NOTICE: This post references card features that have changed, expired, or are not currently available

In a recent post I considered whether it was foolish to use hotel cards for everyday spend. I concluded that using the SPG card for everyday spend makes sense for many people. Most other hotel cards only make sense under specific conditions.

In a recent post I considered whether it was foolish to use hotel cards for everyday spend. I concluded that using the SPG card for everyday spend makes sense for many people. Most other hotel cards only make sense under specific conditions.

In response, a reader asked if he should put everyday spend on his SPG card or his Sapphire Reserve. I said SPG. Even though the Chase Sapphire Reserve Card earns 3X for travel and dining, it only earns 1 Ultimate Rewards point per dollar everywhere else. Since I value SPG points more highly than Ultimate Rewards points (when compared 1 to 1), I recommended using the SPG card for “everywhere else” spend. But, I added, if he had the Chase Freedom Unlimited Card, I’d recommend using that for “everywhere else” spend since it earns 1.5 Ultimate Rewards points per dollar and points can be freely moved to the Sapphire Reserve card.

The reader then clarified that he is trying to earn enough miles for premium cabin flights to Asia and was trying to figure out whether to earn United miles through Chase or through a Marriott Travel Package (which can be indirectly bought with SPG points).

Aha! Suddenly the question became quite interesting! Set aside for now the question of whether or not United miles are best for this reader’s quest (I’d argue no, but that’s a different story…). If you want to earn United miles, which is better for everyday spend? The Freedom Unlimited card paired with the Sapphire Reserve (so that points can be transferred to airlines) or the SPG card?

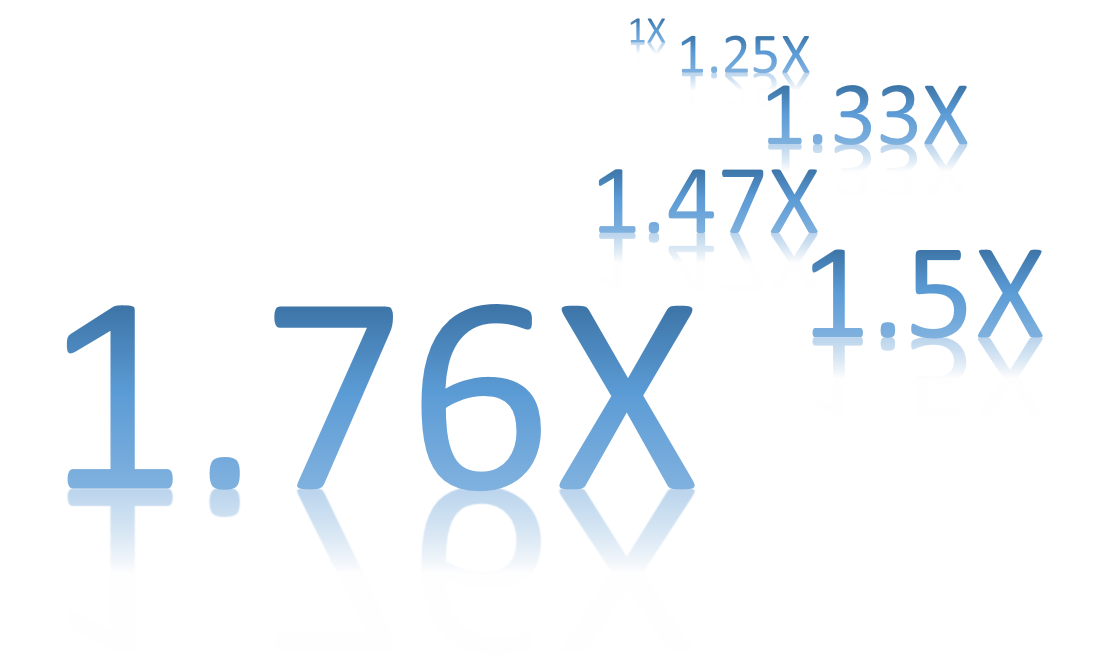

On the face of it, the answer appears simple. The Freedom Unlimited Card effectively earns 1.5 United miles per dollar. Meanwhile, SPG transfers to United at a paltry 2 to 1 ratio. It takes 2 SPG points to get 1 United mile, so arguably the SPG card earns only .5 United miles per dollar (PSA: Please do not convert SPG points directly to United this way!).

But… SPG points are much more valuable now that they can be freely converted 1 to 3 to Marriott. It is now possible to convert 90,000 SPG points into 270,000 Marriott points. And those 270,000 Marriott points can be used to buy a 7 Night Travel Package which includes 132,000 United miles plus a certificate for a 7 night stay in a category 1 through 5 Marriott property.

Even if you throw away the Marriott 7 Night stay certificate, the travel package is a way to exchange 90,000 SPG points for 132,000 United miles. That’s 1.47 miles per point. In other words, if you use your points in this way, the SPG card earns almost the exact same number of United miles as the Freedom Unlimited card: 1.47 United miles per dollar (vs. 1.5 with the Freedom Unlimited).

It gets better…

If you find that you can’t use your 7 night certificate, you may have luck in returning the certificate for 45,000 Marriott points. Since those 45,000 Marriott points can be converted to 15,000 SPG points, that’s a 15K refund. Your net cost in SPG points for those 132,000 United miles would be only 75,000 SPG points (90K – 15K). Now we can recalculate the United miles earned per dollar by the SPG card: 132K / 75K = 1.76 United Miles per Dollar!

Alternatively you can try to get a 5 night travel package. You’re not supposed to be able to get them unless you are a Marriott Vacation Club owner, but some people have been successful in getting them simply by calling and asking. It seems to help to have Marriott elite status and to have the number of points needed for the 5 night package rather than the 7 night package. For full details, see: Marriott 5 Night Travel Packages exist, but they’re secret. Interestingly, while most people have been turned away when they ask for this, I’ve heard three recent success stories. So, it does seem to be possible, if not at all certain.

If you can get the 5 Night 132K United miles package, you’ll need 235K Marriott points (vs 270K with the 7 Night package). That comes to just under 79,000 SPG points. So, with throwing away the 5 Night certificate, the conversion rate is 132 / 79 = 1.67 United miles per dollar with the SPG card! And, if you later refund the 5 night certificate you’ll do even better (but I do not know how many points you’ll get back for that refund).

Final Answer… for earning United Miles

If your goal is to get United miles, and you plan to use SPG points to buy Marriott Travel packages that offer United miles, then the SPG card (business or personal) is the best for everyday spend!

What about other miles?

The Freedom Unlimited Card can be used as a way to earn 1.5 miles per dollar with any of Chase’s transfer partners including: Air France, British Airways, Korean Air, Singapore Airlines, Southwest, United, and Virgin Atlantic.

Meanwhile, even though Marriott travel packages deliver the most miles when you select United, they also offer competitive numbers of miles with the following programs: AA, Aeromexico, Air Canada, Alaska Airlines, British Airways, Copa Airlines, Delta, Frontier Airlines, GOL/Varig, Hawaiian Airlines, Iberia Airlines, Southwest, and Virgin Atlantic.

With each of the above airlines, 7 Night Marriott Travel packages offer 120,000 miles for 270,000 Marriott points (or 90K SPG). That comes to 1.33 miles per dollar with the SPG card. If you then refund the 7 Night certificate, you get 120,000 miles for a net total of 75K SPG points. That comes to 1.6 miles per dollar with the SPG card.

If we look just at the airlines the two programs have in common, we find that the SPG card is better for everyday spend (as long as you plan to buy a travel package and later refund the stay certificate) with the following airlines:

- British Airways

- Southwest

- United

- Virgin Atlantic

It’s also worth noting that Chase does not support some of the valuable airline programs that Marriott does support such as AA, Air Canada, Alaska, and Delta. So, obviously, the SPG card is much better for earning miles in those programs. On the other hand, if you want Air France or Korean miles, or if you want Hyatt hotel points, Chase has you covered. Yes, SPG converts directly to Air France and Korean, but only at the rate of 1.25 miles per point (if you convert 20,000 SPG points at a time, you end up with 25,000 miles).

Other considerations

For now, the SPG card seems to be the single best card for everyday non-bonused spend if you want to earn airline miles (with the exception of Air France or Korean miles).

That said, this analysis depends upon the existence and current pricing of Marriott Travel packages. Marriott could discontinue or raise prices on these packages at any time. Plus, Marriott is expected to create an entirely new rewards program at some point in the future (they’ve said that 2018 would be the earliest it would appear, and my guess is that 2019 is more likely). When that happens, all bets are off.

Still, for short term earnings, I feel pretty comfortable recommending SPG for everyday spend (e.g. spend where you can’t earn 2X or better miles through category bonuses or whatever) if your goal is to earn airline miles. Its a great card too for earning SPG or Marriott points. If you want Hyatt points (which I find to be quite valuable), Chase is the way to go.

Should I change plans?

I’ve reported before that I’ve packed my wallet (and my wife’s) with 3 key cards:

- Chase Sapphire Reserve: 3X Ultimate Rewards points for travel & dining

- CNB Crystal Visa Infinite: 3X bank points (worth about 1.15 cents each towards flights) for gas and grocery

- Chase Freedom Unlimited: 1.5X Ultimate Rewards everywhere else

I still think that’s an excellent combo, but now I’m wondering if I should replace the Freedom Unlimited with SPG. I love Chase points primarily for transferring to Hyatt, but my wife and I may already earn enough Ultimate Rewards points through use of the Sapphire Reserve card (as well as our other Freedom and Ink cards, not pictured). By switching to SPG for our “everywhere else” card, we’ll earn more than 1.5 miles per dollar as long as Marriott Travel Packages stick around in their present form. Plus, unlike the Freedom Unlimited card, SPG cards have no foreign transaction fees.

On the other hand, SPG cards are Amex cards whereas Freedom Unlimited is a Visa card. And Visa is accepted in more places… In other words I’m still on the fence and will probably keep things as is for now. That is, until I get around to printing new card labels…

Key readings

For more details of many of the topics discussed here, please see:

- Marriott SPG Complete Guide to Sweet Opportunities

- Marriott SPG sweet opportunities I missed in round 1

- Marriott 5 Night Travel Packages exist, but they’re secret.

- 12 things you need to know about Marriott Travel Packages

- Chase Freedom Unlimited

- Starwood Preferred Guest Credit Card from American Express

- Starwood Preferred Guest Business Credit Card from American Express

[…] Which card earns the most United miles per dollar? A surprising answer… […]

[…] trying to earn the most United miles per dollar or redeeming for a Southwest Companion pass and a 7-night hotel certificate, the value of a […]

Greg, is it correct that the SPG is NOT a good card to MS with by purchasing visa gc’s, because it is an AmEx card?

Not correct. Amex is problematic to ms with for meeting minimum spend on signup bonuses because buying prepaid cards is explicitly not allowed in the signup offer terms as a way of meeting min spend. Outside of that, just like any bank you could get in trouble for sudden changes in spend habits, but they’re not known to shut people down for buying gift cards.

You can buy 3rd party gift cards though? Like hotels.com, AirBnB, etc?

Not necessarily. The terms don’t define prepaid products to that fine of detail so if they want to come after you for buying 3rd party gift cards they could.

I’d rather use Amex EDP for gas and groceries, which gives 3x for gas and 4.5x for groceries, instead of CNB Crystal.

As for everything else, I currently use Amex Blue for Business, which gives 2.3x for everything up to $50k in the first year, after that I’ll use my grandfathered Priceline with 2x for everything, which is equivalent of 3.333 cents

Yuri, I also have a grandfathered Barclay’s Priceline card with 2x everywhere (and 5x for Priceline purchases, but I never use that). How does that translate to 3 1/3 cents? Is there a redemption option from those points I have overlooked?

For redemption against Priceline purchases it is 1.5 cents per point, then they give you 10% points back, so that’s 1.666 cents per point.

Thanks for enlightening me

Yep, that’s a great combo. If I had those cards I would probably do the same.

I can’t believe you don’t have Amex EDP, which I consider to be one of the best (if not the best) Amex cards.

I can’t believe it either 🙂

I’ve often written about how strong that card is for point earning.

Maybe I am missing something, but I do not see how SPG is better than Chase Freedom Ultimate converting at 1.5 points per dollar. You would need your all-other daily spend category to be at least $78,334 resulting in 235,002 Marriot points via 3:1 conversion which are then used to get the rarely approved 5-night package. If you need to get the 7-night package, then it would take $90,000 in daily spend with the SPG card. So, unless you do heavy MS, it seems the SPG card is not better.

That’s true. SPG points are only this value if you can amass enough for a travel package. Of course many people get SPG points not just from credit card spend but also from signup bonuses, stays, etc.

I have the CSR and CSP. I plan to keep the CSR, so I was thinking of swapping the CSP for the Freedom or Freedom Unlimited. Which do you think makes most sense (rotating categories or 1.5 on everything)?

It really depends on your spend patterns. Obviously 5X is better than 1.5X, but 5X is capped at $1500 spend per quarter and sometimes the categories are sub-optimal. If you like the game of manufacturing spend within those 5X categories you may prefer the regular Freedom. If you prefer to simply earn high value rewards everywhere with no cap, then Freedom Unlimited is the way to go

Greg, this is the first time I have heard about redeeming a 7 night cert from Marriott for 45000 points, can you please expand on that (there wasn’t a link)

same question. I think it should be 35000 (5000 * 7) instead of 45000. But could be wrong.

I’ve mentioned it a few times in prior posts but haven’t had a post dedicated to it. Basically, at their discretion, Marriott Rewards is known to offer a few points back if you find that you can’t use the stay certificate. For the Cat 1-5 7 Night package, they offer 45K points back. If you had bought a higher level package, they’ll give you back 45K plus the difference in point cost between the package you bought and the Cat 1-5 package.

I wrote about it here: https://frequentmiler.com/2016/10/10/share-spg-points/ in the section titled “Better points to miles transfer ratios”

Hubby and I use SPG for everyday spend that doesn’t earn bonus points. That includes some big ticket items, including health, home and car insurance.