s a good argument for using the CSR over the Prestige on award tickets, especially if you’re booking with programs like AA/UA that have really high change/cancel fees.

What to make out of this:

https://www.google.com/amp/s/4wornpassports.com/beware-chase-card-travel-insurance/amp/

TomT

Good post I was tinking it covers all but was wrong again .CHEERS

Each of the Amex Gold, CSR and Prestige are all offering great dining value. However, with Chase already stating that they’re paying a lot of money out for rewards(and looking to decrease), the shift of dining from CSR to Prestige or Amex probably will allow Chase to reduce their overall losses for dining. It might be enough to keep the UR rewards redemptions alive longer. Having 3 cards with similar dining rewards is probably a net good thing for the long term viability of this. There’s only so much dining a person can put on each card with all 3 cards.

I’m with you on not paying the annual fees, but at least for now, I’ve got them all grandfathered in at low rates so I buy some time and free extra dining points until later this year.

Nick….I gotta tell you. You are a good analyst but sometimes miss the mark on your explaining. Not just this article, but often I read your posts and get lost in your math. E.g. from above “The math on that comes out to $1125 in travel purchased through the Chase portal.” I don’t know where you got the $1125 from. You need to spell out your specifics more plainly for us noobs. Please in the future, when doing math equations, please do the math in (). Reread the article, and see if you can see where people might get lost. I really do think there is good stuff here, but I got fatigued in rereading sentences and paragrapshs multiple times. YOu don’t want to lose your loyal readers!!!

I love what you and Greg do….keep up the superb work.

Thanks for the feedback. I certainly want it to be clear for you.

Here were the next couple of sentences after the one you quoted:

If I have the CSR, $1125 in travel will cost me 75,000 Ultimate Rewards points (at 1.5c each). If I instead book with my Chase Ink Plus / Ink Business Preferred, it would cost me 90,000 Ultimate Rewards points to book the same amount of travel.

Here are the equations spelled out more explicitly:

75,000 x $0.015 (redeemed with CSR) = $1,125 in travel

90,000 x $0.0125 (redeemed with Ink Business Preferred) = $1,125 in travel

Having the CSR saves me 15,000 points. I could cash that in at $0.01 each for a $150 check/statement credit — enough to cover the net annual fee on the CSR (not that I necessarily would — but the point is that this gap is enough to cover my cost of keeping the card).

If I redeem more than 75K points, the gap widens and I come out ahead on redeeming points at greater than 1.5 cents per point.

For example:

100,000 x $0.015 (with CSR) = $1,500 in travel

120,000 x $0.0125 (with Ink Business Preferred) = $1,500 in travel

Keeping the CSR then saves me 20,000 points.

You could keep going from there.

Is that clearer?

Not really.

First of all, you go from writing about $1500 to then talking about $1125. Huh? Are they related and if so how. Essentially, the question is: “The math on that comes to $1125 in travel….” Nick, the math on WHAT??????!!!!!

Also, “having the CSR saves me 15,000 points”. ???? As opposed to what? the CIP or CSP??? You still don’t have me here. We have to have at least one of the thrree, CIP, CSP, or CSR to use the Ultimate Rewards. Agreed. So are you comparing them here? I still don’t get it.

And another thing, aren’t we really talking about $55??? The difference between the CSR and CIP/CSP once you pull out the $300 travel credit. Isn’t $55 the real figure to be thinking about here???!!!!

Upon further review, after rereading everything, I think I get what you’re saying. I guess I didn’t understand that fundamentally you are COMPARING the CIP/CSP vs the CSR. I understand your point now.

But to reiterate, isn’t $55 THE issue???

I typed this before you responding saying that you get it, so much of this response is reiterating what I’ve already written, but I figured I’d leave it in case it helps.

I’m not comparing keeping the CSR vs keeping the Ink Business Preferred. I’m keeping the Ink card no matter what. I was illustrating how much travel I have to book at 1.5c per point to come out ahead over booking at 1.25c per point (my next best alternative since I’m keeping the Ink card no matter what). I didn’t mention the Ink fee or the $55 you’re talking about because they don’t have anything to do with whether or not I keep the CSR.

The post is really about whether or not I’m going to use the Prestige heavily. My point was that I want to figure out which card I’m going to have in 2020 between the Prestige and the CSR so I can decide which card to use to book my 2020 flights.

If I decide to keep the CSR, I have to justify its net $150 annual fee ($450 fee – $300 in travel). As Greg pointed out in Monday’s post (linked within this post), if you book a lot of travel through the Chase travel portal, you will save points by keeping the CSR over booking with the Ink Business Preferred.

Travel purchased through the Chase portal costs fewer Ultimate Rewards points if I have the CSR than if I only have the Chase Ink Business Preferred. In the post, I mention the break-even point where I save enough points (by having the CSR) to cover the net fee on the CSR.

If I redeem for at least $1,125 in travel via the Chase portal, I’ll save 15,000 points if I keep the CSR.

That’s because $1,125 in travel will cost me 75,000 points with the CSR (at 1.5 cents per point).

If I didn’t have the CSR and instead used my Chase Ink Business Preferred card, the same $1,125 in travel would cost me 90,000 UR points. (at 1.25c per point).

90,000 points – 75,000 points = 15,000 points. That’s the difference in cost between booking with the CSR vs the Chase Ink Business Preferred.

If I want to buy $1,125 in travel or more through the Chase portal, keeping the CSR will save me 15,000 points or more (the difference gets bigger if I’m booking more travel).

15,000 points can be redeemed for a $150 statement credit, which covers the net annual fee on the CSR ($450 – $300 travel credit = $150). 15,000 points can be used for even better value — that’s the base line.

Again, I’m not making an either/or comparison with the Ink card here, which is why I don’t even mention the fee on the Ink Business Preferred. I’ll keep that whether or not I keep the CSR. My decision here is just whether getting 1.5 cents per point makes enough of a difference to justify the $150 net fee on the CSR.

Hopefully that helps.

Gotcha. Crystal clear now.

One thing I noted with Greg once before about Citi Prestige. Turkish Airways is a transfer partner. You can find great deals to Europe with them. (Yes, you can fly Turkish thru other alliances, but it will usually cost more in points)

Nick

Go find us some Card or Travel deals my Hotel.com hotel canceled on me 1/9 .So What I didn’t like the hotel they transferred me to @ same price so I Canceled . Booked another hotel better but $75 more for 2 nites but it’s Venice .

I was tinking my Greece trip was 20 nites Opp’s 19 so 16 on my Prestige card and 3 on Hotels.com ..A Life Changer Right HaHa.

Let’s not Split Hairs Gentleman lets save $$$.

CHEERS

To make to most educated analysis of whether or not a premium card is worth keeping, I’ve found that Greg’s analysis spreadsheet is an incredibly valuable tool.

I would recommend you guys do a post in a month or so, with your updated analysis, because so many of the benefits have changed.

One thing to consider with Citi cards is that their extended warranty is awfully good. Of course, this ain’t worth a ton to everyone, but might tip the balance.

When I crunch numbers to decide if I want to keep a card based on its AF, I start as a new cardholder might. I take the benefits offered now (not what they were/might change to/wish they were) & decide if they fit a current void at the right price.

In that vein, the only benefit that Citi might offer me over the CSR is 5x on dining. The FNF will be a guaranteed time waster to try & redeem & the other benefits are pretty much duplicated/improved by Chase. And if I earn the extra 2 dinjng points what do I then do with them? The Chase travel portal/redemption/partners are also superior.

Nice try, Citi, in improving your lacking card portfolio, but thus far Chase’s URs can be much better taken to the bank at a nice premium.

Primiary Car rental insurance is important to me (without restrictions about business/personal travel). I’d keep the Sapphire Prefered for this if I didn’t have the Reserve, so the extra cost for the Reserve is $55- or 3667 points.

So you don’t think the prestige is good to keep even if just for the 4th night free benefit a couple of times a year. $495 annual fee less the $250 travel credit… leaves only $245 to cover with two free nights.

The problem is it will be nearly impossible to get any value out of the 4th night free after September. See Zinger #2 in this post:

https://frequentmiler.com/prestige-ups-fee-for-almost-everyone-but-some-positive-notes-also/

U can get 100 nites booking before 9/1 then after 2 Free nites booking from 9/1 to 12/31 then 2 after 1/1 . works Great for me .Stay in 5/2020 then not renew in 7/15/2020 .2 billing before the end .I set it up to cancel 7/15/2019..

There’s no question that long-term the CSR card is a better bet than the Prestige. CSR has Hyatt has a transfer partner whereas Prestige has far less useful airline partners for those living in the US.

Not sure about that. Yes to Hyatt no way to airline partners. Citi TYP offers bonuses each year to members of each of the air alliance networks, so if you learn how to transfer, say Avianca via Star Alliance to United as 1 example, you can actually do better than directly booking United miles with a mile transfer. Read up on it. Nick has a great analysis re Avianca miles.

For the record when was the last time Chase gave a bonus to transferring to an airline carrier???!

Thanks for reminding me that I wanted to respond to this.

I agree with Miles Ahead. Hyatt is a valuable partner. And Chase does have some good partners that Citi doesn’t. But between LifeMiles, Turkish, and transfer bonuses to Virgin Atlantic and Air France / KLM, I’d argue that Citi is much better in terms of useful airline partners for those living in the US.

Chase is better if you regularly fly United / credit flights to United and therefore use your UR points to top off your United account. And having access to BA/IB as a transfer partner is a strength for short flights on AA. But I’d argue that you should be using Membership Rewards with transfer bonuses for BA/IB, not Chase.

I don’t dislike Ultimate Rewards, and the inclusion of Hyatt means it is more useful for me overall, but I don’t think it’s fair to say that Citi has far less useful partners for those living in the US.

In regards to coding of Dining/Restaurants I know that Caterer codes as Dining on Chase Reserve card for sure. Does anyone know if Caterer codes as Dining on Citi Prestige and Amex Gold?

Thank you!

It depends on the MCC code of the merchant – it’s generally not card-dependent but rather payment-network dependent. That is to say that if an establishment codes as a restaurant on a Visa card, it probably does on all Visa cards.

Of course, the Prestige is a Mastercard and the Amex Gold is an Amex. Hard to know for sure how it will code. If I were placing a blind bet, I’d guess that it likely will on the Prestige if it does on Visa cards. I wouldn’t bet on Amex because it seems to be much more variable with Amex.

Your best bet would be to make some sort of small deposit first and see how it codes if possible.

Thank you! I will going to ask the Caterer to do a small test on Prestige and Amex first but in the meantime continue to use Chase Reserve since I know for sure that codes as 3X.

When you cancel the prestige, are you going to get another TYP card at the same time? To minimize the effect of the 24 hour clock. Great analysis by the way.

I very likely will. Assuming I continue to get utility out of my AT&T Access More card, I’ll likely open a Premier first.