Update 2/3/25: This increased 100K offer is now available via referrals. If you’re in a 2- player situation and one of you has a United card, you can apply via a household referral for even more Mileage Plus love. (h/t: DOC)

~~~

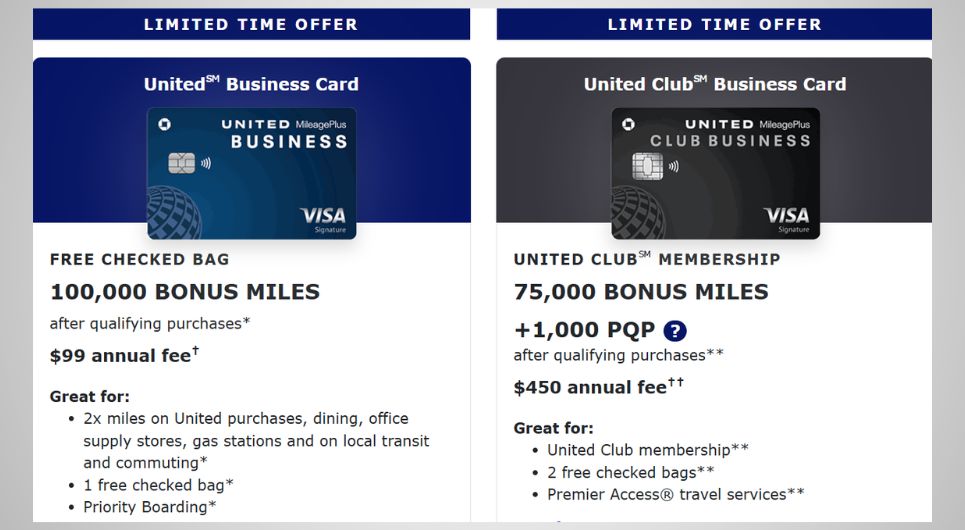

The Chase United Business card now has an increased welcome offer of 100K United MileagePlus miles after only $5K spend in 3 months. We’ve seen offers as high as 150,000 miles on this card before, but with 3-4x the required minimum spend. This kind of return on a $99 card with only $5K in spend will be very attractive for some folks.

This puts the United Business card in the top-10 most valuable business card welcome offers on our Best Offers Page.

The United Club Business card also has an increased offer of 75,000 United Miles and 1,000 Premier Qualifying Points (PQP) after the same $5,000 in minimum spend. That card has a much higher annual fee of $450, but it also comes with a United Club membership was well. That, in addition to the bonus PQP, may be more appealing for some United loyalists.

The Offers & Key Card Details

| Card Offer and Details |

|---|

ⓘ $1060 1st Yr Value EstimateClick to learn about first year value estimates 100K Miles + 2,000 PQP ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 100K miles + 2,000 PQP after $5K spend in first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open.$150 Annual Fee Recent better offer: 125K miles after $5K spend in first 3 months (expired 5/8/25) FM Mini Review: Decent perks such as enhanced access to United saver level economy awards makes this a keeper for some. Earning rate: 2X at restaurants including eligible delivery services , gas stations, and office supply stores ✦ 2X United ✦ 2X United Hotels ✦ 2X on local transit and commuting, including taxicabs, mass transit, tolls, and ride share services Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: $125 annual United travel credit after 5 United flight purchases greater than $100 each calendar year ✦ Earn up to 4,000 PQPs per year: 1 PQP per $20 spend ✦ 2 Economy Plus seat upgrade credits after $25K in purchases in a calendar year Noteworthy perks: Improved economy saver award availability ✦ Unlocks complimentary elite upgrades on award tickets ✦ Free first checked bag ✦ Up to $50 in statement credits for United Hotels purchases up to two times per cardmember year ✦ Up to $100 in rideshare statement credits (up to $8/mo from January to November and up to $12 in December) Priority boarding ✦ 2 United Club passes per year at anniversary ✦ Free DashPass for one year (must activate by 12/31/27) ✦ Primary auto rental collision damage waiver ✦ Up to $25 in TravelBank cash for eligible Avis or Budget car rentals up to two times per cardmember year ✦ 5,000 bonus miles at anniversary when you have this card and also a personal Chase United credit card. ✦ 25% back as a statement credit on United in-flight and Club Premium drink purchases ✦ One $10 Instacart credit per month when you have Instacart+ ✦ FareLock $25 per anniversary year ✦ Up to $100 as a statement credit each anniversary year for JSX flights booked directly |

| Card Offer and Details |

|---|

ⓘ $548 1st Yr Value EstimateClick to learn about first year value estimates 100K Miles + 2,000 PQP ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 100K Miles + 2,000 PQP after $5K in purchases in the first 3 months. Plus, earn an extra 10,000 miles after you add an authorized user to your account in the first 3 months your account is open$695 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 125K Miles after $5K in purchases in the first 3 months (expired 5/8/25) FM Mini Review: While pricey, the Chase United MileagePlus® Club Business Card is a great choice for those who want a United club membership Earning rate: 5X on stays at Renowned Hotels and Resorts for United Cardmembers ✦ 2X United ✦ 1.5X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 28,000 PQPs per calendar year: 1 PQP per $15 spend ✦ Earn 2 global Economy Plus seat upgrades after $40K in purchases in a calendar year ✦ 4 United Club one-time passes and United Club All Access Cardmember membership after $50K in net purchases or earning Premier Gold status and having an authorized user Noteworthy perks: United Club membership ✦ Unlocks complimentary elite upgrades on award tickets ✦ Priority check-in, security screening, baggage handling, and boarding ✦ Up to $200 in statement credits for purchases with Renowned Hotels and Resorts for United Cardmembers each cardmember year ✦ Up to $150 in rideshare statement credits ($12/mo from January to November and $18 in December) ✦ Up to $50 in United TravelBank cash for an eligible Avis or Budget rental made through cars.united.com up to twice per cardmember year ✦ Get one year of complimentary Dash Pass (Must activate by 12/31/27) ✦ Free 1st and 2nd checked bags ✦ Primary auto rental collision damage waiver ✦ Hertz Gold Plus Rewards® President's Circle® ✦ Two $10 Instacart credits monthly when you have Instacart+ membership ✦ Complimentatry Instacart+ membership through 12/31/27 ✦ FareLock $50 per anniversary year ✦ 5,000 bonus miles at anniversary when you have this card and also a personal Chase United credit card ✦ Up to $200 as a statement credit each anniversary year for JSX flights booked directly |

Quick Thoughts

This is a very good offer with a first year value of ~$1100 based on our reasonable redemption values for United miles. That’s a big haul for a $99 annual fee card. While United doesn’t have the sweetest of sweet spots, they do have miles that are very easy to use and also don’t add fuel surcharges onto award tickets.

United also has a potentially interesting sweet spot in the Excursionist Perk. This program feature was meant to make it possible to visit two cities on a round trip award, but Greg has shown how it can be leveraged to save you a bundle of miles with a creative itinerary.

Chase Application Tips

- 5/24 Rule: You are unlikely to be approved for a new card if you have opened 5 or more cards (with any bank) within the past 24 months. Most business cards do not count towards that five-card total. Business cards that DO count include: TD Bank, Discover, and the Capital One Spark Cash Select, Spark Miles, and Spark Miles Select.

- 24 Month Rule: If you’ve had a card before, you can only get a welcome offer on that card again if you no longer have it, AND it's been more than 24 months since you last received a welcome offer for that card. This rule does not apply to the Sapphire Preferred and Reserve cards (see below). There can also be exceptions with some business cards.

- Sapphire cards: The Sapphire Preferred or Sapphire Reserve cards no longer have a family rule that prevents you from getting one if you currently have the other. However, both now have limitations that may prevent you from being eligible for a welcome offer if you've previously had the same card. In that event, you'll get a pop-up window telling you that you're not eligible, and you will be asked whether you want to proceed with the application without the welcome offer attached.

- Southwest "Family" Rules: Chase applies additional "family" rules to the Southwest cards. You're not eligible for the welcome offer on a personal Southwest card if you currently have one, or if you've received a welcome offer on any personal Southwest card within the last 24 months. This doesn't apply to business cards. You also can't be approved for the Southwest consumer card if you already have one open.

- IHG "Family" Rules: You're not eligible for the welcome offer if you've received one on any personal IHG card within the last 24 months. You also can't be approved for another IHG consumer card if you already have one open. You can have both an IHG personal and an IHG business card.

- Ink "Lifetime" Rule: You "may not" be eligible for the welcome offer on an Ink no-annual-fee card if you have ever had the same card or any other Chase for Business card without an annual fee. In addition, you may not be eligible for a welcome offer on a Chase Ink Business Preferred card if you currently have the card or have had it in the past. We don't yet know how consistently this is enforced.

- 2 per month Rule: Most applicants are limited to 2 new cards per 30 days. Business cards are usually limited to one per 30 days.

- Marriott cards: Approval for any Marriott card is governed by a labyrinthine set of unintuitive rules. You can see the full eligibility chart here.

- Card Limits: Chase doesn't have a strict limit on the number of cards you can have, but it does place limits on the total credit it will issue across all cards. Because of this, reconsideration can sometimes be successful by moving credit from one existing card to the new card that you want.

- Application Status: Call (888) 338-2586 to check your application status.

- Reconsideration: If denied, call (888) 270-2127 for personal cards or (800) 453-9719 for business cards, and ask that your application be reconsidered.

Got approved for this card today, despite being 6/24 (got the Cardless Qatar 70k offer too a few hours prior). Got the Ink Cash and the United Explorer in January, P2 got an Ink Cash in April, and this completes my Chase run for 2025.

Anyone successfully got Chase to match this new 100k deal if you used a referral link with 75k miles sign up bonus and annual fee waived for the 1st year? Any DP is greatly appreciated.

I applied for too many Ink cards and Chase has stopped approving them, so I’m taking 6mo off based on some advice I saw on the facebook page. Any idea if that break should apply to all Chase business cards, or just Inks?

P2 was approved today….Thank you @Tim and the FM team

Happy to see this return! Applied and approved. I know United gets a lot of shade, but I continue to get solid value from the program, even such that I’ve transferred Chase UR in at times. I’m surprised it didn’t make Greg’s February best list – I imagine for many this is a clear winner over the Ink Cash and Unlimited offers at the moment.

I am not seeing 24 month restriction in the T&C on the application

The referral offer is still showing as 75k with $0 intro fee first year. If I apply through that and later request match, which usually works with this bank, will they also charge me the new full fee?

Not bad. Recently found a SYD-SFO-LAX Polaris redemption that was 100K one-way. For this low a spend since I’m within 5/24 it’s a no brainer.

barely enough for one way domestic coach. many awards to asia in coach cost 300000 miles one way too. complete useless. 100k united mile is worth $200 and minus the annual fee and it is $100 offer which is not worth the hard pull

Terrible take. Just used 100,000 miles to fly BKK-HND-JFK in business class. Easily worth at least $2,000 to me as that’s what I’d pay if I had to use cash for a business class ticket.

Umm what? You can do round-trip economy to Tokyo from the east coast for 100-110K!

If you have a United card but pay for your flight with Travel Bank funds, are you on the hook for baggage fees? Is it possible to pay for a small part of the flight with the card even if you have remaining Travel Bank funds?

I did it many times to get the free baggage benefits of United cardholder, even for basic economy domestic airfare. Had to put at least $1 on the United credit card with the remaining paid from the Travelbank funds.

You DO NOT have to put anything on your United card. You get a free bag simply by being a cardholder.

This is NOT true for United flights.

REALLY? Have you actually tried it? Because I do it all the time (last time 3 days ago) and I ALWAYS get a free bag when paying with TravelBank in full.

No, I did not try to pay all with Travelbank funds. I paid $1 on the United card with the remaining from Travelbank. Because on another occasion, when I paid full airfare with a different card, it did not give me free checked bag benefit.

Well, there you go.

I see your point. My situation was to get free checked bag with United basic economy purchase using Travelbank funds. This I did not try with Travelbank funds alone, but would this also work?

That’s what I do all the time.

Thanks!

Please confirm you are not having United status for free checked bag.

No status. Try it yourself, 24-hour free cancelation.

Do you have Premier status?

[…] United Business Card 100k Offer: The Chase United Business Card now has a welcome offer of 100k miles after spending $5k in 3 months. This is a lower spending requirement than previous welcome offers. The card is a non-affiliate link. See this post on Frequent Miler. […]

My prediction is that we’re going to see, gradually, all United-cobranded cards that come with an annual fee to offer a minimum SUB of 100k miles. With repeated devaluation rounds recently, a SUB offer less than that amount would interest very few.

Is there still a 100,000 referral link?

Any idea on expiration date of this offer?

Also, is it possible to apply for one Chase business card and one personal card in the same month? If yes, is it better to do it on the same day or space it out?

We haven’t heard anything regarding an expiration date, unfortunately. Chase will approve you for two cards in one day, even two personal cards. At one point, there were some folks who felt it was better to space them out by one day, but I’m not sure that’s really an issue any more.

https://www.usatoday.com/money/blueprint/credit-cards/new-united-business-cards-welcome-offers/#:~:text=There%27s%20a%20%240%20intro%20annual,Offer%20ends%20April%203%2C%202024.

Apparently April 3rd, 2024.

Can you refer from a United personal card? Or does it have to come from the United Business?

No, you can refer from personal to business and vice versa.