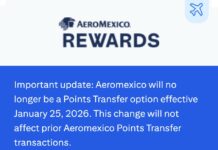

NOTICE: This post references card features that have changed, expired, or are not currently available

Citibank ThankYou Rewards points can be earned from several credit cards, and from some bank accounts. By default, each credit card or bank account has its own ThankYou Rewards account. Citi does provide a way to combine accounts, but should you? In the past, I said no (see this post for details), but now things have changed and the question is once again relevant.

Advantages of combining ThankYou accounts

There are a few advantages to combining accounts:

- Simplicity: View all of your points at once. If you have any expiring points, the soonest to expire points will be used first when you redeem points.

- Quantity: If you don’t have enough points in one account for the award you need, but you do have enough via separate accounts, combining accounts is one way to solve that problem.

- Value: Some accounts make your points more valuable. For example, the Premier card offers a 20% discount when purchasing travel (flights, hotels, car rentals, etc.) with points. And both the Premier and Prestige card allow transferring points to airline programs. By combining your points from other accounts with a Premier or Prestige account, you automatically get access to these higher value rewards even if the system uses your points from an inferior account. One exception: points earned from a bank account cannot be transferred to airline programs even if those points are combined with a Prestige or Premier account.

Disadvantages of combining ThankYou accounts

Combining accounts won’t keep points alive. If you have an account with expiring points, or you close an account that has points associated with it, those points will expire regardless of whether or not they have been combined with other accounts. For more, please see: How to know if or when your ThankYou points expire. As a result of this, combining has a few serious disadvantages:

- Loss of info: Once you combine accounts, there is no easy way to see how many points you have in each account.

- Loss of control: Once you combine accounts, you can’t choose which account to use for redeeming points for an award. The system will automatically use points that expire the soonest (if you do not have any points with expiration dates, then it will use the oldest acquired points). But, what if you’re planning to close one of your accounts and would like to use those points first to avoid losing them when you cancel? Once your accounts are combined, you’re out of luck – you can’t control the order in which combined points are used.

- No way out: Once you combine your accounts, it appears that you cannot undo that action. The ThankYou Rewards website states “Please review your accounts carefully before combining, as this process cannot be undone once you have confirmed it.”

What has changed?

When I last covered this topic in 2016, I recommended against combining points. I argued that you were better off keeping accounts separate and simply moving points from one account to another as needed. Two changes have led me to revise that conclusion:

Prestige 4th Night Free bookable with ThankYou points

The Citi Prestige card has a great benefit: get the 4th night free on hotel stays of 4 nights or longer (see: Complete Guide to Citi Prestige 4th Night Free). When the feature first rolled out, it could only be booked through the Citi Concierge and not through the ThankYou portal. Later, Citi added the option to book through the portal. And, starting in September 1 2019, booking through the ThankYou portal (or by calling ThankYou) will be required.

The reason this changing the answer to whether or not to combine accounts has to do with the Citi Premier card. If you have both the Prestige and Premier card, you can do well by combining those accounts. Once the accounts are combined, you can book a four night hotel stay with ThankYou points and you’ll automatically get a 25% discount for the 4th Night Free benefit AND a 20% discount from the Premier card for booking travel. The two perks combine to a total discount of 40% off.

Unfortunately, hotel prices found on the ThankYou portal are often inflated over prices found elsewhere, so make sure you’re getting a good deal before jumping in.

Citi Rewards+ card introduced

The no-fee Rewards+ card has a great benefit for a no-fee card: get 10% points back when redeeming ThankYou points, up to 10K points back per year. When you combine your Rewards+ account with other cards, you get this 10% rebate on top of any discounts offered by premium cards. For example, the Citi Premier card offers 20% off all travel redemptions, so with this card you would get 10% off the 80% price, for a total point discount of 28%. Even better, if you have the Prestige, Premier, and Rewards+ you could book a four night hotel stay and get 25% off from the Prestige 4th Night free, 20% off from the Premier travel benefit, and 10% back from Rewards+. Altogether you could get up to a 46% discount on 4 night stays! See: Citi Rewards+ is a great companion to Premier or Prestige.

Recommendation

If you have a Rewards+ card and/or either the Premier or Prestige card or both, you should combine those cards together to maximize value. This does mean that you’ll need to be strategic when you want to close an account. Lets say, for example, that you want to cancel your Prestige card to avoid the annual fee, but you’re worried that you may have points associated with the account that would then be lost. A better solution is to product change the Prestige card to either the no-fee Preferred card or the no-fee Rewards+ card. That way, you’ll keep your points.

Caution: When you change to a Preferred card you will most likely keep the same credit card number and therefore you will not reset the clock on when you can sign up for a new ThankYou card. However, when you change to a Rewards+ card you will probably get a new card number and so Citi will count this as having closed the old account. This matters because the signup bonuses for ThankYou cards have the following language (I’ve underlined part of this for emphasis):

Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+℠, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi Premier℠ or Citi Prestige®, or if you have closed any of these cards, in the past 24 months.

How to combine accounts

Log into your Citi account and click through to Rewards. If you haven’t combined accounts, you may get a message asking if you’d like to. If so, follow the prompts to combine accounts. If you get an error, it may be due to having different info (such as a different phone number) associated with the different accounts. It may be possible to fix this by navigating to your profile in the ThankYou portal and editing your profile information. If this doesn’t work, you’ll have to call Citi to combine accounts.

See also

Please see: Citi ThankYou Rewards Complete Guide.

[…] I wanted to combine all of my Citi cards into a single ThankYou Account. If you’re interested, Frequent Miler explains the advantages and disadvantages of combining Citi accounts. […]

Greg, I closed my previous Premier card, Jan 2017. I recently got that card for the 2nd time and working on min. spend. I also closed a Prestige card, Jun 2017. Is it possible, with the new Citi rules to get the Prestige again and get the points on that card too?

[…] The reason the 10% back feature is great is that it works even if points were accumulated from another credit card. The key is that the accounts must be combined into one “pool” of ThankYou points. For example, if you have a bunch of points earned from your Citi Prestige card, you can combine the Prestige ThankYou account with your Rewards+ ThankYou account. Then, when you redeem your Prestige points, you’ll get 10% back. See: Should you combine ThankYou accounts? […]

I have Prestige, Premier and Rewards+. Will calling in through concierge and paying with points still trigger the Premier 20% and Rewards+ 10%? If not, will booking through the portal still get me elite benefits like I do when booking through concierge, or will it be like booking through Chase portal?

When you call the Concierge you can’t pay with points, so no you can’t do that and get the Premier 20% or Rewards+ 10%. You can, after the fact, redeem points against those statement charges at 1 cent each but then you would get only the Rewards+ 10% and not the Premier 20%.

Unfortunately, booking through the portal counts as an OTA booking. You usually won’t get elite benefits (but sometimes the hotels honor them when you call in advance to add your loyalty number) and you definitely won’t earn elite credits or points from the hotel chain.

That’s too bad…still a good use of my leftover TYP for off brand stays though.

Greg,

Hypothetical curiosity:

1. I combine my Prestige & Rewards+ accounts.

2. I redeem all points across BOTH accounts.

3. I get 10% of redeemed points back

If Citi still watermarks future points earned, how are those 10% ‘points-back’ points ‘watermarked’ ?

For the purposes of future card cancellation (Prestige), are those 10% points marked as Rewards+ points, or Prestige points?

You can see here that if they’re ‘marked’ as Prestige points (even though I won’t be able to see/differentiate), and I want to cancel my Prestige, that some amount of those points will eventually remain ‘orphaned/expired’, no matter how many times I do a redemption trying to capture them all.

Thanks 🙂

That’s a really terrific question. I’m pretty sure that the rebated points are Rewards+ points. A phone agent should be able to tell you when you call to cancel the Prestige card whether there are any remaining points in that account.

[…] Should you combine ThankYou accounts? […]

remind me – I just got the premier. If I want the prestige, can I still get it but just not the bonus?

Yes that’s correct

Has anyone managed to combine the Thank You points from Sears card with one of the Thank You card accounts?

“However, when you change to a Rewards+ card you will probably get a new card number and so Citi will count this as having closed the old account.”

Datapoint against this – I converted my Premier to Rewards+ a few weeks ago and kept the same credit card number (confirmed on the phone in advance that this would be the case and indeed it was).

Isn’t there a grace period to use the points associated with an account after cancellation? So if one knows redemption plan for sure, one could cancel the account with those points have an expiration date on them, then on redemption, those points would be used first. Though, the redemption options are then limited by what the remaining open accounts provide, of course.

Yes, that’s a good point.

Interesting and somewhat related data point:

I combined my Premier and Rewards+ accounts, then moved points over from my wife’s Premier account. Transferred these points out to travel partner and the 10% rebate worked.

Yes this definitely just works. At least right now. Did a family combine and also moved those points right over to Cathay. Got the 10% back as well.

I PCed a decades old Aadvantage card to a rewards+ and Citi kept the same number.

So I’m not at all sure your thought above is correct in this particular case.

I don’t know if the PCing of a card counts as closing an account. I had one rep explicitly tell me that closing means out right canceling a card because the account stays open with a PC (same account on your credit report) only difference is the card number tied to your still active account. The rep also said that I should consider contesting it in the event I was denied a bonus.

Just my 2 cents. I won’t be able to check this until July myself. I’d be curious if anyone else has counter data points.

“Once the accounts are combined, you can book a four night hotel stay with ThankYou points and you’ll automatically get a 25% discount for the 4th Night Free benefit AND a 20% discount from the Premier card for booking travel. The two perks combine to a total discount of 40% off”

I did not previously know ab the 20% with premier, I have combined accounts. I did a booking through portal for a 4 night safari property in Africa on TY points and when I do the math it looks like I’m getting 4th night free, but I don’t think I’m getting the 20% I may need to look closer at that.

It’s not clearly marked as a 20% discount when booking the hotel stay, but it should work. Were your accounts combined when you made the booking?

Yes they were combined. I eventually just called in and they ran me through the math. It worked out. Its sometimes hard to tell after the booking is made but essentially they apply the 20% first, then give the 4th night free. At least that’s how the rep explained it. Poor guy. I could tell he pulled out his phone and did some calculations on the calculator.

Cool. Thanks for the follow up