NOTICE: This post references card features that have changed, expired, or are not currently available

We write about credit cards for a living, but which cards do we flex for our day to day spend? On this week’s Frequent Miler on the Air, we talk about what’s in our wallets right now and why. Somewhat surprisingly, we each accept some suboptimal value in specific categories for one reason or another. Find out why on this week’s show in video or podcast format below.

We write about credit cards for a living, but which cards do we flex for our day to day spend? On this week’s Frequent Miler on the Air, we talk about what’s in our wallets right now and why. Somewhat surprisingly, we each accept some suboptimal value in specific categories for one reason or another. Find out why on this week’s show in video or podcast format below.

Then read on for more from this week at Frequent Miler, including the timeline for Marriott’s award chart elimination and certificate top-up, the new value of Hyatt points, and why March 2022 will be a month to remember.

1:04 Giant Mailbag: About that Amex pop-up . . .

4:00 What crazy thing . . . did Qatar do this week?

8:54 Mattress Running the Numbers: Marriott drops award charts

17:44 Main Event: Which is the best card to use? Which card is best for….

26:30 Grocery

34:29 Gas

41:34 Dining

49:33 Travel

59:22 Warehouse stores

1:02:30 Online shopping

1:08:29 Everywhere else

1:22:34 Post roast

1:24:10 Question of the Week: Is it still worth upgrading to the Ritz card? If I do, am I eligible for a new cardmember bonus on the Marriott Boundless card?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week at Frequent Miler

What’s in Greg’s wallet? [2022 Edition]

When I read about the cards in Greg’s wallet, the one I really questioned was his Citi Prestige card. It just didn’t seem that could possibly be worth it at first glance, but when you hear him explain it on Frequent Miler on the Air it starts to come into focus. While that card’s annual fee and general lack of meaningful benefits make it look unappealing at first glance, a combination of the $250 annual travel credit and an annual retention offer from Citi can make it worth keeping since you need to have either the $95 annual fee Premier card or the Prestige card in order to transfer to partners. When you take out the $95 you’ll pay either way and whatever value you assess for the $250 travel credit, it doesn’t take much retention offer to make the Prestige a keeper. Separately, every time I see something about the X1 card I feel like we should add it in my household, but I’m not sure it’s worth the moderate bump in return for additional complexity of redemption. I’ll be curious to see what the PointCard Titan looks like when it launches.

My shifting wallet: What’s in Nick’s wallets now?

After months of an all-Amex all-the-time wallet, the last Amex card shifts out of my wallet this weekend after my final +4 refer-a-friend bonus ends. So what’s next? Surprisingly, still pretty strong return: I’m getting 5x for a lot of my online shopping, 4x in the categories in which I spend the most, and 2.625% cash back everywhere else. See the post for more detail.

If cash is king, is credit the answer?

Spoiler alert: The answer is “maybe not”. With debit cards suddenly offering excellent return on spend — including 2.2% cash back everywhere this year on the Nearside debit card and the PointCard debit card almost constantly offering 5% back on Amazon, Costco, Best Buy, and a lot more, it feels like those people primarily interested in cash back might actually need to consider debit cards more carefully. While I’m not going the Dave Ramsey route and saying that anyone should eschew credit cards, debit cards are having a moment in my wallet.

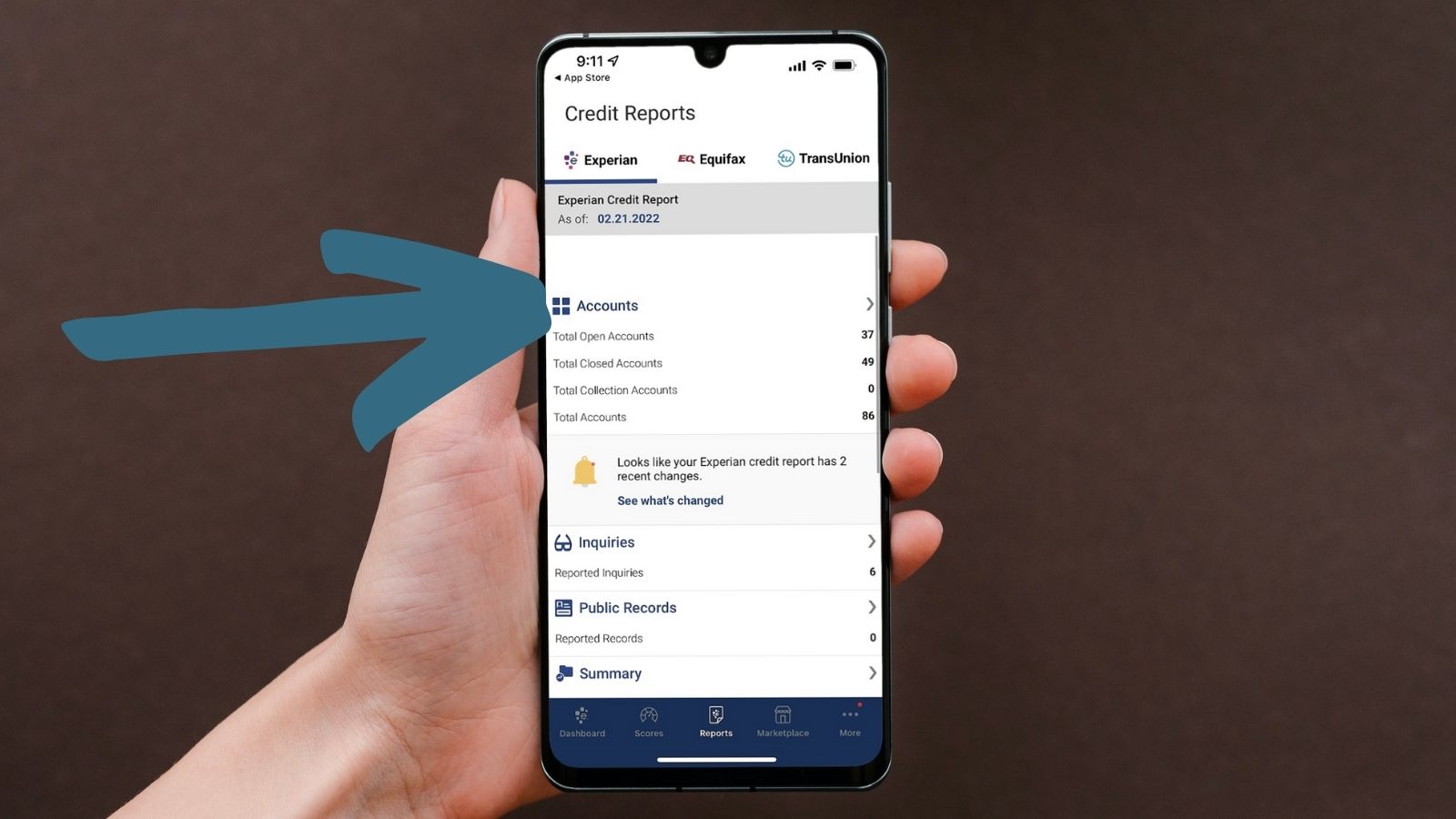

Easy Ways to Count Your 5/24 Status

If you want to apply for Chase credit cards, you will need to have fewer than five new accounts appearing on your credit report over the last two years. So how many new accounts have you opened? Did that business card from an obscure bank report to the personal bureaus? Here are the easy ways to count your status.

Marriott ditches award chart March 29th. Top properties to go up by 30K. Certificate top-off coming in April.

We expected that dynamic pricing would mean that many of the most popular aspirational properties in the Marriott portfolio would become significantly more expensive, so while certainly not happy neither was I surprised to see that many popular Category 8 properties will cost as many as 20K or 30K more points per night when Marriott ditches its award chart next month. On the other hand, I was surprised at how many limited-service mid-tier properties were included in the list and the implications that has on free night certificate usage even when points top-off debuts in April. Here’s what you need to know with more analysis likely to come.

The great loyalty shake-up [On Greg’s mind]

In Greg’s words: “March 2022 is promising to be a monumental month with regards to airline and hotel loyalty”. No kidding! I would say that March 2022 is set to be the biggest month in changes to the airline and hotel loyalty realm since the start of the pandemic (and one of the biggest months I can recall before or after the pandemic). A lot is changing and in this post Greg has most of it — though Qatar’s plans to change from QMiles to Avios, which was announced later in the week, adds one major change to the mix. With many of these changes skewing toward either negative or questionable, I can’t help but wonder what’s next. As they say, beware the Ides of March.

What are Hyatt points worth?

Hyatt points are without a doubt the darling of the points-and-miles blogosphere. That’s for good reason: it is not hard to get excellent value out of Hyatt points and it can be pretty easy to generate them via Chase Ultimate Rewards. Personally, I am finding Hyatt points more and more valuable since traveling with two kids means that a suite is feeling more like a necessity than a luxury and Hyatt makes it easy to book suites with points. That is to say that whatever the mean and median values, I find Hyatt points worth more because of the easy ability to guarantee a suite.

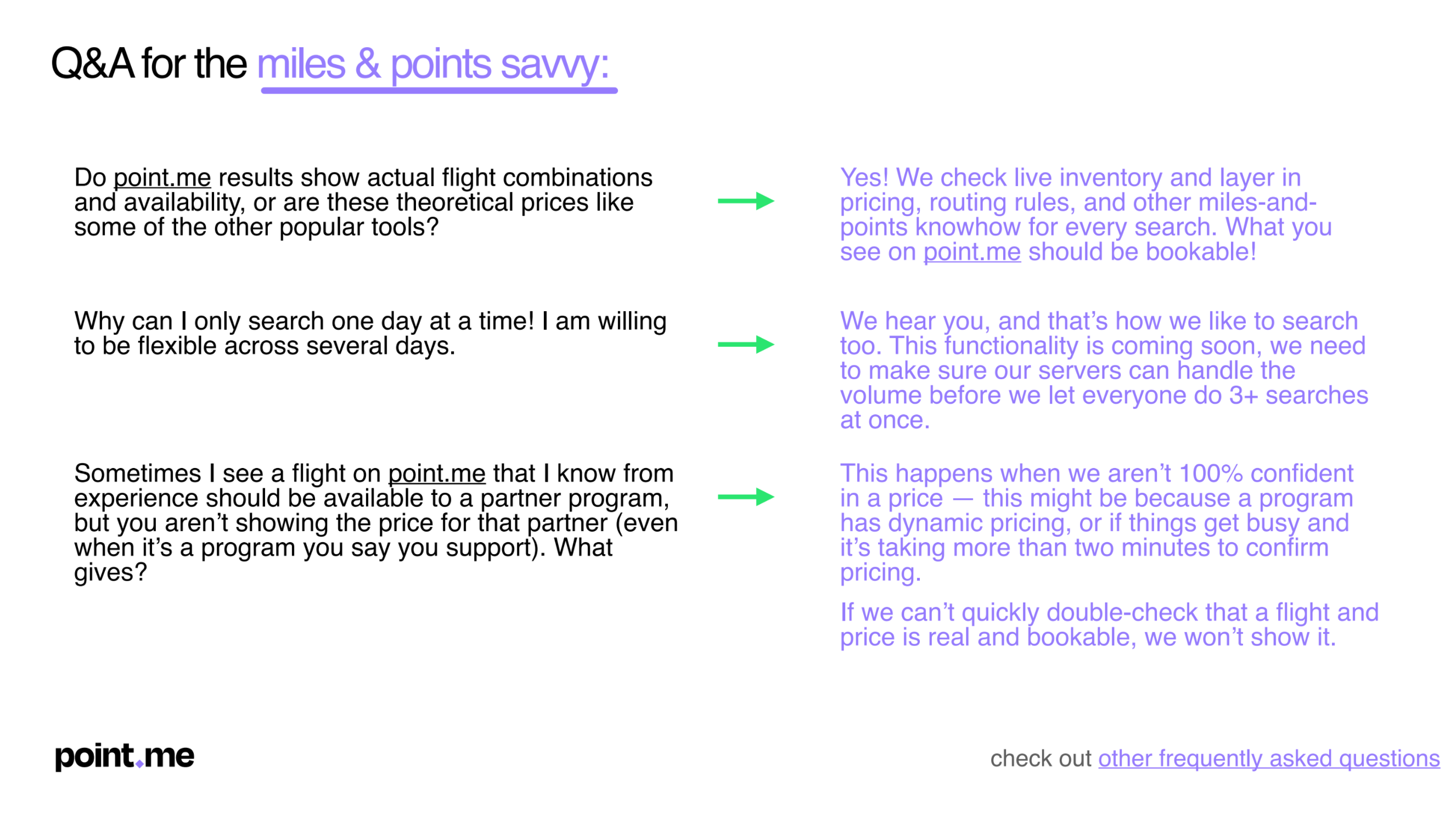

Point.me, a Kayak-like tool for flight awards, has launched. Try it out for free.

This week brought the launch of point.me, a new kayak-like tool for searching for flight awards that has been built from the ground up by a combined team of people with a lot of experience in this field and a wealth of knowledge about award booking. Unfortunately, the initial excitement brought an unexpectedly high level of traffic that slowed things down and prevented a lot of results from populating. This tool works very well when it is working properly — I’ve been using it for quite some time and been thrilled with it, but the results people got on launch on Thursday were not similar to my experiences prior to launch. I expect that things will continue to smooth out over the coming days and weeks and point.me will become an awesome resource for its ability to parse results and provide accurate, non-phantom-space award booking suggestions and fantastic resources to explain the flight booking process.

That’s it for this week at Frequent Miler. Keep an eye on this week’s month-ending last chance deals to be sure you don’t miss any of those ending in February 2022.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

Point.app debit card 5% back seems like an obvious consideration at Costco.

how about 4% cash back on gas with costco card?

That could be a decent option, but it’s capped at $6K spend per year. The New Orleans Pelicans card offers uncapped 4% back. The Costco card also obviously requires a Costco membership. I know many people have one and I actually have one right now, too — but the closest Costco to me is about 2.5hrs away, so I don’t normally maintain a membership.

Ah. costco is the only place I get gas but I use the ink cash for the UR points since I don’t have the costco credit card. Doesn’t sound like there are better visa options out there since you’re using the same card

The article and video make it seem like “what is the best for YOU alone” in these categories, which makes your headline misleading. The best for “most” would eliminate cards with unlimited returns in categories because the average card user doesn’t come anywhere near a cap.

I pretty much exclusively buy gas at Costco, even when traveling. It’s like my personal embassy. However, I’m not using a gas bonus for MS purposes, so the Costco card or Amex Gold would work well for me. That said, 5% unlimited from Abound CU is good too, but you can’t MS with it bc it’s pay-at-pump only.

I didn’t watch the entire video so forgive if this context was provided there, but having some perspective on your baseline objectives when considering the “best” per category would be most helpful in future articles.

If you are getting 5.25% back online with BoA Customized Cash + platinum honors, then you should go to Costco.com and buy gift cards to use in store. This would be better than Altitude Reserve 4.5%.

What is going on with the comments about gas stations?

Right-just catching this episode now—Nick must be referring to gift cards, most notably the Gift of College cards possibly? Funding your investments by MS-ing is a great opportunity. No stores by me have them. I can’t think of any other way to MS at a gas station. On a related note I have been denied using credit cards for any gift card purchase at my local Chevron gas stations (when trying to max out a 5% quarterly category). They say only cash or debit as policy. And that goes for a measly $50 Amazon card too.

Listening to you on the air right now. just a note: There are not many bargains in California for hotel awards, but I just found a Marriott for 6000 ponts a night. No use to me because I don’t want to waste time with Marriott anymore and so a mattress run is out.