NOTICE: This post references card features that have changed, expired, or are not currently available

Update: This post includes offers that were valid at the time of publication, but have since expired. Please click here to see the best offers currently available.

The Citi Forward card currently offers 5X Citi ThankYou points per dollar on restaurants, music, movies, and books. As of June 4th 2016, though, the bonus will go down to 2X points per dollar in those categories. I had previously used my Forward card as my single go-to card for restaurants, Amazon.com purchases (which qualify as bookstore purchases), and movie theaters. Now, starting June 4th, those of us who previously relied on the Forward card will need a new approach…

Best credit cards for restaurants

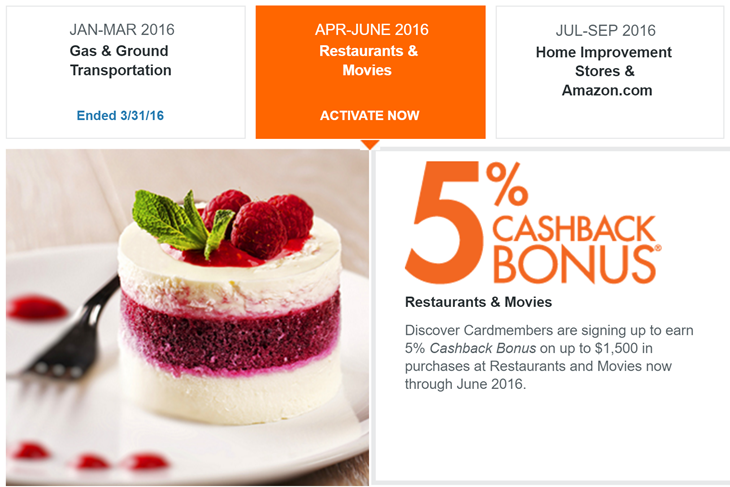

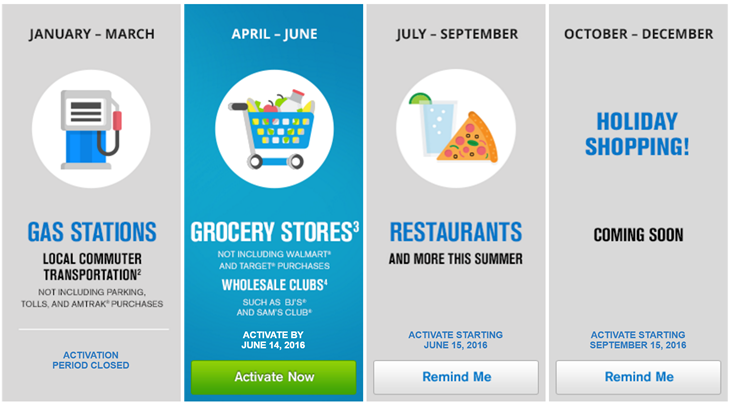

As Travel With Grant pointed out recently, the best cards to use at restaurants are cards with 5X rotating categories during the quarters in which they offer restaurants as a bonus category. This year, that means that one should use the Discover It card at restaurants April through June:

And, use the Chase Freedom card July through September:

Of course, keep in mind that both cards are limited to $1500 in bonus spend per quarter. If you have extra 5X spend available, you can always buy gift cards from your favorite restaurants during the bonus periods in order to extend your 5X earnings.

Note that if you are in your first year of Discover It card membership, you should qualify for double cash back. That means that you will ultimately earn 10% at restaurants through the end of June this year!

When 5X bonus categories are not available, you’ll need a backup card for restaurants. My Best Category Bonuses page shows that its possible to earn 5% cash back with the US Bank Cash+ card, but only at fast food restaurants. Personally, I hardly ever eat fast food, so this card isn’t a great option. The next best options are a large selection of cards offering 3% cash back.

If you prefer miles & points, some cards to consider include:

Amex Hilton Honors Surpass: 6X Hilton points (but Hilton points aren’t worth a lot, so I value 6X Hilton points at only 2.7% cash back)- Amex Premier Rewards Gold: 2X Membership Rewards

- Chase Sapphire Preferred, Sapphire, or Ink Cash: 2X Ultimate Rewards

- Citi Forward, Preferred, Premier, Prestige: 2X ThankYou points

It’s a tough decision! Forgoing 3% cash back for 2X Chase or Citi points, is like buying those points for 1.5 cents each. Personally, I don’t want to pay that much per point, so I’d rather go with a 3% option. On the other hand, the difference in value between a 3% cash back card and a 2X transferable points card is negligible. it’s not worth adding a new card to my wallet if I don’t need to. If I happen to have a card in my wallet that offers 3% cash back, then I’ll use it. Otherwise, I’ll happily get 2X Membership Rewards, Ultimate Rewards or ThankYou points depending upon which card I have with me.

Of the cards I actually have, my 3% options include the Discover It Miles card which gives me 3% cash back for all purchases for the first year of card membership, and the elusive CNB Crystal Visa Infinite card (details here). The CNB card doesn’t really offer 3% cash back, but it does offer 3X points, and points are worth slightly more than 1 cent each when used for airfare. Both of these 3X cards are good options.

Best credit cards for Amazon.com

Amazon.com is significantly different from restaurants. With Amazon, gift cards are readily available from many vendors so it’s really easy to get 5X or better rewards for Amazon.com purchases. Simply buy Amazon.com gift cards whenever there’s a 5X (or better) deal available, then apply the gift card to your account. From then on, your Amazon.com purchases will automatically use your gift card balance. And, now that Amazon.com lets you pay for 3rd party gift cards with your gift card credit, this makes more sense than ever before.

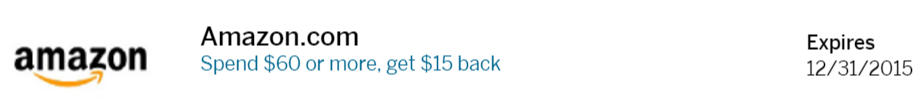

The best deals for Amazon.com gift cards tend to be with Amex Offers (See: Complete guide to Amex Offers). Sometimes offers are available directly with Amazon.com, such as the Spend $60, Get $15 offer from last year:

When this one was available, I added the offer to each of my eligible Amex cards and then proceeded to buy a bunch of $60 e-gift cards from Amazon. Since each $60 purchase resulted in $15 back, I effectively bought Amazon gift card credit for 25% off!

Another option is to use Amex Offers indirectly with Amazon. Often there are offers for stores that sell Amazon gift cards. Examples include Staples, Lowes, Bed Bath & Beyond, and more. In these cases, simply enroll your eligible Amex cards with the offer, and then take your Amex cards to the given store to buy gift cards of your choice.

When Amex Offers aren’t available, there are many other good options. For example, use a card with rotating 5X categories when they offer a bonus at Amazon.com. Discover It is a particularly good choice when you are enrolled in the Double Cash Back for a Year promotion. Discover It has Amazon.com as a bonus option for the entire second half of the year:

Or, use any card with a good category bonus at stores that sell Amazon.com gift cards. For example, this quarter you can buy gift cards at grocery stores and pay with your Freedom card for 5X rewards. It is also very likely that Amazon.com will be included in the Freedom card’s 4th quarter Holiday Shopping bonus.

You can also use a Chase Ink card to buy gift cards at an office supply store for 5X rewards. There are many variations on this trick. See Best Category Bonuses for ideas.

Best credit cards for Movie Theaters

Personally, I don’t spend enough at movie theaters to worry about which card I should use, but I will have to pick something.

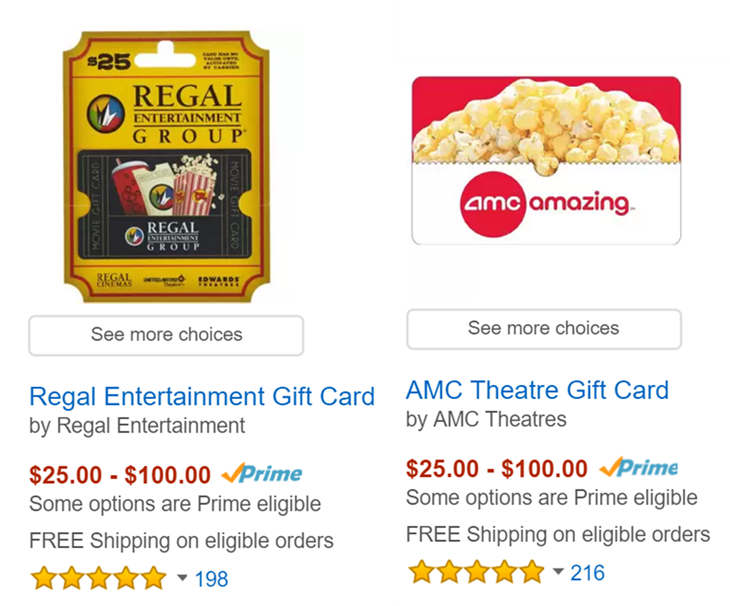

One option is earn bonus points by buying movie theater gift cards at grocery stores, office supply stores, or even at Amazon.com:

I’ll be honest, though. In my case, chances are slim that I’ll bother with gift cards. Instead, I’ll use my Discover It card this quarter for it’s 5X rewards, and then I’ll use my Discover It Miles card for 3% cash back until it turns into a 1.5% chicken about 6 months from now. After that, I’ll be back to the Forward card, or one of my other Citi ThankYou cards, for 2X rewards.

Summary

For dining, a great option is to pay with Discover It and Chase Freedom when they offer 5X category bonuses. At other times, go with either a 3% cash back card, if you have one, or pay with any of the transferable points program cards that offer 2X for dining: Amex Premier Rewards Gold, Chase Sapphire Preferred, Chase Sapphire, Chase Ink Cash, Citi Forward, Citi Preferred, Citi Premier, or Citi Prestige.

For Amazon.com, I recommend prospectively buying Amazon.com gift cards whenever the best deals are available. In particular, look to maximize Amex Offers when they come along.

For movies, the best options are to look for great deals on gift cards; or use a 3% cash back everywhere card (e.g. Discover It Miles, first year); or use one of the Citibank ThankYou cards that offer 2X for entertainment. These include: Citi Forward, Preferred, Premier, or and Prestige.

[…] The best credit cards for restaurants, … – Find the best credit card offers AND support this site; … Best credit cards for Amazon.com. … Best credit cards for Movie Theaters. […]

Worth mentioning the Amazon Prime Store card for an easy 5% off Amazon purchases.

Also AT&T access more through MPX will get you 3x TYP + 2/2.5 United Miles/ $ on Amazon gift cards.

The new Citibank Costco card gets 3% back at restaurants.

The combination of cash back credit cards with the potentially highest return today is the AMEX 5% Blue Cash (or AMEX Blue Cash Preferred if the 5% card is not an option), the Citibank Costco, and the Citibank Double Cash. It is not evident that the Chase Sapphire Preferred combined with the Chase Freedom Unlimited could offer a higher return unless one is a very frequent traveler in premium cabins on long haul international flights with significant dining/travel expenditures and high annual spend (> ~$20k).

Kenm, have you verified that you are getting 5% cash back on the gift cards? I understand that AMEX stopped paying the bonus on cash equivalents and had heard some years back that 5% Blue Cash card users with extensive cash equivalent purchases were having their accounts closed. I also have had the 5% Blue Cash card for years and it is our workhorse card. I also have the Citi Double Cash and will likely have the Citi Costco when it is available.

Have a nice day all.

The new Marvel MasterCard is always 3% back on movies as well as dining and a bunch of other entertainment and hobby categories.

http://www.marvelmastercard.com/

New Costco Citi Visa coming in June does 3% for restaurants.

Hard to imagine forgetting to mention the Amazon store card for Prime members – 5% right there!

I would think that most people doing this for a while would have an original AMEX BLUE CASH.

These cards obviate the need for all these machinations. Just go to your grocery store, in my case safeway, and buy all these gift cards mentioned here for 5 percent off and get the gas discount too.

This amounts to about 8.5 percent cash back for almost every gift card.

Going to Disneyland, buy their gift cards for 8.5 percent off (including gas credit) for your room etc.

Amazon 8.5 Nordstrom 8.5, etc etc.

I only use my Discover It for the 5 percent times 2 categories now, like you or the portal specials for about 6 more months. I was able to meet the Apple Pay 20pc off on 2 cards very easily so that was

Good for over 4 thousand cash back of which I have received over 2k already.

BTW they started me out with a 35 k limit. I had heard they had low limits. Thank you very much for that tip, would never had known about it without you.

But I digress, I just wanted to stress that for me, the Old AMEX BLUE is still the King!

If you have a kroger you should never use cc at Amazon. You can easily get %10 off at amzn if done right you can approach 25%.

Grocery category bonus plus bonus fuel points?

Sam’s Club Mastercard isn’t for everyone, but does give 3% on dining.

The issue I have buying Amazon gift cards is that I let my brother and dad use my account, since I have free two day shipping with Amazon Prime. Normally it’s not an issue since they can use their own payment methods, however when I have a gift card balance it defaults to that and takes a lot of tracking to make sure they haven’t unintentionally used it. I haven’t found a good way around this.

One option is to have them use their own accounts but still get free shipping:

1. share your prime membership with your dad: http://www.amazon.com/gp/help/customer/display.html/ref=cs_gtwyph_prime_share?ie=UTF8&nodeId=200444180

2. Have your brother sign up for a 6 month Amazon Prime student trial: https://www.amazon.com/gp/student/signup/info?ie=UTF8&*Version*=1&*entries*=0

They can uncheck the “pay with gift card balance” option and choose a credit card instead.

Discover is 5% back on movies now, also.

Hi Greg, thanks for linking to my post 🙂

Regarding this sentence: “Discover It is a particularly good choice when you are enrolled in the Double Cash Back for a Year promotion. Discover It has Amazon.com as a bonus option for the entire second half of the year.”

I don’t remember exactly when I signed up for the Discover It double cash back promo, but I think I signed up last summer. Does that mean I earn double cash back through this summer, so the categories in Q3 and Q4 will not be doubled. Does that sound right?

Yes, that’s my situation too

Hmm, just gotta wait and see what happens. I guess if you want to be safe, you should buy $1500 of Amazon egift cards on July 1.

Have you tried to call Citi about some sort of retention offer for the Forward in spite of the massive deval? I got a sweet 2 extra TYP on every $1 last May, so I am waiting until then so it’s been 12 months…but would love to hear if they’re giving any sort of consolation?

I haven’t called yet. I’m planning to wait until June 4th

Chase AARP card pays 3% cash back on all restaurant purchases.

Yep. There are a number of cards that offer 3% cash back on all restaurant purchases. Instead of listing them I linked to the Restaurant section of my Best Category Bonuses page.

You forgot to mention Amex PRG for those who have it – 2x the points on U.S. restaurants, and Amex Membership Rewards program have more transferable partners than Citi Thank You program.

Thanks. You’re right, I did forget that one. Updated.

Thank you!

FYI, the PRG also seems to be missing from the restaurants list on the best category bonuses page

Thanks. I’ll fix that soon.