NOTICE: This post references card features that have changed, expired, or are not currently available

Chase advertises two Marriott cards: Marriott Rewards Premier ($85 per year) and Marriott Rewards Premier Business ($99 per year). The cards vary in a few details, but they’re very similar. Both offer: An annual category 1-5 free night (beginning with your first card anniversary); 15 nights credit per year towards elite status; and 1 night credit towards elite status with each $3,000 spend. And while both offer bonus categories, neither is a good choice for everyday spend. Since Marriott points tend to be worth less than a penny each (see: Reasonable Redemption Values), earning 1 point per dollar for spend is atrocious.

In my opinion, the main reason to get these cards is for their signup bonuses (and note that the business version of the card is not subject to Chase’s 5/24 rule). And reasons for some people to keep the cards beyond the first year are for the annual free nights and/or for the 15 elite night credits if you chase Marriott elite status. If you have both cards you may get 30 elite nights each year (see: “No guarantee”, below). For reference, Marriott elite status levels require earning the following number of elite qualifying nights each year:

- Silver: 10 nights (so you get this automatically with any Marriott card)

- Gold: 50 nights

- Platinum: 75 nights

Now that Marriott will no longer let elites buy back status, the elite credits offered by these credit cards is suddenly meaningful to me. I have Platinum status and I’d like to keep it, but there’s no way I’d stay 75 nights per year at Marriott properties. The credit cards help, though. Having the two cards listed above gives me 30 nights per year, so I would have to stay “only” 45 nights to keep Platinum. That’s still a huge hurdle, but not as bad as 75.

My problem would be solved if I could get more Marriott cards in order to earn more elite nights. Well, maybe I can…

The other Chase Marriott cards

A few months ago Nick pointed out something to me that I found very interesting. If you browse to this Marriott Premier card page, you’ll see a link at the top for “Additional Marriott Rewards Credit Cards”. And if you click the arrow, you’ll see three other cards listed. The first card is the one we already know about: the Marriott Rewards Premier Business Card. The next two, though, are cards you probably didn’t know about (I know that I didn’t). These are non-Premier cards: Marriott Rewards Business Credit Card and Marriott Rewards Credit Card.

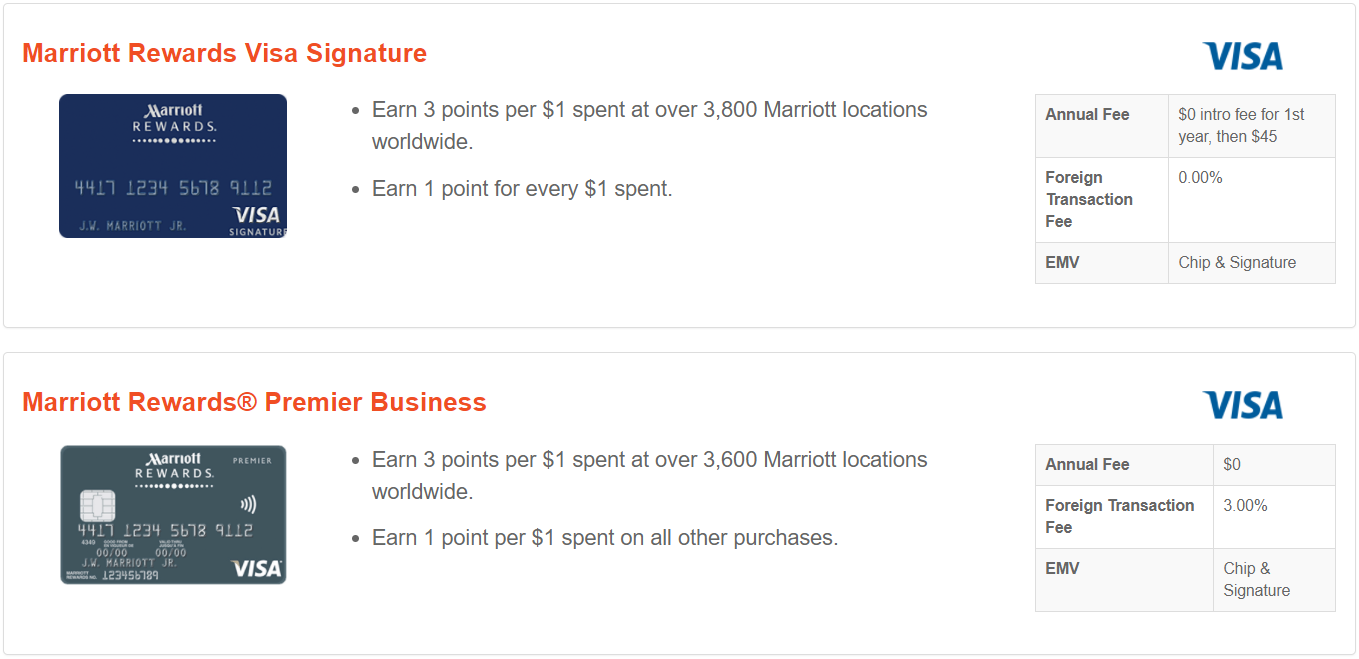

The landing pages for these non-Premier cards show that these cards offer the following benefits:

- Earn 3X points at Marriott and SPG properties, 1X everywhere else

- Earn 10 credits toward Elite Status annually

- Earn one credit toward Elite Status for every $3,000 you spend (this is the same as the premier cards)

The landing pages do not show the cards’ annual fees, nor do they offer any way to get these cards. My assumption was that both cards would have no annual fee, but then I found the cards on a site called walla.by (some may remember Wallaby as the company that once promised a magical card to replace all other credit cards in your wallet).

Wallaby’s site indicated that the personal Marriott card costs $45 per year, but the business card is free. I’m not sure that the business card info is right, though, since Wallaby lists it with “Premier” in its name.

Wallaby’s site indicated that the personal Marriott card costs $45 per year, but the business card is free. I’m not sure that the business card info is right, though, since Wallaby lists it with “Premier” in its name.

I called Chase to see if there was a way to apply for these cards, but the agent I spoke with didn’t think these cards existed. She thought that the card pages I described must have been for old cards that no longer existed (except that the pages refer to SPG, so they couldn’t be that old!). She searched whatever card lists she had access to, but came up empty. I then asked her to look for product change options for my personal and business Marriott Premier cards. Through this route, she found the personal card and verified that it costs $45 per year. There were no product change options for my Marriott Rewards Premier Business card, though, so we had no luck in finding the non-premier version of that card.

For anyone over 5/24, the ability to product change from the personal Marriott Rewards Premier card to the non-premier Marriott Rewards card is of little use. You could do it, but it would be difficult then to get the premier card again (due to 5/24). Fortunately, Travel With Grant recently found another option: Start with the Ritz Carlton card and then product change to either the premier or non-premier version of the personal Marriott Rewards card (whichever you don’t already have).

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

With the business card, it may be worth calling or secure messaging Chase to see if you can product change from the premier to the non-premier card. That option was not available in my account at the time I called, but that doesn’t mean that it is unavailable to everyone. And then, if it has been two years since you received the bonus on the Marriott Rewards Premier Business card, you can apply again and get the bonus again.

No guarantee

Marriott’s credit card terms state: “Only one Marriott Rewards Credit Card account per Rewards member (Rewards member must be the primary cardmember on that account) is eligible for the 15 Nights Elite credit award.” This means that if you get multiple Marriott cards, you’re not supposed to get multiple sets of elite credit. But in my case (and via numerous reader reports), having both the personal and business Marriott Rewards Premier cards does lead to a total of 30 nights elite credit (15 nights from each card).

I suspect that if one were to product change their way into multiples of the exact same card, they wouldn’t then get multiple sets of credit. For example, I bet that if you had two consumer Marriott Rewards Premier cards, you would not get 30 nights credit from having more than one. However, I think it is likely that you would get elite credits from each type of Marriott card you have:

- Marriott Rewards Premier: 15 Nights

- Marriott Rewards Premier Business: 15 Nights

- Marriott Rewards: 10 Nights

- Marriott Rewards Business: 10 Nights

So, if you can find a way to get all four cards, I expect that you’d get 50 nights of elite credit each year automatically. That’s enough for automatic Gold status and you would then need only 25 more nights for Platinum status. And, fortunately, Marriott Rewards free nights booked with points do count towards status.

That said, it’s possible that the elite nights won’t stack. And if that happens, it won’t do any good to complain to Chase or Marriott since the card terms clearly state: “Only one Marriott Rewards Credit Card account per Rewards member (Rewards member must be the primary cardmember on that account) is eligible for the 15 Nights Elite credit award.”

Big Picture

Marriott’s credit card lineup will change in 2018 (see: Marriott announces new credit card lineup) when both Amex and Chase will carry Marriott cards. Chase will offer “mass consumer” and “premium consumer” cards which I expect will be similar to the current Marriott Rewards Premier and Marriott Rewards cards. In the meantime, they also have two business cards. We don’t know if customers with those cards will be transitioned to Amex, or will be allowed to keep the Chase cards long term, or if they’ll be converted to other products. We also don’t know what the signup bonuses will be like with the new cards. Will Chase offer the low-fee card to new applicants? Maybe.

In the meantime, it appears to be at least theoretically possible to get three or four Chase Marriott cards. The main reason to do this, in my opinion, is for the elite night credits. Personally, I’m seriously considering signing up for the Ritz card now in the hopes of product changing it to the non-premier Marriott Rewards card. I would also try again to product change my premier business card to the non-premier version (and then sign-up new for the premier version again), but I’ll have to wait until summer when it’s been two years since I last got a signup bonus on that card. By then, it might be too late (since Amex will be offering Marriott business cards going forward). In fact, it might already be too late (given that I wasn’t offered that product change option over the phone).

Another factor to consider is that it is likely that when Amex rolls out Marriott cards there will be a way to earn status through card ownership and/or through spend. For example, Amex will soon roll-out their high-end Hilton Aspire card (see my review here) which will offer automatic Hilton Diamond status to cardholders. It’s possible that something similar will be available on the Marriott card. So, for many, rather than trying to product change your way into a bunch of Chase cards, you may be better off waiting to see what Amex comes up with.

Side Question: Below it appears as though annual elite nites are stacking. Those comments are from 2018. I have a Marriott Premier Plus business, along w/an AMEX SPG (both to earn 15 elites/year)…that said I do not think the points are stacking through BonVoy.

That’s right. Starting in 2019 the elite nights from multiple credit cards do not stack.

Looks like these cards are the same ones now being advertised on this site: http://credit-cards.marriott.com/

So maybe they were old and have been resurrected? Or this turned out to be a leak…

Great read guys. Thank you. I love this possibility. I do hope the one comment saying the elite credits do not stack is wrong! Haha. Risky feeling to go to the lengths to get this stuff. I surmise if someone got the Ritz and went through the downgrade options – put their premier to he $45 version and the Ritz to the premier, they may be bslr to revert the move if in fact they don’t get all 25 credits for those two. Though how long you’d have to wait to know would be interesting. I assume timed right for the AF’s you could find the answer within say 3 months.

It’s also important to mention that you can obtain platinum via only 50 SPG nights for now, or more importantly 25 “stays”, which timed right would only cost you 225k Marriott points (3k per night SPG reward redemptions at their category 2 properties x 25)… Not to mention having both SPG Biz and personal cards starts you with 2 stays each. And honestly there are a few 2k at night properties worldwide (most people would find it stupid to intentionally stay here 25 times, lol:-, I know) so you could get all this for 150k Marriott points or with both spg cards only 126k Marriott points / 42k SPG – not to mention 3 weeks in

hotel if you have a non convential job as I do.. givrn you can’t check out and in back to back so you’d have to take a day gap between nights.. very unconvential, but gotta admit, just 21 stays ain’t too shabby when you’re only spending 6/9k Marriott points a night.. that’s cheaper than any rate with Marriott expect pointsavers. How is that for a mattress run huh? Rotfl. I guess I’m hyping myself up to do this!

Thanks again for the read!

Forgive my long post on mobile. Wow those mistypes!

[…] Secret Marriott cards, and how to get them […]

What are Chase’s plans on keeping the Ritz Carlton card as I think that is the best way to earn elite status?

I spent $75,000 on it 3 years ago and still have kept the Platinum Status. Usually spending it early in the first year, gives you status for that year and the following year but for some reason I kept the status for a 3rd year. Not sure what will happen come February though.

Amex will offer the “super premium” card in the future. We don’t know what’s going to happen to the Ritz card yet. Here’s more info on the new cards coming:

https://frequentmiler.com/2017/12/05/marriott-announces-new-credit-card-lineup/

When you get Ritz Platinum status does that transfer to Marriott and SPG as well?

This is my second year with Ritz card. My CL is set to $1K to avoid AF, but I really want to MS $75K on this card this year to obtain Platinum. Not sure, if I increase CL, if it would trigger the AF (mine is due in Oct). Also worried about sudden ramp-up in spending on CC. Please advise.

Yes Ritz status is equivalent to Marriott status. You can even call and ask them to convert your rewards account to Marriott Rewards if you want.

I’d be a little wary of ramping up spend too quickly. You’d probably be OK but no way to know for sure.

I can 100% confirm that having both the Marriott Premier and the regular Marriott $45 AF card does NOT stack elite night credits to 25. I had both for over a year and only got the 15 elite night credits from the premier. I even called Marriott + Chase to complain that I should get 25 night credits but the said that the premier card superseded so I only would receive 15 nights. Therefore immediately cancelled the $45 AF version.

You wrote:

“For anyone over 5/24, the ability to product change from the personal Marriott Rewards Premier card to the non-premier Marriott Rewards card is of little use. You could do it, but it would be difficult then to get the premier card again (due to 5/24).”

Noob question here: why is this ability to change from personal Premier to non-Premier of little use? Does Chase treat a product downgrade as a new application? If not then that should not affect one’s 5/24 status. Also, would having a downgraded non-premier card impact the application for a new premier card? (A new app off course adds 1 to one’s running 5/24 total, and would also be subjected to Chase’s 24-month no churn rule).

The purpose of downgrading in this case would be so you could end up with 2 Marriott cards — on Premier and one non-premier. The idea would be to downgrade to the non-Premier now and then re-apply for a Premier. However, if you’re over 5/24, you can’t get a new Marriott Rewards Premier card, so there would be no sense in downgrading. It’s not that the downgrade affects your status — but if you’re already at 10/24, you can’t apply for the Marriott Rewards Premier card again, so this downgrade is of little use to you.

Except that now we know that a Chase Ritz card can be downgraded to a Marriott Premier card, that’s more interesting. Since the Ritz card is not subject to 5/24 (that is to say that you can be at 10/24 and still be approved for it), you could apply for that card, downgrade your Marriott Premier to a non-Premier and then downgrade your Ritz to a Marriott Premier. Theoretically. Though Bob, in the comment below this one, says that he did not get stacking elite credits, so it sounds like it might not work out (though someone above did report stacking credits with multiple of the business card).

Does that make more sense?

Got it.

If you downgrade an existing Ritz to a Marriott Premier do you still get the Marriott elite credits, or are credits only given for a new application?

Not sure if you’ve covered it here before, but Chase has multiple “secret” United cards, too. They serve the same purpose as downgrade-only options.

Can you elaborate on this, please?

Just like the Marriott cards referenced in Greg’s post, Chase has a few United cards that you can’t apply for but you can downgrade another United card to. I forget the names, but one has a $45 AF and one has a $0 AF. Benefits are scarce, but they’re options a retention specialist can offer you to keep a United account open and avoid paying a higher fee.

Thanks for taking the time to reply. Do you know if these cards come with the increased award availability?

They do not grant access to extra award availability.

Are you sure they don’t grand access to the same expanded award availability as other Chase United cards? I’ve been told they do.

Nick, the one time I asked, I was told they don’t. That was a few years ago, and it’s possible things have changed or I was given bad info.

Does the $45 fee personal card offer annual free night? I asked Chase the same question a few months ago, but did not get a clear answer.

No, this one doesn’t come with an annual free night.

I have one personal Marriott and Two business Marriotts. I get 45 elite nights and three award nights per year. This plus award and paired stays keeps me platinum.

How did you end up with 2 business Marriott cards? Can you apply for another if you already have one?

I have one personal Premier and one business. I receive 30 nights. Although I agree that the cash value of the points is poor, I use the points for free nights quite often. Thus, I run many thousands of dollars of spending through the cards each year. In toto, this keeps me Platinum.

Corbett — just some food for thought here: if you’re running many thousands of dollars in spending through those cards to earn points for free nights, you would be earning more points on non-bonuses spend by using a Chase Freedom Unlimited (1.5x everywhere) and transferring to Marriott (if you also have a Sapphire Preferred/Reserve or an Ink Business Preferred).

Alternatively, if you’re getting poor cash value out of the points (let’s say you get less than 1 cent per point), you would get more “free nights” by spending on a 2%-3% cash back card and using that cash to pay for your nights. For example, if you spend $100,000 per year on your Marriott cards (on non-bonused spend), you’ll earn 100,000 Marriott points. Based on our RRVs, that’s worth about $720. You might do better — let’s say you get 1 cent per point on your redemptions…that’s $1,000 (5 nights in a category 5 hotel probably comes out to about this value — maybe a few hundred more if you find yourself a really good redemption).

If you instead used a 2% cash back card, you’d have $2,000 at the end of the year. You could pay for your $1,000 hotel and have $1,000 in your pocket to pay for your food, drinks, and entertainment for the week (not to mention the fact that you’d earn Marriott points on your $1,000 spend on the hotel). If you used a card like the Alliant cashback card or the Discover IT Miles card, which both earn 3% back the first year, you’d have $3,000 — enough to pay for that $1,000 hotel a couple times over.

Now, if you’re spending many thousands of dollars in order to earn elite nights for status, that obviously changes the dynamic — spending on one of those cash back options won’t get you elite night credits…and if you’re currently spending a significant amount at Marriott hotels or on the other bonus categories, you’ll end up with more than 100,000 points. Is it enough more to justify spending on the Marriott cards? I don’t know, though I’d suspect in most cases it isn’t.

If status is your game plan, you’d be better off spending $75,000 on the Ritz-Carlton card as that will earn you Platinum status — though it still comes at a significant cost since you’re still only earning 1 point per dollar (Ritz points = Marriott points). You’re earning about $540 in Marriott points in lieu of $2,250 in cash back at 3% — so you’d need to be getting more than $1700 in value out of the Platinum benefits to justify this.

If you spend a lot at Marriott hotels, you’re better off with the SPG cards since those earn 2x at Marriott — the equivalent of 6x Marriott points (or 1x more than the Marriott cards earn at Marriott hotels).

All that is meant as something to consider. I obviously don’t know your situation and I know that your definition of “many thousands” might be wildly different than my examples above. Maybe you pick up your 30 nights in elite credit from credit cards and you do another 40 nights for work and then you spend $15K to pick up 5 more nights via Marriott credit card spend. That would make sense to me. But if you’re spending many tens of thousands, it would begin to make less sense than the alternatives.

That’s awesome. I should try getting a second Marriott business card for a second business…

Mike, Did you get the bonus 75K points for both your business cards?

Chase does show old cards that you can’t apply for anymore (i.e. the Continental Presidential Plus Card) so i’m pretty sure you can’t signup for these old cards.

https://www.chase.com/online/Credit-Cards/united-presidential-plus-new.htm

Good stuff. Do you know if elite nights earned through credit cards count towards Marriott lifetime Platinum?

Yes they do.

Yes those nights count towards my lifetime status.